TCPP Flame Retardant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432782 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

TCPP Flame Retardant Market Size

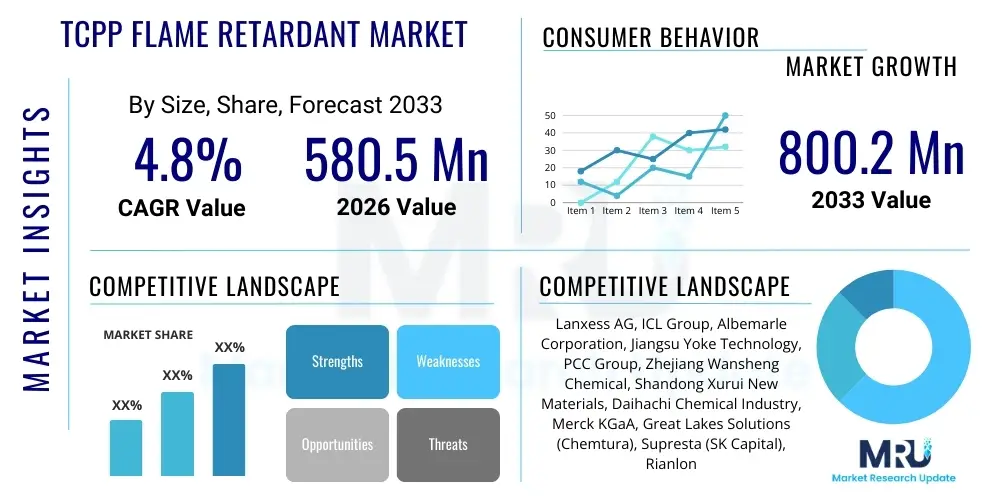

The TCPP Flame Retardant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 580.5 Million in 2026 and is projected to reach USD 800.2 Million by the end of the forecast period in 2033.

TCPP Flame Retardant Market introduction

The TCPP (Tris(2-chloro-1-methylethyl) phosphate) Flame Retardant Market encompasses the production, distribution, and consumption of this organophosphorus compound primarily utilized to enhance the fire safety characteristics of various polymeric materials. TCPP is classified as a halogenated organophosphate, known for its effectiveness in the condensed phase mechanism of flame retardation, which allows it to interrupt the combustion process by forming a protective char layer and reducing the release of flammable gases. Its exceptional cost-performance ratio and compatibility with diverse polymer matrices, especially polyurethane (PU) foams, render it a staple chemical in the construction, automotive, and electronics sectors. The intrinsic chemical structure of TCPP provides high thermal stability and low volatility, crucial attributes for long-term incorporation into rigid and flexible foams used extensively for insulation purposes.

The primary applications driving the demand for TCPP include rigid polyurethane foams used in building insulation, flexible PU foams employed in furniture and bedding, and various coatings and adhesives. In the construction industry, stringent fire safety codes, particularly in developed economies, necessitate the incorporation of reliable flame retardants into insulating materials, making TCPP a preferred choice due to its effectiveness in achieving standards like ASTM E84 and EN 13501. Moreover, the global shift towards energy-efficient building standards directly correlates with increased demand for highly effective thermal insulation, thereby underpinning the continuous market growth for TCPP. Despite regulatory scrutiny regarding certain halogenated compounds, TCPP maintains market dominance owing to the difficulty in finding cost-effective, high-performance alternatives for specific applications.

Key driving factors for the TCPP market involve rapid urbanization and infrastructure development in the Asia Pacific region, leading to exponential growth in the construction and insulation markets. The robust demand for automobiles globally also contributes significantly, as TCPP is used in seating, dashboard components, and interior textiles to meet mandatory safety standards. Furthermore, continuous technological advancements in manufacturing processes aim to minimize residual volatile organic compounds (VOCs) and enhance the purity of commercial-grade TCPP, improving its environmental profile and ensuring compliance with evolving global health and safety regulations. The versatility and established efficacy of TCPP ensure its sustained relevance across multiple high-growth end-use sectors.

TCPP Flame Retardant Market Executive Summary

The TCPP Flame Retardant Market is experiencing dynamic shifts, characterized by strong demand from the global construction sector, balanced against increasing regulatory pressures concerning halogenated chemicals and a growing preference for sustainable alternatives. Business trends indicate consolidation among major global chemical manufacturers seeking to optimize supply chains and increase production efficiency, particularly in response to volatile raw material costs, specifically propylene oxide and phosphorusoxychloride. Regional trends show robust market expansion in the Asia Pacific (APAC), fueled by massive infrastructure investments in China, India, and Southeast Asian nations where thermal insulation standards are rapidly being implemented or strengthened. Conversely, mature markets in North America and Europe are focusing more on regulatory compliance and the development of low-emission, high-purity grades of TCPP.

Segmentation trends highlight the dominance of the polyurethane foams segment, which accounts for the vast majority of TCPP consumption, driven primarily by the need for rigid foams in energy-efficient construction. Within the application types, the construction and building segment remains the cornerstone of market demand, followed by automotive interiors and electrical casings. A critical trend impacting future segmentation involves the increasing investment in flexible foam applications, specifically for bedding and upholstered furniture, where flame retardancy standards are becoming stricter in response to fire safety legislation. The competitive landscape is intensely focused on product differentiation through purity levels and customized formulations designed to meet highly specific fire testing requirements across different polymer systems.

Strategic initiatives across the industry include vertical integration to secure precursor chemical supply and aggressive capacity expansions, particularly in regions with lower operating costs. While TCPP faces long-term challenges from non-halogenated alternatives, its established performance profile and cost-effectiveness ensure short-to-medium-term market stability. Companies are strategically balancing the need to maintain existing TCPP market share while simultaneously investing in next-generation phosphorus and silicon-based flame retardants to prepare for potential future regulatory shifts. The overall market trajectory remains positive, underpinned by non-negotiable global fire safety standards and sustained growth in infrastructure and manufacturing activities worldwide.

AI Impact Analysis on TCPP Flame Retardant Market

User queries regarding AI's influence on the TCPP market frequently revolve around how artificial intelligence can optimize the synthesis and formulation of flame retardants, mitigate supply chain risks associated with precursor chemicals, and accelerate the discovery of safer, more sustainable alternatives. Common concerns include the cost implication of adopting AI-driven manufacturing processes and the predictability of future regulatory environments. Users are primarily seeking reassurance that AI can enhance the efficiency of existing TCPP production while simultaneously aiding R&D efforts to future-proof the industry against bans on halogenated compounds. The consensus theme is that AI will transform TCPP production from a batch-based, empirical process to a data-driven, continuous operation, thereby reducing waste and improving product consistency, which is crucial for achieving high-specification certifications required in end-use applications like aerospace or high-performance insulation panels.

AI’s influence is segmented into operational efficiency and predictive intelligence. Operationally, machine learning algorithms are being applied to optimize reactor conditions (temperature, pressure, catalyst concentration) during the synthesis of TCPP, leading to higher yields and reduced energy consumption. Predictive intelligence, on the other hand, utilizes complex data modeling to forecast fluctuations in the pricing and availability of key raw materials such as phosphorus oxychloride and epichlorohydrin, allowing manufacturers to implement dynamic inventory strategies and hedge against market volatility. Furthermore, AI-powered predictive maintenance minimizes unscheduled downtime in capital-intensive chemical plants, thereby guaranteeing stable production schedules necessary to meet the high-volume demand from the rapidly expanding construction sector, particularly during peak building seasons in Asia Pacific and North America.

In the area of product innovation, AI is playing an increasingly vital role in molecular design. Generative models are being used to simulate the flame retardancy mechanism of novel organophosphates, allowing researchers to screen thousands of potential TCPP derivatives or synergistic blends without extensive physical laboratory testing. This high-throughput computational screening drastically reduces the time-to-market for specialized or regulatory-compliant formulations. This capability is especially important given the increasing regulatory scrutiny worldwide, compelling producers to rapidly develop TCPP grades with lower migration potential or enhanced thermal stability, thus ensuring that the industry can maintain its competitive edge while adhering to evolving environmental and health mandates.

- AI optimizes chemical reaction parameters, enhancing TCPP yield and purity.

- Machine learning algorithms predict raw material price fluctuations (e.g., phosphorus and chlorine precursors), enabling proactive procurement strategies.

- Predictive maintenance schedules in manufacturing plants reduce operational downtime and ensure steady supply.

- AI accelerates the R&D cycle for next-generation, potentially non-halogenated, alternatives to TCPP through molecular simulation.

- Advanced analytics improve quality control by identifying deviations in TCPP formulation leading to better regulatory compliance.

- Demand forecasting models refine production planning to match the cyclical nature of the construction and automotive industries.

DRO & Impact Forces Of TCPP Flame Retardant Market

The market for TCPP Flame Retardants is shaped by a confluence of strong market drivers, significant regulatory restraints, and compelling technological opportunities, all interacting as impact forces. Key drivers include increasingly stringent global fire safety standards, especially within the construction sector, where materials like rigid polyurethane insulation foam must meet demanding fire codes to minimize property damage and loss of life. The massive global urbanization trend, particularly in emerging economies, mandates increased use of standardized building materials, further amplifying the demand for effective and economical flame retardants like TCPP. Simultaneously, the restraints are dominated by regulatory actions, particularly in Europe and parts of North America, focused on reducing the use of halogenated flame retardants due to environmental and potential human health concerns, leading to sustained pressure on manufacturers to seek alternatives or provide low-VOC formulations. The market dynamic is characterized by the constant tension between performance requirements and environmental compliance.

Opportunities for market players primarily lie in developing high-purity TCPP grades with lower volatile organic content (VOC) profiles to appease regulatory bodies and market demand for safer products. Furthermore, strategic alliances and focused R&D on synergistic blends combining TCPP with non-halogenated compounds (like melamine or red phosphorus derivatives) present a viable pathway to maintaining performance while improving environmental acceptability. The rising global focus on energy efficiency in buildings provides a robust long-term opportunity, as insulation remains the largest application area, consistently driving TCPP consumption. Impact forces include economic cycles affecting the construction industry, geopolitical instability impacting phosphorus supply chains, and continuous innovation in polymer science which can either introduce high-performing non-TCPP alternatives or further integrate TCPP into complex, multi-layered material systems.

Ultimately, the impact forces suggest a market segment undergoing transformation. While the high efficacy and cost advantages of TCPP provide inertial resistance to immediate replacement, sustained regulatory pressure ensures that innovation towards less hazardous alternatives remains a critical business imperative. Companies that successfully navigate this environment by demonstrating rigorous risk management, investing in product stewardship, and achieving compliance with the most stringent global standards are positioned for market leadership. The immediate impact is a focus on formulation adjustments and advanced testing protocols, whereas the long-term impact involves diversification into sustainable flame retardant chemistries while leveraging TCPP’s established application base in regions where regulatory scrutiny is less intense or where cost-performance remains the paramount decision factor.

Segmentation Analysis

The TCPP Flame Retardant market is comprehensively segmented based on its Purity Grade, Application Method, and primary End-Use Industry, reflecting the diverse requirements of the end-user landscape. Purity grade segmentation differentiates between technical grade TCPP, often used in less sensitive applications like construction materials, and high-purity grades, which are required for stringent applications such as electrical casings, automotive components, and certain flexible foams where low fogging and low residual VOCs are paramount. Application Method segmentation primarily includes reactive flame retardants, which chemically bond with the polymer, and additive flame retardants like TCPP, which are physically mixed into the material, with TCPP overwhelmingly falling into the additive category, demonstrating its ease of incorporation into polyurethane systems.

The end-use industry segmentation forms the core of market revenue analysis, dominated by the construction and building segment due to the vast volumes of rigid polyurethane (PU) insulation foam consumed globally. This segment's growth is inherently tied to global construction activity and evolving energy efficiency mandates. The second critical segment is the automotive sector, where TCPP is used in seating, headliners, and under-the-hood components to meet strict vehicular fire safety standards (FMVSS 302). Furthermore, the electrical and electronics sector utilizes TCPP in casings and circuit board coatings to prevent short-circuit fires. Geographic segmentation also plays a crucial role, highlighting the differential regulatory environments and consumption patterns between regions like APAC (high volume, rapidly growing) and Europe (stable volume, high regulatory constraint).

- By Purity Grade:

- Technical Grade TCPP

- High Purity Grade TCPP (Low VOC)

- By Application Method:

- Additive Flame Retardants (Dominant)

- Reactive Flame Retardants (Minimal Use in TCPP Context)

- By End-Use Industry:

- Construction and Building (Rigid PU Foam Insulation)

- Automotive (Seating, Interiors, Engine Components)

- Furniture and Bedding (Flexible PU Foam)

- Electrical and Electronics

- Coatings and Adhesives

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For TCPP Flame Retardant Market

The value chain for the TCPP Flame Retardant Market is highly integrated, starting from the extraction and processing of core raw materials upstream and culminating in the delivery of fire-safe final products downstream. Upstream analysis reveals reliance on key chemical precursors: phosphorus oxychloride, propylene oxide, and epichlorohydrin. The stability and pricing of these commodities are critical factors determining the profit margins for TCPP manufacturers. Manufacturers must manage complex chemical synthesis processes, often requiring stringent safety and environmental controls. Given the chemical nature of TCPP, vertical integration by large chemical conglomerates is common, allowing better control over raw material sourcing and quality assurance, which directly impacts the purity and effectiveness of the final flame retardant product supplied to the market.

Midstream activities involve the actual chemical synthesis, purification, and granulation or liquid formulation of TCPP. This stage requires significant technological expertise to ensure compliance with product specifications, such as thermal stability, viscosity, and low residual volatility. Distribution channels for TCPP are bifurcated into direct sales and indirect sales. Direct distribution is favored for large-volume customers, such as major multinational polyurethane system houses or large construction material manufacturers, ensuring technical support and tailored logistics. Indirect distribution relies on specialized chemical distributors and regional agents who manage smaller orders and provide localized stockholding and delivery services to smaller, regional foam manufacturers or compounders, thereby widening market access.

Downstream analysis focuses on the integration of TCPP into end-use products. The largest customers are the rigid and flexible polyurethane foam producers who incorporate the additive during the foaming process. These foam products are then sold to the construction sector (insulation panels), automotive manufacturers (seating components), and furniture producers. The final consumer purchasing decisions, though indirect, are heavily influenced by regulatory mandates and safety certifications achieved by the end-products. The efficiency of the entire chain is dependent on minimizing logistical costs for a relatively high-volume chemical and ensuring the rapid adoption of newly compliant or purified formulations across all manufacturing touchpoints.

TCPP Flame Retardant Market Potential Customers

The primary potential customers and end-users of TCPP flame retardants are manufacturers of polymeric materials who are legally mandated or voluntarily choose to comply with fire safety standards. The most significant customer base comprises the global polyurethane system houses and foam producers, both rigid and flexible, as TCPP is exceptionally effective and cost-efficient in these matrices. These include large-scale manufacturers of thermal insulation boards utilized in commercial and residential buildings, cold storage facilities, and pipe insulation. Furthermore, the construction chemicals industry, which produces specialized coatings, sealants, and adhesive systems requiring flame resistance, represents a substantial customer segment constantly seeking proven, reliable fire-retarding additives for enhancing product performance.

A secondary, yet crucial, group of buyers includes companies in the transportation sector, specifically automotive OEMs and Tier 1 suppliers. These entities purchase TCPP either directly or as an additive within compounded plastics and textiles used for car interiors, engine compartments, and vehicle sound-dampening materials to adhere to stringent transportation safety regulations. The electronics and electrical appliance manufacturing sector also forms a key customer base, utilizing TCPP in injection-molded plastic casings and potting compounds where heat generation is a constant concern. These customers prioritize high thermal stability and electrical performance, alongside flame retardancy, demanding high-purity, low-fogging grades of TCPP to prevent component corrosion or interference.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Million |

| Market Forecast in 2033 | USD 800.2 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, ICL Group, Albemarle Corporation, Jiangsu Yoke Technology, PCC Group, Zhejiang Wansheng Chemical, Shandong Xurui New Materials, Daihachi Chemical Industry, Merck KGaA, Great Lakes Solutions (Chemtura), Supresta (SK Capital), Rianlon Corporation, Chitec Technology, Tianjin Bohai Chemical Industry, Italmatch Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TCPP Flame Retardant Market Key Technology Landscape

The technological landscape surrounding the TCPP Flame Retardant market primarily focuses on refining synthesis processes to enhance purity and minimize environmental impact, rather than developing fundamentally new applications for the molecule itself. Core manufacturing technology involves the phosphorylation of chlorinated alcohols, typically requiring batch or semi-continuous reaction systems. Recent technological advancements aim to optimize these reaction conditions, utilizing advanced catalysis techniques and sophisticated filtration systems to yield High Purity Grade TCPP with extremely low levels of volatile organic compounds (VOCs). This low-VOC focus is a direct response to health and safety regulations, particularly in the European Union and North America, necessitating investment in specialized purification trains and handling systems to ensure product compliance for sensitive applications like bedding and aerospace materials.

Furthermore, technology is rapidly evolving in the application side, specifically concerning the formulation of polymer systems containing TCPP. Significant R&D is directed towards creating synergistic flame retardant packages. This involves combining TCPP, an effective vapor-phase and condensed-phase inhibitor, with intumescent agents or mineral fillers. These blended formulations aim to meet new, more rigorous fire tests (e.g., California Technical Bulletin 117-2013) while potentially reducing the overall TCPP loading, thereby mitigating health concerns associated with high concentrations. Advances in continuous mixing and dispensing technologies for polyurethane foams ensure homogeneous dispersion of TCPP throughout the matrix, maximizing its efficiency at lower usage levels and improving the structural integrity of the final insulating product.

In response to long-term sustainability pressures, technology development also includes sophisticated analytical tools and modeling software that predict the environmental fate and toxicity of various TCPP formulations. Chromatography and mass spectrometry techniques are being employed to monitor residual reactants and byproducts rigorously, ensuring the final product meets the highest possible standards for worker safety and consumer exposure. The future technological trajectory is characterized by digital manufacturing integration (Industry 4.0 principles) to achieve real-time process control, further optimizing energy consumption during synthesis and ensuring unprecedented batch-to-batch consistency, which is vital for multinational customers operating under global quality standards.

Regional Highlights

- Asia Pacific (APAC): The APAC region dominates the global TCPP market in terms of both consumption volume and growth rate. This exponential growth is primarily driven by massive infrastructure expansion, rapid urbanization, and a burgeoning middle class demanding higher quality residential and commercial construction. China and India are the largest consumers, rapidly adopting international building codes that mandate the use of flame-retardant insulation (rigid PU foam). Furthermore, the expanding manufacturing base in Southeast Asia, particularly in automotive and electronics production, contributes significantly to regional demand, positioning APAC as the primary engine for future market growth despite increasing localized regulatory scrutiny.

- North America: North America represents a mature, high-value market characterized by stringent fire safety codes and a strong focus on energy efficiency (e.g., LEED certification). Demand for TCPP is stable, largely driven by residential and commercial roofing and wall insulation. However, the region is highly sensitive to environmental regulations, leading to a strong preference for High Purity, low-VOC TCPP grades. Market participants here focus on innovation in formulation to maintain performance while navigating state-level restrictions and managing public perception regarding halogenated chemicals.

- Europe: Europe is defined by its rigorous regulatory framework, notably REACH, which heavily influences the acceptable use and classification of flame retardants. While demand for insulation (driven by ambitious EU climate targets) remains high, the market is characterized by active substitution attempts towards non-halogenated alternatives due to long-term environmental concerns associated with TCPP. European producers often lead in developing ultra-pure TCPP grades and synergistic blends to maintain market presence while investing heavily in sustainable alternatives, balancing performance necessity with strict regulatory compliance.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets exhibiting accelerated growth, largely mirroring the urbanization trends seen earlier in APAC. MEA, particularly the GCC countries, sees robust demand due to large-scale construction projects and rising standards for fire safety in petrochemical facilities and commercial complexes. LATAM markets are slowly standardizing their building codes, leading to gradual but steady growth in TCPP consumption, supported by international chemical distributors establishing local partnerships to streamline supply logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TCPP Flame Retardant Market.- Lanxess AG

- ICL Group

- Albemarle Corporation

- Jiangsu Yoke Technology Co., Ltd.

- PCC Group

- Zhejiang Wansheng Chemical Co., Ltd.

- Shandong Xurui New Materials Co., Ltd.

- Daihachi Chemical Industry Co., Ltd.

- Merck KGaA

- Great Lakes Solutions (Acquired by Lanxess)

- Supresta LLC (SK Capital)

- Rianlon Corporation

- Chitec Technology Co., Ltd.

- Tianjin Bohai Chemical Industry Co., Ltd.

- Italmatch Chemicals S.p.A.

- Adeka Corporation

- Hubei Xingfa Chemicals Group Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Huntsman Corporation

- BASF SE

Frequently Asked Questions

Analyze common user questions about the TCPP Flame Retardant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the TCPP Flame Retardant Market?

The primary driver is the global implementation of stricter fire safety regulations across the construction industry, particularly the mandatory requirement for effective flame retardancy in rigid polyurethane foam used for building insulation.

Is TCPP considered a halogenated or non-halogenated flame retardant?

TCPP (Tris(2-chloro-1-methylethyl) phosphate) is classified as a halogenated organophosphate flame retardant, meaning it contains chlorine atoms within its chemical structure, which contributes to its high efficacy.

Which end-use industry holds the largest market share for TCPP consumption?

The Construction and Building industry holds the largest market share, driven overwhelmingly by the high-volume consumption of TCPP as an additive in rigid polyurethane (PU) foam insulation panels and spray foam systems.

What are the main regulatory challenges facing the TCPP market?

The main challenges stem from increasing regulatory scrutiny in developed markets, notably in Europe and North America, concerning the long-term environmental and health impact of certain halogenated compounds, pressuring manufacturers to develop low-VOC or alternative formulations.

How is the TCPP market utilizing AI technology?

The market is leveraging AI to optimize TCPP synthesis processes for higher purity and lower energy consumption, predict volatility in raw material supply chains, and accelerate the computational screening and design of next-generation flame retardant formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager