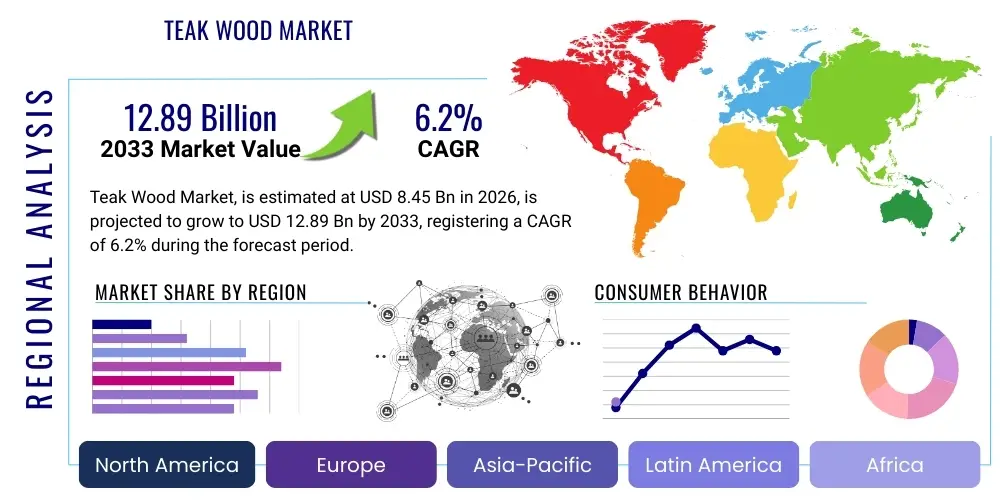

Teak Wood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437531 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Teak Wood Market Size

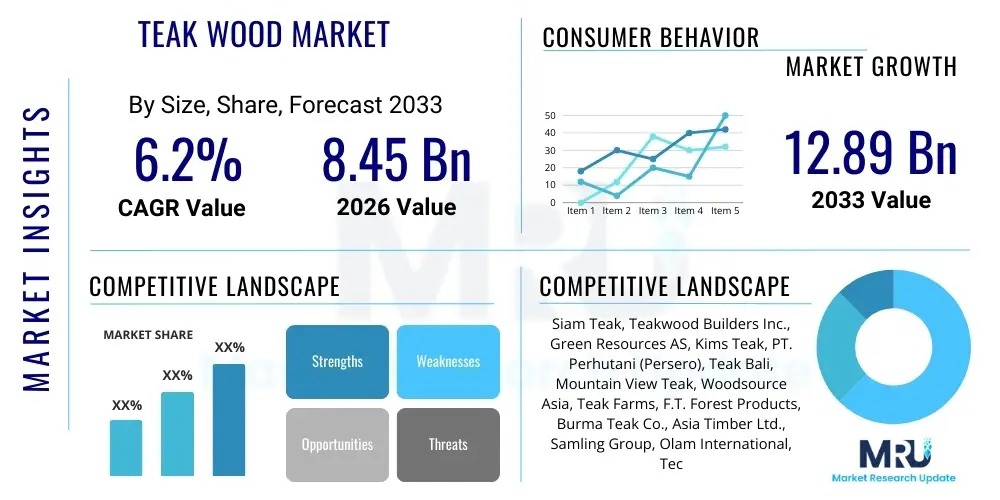

The Teak Wood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 8.45 Billion in 2026 and is projected to reach USD 12.89 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the increasing global demand for luxury, durable, and weather-resistant materials, particularly in high-end construction, marine applications, and outdoor furniture sectors. The inherent superior qualities of teak, such as its natural oils, exceptional dimensional stability, and resistance to pests and decay, solidify its status as a premium wood product, justifying its higher price point and sustaining market value growth even amidst volatile global timber markets. Market valuation is heavily influenced by sustainable sourcing practices and regulatory controls governing tropical hardwood harvesting, which are increasingly driving consumers towards certified plantation teak over naturally harvested options.

Teak Wood Market introduction

The Teak Wood Market encompasses the global trade, harvesting, processing, and distribution of timber derived from the Tectona grandis tree species. Known for its exceptional strength, durability, and resistance to water and pests due to high silica and oil content, teak is categorized as a luxury tropical hardwood. The primary product forms include logs, sawn timber, veneers, and finished products like furniture and decking. Major applications span high-end furniture (both indoor and outdoor), marine construction (boat decks and trim), exterior decking and siding in premium residential and commercial projects, and decorative items. Key benefits driving its adoption include longevity, low maintenance requirements, and aesthetic appeal that improves with age. Driving factors for market expansion include the burgeoning luxury real estate sector globally, rising consumer income in emerging economies, and the growing preference for natural, sustainable materials certified under schemes like the Forest Stewardship Council (FSC). However, the market faces constraints related to illegal logging concerns and the long maturity cycle of the teak tree, necessitating reliance on well-managed, certified plantations for sustainable supply.

Teak Wood Market Executive Summary

The Teak Wood Market is characterized by robust demand, constrained supply from natural sources, and a strong pivot toward certified plantation forestry. Business trends highlight increasing investments in vertically integrated teak plantations across Southeast Asia and Latin America to secure long-term, verifiable supply chains. Technology adoption, especially in sophisticated wood processing and kiln drying, is enhancing material yield and quality consistency, thereby commanding premium prices. Geographically, Asia Pacific remains the dominant consumption and production hub, driven by massive furniture manufacturing industries in China and Vietnam, and sustained domestic demand from India. North America and Europe represent critical high-value markets, primarily importing finished goods and premium logs for custom joinery and marine use. Segment trends indicate the Marine application segment is exhibiting high growth due to stringent material requirements for yacht construction, while the 'Plantation Teak' source segment is rapidly replacing 'Natural Teak' as buyers prioritize environmental compliance and traceability. Sustainability certification is evolving from a competitive advantage to a basic market entry requirement, fundamentally reshaping procurement strategies across the value chain.

AI Impact Analysis on Teak Wood Market

User queries regarding AI in the Teak Wood market frequently center on maximizing yield, optimizing tree growth cycles, and enhancing supply chain traceability to combat illegal logging. Key themes include the implementation of predictive analytics for forest management (e.g., predicting disease outbreaks or optimal harvest times), utilizing satellite imagery combined with machine learning for comprehensive forest inventory and monitoring, and leveraging AI-powered systems for grading and sorting processed timber based on quality and defect detection. Users are primarily concerned about how AI can democratize sustainable farming practices, reduce the reliance on manual, subjective grading processes, and provide verifiable, immutable chain-of-custody documentation, thereby ensuring compliance with stringent global timber regulations such as the European Union Timber Regulation (EUTR) and the U.S. Lacey Act. The expectation is that AI will introduce unprecedented levels of efficiency and transparency, addressing the market's fundamental challenges related to sustainability and consistent supply.

- AI-powered remote sensing and image analysis optimize forest inventory management, accurately tracking tree health and growth rates, leading to predictive harvesting schedules.

- Machine learning algorithms enhance timber grading processes, automating defect detection and ensuring highly consistent wood quality, minimizing waste in sawmills.

- Predictive analytics models improve logistical efficiency by forecasting demand fluctuations and optimizing shipping routes for high-value teak logs and products.

- Blockchain technology, often integrated with AI sensors, creates immutable, transparent records of the wood's origin and journey, combating illegal sourcing and ensuring verifiable sustainability.

- AI-driven robotics and automated cutting systems maximize yield from each log, reducing labor costs and improving precision in specialized applications like marine decking.

DRO & Impact Forces Of Teak Wood Market

The dynamics of the Teak Wood Market are heavily influenced by the interplay of robust demand (Driver), environmental constraints (Restraint), and the emergence of controlled forestry (Opportunity), collectively forming powerful Impact Forces. Key drivers include the unparalleled durability and aesthetic appeal of teak, essential for marine and luxury outdoor sectors, coupled with rising global consumer wealth enabling purchases of premium goods. Restraints manifest predominantly through stringent international regulations on tropical timber, the long cultivation period required (20-25 years minimum for harvestable size), and the resulting high operational costs compared to fast-growing softwoods. Opportunities are vast within the realm of certified sustainable plantation management, enabling companies to meet ethical sourcing demands and command premium pricing for verifiable 'green' teak. These forces collectively exert pressure on the supply chain, forcing traditional players to adopt modern, transparent forestry and processing techniques to maintain market viability and access lucrative global consumer bases. The shift towards sustainable sourcing is the most significant impact force, fundamentally altering the competitive landscape and driving vertical integration among major market participants.

Specifically, the long-term investment horizon required for teak cultivation acts as a significant barrier to entry, concentrating supply among established entities or large institutional investors who can absorb these timelines. This constraint, while limiting short-term supply responsiveness, simultaneously stabilizes long-term market pricing by preventing sudden oversupply. The increasing sophistication of wood treatments and composite materials (substitutes) poses a moderate restraint, but these alternatives have yet to fully replicate the natural beauty and inherent decay resistance of real teak, particularly in severe-use environments like marine decking. Therefore, while substitutes cap price escalation, they do not displace high-grade teak from its core luxury and industrial applications. The strongest opportunity lies in gene-pool management and biotechnological improvements aimed at reducing the maturity cycle and improving wood quality in plantation settings, potentially unlocking new supply avenues and mitigating the supply deficit.

The overall impact forces dictate that the future market success is dependent not just on volume production but on provenance and quality assurance. Regulatory compliance is now an overriding impact force; suppliers who cannot demonstrate legal and sustainable harvesting practices are effectively excluded from the lucrative markets in the EU, North America, and Australia. This pushes the entire industry towards rigorous auditing and digital tracing technologies. The confluence of high demand from luxury markets and strict environmental governance ensures that only high-quality, certified teak will drive market growth, while non-certified or inferior grades face diminishing market acceptance and price erosion.

Segmentation Analysis

The Teak Wood Market is highly differentiated based on source, application, grade, and end-use, reflecting the varied quality and utility of the timber across industries. Segmentation analysis provides crucial insights into price elasticity, demand concentration, and growth potential within specific niche markets. The 'Source' segment is undergoing the most rapid change, with Plantation Teak now dominating volume due to sustainability requirements and consistent quality control, increasingly favored over naturally grown Teak which faces greater supply restrictions and higher risk of non-compliance. Application segments clearly delineate the high-value uses, with Marine and Outdoor Furniture consistently driving premium pricing due to the demanding environmental conditions these products must withstand. End-user categorization helps in understanding procurement behaviors, where commercial users (like hospitality and shipbuilding) demand large volumes with certified consistency, while residential consumers prioritize aesthetic features and design flexibility.

The Grade segmentation—A, B, and C—is critical for pricing and application matching. A-Grade teak, derived from mature trees' heartwood and boasting the highest oil content and dimensional stability, exclusively serves the luxury yacht building and high-end architectural millwork markets, commanding the highest margins. B-Grade and C-Grade, utilized for standard furniture and construction, compete more directly with substitute hardwoods and synthetics, although they still retain better longevity than most alternatives. Analyzing these segments is vital for supply chain participants to strategically allocate resources, optimize log breakdown, and tailor marketing efforts. For instance, increasing global preference for outdoor living spaces post-pandemic has specifically propelled the demand for durable outdoor furniture, bolstering the B-Grade and A-Grade demand in residential end-use.

Furthermore, regional variations significantly impact segment dominance. Asia Pacific, for example, shows strong consumption across all grades and applications due to its manufacturing base and robust domestic construction markets, whereas European consumption is heavily skewed towards A-Grade logs and finished luxury products imported primarily for marine refurbishment and high-end residential installations. Effective segmentation allows companies to focus on supply diversification strategies, such as developing specialized processing capabilities for B and C grade materials to maximize recovery rates and overall profitability, ensuring that no part of the harvested resource is wasted, thereby supporting the sustainable ethos of modern teak forestry.

- By Source:

- Natural/Wild Teak

- Plantation/Cultivated Teak (FSC Certified, Non-Certified)

- By Application:

- Furniture (Outdoor/Patio, Indoor)

- Marine Construction (Yacht Decking, Components)

- Building & Construction (Flooring, Decking, Doors, Windows)

- Decorative & Other Products (Paneling, Carvings)

- By Grade:

- A Grade (Heartwood, Premium Quality)

- B Grade (Mid-Quality)

- C Grade (Sapwood/Lower Quality)

- By End-Use:

- Residential

- Commercial (Hotels, Resorts, Public Spaces)

- Industrial (Shipyards, Large Construction Projects)

Value Chain Analysis For Teak Wood Market

The Teak Wood Market value chain is long and complex, starting with long-term, capital-intensive upstream activities and concluding with highly specialized downstream processing and distribution. The upstream phase involves land acquisition, long-term silviculture, and sustainable forest management, which can span decades and require significant capital for plantation establishment, pest control, and thinning operations. Key upstream players include specialized forestry asset managers and large private/government-backed plantation companies (especially in countries like Indonesia, Myanmar, Costa Rica, and Brazil). Efficiency at this stage is crucial, focusing on maximizing yield per hectare and ensuring genetic quality of the trees to produce highly sought-after A-Grade timber. The transition to plantation forestry has integrated sophisticated technologies like GIS mapping and drone surveillance into this phase, increasing transparency and optimizing land use for long-term profit realization.

Midstream activities involve harvesting, log transportation, and primary processing (sawmilling and drying). Due to the high value of teak, precision cutting and meticulous kiln drying are essential to prevent cracking, warping, and value loss. This stage is dominated by specialized sawmills equipped to handle dense tropical hardwoods, often located proximate to the plantation sites. Direct distribution channels frequently involve large volume sales of rough logs or sawn timber directly from the plantation owner or sawmill to major processing hubs in consuming countries (e.g., China, Vietnam, Italy). Indirect channels involve brokers, agents, and local traders who facilitate transactions, particularly for smaller plantations or specialized wood parcels, adding liquidity but also complexity to price discovery and provenance verification.

Downstream activities focus on secondary processing and final distribution. This includes manufacturing high-end products such as yacht components, luxury furniture, and custom architectural millwork. Manufacturers often rely on established relationships with verified upstream suppliers to maintain a consistent flow of certified raw material. Final product distribution heavily relies on specialized retail networks, marine outfitters, architectural suppliers, and e-commerce platforms targeting high-net-worth individuals and commercial clients. The profitability in the downstream is contingent upon brand reputation, design innovation, and maintaining credible sustainability certifications, as end-users are willing to pay a substantial premium for guaranteed quality and ethical sourcing. Traceability requirements strongly favor direct or tightly controlled indirect distribution channels.

Teak Wood Market Potential Customers

Potential customers for Teak Wood are predominantly concentrated in sectors demanding premium, durable, and aesthetically superior materials where cost is a secondary concern to longevity and quality. The primary end-users or buyers are high-end furniture manufacturers specializing in outdoor and marine-grade products, who require large, consistent batches of B-Grade and C-Grade wood for volume production and A-Grade for flagship pieces. Secondly, the global marine industry, particularly yacht and luxury boat builders (shipyards), represents a highly inelastic customer base, demanding exclusively A-Grade, vertically grained teak for decking, railings, and interior finishes, where its natural water resistance is critical to vessel safety and value preservation. These buyers often enter into long-term supply contracts to ensure material consistency for custom build projects.

Another significant customer segment includes commercial developers and hospitality operators (hotels, luxury resorts, theme parks) who use teak for durable, elegant exterior decking, poolside furniture, and permanent exterior structures that must withstand heavy traffic and harsh climates with minimal maintenance. These clients prioritize durability and the long-term return on investment offered by teak over cheaper alternatives. Furthermore, high-net-worth residential homeowners and custom home builders constitute a key segment, purchasing teak for high-end flooring, custom millwork, and exterior cladding, often specifying FSC certification as a non-negotiable requirement. The purchasing decisions of these end-users are intrinsically linked to the verified origin and sustainability claims of the timber, making transparent sourcing critical for securing these lucrative B2C and B2B contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.45 Billion |

| Market Forecast in 2033 | USD 12.89 Billion |

| Growth Rate | CAGR 6.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siam Teak, Teakwood Builders Inc., Green Resources AS, Kims Teak, PT. Perhutani (Persero), Teak Bali, Mountain View Teak, Woodsource Asia, Teak Farms, F.T. Forest Products, Burma Teak Co., Asia Timber Ltd., Samling Group, Olam International, Tectona Grandis Inc., EcoPlanet Bamboo, World Forest Group, Tropical Forest Products, New Zealand Farm Forestry, and Teak Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Teak Wood Market Key Technology Landscape

The Teak Wood market is increasingly integrating advanced technology to address the core challenges of long growth cycles, supply chain opacity, and optimizing resource utilization. One critical technological advancement is in silviculture, utilizing genetic modification and tissue culture propagation to develop high-yield, disease-resistant teak clones that achieve harvestable dimensions in shorter timeframes than traditional methods—potentially cutting the maturity cycle by several years while maintaining wood quality characteristics. Precision forestry techniques, including the use of high-resolution satellite imagery, drones, and geographic information systems (GIS), are employed for meticulous monitoring of plantation health, volumetric analysis, and site-specific nutrient management. These tools allow plantation managers to optimize inputs and predict yields with higher accuracy, transforming traditional, generalized farming methods into data-driven operations.

Furthermore, technology plays a pivotal role in post-harvest processing and logistics. Modern, vacuum-assisted kiln drying technologies are crucial for reducing the moisture content of dense teak uniformly and quickly, minimizing the defects (checking, warping) that can significantly devalue high-grade logs. Sophisticated computer vision systems and non-destructive testing (NDT) methods are being deployed in sawmills to automatically grade timber based on knot density, grain pattern, and defect location, ensuring optimal log breakdown to maximize the recovery of A-Grade pieces. This automation reduces human error, speeds up processing, and establishes objective quality standards, which is vital for international trade compliance.

Finally, digital traceability solutions, primarily relying on integrated sensor technology (e.g., RFID tags embedded in logs) linked to centralized digital ledgers or blockchain platforms, are revolutionizing supply chain integrity. These technologies provide an immutable record of a log's journey from its exact felling location in a certified plantation through to the final end-product manufacturer. This level of transparency is essential for fulfilling strict regulatory requirements in import markets and satisfying consumer demand for ethical sourcing, effectively mitigating the market risk associated with illegal or non-certified timber and enabling the command of premium pricing for verifiably sustainable teak products.

Regional Highlights

The global Teak Wood market demonstrates pronounced regional disparities in both production capacity and consumption patterns, which heavily influence global trade flows and pricing mechanisms. Asia Pacific (APAC) stands as the undisputed heart of the market, serving as the dominant production base, particularly Indonesia, Myanmar, and India, which house the largest natural and historical plantation stocks. China and Vietnam, while not major growers, are massive processing and manufacturing hubs, importing raw teak logs and sawn timber, primarily from African and Latin American plantations, to produce finished furniture and components exported globally. India is a significant consumer, driven by its large domestic demand for construction and premium residential use, making it a critical market for internal teak distribution and trade.

Europe and North America represent the highest-value consumer markets, demanding A-Grade, certified teak for marine, luxury outdoor furniture, and architectural applications. These regions are characterized by stringent import regulations (like EUTR/Lacey Act), leading to a high willingness to pay premiums for FSC-certified or verifiable plantation teak. European demand is particularly strong in coastal countries for yacht building and restoration, ensuring sustained demand for the highest quality product. North American consumption is driven by the robust luxury housing market and the popularity of durable, high-end outdoor living spaces, prioritizing brands that demonstrate environmental stewardship through verified sourcing.

Latin America, especially countries like Costa Rica, Brazil, and Ecuador, has emerged as a crucial growth region for plantation teak. These nations offer suitable climatic conditions and large land availability, attracting significant foreign investment into sustainable teak forestry. The strategic importance of Latin America lies in its ability to supply certified, conflict-free teak to the premium Western markets (North America and Europe), acting as a reliable alternative to traditional Asian sources facing regulatory scrutiny or diminishing natural stock. The Middle East and Africa (MEA) region presents a nascent but fast-growing market, with consumption driven by large-scale infrastructure projects, luxury resort development, and high-net-worth residential consumption in the GCC nations, reliant almost entirely on imports of finished teak products or processed timber.

- Asia Pacific (APAC): Dominant production and processing hub; high domestic consumption (India); major manufacturing centers for global export (China, Vietnam); key focus on plantation scaling in countries like Indonesia and Thailand.

- Europe: High-value import market focused on A-Grade, FSC-certified teak; primary applications in luxury marine and high-end outdoor furniture; stringent regulatory compliance demands drive sourcing strategies.

- North America: Significant consumer market driven by luxury residential construction and premium outdoor living trends; strong preference for verifiable, sustainable (FSC) sources, leading to high import prices.

- Latin America: Major emerging region for certified plantation teak supply; expanding investment in sustainable silviculture in countries such as Costa Rica and Brazil; positioning itself as a key supplier to Western markets.

- Middle East & Africa (MEA): Import-dependent region with growing consumption linked to luxury real estate development and high-end hospitality sectors in the GCC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Teak Wood Market.- Siam Teak

- Teakwood Builders Inc.

- Green Resources AS

- Kims Teak

- PT. Perhutani (Persero)

- Teak Bali

- Mountain View Teak

- Woodsource Asia

- Teak Farms

- F.T. Forest Products

- Burma Teak Co.

- Asia Timber Ltd.

- Samling Group

- Olam International

- Tectona Grandis Inc.

- EcoPlanet Bamboo

- World Forest Group

- Tropical Forest Products

- New Zealand Farm Forestry

- Teak Solutions

Frequently Asked Questions

Analyze common user questions about the Teak Wood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for plantation teak over natural teak?

The primary factor driving demand for plantation teak is the stringent global requirement for verified sustainability, traceability, and legality (e.g., FSC certification), which is reliably provided by managed plantations, mitigating the risks associated with illegal logging of natural teak.

How does the high price of teak wood impact its market growth?

While the high price limits volume market penetration, it reinforces teak’s status as a luxury commodity. The price elasticity is low in key sectors like marine construction and high-end furniture, ensuring sustained market growth driven by premium value rather than mass volume.

What role does technology play in the modern teak wood supply chain?

Technology enhances efficiency and transparency. Key applications include precision forestry (drones, GIS) for yield optimization, automated kiln drying for quality assurance, and blockchain integration for robust, verifiable chain-of-custody documentation, essential for international trade compliance.

Which application segment holds the largest potential for future growth?

The Marine Construction segment, specifically high-end yacht building and refurbishment, holds significant growth potential due to the indispensable nature of teak’s natural properties in harsh marine environments and sustained investment in global luxury vessel markets.

Which region dominates the production and consumption of teak wood?

Asia Pacific (APAC) dominates both global production, primarily through large plantation holdings in Indonesia and Myanmar, and overall volume consumption, driven by massive domestic markets (India) and global export manufacturing hubs (China and Vietnam).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager