Team Building Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438686 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Team Building Service Market Size

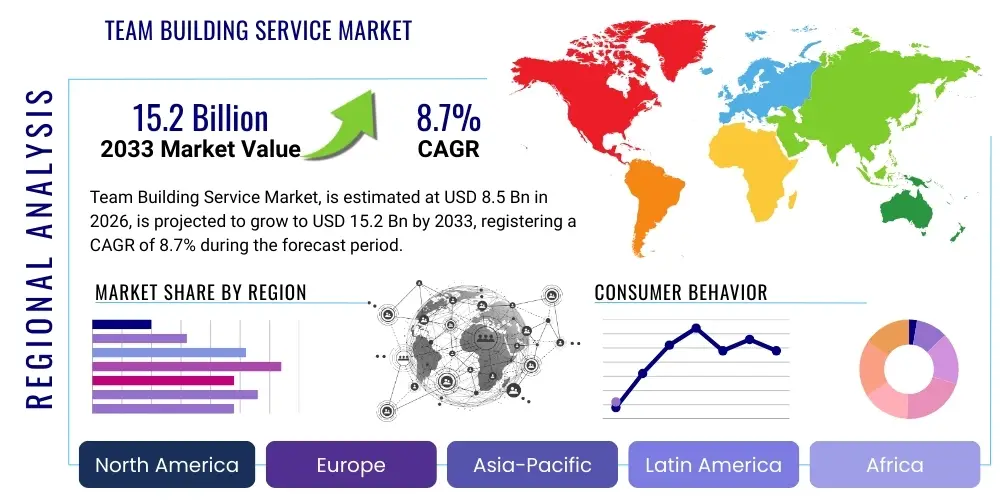

The Team Building Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 15.2 Billion by the end of the forecast period in 2033.

Team Building Service Market introduction

The Team Building Service Market encompasses a wide range of structured activities, programs, and workshops designed to enhance group cohesiveness, improve communication, and boost productivity within organizations. These services are crucial for fostering a positive organizational culture, resolving interpersonal conflicts, and ensuring that diverse teams work effectively toward common strategic goals. The primary product offering includes experiential learning activities, skills-based training, corporate retreats, and virtual team engagement platforms, catering to the evolving needs of modern, often geographically dispersed, workforces. The core value proposition lies in translating enhanced interpersonal dynamics into tangible business results, such as reduced employee turnover and increased innovation capacity.

Major applications for team building services span across various industries, including Information Technology, Finance, Healthcare, Manufacturing, and Education. The services are utilized for onboarding new teams, managing change within the organization, leadership development, and improving cross-departmental collaboration. Key benefits derived from these activities include significant improvements in employee morale, better problem-solving capabilities, and higher overall organizational resilience. Companies are increasingly recognizing team building not as an optional perk but as a strategic investment essential for sustained competitive advantage in dynamic market conditions.

Driving factors propelling this market include the global shift towards hybrid and remote work models, necessitating tailored solutions for remote team cohesion. Furthermore, the rising awareness among human resources departments regarding the direct correlation between employee engagement and profitability fuels the demand for professional, data-driven team development programs. Economic stability in developed and emerging economies, coupled with increased corporate training budgets, further supports market expansion. The continuous need for innovation and agility in fast-paced sectors ensures a consistent demand for services focused on enhancing collaborative efficiency.

Team Building Service Market Executive Summary

The global Team Building Service Market is characterized by robust growth, driven primarily by the paradigm shift in corporate workforce structures favoring remote and hybrid models. Business trends show a strong inclination toward virtual team building platforms and tailored, skills-based experiential learning programs focused on high-stakes business objectives rather than generalized recreational activities. Key market players are rapidly integrating digital solutions, including gamification and AR/VR experiences, to offer scalable and measurable results, moving away from purely physical, one-off events. Investments in measurable outcomes and analytical tools to justify the ROI of team building services are defining current industry practices, leading to consolidation among providers offering comprehensive technological platforms.

Regionally, North America and Europe maintain dominance due to high corporate spending on employee development and early adoption of innovative HR practices, particularly within the technology and finance sectors. The Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid industrialization, the proliferation of multinational corporations, and increasing emphasis on professionalizing Human Capital Management (HCM) across major economies like India and China. Latin America and MEA are showing steady adoption, primarily focused on leadership development and improving operational efficiency in resource-intensive industries, often utilizing outdoor and adventure-based activities for maximum impact.

Segment trends indicate that the experiential learning segment holds the largest market share, valued for its effectiveness in delivering tangible behavioral change, while the virtual/remote segment is poised for the fastest CAGR, reflecting the sustained prevalence of distributed teams globally. Furthermore, the segmentation by end-user shows that large enterprises remain the primary revenue source due to larger dedicated budgets and greater employee volume, but the Small and Medium Enterprises (SMEs) segment is growing significantly, increasingly recognizing the affordability and flexibility offered by outsourced team building consulting. Customized program design, which addresses specific organizational pain points such as diversity and inclusion, is becoming the highest-value offering across all segments.

AI Impact Analysis on Team Building Service Market

Common user inquiries regarding AI’s impact on the Team Building Service Market center on whether AI will replace human facilitators, how technology can personalize team dynamics analysis, and the potential for AI-driven platforms to manage continuous virtual team engagement effectively. Users are particularly interested in AI's role in diagnosing team weaknesses objectively (e.g., communication bottlenecks, resource allocation conflicts) and automatically recommending customized interventions. The prevailing expectation is that AI will not eliminate the need for team building but will serve as a powerful analytical and personalization tool, shifting the focus of human facilitators from logistical planning to complex intervention delivery and emotional intelligence training. Concerns often revolve around data privacy related to employee performance metrics used by AI systems and maintaining the human touch necessary for genuine team bonding.

- AI-driven Diagnostics: Utilizes machine learning to analyze communication patterns, workflow data, and sentiment analysis to objectively identify functional and dysfunctional team dynamics, providing actionable insights before intervention.

- Personalized Program Generation: Algorithms customize team building activities and content based on specific group needs, project requirements, and individual personality profiles (e.g., using DISC or Myers-Briggs data).

- Virtual Facilitation & Gamification: AI chatbots and sophisticated interactive interfaces enhance engagement in virtual team sessions, managing complex logistics, scoring games, and providing real-time feedback loops.

- Automation of Administrative Tasks: AI streamlines scheduling, participant management, post-event reporting, and resource allocation, freeing up human facilitators to concentrate on direct interaction and deeper psychological insights.

- Predictive Turnover Risk: AI analyzes team cohesion scores derived from activities to predict potential turnover or conflict areas, enabling proactive intervention strategies.

- Continuous Feedback Loops: Automated post-activity surveys and sentiment analysis ensure ongoing monitoring of team health, providing longitudinal data for measurable ROI.

DRO & Impact Forces Of Team Building Service Market

The Team Building Service Market is profoundly shaped by four critical impact forces: Drivers, Restraints, Opportunities, and the overall macroeconomic and structural forces acting upon corporate human capital strategies. The primary drivers include the mandatory shift to remote work, which necessitates formal tools for maintaining corporate culture and cohesion, alongside the growing institutional recognition that employee well-being directly impacts productivity metrics. These forces ensure a sustained, essential expenditure on team dynamics, moving it from a discretionary expense to a strategic operational investment. However, market growth is often constrained by high per-employee costs associated with bespoke programs and the difficulty organizations face in quantitatively measuring the Return on Investment (ROI) of soft-skills training, which can lead to budget scrutiny during economic downturns.

Significant opportunities arise from the increasing demand for specialized, high-impact training focusing on specific organizational competencies such as managing neurodiversity, cross-cultural competence in global teams, and agile methodology adoption. The integration of advanced digital technologies, including virtual reality and artificial intelligence, presents a transformative opportunity to scale services globally while maintaining a high degree of personalization and measurability. These technological integrations allow providers to offer continuous engagement models rather than single-day events, significantly enhancing perceived value and effectiveness.

The major impact forces driving the market trajectory include globalization, which creates complex, geographically dispersed teams requiring sophisticated cross-cultural training, and demographic shifts, which necessitate intergenerational team alignment. Furthermore, the intense competitive landscape across industries compels companies to prioritize innovative workplace cultures to attract and retain top talent. These external pressures mandate the regular, strategic use of team building services not just for maintenance, but as a critical lever for organizational transformation and adaptation to continuous market disruption.

- Drivers:

- Global rise of remote and hybrid working models.

- Increasing corporate focus on employee engagement and wellness mandates.

- Growing recognition of the link between team cohesion and innovation/productivity.

- High levels of staff turnover requiring continuous team reintegration and bonding.

- Restraints:

- High perceived cost and difficulty in quantifying the direct financial ROI of soft-skill activities.

- Lack of internal expertise in selecting appropriate vendors and programs.

- Scheduling conflicts and logistical challenges inherent in coordinating large, geographically distributed teams.

- Resistance from employees who view mandatory team building activities as non-essential or time-consuming.

- Opportunities:

- Development and adoption of scalable, AI-driven virtual team building platforms.

- Specialization in high-demand areas like diversity, equity, and inclusion (DEI) training and leadership cohort development.

- Expansion into the rapidly growing Small and Medium Enterprise (SME) segment through modular, affordable offerings.

- Leveraging augmented and virtual reality (AR/VR) for highly immersive and effective experiential training simulations.

- Impact Forces:

- Technological disruption demanding agile team structures.

- Economic volatility influencing corporate training budgets.

- Regulatory and ethical pressures concerning employee privacy and surveillance in data-driven team diagnostics.

- Shifting generational work values emphasizing collaboration, meaning, and workplace culture.

Segmentation Analysis

The Team Building Service Market is comprehensively segmented based on Activity Type, Application, End-User, and Delivery Mode, reflecting the diversity of organizational needs and preferences globally. This segmentation allows service providers to precisely tailor their offerings, optimize pricing strategies, and target specific organizational demographics effectively. The analysis reveals that while traditional physical activities still hold a substantial share, the fastest revenue acceleration is occurring in segments facilitating scalable and measurable outcomes, particularly within the digital domain. Understanding these distinctions is critical for both market entrants and established vendors seeking to refine their competitive positioning and resource allocation based on predicted growth pockets and evolving customer demands.

Segmentation by Activity Type, encompassing corporate retreats, skills-based workshops, and experiential games, determines the depth of engagement and the specific outcomes sought by the client. For instance, skills-based workshops generally target measurable improvements in areas like communication or conflict resolution, commanding higher premium fees, whereas retreats often prioritize cultural alignment and stress reduction. Delivery Mode segmentation—covering both physical/in-person and virtual/remote services—is perhaps the most dynamically changing segment, with hybrid models rapidly becoming the norm, requiring vendors to be proficient in seamless digital and physical transitions.

The End-User segment differentiates between Large Enterprises (LEs) and Small and Medium Enterprises (SMEs), acknowledging the disparity in budget size, operational scale, and the complexity of organizational challenges addressed. While LEs demand highly customized, large-scale programs, SMEs seek modular, cost-effective solutions that can be implemented quickly. Overall, the increasing strategic importance of team dynamics means that segments focusing on measurable, continuous improvement—regardless of delivery mode—are expected to capture the majority of future market value.

- By Activity Type:

- Skills-Based Workshops (Communication, Conflict Resolution, Leadership)

- Experiential Learning Activities (Outdoor Challenges, Ropes Courses, Adventure Games)

- Corporate Retreats and Offsites

- Social and Recreational Activities (Cooking Classes, Escape Rooms, Virtual Happy Hours)

- By Application:

- Employee Engagement and Morale Improvement

- Organizational Change Management

- Leadership and Professional Development

- New Team Onboarding and Integration

- Diversity, Equity, and Inclusion (DEI) Training

- By End-User:

- Large Enterprises (LEs)

- Small and Medium Enterprises (SMEs)

- By Delivery Mode:

- In-Person/Physical

- Virtual/Remote

- Hybrid Models

- By Industry Vertical:

- Information Technology (IT) and Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Manufacturing and Logistics

- Government and Public Sector

- Education and Non-Profit

Value Chain Analysis For Team Building Service Market

The value chain for the Team Building Service Market begins with upstream activities focused on content development and specialized resource acquisition. Upstream analysis involves market research to identify specific corporate behavioral pain points, the creation of proprietary methodologies, and the training and certification of expert facilitators. Key inputs at this stage include psychological models, proprietary software for diagnostics, and securing unique or exclusive physical activity locations. The quality of the intellectual property—the methodology and design originality—is the primary value driver upstream, differentiating premium providers from general recreational organizers.

Midstream activities center on service delivery, which includes customization, logistics, and execution. This involves designing the program based on client needs, managing all scheduling and physical/virtual setup requirements, and deploying highly trained facilitators to execute the program. The efficiency of the distribution channel is critical here; direct distribution through in-house sales teams ensures high customization and control, typically utilized for large enterprises. Indirect channels involve partnerships with HR consulting firms or large event management companies, offering broader reach but less margin control. The successful integration of technology for both delivery (e.g., virtual platform maintenance) and real-time data collection enhances the perceived value of the execution phase significantly.

Downstream analysis focuses on post-activity engagement and measurable outcomes. This stage includes detailed debriefings, comprehensive reporting on team metrics (communication scores, conflict resolution indices), and follow-up consulting to ensure behavioral reinforcement within the workplace. This continuous engagement—moving beyond a single event to a programmatic approach—solidifies client retention and generates valuable referral business. The distribution channels are predominantly direct for high-value consulting (to maintain data privacy and client relationship integrity) and indirect for mass-market virtual products sold through subscription models or large e-learning platforms.

Team Building Service Market Potential Customers

Potential customers for the Team Building Service Market are highly diverse, encompassing virtually every sector that relies on collaborative human capital for operational success. The core customer base consists of Human Resources (HR) departments, Learning and Development (L&D) executives, and C-suite leadership (CEOs, COOs) responsible for organizational productivity, culture, and strategic transformation. These buyers look for solutions that address measurable deficiencies, such as high employee attrition, low cross-functional collaboration scores, or the integration challenges following mergers and acquisitions (M&A). They view team building not as an expenditure on entertainment, but as a critical tool for risk mitigation and performance optimization.

Within specific industry verticals, technology companies are prime targets, often requiring complex training in agile methodologies, rapid innovation fostering, and managing highly distributed, global engineering teams. Financial and BFSI firms prioritize services that enhance ethical compliance, crisis management capabilities, and resilience under pressure, often utilizing intensive simulation-based scenarios. Furthermore, the burgeoning SME sector, particularly those experiencing rapid growth and hiring surges, represents a significant customer pool. These smaller organizations require services that quickly establish a cohesive, positive culture to maximize the output of limited resources and compete effectively with larger, established industry players.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 15.2 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TeamBonding, Corporate Team Building, Inc., Wildgoose Events, Team Building USA, Outback Team Building & Training, Team Building Asia, Blue Hat Teambuilding, Catalyst Global, AdVenture Games, Summit Team Building, Global Team Challenge, HRD, Inc., Team Builders Plus, The Go Game, Ultimate Team Building, Cluetivity, City Challenge, Teambuilding.com, Emerge Team Building, and Elevate Corporate Training. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Team Building Service Market Key Technology Landscape

The technological landscape of the Team Building Service Market is undergoing rapid transformation, moving away from purely analog methods toward sophisticated digital platforms that enhance scalability, interactivity, and measurement. Key technologies utilized include robust Virtual Event Platforms (VEPs) capable of hosting high-engagement, multi-modal activities for global, distributed teams. These VEPs incorporate features such as break-out room functionality, real-time feedback mechanisms, and integrated communication tools, ensuring parity between physical and virtual engagement experiences. Furthermore, mobile applications are increasingly used to support gamification components, allowing participants to track progress, solve collaborative puzzles, and engage in Augmented Reality (AR) scavenger hunts, blending digital interaction with real-world exploration for hybrid teams.

Artificial Intelligence (AI) and Machine Learning (ML) constitute a foundational technology layer, primarily used for diagnostic purposes and personalization. AI algorithms analyze pre-activity assessments and in-session interaction data to generate individualized team development prescriptions, significantly enhancing the precision and effectiveness of interventions. Beyond diagnostics, Virtual Reality (VR) and Mixed Reality (MR) are gaining traction, particularly in simulations for high-stakes environments such as crisis management, leadership decision-making, and specialized technical collaboration. VR offers a safe, immersive environment for teams to practice complex interactions without real-world consequences, maximizing learning retention and application transfer back to the workplace.

The overarching technological trend is the focus on data analytics and measurement tools. Providers are leveraging cloud-based platforms to gather longitudinal data on team performance metrics, enabling them to demonstrate clear Return on Investment (ROI) to clients. Blockchain technology is also being explored, primarily for securing highly sensitive employee data used in diagnostics and ensuring transparency in tracking credentialed facilitator usage. The continuous integration of API connectivity with existing Human Resource Management Systems (HRMS) and Learning Management Systems (LMS) ensures that team building insights are seamlessly integrated into the broader organizational talent management framework, establishing team building as an integral part of continuous professional development.

Regional Highlights

- North America: Market Leader in Innovation and Spending

- Europe: Focus on Compliance and Work-Life Integration

- Asia Pacific (APAC): Highest Growth Velocity

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging and Resource-Centric Demand

North America, particularly the United States and Canada, remains the largest revenue contributor to the Team Building Service Market, characterized by high corporate training budgets and a culture of proactive investment in talent management. The market here is highly mature, driven by the massive presence of multinational technology and finance companies that pioneered hybrid work models, necessitating sophisticated virtual and continuous engagement solutions. Demand is heavily concentrated in the skills-based segment, focusing on measurable outcomes related to psychological safety, diversity and inclusion training, and high-performance team coaching. The competitive landscape is dominated by both large, specialized consulting firms and innovative startups leveraging proprietary AI-driven diagnostics to offer data-backed services.

The region benefits from a robust ecosystem of specialized vendors, high accessibility to capital for service providers to innovate, and rapid adoption of cutting-edge technologies like VR simulation and predictive analytics for team dynamics. Companies in Silicon Valley and financial hubs like New York drive demand for customized, high-intensity programs aimed at maintaining innovation speed and operational agility. Regulatory environments, while generally favorable, increasingly require vendors to adhere to strict data privacy and security standards, especially when handling sensitive employee metrics. This region will continue to lead in market value, driven by premium pricing for personalized, high-ROI interventions.

The European market for team building services is mature and steady, emphasizing corporate social responsibility (CSR), cultural alignment, and compliance with stringent labor laws focused on employee well-being. Countries in Western Europe, such as the UK, Germany, and France, exhibit strong demand for traditional, experiential activities that prioritize work-life balance and psychological well-being alongside technical collaboration. Scandinavia, in particular, leads in adopting services that reinforce flat organizational hierarchies and collaborative decision-making structures. Demand is distributed across manufacturing, automotive, and professional services sectors, often utilizing services to manage cross-border team integration following the expansion of the European Union.

Growth in Europe is primarily fueled by mandatory continuous professional development requirements and a societal emphasis on robust employee protection. The transition to hybrid work, while slower than in North America, is accelerating demand for localized virtual solutions sensitive to multiple languages and cultural nuances. European vendors often emphasize sustainability in their retreat offerings and place a strong focus on methodologies rooted in behavioral science. The market growth rate is moderate but highly stable, characterized by long-term contracts and a preference for established, reputable providers offering demonstrable success histories in cross-cultural training.

The Asia Pacific region is forecast to exhibit the highest CAGR, driven by rapid economic expansion, urbanization, and the professionalization of Human Resources practices across emerging economies like India, China, and Southeast Asia. The influx of Western multinational corporations demands localized services that align local teams with global corporate cultures and standards, leading to massive demand for intercultural communication training and leadership development programs. In countries like Japan and South Korea, where hierarchical structures are prominent, team building services are strategically used to bridge generational gaps and encourage bottom-up communication and innovation.

The APAC market is highly fragmented, with strong regional players catering to localized cultural sensitivities. China and India are major engines of growth, with demand focused heavily on large-scale employee engagement events and skills-based training needed for rapidly expanding tech and manufacturing sectors. Infrastructure constraints in some emerging markets mean virtual solutions are crucial for reaching dispersed teams efficiently. As corporate budgets increase, there is a distinct move toward high-quality, measurable programs, moving away from purely social events, signifying a maturing market demanding sophisticated, outcome-focused interventions.

The LATAM market is growing steadily, with Brazil and Mexico as key contributors. Demand is strongly tied to resource-intensive industries (energy, mining, manufacturing) and finance. Team building here often focuses on improving operational efficiency, safety compliance, and fostering leadership resilience in often volatile economic conditions. Outdoor and adventure-based activities are particularly popular, leveraging the unique geographical attributes of the region for high-impact experiential learning. Market penetration remains lower than in North America and Europe, but increasing foreign direct investment is stimulating corporate spending on organizational development.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is characterized by significant investment in large-scale infrastructure projects and a rapidly diversifying economy. Team building services are utilized heavily for managing diverse, expatriate workforces, emphasizing cultural assimilation, ethics, and performance optimization. Demand in this region is highly seasonal and project-based, with substantial opportunities in government and semi-government sectors seeking to implement global best practices. Africa presents a long-term growth opportunity, with increasing focus on foundational management skills and scaling capabilities across emerging business hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Team Building Service Market.- TeamBonding

- Corporate Team Building, Inc.

- Wildgoose Events

- Team Building USA

- Outback Team Building & Training

- Team Building Asia

- Blue Hat Teambuilding

- Catalyst Global

- AdVenture Games

- Summit Team Building

- Global Team Challenge

- HRD, Inc.

- Team Builders Plus

- The Go Game

- Ultimate Team Building

- Cluetivity

- City Challenge

- Teambuilding.com

- Emerge Team Building

- Elevate Corporate Training

Frequently Asked Questions

Analyze common user questions about the Team Building Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Team Building Service Market?

The Team Building Service Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033, driven largely by the global adoption of hybrid work models and increased corporate focus on measurable employee engagement.

How is AI transforming the delivery of team building services?

AI is transforming the market by offering sophisticated diagnostic tools to analyze team dynamics and communication patterns, enabling the personalization of activity recommendations, automating administrative tasks, and enhancing engagement within virtual team building platforms.

Which segment holds the highest growth potential in the Team Building Service Market?

The Virtual/Remote Delivery Mode segment is anticipated to exhibit the fastest growth rate, fueled by the persistent need for effective strategies to maintain cohesion and collaboration among geographically distributed and international teams post-pandemic.

What are the primary challenges restraining market growth?

The main restraints include the difficulty for organizations to quantitatively measure the direct Return on Investment (ROI) of soft-skills training programs and the high per-employee cost associated with highly customized, expert-led team building interventions.

Which regions are leading the investment in team building solutions?

North America currently leads the market in overall expenditure and innovation adoption, while the Asia Pacific (APAC) region is projected to experience the highest growth velocity due to rapid industrialization and the professionalization of corporate HR functions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager