Tailgating Detection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435925 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tailgating Detection Market Size

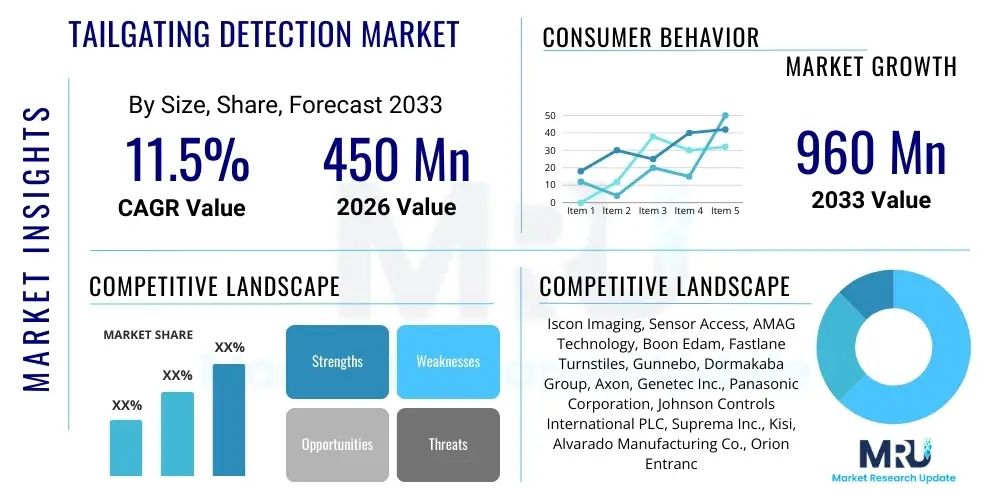

The Tailgating Detection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 960 Million by the end of the forecast period in 2033.

Tailgating Detection Market introduction

The Tailgating Detection Market encompasses advanced physical security solutions designed to prevent unauthorized individuals from following authorized personnel through restricted access points, such as doors, turnstiles, or portals, without presenting valid credentials. This market is primarily driven by the escalating need for enhanced security across critical infrastructure, corporate campuses, and government facilities where maintaining strict access control integrity is paramount. Tailgating detection systems leverage sophisticated technologies, including 3D volumetric imaging, optical sensors, biometric authentication, and deep learning video analytics, to accurately distinguish between legitimate single entry and fraudulent multiple entries. Major applications span high-security zones in the banking, financial services, and insurance (BFSI) sector, data centers requiring robust perimeter protection, and research laboratories holding sensitive intellectual property.

These specialized security products, ranging from single-person optical turnstiles to sophisticated detection algorithms integrated into existing CCTV infrastructure, provide significant benefits, including reducing internal security breaches, enhancing compliance with stringent regulatory standards (like GDPR and HIPAA), and ensuring overall site safety. The increasing integration of IoT sensors and network connectivity further enables real-time alerts and seamless integration with broader Physical Security Information Management (PSIM) systems, streamlining security operations. Key driving factors include the persistent threat of corporate espionage and vandalism, coupled with the increasing digitalization of assets, which necessitates multi-layered physical security protocols that conventional access control methods often fail to adequately address.

Tailgating Detection Market Executive Summary

The global Tailgating Detection Market is undergoing rapid technological evolution, transitioning from basic sensor-based systems to highly intelligent, AI-driven solutions capable of predicting and flagging anomalous behavior rather than merely reacting to entry violations. Business trends indicate a strong move toward subscription-based security services and integration frameworks that allow detection systems to communicate effectively with biometric readers and visitor management platforms. Regional trends show that North America and Europe remain the primary revenue generators due to high security awareness and strict regulatory mandates, while the Asia Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization and massive infrastructure development requiring immediate security upgrades. Segment trends highlight the increasing dominance of the software and services segment, driven by the demand for continuous system maintenance, cloud-based analytics, and firmware updates that improve detection accuracy over time, often outpacing hardware sales growth.

Furthermore, the market exhibits a clear preference for integration over replacement, meaning manufacturers are focusing on creating systems compatible with legacy access control infrastructure, lowering the barrier to adoption for established enterprises. The BFSI and IT & Telecom sectors continue to represent the largest segments in terms of end-use, given their high transaction volumes and the extreme value of the data they manage. However, the diversification of threats is pushing sectors like healthcare and pharmaceuticals, which require strict control over sensitive materials and patient data, to significantly increase their investment in advanced anti-tailgating technologies. This strategic shift underscores the market's trajectory towards proactive, rather than reactive, security posture management.

AI Impact Analysis on Tailgating Detection Market

User inquiries regarding AI in Tailgating Detection predominantly center on three core themes: accuracy improvement, false alarm reduction, and integration capabilities with existing video surveillance infrastructure. Users frequently question how AI, specifically deep learning and computer vision, can differentiate between intentional tailgating (a security threat) and accidental close following (a non-threat, such as a crowded lobby scenario), thereby minimizing operational disruptions caused by nuisance alerts. There is also significant user interest in AI's role in predictive security, analyzing movement patterns to flag suspicious behavior before a violation occurs, and how AI-powered systems maintain data privacy compliance, especially when integrated with facial recognition or biometric authentication mechanisms. The collective expectation is that AI will transform tailgating detection from a purely mechanical or sensor-driven enforcement tool into an intelligent, adaptive security layer that learns and evolves with facility usage patterns.

- AI-driven computer vision enhances detection accuracy by analyzing body shape, speed, and distance separation in complex, high-traffic environments, significantly reducing errors compared to traditional optical sensors.

- Machine learning algorithms enable the system to adapt to varying lighting conditions, clothing, and carrying objects, ensuring consistent performance regardless of environmental changes.

- Deep learning models facilitate the differentiation between genuine tailgating events and benign situations like assisted entry (e.g., person holding the door for a wheelchair user), resulting in fewer false positives.

- Predictive analytics use AI to analyze typical flow patterns and flag anomalies, allowing security personnel to intervene proactively before a breach is fully executed.

- Integration of AI with biometric data (facial geometry, gait recognition) strengthens multi-factor authentication requirements at sensitive checkpoints, making it harder to bypass.

- AI assists in the automated reporting and auditing of security logs, providing detailed video evidence and metadata surrounding every detection event for compliance and post-incident investigation.

DRO & Impact Forces Of Tailgating Detection Market

The Tailgating Detection Market is strongly influenced by the dual pressures of increasing global security risks and rapid technological advancements in sensor and video analytics. The primary drivers include the escalating frequency of security breaches and the mandatory compliance requirements imposed by regulatory bodies across industries like finance and healthcare. However, the high initial capital expenditure associated with sophisticated 3D volumetric scanning technologies and the complexity of integrating new systems into outdated infrastructure pose significant restraints, particularly for small and medium-sized enterprises (SMEs). Opportunities are concentrated around the development of cost-effective, cloud-based detection services and the expansion into emerging markets where physical security infrastructure is currently underdeveloped. The impact forces are characterized by moderate pressure from competition, given the specialized nature of the technology, coupled with high influence from technological advancements that consistently raise the performance baseline and lower the detection margin for error.

Segmentation Analysis

The Tailgating Detection Market is broadly segmented across technology, component, application, and end-use industry, reflecting the diverse security needs across the operational landscape. Segmentation by technology allows for the differentiation between traditional sensor-based systems (like infrared and optical beams) and advanced systems utilizing 3D imaging, ultrasonic sensors, and sophisticated video analytics powered by AI. Component segmentation highlights the ecosystem breakdown into hardware (turnstiles, sensors, cameras), software (detection algorithms, PSIM integration), and services (installation, maintenance, consulting). Understanding these segments is crucial as enterprises often select a combination of components tailored to the specific threat profile and operational flow of their facilities, emphasizing robustness in high-throughput environments and extreme accuracy in high-security environments.

- By Component:

- Hardware (Sensors, Cameras, Turnstiles, Security Portals)

- Software (Video Analytics, Access Control Integration, Reporting Tools)

- Services (Installation, Maintenance & Support, Managed Security Services)

- By Technology:

- Volumetric Scanning (3D Imaging, LiDAR)

- Optical Sensor Systems (Infrared, Photoelectric)

- Video Analytics & Computer Vision (AI-based Detection)

- Biometric Integration

- By Application:

- Man Trap (Security Booths)

- Access Control Turnstiles (Optical, Full Height)

- Doorway Monitoring

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom and Data Centers

- Government & Defense

- Healthcare & Pharmaceuticals

- Manufacturing & Industrial

- Transportation & Logistics

- Education & Research

Value Chain Analysis For Tailgating Detection Market

The value chain for the Tailgating Detection Market begins with upstream activities centered on the research and development of highly specialized sensor technology and advanced machine learning algorithms. Upstream providers are responsible for manufacturing sophisticated components such as 3D time-of-flight cameras, high-precision infrared sensors, and proprietary chips that process complex spatial data in real-time. This phase requires significant investment in intellectual property and calibration expertise to ensure minimal detection latency and high accuracy under diverse operational constraints. Key challenges at this stage include sourcing high-quality optical components and maintaining stringent quality control over embedded systems, as the reliability of the entire security solution depends heavily on the foundational hardware components provided by these upstream specialists.

Moving downstream, the value chain involves system integration, deployment, and long-term maintenance. Major system manufacturers often integrate third-party sensors with their proprietary software platforms, customizing solutions for specific end-use environments (e.g., high-traffic airports versus low-traffic server rooms). Distribution channels are critical; while high-end bespoke security portals are often sold directly to large corporate or government clients due to complex installation requirements, standard optical turnstiles frequently move through specialized security distributors and certified value-added resellers (VARs). The shift toward managed security services means that downstream service providers play an increasing role in ongoing system health monitoring, remote diagnostics, and essential software updates, transforming the revenue model toward recurring service contracts.

Direct distribution often provides manufacturers greater control over the installation quality and client relationship, which is vital for highly sensitive projects in government and critical infrastructure sectors. Conversely, indirect channels, utilizing integrators and regional distributors, allow manufacturers to achieve broader market reach, particularly in geographical regions where localized support and quick response times are necessary. The strength of the value chain ultimately lies in the seamless integration between the hardware detection module and the central access control software, ensuring that alerts are timely and actionable within the client’s existing Physical Security Information Management framework.

Tailgating Detection Market Potential Customers

Potential customers for Tailgating Detection systems are organizations that prioritize data confidentiality, operational safety, and the protection of high-value physical assets, necessitating stringent identity verification at entry points. The primary buyers fall into sectors characterized by high regulatory scrutiny, high-density employee populations, or the storage of highly sensitive material. Data centers and major technology corporations represent crucial end-users, given the imperative to prevent unauthorized physical access to servers and networking equipment, where a single breach could lead to catastrophic data loss or service disruption. These entities often demand the highest level of security assurance, frequently adopting multi-modal solutions that combine tailgating detection with biometric and anti-passback mechanisms.

Furthermore, government and defense facilities, including embassies, military bases, and research laboratories, are perennial high-demand customers, viewing tailgating detection not merely as an access control feature but as a fundamental national security requirement. These clients seek systems certified for reliability and tamper resistance, often favoring robust, full-height security portals over standard turnstiles. The healthcare and pharmaceutical industries are also rapidly increasing their adoption rate. Hospitals and clinics must comply with privacy laws (like HIPAA), and pharmaceutical companies must protect high-value controlled substances and proprietary drug research from theft or contamination. These diverse customer needs drive the market toward customized solutions tailored to specific throughput rates and environmental constraints.

The educational sector, particularly large university campuses with dedicated research facilities and extensive student housing, represents another key customer base. While general campus security might rely on less stringent measures, specialized engineering and bioscience labs require commercial-grade anti-tailgating measures to secure equipment and intellectual property. The modern customer demands not just a detection mechanism, but a holistic security solution that integrates seamlessly with existing Human Resources databases and visitor pre-registration platforms, simplifying compliance and ensuring a secure, yet manageable, flow of authorized personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 960 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Iscon Imaging, Sensor Access, AMAG Technology, Boon Edam, Fastlane Turnstiles, Gunnebo, Dormakaba Group, Axon, Genetec Inc., Panasonic Corporation, Johnson Controls International PLC, Suprema Inc., Kisi, Alvarado Manufacturing Co., Orion Entrance Control Inc., PERCo, Controlled Access, Automatic Systems, Integrated Design Limited (IDL), and Saima Sicurezza S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tailgating Detection Market Key Technology Landscape

The technology landscape of the Tailgating Detection Market is defined by the convergence of advanced sensing technologies, sophisticated data processing capabilities, and networking infrastructure. Historically, detection relied on simple optical beams, but the modern market is dominated by technologies offering volumetric detection. Key advancements include the deployment of 3D time-of-flight (ToF) sensors and LiDAR, which create a highly accurate, three-dimensional map of the access lane. This allows the system to calculate the volume and spatial separation of individuals, providing definitive proof of unauthorized entry attempts even when individuals are in close proximity, a significant improvement over 2D systems that can be easily fooled by objects carried or close following.

Furthermore, AI-powered video analytics is fundamentally transforming the market. High-resolution cameras combined with deep learning algorithms are now capable of analyzing gait patterns, movement trajectories, and the temporal sequence of credential presentation and entry. This software-centric approach not only increases the accuracy of detection but also allows for retrofitting existing security cameras with intelligent detection capabilities, reducing the need for complete hardware overhaul. The software side is characterized by robust integration protocols (like ONVIF and proprietary APIs) that ensure seamless communication with corporate identity management systems and Physical Access Control Systems (PACS), allowing for immediate, automated lockdown responses or personalized security attendant alerts.

The shift towards cloud computing and edge processing is also prominent. Edge devices, such as smart cameras embedded with detection software, perform immediate analysis locally, minimizing network latency and speeding up response times. Cloud platforms, meanwhile, handle large-scale data aggregation for trend analysis, allowing security managers to review historical tailgating incidents, refine security policies, and identify specific vulnerable access points across multiple facilities globally. Biometric integration, including fingerprint, iris, and increasingly facial recognition, serves as the final, reinforcing layer of authentication, ensuring that the detected unauthorized individual is not only physically present but also lacks the necessary authorized biometric identity associated with the presented credential.

Regional Highlights

The global Tailgating Detection Market exhibits significant regional variation in adoption rates, technological preferences, and growth drivers. North America, specifically the United States, holds the largest market share due to stringent governmental regulations, high prevalence of critical infrastructure (data centers, nuclear facilities), and a robust commercial sector that prioritizes advanced security measures. Early adoption of integrated security platforms and substantial spending on advanced technologies like 3D volumetric scanners and AI video analytics characterize this region. The presence of major technology providers and a mature security integration ecosystem further solidifies North America’s leading position.

Europe represents the second-largest market, driven by powerful data protection regulations (such as GDPR) that necessitate tight control over physical access to infrastructure storing personal data. Countries like Germany and the UK show high demand, particularly in the financial and manufacturing sectors. European customers often emphasize system aesthetics and design, leading to strong growth for specialized security portals and discreetly integrated optical turnstiles. Furthermore, the region’s focus on smart city initiatives and secure public transportation hubs provides continuous demand for robust, high-throughput anti-tailgating solutions.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. Rapid industrialization, massive urban development projects, and increasing foreign direct investment in technology and manufacturing hubs (particularly in China, India, and Southeast Asia) are fueling this expansion. While cost remains a consideration, the growing awareness of corporate security threats and the implementation of standardized security protocols are rapidly accelerating the transition from basic access control systems to sophisticated tailgating detection technology. The Middle East and Africa (MEA) region, particularly the UAE and Saudi Arabia, are also demonstrating substantial growth due to significant governmental investment in smart infrastructure, highly secure corporate headquarters, and high-security oil and gas facilities.

- North America: Dominant market share; driven by critical infrastructure protection and high regulatory compliance standards (e.g., NERC-CIP). High adoption of AI and biometric integration.

- Europe: Mature market with strong growth in BFSI and corporate segments; emphasizes aesthetic design and compliance with GDPR for data center security.

- Asia Pacific (APAC): Fastest-growing market; fueled by rapid urbanization, increasing industrial security awareness, and large-scale infrastructure projects in countries like China and India.

- Latin America (LATAM): Moderate growth driven by multinational corporate investment and rising security concerns in metropolitan areas, focusing on cost-effective, durable solutions.

- Middle East & Africa (MEA): Emerging market; growth concentrated around government facilities, energy sector projects, and major construction initiatives requiring premium security solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tailgating Detection Market.- Boon Edam

- Gunnebo

- Dormakaba Group

- Automatic Systems

- Integrated Design Limited (IDL)

- Alvarado Manufacturing Co.

- Iscon Imaging

- Fastlane Turnstiles

- Orion Entrance Control Inc.

- Controlled Access

- PERCo

- Saima Sicurezza S.p.A.

- AMAG Technology

- Johnson Controls International PLC

- Genetec Inc.

- Suprema Inc.

- Kisi

- Sensor Access

- Axon

- Panasonic Corporation

Frequently Asked Questions

Analyze common user questions about the Tailgating Detection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between anti-tailgating technology and standard access control?

Standard access control verifies identity (who enters) but does not monitor throughput (how many enter). Anti-tailgating technology uses volumetric or optical sensors, often enhanced by AI, to ensure only one authenticated person passes per authorized credential scan, preventing unauthorized followers (tailgaters) from gaining entry immediately behind the authorized individual.

Which technology provides the highest level of accuracy for tailgating detection?

3D Volumetric Scanning, utilizing technologies like Time-of-Flight (ToF) cameras or LiDAR, generally provides the highest accuracy. These systems map the access space in three dimensions, allowing for precise calculation of mass and separation distance between individuals, significantly minimizing false positives in crowded environments compared to 2D optical sensors.

How does AI reduce false alarms in tailgating detection systems?

AI, specifically deep learning computer vision, is trained to distinguish between intentional security violations (tailgating) and benign actions, such as individuals carrying large packages, using a wheelchair, or standing too close momentarily. This contextual understanding prevents the system from generating nuisance alerts, focusing security staff on genuine threats.

Which industry is the largest end-user of anti-tailgating solutions globally?

The IT & Telecom and Data Center sector is currently the largest end-user segment. This is driven by the absolute necessity of protecting high-value digital assets and critical infrastructure, requiring multi-layered physical security solutions that strictly enforce one-person-per-credential access policies.

What are the key restraint factors affecting market growth?

The key restraints include the high upfront capital investment required for installing advanced, integrated security portals or specialized volumetric sensors, and the technical complexity involved in seamlessly integrating these modern detection systems with legacy access control and building management systems already in place at older facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tailgating Detection Market Size Report By Type (Imaging Measurement Tech, Non-Imaging Tech), By Application (Commercial Areas, Public Organizations & Government Departments, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Tailgating Detection System (TDS) Market Statistics 2025 Analysis By Application (Commercial Areas, Government Departments and Organizations), By Type (Imaging Measurement System, Non-Imaging System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager