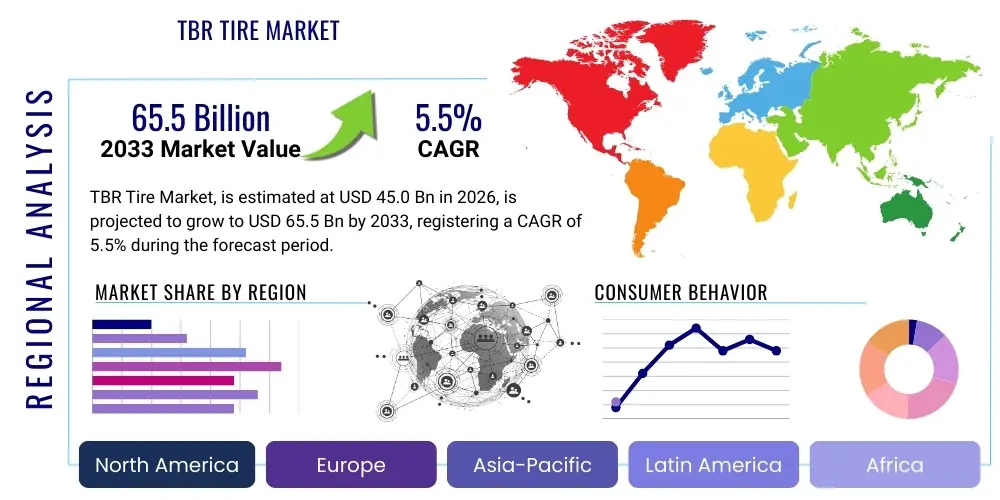

TBR Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435262 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

TBR Tire Market Size

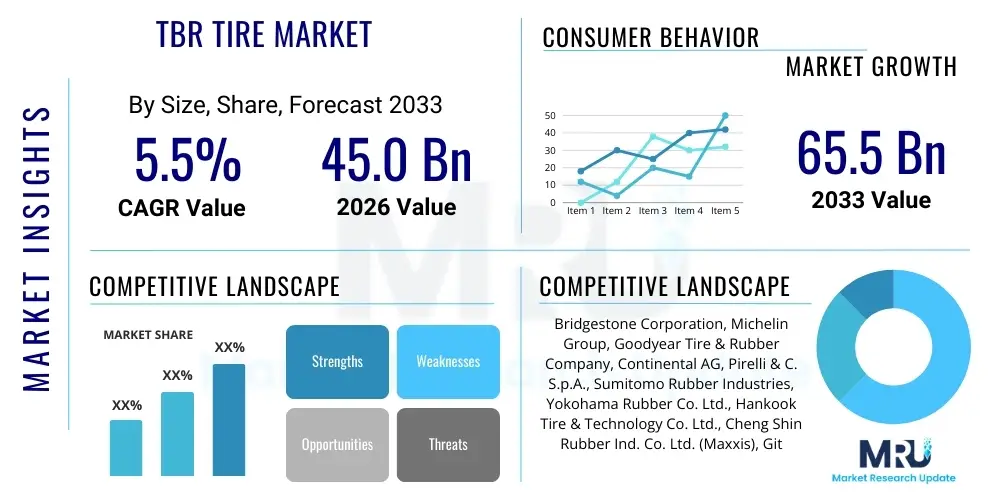

The TBR Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 45.0 billion in 2026 and is projected to reach USD 65.5 billion by the end of the forecast period in 2033.

TBR Tire Market introduction

The Truck and Bus Radial (TBR) Tire Market encompasses the manufacturing, distribution, and sale of specialized radial tires designed for heavy-duty commercial vehicles, including long-haul trucks, regional delivery fleets, and public transit buses. Unlike bias-ply tires, TBR tires feature steel belts under the tread, providing superior structural integrity, enhanced load-carrying capacity, and significantly improved heat dissipation. This radial construction is critical for the demanding operational requirements of commercial logistics, ensuring greater stability, reduced rolling resistance, and enhanced safety during continuous, high-speed travel over long distances.

Major applications for TBR tires span across freight transportation, construction, mining, and passenger transport sectors. The principal benefit derived from using TBR technology is the dramatic reduction in Total Cost of Ownership (TCO) for fleet operators, primarily through extended tire life and high retreadability rates, which maximize the utility of the expensive casing structure. Furthermore, the inherent design of radial tires contributes directly to better fuel efficiency due to lower rolling resistance compared to older tire types, aligning with growing global mandates for reduced carbon emissions within the logistics industry.

Key driving factors accelerating market expansion include the sustained growth in global trade, particularly the surge in e-commerce necessitating robust last-mile and long-haul delivery capabilities, and significant investments in road infrastructure across developing economies. Regulatory environments in North America and Europe mandating improved fuel economy and reduced noise pollution are compelling manufacturers to innovate with advanced rubber compounds and tread designs. The increasing fleet modernization initiatives, especially the shift from older bias-ply tires to modern radial tires in emerging markets, further solidify the foundation for sustained market growth throughout the forecast period.

TBR Tire Market Executive Summary

The TBR Tire Market is characterized by intense competition and a strong cyclical correlation with global economic health, particularly trade volume and commercial vehicle sales. Current business trends indicate a significant push towards premiumization, where fleet operators prioritize tire performance metrics—such as fuel efficiency (low rolling resistance) and durability—over initial unit cost, driven by the desire to minimize operational expenses. Furthermore, manufacturers are strategically investing heavily in advanced manufacturing techniques, including smart factory integration and materials science, to counteract rising raw material costs and improve product consistency, leading to market consolidation among the top tier players who possess the necessary capital for such technological advancements.

Regionally, the Asia Pacific (APAC) continues to dominate the TBR landscape, fueled by massive government investments in infrastructure, rapidly expanding logistics networks in China and India, and high commercial vehicle production volumes. While North America and Europe remain crucial revenue generators, these regions function primarily as mature replacement markets, focusing on high-value, specialized tires that meet stringent safety and environmental regulations, particularly concerning noise limits and winter performance. Emerging markets in Latin America and the Middle East and Africa (LAMEA) are exhibiting rapid, albeit often volatile, growth as local economies professionalize their logistics sectors and increase heavy-duty fleet purchases.

Segment trends reveal that the aftermarket or replacement segment holds a commanding market share, consistently outpacing the Original Equipment Manufacturer (OEM) segment. This dominance is intrinsically linked to the inherent wear-and-tear nature of the product, requiring continuous replacement cycles over the life of a commercial vehicle. The long-haul application segment, driven by the need for ultra-low rolling resistance and extended mileage, is seeing rapid technological innovation, while the urban/regional segment emphasizes durability, retreadability, and resistance to curbside damage. The future growth trajectory is heavily reliant on the successful integration of digitalization and sensor technology into the core tire product.

AI Impact Analysis on TBR Tire Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the TBR Tire Market largely revolve around achieving optimal operational efficiency, extending tire lifespan, and enhancing predictive safety measures. Users frequently inquire about how AI can refine compound formulation, automate complex quality control processes during manufacturing, and, crucially, optimize fleet maintenance schedules. The central theme underlying these inquiries is the expectation that AI integration will shift fleet management from reactive repairs to proactive, data-driven decisions, resulting in substantial savings in fuel and repair expenditures, ultimately minimizing downtime for high-value assets.

In the manufacturing domain, AI algorithms are being employed to analyze vast datasets related to material properties, curing parameters, and machine tolerance, allowing for real-time adjustments that significantly reduce defects and standardize product quality across different batches and plants. This capability is paramount in TBR production, where slight inconsistencies in the radial structure can dramatically affect performance and safety. Furthermore, AI contributes heavily to simulation-driven design, accelerating the development of new tread patterns and casing structures optimized for specific regulatory requirements, such as reduced hydroplaning risk or lower road noise emissions.

For fleet operations, AI-powered telematics systems are transforming the tire as a service model. By continuously analyzing sensor data collected from TPMS (Tire Pressure Monitoring Systems) and integrated tire sensors—monitoring temperature, load, speed, and wear depth—AI models can predict potential failures before they occur. This predictive capability allows fleet managers to schedule maintenance or retreading precisely when needed, maximizing the tire's serviceable life while preventing dangerous blowouts, thereby optimizing asset utilization and minimizing catastrophic risks associated with heavy commercial transport.

- AI-driven optimization of rubber compound chemistry for targeted performance (e.g., wet grip, low rolling resistance).

- Implementation of deep learning models for automated visual inspection during the vulcanization and finishing stages, ensuring zero-defect manufacturing.

- Predictive maintenance scheduling utilizing telematics data to forecast optimal retread timing, maximizing casing utilization.

- Route optimization integration with tire wear models, advising drivers on conditions that minimize abrasion and stress.

- Enhanced inventory management through demand forecasting based on fleet size, geographical location, and average vehicle mileage.

DRO & Impact Forces Of TBR Tire Market

The market dynamics of the TBR sector are profoundly shaped by a combination of robust growth drivers and persistent structural restraints, which collectively generate significant opportunities and impact the strategic trajectory of major players. Key drivers center around the inexorable expansion of the global logistics and transportation sector, underpinned by e-commerce proliferation and sustained infrastructure spending worldwide, particularly in fast-growing Asian economies. Simultaneously, stringent regulatory pressures in developed economies, focusing on reducing carbon footprint through tire efficiency labeling, compel innovation, creating a demand cycle for technologically advanced and premium products.

However, the industry faces severe restraints, most notably the high volatility and unpredictable pricing of essential raw materials, including natural rubber, synthetic rubber derived from petrochemicals, and steel cord. This material cost instability exerts constant pressure on manufacturer margins and necessitates complex hedging strategies. Additionally, the increasing complexity of environmental disposal regulations for end-of-life tires poses logistical and cost challenges for the entire value chain. Geopolitical trade tensions and tariffs also present significant friction, potentially disrupting global supply chains optimized for low-cost production in regions like Southeast Asia.

Opportunities within the TBR market are strongly linked to the adoption of advanced material science, particularly the development of non-oil-derived or bio-based feedstocks and the expansion of smart tire technology that integrates seamlessly with Vehicle-to-Infrastructure (V2I) and fleet management systems. These technological leaps offer significant avenues for differentiation and value creation. The main impact force in the market is the sustained focus on Total Cost of Ownership (TCO) by major fleet buyers, which prioritizes longevity, fuel efficiency, and retreadability, forcing manufacturers to shift away from simple price competition toward performance and lifecycle guarantees.

Segmentation Analysis

The TBR Tire Market is primarily segmented across three critical dimensions: Vehicle Type, Application Type, and End-Use Channel. Understanding these segmentations is vital for manufacturers to tailor product specifications and distribution strategies effectively. The Vehicle Type segmentation distinguishes between tires designed for heavy-duty trucks (Class 8 in North America, often requiring higher load indexes and deep tread depths) and those for commercial buses (which prioritize passenger comfort, low noise, and specific urban cycling durability). The structural requirements for these segments necessitate distinct engineering approaches, ranging from high-speed stability features for long-haul trucking to enhanced sidewall protection for continuous city use.

The Application Type segmentation further refines product categories based on operational environments, separating the market into Long Haul (focused on maximizing fuel economy and mileage), Regional Haul (requiring a balance of grip, durability, and moderate rolling resistance), and Urban/Mixed Service (demanding superior cut and chip resistance, high torque capability, and enhanced traction). The performance requirements for a tire used in demanding mining operations differ vastly from one used on a highway freighter, mandating specialized compounding and structural reinforcements in each category.

In terms of the End-Use Channel, the market is divided into OEM (Original Equipment Manufacturer) and Replacement (Aftermarket) sales. The replacement segment is the largest and most stable revenue stream, driven by the non-negotiable wear cycle of tires. Conversely, the OEM segment is inherently tied to the often-cyclical commercial vehicle production schedule but offers manufacturers high-volume sales and serves as a critical pathway for introducing new technologies and setting market benchmarks, influencing subsequent aftermarket purchasing decisions based on initial factory fitment performance.

- By Vehicle Type

- Truck Tires (Heavy, Medium, Light Duty)

- Bus Tires (City, Coach, School Bus)

- By Application Type

- Long Haul

- Regional Haul

- Urban/Mixed Service

- Off-Road/Severe Service (Construction, Mining)

- By End-Use Channel

- Original Equipment Manufacturer (OEM)

- Replacement Market (Aftermarket)

- By Tire Type

- Tube Type

- Tubeless

- By Sales Channel

- Specialty Tire Dealers

- Independent Workshops and Garages

- Online Retailing

- Direct Fleet Sales

Value Chain Analysis For TBR Tire Market

The TBR Tire value chain is capital-intensive and begins with a complex upstream analysis focused on securing a consistent and cost-effective supply of raw materials. Key upstream inputs include natural rubber (highly dependent on Southeast Asian agricultural output), synthetic rubber (a petrochemical derivative sensitive to oil price fluctuations), carbon black, steel cord, and specialized chemicals. Managing the volatility and securing favorable long-term contracts for these materials is a major determinant of profitability. Given the global nature of production and sourcing, geopolitical stability and logistics efficiency in transporting these bulk raw materials are critical preliminary steps before the manufacturing phase.

The midstream phase involves the sophisticated manufacturing process, which includes mixing, compounding, building, and vulcanization—a highly automated process requiring massive investments in machinery and technology, particularly for producing high-quality radial casings capable of multiple retreads. Manufacturers differentiate themselves here through precision engineering and intellectual property related to tread patterns and internal structure. Following production, distribution becomes paramount; large multinational companies often utilize direct sales models for major national and international fleet customers, securing long-term supply and service contracts, providing integrated tire management solutions.

The downstream analysis focuses on reaching the final customer through both direct and indirect channels. Direct channels involve manufacturers selling directly to OEMs or major national fleets, providing economies of scale and centralized logistics support. Indirect channels utilize specialized dealer networks, independent distributors, and dedicated service centers that are crucial for the aftermarket segment, offering mounting, balancing, and, most importantly, professional retreading services. Retreading—the process of applying a new tread to a worn casing—is a foundational element of the TBR market, extending product life and significantly lowering TCO, making the downstream service infrastructure a crucial competitive differentiator.

TBR Tire Market Potential Customers

The primary consumers of TBR tires are large-scale commercial fleet operators who manage extensive networks of heavy-duty vehicles for logistics, freight, and distribution services. These fleets, including national parcel carriers, major third-party logistics (3PL) providers, and international haulage companies, prioritize product performance that translates directly into cost savings, particularly fuel efficiency and guaranteed longevity. For these high-volume buyers, the relationship is often direct, involving long-term service contracts, technical support, and customized tire management programs aimed at maximizing uptime and ensuring regulatory compliance across vast operational territories.

Secondary but equally vital customer groups include Original Equipment Manufacturers (OEMs) of trucks and buses, who represent a concentrated purchase volume linked to new vehicle production cycles. While OEM pricing is highly competitive, securing these contracts is strategically important as it establishes a tire brand's quality reputation and ensures baseline volume production. Additionally, municipal and governmental entities, such as public transit authorities and defense organizations, constitute stable customer bases requiring specialized tires that meet stringent safety, noise, and durability standards specific to regulated urban environments or severe operational duties.

Independent owner-operators and smaller regional trucking companies represent the fragmented segment of the replacement market, typically accessing products through indirect distribution channels like local tire dealers and workshops. These buyers are often more price-sensitive but increasingly recognize the long-term value derived from quality radial tires that offer better mileage and retreadability, shifting their purchasing criteria away from initial unit cost toward verifiable performance metrics and reliable warranty support. The purchasing decision for all customer groups is fundamentally focused on achieving the lowest cost per kilometer (CPK) rather than the lowest unit price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 billion |

| Market Forecast in 2033 | USD 65.5 billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Yokohama Rubber Co. Ltd., Hankook Tire & Technology Co. Ltd., Cheng Shin Rubber Ind. Co. Ltd. (Maxxis), Giti Tire Pte. Ltd., Apollo Tyres Ltd., MRF Limited, Kumho Tire Co. Inc., Triangle Tyre Co. Ltd., Zhongce Rubber Group Co. Ltd. (ZC Rubber), Toyo Tire Corporation, Sailun Group Co. Ltd., Linglong Tire Co., Titan International, Double Coin Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TBR Tire Market Key Technology Landscape

The technological landscape of the TBR Tire Market is undergoing rapid evolution, moving beyond basic radial construction towards advanced material science and digital integration. A core focus remains on enhancing the structural integrity of the tire casing, which is the most expensive component and determines retreadability. Current advancements include the use of high-tensile steel cord and specialized textile reinforcements to allow for higher load indices and sustained performance under severe operational stress. Furthermore, continuous R&D is devoted to developing next-generation tread compounds, often incorporating high-dispersion silica and specialized polymers, to drastically reduce rolling resistance while maintaining required wet grip and wear characteristics, directly addressing fuel economy regulations.

The most transformative technology currently gaining traction is the integration of digital intelligence, resulting in the proliferation of 'smart tires.' These tires incorporate internal sensors—such as Bluetooth chips or RFID tags combined with TPMS—that continuously monitor critical parameters like internal temperature, air pressure, and tread depth. This real-time data collection, facilitated by sophisticated embedded electronics, allows fleet managers to transition from manual checks to proactive, condition-based monitoring, preventing catastrophic failures and optimizing maintenance cycles. The standardization and durability of these embedded sensors are critical areas of current technological research, ensuring they withstand the extreme mechanical forces and heat generated during commercial use.

Sustainability represents another critical technological frontier, influencing both material inputs and manufacturing processes. Manufacturers are actively pursuing technologies that enable the incorporation of higher percentages of sustainable raw materials, including derived rubber from non-food crops, bio-oils, and recycled end-of-life tire materials processed through pyrolysis or devulcanization techniques. Concurrently, manufacturing plants are adopting Industry 4.0 standards, utilizing Artificial Intelligence and automation to optimize energy consumption during the curing process and improve resource efficiency, positioning the industry toward achieving ambitious circular economy goals mandated by global environmental frameworks.

Regional Highlights

The regional dynamics of the TBR Tire Market show stark contrasts based on economic maturity, regulatory environment, and infrastructure development. Asia Pacific (APAC) stands out as the global growth engine, commanding the largest market share both in terms of volume and value. This dominance is attributable to the region’s expansive manufacturing base—particularly in China and Southeast Asia—high rates of urbanization, and massive governmental investments in infrastructure projects, such as highways and logistics hubs, which necessitate continuous fleet expansion and replacement. The high volume of commercial vehicle production in countries like China and India further solidifies APAC’s lead, driving both OEM and replacement demand, though price competition remains fierce in this region.

North America and Europe constitute highly mature markets characterized by stringent regulatory oversight concerning fuel efficiency (e.g., EU tire labeling regulations) and environmental impact. Growth here is primarily driven by the replacement cycle and the demand for premium, high-performance TBR tires that offer superior fuel savings and low noise operation. Fleet operators in these regions are highly sophisticated buyers, focused on documented Cost Per Kilometer (CPK) performance and increasingly adopting advanced features like embedded sensors and tire management services, prioritizing long-term operational efficiency over upfront cost.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting strong potential due to improving economic conditions, increased regional trade, and significant investment in sectors like mining, construction, and oil & gas, all of which require heavy-duty transport capabilities. However, these markets often face challenges related to varied road quality and unpredictable fuel pricing. Demand in LAMEA often favors durable, robust tires capable of handling severe service conditions, and the adoption of radial technology is still in the process of replacing older bias-ply standards in many local markets, presenting significant future growth opportunities for manufacturers capable of offering high-durability products.

- Asia Pacific (APAC) is the largest market, driven by fleet expansion, massive infrastructure spending, and high-volume commercial vehicle production, especially in China and India.

- North America is a high-value replacement market focusing intensely on fuel-efficient (SmartWay verified) and premium low-rolling-resistance tires to minimize operating costs for large interstate fleets.

- Europe emphasizes regulatory compliance, leading demand for tires optimized for low noise emissions and high safety ratings, benefiting manufacturers focused on advanced R&D and performance labeling.

- Latin America shows strong growth potential, particularly in Brazil and Mexico, fueled by expanding agricultural and commodity logistics requiring highly durable TBR products.

- Middle East and Africa (MEA) growth is localized, driven by construction and resource extraction activities, favoring tires engineered for extreme heat and demanding operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TBR Tire Market.- Bridgestone Corporation

- Michelin Group

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries

- Yokohama Rubber Co. Ltd.

- Hankook Tire & Technology Co. Ltd.

- Cheng Shin Rubber Ind. Co. Ltd. (Maxxis)

- Giti Tire Pte. Ltd.

- Apollo Tyres Ltd.

- MRF Limited

- Kumho Tire Co. Inc.

- Triangle Tyre Co. Ltd.

- Zhongce Rubber Group Co. Ltd. (ZC Rubber)

- Toyo Tire Corporation

- Sailun Group Co. Ltd.

- Linglong Tire Co.

- Titan International

- Double Coin Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the TBR Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for TBR tires globally?

The primary driver is the sustained growth of the global logistics and freight sector, heavily influenced by the expansion of e-commerce and subsequent increase in commercial vehicle fleet usage worldwide, necessitating durable, reliable, and fuel-efficient tires.

How does radial construction benefit commercial fleet operations?

Radial construction provides superior load capacity, enhanced heat dissipation crucial for long-haul stability, better fuel economy through reduced rolling resistance, and high retreadability, which significantly lowers the Total Cost of Ownership (TCO) for fleets.

Which segment holds the largest share in the TBR Tire Market?

The Replacement Market (Aftermarket) holds the largest market share. This is due to the inherent wear and tear of tires, requiring continuous replacement cycles over the multi-year lifespan of commercial trucks and buses.

What role does smart technology play in the future of TBR tires?

Smart technology, primarily integrated sensors (TPMS), enables real-time monitoring of tire pressure and temperature. This facilitates predictive maintenance, maximizes tire lifespan by optimizing service timing, and enhances overall vehicle safety and operational efficiency.

What are the main regional challenges faced by TBR manufacturers?

Manufacturers face differing challenges regionally: high raw material price volatility globally, stringent environmental and safety regulations in North America and Europe, and logistical complexities combined with infrastructure variability in emerging markets like LAMEA.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager