Tailored Blank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432749 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Tailored Blank Market Size

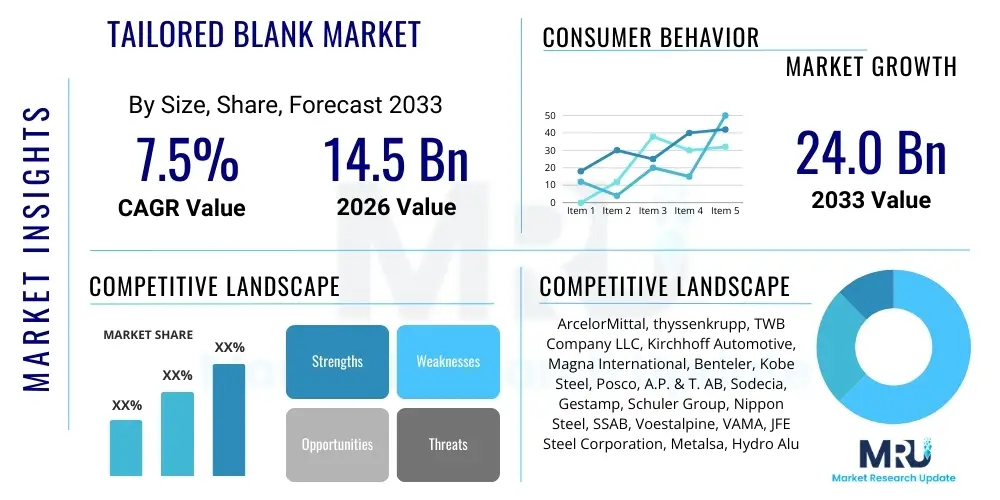

The Tailored Blank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 24.0 Billion by the end of the forecast period in 2033.

Tailored Blank Market introduction

The Tailored Blank Market centers on the production and utilization of sheet metal blanks manufactured with varying thicknesses, materials, or coatings within a single component. These advanced metallic components, primarily used in the automotive and aerospace industries, are crucial for lightweighting strategies, enhancing crash safety performance, and improving overall structural efficiency. Tailored blanks enable engineers to place specific material properties exactly where they are needed in a structural part, such as high-strength steel in impact zones and thinner, lighter material elsewhere, significantly reducing vehicle weight without compromising stiffness or safety standards. This customization allows for optimal material utilization, leading to substantial cost savings and reduced scrap rates compared to traditional stamping processes using monolithic sheets. The increasing global focus on fuel efficiency, stringent emissions regulations, and the rapid expansion of electric vehicle (EV) production are acting as primary stimulants for the wider adoption of tailored blank technology across various manufacturing sectors.

Tailored blanks encompass several manufacturing methods, including Tailor Welded Blanks (TWB), which are the most common and typically involve laser welding two or more sheets of different specifications together; Tailor Rolled Blanks (TRB), where the sheet thickness is varied continuously during the rolling process; and Tailor Heat Treated Blanks (THTB). The major applications are concentrated within the automotive Body-in-White (BiW) structure, including door inner panels, side frame rails, pillars (A, B, C), floor pans, and engine cradles. By optimizing material distribution, these blanks provide superior performance characteristics, such as enhanced dent resistance and better distribution of load during impact scenarios. The resultant parts require less complex tooling and fewer assembly steps, streamlining the overall manufacturing workflow for OEMs (Original Equipment Manufacturers). This intrinsic ability to customize material properties is fundamentally reshaping how vehicle structures are designed, prioritizing safety, efficiency, and sustainability.

Key benefits driving the market include significant mass reduction, leading directly to improved fuel economy for internal combustion engine vehicles (ICEVs) and extended range for Battery Electric Vehicles (BEVs). Furthermore, the integration of tailored blanks reduces the number of individual stamped parts required for an assembly, simplifying logistics, reducing assembly time, and lowering capital investment in tooling. The development of advanced material combinations, such as pairing aluminum alloys with high-strength steels, is expanding the scope of tailored blank applications beyond traditional automotive safety cages. However, the sophisticated nature of production, requiring high-precision welding and forming equipment, presents technological barriers to entry, maintaining the competitive edge for specialized market participants who possess the requisite expertise in laser processing and material science.

Tailored Blank Market Executive Summary

The global Tailored Blank Market is characterized by robust growth, primarily propelled by the worldwide push towards vehicle lightweighting mandated by stricter environmental and safety regulations. Business trends indicate a strong shift towards multi-material tailored blanks, incorporating sophisticated combinations of ultra-high-strength steels (UHSS), advanced high-strength steels (AHSS), and aluminum alloys to achieve optimal performance profiles. Market expansion is heavily influenced by the accelerating production volumes within the electric vehicle segment, as OEMs seek every possible avenue to minimize battery consumption through structural mass reduction. Strategic partnerships between steel producers, specialized blank manufacturers, and Tier 1 automotive suppliers are critical success factors, focusing on integrating advanced laser welding techniques and quality inspection systems to handle complex geometries and dissimilar material pairings. Furthermore, technological innovation in Tailor Rolled Blank manufacturing is providing alternatives to traditional welding processes, offering continuous variation in thickness which is highly valuable for large structural components, indicating a diversification in processing technologies.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, spurred by massive automotive production growth in China, India, and Southeast Asia, coupled with increasing governmental mandates regarding vehicle safety standards (e.g., C-NCAP, ASEAN NCAP). Europe and North America maintain significant market shares, characterized by early adoption of these technologies, particularly driven by European premium automobile manufacturers known for pioneering advanced lightweight materials in high-volume models. The demand in these established markets focuses heavily on technological refinement, automation, and the expansion of tailored blanks into non-traditional automotive applications, such as heavy-duty trucks and trains, where weight reduction yields considerable operational benefits. Moreover, regulatory pressures concerning CO2 emissions in the EU continue to solidify the foundational demand for ultra-lightweight solutions, ensuring sustained investment in tailored blank capabilities.

Segmentation analysis reveals that the Tailor Welded Blank (TWB) segment, specifically utilizing laser welding technology, continues to hold the largest market share due to its proven reliability, cost-effectiveness, and flexibility in joining different thicknesses and materials. Material-wise, Steel Tailored Blanks, encompassing AHSS and UHSS variants, dominate the volume, reflecting their indispensable role in automotive safety cages. However, the Aluminum Tailored Blanks segment is witnessing the fastest growth rate, directly correlated with the increasing trend of using aluminum for closures and large-format structural components in premium and electric vehicles to achieve maximum weight savings. The Body-in-White application segment remains the primary end-use, demanding increasing sophistication in blank design to accommodate complex stamping processes necessary for modern vehicle aesthetics and aerodynamics.

AI Impact Analysis on Tailored Blank Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Tailored Blank Market frequently center on three critical themes: efficiency enhancement in production, predictive quality control, and optimization of material design. Users are primarily concerned with how AI can streamline the highly complex welding parameters required for dissimilar materials (e.g., steel-aluminum combinations), inquiring about the use of machine learning algorithms to reduce defects like porosity, distortion, and inadequate fusion, thereby boosting first-pass yield rates. Another major area of interest is the application of AI in Generative Design, where algorithms could potentially design optimal blank layouts and material thickness variations that minimize weight while meeting demanding stiffness and crash safety requirements—a task currently requiring intensive simulation and human expertise. Finally, there is a recognized expectation that AI-powered analytics will transform the supply chain, enabling predictive maintenance for specialized equipment (like high-power lasers and robotic handling systems) and optimizing inventory management of various sheet steel and aluminum coils to reduce lead times and buffer costs.

- AI-driven Predictive Quality Control: Machine vision and learning models analyze real-time welding data (power, speed, temperature) to predict and prevent weld defects, significantly improving consistency and reducing scrap rates, particularly for complex TWB geometries.

- Generative Design Optimization: AI algorithms rapidly simulate millions of blank configurations (material type, thickness transitions, weld lines) to identify structurally superior and lighter designs that minimize material usage while adhering to stringent mechanical performance criteria.

- Advanced Process Parameter Tuning: Machine learning optimizes complex manufacturing variables in processes like laser welding and tailored rolling, ensuring perfect alignment and heat input management for dissimilar materials, accelerating the ramp-up phase for new product introductions.

- Supply Chain and Inventory Management: AI enhances demand forecasting for various sheet materials and enables predictive maintenance for high-value manufacturing assets, minimizing unplanned downtime and optimizing material flow from steel mills to stamping facilities.

- Automated Visual Inspection: High-speed cameras coupled with deep learning networks automate the inspection of weld seams for micro-cracks, misalignment, and surface imperfections far faster and more accurately than traditional manual or rule-based systems.

- Simulation Speed Enhancement: AI-assisted meta-modeling drastically reduces the computational time required for large-scale Finite Element Analysis (FEA) related to stamping feasibility and crash performance of new tailored blank designs.

DRO & Impact Forces Of Tailored Blank Market

The Tailored Blank Market is powerfully driven by stringent global regulations requiring improved fuel economy and reduced carbon emissions, primarily targeting the automotive sector. This regulatory environment necessitates aggressive vehicle lightweighting, which tailored blanks inherently facilitate by allowing the precise placement of lighter, stronger materials. The concurrent growth of the Battery Electric Vehicle (BEV) segment further amplifies this demand, as extending driving range remains a critical consumer selling point, achievable through structural mass reduction. However, the market faces significant restraints, chiefly the high initial capital investment required for specialized equipment, such as high-power laser welding stations and sophisticated handling robotics, which can be prohibitive for smaller manufacturers. Additionally, the complexity involved in joining dissimilar materials (e.g., aluminum to steel) presents ongoing metallurgical and technical challenges that require continuous research and development, often constraining application scope.

Opportunities within the market lie in the expansion of tailored blank technology into non-automotive sectors, including aerospace, construction equipment, and energy infrastructure, where structural integrity and weight savings are equally valued. Significant growth potential exists in the development and industrialization of next-generation processes like Tailor Rolled Blanks (TRB) and sophisticated hydroforming applications utilizing pre-welded or pre-rolled blanks, offering new ways to achieve continuous thickness variations and intricate three-dimensional shapes. Furthermore, the increasing adoption of multi-material design philosophies, moving beyond simple two-material blends to complex three or four-component blanks, opens new avenues for customization and specialized performance. Investing in advanced non-destructive testing (NDT) methodologies for quality assurance, leveraging AI and machine vision, represents another key area for market participants to solidify their competitive position.

Impact forces within the market are predominantly exerted by technological advancement and regulatory compliance. The perpetual need to improve crash safety standards globally acts as a foundational pull factor, ensuring that ultra-high-strength steel segments within tailored blanks remain essential. Simultaneously, material innovation—the constant introduction of lighter, stronger, and more formable grades of steel and aluminum—drives the necessary evolution of welding and joining techniques. Should the pace of material joining technology fail to keep up with the introduction of new advanced materials, market adoption could be slowed. Conversely, advancements in laser technology (e.g., fiber lasers, wobble welding) that enhance the speed, quality, and versatility of welding dissimilar materials will strongly accelerate market penetration across various applications, cementing tailored blanks as the preferred method for structural optimization in future mobility designs.

Segmentation Analysis

The Tailored Blank Market is comprehensively segmented based on the material utilized, the manufacturing process employed, and the end-use application area, providing a granular view of market dynamics and growth potential across various product types and industry verticals. This segmentation is crucial for understanding the specific technological demands and regional adoption patterns, particularly concerning the material science challenges inherent in modern lightweight construction. The dominant segment remains the utilization of advanced high-strength steels due to their excellent balance of cost, formability, and required strength for primary safety structures. However, the fastest growth is observed in segments supporting electric vehicle manufacturing, driving demand for specialized aluminum blanks and complex, multi-material structures.

- By Material Type:

- Steel Tailored Blanks (AHSS, UHSS, Mild Steel)

- Aluminum Tailored Blanks (5xxx, 6xxx series alloys)

- Others (Titanium alloys, Hybrid materials, Carbon Fiber Reinforced Polymers (CFRP) integration)

- By Process:

- Tailor Welded Blanks (TWB)

- Laser Welding (Continuous Wave, Pulsed)

- Mash Seam Welding

- Brazing/Soldering

- Tailor Rolled Blanks (TRB)

- Tailor Heat Treated Blanks (THTB)

- Tailor Welded Blanks (TWB)

- By Application:

- Automotive

- Body-in-White (BiW) (Pillars, Door Inners, Side Frames)

- Chassis and Suspension Components

- Closures (Hoods, Decklids, Doors)

- Aerospace and Defense (Structural components, Fuselage sections)

- Construction and Industrial Machinery

- Others (Appliances, Rail transport)

- Automotive

Value Chain Analysis For Tailored Blank Market

The value chain for the Tailored Blank Market begins upstream with primary material suppliers—major steel and aluminum producers who provide high-quality, specialized coils and sheets of varying grades and thicknesses. This stage is highly critical as the metallurgical properties and surface quality of the source material directly dictate the weldability and final performance of the blank. Key activities upstream involve meticulous quality control, advanced alloy development (especially for AHSS/UHSS), and logistics planning to supply just-in-time materials to the blank processors. Price volatility of primary metals significantly influences the cost structure downstream, requiring tailored blank manufacturers to maintain robust hedging and procurement strategies. Relationships at this stage are often long-term contractual agreements ensuring consistent supply of highly specific material grades necessary for safety-critical components.

The intermediate stage is the core of the market, focusing on the specialized processing of the raw coils into tailored blanks. This involves material handling, precise cutting, and high-precision joining operations—predominantly laser welding for TWBs or specialized rolling for TRBs. Tailored blank producers invest heavily in highly automated production lines, including advanced sensor technology, optical weld inspection systems, and high-speed robotic manipulation to achieve micron-level accuracy when joining materials. Distribution channels vary, involving both direct sales to major automotive OEMs (especially for highly integrated suppliers like TWB Company LLC or specialized divisions of large Tier 1s like Gestamp or Benteler) and indirect sales through specialized service centers or regional fabricators who cater to smaller volume requirements or specialized industrial applications. The technical consultancy provided at this stage, helping OEMs optimize design for manufacturing (DFM), adds immense value.

Downstream, the value chain culminates with the end-users, overwhelmingly dominated by automotive stamping operations. The tailored blanks are delivered ready for subsequent forming processes, such as deep drawing or hydroforming, which transform the flat blank into the final 3D structural component (e.g., a B-pillar or side rail). The successful adoption of tailored blanks depends on seamless integration with the OEM’s stamping and assembly lines, requiring close collaboration on tooling design to prevent defects like wrinkling or tearing during forming. The final integration point is the vehicle assembly plant, where these components contribute to the Body-in-White structure. Customer proximity and efficient logistics are vital in the downstream phase due to the large, bulky nature of the finished components and the industry requirement for extremely high quality and reliability in safety-critical parts.

Tailored Blank Market Potential Customers

The primary customers and end-users of tailored blanks are large-scale manufacturers operating in sectors where weight reduction, structural integrity, and material efficiency are paramount design objectives. Automotive OEMs constitute the vast majority of the customer base, ranging from high-volume manufacturers (targeting mass-market vehicles) to specialized luxury and performance car producers. These customers leverage tailored blanks extensively in the Body-in-White (BiW) structure to meet regulatory requirements for crash safety and emissions, while simultaneously improving vehicle dynamics and fuel economy or electric range. The shift toward electric vehicles has intensified their need for tailored blanks, particularly aluminum variants, to offset the heavy weight of battery packs. Furthermore, Tier 1 and Tier 2 suppliers who specialize in structural components and sub-assemblies (e.g., chassis modules, suspension components) also represent significant direct customers.

Beyond the core automotive sector, potential customers are found in specialized transportation and manufacturing industries. The Aerospace and Defense sector utilizes tailored blanks, especially those incorporating advanced aluminum and titanium alloys, in non-critical structural components where weight savings directly translate to improved payload capacity and operational range. Manufacturers of heavy industrial machinery, such as agricultural equipment, construction vehicles, and material handling systems, are increasingly adopting tailored blanks to reduce overall machine mass, improve maneuverability, and achieve better energy efficiency. Finally, the rail and marine transport industries, although smaller consumers, are exhibiting nascent demand for tailored structures to enhance the stiffness and reduce the overall energy consumption of trains and specialized vessels. For all these end-users, the compelling value proposition lies in the ability of tailored blanks to reduce material waste, simplify assembly, and optimize component performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 24.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, thyssenkrupp, TWB Company LLC, Kirchhoff Automotive, Magna International, Benteler, Kobe Steel, Posco, A.P. & T. AB, Sodecia, Gestamp, Schuler Group, Nippon Steel, SSAB, Voestalpine, VAMA, JFE Steel Corporation, Metalsa, Hydro Aluminium, Fraunhofer-Gesellschaft. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tailored Blank Market Key Technology Landscape

The core technology underpinning the Tailored Blank Market is high-precision joining, predominantly utilizing advanced laser welding systems. Fiber lasers and disk lasers have become the industry standard due to their high power density, superior beam quality, and efficiency, enabling high-speed welding of complex shapes and dissimilar material combinations with minimal heat affected zone (HAZ) and distortion. Recent technological advancements focus heavily on "wobble welding" or beam oscillating techniques, which dynamically manipulate the laser focus to manage melt pool behavior and bridge gaps more effectively, crucial when joining varying thicknesses or grades of steel and aluminum. Furthermore, the integration of real-time monitoring and adaptive control systems, often powered by AI, ensures instantaneous adjustment of process parameters, guaranteeing the high metallurgical integrity required for safety-critical automotive components, which is a key competitive differentiator among specialized blank producers.

Beyond traditional Tailor Welded Blanks (TWB), the landscape includes the burgeoning technology of Tailor Rolled Blanks (TRB). TRB involves manipulating the thickness profile of a coil continuously during the cold or hot rolling process, eliminating the need for a weld seam. This process is particularly advantageous for producing large, continuous components like floor panels or roof sections that require a gradient in thickness rather than an abrupt transition. While the initial capital expenditure for TRB mills is substantial, the final product offers enhanced formability during the subsequent stamping process and removes the potential stress concentration associated with a weld seam. Adoption of TRB is increasing, particularly in high-volume production lines where component geometry permits continuous thickness variation, providing vehicle engineers with greater flexibility in structural design and weight optimization.

A third critical area involves the development of hybrid processing technologies and sophisticated material handling. This includes utilizing advanced tooling and robotic systems for the precise alignment of dissimilar material sheets prior to welding, ensuring tolerances are maintained within fractions of a millimeter. Furthermore, the market is seeing increased research into combining tailored blanks with subsequent forming methods like hydroforming, where the tailored blank is formed into a hollow structural part using high-pressure fluid. This combination allows for the creation of components with extremely high stiffness-to-weight ratios and complex cross-sections that cannot be achieved through traditional stamping alone. The convergence of advanced laser processing, intelligent automation, and specialized forming techniques defines the cutting-edge of the tailored blank production landscape, driving efficiency gains and expanding the viable application envelope for these optimized structures.

Regional Highlights

- Asia Pacific (APAC): APAC, led by manufacturing hubs in China, Japan, South Korea, and India, constitutes the largest and fastest-growing market for tailored blanks globally. This accelerated growth is driven by the massive expansion of automotive production, particularly in the mass-market and emerging EV sectors. Government initiatives enforcing stricter crash safety norms (like China's C-NCAP) and escalating demand for high-mileage vehicles directly mandate lightweighting solutions. The region is witnessing significant investment in local production capabilities by both domestic and international tailored blank suppliers aiming to serve the vast OEM network.

- Europe: Europe holds a highly mature market characterized by the early and extensive adoption of tailored blanks, especially within the premium vehicle segment (Germany, France, UK). The demand here is fundamentally driven by the European Union’s extremely stringent CO2 emission targets, forcing OEMs to prioritize innovative lightweight technologies such as complex multi-material (steel-aluminum) tailored blanks. Europe leads in the adoption of advanced laser welding technologies and is a hub for research into next-generation processing like Tailor Rolled Blanks (TRB) and specialized heat treatment processes (THTB).

- North America: North America exhibits stable demand, dominated by the requirements of the "Detroit Three" and Japanese/European transplants. The market here is focused on achieving higher safety ratings (IIHS, NHTSA) and accommodating the large, complex structural parts required for trucks and SUVs, which form a significant portion of regional vehicle sales. There is a specific and growing demand for high-strength steel tailored blanks used in heavy-duty applications, alongside rapid growth in aluminum blank use tied to the rising production of large electric pickup trucks and SUVs.

- Latin America: The market in Latin America, while smaller, is exhibiting steady growth, primarily centralized in Brazil and Mexico, due to their established roles as regional automotive manufacturing and export bases. Market growth is constrained by economic volatility and slower adoption of advanced material standards compared to Europe or APAC, focusing predominantly on cost-effective steel tailored blanks for high-volume, mid-range vehicle segments.

- Middle East and Africa (MEA): MEA represents an emerging market with limited domestic production capacity, relying heavily on imports for tailored blanks. Demand is largely correlated with the limited localized automotive assembly operations (e.g., Turkey, South Africa) and infrastructure development projects that require high-performance, durable metal components. Future growth hinges on foreign direct investment in local automotive supply chains and the establishment of manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tailored Blank Market.- ArcelorMittal

- thyssenkrupp

- TWB Company LLC (A Joint Venture of Worthington Steel and Wuhan Iron & Steel Co.)

- Kirchhoff Automotive

- Magna International

- Benteler

- Kobe Steel

- Posco

- A.P. & T. AB

- Sodecia

- Gestamp

- Schuler Group

- Nippon Steel Corporation

- SSAB

- Voestalpine AG

- VAMA (Valin ArcelorMittal Automotive Steel)

- JFE Steel Corporation

- Metalsa S.A. de C.V.

- Hydro Aluminium

- Wuhan Iron and Steel Group Co. (WISCO)

Frequently Asked Questions

Analyze common user questions about the Tailored Blank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Tailor Welded Blanks (TWB) over conventional stamping?

The main advantage of TWB lies in material optimization. It allows automotive engineers to weld materials of different thicknesses, strengths, and coatings into a single blank before forming. This customization significantly reduces component weight, minimizes material cost by placing expensive high-strength steel only where needed, and simplifies assembly by reducing the total number of parts and welding operations, ultimately enhancing crash performance and fuel efficiency.

How is the electric vehicle (EV) segment influencing the demand for Tailored Blanks?

The EV segment is critically dependent on weight reduction to maximize battery range. Consequently, EVs are driving high demand for complex tailored blanks, particularly those utilizing lightweight materials like aluminum alloys, often paired with ultra-high-strength steel for battery protection structures and large body panels. This structural mass reduction directly translates into extended range and improved energy efficiency for BEVs.

What are the major challenges associated with the production of multi-material tailored blanks?

The primary challenges involve metallurgical incompatibility and thermal management during the welding process. Joining dissimilar materials (e.g., steel to aluminum) requires highly specialized techniques, such as advanced laser welding with precise heat control or friction stir welding, to prevent the formation of brittle intermetallic compounds, porosity, and thermal distortion, ensuring the weld seam maintains structural integrity under stress.

Which application segment accounts for the largest share of the Tailored Blank Market?

The Body-in-White (BiW) structure within the automotive application segment holds the largest market share. Tailored blanks are essential for key safety components such as the A-pillars, B-pillars, roof rails, and side frame members, where precise placement of varying strength steels is mandatory to meet stringent governmental and consumer crash safety test ratings while reducing overall vehicle mass.

What is the role of Tailor Rolled Blanks (TRB) in the lightweighting trend compared to TWB?

TRB offers continuous, gradual thickness variation within a single sheet, eliminating the abrupt material transition of a weld seam found in TWB. This results in superior formability and reduces stress concentration issues, making TRB ideal for large, complex surfaces requiring continuous thickness gradients, such as door inner panels or floor structures, contributing significantly to sophisticated lightweight design.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager