TD LTE Ecosystem Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432946 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

TD LTE Ecosystem Market Size

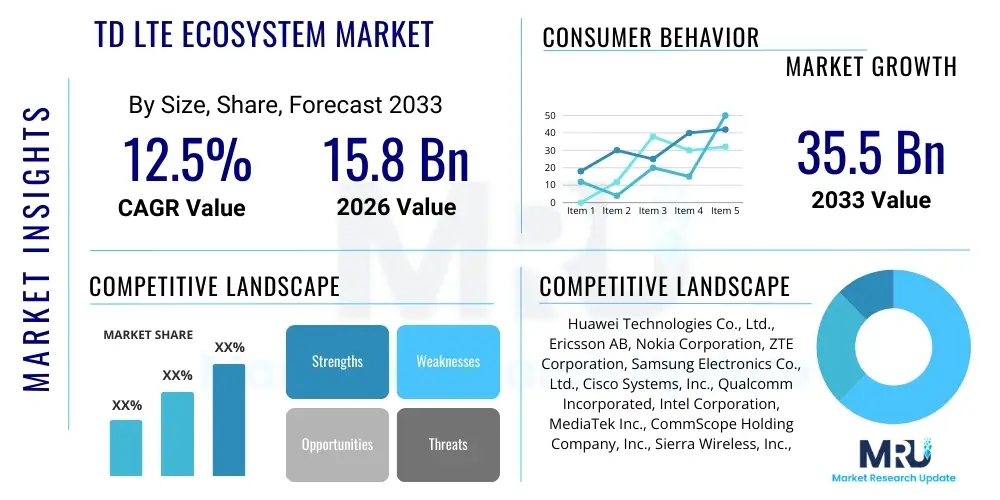

The TD LTE Ecosystem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 35.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for high-speed mobile broadband services, especially in dense urban environments and emerging economies where spectrum efficiency afforded by Time Division Duplexing (TDD) technology is highly valuable. Furthermore, the extensive deployment of private LTE networks across critical infrastructure sectors such as utilities, transportation, and industrial manufacturing significantly contributes to market expansion, cementing TD-LTE’s role as a resilient foundation for mission-critical connectivity before and during the ongoing transition to 5G New Radio (NR) implementations.

TD LTE Ecosystem Market introduction

The TD LTE Ecosystem Market encompasses all components, infrastructure, software, and services required for the deployment and operation of Long-Term Evolution networks utilizing Time Division Duplexing. TD-LTE, unlike Frequency Division Duplexing (FDD-LTE), uses the same frequency band for both uplink and downlink transmission, separating the two streams in time. This inherent flexibility allows network operators to dynamically allocate spectrum resources based on immediate traffic requirements—a significant advantage in data-heavy environments where downlink traffic often far exceeds uplink needs. Key products within this ecosystem include base stations (eNodeBs), core network elements (EPCs), customer premise equipment (CPE), and a range of compatible user equipment (UE).

Major applications of TD-LTE span enhanced mobile broadband (eMBB) delivery, fixed wireless access (FWA), and the backbone for massive machine-type communications (mMTC) in industrial Internet of Things (IIoT) settings. Its ability to support asymmetrical data rates makes it exceptionally suitable for streaming video, large file downloads, and providing connectivity solutions in rural or underserved areas via FWA deployment. The technology leverages standardized protocols, ensuring interoperability between various vendors and supporting seamless integration into existing 3G and 4G infrastructure, offering a cost-effective and high-performance path for network evolution.

The primary driving factors fueling the market include the global surge in data consumption, necessitating more efficient spectrum utilization, especially in allocated TDD bands (such as 2.3 GHz and 2.6 GHz). Additionally, governmental initiatives promoting digital inclusion and smart city development heavily rely on robust, high-capacity wireless infrastructure, which TD-LTE readily provides. The benefits derived from TD-LTE deployment include superior spectral efficiency, lower network latency compared to previous generations, reduced capital expenditure due to shared frequency components, and the flexibility to adapt to asymmetric traffic patterns, enhancing overall user experience and network performance metrics.

- Product Description: Time Division Long-Term Evolution (TD-LTE) infrastructure and services utilizing TDD for dynamic spectrum allocation.

- Major Applications: Enhanced Mobile Broadband (eMBB), Fixed Wireless Access (FWA), Industrial IoT (IIoT), Public Safety Networks, and Smart City infrastructure.

- Benefits: Superior spectral efficiency, flexible resource allocation, reduced latency, and cost-effective deployment in data-intensive environments.

- Driving Factors: Exponential growth in mobile data traffic, increasing penetration of smart devices, governmental support for digital infrastructure, and the demand for private LTE solutions.

TD LTE Ecosystem Market Executive Summary

The TD LTE Ecosystem Market is characterized by vigorous business trends centered on infrastructure modernization and spectral optimization. A significant trend involves the accelerated deployment of private TD-LTE networks within large enterprises, often leveraging unlicensed or dedicated spectrum bands (like CBRS in the U.S.), driven by the need for enhanced security, localized control, and guaranteed quality of service (QoS) for mission-critical operations in manufacturing, mining, and port logistics. Concurrently, major telecom operators are strategically positioning TD-LTE as a crucial stepping stone or complementary layer to their 5G Non-Standalone (NSA) and Standalone (SA) deployments, particularly using higher-frequency TDD bands for capacity augmentation in metropolitan areas. Consolidation among infrastructure providers and escalating competition in the small cell and Massive MIMO equipment segments are defining the commercial landscape.

Regionally, Asia Pacific (APAC) continues to dominate the TD LTE market, primarily due to large-scale network deployments in China and India, which heavily favor TDD technology for its spectrum efficiency in densely populated areas. Regulatory mandates and early adoption of 4G standards in these regions have created a massive installed base. North America and Europe, while having strong FDD foundations, are seeing substantial growth in the Private LTE segment driven by industrial digitalization and public safety applications utilizing specific TDD spectrum holdings. The Middle East and Africa (MEA) exhibit high growth potential, fueled by FWA deployments aimed at bridging the digital divide and rapid urbanization requiring new high-capacity mobile infrastructure.

Segment-wise, the Infrastructure component, specifically eNodeBs (Base Stations) and Core Network elements, holds the largest market share, reflecting continuous investment in network expansion and density enhancement. However, the Services segment, encompassing managed services, system integration, and professional services, is projected to register the fastest CAGR, as operators increasingly rely on external expertise to manage complex network environments and optimize the coexistence of 4G and 5G technologies. The growth of the IoT segment, particularly specialized TD-LTE modules designed for industrial sensors and telemetry, underscores the technology’s versatility beyond traditional mobile broadband connectivity.

AI Impact Analysis on TD LTE Ecosystem Market

Common user inquiries regarding AI in the TD LTE ecosystem frequently revolve around operational efficiency, predictive maintenance, and seamless network resource management during the 4G-to-5G transition. Users are concerned about how AI can maximize the asymmetrical resource allocation inherent in TD-LTE to improve user experience (e.g., reducing buffering during peak hours) and whether AI-driven analytics can optimize the handoff procedures between TD-LTE and FDD-LTE or 5G NR layers. The key themes summarized from user expectations center on employing AI to automate network optimization tasks, predicting equipment failures (especially complex components like Massive MIMO antennas), and enhancing cybersecurity protocols applied to the core network (EPC). There is a high expectation that AI will transform network operations from reactive troubleshooting to proactive, self-optimizing systems, crucial for maintaining QoS in dense, dynamic TDD environments.

AI’s influence is profound, primarily manifesting in Network Function Virtualization (NFV) and Software-Defined Networking (SDN) deployments, which are fundamental to modern TD-LTE architecture. Machine learning algorithms are now essential for real-time traffic prediction, allowing the network to dynamically adjust the TDD uplink-downlink configuration ratio (e.g., from 3:1 to 2:2) to match evolving user behavior. This capability significantly improves spectrum utilization efficiency, which is a core benefit of TD-LTE technology. Furthermore, AI models are integrated into Self-Organizing Networks (SON) functionalities to automate cell planning, interference reduction, and load balancing, drastically reducing the operational expenditure (OPEX) for service providers.

By analyzing massive datasets generated by user equipment and network infrastructure, AI provides critical insights into potential bottlenecks and coverage gaps. For TD-LTE specifically, where interference management is complex due to shared frequency usage, AI-powered tools provide sophisticated interference mitigation techniques that surpass traditional algorithms. This advanced optimization ensures that TD-LTE layers continue to deliver high-quality service, protecting the investment made in 4G infrastructure while service providers roll out 5G capabilities, ensuring smooth interoperability and lifecycle extension of current assets.

- Automated Network Optimization: AI/ML algorithms dynamically adjust TDD frame configuration and scheduling based on real-time traffic patterns and predictive analysis.

- Predictive Maintenance: Utilizing sensor data and performance metrics to anticipate hardware failures in eNodeBs and core network elements, maximizing uptime.

- Enhanced Interference Management: AI models provide sophisticated, real-time interference mitigation in TDD environments, crucial for performance in dense urban deployments.

- Security and Fraud Detection: Applying behavioral analytics within the EPC to identify anomalies and protect against sophisticated cyber threats targeted at critical infrastructure.

- Seamless Handoff Optimization: Improving mobility management and quality of experience (QoE) during transitions between TD-LTE, FDD-LTE, and 5G networks.

DRO & Impact Forces Of TD LTE Ecosystem Market

The TD LTE Ecosystem Market is significantly influenced by a set of dynamic forces encompassing global infrastructure investment, regulatory shifts, and technological maturity. The primary drivers include the inherent spectral efficiency of TDD, which is highly advantageous for operators in spectrum-constrained markets, and the accelerating global movement toward industrial and private LTE networks requiring dedicated, high-throughput wireless capabilities. Opportunities are vast, particularly in emerging economies and vertical sectors (e.g., utilities, public safety) seeking reliable broadband access where TD-LTE offers a mature and cost-effective deployment path compared to immediate 5G investments. However, the market faces restraints, chiefly the global push towards 5G NR, which may cannibalize future TD-LTE investments, and the historical challenge of cross-border interference management inherent to TDD technology, necessitating complex coordination among neighboring operators.

The key impact forces dictating the market's direction are capital expenditure prioritization by Mobile Network Operators (MNOs) and the evolving standardization landscape. When MNOs prioritize 5G deployment, resources are diverted away from expanding 4G TD-LTE capacity, impacting equipment vendors in the short term. Conversely, regulatory mandates requiring FWA connectivity in rural areas provide a significant boost, as TD-LTE remains a robust and mature technology for these use cases. The decision by regulators to allocate mid-band spectrum (crucial for high-capacity TD-LTE) for 5G also presents a challenge, forcing existing TD-LTE infrastructure onto different, often less favorable, frequency bands or necessitating expensive equipment upgrades to support 5G coexistence.

Ultimately, the resilience of the TD LTE ecosystem is anchored in its proven reliability and the vast global installed base, making immediate replacement cost-prohibitive. The market is thus shifting its focus from solely consumer mobile broadband to specialized, mission-critical applications. The increasing adoption of converged networks (LTE and 5G operating simultaneously) transforms TD-LTE from a standalone solution into a vital component of the heterogeneous network architecture, ensuring its long-term relevance. The availability of low-cost TD-LTE user equipment and chipsets further lowers the barrier to entry for smaller operators and enterprise deployments.

Segmentation Analysis

The TD LTE Ecosystem Market is comprehensively segmented based on Component, Deployment Type, Application, and End-User, reflecting the diverse ways in which this technology is utilized globally. The Component segment distinguishes between the physical infrastructure (hardware), the software that manages the network, and the essential professional services required for deployment and optimization. Deployment Type differentiates between Public Networks (operated by MNOs for consumer services) and Private Networks (dedicated systems for enterprises or specific sectors). Analyzing these segments provides critical insight into market dynamics, highlighting the shift toward customized solutions tailored for vertical industries and the ongoing investment priorities of large telecom carriers globally.

- By Component:

- Infrastructure (eNodeB/Base Stations, Core Network Elements – EPC, Routers, Gateways)

- Services (Managed Services, System Integration, Consulting Services, Professional Services)

- Devices (Smartphones, Tablets, M2M Modules, CPE/FWA devices, USB Modems)

- By Deployment Type:

- Public LTE Networks

- Private LTE Networks (Enterprise, Industrial, Government/Public Safety)

- By Application:

- Mobile Broadband

- Fixed Wireless Access (FWA)

- Massive Machine-Type Communications (IoT/M2M)

- Public Safety and Mission Critical Services

- By End-User:

- Telecommunication Operators

- Government and Public Safety Agencies

- Utilities and Energy Sector

- Transportation and Logistics

- Manufacturing and Industrial

- Healthcare

Value Chain Analysis For TD LTE Ecosystem Market

The TD LTE Ecosystem value chain begins with upstream activities dominated by component manufacturers and intellectual property (IP) holders. This layer includes chipset vendors (like Qualcomm, MediaTek) and specialized equipment manufacturers providing baseband units, radio frequency (RF) components, and advanced antenna systems (such as Massive MIMO modules). These entities invest heavily in R&D to ensure compliance with 3GPP standards and optimize spectral performance, particularly critical for TD-LTE’s TDD synchronization requirements. Key upstream metrics involve minimizing power consumption and increasing component capacity to support growing user density and data throughput demands within specific TDD frequency bands.

The midstream section of the value chain is comprised of network equipment providers (NEPs) and system integrators. NEPs (like Ericsson, Huawei, Nokia) assemble the components into comprehensive network solutions, including eNodeBs, packet core systems (EPC), and operational support systems (OSS/BSS). System integrators play a crucial role in planning, deployment, optimization, and integrating TD-LTE infrastructure with legacy 2G/3G networks or new 5G overlays. Distribution channels are typically direct, involving long-term contracts between the major NEPs and Mobile Network Operators (MNOs) or large enterprise clients for private networks. The indirect channel involves value-added resellers (VARs) and smaller regional distributors, often serving the enterprise or municipal FWA segments.

Downstream activities focus on service delivery and end-user engagement, primarily driven by MNOs who operate the public networks and enterprise customers utilizing private infrastructure. MNOs are responsible for network operations, maintenance, user acquisition, and billing, leveraging the TD-LTE infrastructure to deliver mobile broadband and FWA services. The efficiency and quality of service delivered downstream directly impact customer retention and average revenue per user (ARPU). The rapid growth of the private LTE sector has introduced a new class of end-users—industrial operators and utilities—who purchase and maintain their dedicated networks, transforming the traditional MNO-centric downstream model.

TD LTE Ecosystem Market Potential Customers

The primary potential customers and end-users of the TD LTE Ecosystem are strategically diverse, ranging from traditional telecom giants focused on mass-market service delivery to highly specialized industrial entities seeking customized connectivity solutions. Mobile Network Operators (MNOs) represent the largest buyer group, requiring high-capacity TD-LTE infrastructure to meet accelerating consumer data demand, especially in APAC where TDD spectrum is prevalent. These operators rely on TD-LTE for densification strategies, rural broadband initiatives via FWA, and as a capacity layer complementing their 5G Non-Standalone architecture.

A rapidly expanding customer base resides within the vertical industries, driven by the digitalization mandates of Industry 4.0. Manufacturing firms, especially those with large campuses or complex assembly lines, are adopting private TD-LTE networks to facilitate automation, track assets, and ensure low-latency communication for robotics and automated guided vehicles (AGVs). Similarly, the Energy and Utility sectors are major buyers, deploying TD-LTE for smart grid applications, remote monitoring of infrastructure (pipelines, power stations), and secure operational technology (OT) communications, demanding high reliability and resilience over coverage.

Furthermore, government and public safety agencies constitute a crucial segment. These entities require secure, resilient, and dedicated broadband networks (often Band 14 or equivalent public safety spectrum) for mission-critical voice, video, and data transmission during emergencies and daily operations. TD-LTE’s proven stability and capability to handle large volumes of video streaming from body-worn cameras or drones make it the technology of choice for these demanding, high-stakes environments, ensuring reliable communication pathways when commercial networks might be saturated or compromised.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 35.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, ZTE Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., Qualcomm Incorporated, Intel Corporation, MediaTek Inc., CommScope Holding Company, Inc., Sierra Wireless, Inc., Casa Systems, Inc., Airspan Networks, Inc., Juniper Networks, Inc., Affirmed Networks (now Microsoft), Mavenir Systems, Ruckus Networks (CommScope), Cradlepoint, Inc., Druid Software, Lemko Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TD LTE Ecosystem Market Key Technology Landscape

The TD LTE Ecosystem’s technology landscape is defined by continuous evolution within the 3GPP standards framework, focusing on maximizing spectral capacity and ensuring seamless interworking with next-generation technologies. Core to TD-LTE technology is the use of Time Division Duplexing, which requires highly accurate synchronization across all cells to minimize interference, especially crucial in bands like B40 (2.3 GHz). Key hardware innovations center around Massive MIMO (Multiple Input, Multiple Output) antenna systems, which significantly increase throughput by leveraging spatial multiplexing. These sophisticated antenna arrays, often deployed in TDD networks due to the benefit of channel reciprocity, allow operators to serve multiple users simultaneously using the same time-frequency resources, drastically boosting capacity in high-density areas.

Another crucial technological aspect involves the transition to network virtualization. The adoption of Cloud-RAN (C-RAN) and virtualization of the Evolved Packet Core (vEPC) allows network functions to be deployed on commodity hardware, offering greater agility, scalability, and efficiency. This shift enables operators to dynamically allocate core network resources based on geographic demand, which is particularly beneficial for the bursty, asymmetrical traffic characteristic of TD-LTE networks. Furthermore, the development of advanced self-organizing network (SON) functionalities using embedded artificial intelligence automates complex configuration tasks, such as optimizing power levels and managing inter-cell interference, which is particularly challenging in TDD deployments.

In terms of user equipment (UE), the technology landscape is driven by highly integrated chipsets that support carrier aggregation across TDD and FDD bands (LTE-Advanced features) and seamless handover between 4G and 5G New Radio (NR) networks in Non-Standalone (NSA) mode. Specialized devices, such as industrial-grade CPE and Cat-M/NB-IoT modules utilizing the TD-LTE bands, are vital for expanding the market into IIoT and Fixed Wireless Access applications. As the 5G migration accelerates, TD-LTE remains essential, providing the robust anchor layer for initial 5G deployments (EN-DC) and continuing to serve as the primary network layer for regions where 5G rollout is slow or cost-prohibitive.

Regional Highlights

The global TD LTE Ecosystem Market exhibits distinct regional dynamics driven by unique regulatory environments, spectrum allocations, and consumer data demands.

- Asia Pacific (APAC): APAC is the global leader in the TD LTE market, characterized by immense deployments in countries like China and India, where large-scale population density necessitates highly spectral efficient TDD technology. China Mobile, the world’s largest mobile operator, has championed TD-LTE, creating a massive ecosystem and driving standardization efforts. FWA deployments in Southeast Asia and rural connectivity projects in India further solidify APAC’s dominance.

- North America: North America presents a highly sophisticated, yet segmented, market. While FDD has historically been dominant, TDD technology is crucial for capacity augmentation (often in mid-band spectrum like 2.5 GHz/B41) and, more notably, for the rapidly growing Private LTE segment, especially utilizing the CBRS band (3.5 GHz). Public safety networks and large industrial enterprises are key growth drivers here, valuing the control and security offered by dedicated TD-LTE infrastructure.

- Europe: The European TD LTE market is characterized by a strong focus on industrial digitalization and smart infrastructure projects. TDD spectrum is actively utilized for specific capacity layers, particularly in dense metropolitan areas. The push towards 5G is highly integrated, with operators leveraging existing TD-LTE infrastructure to facilitate Non-Standalone 5G deployments, ensuring a continuous upgrade path for network assets.

- Latin America (LATAM): LATAM is a high-growth region for TD-LTE, primarily driven by the urgent need for Fixed Wireless Access (FWA) services to connect underserved and rural populations. Governments and operators view TD-LTE as a cost-effective, high-throughput solution compared to laying fiber infrastructure. Brazil and Mexico are leading the charge, utilizing available TDD spectrum to rapidly expand broadband penetration.

- Middle East and Africa (MEA): MEA shows robust potential, fueled by rapid urbanization and increasing mobile penetration. TD-LTE is fundamental for delivering mobile broadband and addressing the digital divide. Operators are investing heavily in new TDD infrastructure, often bypassing 3G to deploy 4G services directly, capitalizing on the availability of favorable TDD spectrum allocations in the region. The high density of mobile data usage across urban centers requires the capacity efficiencies provided by TDD technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TD LTE Ecosystem Market.- Huawei Technologies Co., Ltd.

- Ericsson AB

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- Qualcomm Incorporated

- Intel Corporation

- MediaTek Inc.

- CommScope Holding Company, Inc.

- Sierra Wireless, Inc.

- Casa Systems, Inc.

- Airspan Networks, Inc.

- Juniper Networks, Inc.

- Mavenir Systems

- Cradlepoint, Inc.

- Sequans Communications S.A.

- ASUSTeK Computer Inc.

- Telrad Networks

- Tait Communications

- Cambium Networks

Frequently Asked Questions

Analyze common user questions about the TD LTE Ecosystem market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical distinction between TD LTE and FDD LTE?

TD LTE (Time Division Duplexing) uses a single frequency band, separating uplink and downlink transmissions in time slots, allowing for dynamic, asymmetrical spectrum allocation. FDD LTE (Frequency Division Duplexing) uses two separate, synchronized frequency bands for uplink and downlink, resulting in symmetrical allocation.

How does the shift to 5G New Radio (NR) affect the TD LTE Ecosystem?

The 5G NR shift integrates TD LTE through Non-Standalone (NSA) architecture, where TD LTE acts as the anchor layer (EN-DC). TD LTE infrastructure continues to be vital for capacity layering, maintaining service continuity, and supporting the massive base of existing 4G user equipment during the transition phase, ensuring its continued relevance in a heterogeneous network environment.

What are the key advantages of using TD LTE for Private Networks?

TD LTE offers critical advantages for private networks, including dedicated control over spectrum resources, enhanced security, high capacity via technologies like Massive MIMO, and the ability to customize uplink/downlink ratios suitable for industrial applications like video surveillance and real-time automation.

Which geographical region dominates the adoption of TD LTE technology?

The Asia Pacific (APAC) region, particularly China and India, dominates the TD LTE market due to early and massive government-backed investments in TDD spectrum for high-density urban coverage and the subsequent creation of the largest global installed base for this technology.

What role does Artificial Intelligence play in optimizing TD LTE network performance?

AI is crucial for maximizing TD LTE efficiency by implementing Self-Organizing Networks (SON). AI algorithms enable real-time dynamic configuration of the TDD frame structure to match fluctuating user traffic demands, optimize power levels, and minimize inter-cell interference, enhancing overall quality of service and reducing operational expenditure.

The comprehensive analysis of the TD LTE Ecosystem Market reveals a sector undergoing strategic transformation, driven by industrial use cases and coexisting with the nascent stages of 5G deployment. While the core technology remains stable and robust, market growth is increasingly reliant on innovative applications in private networking, specialized IoT modules, and the integration of AI-driven optimization tools to enhance spectral utilization. Infrastructure vendors must navigate the balancing act between supporting legacy 4G deployments and providing seamless, cost-effective upgrade paths to 5G NR, ensuring that TD-LTE assets deliver maximum long-term value to network operators and enterprise clients globally. The projected growth indicates sustained vitality, particularly in regions where efficient use of available mid-band TDD spectrum is paramount for achieving digital inclusion goals and meeting escalating data throughput requirements.

Furthermore, the segmentation analysis underscores the diversification of revenue streams away from purely consumer-centric services. The Services segment, encompassing complex system integration and specialized managed operations, is set to be the fastest-growing component, reflecting the technical complexity of operating dense, multi-layered networks. As TDD technology is increasingly utilized for mission-critical applications in utilities, mining, and public safety, the demand for high-reliability, secure professional services tailored to these verticals will become a critical determinant of market success. Therefore, key players must strategically focus their R&D efforts not only on hardware advancements like more efficient Massive MIMO arrays but also on the sophisticated software and service offerings that guarantee performance and network resilience in challenging operational environments.

In conclusion, the TD LTE Ecosystem is far from obsolete; it is evolving into an essential, highly adaptable technology layer within the broader mobile broadband infrastructure. Its inherent characteristics, such as spectral flexibility and maturity, make it an indispensable tool for both bridging the digital divide in emerging markets and serving as a secure, high-capacity backbone for advanced industrial and public safety applications in developed economies. Successful navigation of this market requires a deep understanding of regional spectrum allocations, the specific connectivity demands of vertical industries, and a commitment to integrating virtualization and AI technologies to future-proof network investments and deliver optimized user experiences across the global mobile landscape.

The integration of TD-LTE within the overall 5G strategy, particularly its role as the foundation for converged networks, highlights its strategic importance beyond a mere legacy technology. Operators leveraging TD-LTE’s high-capacity bands are better positioned to handle the initial surge in 5G data traffic by offloading substantial load, thereby ensuring a smoother and more capital-efficient 5G rollout. This symbiotic relationship between 4G TDD and 5G NR is expected to sustain high demand for TD-LTE core network and radio access network components for the foreseeable future, justifying the robust market growth projections detailed in this report. Vendors focusing on dual-mode or multi-mode equipment that efficiently supports both standards are poised to capture significant market share.

Geographically, while APAC remains the powerhouse, the rapid penetration of private LTE solutions in North America and Europe, driven by sectors like manufacturing and logistics, represents a high-value opportunity segment. These enterprises demand tailored connectivity solutions that commercial MNOs cannot always guarantee, making TD-LTE an attractive proposition due to its maturity, reliability, and the availability of dedicated spectrum (e.g., CBRS). Understanding these niche market requirements and providing robust, customized TD-LTE solutions will be crucial for competitive differentiation among equipment manufacturers and service providers aiming for growth beyond traditional telecom contracts.

Regulatory frameworks also constitute a powerful impact force. Decisions regarding spectrum harmonization and refarming, especially concerning the mid-band frequencies vital for both TD-LTE capacity and early 5G deployments, directly influence operator investment strategies. Clarity and consistency in global regulatory policy are essential for facilitating cross-border equipment manufacturing and deployment. Market participants must maintain close engagement with regulatory bodies to anticipate spectrum availability and leverage opportunities arising from initiatives designed to promote rural broadband access or establish standardized public safety communication networks based on the TD-LTE platform.

Finally, the competitive landscape is intensely focused on innovation in radio technologies. The continuous improvement of Massive MIMO algorithms, coupled with advancements in small cell technology for densification, ensures that TD-LTE remains a high-performance choice. The market increasingly values energy-efficient solutions and software-defined architectures that minimize the total cost of ownership (TCO) for network operators. The ability of major NEPs to offer open and interoperable solutions (Open RAN components supporting TD-LTE) will also challenge traditional market structures, fostering greater competition and potentially accelerating innovation cycles within the ecosystem.

The TD LTE ecosystem's technological resilience is further demonstrated by its strong fit for Fixed Wireless Access (FWA) applications, especially in areas with challenging topography or prohibitive fiber costs. The ability of TD-LTE base stations, particularly those utilizing high-gain antennas and dedicated CPE, to deliver fiber-like speeds over significant distances makes it an immediate and economically viable solution for closing the connectivity gap. This application alone ensures significant ongoing investment, especially in developing regions and specific parts of developed markets where last-mile broadband connectivity remains a challenge. The focus here is on low-latency, high-reliability CPE devices and optimized backhaul solutions.

In terms of application segmentation, the growth trajectory of Massive Machine-Type Communications (mMTC) relying on TD-LTE is undeniable. Industrial IoT deployments require networks capable of handling millions of low-power devices with intermittent, small data transmissions. While NB-IoT and Cat-M are often layered on top of the TD-LTE infrastructure, the underlying TDD capacity provides the necessary robustness and security for connecting critical industrial sensors, smart utility meters, and large-scale environmental monitoring systems. This integration secures TD-LTE’s position as a foundational element of the emerging smart infrastructure landscape.

The value chain continues to see compression and integration. Chipset manufacturers are increasing their influence by embedding greater functionality (including AI processing capabilities for real-time optimization) directly into the silicon. This move forces network equipment providers to focus more on software optimization and system integration rather than purely hardware innovation. Moreover, the rise of cloud-native vEPC solutions simplifies the core network layer, reducing the dependency on proprietary hardware and encouraging the adoption of open interfaces, thereby increasing flexibility for MNOs transitioning to 5G Standalone (SA) architectures, often reusing TD-LTE core virtualization principles.

A critical challenge within the DRO framework remains the complexity of spectrum coordination in TDD environments. International frequency assignment and the risk of cross-border interference require sophisticated network planning tools and bilateral agreements between neighboring countries or operators. Failure to effectively manage this interference can severely degrade the quality and capacity of TD-LTE services. Consequently, the demand for advanced software solutions specializing in TDD synchronization and interference mitigation techniques remains high, representing a specific market opportunity for niche software developers within the ecosystem.

Finally, the security implications of utilizing TD-LTE for public safety and critical infrastructure are driving significant investment into specialized network security services and equipment hardening. As these networks carry mission-critical voice and video data, robustness against cyberattacks and resilience against natural disasters become paramount requirements. This segment demands stringent compliance with governmental regulations and the adoption of advanced authentication and encryption protocols, pushing innovation in the security layer of the TD-LTE core network components, ensuring the technology meets the highest standards of reliability and data integrity.

The market trajectory confirms that the TD LTE ecosystem is pivoting towards high-value, niche applications that leverage its inherent strengths. Instead of a complete replacement by 5G, TD-LTE is experiencing a strategic repositioning as an essential enabling technology for enterprise digitalization and specialized high-capacity segments. This ensures a prolonged lifecycle for existing infrastructure and continuous demand for advanced services that help operators and enterprises extract maximum utility from their TDD spectrum holdings. This strategic pivot, coupled with ongoing technological refinements like improved Massive MIMO and virtualization, underpins the positive CAGR forecast for the 2026-2033 period, transforming TD-LTE from a mass-market mobile technology into a critical infrastructure enabler.

The competitive strategy among key players is increasingly focused on providing holistic solutions that facilitate the 4G/5G coexistence model. Vendors like Ericsson, Nokia, and Huawei are heavily promoting their converged core networks (EPC/5GC) that allow for smooth migration and efficient utilization of both TD-LTE and 5G NR assets under a single operational umbrella. This approach minimizes operational complexities for MNOs and maximizes network longevity. Smaller players and specialized vendors, meanwhile, find success in providing highly focused solutions for the private LTE market, offering optimized eNodeBs and simplified core solutions tailored for specific industrial bandwidth and latency requirements, thereby diversifying the competitive landscape and driving specialized innovation.

Furthermore, the investment patterns in emerging markets strongly favor TD-LTE due to its favorable total cost of ownership (TCO) compared to immediate, full-scale 5G deployment. For network operators in Africa and parts of Latin America, TD-LTE allows for rapid deployment of high-speed internet services using readily available spectrum, significantly enhancing market competitiveness against fixed broadband providers. This economic efficiency factor acts as a powerful driver, cementing TD-LTE’s role as the primary broadband technology in these developing regions throughout the forecast period, securing long-term demand for low-cost, high-reliability infrastructure components.

The evolution of devices within the TD LTE ecosystem is another vital area of focus. Device manufacturers must ensure their equipment supports complex carrier aggregation scenarios that combine various TDD and FDD bands to deliver peak speeds. The maturation of chipsets capable of handling multi-mode, multi-band configurations efficiently is crucial for consumer acceptance and seamless interoperability. Moreover, the growth in dedicated machine-to-machine (M2M) modules optimized for long battery life and rugged operational conditions, utilizing TD-LTE Cat-M or NB-IoT capabilities, continues to expand the ecosystem's application scope into remote monitoring and logistics, creating substantial market demand for specialized device segments.

In summary, the TD LTE Ecosystem Market is distinguished by its technological maturity, application versatility, and strategic position within the global wireless evolution roadmap. The market thrives on the balance between mass-market capacity solutions in APAC and high-value, secured private network deployments in mature markets. The continuous integration of AI and virtualization technologies ensures operational efficiency, mitigating the restraints imposed by the 5G transition and confirming TD-LTE’s enduring role as a foundational technology layer critical for achieving global connectivity and industrial digitalization objectives. The forecast period anticipates strong growth driven by targeted applications and regional infrastructure expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager