Talent Intelligence Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432660 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Talent Intelligence Software Market Size

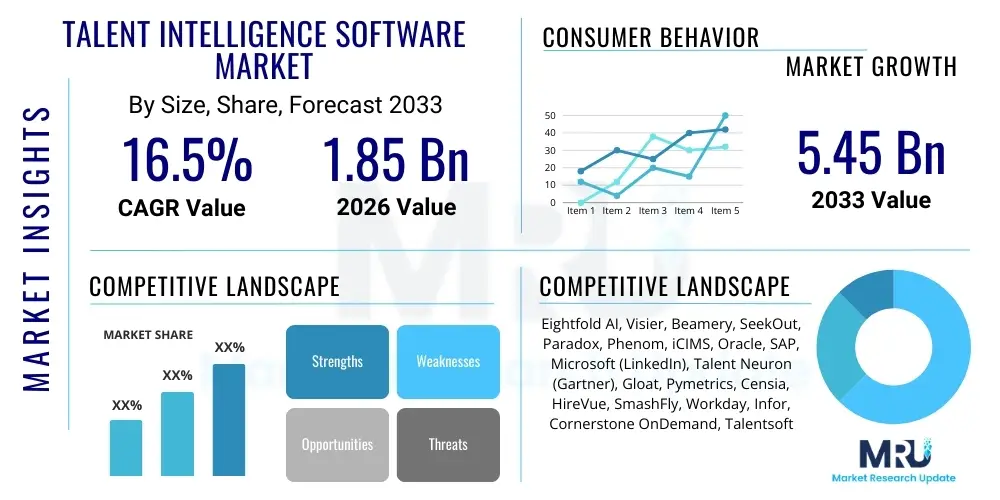

The Talent Intelligence Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $5.45 Billion by the end of the forecast period in 2033.

Talent Intelligence Software Market introduction

The Talent Intelligence Software Market encompasses a sophisticated suite of technologies designed to leverage data and analytics to inform strategic workforce planning, talent acquisition, retention, and development decisions. These platforms move beyond traditional HRIS functions by integrating external market data—such as competitor hiring trends, skill demand, compensation benchmarks, and passive candidate pools—with internal organizational data, including employee performance, internal mobility, and flight risk indicators. The core product offering involves advanced data aggregation, machine learning algorithms, and predictive modeling capabilities, enabling organizations to gain actionable insights into their current and future talent needs. Key solutions include sourcing optimization, skill gap analysis, internal talent marketplaces, and predictive hiring models, establishing Talent Intelligence as a critical strategic layer above conventional HR technology stacks.

Major applications of this software span the entire talent lifecycle, beginning with highly targeted recruitment strategies that identify and engage best-fit candidates, often before they actively seek new roles. Furthermore, these systems are crucial for workforce planning, allowing organizations to forecast future skill shortages based on business trajectory and technological shifts, thereby facilitating proactive training and development programs or targeted external hiring. The primary benefits realized by adopting Talent Intelligence platforms include a significant reduction in time-to-hire, improved quality of hire, enhanced employee retention rates through personalized career pathing, and overall optimization of human capital investments. By providing objective, data-driven insights, these tools mitigate subjective decision-making biases inherent in manual talent processes.

The market growth is primarily driven by the increasing complexity of global talent shortages, the rapid pace of digital transformation requiring new and specialized skills, and the imperative for businesses to remain competitive by effectively managing and mobilizing their workforce. Organizations are recognizing that human capital is their most valuable asset, and traditional methods of managing talent are insufficient to meet modern strategic demands. Consequently, the push toward data democratization within HR, coupled with advancements in artificial intelligence and natural language processing (NLP) capabilities, fundamentally drives the accelerated adoption of dedicated Talent Intelligence software across diverse industries.

Talent Intelligence Software Market Executive Summary

The Talent Intelligence Software Market is experiencing robust acceleration, underscored by significant business trends focusing on strategic workforce agility and data-driven decision-making in human resources. Current business trends indicate a strong pivot towards integrated platforms that offer end-to-end talent lifecycle visibility, moving away from fragmented point solutions. The emphasis is shifting from merely tracking HR metrics to leveraging deep predictive analytics to inform C-suite strategies, treating talent data as a primary business intelligence asset. Furthermore, the necessity for addressing profound skill gaps, particularly in technology and specialized engineering fields, mandates the use of these tools for both immediate sourcing and long-term skill development planning, fueling investments across large enterprises and technologically mature Small and Medium-sized Enterprises (SMEs). This operational shift is heavily influenced by the competitive landscape, where the ability to quickly acquire, understand, and retain top talent provides a distinct market advantage.

Regionally, North America maintains its dominance, driven by high technology adoption rates, the presence of major software vendors, and advanced enterprise readiness for complex data solutions. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth trajectory, propelled by massive workforces undergoing rapid digitalization, particularly in emerging economies like India and Southeast Asia, where companies are leapfrogging traditional HR practices directly into AI-powered intelligence systems. European markets are also growing steadily, though adoption is modulated by strict regulatory environments, notably the General Data Protection Regulation (GDPR), which necessitates vendors offering sophisticated data anonymization and compliance features. This regional disparity in regulatory complexity influences deployment models and feature prioritization among global providers.

Segment trends reveal that the Cloud deployment model is overwhelmingly preferred due to its scalability, lower upfront costs, and faster implementation timelines, aligning perfectly with the dynamic nature of talent acquisition needs. Large Enterprises remain the primary revenue generators due to their complex talent requirements and substantial budgets, yet the SME segment is quickly expanding, driven by affordable subscription-based (SaaS) offerings and simplified integration capabilities. From an application perspective, Recruitment and Strategic Workforce Planning segments hold the largest shares, reflecting the immediate business need to optimize external hiring and future-proof organizational skills. The software component segment continues to dominate revenue, but the associated professional services, including integration, customization, and data interpretation consulting, are rapidly increasing their market share as organizations require expert guidance to maximize the utility of advanced intelligence platforms.

AI Impact Analysis on Talent Intelligence Software Market

User queries regarding the impact of Artificial Intelligence primarily revolve around three critical themes: efficiency gains in sourcing and screening, the accuracy and ethical fairness of automated decisions, and the overall future role of human recruiters. Users frequently ask if AI-powered platforms can truly eliminate unconscious bias, how specific algorithms determine 'best fit' profiles, and the reliability of predictive modeling for employee flight risk. There is a strong expectation that AI will automate mundane tasks, freeing recruiters for strategic candidate engagement, but simultaneously, concerns linger about the 'black box' nature of complex algorithms and the need for explainable AI in high-stakes HR decisions. The synthesis of these questions indicates that while AI is seen as foundational to the next generation of talent intelligence, its implementation must prioritize transparency, verifiable ethical standards, and effective human-machine collaboration rather than complete replacement.

- AI significantly enhances predictive analytics capabilities, allowing for proactive identification of future skill needs and high-risk employee flight patterns.

- Natural Language Processing (NLP) rapidly analyzes vast amounts of structured and unstructured data (resumes, job descriptions, market trends) for superior pattern recognition and skill mapping.

- Automation of initial candidate sourcing, screening, and outreach functions leads to substantial improvements in recruitment efficiency and candidate experience personalization.

- The development and deployment of Ethical AI frameworks are critical to mitigate algorithmic bias and ensure equitable hiring and promotion decisions across diverse candidate pools.

- AI drives the creation of internal talent marketplaces, recommending personalized career pathways and training to employees based on organizational needs and individual profiles.

- Machine Learning (ML) models continuously refine job matching accuracy and forecasting models based on real-time hiring outcomes and performance data feedback loops.

DRO & Impact Forces Of Talent Intelligence Software Market

The Talent Intelligence Software Market is dynamically shaped by a potent combination of driving forces, inherent constraints, and emerging opportunities, all interacting to define the pace and direction of market growth. Primary drivers include the global intensification of the war for talent, which necessitates data-driven precision in hiring, coupled with the rapid digitalization of HR functions across industries seeking operational excellence. Restraints largely center on organizational inertia regarding technology adoption, significant upfront investment costs associated with comprehensive platform integration, and critical concerns surrounding data privacy compliance, especially in stringent regulatory environments like Europe. Opportunities abound in leveraging sophisticated predictive analytics for proactive workforce restructuring and the expansion of offerings tailored specifically for niche sectors, particularly professional services and highly regulated industries where talent specialization is paramount. These interacting forces collectively create a high-impact environment, accelerating innovation while simultaneously increasing the complexity of implementation and ensuring data governance.

A key driver is the undeniable strategic mandate for Chief Human Resources Officers (CHROs) and CEOs to possess real-time, accurate insight into the organization's human capital potential and risk. Traditional HR systems fail to provide this external market context, compelling investment in specialized intelligence platforms that map internal competencies against external market demand and competitor activity. However, the complexity of integrating these advanced systems with legacy Human Capital Management (HCM) infrastructure presents a significant restraint, often requiring costly and time-consuming custom API development or data migration projects. Furthermore, the successful deployment of Talent Intelligence hinges on the availability of high-quality, comprehensive data, and organizations frequently struggle with fragmented data sources and inconsistent data hygiene practices, limiting the efficacy of predictive models.

The overarching opportunities in this market segment lie in the refinement of specialized software modules and the integration of next-generation technologies. Specifically, there is substantial opportunity in offering deep vertical-specific solutions that cater precisely to the unique compliance and skill requirements of industries such as healthcare, finance, or highly technical manufacturing. Moreover, the evolution of talent intelligence platforms into comprehensive internal talent marketplace solutions presents a significant growth vector, fostering employee engagement, reducing turnover, and optimizing internal mobility. The increasing acceptance of remote and hybrid work models worldwide also presents an opportunity for talent intelligence software to effectively map, manage, and engage geographically dispersed workforces, providing essential insights into global talent pools and regulatory requirements.

Segmentation Analysis

The Talent Intelligence Software Market is comprehensively segmented based on various technical and operational criteria, reflecting the diverse needs of the global user base and the technological landscape of the offering. Key segmentation categories include deployment mode, enterprise size, component type, and specific application areas. This segmentation allows vendors to tailor their solutions effectively, addressing the unique scale requirements of large multinational corporations versus the budget constraints and integration simplicity needed by Small and Medium-sized Enterprises (SMEs). The component segment distinguishes between core software platform sales and high-value professional services, which often include implementation, training, and strategic consulting on interpreting intelligence data.

Analyzing segmentation provides critical insight into market dynamics. For instance, the deployment segment highlights the preference for flexible, scalable solutions, with the Cloud-based segment dominating market share due to its accessibility and ongoing advancements in security protocols. Conversely, the smaller On-Premise segment caters primarily to highly regulated sectors or organizations with stringent data sovereignty requirements. The Application segment reveals the immediate needs driving purchase decisions; while recruitment remains critical for addressing urgent shortages, the Workforce Planning segment is witnessing accelerating investment as organizations prioritize long-term strategic resiliency. Understanding these segmentation nuances is crucial for strategic positioning and product development within the competitive landscape.

- By Deployment Mode:

- Cloud-based

- On-Premise

- By Component:

- Software (Platform/Solution)

- Services (Consulting, Integration, Support)

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application:

- Recruitment and Sourcing

- Strategic Workforce Planning

- Talent Mobility and Retention

- Performance Management and Development

- Compensation and Benefits Benchmarking

Value Chain Analysis For Talent Intelligence Software Market

The value chain for the Talent Intelligence Software Market is fundamentally data-centric, beginning with data sourcing and culminating in the delivery of actionable strategic insights to the end-user. The upstream activities involve raw data acquisition, where proprietary external data providers (e.g., job board aggregators, social professional networks, compensation data firms) and internal data sources (e.g., HCM systems, performance reviews) feed information into the platform. This raw, often unstructured data is then subjected to sophisticated data processing, cleaning, and normalization by the core software developers, utilizing advanced NLP and ML algorithms to structure and interpret the information. Key activities at this stage include ethical data compliance checks and establishing secure data architecture, ensuring the integrity and usability of the intelligence generated.

Midstream activities are dominated by software development and platform refinement. Vendors invest heavily in R&D to enhance algorithmic accuracy, improve user interfaces, and build seamless integration capabilities (APIs) with existing enterprise systems. System integrators and implementation partners play a critical role here, customizing the standard software offering to meet specific organizational processes and data environments. These partners bridge the technical gap between the vendor’s general product and the client's complex, idiosyncratic data landscape. Effective value creation at this stage relies heavily on the ability to provide fast, reliable, and secure platform deployment, coupled with comprehensive training for HR and recruiting teams on utilizing the intelligence dashboard effectively.

Downstream distribution channels involve both direct sales and indirect partnerships. Direct sales channels, typically used for large enterprise accounts, provide tailored support, custom contracts, and high-touch strategic consulting directly from the vendor. Indirect channels involve value-added resellers (VARs), strategic technology alliances (e.g., partnerships with major HCM providers like SAP or Oracle), and global consulting firms. These indirect channels extend market reach, particularly into specialized geographical or industrial segments. The ultimate value delivery is the transformation of complex data into clear, strategic recommendations that directly influence business outcomes, such as decreasing operational costs associated with high turnover or accelerating market entry into new regions by identifying necessary local talent quickly.

Talent Intelligence Software Market Potential Customers

The primary consumers and potential customers of Talent Intelligence Software span a wide array of organizational functions and sizes, united by the strategic need to optimize human capital. The End-Users are predominantly Corporate HR Departments, specifically Talent Acquisition teams, Workforce Planning managers, and Strategic HR Business Partners, who rely on the software to transition from reactive to proactive talent strategies. Beyond HR, business leaders, including C-level executives (CEO, COO) and department heads, increasingly rely on the aggregated intelligence reports to make critical decisions regarding budgeting, geographical expansion, and succession planning. Essentially, any organization facing significant competition for skilled labor, experiencing high turnover, or undergoing rapid technological transition constitutes a prime potential customer.

Potential customers are classified both by industry and by operational complexity. Highly regulated industries such as Financial Services and Healthcare, which require specialized compliance skills and face intense scrutiny, are high-value buyers seeking predictive tools to manage risk and skill obsolescence. The Technology and Telecommunications sectors, driven by relentless innovation and the constant demand for highly specialized technical skills, are historically early and heavy adopters. Furthermore, manufacturing and logistics sectors, currently undergoing massive automation and digitization efforts, represent a burgeoning customer base seeking intelligence on operational technology (OT) skills and workforce retraining needs. Geographic location also defines potential customers, with multinational corporations (MNCs) requiring global talent mapping capabilities being particularly attractive clients for comprehensive platform providers.

The expansion of potential customers into the Small and Medium-sized Enterprise (SME) segment is a key market dynamic. While historically confined to large enterprises, the availability of robust, cost-effective, and easy-to-implement SaaS solutions has opened this market segment significantly. SMEs, despite having smaller budgets, often face disproportionately higher risks associated with a single bad hire or talent loss. Therefore, they seek streamlined, user-friendly solutions that offer high-impact intelligence without requiring dedicated data science teams. These potential customers prioritize rapid time-to-value and strong integration capabilities with common business tools, making them a crucial target for vendors specializing in tiered, subscription-based models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $5.45 Billion |

| Growth Rate | CAGR 16.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eightfold AI, Visier, Beamery, SeekOut, Paradox, Phenom, iCIMS, Oracle, SAP, Microsoft (LinkedIn), Talent Neuron (Gartner), Gloat, Pymetrics, Censia, HireVue, SmashFly, Workday, Infor, Cornerstone OnDemand, Talentsoft |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Talent Intelligence Software Market Key Technology Landscape

The technological backbone of the Talent Intelligence Software Market is defined by the convergence of Big Data processing capabilities, sophisticated machine learning (ML) algorithms, and advanced natural language processing (NLP). Central to these platforms is the ability to ingest and rapidly process massive, heterogeneous datasets—both internal organizational data and external market intelligence—using robust cloud-native architecture. Big Data platforms, typically utilizing technologies like Hadoop or Spark, are essential for storing and managing the scale of information required for meaningful trend analysis. Furthermore, the effectiveness of the intelligence generated is entirely dependent on the quality and performance of proprietary ML models, which are constantly trained and refined to improve predictive accuracy for metrics like candidate success likelihood, employee turnover risk, and required skill transition velocity. Vendors are heavily investing in developing advanced deep learning models to handle nuanced data inputs, such as analyzing contextual information from job postings and online professional profiles.

Natural Language Processing (NLP) is a critical enabling technology, essential for transforming unstructured text data—resumes, performance reviews, organizational documents, and job descriptions—into structured, usable features for algorithmic analysis. NLP enables powerful semantic search capabilities, ensuring that talent mapping extends beyond simple keyword matching to understanding contextual skills and professional experience. Beyond core data processing, API integration frameworks are paramount, facilitating seamless, real-time data exchange with various Human Capital Management (HCM) suites, Applicant Tracking Systems (ATS), and Customer Relationship Management (CRM) tools. This interoperability is non-negotiable for enterprise adoption, allowing Talent Intelligence platforms to function as the strategic brain layer atop existing operational HR technology infrastructure, extracting value without forcing a complete system overhaul.

Looking forward, the technology landscape is being significantly influenced by the development of Explainable AI (XAI) and frameworks for ethical bias mitigation. As Talent Intelligence systems increasingly influence critical decisions—such as who is sourced, who is promoted, and who is trained—there is growing demand for models that can provide transparent reasoning for their recommendations, moving beyond simple correlational analysis. Vendors are integrating dedicated audit trails and bias detection modules that monitor data inputs and algorithmic outputs for potential discriminatory patterns. This emphasis on governance, transparency, and ethical computation, coupled with the increasing adoption of generative AI techniques for content creation (e.g., job descriptions, personalized outreach), defines the frontier of technological differentiation in the Talent Intelligence Software Market, ensuring that innovation aligns with regulatory compliance and social responsibility.

Regional Highlights

North America currently stands as the dominant market for Talent Intelligence Software, characterized by high technological maturity, extensive investment in cloud computing infrastructure, and the presence of a majority of the leading market innovators and providers. The strong emphasis placed on data-driven decision-making within large U.S. and Canadian enterprises, combined with a highly competitive labor market across the technology, finance, and healthcare sectors, fuels robust demand. Organizations in this region are advanced in integrating HR technology strategically, viewing Talent Intelligence as an essential tool for maintaining competitive advantage and navigating complex, constantly shifting skill requirements. Furthermore, high VC funding for HR Tech startups ensures continuous innovation and rapid deployment of advanced ML and AI features, setting global benchmarks for product sophistication and functionality.

Europe represents the second-largest market, exhibiting strong growth driven by digitalization efforts across the UK, Germany, France, and the Nordic countries. The European market, however, is heavily shaped by strict data protection regulations, most notably the GDPR (General Data Protection Regulation). This regulatory environment necessitates that vendors offer exceptionally robust data governance, anonymization, and security features, often requiring localized data processing capabilities. European businesses are increasingly investing in Talent Intelligence primarily for internal mobility and skill gap analysis, driven by aging workforces and the need to reskill existing employees efficiently. Adoption rates are steady but cautious, prioritizing compliance and integration seamlessness over speed of deployment, often favoring solutions that demonstrate proven reliability within complex regulatory frameworks.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period, fueled by rapid economic expansion, massive workforce populations, and accelerated adoption of cloud infrastructure across countries like China, India, Australia, and Singapore. The sheer scale of hiring and workforce management challenges in APAC necessitates sophisticated automation and intelligence tools. Organizations in this region are often leapfrogging older HR technologies, adopting advanced AI-powered platforms directly to manage hyper-growth and dynamic market changes. Singapore and Australia serve as regional innovation hubs, mirroring North American adoption rates, while emerging markets like India show massive potential due to a large, rapidly professionalizing workforce seeking career development and skill matching facilitated by internal talent intelligence platforms. Investment is strong, driven by regional manufacturing giants and the burgeoning tech ecosystem.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for Talent Intelligence Software, demonstrating increasing, albeit localized, demand. In LATAM, economic stability improvements and increased foreign investment drive the need for professionalized talent management, with countries like Brazil and Mexico leading the adoption charge, particularly among multinational subsidiaries. The MEA region, heavily influenced by government-led digital transformation initiatives (e.g., Saudi Vision 2030, UAE's tech focus), shows significant growth potential. Investments are concentrated in high-value sectors such as oil and gas, finance, and government services, where skill scarcity and large-scale workforce localization mandates require precise, data-driven intelligence solutions. These regions often rely heavily on global vendors who can provide localized support and handle cross-border data requirements efficiently.

- North America: Market leader due to technological maturity, high competition for specialized talent, and strong vendor presence.

- Europe: High growth potential, heavily influenced by GDPR compliance, focusing on internal mobility and workforce reskilling.

- Asia Pacific (APAC): Fastest growing region, driven by massive workforces, rapid digitalization, and leapfrogging technology adoption, especially in recruitment and sourcing applications.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets showing strong localized growth, driven by digital transformation mandates and foreign investment requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Talent Intelligence Software Market.- Eightfold AI

- Visier

- Beamery

- SeekOut

- Paradox

- Phenom

- iCIMS

- Oracle

- SAP

- Microsoft (LinkedIn Talent Solutions)

- Talent Neuron (Gartner)

- Gloat

- Pymetrics (a Harver company)

- Censia

- HireVue

- SmashFly (Symphony Talent)

- Workday

- Infor

- Cornerstone OnDemand

- Talentsoft (Saba Software)

Frequently Asked Questions

Analyze common user questions about the Talent Intelligence Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Talent Intelligence Software and standard HCM/HRIS platforms?

Talent Intelligence Software differs primarily by its strategic focus on external market data and predictive analytics. While HCM/HRIS platforms manage internal operational HR data (payroll, employee records), Talent Intelligence integrates external context (skill demand, competitor hiring, compensation benchmarks) to inform future strategy and risk, acting as a predictive layer.

How does Talent Intelligence Software help mitigate bias in the hiring process?

These platforms mitigate bias by standardizing skill assessment criteria, focusing on objective data points over subjective interpretations, and implementing specialized ethical AI algorithms that audit and flag potentially biased language in job descriptions or historical hiring patterns. This promotes fairness through structured, data-driven decision-making.

Is cloud deployment mandatory for utilizing advanced Talent Intelligence features?

While not strictly mandatory, the vast majority of advanced Talent Intelligence features, particularly those requiring real-time external data scraping, large-scale processing, and frequent model updates (AI/ML), are most effectively and efficiently delivered via scalable, cloud-based (SaaS) deployment models. On-premise options are generally reserved for organizations with highly restrictive data sovereignty requirements.

What industries are showing the fastest adoption rate of Talent Intelligence platforms?

The Technology and Telecommunications, Financial Services, and Professional Services sectors currently show the fastest adoption rates globally. These industries are characterized by intense competition for highly specialized skills, rapid technological change, and the urgent need for strategic workforce planning to maintain market relevance.

What are the greatest implementation challenges for new adopters of this technology?

The greatest challenges typically involve integrating the new platform with existing legacy Human Capital Management (HCM) and Applicant Tracking Systems (ATS), ensuring robust data quality and hygiene across all integrated sources, and addressing internal organizational change management to ensure HR teams effectively adopt and trust the data-driven insights provided by the software.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager