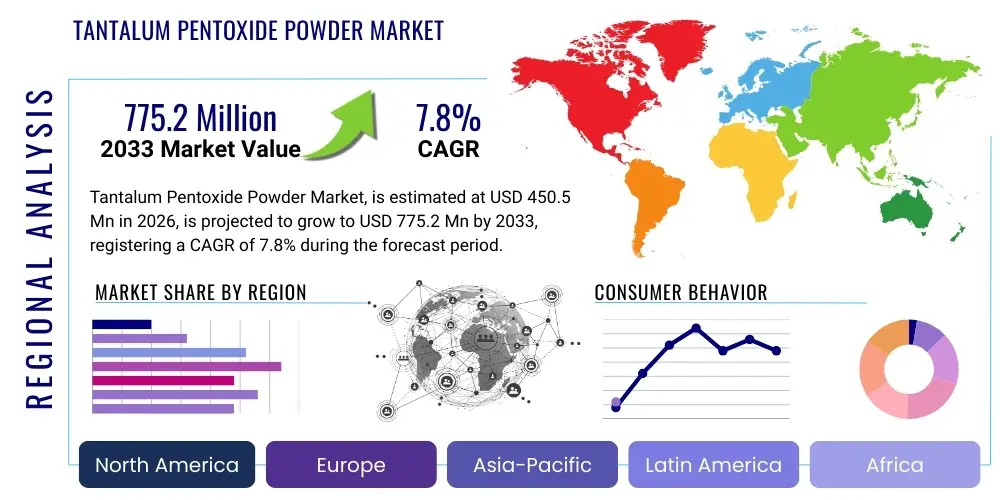

Tantalum Pentoxide Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438993 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tantalum Pentoxide Powder Market Size

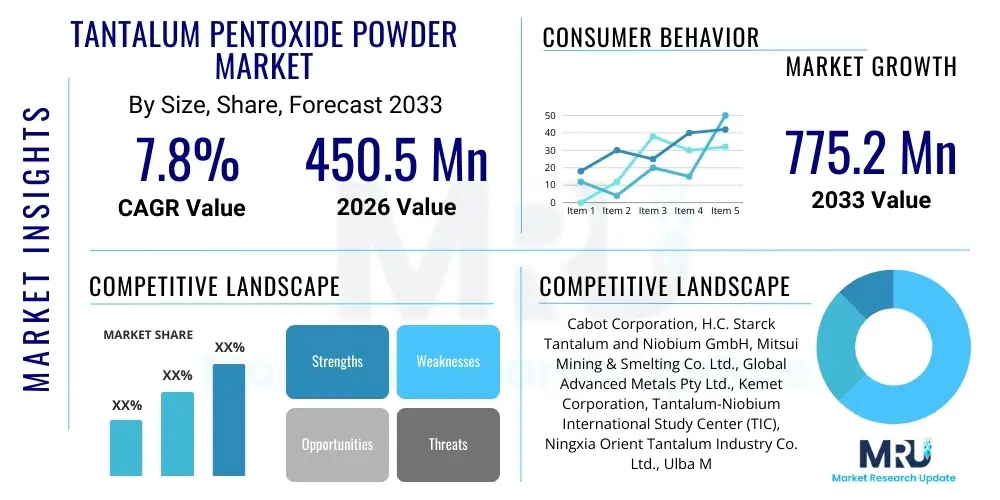

The Tantalum Pentoxide Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 775.2 Million by the end of the forecast period in 2033.

Tantalum Pentoxide Powder Market introduction

Tantalum Pentoxide ($\text{Ta}_2\text{O}_5$) powder, a white, high-melting-point inorganic compound, serves as a crucial material across advanced technological sectors due to its exceptional dielectric properties and high refractive index. As the primary oxide of tantalum, $\text{Ta}_2\text{O}_5$ is fundamentally important in the manufacture of high-capacitance capacitors, particularly tantalum electrolytic capacitors, which are indispensable components in miniaturized electronic devices such as smartphones, laptops, and automotive electronics. Its high dielectric constant allows for significant charge storage in small volumes, driving its necessity in the trend toward smaller, more powerful electronic gadgets. Furthermore, its chemical stability and resistance to corrosion expand its application profile beyond electronics into specialized chemical processing and medical implants, ensuring a sustained high demand globally, particularly from the Asia Pacific region which dominates electronics manufacturing.

The product description encompasses various purity grades, ranging from standard 99.9% purity used in general ceramic applications to ultra-high purity grades (99.999% and above) critical for advanced semiconductor fabrication and precision optical coatings. These variations in purity directly influence the performance and cost, targeting niche segments requiring minimal impurity interference. Major applications center around thin-film deposition for semiconductor memory (DRAM and embedded memory), where $\text{Ta}_2\text{O}_5$ is utilized as a high-k dielectric gate insulator, and in multilayer ceramic capacitors (MLCCs) where its stability is paramount. The benefits derived from using Tantalum Pentoxide powder include enhanced device reliability, reduced power consumption in semiconductor devices, superior optical transmission characteristics in infrared applications, and excellent adhesion properties when used in sputtering targets or chemical vapor deposition (CVD) precursors.

The market is primarily driven by the exponential growth in consumer electronics, the pervasive rollout of 5G infrastructure, and the surging demand for electric vehicles (EVs) which require high-performance, compact power management systems utilizing tantalum capacitors. Moreover, increasing investments in renewable energy infrastructure, such as solar panels and high-efficiency power converters, also leverage the stable and high-performance characteristics of $\text{Ta}_2\text{O}_5$-based components. Technological advancements in deposition techniques, such as Atomic Layer Deposition (ALD), are making ultra-thin $\text{Ta}_2\text{O}_5$ films achievable with higher precision, further cementing its role as a cornerstone material in next-generation microelectronics and advanced materials science, thereby sustaining robust market expansion throughout the forecast period.

Tantalum Pentoxide Powder Market Executive Summary

The Tantalum Pentoxide Powder Market exhibits strong growth momentum, primarily fueled by the sustained expansion of the global semiconductor industry and the ongoing trend of electronic miniaturization. Business trends highlight a consolidation among major raw material suppliers (tantalum ore processors) and key powder manufacturers, focusing on vertically integrated supply chains to ensure control over purity and pricing, especially for electronic-grade powders. Strategic investments are heavily skewed towards improving ALD and CVD precursor technologies to achieve higher purity and better film uniformity essential for 3D NAND and advanced logic chips. Regionally, the Asia Pacific (APAC) remains the dominant market, driven by massive manufacturing bases in China, South Korea, Taiwan, and Japan, which collectively account for the vast majority of global capacitor and semiconductor production. North America and Europe show steady demand, primarily driven by specialized defense, aerospace, and high-reliability industrial applications, emphasizing ultra-high purity powders and advanced sputtering targets.

Segment trends reveal that the Electronic Grade Tantalum Pentoxide powder (purity 99.99% and above) is the fastest-growing category, reflecting the intense focus of the industry on advanced microelectronics where impurities even at the ppm level can cause device failure. Within applications, the capacitor segment, particularly high-reliability tantalum chip capacitors, maintains the largest market share but the thin-film application segment, crucial for semiconductor high-k dielectrics, is expanding rapidly due to its fundamental role in scaling down transistor dimensions. The growing adoption of advanced packaging technologies and heterogenous integration within the semiconductor sphere further necessitates highly controlled $\text{Ta}_2\text{O}_5$ powder characteristics, leading to greater specialization among manufacturers and a subsequent premium placed on certified, ultra-pure materials necessary for consistent device yield.

In summary, the market outlook is overwhelmingly positive, characterized by high demand stability linked to essential electronic components, coupled with innovative application developments in photonics and energy storage. Supply chain resilience remains a key challenge, given the geopolitical concentration of tantalum mining and processing. Success in this market hinges on manufacturers' abilities to consistently deliver ultra-high purity materials while navigating complex environmental, social, and governance (ESG) compliance related to conflict minerals, ensuring sustainable and responsible sourcing practices are integrated into their operational frameworks to satisfy increasingly rigorous regulatory requirements and corporate responsibility mandates from major end-users like Apple and Samsung.

AI Impact Analysis on Tantalum Pentoxide Powder Market

Analysis of common user questions regarding AI's impact on the Tantalum Pentoxide Powder market reveals a focus on two primary themes: optimization of manufacturing processes and the resultant demand shift from AI-driven electronics. Users frequently inquire about how AI and Machine Learning (ML) can improve yield rates, minimize waste during complex purification and sintering stages, and predict optimal synthesis parameters for ultra-high purity $\text{Ta}_2\text{O}_5$. A major concern revolves around the massive surge in data center and edge computing infrastructure required for AI models, which necessitates extremely high-performance, stable capacitors (often tantalum-based) and advanced high-k dielectrics to handle intense computational loads efficiently. The consensus expectation is that while AI itself will not be used as a component material, it will drastically optimize the efficiency of $\text{Ta}_2\text{O}_5$ production while simultaneously becoming the single largest driver for demand in ultra-reliable, compact power delivery systems, thereby fundamentally influencing market dynamics through demand generation and process optimization.

- AI-driven Predictive Maintenance: Enhancing efficiency of high-temperature processing equipment (furnaces, reactors) to reduce downtime and ensure consistent powder particle morphology.

- Quality Control Optimization: Utilizing computer vision and ML algorithms for real-time analysis of powder particle size distribution and defect detection, guaranteeing ultra-high purity levels required for semiconductor use.

- Demand Forecasting Accuracy: Improving accuracy in forecasting demand for electronic grade powder by analyzing global semiconductor manufacturing cycles and consumer electronics production metrics.

- Semiconductor Design Acceleration: AI-assisted material simulation speeds up the adoption and integration of $\text{Ta}_2\text{O}_5$ as a high-k dielectric in advanced processor and memory designs, driving specification shifts.

- Supply Chain Resilience: ML optimization models used to manage and diversify sourcing of raw tantalum, mitigating risks associated with geopolitical instabilities and conflict mineral regulations.

- Increased Data Center Demand: Massive scaling of AI infrastructure (servers, GPUs) necessitates vast quantities of highly reliable tantalum capacitors for power filtering and voltage regulation, escalating market volume.

- Process Parameter Optimization: Using deep learning to determine the precise temperature, pressure, and chemical concentrations required for achieving specific crystallographic structures and desired powder surface chemistries.

DRO & Impact Forces Of Tantalum Pentoxide Powder Market

The Tantalum Pentoxide Powder Market is primarily influenced by the accelerating global electronics market and the inherent technical advantages of $\text{Ta}_2\text{O}_5$ in high-performance applications. The main driver is the persistent demand for miniaturization and high reliability in passive components, especially within 5G devices, advanced automotive electronics (ADAS and EVs), and enterprise storage solutions, all of which heavily rely on high-capacitance tantalum capacitors. Restraints predominantly revolve around the supply chain's vulnerability; tantalum is classified as a conflict mineral, necessitating strict sourcing compliance which adds complexity and cost. Furthermore, volatility in the pricing and availability of raw tantalum ore impacts manufacturing margins and strategic inventory management. Opportunities arise from expanding applications in advanced photonics, such as anti-reflection coatings for high-power lasers and specialized windows, and the development of new solid-state battery technologies where $\text{Ta}_2\text{O}_5$ can be utilized as a stable electrolyte or additive, diversifying the end-user base beyond traditional electronics and capitalizing on the global energy transition.

The impact forces operate through a complex interplay of technological push and regulatory pull. Technological advancements, specifically in Atomic Layer Deposition (ALD) for ultra-thin films in semiconductors, create a strong upward pull for ultra-high purity powders, mandating stricter quality control and higher manufacturing sophistication. Regulatory forces, particularly those governing conflict minerals (e.g., Dodd-Frank Act Section 1502, EU Conflict Minerals Regulation), exert a significant impact, forcing companies to implement rigorous due diligence systems, which acts as a barrier to entry for smaller, less compliant players but solidifies the position of established, ethical sourcing leaders. The competitive landscape is shaped by the ability of key manufacturers to secure long-term raw material contracts and maintain technological superiority in purification, leading to high capital investment requirements and moderate to high barriers to entry for new competitors aiming at the premium electronic grade segments. This dynamic ensures that while demand remains robust, profitability is closely tied to operational excellence and strategic supply management.

Segmentation Analysis

The Tantalum Pentoxide Powder market is comprehensively segmented based on its purity grade, critical for specific applications; the primary application areas where its unique properties are utilized; and the end-use industries that ultimately consume the final products. Segmentation by purity is crucial as performance requirements differ vastly between metallurgical uses and high-end semiconductor fabrication, with ultra-high purity (99.999% and above) commanding the highest premium and experiencing the fastest growth due to stringent microelectronics standards. Application segmentation highlights the dominance of passive components (capacitors) but underscores the growing strategic importance of thin films in advanced optics and memory devices. End-use segmentation clearly maps the market's dependence on the electronics sector but also indicates emerging potential in aerospace, energy storage, and chemical processing where high stability and resistance are valued.

This multi-faceted segmentation allows market participants to tailor their production processes and distribution strategies, ensuring optimized supply chain efficiency. Manufacturers catering to the semiconductor segment must invest heavily in controlled environment facilities and advanced analytical testing, while those serving the general industrial or chemical catalyst segments may focus more on scale and cost-efficiency. The dynamic interplay between the purity required and the end-use performance criteria dictates pricing structures and competitive positioning within the global market. Furthermore, understanding the geographic concentration of these segmented demands—with APAC leading in electronics grade consumption—is vital for strategic capacity planning and logistics management, ensuring that highly sensitive materials are transported and stored under optimal conditions to maintain their critical specifications.

- By Purity Grade:

- Standard Grade (99.0% - 99.9%)

- Electronic Grade (99.9% - 99.99%)

- Ultra-High Purity Grade (99.999% and above)

- By Application:

- Capacitors (Tantalum Electrolytic Capacitors)

- Optical Coatings and Filters

- Thin Films (Semiconductor High-k Dielectrics)

- Catalysts and Chemical Processing

- Sputtering Targets

- By End-Use Industry:

- Electronics and Semiconductors

- Aerospace and Defense

- Chemical and Pharmaceutical

- Energy and Power

- Medical Devices

Value Chain Analysis For Tantalum Pentoxide Powder Market

The Tantalum Pentoxide Powder value chain begins upstream with the mining and concentration of Tantalite ore, the primary source of Tantalum. This ore is then processed into intermediate materials, such as potassium fluorotantalate, which undergoes complex refining and reduction processes, often involving hydrometallurgy, to produce high-purity Tantalum metal or precursor chemicals. The quality and source transparency at this initial upstream stage are critical, especially considering the conflict mineral status of Tantalum, which adds significant complexity to procurement and necessitates rigorous audits and certifications. Key players in this upstream segment are concentrated geographically, predominantly in Africa (DRC, Rwanda) and Australia, creating supply vulnerability that impacts the entire downstream market.

The midstream involves the specialized conversion of Tantalum precursors into various grades of $\text{Ta}_2\text{O}_5$ powder through chemical precipitation and high-temperature calcination and sintering processes. Manufacturers differentiate themselves here by their capability to achieve ultra-high purity levels and precise control over particle morphology, which is crucial for maximizing capacitor performance and film uniformity. Distribution channels are typically a mix of direct sales to large, strategic end-users like major capacitor manufacturers (e.g., Kemet, Vishay) and indirect distribution through specialized chemical and material distributors who cater to smaller optical coating or specialty chemical firms. Direct sales ensure tight quality control and customized specifications for high-volume semiconductor clients, while indirect channels provide wider market penetration for standard grades.

Downstream utilization centers around the application of the $\text{Ta}_2\text{O}_5$ powder. The largest consumers are the electronics assembly firms and Original Equipment Manufacturers (OEMs). For capacitor applications, the powder is sintered onto anode wire to form the highly porous structure necessary for electrolytic capacitors. For thin films, it is processed into sputtering targets or used as a high-k dielectric precursor in CVD/ALD chambers by semiconductor foundries (fabs). The robust growth in demand is occurring primarily in the downstream, driven by the proliferation of 5G devices, cloud computing infrastructure, and the massive scaling of EV production, linking the entire chain's profitability to sustained innovation and consumption rates within the high-tech manufacturing sector globally.

Tantalum Pentoxide Powder Market Potential Customers

The primary consumers and end-users of Tantalum Pentoxide powder are entities involved in the production of advanced electronic components and specialized high-reliability devices. Historically, the largest buyer segment comprises capacitor manufacturers, particularly those focusing on solid tantalum chip capacitors, which are irreplaceable in mission-critical applications where stability, miniaturization, and reliability under extreme temperature variation are non-negotiable, such as military avionics and deep-sea telecommunications equipment. These customers prioritize consistency, long-term supply agreements, and guaranteed purity over marginal cost savings, as component failure carries exceptionally high penalties in their end products.

Another rapidly expanding customer base includes semiconductor fabrication plants (foundries) and specialized material companies providing precursors for high-k gate dielectrics and memory elements. As transistor geometries shrink, the need for materials like $\text{Ta}_2\text{O}_5$ to replace traditional silicon dioxide becomes paramount to prevent current leakage and maintain device performance. These buyers demand the absolute highest purity (99.999% and greater), often procured in specialized forms such as finely milled powder for sputtering targets or liquid precursors for ALD, requiring suppliers to possess exceptional analytical capabilities and rigorous contamination controls. Furthermore, optical companies specializing in high-performance lenses, prisms, and anti-reflection coatings for laser systems and scientific instruments represent niche but high-value customers, leveraging the high refractive index and excellent transparency of the material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 775.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, H.C. Starck Tantalum and Niobium GmbH, Mitsui Mining & Smelting Co. Ltd., Global Advanced Metals Pty Ltd., Kemet Corporation, Tantalum-Niobium International Study Center (TIC), Ningxia Orient Tantalum Industry Co. Ltd., Ulba Metallurgical Plant, China Minmetals Rare Earth Co. Ltd., A.L.M.T. Corp., Stanford Advanced Materials, Materion Corporation, AMG Advanced Metallurgical Group N.V., Advanced Technology & Materials Co. Ltd. (AT&M), Showa Denko K.K., Treibacher Industrie AG, Metal Powder & Equipment, Xiamen Tungsten Co. Ltd., Admat, Plansee SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tantalum Pentoxide Powder Market Key Technology Landscape

The technological landscape of the Tantalum Pentoxide Powder market is characterized by continuous innovation aimed at achieving superior purity, controlling particle morphology, and optimizing film deposition. A fundamental technology is the advanced purification process, involving solvent extraction and fractional crystallization, essential for stripping trace impurities like iron, manganese, and silicon that severely degrade performance in sensitive electronic components. Manufacturers are increasingly utilizing sophisticated cleanroom environments and real-time analytical techniques, such as ICP-Mass Spectrometry, to validate ultra-trace element content, ensuring the final powder meets the 5N (99.999%) or even 6N purity levels required for state-of-the-art semiconductor applications. The ability to precisely control the crystalline structure and surface area of the powder is another technological differentiator, directly impacting the capacitance value and reliability of sintered anodes, driving R&D into specialized calcination and reduction furnace designs.

The processing technology has strong linkages to the semiconductor thin-film industry. The use of $\text{Ta}_2\text{O}_5$ as a high-k dielectric necessitates specialized deposition methods. Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD) rely on high-purity $\text{Ta}_2\text{O}_5$ precursors (often liquid organometallic compounds derived from the powder) rather than the powder itself, driving demand for chemical synthesis expertise among powder producers. Furthermore, Physical Vapor Deposition (PVD) techniques, such as sputtering, require the powder to be pressed and sintered into dense, high-purity sputtering targets. Technological advancements focus on increasing the density and homogeneity of these targets to minimize spitting and maximize deposition rate and film quality, a critical factor for large-scale microchip fabrication and high-end optical coating processes.

Emerging technological focus also includes the integration of $\text{Ta}_2\text{O}_5$ into energy storage technologies. Research into solid-state batteries explores using Tantalum Pentoxide as a stabilizing additive or protective layer due to its superior chemical stability and high ionic conductivity when doped. This requires developing novel synthesis routes, potentially including sol-gel processing or plasma synthesis, to create nano-structured or highly porous $\text{Ta}_2\text{O}_5$ powders optimized for electrochemical performance rather than just dielectric constant. The successful implementation of these novel materials could open entirely new, high-volume markets beyond the traditional electronics sector, necessitating significant shifts in current manufacturing methodologies and product specifications from standard bulk production toward specialized nano-particle synthesis.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, particularly Greater China, South Korea, Taiwan, and Japan, holds the undisputed majority share of the Tantalum Pentoxide Powder market, both in terms of consumption and manufacturing capacity. This dominance is directly attributable to the region's position as the global hub for semiconductor fabrication (memory and logic), consumer electronics assembly, and passive component production. The continuous governmental and private investment into establishing advanced foundries (e.g., TSMC, Samsung, SK Hynix) drives an unparalleled demand for ultra-high purity $\text{Ta}_2\text{O}_5$ for high-k dielectrics and high-capacitance chips necessary for advanced data centers, AI computing, and 5G base stations. The market here is intensely competitive and highly sensitive to supply chain disruptions, emphasizing the need for robust, localized sourcing and purity verification.

- North America (NA) Specialized Demand: The North American market, while smaller in volume compared to APAC, represents a high-value segment characterized by demand from the aerospace, defense, and high-reliability industrial sectors. Companies in this region require stringent quality certifications (e.g., AS9100) and often procure custom-specified powders or targets for use in military-grade electronics, specialized optical systems (including satellite components), and medical implants. Innovation in NA focuses heavily on new thin-film applications and the development of next-generation precursors for ALD, driven by research institutions and specialized material science firms. The focus here is on performance and technological edge rather than cost-per-kilogram.

- Europe's Focused Growth: The European market shows steady growth, primarily driven by the automotive electronics sector, particularly the rapid adoption of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), which rely heavily on stable, high-reliability tantalum capacitors for power management and safety-critical functions. Additionally, Europe hosts significant players in industrial machinery and specialized chemical processing, utilizing $\text{Ta}_2\text{O}_5$ in catalytic applications and high-temperature chemical reactors. Regulatory compliance, specifically concerning ethical sourcing (Conflict Mineral Regulation), is highly enforced in the EU, shaping procurement strategies and favoring suppliers with verifiable, audited supply chains from mine to material.

- Latin America and MEA Emerging Markets: Latin America and the Middle East and Africa (MEA) currently represent marginal markets for Tantalum Pentoxide powder, mainly serving basic industrial applications and localized chemical processing. However, the MEA region is critical due to its role as a key source of raw Tantalum ore (Tantalite), which places it at the very start of the global value chain. Future growth in end-use consumption is anticipated, tied to infrastructure development, telecommunications expansion, and investments in local renewable energy projects, gradually increasing the localized demand for capacitors and electronic components, though high-purity imports will likely dominate consumption for the foreseeable future.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tantalum Pentoxide Powder Market.- Cabot Corporation

- H.C. Starck Tantalum and Niobium GmbH

- Mitsui Mining & Smelting Co. Ltd.

- Global Advanced Materials Pty Ltd.

- Kemet Corporation

- Tantalum-Niobium International Study Center (TIC)

- Ningxia Orient Tantalum Industry Co. Ltd.

- Ulba Metallurgical Plant

- China Minmetals Rare Earth Co. Ltd.

- A.L.M.T. Corp.

- Stanford Advanced Materials

- Materion Corporation

- AMG Advanced Metallurgical Group N.V.

- Advanced Technology & Materials Co. Ltd. (AT&M)

- Showa Denko K.K.

- Treibacher Industrie AG

- Metal Powder & Equipment

- Xiamen Tungsten Co. Ltd.

- Admat

- Plansee SE

Frequently Asked Questions

Analyze common user questions about the Tantalum Pentoxide Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Tantalum Pentoxide Powder?

The primary driver is the pervasive demand for high-capacitance, reliable, and miniaturized electronic components, particularly high-performance tantalum electrolytic capacitors, which are critical for power management in consumer electronics, 5G infrastructure, and Electric Vehicles (EVs). Its high dielectric constant ($\text{k}$) allows for the necessary performance in shrinking form factors.

How does the purity grade of Tantalum Pentoxide ($\text{Ta}_2\text{O}_5$) affect its application?

Purity grade is critical; standard grades (99.9%) are used for general metallurgy and chemical applications, while Electronic Grade and Ultra-High Purity Grade (99.999% and above) are mandatory for semiconductor fabrication (as high-k dielectrics) and precision optical coatings, where trace impurities must be strictly avoided to ensure device yield and performance.

What are the main supply chain challenges faced by the $\text{Ta}_2\text{O}_5$ market?

The main challenges involve the geopolitical concentration of raw tantalum ore (tantalite) mining, leading to price volatility and supply risk, and the necessity for rigorous compliance with conflict mineral regulations (e.g., Dodd-Frank, EU Regulation), which increases sourcing complexity and operational costs for end-users.

Is Tantalum Pentoxide used in the semiconductor industry?

Yes, Tantalum Pentoxide is a crucial material in the semiconductor industry, primarily used as a high-k dielectric material in high-density DRAM and non-volatile memory (NAND) devices, where its high dielectric constant helps scale down capacitor size and reduce current leakage in advanced node fabrication processes.

Which regional market holds the largest share for Tantalum Pentoxide Powder consumption?

The Asia Pacific (APAC) region, driven by its massive manufacturing capacity for semiconductors, passive electronic components, and consumer electronics in countries such as China, South Korea, and Taiwan, holds the largest global market share for high-purity Tantalum Pentoxide Powder consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager