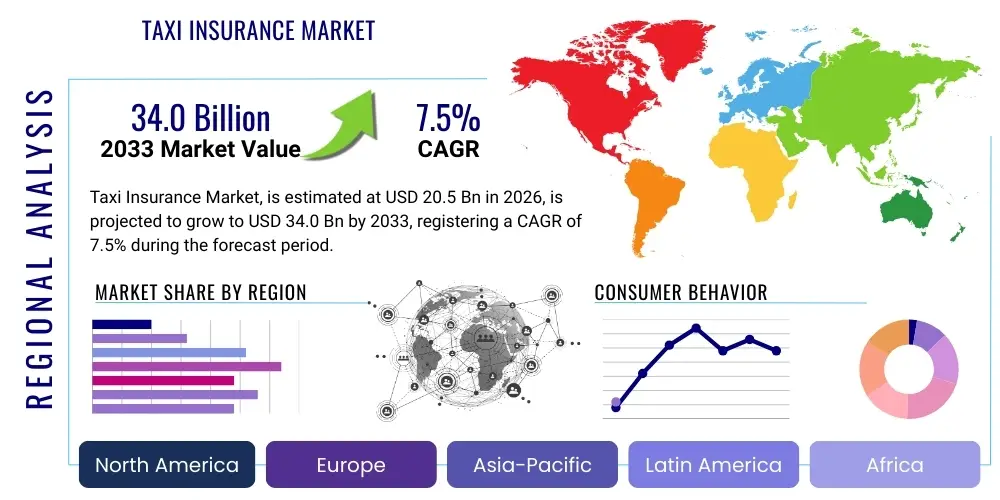

Taxi Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438755 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Taxi Insurance Market Size

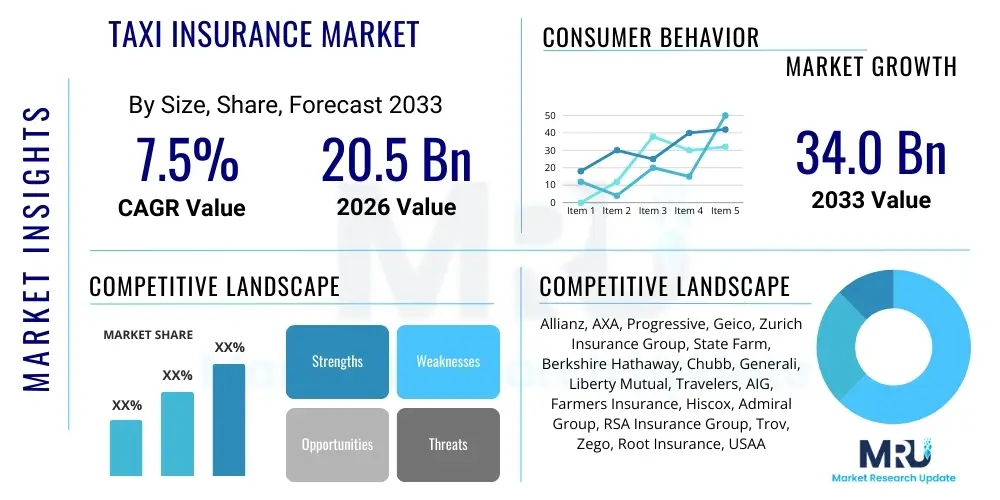

The Taxi Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $20.5 Billion USD in 2026 and is projected to reach $34.0 Billion USD by the end of the forecast period in 2033.

Taxi Insurance Market introduction

The Taxi Insurance Market encompasses specialized insurance products designed to cover risks associated with commercial passenger transport vehicles, distinct from standard personal auto insurance due to higher mileage, increased liability exposure, and regulatory requirements. This sector provides essential financial protection against property damage, bodily injury liability, and operational interruption caused by accidents or incidents. The core product offering typically includes comprehensive, collision, and expansive third-party liability coverage tailored to meet stringent government and municipal mandates globally.

Major applications of taxi insurance extend across traditional licensed taxis, non-emergency medical transportation (NEMT) services, and increasingly, vehicles operating under Transportation Network Companies (TNCs) or ride-hailing platforms. The rapid expansion of urban mobility services and the subsequent regulatory adaptation by cities have fundamentally altered the risk profiles insurers must underwrite. Key benefits derived from robust taxi insurance include regulatory compliance, critical operational stability post-incident, and the ability to mitigate large financial losses associated with public liability claims, which are often amplified in commercial transport settings.

Driving factors propelling market growth include the globalization of ride-sharing services, increasing urbanization leading to higher demand for public and private hire vehicles, and continuous advancements in telematics technology allowing for more accurate, risk-based pricing. Furthermore, the mandatory nature of commercial vehicle insurance, coupled with rising accident severity rates in dense urban environments, ensures sustained demand for these specialized policies. Regulatory bodies continually update minimum coverage limits, forcing fleet owners and independent drivers to seek comprehensive insurance solutions, thereby underpinning market expansion.

Taxi Insurance Market Executive Summary

The Taxi Insurance Market is defined by intense competition and rapid technological integration, driven primarily by the transition from traditional taxi models to hybrid models incorporating ride-hailing services. Business trends indicate a strong move towards usage-based insurance (UBI) utilizing telematics data, allowing insurers to segment risks more effectively and offer personalized premium structures. The shift toward electric and autonomous vehicles presents both a challenge—requiring new policy structures—and an opportunity for insurers to redefine coverage based on highly controlled operational parameters. Carriers focusing on digital distribution and instant policy issuance are gaining significant market share by reducing administrative friction for commercial clients.

Regional trends highlight dynamic regulatory environments, particularly in developed markets like North America and Europe, where regulatory mandates often differentiate between traditional taxi operators and TNC drivers, creating distinct product requirements. The Asia Pacific region, led by massive growth in India and China's urban centers, is experiencing the highest volume growth, driven by rapid urbanization and the proliferation of local ride-sharing platforms. Insurers are customizing policies to address unique regional risks, such as differing road infrastructure quality and varying levels of enforcement regarding vehicle maintenance and safety standards. The competitive landscape is increasingly globalized, with global carriers leveraging data analytics to standardize risk assessment across diverse geographies.

Segment trends underscore the dominance of comprehensive coverage due to escalating repair costs and asset value protection requirements, particularly for newer fleets. The emergence of specialized policies covering the ‘gap time’ between a ride-hailing driver accepting a fare and picking up a passenger (Period 2 coverage) represents a crucial micro-segment addressing regulatory grey areas. Distribution channel trends show a clear pivot toward direct digital channels and partnerships with fleet management software providers, bypassing traditional brokerage models to reduce commissions and improve data flow accuracy, supporting a lower operating expense ratio for digitally adept insurers.

AI Impact Analysis on Taxi Insurance Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change premium calculation, claims speed, and personalized risk assessment in the volatile taxi insurance sector. Key concerns revolve around the potential for algorithmic bias in pricing, data privacy implications arising from extensive telematics usage, and the eventual impact of autonomous vehicle technology on liability underwriting. Users seek clarity on whether AI tools can realistically reduce the high fraud rates common in commercial auto claims and how machine learning models are optimizing route analysis to predict future accident frequency. The expectation is that AI integration will lead to hyper-personalized, dynamic pricing models, moving away from static, pooled risk assessments to granular, behavioral-driven premiums, thereby lowering costs for safe drivers and improving overall market efficiency.

AI is transforming the underwriting process by utilizing machine learning algorithms to process vast datasets, including driver behavior collected via telematics, historical claim patterns, geopolitical data, and real-time traffic conditions. This capability allows insurers to move beyond basic demographics and create highly predictive risk scores, ensuring premiums are commensurate with the true operational exposure of each taxi or fleet. Furthermore, AI-powered predictive analytics are instrumental in identifying potential fraud indicators at the point of policy application or during the claims submission process. By cross-referencing metadata and scrutinizing claim narratives against established fraudulent patterns, insurers can significantly reduce leakage and improve profitability in a traditionally high-loss line of business.

In the claims handling domain, AI is accelerating decision-making through automated First Notice of Loss (FNOL) processing and computer vision techniques for rapid damage assessment from accident photos. Chatbots and natural language processing (NLP) systems manage routine customer inquiries, allowing human adjusters to focus on complex or contested claims. This enhanced efficiency drastically reduces the cycle time for claims settlement, a critical factor for commercial operations that require vehicles back on the road quickly. The adoption of these AI-driven tools is creating competitive advantages for forward-thinking insurers, enabling them to offer superior customer experiences and maintain tighter control over loss ratios.

- AI-driven Telematics Analysis: Enables precise, real-time assessment of driving behavior (speed, braking, acceleration) to customize premiums.

- Automated Claims Processing: Utilizes machine learning and computer vision to expedite damage assessment and liability determination, reducing settlement times.

- Enhanced Fraud Detection: Deploys predictive models to identify and flag suspicious claim patterns and application misrepresentations, minimizing financial losses.

- Dynamic Pricing Models: Allows for the continuous adjustment of policy premiums based on operational changes and newly acquired risk data.

- Predictive Maintenance Insights: Provides data suggesting necessary vehicle maintenance, reducing mechanical failures that could lead to accidents and subsequent claims.

- Personalized Product Customization: AI segments the driver population to offer policies perfectly tailored to unique usage patterns (e.g., part-time vs. full-time ride-hailing drivers).

DRO & Impact Forces Of Taxi Insurance Market

The Taxi Insurance Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively shape the market's trajectory and profitability. Key drivers include the exponential growth in urban population density worldwide, which necessitates more commercial transport options, thereby increasing the insurable base. Mandatory regulatory frameworks requiring high minimum liability coverage also sustain demand. However, the market faces significant restraints, primarily the high frequency and severity of claims compared to private auto insurance, which strains underwriting profitability and leads to cyclical premium volatility. Furthermore, the lack of standardized regulatory definitions across different municipalities for TNCs complicates multi-regional policy management for large fleet operators and insurers alike. These forces necessitate continuous adaptation in product design and pricing models to maintain viability.

Opportunities in this sector are abundant, particularly through technological leverage. The development of specialized telematics hardware and software offers insurers the chance to mitigate behavioral risks proactively, turning potentially high-risk drivers into manageable accounts. Insurers can capitalize on the evolving mobility landscape by designing flexible, modular insurance products that seamlessly cover transitions between personal use, ride-hailing, and delivery services (the 'gig economy' driver). Furthermore, strategic partnerships with large fleet operators and TNCs for embedded insurance products represent a major growth vector, allowing for efficient data exchange and streamlined policy administration at scale.

The primary impact forces include stringent governmental safety regulations concerning vehicle standards and driver hours, macroeconomic conditions affecting consumer travel spending, and the intense competitive pressure from InsurTech startups focusing exclusively on commercial mobility solutions. The transition towards Electric Vehicles (EVs) in taxi fleets presents a unique impact force; while EVs have fewer moving parts, reducing mechanical risk, their high upfront cost and complex battery damage replacement inflate comprehensive coverage requirements. Ultimately, success in this market is determined by an insurer's ability to efficiently aggregate, analyze, and apply granular data to navigate the inherent volatility and high exposure characteristic of commercial passenger transport.

Segmentation Analysis

The Taxi Insurance Market is primarily segmented by the type of coverage offered, the vehicle classification, the policy duration, and the distribution channel utilized for policy purchase. This comprehensive segmentation allows insurers to tailor their risk models and marketing strategies to specific sub-populations within the commercial transport ecosystem. Coverage type segmentation is crucial as it reflects the varying levels of financial protection mandated by regulatory bodies and sought by fleet owners for asset security. Vehicle classification, particularly the distinction between traditional medallion taxis and ride-hailing vehicles, dictates the complexity of the underwriting process due to fundamental differences in operational models and hours of utilization.

Policy duration segmentation reflects the evolving nature of the workforce, accommodating both established, annual fleet operations and the growing population of gig economy drivers who prefer shorter, pay-as-you-go or monthly policies that match their commitment flexibility. Distribution channels are rapidly shifting, moving away from traditional brokers toward direct online platforms, which are favored by technologically savvy, smaller operators seeking instant quotes and immediate coverage activation. Understanding the preferences and risk profiles across these segments is essential for developing products that achieve maximum market penetration and sustainable loss ratios in this competitive field.

The interplay between these segments defines competitive advantages. For instance, an insurer specializing in short-term policies distributed digitally to TNC drivers needs highly sophisticated automated underwriting capable of handling high transaction volumes and rapidly changing risk data. Conversely, insurers focused on large, traditional taxi fleets prioritize stability, comprehensive fleet management services, and strong relationships with established brokers, emphasizing loss control and negotiated bulk rates. The ability to successfully cross-sell additional products like gap coverage or uninsured motorist protection within these distinct segments further enhances profitability.

- By Coverage Type:

- Third-Party Liability (Mandatory)

- Comprehensive Coverage (Physical Damage)

- Collision Coverage

- Personal Injury Protection (PIP)/Medical Payments

- Uninsured/Underinsured Motorist Coverage

- By Vehicle Type:

- Traditional Medallion Taxis

- Ride-Hailing Vehicles (TNCs/Gig Economy Drivers)

- Fleet Vehicles (Managed by large operators)

- Specialized Transport (e.g., Limousines, Non-Emergency Medical Transport)

- By Policy Type:

- Annual Policies

- Short-Term/Usage-Based Policies

- Monthly Renewable Policies

- By Distribution Channel:

- Insurance Agents and Brokers

- Direct Insurers (Online Platforms)

- Aggregators and Comparison Websites

Value Chain Analysis For Taxi Insurance Market

The value chain for the Taxi Insurance Market starts with upstream analysis focusing on data acquisition and technology development. This involves the creation and maintenance of sophisticated actuarial models, investment in predictive analytics software, and the acquisition of data feeds (telematics, geospatial data, claims history repositories). Key upstream partners include data providers, AI/ML developers, and reinsurers who manage catastrophic risks. Efficient data management and highly accurate risk modeling at this stage are crucial, as they directly influence the competitiveness and profitability of the policy pricing downstream. Reinsurance partnerships are particularly vital given the high severity risk associated with commercial vehicle liability.

Midstream activities encompass policy manufacturing, distribution, and underwriting. Underwriting is the critical core function, where risk is assessed and priced. Distribution channels involve both direct platforms (online portals enabling self-service and immediate quotes) and indirect channels (local brokers specializing in commercial lines who manage relationships with fleet owners). The shift toward digitization is optimizing the midstream by lowering acquisition costs and enhancing the speed of issuance. Insurers that can seamlessly integrate automated underwriting with rapid claims processing maintain a strong competitive edge in this highly transactional market.

Downstream analysis focuses on customer interaction, claims processing, and policy servicing. This stage is dominated by efficient claims management, utilizing rapid response teams, digital claim submission tools, and centralized repair networks. The quality of customer service, particularly during the stressful claims period, dictates customer retention. Direct distribution emphasizes lower costs and immediate access, while indirect distribution relies on brokers providing personalized advice and complex policy management, particularly for large fleet clients. Successful downstream execution requires strong IT infrastructure to support 24/7 commercial operations and immediate regulatory compliance reporting.

Taxi Insurance Market Potential Customers

The primary potential customers in the Taxi Insurance Market are diverse groups operating vehicles for commercial passenger transport, ranging from large corporate entities to independent owner-operators. The largest consumer base comprises commercial fleet operators who manage dozens to hundreds of vehicles, requiring master policies, sophisticated loss control services, and tailored risk management programs. These customers prioritize stability, bulk pricing discounts, and robust claims handling capabilities that minimize vehicle downtime, understanding that every hour a taxi is off the road results in lost revenue. They require complex coverage that often includes named driver exclusions, hired and non-owned auto liability, and gap coverage.

A rapidly expanding customer segment is the individual owner-operator working primarily for Transportation Network Companies (TNCs) like Uber and Lyft, or similar local platforms. These drivers, often part of the gig economy, seek flexible, cost-effective insurance solutions, preferring pay-as-you-go or hybrid policies that automatically adjust coverage based on the vehicle’s status (personal vs. commercial use). This segment is highly price-sensitive and typically engages with insurers through direct online channels or via integration with the TNC's platform. They require coverage that explicitly addresses the unique 'Period 1' and 'Period 2' liability gaps inherent in ride-hailing operations.

Other potential buyers include specialized service providers such as non-emergency medical transport (NEMT) companies, hotel shuttle services, and airport limousine providers. These customers often face unique regulatory requirements related to passenger safety and accessibility, necessitating higher liability limits and specialized endorsements. They value insurers who understand compliance complexities and can offer comprehensive coverage that integrates seamlessly with their high-reliability operational standards. Marketing efforts must address the distinct risk mitigation needs of each customer type to capture maximum market share efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion USD |

| Market Forecast in 2033 | $34.0 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz, AXA, Progressive, Geico, Zurich Insurance Group, State Farm, Berkshire Hathaway, Chubb, Generali, Liberty Mutual, Travelers, AIG, Farmers Insurance, Hiscox, Admiral Group, RSA Insurance Group, Trov, Zego, Root Insurance, USAA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Taxi Insurance Market Key Technology Landscape

The key technology landscape of the Taxi Insurance Market is dominated by advanced telematics and Usage-Based Insurance (UBI) platforms. Telematics devices, ranging from OBD-II plug-ins to smartphone applications, continuously collect granular data on driver behavior, including harsh braking, rapid acceleration, speeding, and trip duration. This data is the foundation for highly personalized risk scores, allowing insurers to offer competitive premiums to demonstrably safer drivers, thereby attracting lower-risk commercial accounts. Furthermore, integrating telematics data with accident reconstruction software enables rapid and highly accurate liability assessment following an incident, reducing the potential for protracted claims disputes and associated legal costs.

Beyond telematics, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) is critical for operational efficiency. AI is extensively used in automated underwriting to instantly process commercial applications, cross-verify compliance documents, and calculate premiums in real-time. On the claims side, AI-driven solutions include chatbots for initial customer interaction, Natural Language Processing (NLP) for reviewing police reports and witness statements, and computer vision technologies for preliminary damage estimation from photos submitted digitally. This automation is essential for managing the high volume of transactions and claims typical in the taxi insurance segment efficiently.

Blockchain technology, while nascent, holds promise for improving security and transparency within the policy life cycle. It can be used to create immutable records of policy issuance, claims history, and regulatory compliance status, simplifying cross-border operations and reducing potential fraud related to policy manipulation. Furthermore, sophisticated cloud-based policy administration systems (PAS) are replacing legacy mainframe systems, offering insurers the scalability and flexibility required to rapidly launch new, modular insurance products tailored to the fast-evolving gig economy and autonomous vehicle testing environments, ensuring technological agility remains a core competitive differentiator.

Regional Highlights

- North America: This region is characterized by highly evolved regulatory frameworks, particularly in major metropolitan areas, demanding high liability limits. The growth is fueled by the mature ride-hailing market and significant investment in InsurTech focused on commercial auto. Key trends include sophisticated telematics adoption and the ongoing convergence of personal and commercial auto policies to cover TNC drivers, notably in the US and Canada.

- Europe: Driven by strong regulatory harmonization within the EU, this market sees strong adoption of UBI, particularly in the UK, Germany, and France. European taxi fleets are rapidly transitioning to Electric Vehicles (EVs), necessitating changes in policy design to account for battery replacement costs and specialized repair networks. Competition is high among established global insurers and specialized local underwriters focused on specific geographic risk pools.

- Asia Pacific (APAC): APAC represents the fastest-growing market by volume, propelled by rapid urbanization in countries like India, China, and Indonesia, and the proliferation of local super-app transportation services. The region is marked by significant variability in road infrastructure and enforcement, leading to higher baseline risks. The opportunity lies in providing affordable, micro-insurance products accessible via mobile platforms to millions of new drivers entering the commercial transport sector.

- Latin America: This region faces challenges related to high traffic congestion, regulatory inconsistency, and elevated theft rates, requiring specific endorsements for comprehensive policies. Market growth is strong, driven by unmet demand for reliable public transport alternatives. Insurers are focusing on integrating advanced anti-theft and tracking technologies as prerequisites for coverage.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in highly developed urban centers (e.g., UAE, Saudi Arabia, South Africa). The market demands high-quality service and often requires Sharia-compliant products in certain jurisdictions. The adoption of modern fleet management systems by transport companies is driving demand for integrated insurance solutions that cover complex operational and geopolitical risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Taxi Insurance Market.- Allianz SE

- AXA Group

- Progressive Corporation

- Geico (A Berkshire Hathaway Subsidiary)

- Zurich Insurance Group AG

- State Farm Mutual Automobile Insurance Company

- Chubb Limited

- Generali Group

- Liberty Mutual Insurance

- Travelers Companies, Inc.

- American International Group (AIG)

- Farmers Insurance Exchange

- Hiscox Ltd.

- Admiral Group plc

- RSA Insurance Group Ltd.

- Trov Insurance

- Zego (WeSmartPark Ltd.)

- Root Insurance Company

- USAA (United Services Automobile Association)

- Tokio Marine Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Taxi Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between personal auto insurance and taxi insurance?

Taxi insurance, or commercial auto insurance, covers vehicles used for profit and passenger transport, involving significantly higher liability limits and more complex risk assessment due to increased mileage, constant road exposure, and regulatory mandates, which are not covered under standard personal policies.

How is the growth of ride-hailing services impacting taxi insurance premiums?

The growth of ride-hailing services has introduced hybrid policies and usage-based insurance (UBI) models. While TNC drivers face higher risks and liability exposure, telematics data allows insurers to price the risk more accurately, potentially lowering premiums for proven safe drivers compared to generalized high-risk pooled rates.

Which geographical region holds the highest potential for growth in the taxi insurance market?

The Asia Pacific (APAC) region, driven by rapid urbanization and the vast, growing population adopting ride-sharing and taxi services in metropolitan areas like Mumbai, Beijing, and Jakarta, is projected to exhibit the highest volumetric growth throughout the forecast period.

What role does telematics technology play in commercial taxi insurance underwriting?

Telematics technology is essential for Usage-Based Insurance (UBI). It collects granular driving data (speeding, hard braking) in real-time, enabling insurers to transition from static risk profiles to dynamic, behavioral pricing models, enhancing underwriting profitability and fraud detection.

How are electric vehicles (EVs) affecting the cost of comprehensive taxi insurance coverage?

While EVs may reduce long-term mechanical claims, their high initial purchase price and the specialized, expensive nature of battery replacement and repair in the event of a collision increase the required limits and cost of comprehensive coverage for taxi fleet owners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager