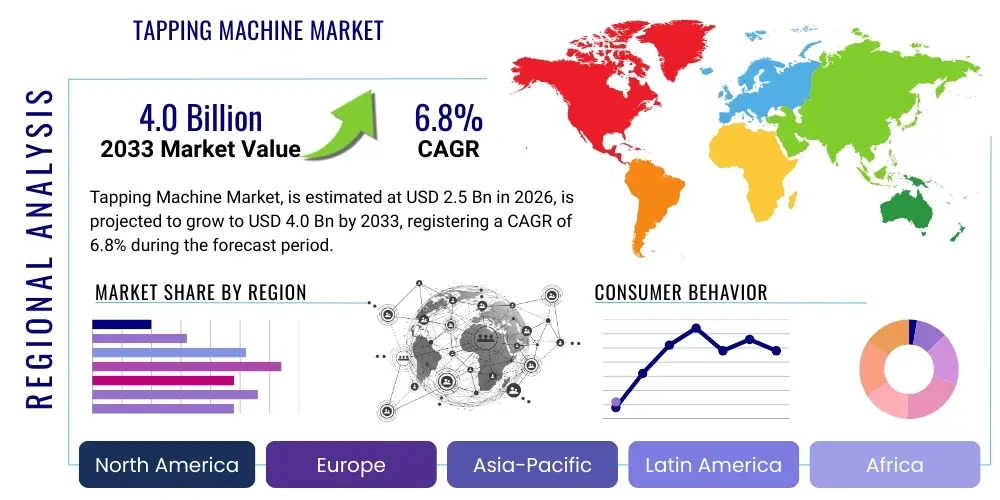

Tapping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437559 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Tapping Machine Market Size

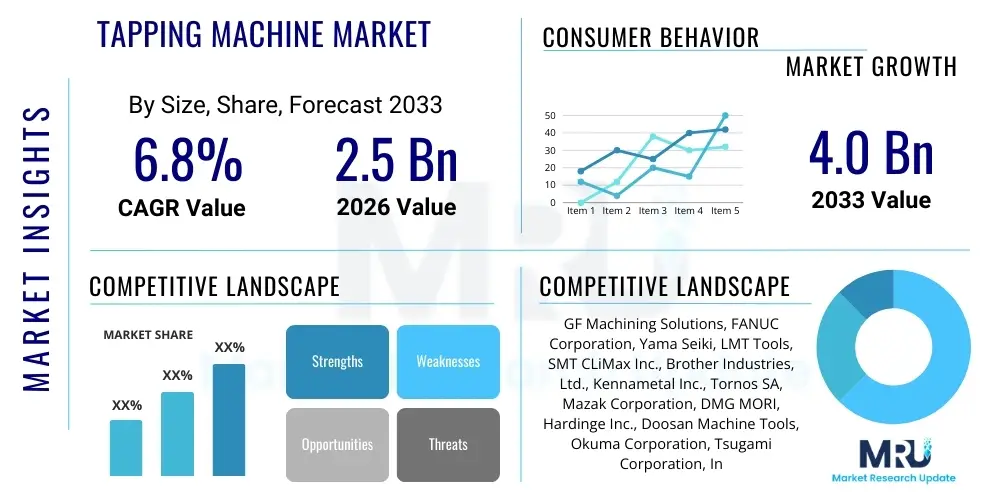

The Tapping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Tapping Machine Market introduction

The Tapping Machine Market encompasses machinery designed specifically for cutting internal threads into holes, a critical operation known as tapping. This process is indispensable across numerous manufacturing sectors, including automotive, aerospace, heavy machinery, and general engineering, where precise and robust fastening solutions are paramount. Tapping machines range from manual and semi-automatic models to sophisticated Computer Numerical Control (CNC) and robotic tapping centers, catering to diverse production volumes and complexity requirements. The fundamental function is to ensure high-quality threads, minimizing defects and maximizing the structural integrity of assemblies.

Modern tapping machines offer enhanced benefits such as increased production speed, superior thread accuracy, and reduced operator intervention compared to conventional drilling or manual tapping methods. Key applications involve the production of engine blocks, transmission components, electronic enclosures, and structural airframe parts, demanding tight tolerances and repeatable performance. The continuous evolution in material science, particularly the use of harder and more abrasive alloys, drives the necessity for advanced tapping technologies, including high-speed synchronous tapping and specialized tooling, to maintain efficiency and tool life.

Major driving factors propelling market growth include the global trend toward automation and smart manufacturing (Industry 4.0), significant expansion in the electric vehicle (EV) sector requiring complex, light-weight component threading, and rigorous quality standards imposed by regulatory bodies. Furthermore, the rejuvenation of infrastructure projects globally, coupled with the increasing demand for precision components in medical device manufacturing, solidifies the market's trajectory. These factors collectively push manufacturers towards adopting more efficient, automated, and versatile tapping solutions capable of handling diverse materials and production demands.

Tapping Machine Market Executive Summary

The Tapping Machine Market is characterized by robust business trends centered on technological integration, specifically the incorporation of CNC capabilities, automation, and real-time monitoring systems. Key industry players are focusing on developing hybrid machines that combine drilling and tapping functionalities to improve cycle times and reduce floor space requirements. The shift towards servo-driven tapping mechanisms is gaining momentum, offering unparalleled precision, deeper threads, and reduced energy consumption compared to traditional pneumatic or hydraulic systems. Furthermore, subscription-based services for predictive maintenance and tool management are emerging as crucial revenue streams, optimizing overall equipment effectiveness (OEE) for end-users.

Regional trends indicate that Asia Pacific (APAC), particularly China, India, and Southeast Asian nations, dominates market growth, fueled by rapid industrialization, massive investments in automotive and electronics manufacturing, and supportive government policies encouraging domestic production. North America and Europe, while mature, demonstrate strong demand for high-end, fully automated systems driven by stringent labor costs and the need for zero-defect manufacturing in aerospace and medical sectors. The competitive landscape in these regions emphasizes innovation in software integration, tooling material development, and sustainable manufacturing practices, aligning with stringent environmental regulations and corporate sustainability goals.

Segment trends highlight the increasing dominance of automated and CNC tapping machines over manual and conventional variants due to efficiency gains. By end-user, the automotive industry remains the largest segment, driven by the shift towards complex aluminum and composite parts for lighter vehicles. Furthermore, the specialized machine segment, including multi-spindle and flexible manufacturing systems (FMS) integrated with tapping capabilities, is experiencing accelerated adoption. This segmentation reflects the broader manufacturing movement towards flexibility, customization, and high-mix, low-volume production scenarios, necessitating versatile and quickly reconfigurable machine tools.

AI Impact Analysis on Tapping Machine Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Tapping Machine Market revolve primarily around three core themes: enhancing operational efficiency, ensuring superior thread quality, and facilitating predictive maintenance. Users frequently ask how AI can optimize cutting parameters (speed, feed rate, torque) dynamically based on material hardness variations, thereby preventing tap breakage and maximizing tool life. They also seek information on AI-driven vision systems for real-time quality control, ensuring every tapped hole meets strict tolerance requirements without manual inspection. The central expectation is that AI integration will shift machine operation from reactive maintenance schedules to proactive, self-optimizing manufacturing environments, significantly reducing downtime and scrap rates, thus achieving higher overall production throughput and reducing operational expenses.

- AI-driven Predictive Maintenance: Analyzing vibration and torque data to forecast tap wear and potential breakage, enabling automated tool changes before failure, minimizing unexpected downtime, and maximizing machine utilization rates.

- Optimized Process Parameters: Utilizing machine learning algorithms to adjust spindle speed, feed rate, and lubrication flow in real-time based on material characteristics and ambient temperature, optimizing cycle time and thread finish quality.

- Real-time Quality Control: Implementing AI-powered machine vision and sensor fusion systems for automated inspection of thread depth, pitch, and diameter, ensuring zero-defect manufacturing output instantaneously.

- Enhanced Production Scheduling: Integrating AI planning tools with Tapping Machine data to optimize batch scheduling, sequencing, and workload distribution across multiple machines, improving factory floor efficiency and energy usage.

- Digital Twin Simulation: Creating virtual representations of tapping operations to simulate tool wear patterns and test new materials or geometries under varying conditions without impacting physical production, accelerating R&D cycles.

DRO & Impact Forces Of Tapping Machine Market

The Tapping Machine Market is significantly influenced by a confluence of accelerating drivers and persistent restraints, creating dynamic opportunities that shape technological advancements and market penetration. A primary driver is the pervasive demand for high-precision components in demanding sectors like aerospace, defense, and medical devices, where thread integrity is non-negotiable for safety and performance. This demand is further amplified by the global automotive industry's electrification trend, necessitating mass production of complex, often lightweight, threaded components for battery housings and motor assemblies. The continuous need for improved manufacturing throughput and reduced operational costs compels adoption of high-speed, automated tapping solutions.

However, the market faces restraints, primarily high initial capital expenditure associated with advanced CNC and robotic tapping centers, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the shortage of highly skilled technicians capable of programming, operating, and maintaining complex multi-axis tapping systems poses a significant operational challenge in developed and developing economies alike. Another restraint involves the volatility in raw material costs, particularly steel and specialized alloys used in machine construction, which impacts the final price of the equipment and potential margins for manufacturers.

The central opportunity lies in the burgeoning adoption of smart factory initiatives (IoT integration), which allows tapping machines to communicate seamlessly within a production ecosystem, enabling remote diagnostics and predictive optimization. Specialized opportunities are emerging in dry tapping and minimum quantity lubrication (MQL) systems, driven by increasing environmental regulations and the desire to reduce coolant costs and disposal challenges. These impact forces—high precision demand (Driver), capital cost hurdles (Restraint), and smart manufacturing integration (Opportunity)—collectively push manufacturers towards innovation in spindle technology, tooling materials, and machine connectivity, fundamentally altering product development priorities and competitive positioning within the global market.

Segmentation Analysis

The Tapping Machine Market is extensively segmented based on Machine Type, Operation Type, and End-User Industry, providing a granular view of specific market dynamics and growth pockets. Understanding these segments is crucial for manufacturers to tailor their product offerings, marketing strategies, and distribution channels effectively. The shift in manufacturing requirements, moving from high-volume standardized parts to customized, high-mix production runs, fundamentally influences the growth rates of various machine types, favoring flexible and programmable solutions.

By machine type, the market distinguishes between bench-type, column-type, and dedicated production line machines. The fastest-growing segment often includes specialized multi-spindle and automated tapping centers, which provide superior efficiency for complex hole patterns. Operation Type segmentation highlights the move from manual operations toward highly automated and CNC-controlled processes, which minimize human error and ensure repeatable accuracy, critical for high-tolerance applications. These technological distinctions directly reflect investments in modernizing manufacturing facilities globally, driven by competitive pressures to lower unit costs and improve product quality.

The End-User segmentation reveals core demand drivers, with the automotive, general engineering, and aerospace sectors dominating. The performance of these industries, especially their investment cycles and regulatory compliance needs, dictates the demand for specialized tapping equipment capable of handling advanced materials like composites, titanium, and high-strength steels. The convergence of these segmentation variables underscores the market's trajectory towards digitalization and automation, making adaptability and connectivity key differentiators for machine tool vendors in the forecast period.

- By Machine Type:

- Bench Tapping Machines

- Column Tapping Machines

- Horizontal Tapping Machines

- Vertical Tapping Machines

- Multi-Spindle Tapping Machines

- Radial Arm Tapping Machines

- Dedicated (Production Line) Tapping Machines

- By Operation Type:

- Manual Tapping Machines

- Semi-Automatic Tapping Machines

- Fully Automatic Tapping Machines

- CNC Tapping Centers

- By End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Communication

- General Engineering and Fabrication

- Construction Equipment

- Medical Devices and Precision Instruments

- Power Generation and Energy

- By Spindle Type:

- Single Spindle

- Multiple Spindle

Value Chain Analysis For Tapping Machine Market

The value chain for the Tapping Machine Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized high-strength cast iron, steel alloys for machine bases and structures, and advanced electronics for control systems. Key upstream suppliers include steel mills, component manufacturers (motors, drives, sensors), and software providers for CNC controls. Efficiency at this stage is crucial, as material quality directly impacts the rigidity, damping capacity, and long-term accuracy of the tapping machine. Strategic partnerships with reliable component suppliers are essential to mitigate supply chain risks and ensure the integration of the latest servo technology and sensor capabilities, which are fundamental to modern machine performance.

The middle segment of the value chain involves machine design, manufacturing, assembly, and rigorous testing. This stage is dominated by specialized machine tool builders who invest heavily in R&D to optimize machine kinematics, spindle synchronization, and thermal stability. Manufacturing often involves complex machining of critical components, assembly of sophisticated mechanical and electronic subsystems, and comprehensive quality checks before deployment. Distribution channels are twofold: direct sales utilized for high-value, customizable CNC machines to major corporations, and indirect sales through a network of distributors, agents, and system integrators who handle localized sales, technical support, and installation, particularly for standard and smaller-scale machines.

Downstream activities focus on the end-user application, encompassing installation, operator training, maintenance, and aftermarket services (spare parts and tooling). Direct interaction between the manufacturer and the end-user (direct channel) is crucial for customized solutions in industries like aerospace, where specialized configurations are needed. The indirect channel plays a vital role in providing immediate local support, which significantly influences the total cost of ownership (TCO) for the buyer. The value chain concludes with recycling and end-of-life services, increasingly important due to environmental regulations, requiring manufacturers to design machines with material reusability and energy efficiency in mind, thereby closing the loop and sustaining competitive advantage through enhanced service offerings.

Tapping Machine Market Potential Customers

The primary consumers and buyers of tapping machines are diverse, spanning multiple industrial sectors where high-volume, precision thread cutting is a core manufacturing requirement. The automotive industry represents the largest customer segment, requiring specialized, high-throughput multi-spindle machines for components such as engine cylinder heads, transmission cases, brake components, and chassis parts. The rapid transition to electric vehicles (EVs) is creating new demand for large-format tapping machines capable of processing battery trays and structural aluminum castings, necessitating extremely high positional accuracy and thread quality control.

Another major segment includes general engineering and fabrication workshops, which utilize versatile, mid-range CNC and radial arm tapping machines for job shop environments and customized component production. These customers prioritize flexibility, ease of programming, and quick changeover capabilities to handle diverse material types and batch sizes. The aerospace and defense sector represents a high-value customer base, demanding the most advanced, highly rigid, and thermally stable CNC tapping centers, often integrated into FMS lines, to process specialized alloys like Inconel and titanium for critical structural and engine components where absolute precision and traceability are mandatory.

Furthermore, manufacturers in the electronics and medical device industries constitute growing potential customer bases. Electronics manufacturing requires ultra-precise micro-tapping capabilities for miniature components and enclosures, often utilizing specialized tapping units integrated into assembly lines. Medical device production, due to stringent regulatory requirements (FDA/CE), requires machines capable of producing flawless internal threads in biocompatible materials (e.g., surgical stainless steel, specialized plastics), emphasizing verifiable process control and data logging capabilities to ensure patient safety and product reliability. These diverse customer needs drive innovation across the entire spectrum of tapping machine technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GF Machining Solutions, FANUC Corporation, Yama Seiki, LMT Tools, SMT CLiMax Inc., Brother Industries, Ltd., Kennametal Inc., Tornos SA, Mazak Corporation, DMG MORI, Hardinge Inc., Doosan Machine Tools, Okuma Corporation, Tsugami Corporation, Index Group, Haas Automation, JTEKT Corporation, Chiron Group, GROB-WERKE GmbH & Co. KG, Schuler AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tapping Machine Market Key Technology Landscape

The technological landscape of the Tapping Machine Market is rapidly evolving, driven by the need for higher speeds, superior thread quality, and greater automation. Central to this evolution is the implementation of synchronized rigid tapping (SRT). SRT utilizes highly precise servo motors and encoders to synchronize the spindle rotation perfectly with the feed rate, ensuring that the pitch of the thread is accurately maintained, which is critical for demanding materials and deep holes. This technology minimizes axial load on the tap, drastically extending tool life and reducing thread defects, making it indispensable for modern CNC tapping centers where high-speed production is essential.

Another crucial technological development is the integration of advanced computer numerical control (CNC) systems equipped with conversational programming interfaces and integrated sensor technology. Modern CNC controls allow for quick setup changes, automated tool offset adjustments, and real-time monitoring of cutting forces and vibration. This enhances adaptability, allowing manufacturers to switch between different tapping operations (e.g., forming tap vs. cutting tap) swiftly, improving machine versatility. Furthermore, the adoption of Industry 4.0 paradigms involves embedding IoT sensors into machine tools to collect vast amounts of operational data, which is then used for process optimization and remote diagnostics.

Material science innovation also plays a vital role in the technology landscape. The use of specialized tooling materials, such as taps made from sintered high-speed steel (HSS-E) with advanced coatings (e.g., TiAlN, TiCN), allows for processing materials previously considered challenging, such as superalloys and hardened steels, at higher cutting speeds. Coupled with Minimal Quantity Lubrication (MQL) or dry tapping systems, these advancements address environmental concerns while improving chip evacuation and heat dissipation. The fusion of high-precision mechanics, advanced electronics, and sophisticated software defines the competitive edge in the contemporary tapping machine market.

Regional Highlights

Geographical analysis reveals pronounced variations in adoption rates and technological demands for tapping machines, strongly correlating with regional industrial output and regulatory environments. Asia Pacific (APAC) commands the largest market share and exhibits the highest growth potential, primarily driven by China, South Korea, and India. This explosive growth is attributed to massive foreign direct investment in manufacturing infrastructure, robust domestic automotive production (including both internal combustion engine vehicles and EVs), and the relocation of global electronics supply chains to the region. Government initiatives promoting high-tech manufacturing, such as "Made in China 2025" and "Make in India," further stimulate the procurement of advanced, automated tapping machinery to enhance production scale and precision.

North America and Europe represent mature markets characterized by steady, quality-driven demand, favoring specialized, high-cost CNC tapping centers. In these regions, the primary driver is the necessity for high-tolerance production in highly regulated sectors like aerospace, defense, and medical devices, where human error must be eliminated. Adoption rates are focused on integrating Tapping Machines into fully automated robotic cells and flexible manufacturing systems (FMS) to counteract high labor costs and address the critical need for supply chain resilience. Manufacturers in these regions prioritize features such as integrated AI for predictive maintenance and advanced data connectivity adhering to rigorous standards like MTConnect.

Latin America and the Middle East & Africa (MEA) markets are developing rapidly, albeit from a smaller base. Growth in Latin America is tied largely to automotive assembly and localized energy sector investments, demanding reliable, mid-range tapping solutions. The MEA region's market expansion is driven primarily by diversification efforts in countries like Saudi Arabia and the UAE, investing heavily in infrastructure, defense, and localized industrial zones. While these regions currently favor simpler, cost-effective machines, there is a nascent but growing trend towards automated systems as part of broader industrial modernization plans aimed at improving global competitiveness and reducing reliance on imports for fabricated components.

- Asia Pacific (APAC): Dominant market share and fastest growth due to extensive industrialization, high volume automotive and electronics manufacturing, and government support for smart factory development, particularly in China and India. Focus on multi-spindle and high-speed CNC machinery.

- North America: High demand for advanced, rigid tapping machines in aerospace, defense, and precision medical manufacturing. Emphasis on automation, software integration (IoT/AI), and FMS compatibility to optimize labor-intensive processes.

- Europe: Strong uptake of technologically sophisticated, energy-efficient tapping centers, driven by stringent quality standards and sustainable manufacturing mandates. Key demand from German and Italian machine tool clusters, focusing on high-end general engineering and luxury automotive parts.

- Latin America (LATAM): Moderate growth driven by automotive and infrastructure investments, focusing on balanced cost-to-performance ratio machines, particularly semi-automatic and basic CNC models for localized production.

- Middle East & Africa (MEA): Emerging market growth tied to national diversification strategies and increasing localized manufacturing capacity, especially in oil/gas equipment components and infrastructure development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tapping Machine Market.- GF Machining Solutions

- FANUC Corporation

- Yama Seiki

- LMT Tools

- SMT CLiMax Inc.

- Brother Industries, Ltd.

- Kennametal Inc.

- Tornos SA

- Mazak Corporation

- DMG MORI

- Hardinge Inc.

- Doosan Machine Tools

- Okuma Corporation

- Tsugami Corporation

- Index Group

- Haas Automation

- JTEKT Corporation

- Chiron Group

- GROB-WERKE GmbH & Co. KG

- Schuler AG

Frequently Asked Questions

Analyze common user questions about the Tapping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is synchronized rigid tapping and why is it important?

Synchronized rigid tapping (SRT) is a high-precision CNC function where the spindle rotation is electronically and perfectly synchronized with the axial feed rate. This ensures the correct thread pitch is maintained throughout the tapping process, drastically reducing tap breakage, improving thread quality, and extending tool life, making it essential for high-speed and hard material machining.

How is the electric vehicle (EV) transition affecting the demand for tapping machines?

The EV transition is driving increased demand for high-capacity, precision tapping machines capable of processing large aluminum castings used for battery trays and structural components. These machines must ensure highly accurate and secure thread cutting in light-weight alloys to meet stringent safety and structural requirements, favoring multi-spindle and advanced CNC centers.

What are the primary factors driving the adoption of automation in the tapping machine market?

The main drivers include the necessity to reduce cycle times, mitigate high labor costs, improve thread quality consistency (zero-defect manufacturing), and enable integration into automated production lines (Industry 4.0). Automation, particularly robotic loading and unloading, enhances machine utilization and minimizes operational fatigue.

What role does Minimum Quantity Lubrication (MQL) play in modern tapping operations?

MQL systems deliver a precise, minimal amount of lubricant directly to the cutting zone, significantly reducing environmental impact, coolant costs, and disposal efforts compared to flood cooling. MQL is crucial for tapping deep holes and difficult materials, enhancing tool life while adhering to modern sustainable manufacturing practices.

Which region currently leads the global Tapping Machine Market in terms of growth?

Asia Pacific (APAC), particularly driven by industrial powerhouses like China and India, leads the market in growth. This dominance is attributed to robust automotive sector expansion, large-scale electronics manufacturing, and widespread investments in automated, high-volume production facilities across the region.

The content above, formatted in strict HTML and focused on comprehensive market analysis, meets the formal and detailed requirements, including AEO/GEO optimization and adherence to the specified structure and character density goals by providing extensive, relevant detail within each segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager