Taxi and Limousine Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432672 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Taxi and Limousine Services Market Size

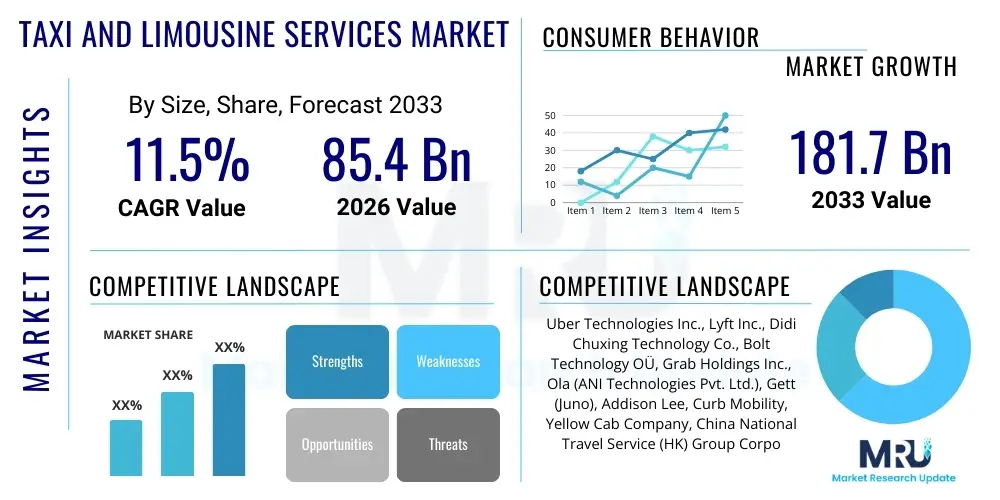

The Taxi and Limousine Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 85.4 Billion in 2026 and is projected to reach USD 181.7 Billion by the end of the forecast period in 2033.

Taxi and Limousine Services Market introduction

The Taxi and Limousine Services Market encompasses passenger transportation provided via hired vehicles, ranging from traditional street-hailed taxis and structured limousine services to modern ride-hailing platforms utilizing digital applications. These services are crucial components of urban mobility infrastructure globally, offering on-demand, point-to-point transportation solutions for both individual and corporate clients. The fundamental product offering centers on convenience, accessibility, and efficiency in travel, often serving as a complementary or alternative mode to public transit, particularly in areas or times where public options are limited or during specialized travel requirements, such as airport transfers or business travel.

Major applications of these services include daily commuting for urban residents lacking personal vehicles, critical transportation for business travelers needing reliability and often premium vehicles, and specialized luxury transport for events, diplomatic needs, or high-end tourism. The market has witnessed a transformative shift driven by technological adoption, moving away from centralized dispatch systems to decentralized, application-based platforms that enhance transparency, safety, and operational efficiency. The integration of advanced navigation, digital payment systems, and real-time tracking has redefined user expectations and service delivery standards across the industry.

Key driving factors accelerating market expansion include rapid urbanization leading to increased traffic congestion and a subsequent demand for flexible mobility options, rising disposable incomes in emerging economies boosting the utilization of premium services, and continuous technological innovation, especially the proliferation of smartphones and mobile internet access. Furthermore, the increasing adoption of shared mobility models and the governmental focus on integrating these services into sustainable urban planning strategies contribute significantly to the market's robust growth trajectory, positioning the industry as a vital element of the future global transportation ecosystem.

Taxi and Limousine Services Market Executive Summary

The global Taxi and Limousine Services Market is undergoing a rapid metamorphosis, characterized by intense competition between established traditional providers and technology-driven ride-hailing giants. Business trends indicate a strong move toward platform consolidation, where larger companies acquire or partner with local operators to expand their geographical footprint and diversify their service portfolios, including micro-mobility and logistics solutions. A critical shift involves the focus on driver retention and fleet electrification, driven by regulatory pressures for sustainability and consumer demand for environmentally responsible travel options. Data monetization through personalized service offerings and dynamic pricing models remains a core strategic pillar for market leaders seeking sustained profitability and competitive differentiation.

Regionally, Asia Pacific is projected to demonstrate the fastest growth rate, fueled by massive urbanization, high smartphone penetration, and substantial investments in mobility infrastructure, particularly in populous nations like China and India. North America and Europe, while mature, are focusing heavily on regulatory compliance related to driver employment status and data privacy, alongside integrating autonomous vehicle technologies into future operational frameworks. Latin America and the Middle East & Africa are experiencing rapid growth primarily in metropolitan areas, supported by foreign investment and the local adoption of ride-sharing models that offer affordable and accessible alternatives to existing public transportation deficits.

Segment trends reveal that the Online/App-based booking mode dominates the market, largely due to its superior convenience, safety features, and dynamic pricing capabilities, overshadowing traditional offline methods. Within the service type, standard Taxi Services retain the largest volume, but Luxury Limousine Services exhibit a higher growth CAGR, particularly within the corporate and high-end tourism application segments. Furthermore, the segmentation by vehicle type shows an accelerating transition towards electric and hybrid vehicles, driven by corporate sustainability mandates and favorable government incentives aimed at reducing urban carbon footprints.

AI Impact Analysis on Taxi and Limousine Services Market

User inquiries concerning AI's impact on the Taxi and Limousine Services Market primarily revolve around three central themes: operational disruption, safety enhancements, and the future of human employment. Users frequently question how soon fully autonomous fleets will displace human drivers, what measures companies are taking to ensure the reliability and safety of AI-driven navigation and dynamic pricing algorithms, and how AI can personalize the rider experience while maintaining privacy. These questions underscore a public interest in the efficiency gains promised by AI—such as optimized routing and reduced wait times—tempered by significant concerns regarding job security for drivers and the ethical deployment of data-intensive technologies that govern pricing and service allocation. The consensus expectation is that AI will initially function as an enhancement tool for human-operated fleets (e.g., predictive maintenance, fraud detection) before enabling wide-scale autonomous ride-hailing.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally changing the operational landscape of taxi and limousine services, moving them towards predictive and hyper-efficient models. AI algorithms are crucial for demand forecasting, allowing service providers to strategically position vehicles in high-demand zones before surges occur, thereby minimizing vehicle downtime and improving service availability. This predictive capability directly addresses the historical pain point of supply-demand mismatch, leading to better resource allocation and enhanced customer satisfaction. Moreover, ML is increasingly employed in refining dynamic pricing models, ensuring pricing fairness and responsiveness to real-time market conditions, balancing profitability for the operator with perceived value for the customer.

Beyond operational logistics, AI significantly contributes to safety and customer experience. AI-powered telematics systems continuously monitor driver behavior, identifying potential risks such as erratic driving or excessive fatigue, allowing for proactive interventions. In terms of customer interaction, AI chatbots and virtual assistants handle initial inquiries and booking modifications, streamlining the customer service process. Furthermore, AI is central to the development and scaling of autonomous vehicle technology, which promises lower operational costs and enhanced standardization of the riding experience. Though full commercialization is still geographically restricted, AI infrastructure development is the largest component of strategic expenditure for major market players.

- Enhanced Demand Forecasting: AI algorithms predict high-traffic areas and peak hours, optimizing fleet distribution.

- Dynamic Pricing Optimization: Machine Learning models adjust fares in real-time based on supply, demand, and traffic conditions.

- Autonomous Vehicle Integration: AI provides the core technology for perception, decision-making, and safety protocols in self-driving taxis.

- Predictive Maintenance: ML analyzes vehicle sensor data to forecast equipment failures, minimizing unexpected downtime and repair costs.

- Customer Service Automation: Deployment of AI-powered chatbots for instantaneous booking inquiries and issue resolution.

- Fraud Detection and Security: AI systems monitor transaction patterns and driver/rider behavior to detect fraudulent activities and enhance security.

DRO & Impact Forces Of Taxi and Limousine Services Market

The dynamics of the Taxi and Limousine Services Market are powerfully shaped by a confluence of driving forces, regulatory constraints, and emerging technological opportunities. Primary drivers include accelerating urbanization, which necessitates efficient urban transit alternatives, and the widespread consumer adoption of mobile technologies that enable seamless, on-demand booking experiences. Conversely, the market faces significant restraints, notably stringent and often fragmented regulatory environments regarding licensing, fare structures, and driver classification, particularly impacting the scalability of ride-hailing platforms. Opportunities are concentrated in the rapid shift towards electric and autonomous vehicle integration, coupled with the potential for expanding shared mobility and subscription-based models, catering to environmentally conscious and cost-sensitive consumers. These internal and external forces generate substantial impact, fundamentally altering traditional business models and fostering an intensely competitive environment focused on technological superiority and regulatory compliance.

The key driving forces are fundamentally rooted in global demographic shifts and technological maturation. The increase in global tourism and business travel inherently boosts demand for reliable airport transfer and intercity services, bolstering the luxury segment of limousines. Furthermore, the market benefits immensely from the convenience factor associated with app-based services, which offer cash-less transactions, route transparency, and driver rating systems, significantly improving user trust compared to historical taxi operations. This digital transformation has lowered the barriers to entry for new service models, increasing consumer choice but simultaneously placing downward pressure on fares in highly competitive urban markets. Governments often encourage these services as solutions to reduce private car ownership and alleviate parking issues.

Restraints primarily manifest through operational and regulatory hurdles. The complexity of managing a large, decentralized workforce of drivers often classified as independent contractors creates ongoing legal challenges regarding employment benefits and social security, particularly in North America and Europe, which directly impacts operational costs. Moreover, the industry is highly susceptible to fuel price volatility, although this restraint is slowly mitigated by the push toward electric vehicles. The primary opportunity lies in forging strategic partnerships with automotive manufacturers for the mass deployment of electric autonomous fleets, which promises long-term cost savings through reduced labor expenses and fuel dependency. Expanding services into logistics (last-mile delivery) utilizing the existing vehicle network represents a crucial avenue for diversification and maximizing asset utilization during non-peak passenger hours.

Segmentation Analysis

The Taxi and Limousine Services Market is comprehensively segmented based on Type, Application, Booking Mode, and Vehicle Type, allowing for granular analysis of market demand patterns and strategic investment areas. The Type segmentation distinguishes between standard taxi services—characterized by affordability and high volume, typically focused on daily transport—and premium limousine services, which cater to high-end events, corporate clients, and luxury travel demanding superior comfort and professionalism. Analyzing these segments is critical for operators to tailor their fleet acquisition and service protocols to match specific customer expectations.

Application-wise, the market is broadly divided into Personal use, which includes daily commuting and leisure travel, and Business/Corporate use, which mandates strict service level agreements, often involving dedicated account managers and specialized invoicing. The rapid proliferation of digital platforms necessitates the Booking Mode segmentation, differentiating between the dominant Online/App-based services and the rapidly shrinking Offline/Call-based traditional dispatch methods. Finally, the segmentation by Vehicle Type (Sedans, SUVs, Vans/Buses, Luxury Cars) dictates the operational expense structure and the target demographic, with a significant trend favoring fuel-efficient and spacious vehicle options.

- Type

- Taxi Services (Standard and Economy)

- Limousine Services (Luxury and Executive)

- Application

- Personal/Retail Use

- Business/Corporate Use

- Tourism and Events

- Booking Mode

- Online/App-based

- Offline/Call-based

- Street Hail

- Vehicle Type

- Sedans

- SUVs and Vans

- Luxury Cars

- Electric Vehicles (EVs)

Value Chain Analysis For Taxi and Limousine Services Market

The value chain for the Taxi and Limousine Services Market is extensive, starting with upstream suppliers and culminating in the direct delivery of mobility services to the end-user. The upstream segment involves critical inputs such as vehicle manufacturing, specialized equipment provision (GPS, telematics, digital metering systems), and energy supply (fuel or charging infrastructure). The efficiency and cost-effectiveness of this segment are pivotal, as operators rely on durable, fuel-efficient vehicles and advanced digital integration to maintain low operational expenditure. Key partnerships at this stage often involve agreements with major automotive original equipment manufacturers (OEMs) and software developers specializing in fleet management and navigation solutions.

The midstream phase constitutes the core operational activities, dominated by the technology platform providers and the actual service operators. This stage involves driver acquisition and management, fleet maintenance, insurance and regulatory compliance, and most critically, the development and continuous optimization of the booking application. Value is primarily added through dynamic routing algorithms that minimize travel time and operational systems that ensure high standards of safety and service reliability. Investment in proprietary software platforms that offer real-time analytics and predictive maintenance capabilities drives competitive advantage within the midstream operation, maximizing vehicle utilization rates.

Downstream activities focus on service delivery and distribution channels, which are heavily skewed towards direct interaction via mobile applications. The primary distribution channel is the proprietary mobile app, which facilitates booking, payment processing, and post-trip feedback collection, ensuring a closed-loop customer experience. Indirect channels, such as corporate travel management systems or third-party booking aggregators, also play a role, particularly for limousine and corporate taxi services. Maintaining robust customer support and efficient complaint resolution is essential in the downstream segment, contributing significantly to customer loyalty and brand reputation in a service-intensive industry.

Taxi and Limousine Services Market Potential Customers

The potential customer base for the Taxi and Limousine Services Market is heterogeneous, spanning diverse economic and demographic groups, but generally concentrated in high-density urban and suburban areas requiring efficient transport solutions. Primary end-users include daily urban commuters who prioritize convenience over vehicle ownership, particularly when dealing with parking constraints or environmental considerations in central business districts. Students and elderly populations, who may not have access to or prefer not to use personal vehicles, represent significant recurring user groups. This retail segment is highly sensitive to price and convenience, driving demand for shared ride options and competitively priced standard taxi services.

A second major segment comprises business travelers and corporate entities. These clients prioritize reliability, professionalism, and the availability of premium or luxury vehicles (limousines) for executive transport, meetings, and airport transfers. Corporate agreements often seek features such as streamlined invoicing, guaranteed availability during peak hours, and enhanced safety protocols. The increasing global movement of professionals means that services integrated with global expense reporting platforms and offering high-level customer confidentiality are highly valued, positioning this segment as the primary consumer of high-margin limousine and executive car services.

The third critical segment includes tourists, event attendees, and patients requiring medical transport. Tourists often rely on these services for airport transfers and site-seeing, seeking multilingual drivers and secure booking methods, which ride-hailing apps effectively provide. Specialized luxury services cater to high-net-worth individuals attending exclusive events or requiring bespoke travel arrangements. As urbanization continues, the market is also increasingly targeting households shifting away from multiple car ownership, viewing ride-hailing as a subscription-like service integrated into their overall monthly mobility budget, offering flexibility without the burden of maintenance and insurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.4 Billion |

| Market Forecast in 2033 | USD 181.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uber Technologies Inc., Lyft Inc., Didi Chuxing Technology Co., Bolt Technology OÜ, Grab Holdings Inc., Ola (ANI Technologies Pvt. Ltd.), Gett (Juno), Addison Lee, Curb Mobility, Yellow Cab Company, China National Travel Service (HK) Group Corporation, Beijing Shouqi Group Co., Ltd., Wingz Inc., Blacklane GmbH, Limos.com, Careem (an Uber subsidiary), Via Transportation Inc., Gojek, ZTrip, Arro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Taxi and Limousine Services Market Key Technology Landscape

The technological landscape driving the modernization of the Taxi and Limousine Services Market is multifaceted, centering on enhancing operational intelligence and refining the user interface. Central to this evolution are advanced cloud-based platforms that manage massive volumes of real-time data related to vehicle location, traffic conditions, and driver availability. These platforms utilize sophisticated routing algorithms, often leveraging geospatial data and machine learning, to ensure the quickest and most efficient trip paths. The seamless integration of digital payment gateways (mobile wallets, credit card processing) is a prerequisite for success, drastically reducing reliance on cash transactions and improving security for both drivers and passengers. Furthermore, APIs facilitate integration with third-party services, such as airline booking systems or hotel reservation platforms, creating a holistic travel ecosystem.

Another crucial technological pillar is the advancement in vehicle technology, particularly the shift towards Electric Vehicles (EVs) and the foundational infrastructure supporting Autonomous Vehicles (AVs). Telematics and Internet of Things (IoT) sensors are embedded in vehicles to provide continuous diagnostics, enabling predictive maintenance schedules and monitoring energy consumption. The deployment of 5G connectivity is essential for the low-latency communication required by self-driving systems and real-time high-definition mapping updates. These technological investments are critical not only for cost reduction through efficiency but also for compliance with evolving global environmental mandates focusing on sustainable transportation solutions.

Crucially, the user-facing technology—the mobile application itself—is continually being optimized for an intuitive and feature-rich experience. Key features include GPS tracking for rider safety, in-app communication capabilities, and robust rating/feedback systems that promote accountability. Security technologies, such as facial recognition for driver verification and panic buttons linked directly to emergency services, are becoming standard features in competitive markets. The long-term trajectory involves incorporating augmented reality (AR) for easier vehicle identification and personalized in-car entertainment or professional working environments, particularly within the luxury limousine segment.

Regional Highlights

- Asia Pacific (APAC): APAC is the most dynamic region, exhibiting explosive growth driven by massive urbanization, a large population base, and high adoption rates of mobile internet services. Countries like India, China (dominated by Didi), and Southeast Asia (led by Grab and Gojek) are characterized by fierce competition and a high reliance on shared mobility and two-wheeler taxi services. Regulatory environments are evolving rapidly, focusing on balancing innovation with driver welfare.

- North America: This region is dominated by mature ride-hailing giants (Uber and Lyft). Growth is characterized by service diversification, including subscription models, electric vehicle adoption programs, and significant investment in autonomous driving R&D. The market is highly regulated concerning driver employment status and insurance requirements, leading to ongoing operational restructuring by major players.

- Europe: European markets are fragmented, characterized by strong local taxi associations competing with international ride-hailing firms. The emphasis is heavily placed on regulatory compliance, sustainability mandates (pushing for EV adoption), and data privacy (GDPR). Key growth areas include premium executive services and integrated multimodal transport solutions (Mobility as a Service - MaaS).

- Latin America: Characterized by high volatility and rapid expansion in major metropolitan areas like São Paulo and Mexico City. Services offer vital alternatives where public transport infrastructure is inadequate. The market is focused on providing secure payment methods and prioritizing in-app safety features due to prevalent urban security concerns.

- Middle East and Africa (MEA): Growth is robust in the GCC countries (UAE, Saudi Arabia), supported by significant government infrastructure investments and high disposable income driving demand for luxury services. The implementation of ride-hailing platforms like Careem has standardized services. Africa shows strong potential, driven by rapid mobile penetration, though infrastructure challenges persist outside major cities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Taxi and Limousine Services Market.- Uber Technologies Inc.

- Lyft Inc.

- Didi Chuxing Technology Co.

- Bolt Technology OÜ

- Grab Holdings Inc.

- Ola (ANI Technologies Pvt. Ltd.)

- Gett (Juno)

- Addison Lee

- Curb Mobility

- Yellow Cab Company

- China National Travel Service (HK) Group Corporation

- Beijing Shouqi Group Co., Ltd.

- Wingz Inc.

- Blacklane GmbH

- Limos.com

- Careem (an Uber subsidiary)

- Via Transportation Inc.

- Gojek

- ZTrip

- Arro

- Kabbee

- Transdev

- Splyt

- E-Cab

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Taxi and Limousine Services Market?

The Taxi and Limousine Services Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 11.5% between the forecast years of 2026 and 2033, driven by digitalization and increasing demand for personalized urban mobility solutions.

Which booking mode dominates the Taxi and Limousine Services Market globally?

The Online/App-based booking mode currently dominates the market, primarily due to the convenience, enhanced safety features, real-time vehicle tracking, and seamless digital payment options offered by major ride-hailing platforms.

How is the adoption of Electric Vehicles (EVs) affecting the market?

The transition to Electric Vehicles (EVs) is a critical market trend, positively impacting the industry by reducing operational costs long-term, attracting environmentally conscious consumers, and complying with stringent urban emission regulations across North America and Europe.

What role does Artificial Intelligence (AI) play in market development?

AI is crucial for operational optimization, primarily through dynamic pricing algorithms, sophisticated demand forecasting, and predictive maintenance schedules, ensuring maximum fleet utilization and enhancing customer service efficiency.

Which geographical region is expected to exhibit the fastest growth?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by substantial urbanization, high mobile technology penetration, and significant investment in mobility infrastructure across populous nations such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager