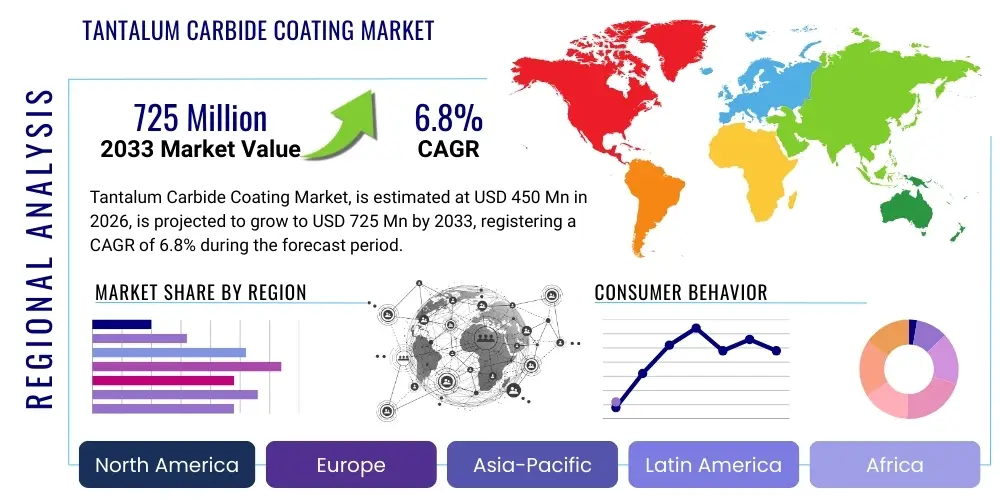

Tantalum Carbide Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438245 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Tantalum Carbide Coating Market Size

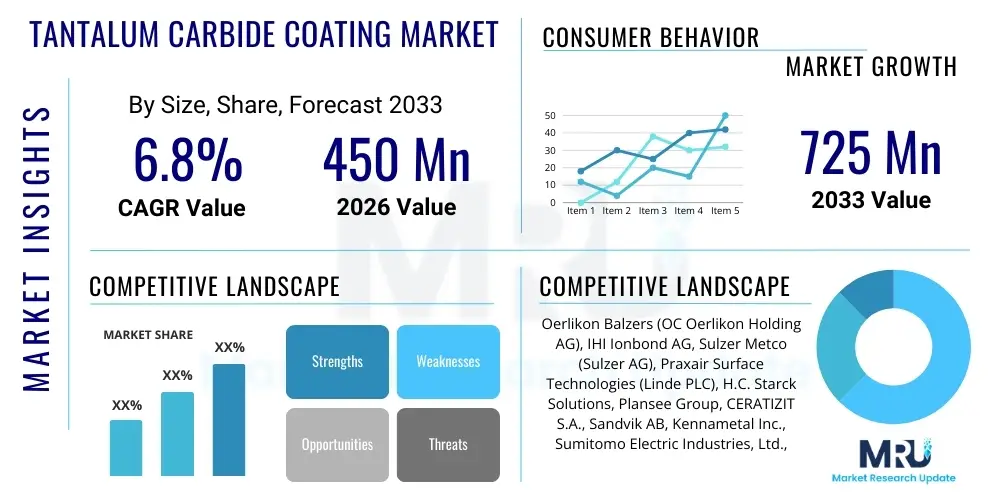

The Tantalum Carbide Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 725 million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing demand for high-performance materials capable of operating under extreme thermal and mechanical stress across critical industries such as aerospace, defense, and high-speed machining.

Tantalum Carbide Coating Market introduction

The Tantalum Carbide (TaC) Coating Market encompasses the deposition and application of TaC thin films onto various substrate materials to enhance surface properties. Tantalum Carbide, a refractory ceramic material, is renowned for its exceptional characteristics, including ultra-high hardness, remarkable resistance to wear, superior thermal stability, and chemical inertness, making it indispensable in severe operating environments. These coatings are typically applied using advanced vacuum deposition techniques, such as Chemical Vapor Deposition (CVD) or Physical Vapor Deposition (PVD), ensuring excellent adhesion and uniformity across complex geometries.

Major applications of TaC coatings span across sophisticated industrial sectors. In the manufacturing sector, TaC coatings significantly prolong the lifespan of cutting tools, inserts, and molds used for processing high-strength alloys, thereby improving efficiency and reducing downtime. Within the aerospace and defense industries, these coatings are vital for components exposed to high-velocity erosion and thermal cycling, such as turbine blades, rocket nozzles, and protective barriers. Furthermore, the nuclear industry utilizes Tantalum Carbide for its low neutron cross-section and corrosion resistance in reactor components and cladding.

The principal benefits driving market adoption include enhanced operational longevity, improved product performance stability at temperatures exceeding 2000°C, and significant cost savings derived from reduced component replacement frequency. Key driving factors fueling market growth are the accelerating globalization of advanced manufacturing, intensified investment in hypersonic and high-thrust propulsion systems within the defense sector, and the persistent need for materials that can withstand highly corrosive and abrasive industrial processes. The continuous advancement in deposition technologies is further lowering application costs and expanding the viability of TaC coatings into new commercial areas.

Tantalum Carbide Coating Market Executive Summary

The Tantalum Carbide Coating market is characterized by intense technological competition and strategic vertical integration among key players aiming to control the supply chain from raw material sourcing (Tantalum metal) to specialized coating services. Business trends indicate a strong pivot towards customized coating solutions, focusing on multi-layer and gradient coatings that offer superior performance characteristics compared to monolithic TaC layers. Research and Development (R&D) efforts are concentrated on improving deposition efficiency and reducing the internal stresses within the coating layer, which is crucial for maximizing tool life. Furthermore, sustainability is becoming a key market differentiator, pushing companies to explore more environmentally friendly deposition precursors and processes.

Geographically, the Asia Pacific (APAC) region currently dominates the market and is projected to maintain the highest growth trajectory, fueled by expansive growth in electronics manufacturing, rapid industrialization in nations like China and India, and increasing regional investment in high-precision tooling for the automotive and energy sectors. North America and Europe, while representing mature markets, exhibit strong demand primarily from high-value defense, aerospace maintenance, repair, and overhaul (MRO), and specialized medical device manufacturing sectors. Regional trends suggest that localization of advanced coating facilities near major manufacturing hubs is critical for securing market share due to the sensitive nature of the coated products and the need for rapid turnaround times.

Segmentation trends highlight that the cutting tools segment remains the largest end-user category due to the sheer volume of metalworking operations globally. However, the aerospace and defense segment is anticipated to register the fastest growth rate, propelled by next-generation aircraft and missile development requiring materials with unparalleled thermal stability. Technology-wise, Chemical Vapor Deposition (CVD) holds a significant market share due to its superior conformity, but Physical Vapor Deposition (PVD) techniques, particularly magnetron sputtering, are gaining traction due to lower substrate temperature requirements and better control over film morphology, making them suitable for thermally sensitive components.

AI Impact Analysis on Tantalum Carbide Coating Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the high complexity and cost associated with optimizing TaC coating processes. Common questions revolve around predictive maintenance for expensive PVD/CVD equipment, optimizing precursor flow rates and temperature gradients to achieve desired stoichiometry and crystalline structure, and reducing material waste through precise process control. Users are keen to understand how machine learning models can accelerate the discovery of novel deposition parameters that yield defect-free, ultra-hard coatings suitable for extreme environments, thereby moving away from traditional, time-consuming trial-and-error methods. There is significant expectation that AI will standardize quality control across different batches and geographical locations, addressing major inconsistencies inherent in complex vacuum coating operations.

The integration of AI and Machine Learning (ML) is beginning to revolutionize the Tantalum Carbide coating landscape by moving process control from manual empirical adjustments to data-driven predictive modeling. AI algorithms are particularly effective in analyzing vast datasets generated by real-time monitoring sensors within CVD/PVD reactors, correlating parameters like plasma density, bias voltage, and gas mixture ratios with final coating properties such as microhardness, adhesion, and film thickness uniformity. This capability allows manufacturers to achieve 'first-time-right' manufacturing of highly specialized TaC coatings, drastically reducing scrap rates and lowering overall production costs, which is a major restraint for the market.

Furthermore, AI-driven simulations are being utilized for virtual material design, predicting how alloying elements or composite structures incorporating TaC nanoparticles will behave under specific operational stresses, such as thermal shock or high-velocity impact. This shortens the material qualification phase, enabling quicker introduction of advanced TaC coating variations to demanding markets like semiconductors (where extreme purity is essential) and specialized tooling. The primary impact is enhanced efficiency, superior quality control, and accelerated innovation cycles, positioning AI as a crucial enabler for market expansion.

- AI-driven optimization of CVD/PVD parameters, leading to superior coating quality and reduced deposition time.

- Predictive maintenance analytics for high-cost coating equipment, minimizing unplanned downtime and operational expenditure.

- Machine learning models used for defect classification and automated inspection, ensuring high batch consistency and quality control (QC).

- Accelerated discovery of novel TaC composite material compositions and microstructure designs through virtual screening.

- Supply chain optimization for Tantalum raw material, predicting demand fluctuation and managing inventory based on real-time market signals.

DRO & Impact Forces Of Tantalum Carbide Coating Market

The Tantalum Carbide Coating market is shaped by a confluence of accelerating demand from high-technology sectors (Drivers), balanced against significant material and technological challenges (Restraints), opening avenues for expansion into new applications (Opportunities), all interacting through external market dynamics (Impact Forces). A primary driver is the global emphasis on enhancing energy efficiency and reducing component failure rates in demanding machinery, necessitating the use of extremely hard and thermally stable refractory coatings like TaC. However, the high capital expenditure required for sophisticated deposition equipment and the inherent complexity of achieving uniform coating thickness on intricate parts serve as major restraints. The opportunity lies in the burgeoning electric vehicle (EV) manufacturing and semiconductor industries, which require specialized tooling and components that can withstand extremely high-purity and abrasive environments. These market dynamics are significantly impacted by geopolitical instability affecting Tantalum supply chains and stringent environmental regulations governing chemical handling in deposition processes.

Key drivers include the burgeoning aerospace and defense expenditure globally, particularly in countries investing heavily in hypersonic flight technology where TaC's high melting point (3880°C) is critical for thermal protection systems. The expansion of high-speed CNC machining and the trend towards dry cutting in the metalworking industry also mandate the use of superior wear-resistant coatings, thereby fueling the demand for TaC. Restraints are primarily tied to the high cost and volatility of Tantalum raw materials, which are often sourced from politically sensitive regions, alongside the technical difficulty and energy intensity of the PVD/CVD processes required to achieve industrial-scale deposition with precision. Furthermore, scaling up novel TaC coating techniques from laboratory to mass production remains a considerable technological hurdle.

Opportunities are strongly evident in the photovoltaic and advanced electronics sectors, where Tantalum Carbide films can be used for diffusion barriers or protective layers due to their chemical inertness and high density. The development of advanced composite materials, such as TaC reinforced ceramics, also offers a significant growth avenue. The market’s impact forces include intense competition from alternative hard coatings like Tungsten Carbide (WC) and specialized Diamond-Like Carbon (DLC), requiring continuous innovation in TaC coating performance. Regulatory compliance, especially concerning industrial emissions from CVD processes, and the strategic importance of Tantalum in national defense portfolios also exert significant external pressure and influence market strategies.

Segmentation Analysis

The Tantalum Carbide Coating market is systematically segmented based on Technology, Application, and End-User Industry, reflecting the diversity of material requirements across various industrial sectors. The technology segment differentiates between the high-temperature, high-conformal nature of Chemical Vapor Deposition (CVD) and the lower-temperature, physically driven processes of Physical Vapor Deposition (PVD). Application segmentation focuses on the functional use, distinguishing between components requiring enhanced wear resistance (e.g., cutting tools) and those needing superior thermal protection and chemical stability (e.g., aerospace components and nuclear systems). This multi-dimensional segmentation allows for precise market sizing and strategic targeting based on specific material performance criteria required by end-users.

The dominance of specific segments is closely linked to industrial capital spending. The cutting tools segment consistently accounts for the largest volume consumption due to the continuous cycle of tool wear and replacement across global manufacturing facilities. However, the aerospace and defense segment, while lower in volume, commands higher revenue due to the critical nature and high value of the components coated, necessitating premium, certified TaC processes. The increasing regulatory emphasis on durability and operational safety in high-stress environments, particularly in the energy and nuclear sectors, is further validating the high cost associated with TaC coatings.

Future growth is expected to be catalyzed by the semiconductor and electronics segment, driven by the demand for ultra-pure, ultra-hard materials required for advanced fabrication techniques. As chip geometries shrink and etching processes become more demanding, the unique resistance profile of TaC positions it as a preferred material for critical chamber components. This shift indicates a gradual transition in focus from traditional industrial tooling towards high-tech, precision engineering applications, demanding greater sophistication in deposition control and quality assurance methodologies.

- By Technology:

- Chemical Vapor Deposition (CVD)

- Physical Vapor Deposition (PVD)

- Others (including Atomic Layer Deposition (ALD) and Thermal Spray)

- By Application:

- Cutting Tools and Inserts

- Wear Parts and Molds

- Thermal Barrier Coatings (TBC)

- Diffusion Barriers

- By End-User Industry:

- Aerospace and Defense

- Automotive and Transportation

- Semiconductors and Electronics

- Nuclear and Energy

- Industrial Manufacturing and Metalworking

Value Chain Analysis For Tantalum Carbide Coating Market

The value chain for the Tantalum Carbide Coating market is characterized by a high degree of specialization and integration, starting with the complex and geographically concentrated sourcing of raw Tantalum. The upstream analysis focuses on the mining and purification of Tantalum ores (tantalite), followed by the chemical conversion into high-purity Tantalum Carbide powder, a process requiring significant energy and expertise. Because Tantalum is considered a conflict mineral and its supply chain is often subject to geopolitical risks, securing a stable and ethical supply of high-grade TaC precursor material is a foundational challenge for the entire market. Only a few specialized chemical manufacturers possess the capability to produce TaC powder suitable for advanced CVD/PVD processes.

The midstream of the value chain involves the manufacturing of sophisticated coating equipment (CVD/PVD reactors) and the actual deposition service providers. Equipment manufacturing is dominated by global technology leaders, providing customized, high-vacuum systems. The coating service phase, where Tantalum Carbide is applied, requires highly skilled technical personnel and significant capital investment in cleanroom facilities. The distribution channel is predominantly direct, especially for high-value applications in aerospace and nuclear, where Original Equipment Manufacturers (OEMs) often work directly with certified coating specialists. For high-volume cutting tool applications, distribution may involve specialized industrial distributors or tool supply houses.

Downstream analysis centers on the integration of coated components into the final product. Direct sales are common for bespoke items, ensuring quality control and intellectual property protection between the coater and the end-user (e.g., jet engine manufacturer). Indirect sales routes exist primarily for standard industrial tools and wear parts, relying on established global distribution networks. Critical success factors across the chain include maintaining material purity to avoid coating defects, ensuring process scalability, and achieving necessary industry certifications (e.g., AS9100 for aerospace) to access premium markets, thereby reinforcing the market's high barrier to entry.

Tantalum Carbide Coating Market Potential Customers

Potential customers for Tantalum Carbide coatings are found within industries that operate components under extreme thermal, mechanical, or chemical conditions, prioritizing durability and performance longevity over initial material cost. The primary buyers are large multinational corporations and governmental agencies involved in sophisticated manufacturing and national security. Tooling manufacturers represent a core customer base, consistently requiring hard, inert coatings for their inserts, drills, and end mills used in processing superalloys like Inconel and titanium for the energy and aerospace sectors. These companies value TaC for its ability to extend tool life by several orders of magnitude compared to conventional coatings.

The aerospace and defense sector, including major jet engine manufacturers (OEMs) and specialized military contractors, constitutes another critical customer segment. These buyers utilize TaC coatings for components operating in the hot sections of gas turbines, rocket nozzles, and erosion shields, where temperatures exceed the limits of most other materials. Here, the purchase decision is heavily influenced by certified reliability, adherence to strict performance specifications, and the ability of the coating provider to handle complex component geometries and deliver traceability.

Emerging, high-growth customer segments include semiconductor fabrication facilities (fabs) and specialized medical device manufacturers. In semiconductors, TaC is used to protect reactor chambers and component tooling from aggressive plasma etching environments, demanding ultra-high purity and etch resistance. Nuclear power operators and fuel rod manufacturers also remain significant buyers, utilizing TaC’s specific nuclear properties and corrosion resistance for internal reactor infrastructure and cladding applications. Procurement in these sectors involves highly technical consultation and long-term supply contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 725 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oerlikon Balzers (OC Oerlikon Holding AG), IHI Ionbond AG, Sulzer Metco (Sulzer AG), Praxair Surface Technologies (Linde PLC), H.C. Starck Solutions, Plansee Group, CERATIZIT S.A., Sandvik AB, Kennametal Inc., Sumitomo Electric Industries, Ltd., Miba AG, Advanced Refractory Metals, Plasma-Therm LLC, Richter Precision Inc., Vapor Technologies Inc., Federal-Mogul LLC, VST Enameled Wires, CoorsTek Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tantalum Carbide Coating Market Key Technology Landscape

The Tantalum Carbide coating market relies heavily on advanced vacuum deposition techniques, where Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) remain the core technologies. CVD involves reacting gaseous precursors (often Tantalum halides and hydrocarbons) on a heated substrate surface to form a dense, highly conformal coating. Its key advantage is the ability to coat complex internal geometries uniformly, making it preferred for intricate aerospace and reactor components. However, CVD requires high processing temperatures (often above 1000°C), which limits its use on thermally sensitive substrates and can lead to thermal stress issues.

In contrast, PVD methods, such as magnetron sputtering and cathodic arc deposition, operate at lower temperatures, preserving the integrity of underlying materials, and offer better control over film microstructure and residual stresses. PVD processes typically involve bombarding a TaC target with high-energy ions to deposit the material onto the substrate. Recent technological advancements in PVD focus on High Power Impulse Magnetron Sputtering (HiPIMS), which achieves denser, smoother films with enhanced adhesion, bridging some of the performance gaps traditionally seen between PVD and CVD. These innovations are critical for applications demanding exceptional surface finish and precision, such as in high-precision micro-tooling.

Beyond the primary techniques, emerging technologies like Atomic Layer Deposition (ALD) are gaining traction, especially in the semiconductor segment. ALD provides ultimate control over film thickness at the atomic level, enabling the deposition of ultra-thin, highly conformal TaC layers crucial for diffusion barriers and gate electrode materials in microelectronics. Another area of innovation involves hybrid processes that combine elements of CVD and PVD, aiming to leverage the benefits of both techniques—achieving both excellent conformity and high film density simultaneously. Continuous investment in process monitoring and control systems, often integrated with AI, is essential to maximize the efficiency and repeatability of these complex, high-vacuum deposition technologies.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Potential

- North America: Focus on High-Value Aerospace and Defense Applications

- Europe: Advanced Tooling and Automotive Innovation

- Latin America (LATAM), Middle East, and Africa (MEA): Emerging Markets and Resource-Driven Demand

The APAC region is the undisputed leader in the Tantalum Carbide Coating market, driven by its expansive and rapidly maturing manufacturing sector, particularly in China, Japan, South Korea, and India. This dominance stems from massive investments in automotive production, electronic device manufacturing (requiring TaC for specialized wafer handling and etching components), and general industrial machinery. China, in particular, showcases robust internal demand for high-performance cutting tools to support its advanced metalworking industries. The relatively lower operational costs and the rapid adoption of advanced PVD and CVD facilities contribute significantly to the region's market volume. Future growth is projected to remain strongest here, supported by government initiatives promoting domestic high-tech industrial self-sufficiency, although geopolitical trade tensions present a potential risk to the raw material supply chain.

North America holds a substantial market share, defined by its strong reliance on the aerospace, defense, and oil and gas sectors. The U.S. defense industrial base is a major consumer of TaC coatings for mission-critical components requiring extreme temperature tolerance, such as those used in hypersonic weapons systems and advanced fighter jet engines. The region leads in R&D, focusing heavily on next-generation coating formulations and certified processes compliant with stringent regulatory standards (e.g., FAA regulations). While manufacturing output is not as voluminous as APAC, the high value associated with certified components in defense and specialized medical devices ensures premium pricing and stable demand, driven primarily by technological specifications rather than cost competition.

Europe represents a mature but technologically advanced market, particularly dominant in the high-precision tooling and premium automotive sectors (Germany, Switzerland). European manufacturers prioritize quality, long-term performance, and adherence to stringent environmental, social, and governance (ESG) standards, which influence coating process selection. The demand for TaC is strong within European tool manufacturers that supply specialized molds and dies for complex component fabrication, including those used in the transition to electric vehicle (EV) components, requiring corrosion resistance and wear parts optimization. Continued innovation in deposition equipment manufacturing and strong academic research institutions focused on materials science reinforce Europe's position as a key innovation hub in TaC coating technology.

LATAM and MEA represent emerging markets with growth centered around resource extraction and localized industrialization. In the Middle East and Africa, demand is primarily driven by the oil and gas sector, where TaC coatings protect drilling equipment, valves, and pipelines from severe abrasion and corrosion in extreme downhole conditions. Latin America’s demand is tied to mining and automotive maintenance. These regions often rely on imported coated tools or service providers from North America and Europe, but increasing local investment in industrial infrastructure suggests a potential for localized coating facility establishment in the long term, particularly to service critical national industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tantalum Carbide Coating Market.- Oerlikon Balzers (OC Oerlikon Holding AG)

- IHI Ionbond AG

- Sulzer Metco (Sulzer AG)

- Praxair Surface Technologies (Linde PLC)

- H.C. Starck Solutions

- Plansee Group

- CERATIZIT S.A.

- Sandvik AB

- Kennametal Inc.

- Sumitomo Electric Industries, Ltd.

- Miba AG

- Advanced Refractory Metals

- Plasma-Therm LLC

- Richter Precision Inc.

- Vapor Technologies Inc.

- Federal-Mogul LLC

- Vaupell (a subsidiary of TriMas Corporation)

- CoorsTek Inc.

- Saint-Gobain S.A.

- Müller & Schade AG

Frequently Asked Questions

Analyze common user questions about the Tantalum Carbide coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Tantalum Carbide coatings?

The primary applications driving demand are high-performance cutting tools for machining aerospace superalloys, thermal barrier coatings for jet engine components and rocket nozzles, and protective layers in high-purity semiconductor processing equipment due to TaC's exceptional hardness and thermal stability.

Which deposition technologies are predominantly used for applying Tantalum Carbide coatings?

Tantalum Carbide coatings are predominantly applied using Chemical Vapor Deposition (CVD), which provides superior conformity on complex shapes, and Physical Vapor Deposition (PVD), including sputtering and cathodic arc techniques, which allow for lower processing temperatures and better control over film morphology and stress.

What is the key advantage of Tantalum Carbide over other hard coatings like Tungsten Carbide (WC)?

Tantalum Carbide possesses an ultra-high melting point (near 3880°C), significantly higher than Tungsten Carbide, making it superior for extreme high-temperature and high-wear environments, particularly in critical aerospace and defense components where thermal degradation is a major concern.

Which geographic region is expected to lead the Tantalum Carbide Coating market growth?

The Asia Pacific (APAC) region is expected to lead the Tantalum Carbide Coating market growth, driven by rapid industrialization, massive expansion in electronics manufacturing, and increasing regional investment in sophisticated tooling and industrial machinery across countries like China and India.

What are the main market restraints impacting the growth of Tantalum Carbide coatings?

The main market restraints include the high capital investment required for advanced PVD/CVD deposition equipment, the inherent technical complexity of achieving uniform, high-quality films, and the cost and supply chain volatility associated with sourcing Tantalum, which is often a geopolitically sensitive refractory metal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager