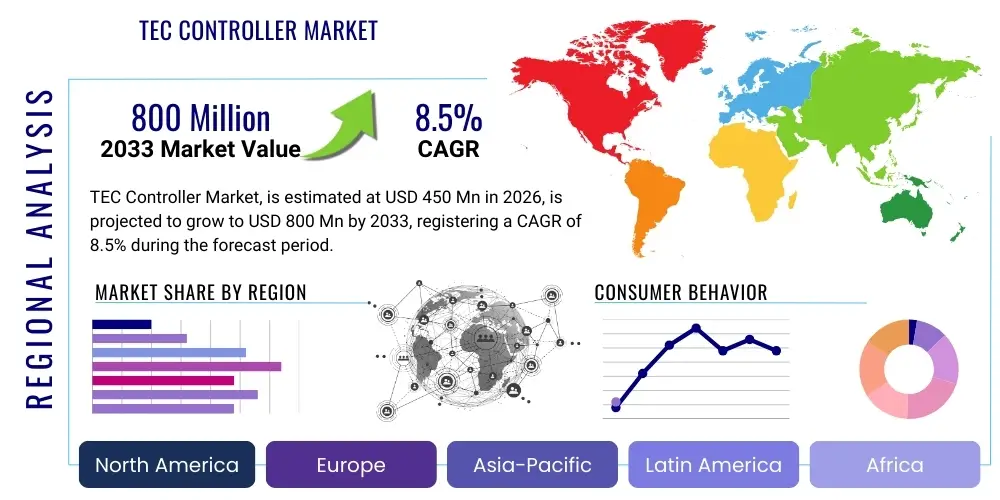

TEC Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436111 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

TEC Controller Market Size

The TEC Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

TEC Controller Market introduction

TEC Controllers, short for Thermoelectric Cooler Controllers, are sophisticated electronic devices utilized to precisely regulate the temperature of an object or fluid using a Peltier module (thermoelectric cooler). These controllers manage current flow direction and amplitude through the TEC module to enable both heating and cooling functions, maintaining target temperatures with exceptional accuracy and stability, often down to millikelvin levels. Their core functionality revolves around proportional-integral-derivative (PID) feedback loops, ensuring rapid response to thermal disturbances and maintaining steady-state conditions critical for high-performance applications. The demand for highly stable thermal environments in precision instruments drives the necessity for advanced TEC control systems.

The primary applications of TEC Controllers span across highly sensitive sectors, including photonics, medical diagnostics, telecommunications, and high-performance computing. In the photonics industry, TEC controllers are indispensable for stabilizing the operating temperature of laser diodes and fiber optics, which directly influences wavelength stability, output power, and overall device lifespan. For medical and biotechnology instruments, such as DNA sequencers and polymerase chain reaction (PCR) machines, precise thermal cycling and sample temperature maintenance are mandatory for accurate results. The growing miniaturization of electronic components and the increasing complexity of optical systems necessitate compact, highly efficient, and digitally controllable TEC solutions, thereby expanding the market footprint.

The key benefits derived from employing specialized TEC Controllers include enhanced thermal stability, improved system reliability, reduced power consumption through optimized control algorithms, and rapid thermal cycling capabilities. Driving factors for market growth include the burgeoning adoption of high-speed optical communication networks (5G and beyond), the accelerating need for advanced diagnostic and therapeutic medical devices, and the continuous innovation in sensor technology that demands precise temperature compensation. Furthermore, the shift towards digital control interfaces (like USB, I2C, and SPI) that allow seamless integration with modern embedded systems is fueling the expansion of the TEC controller market globally.

TEC Controller Market Executive Summary

The TEC Controller market is characterized by robust growth, primarily fueled by the increasing complexity and precision requirements within the telecommunications, aerospace, and life sciences sectors. Business trends indicate a strong move toward high-power density controllers capable of handling larger Peltier modules while maintaining extremely low noise and high stability. There is a palpable shift towards digital controllers offering enhanced connectivity and data logging features, enabling predictive maintenance and better system integration. Key manufacturers are focusing on miniaturization and the development of highly efficient, low-power consumption modules tailored for portable and battery-operated equipment, representing a significant technological pivot in the market landscape.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive investments in optical infrastructure development, particularly in China and South Korea, coupled with the rapid expansion of semiconductor manufacturing and consumer electronics production requiring stringent thermal management. North America and Europe maintain leading market shares due to the presence of established players, high expenditure on advanced R&D in aerospace and defense, and the maturity of the medical device manufacturing industries that require premium, validated thermal control solutions. Regulatory environments, particularly those governing medical and aerospace components, dictate high barriers to entry and enforce stringent quality standards, impacting regional competitive strategies.

Segmentation trends highlight the dominance of the high-power output segment, catering to industrial laser systems and data center components where thermal loads are substantial. However, the low-to-medium power segment, crucial for portable medical devices and consumer LiDAR/sensor applications, is exhibiting accelerated unit growth. By application, the photonics and optical communications segment remains the largest consumer, yet the emerging market for advanced automotive sensors (crucial for autonomous driving systems) is expected to show the highest CAGR during the forecast period. The increasing adoption of TEC controllers in quantum computing and sophisticated laboratory instrumentation further diversifies the revenue streams, moving beyond traditional applications.

AI Impact Analysis on TEC Controller Market

User queries regarding the intersection of Artificial Intelligence and TEC Controllers frequently revolve around optimizing thermal control performance, predicting component failure, and reducing energy expenditure in large-scale installations like data centers. Users are keenly interested in whether AI can move beyond traditional PID loops to implement predictive thermal management strategies that anticipate heat loads based on operational data, rather than merely reacting to real-time temperature fluctuations. Concerns often address the implementation complexity and the data requirements necessary to train effective AI models for dynamic thermal environments. Expectations are high concerning AI’s ability to minimize temperature overshoot and undershoot, crucial for protecting sensitive components like high-power laser diodes, and to enhance the overall energy efficiency of cooling systems by fine-tuning the balance between required stability and power consumption. Furthermore, inquiries focus on using machine learning algorithms for anomaly detection, thereby identifying early signs of controller or TEC module degradation, transitioning thermal management from reactive maintenance to proactive, intelligent control.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze historical operating data (current, voltage, temperature stability metrics) to predict the lifespan and potential failure points of the TEC controller or the Peltier module itself, maximizing uptime and reliability.

- Optimized PID Tuning: AI models can dynamically adjust PID parameters in real-time based on ambient conditions, system load changes, and aging components, leading to superior temperature stability compared to static or manually tuned controllers.

- Energy Efficiency Enhancement: Implementation of reinforcement learning to minimize the current required to maintain temperature stability, resulting in significant power savings, especially critical in battery-powered devices and large-scale thermal management systems.

- Advanced Thermal Profiling: AI enables the creation of complex thermal profiles for highly sensitive applications, allowing the controller to run custom, non-linear control loops that optimize performance across various operational states.

- Integration with Smart Grids and IoT: AI facilitates the seamless integration of TEC thermal data into broader IoT monitoring frameworks and smart energy grids, allowing centralized optimization of cooling resources across distributed systems.

DRO & Impact Forces Of TEC Controller Market

The TEC Controller market dynamics are shaped by a powerful confluence of driving forces, inherent restraints, and burgeoning opportunities that determine its long-term trajectory and influence market saturation levels. Primary drivers include the relentless technological pressure for increased precision and stability in advanced manufacturing and scientific research, necessitating controllers capable of sub-millikelvin accuracy. The explosive demand stemming from the 5G and 6G deployment, requiring thermal stability for optical transceivers and network equipment, acts as a major catalyst. Furthermore, the expansion of autonomous vehicles utilizing LiDAR and advanced sensor arrays, all requiring robust temperature control in harsh environments, significantly contributes to market expansion. These drivers create a compelling need for high-quality, high-reliability TEC control solutions.

However, the market growth faces significant restraints. The complexity and high cost associated with manufacturing high-precision digital TEC controllers, particularly those incorporating advanced interfaces and specialized firmware, limit rapid adoption in cost-sensitive applications. Furthermore, the energy inefficiency of the TEC modules themselves (Peltier devices) remains a perpetual challenge; while the controller optimizes usage, the fundamental efficiency of thermoelectric cooling is lower than traditional methods, posing a constraint in large-scale cooling applications where power consumption is paramount. The necessity for highly specialized technical expertise for installation, tuning, and maintenance also serves as a bottleneck, particularly in emerging geographical markets.

Opportunities in the TEC controller market are significant and often leverage technological convergence. The rise of quantum computing and superconducting technologies creates a niche demand for ultra-low temperature, highly stable thermal management systems. The transition towards smart factory automation (Industry 4.0) opens avenues for TEC controllers integrated with predictive maintenance and remote diagnostic capabilities. Moreover, the environmental sustainability movement is creating an opportunity for manufacturers to develop and market 'Green TEC Controllers' optimized for maximum energy recovery and minimal waste heat generation. The collective impact forces show that while cost and efficiency remain hurdles, the irresistible demand for precision in high-growth industries ensures sustained market momentum and justifies investment in specialized control technologies.

Segmentation Analysis

The TEC Controller market is structurally segmented based on output power, control method, end-user application, and geographical region, reflecting the diverse technical requirements and varied operational environments across industries. Understanding these segments is crucial as different applications demand distinct control characteristics—ranging from high-speed thermal cycling needed in PCR machines to the long-term, ultra-stable temperature maintenance required for aerospace-grade lasers. Segmentation by control method, particularly the distinction between analog and digital controllers, dictates the level of integration, remote control capabilities, and the precision achievable, driving pricing and adoption rates across different market verticals.

- By Output Power:

- Low Power (Under 10W)

- Medium Power (10W - 50W)

- High Power (Above 50W)

- By Control Method:

- Analog Controllers

- Digital Controllers (PID, Microprocessor-based)

- By Application:

- Photonics and Optical Communications

- Medical and Biotechnology

- Aerospace and Defense

- Industrial Lasers and Material Processing

- Automotive Sensors and LiDAR

- Scientific Instrumentation and Research

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For TEC Controller Market

The value chain for the TEC Controller market begins with the upstream segment, which encompasses raw material sourcing and the manufacturing of critical electronic components. This includes specialized semiconductor fabrication for integrated circuits (ICs), precision sensor manufacturing (thermistors, RTDs), and the production of high-quality power components (MOSFETs, capacitors). Key upstream relationships involve suppliers of high-performance microcontrollers and digital signal processors (DSPs) which are essential for implementing sophisticated PID algorithms and advanced communication protocols. Stability and reliability in the TEC controller are highly dependent on the quality and robustness of these foundational electronic inputs, making supplier qualification a crucial activity in the upstream segment. Furthermore, the design and validation of custom control algorithms represent a significant portion of the value added early in the chain.

The core value creation stage is the manufacturing and assembly of the TEC controller units, including PCB design, firmware development, rigorous calibration, and quality testing. Distribution channels play a vital role, often categorized into direct and indirect routes. Direct distribution involves sales teams interacting directly with large OEMs (Original Equipment Manufacturers) in the medical, defense, and telecommunication sectors who require customized thermal solutions and technical support. Indirect distribution utilizes specialized electronic distributors, regional resellers, and online e-commerce platforms, particularly for standard, off-the-shelf controllers targeting research laboratories, smaller industrial integrators, and prototype developers.

The downstream segment focuses on the integration of the TEC controller into the final application—such as laser systems, environmental chambers, or diagnostic instruments—and providing post-sale support, training, and maintenance. Given the sensitivity of the end applications, high-quality technical support and long-term product lifecycle management are significant value differentiators. The ultimate end-users are dependent on the seamless performance of the controller for their primary operations, making system compatibility and software interface ease of use critical elements in the downstream interaction. Optimization of the distribution channel often involves selecting partners capable of offering local technical assistance, thereby shortening reaction times for high-stakes applications.

TEC Controller Market Potential Customers

The core potential customers for TEC Controllers are highly specialized organizations that rely on extreme temperature stability and precision for their operational success, predominantly within the technological and scientific domains. End-users are generally sophisticated entities such as OEM manufacturers of high-power laser systems used in industrial cutting and welding, where minor temperature variations affect beam quality and consistency. Another major segment includes biotechnology and pharmaceutical companies that require precise thermal cycling and incubation environments for research, drug discovery, and diagnostics, leveraging controllers embedded within PCR machines, blood analyzers, and cryopreservation equipment. These buyers prioritize control accuracy, compliance with regulatory standards (e.g., FDA validation), and long-term reliability.

Furthermore, telecommunications infrastructure providers and component manufacturers represent a large and growing customer base. They purchase TEC controllers for stabilizing the wavelength of semiconductor lasers and optical amplifiers used in fiber optic networks (5G backhaul and data centers). For these customers, low noise operation, power efficiency, and remote monitoring capabilities are paramount. The aerospace and defense sector also constitutes critical buyers, integrating robust, ruggedized TEC controllers into infrared sensors, targeting systems, and advanced military communication modules that must function reliably under extreme temperature swings and high vibration conditions. Their purchasing criteria often mandate adherence to stringent military specifications and extended temperature ranges.

The final significant segment consists of research institutions and university laboratories. These customers require flexible, highly programmable TEC controllers for various scientific experiments, ranging from material characterization to quantum physics studies. While volume orders from research labs are lower than those from large OEMs, this segment drives demand for controllers offering maximum configurability, complex software interfaces, and compatibility with various thermistor types and custom thermal loads. Ultimately, any industry where thermal management directly impacts measurement accuracy, signal integrity, or component longevity is a prime candidate for high-precision TEC controller solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meerstetter Engineering, Wavelength Electronics, Thorlabs, TE Technology, RMT Ltd., Advanced Thermal Solutions, Inc., Laird Thermal Systems, Oven Industries, Analog Devices, TDK Lambda, Sensata Technologies, MKS Instruments (Newport), Alpha Omega Instruments, Custom Thermoelectric, II-VI Incorporated (Coherent), AMS Technologies, Micron Semiconductor, HiTek Power, Caliente LLC, National Instruments (NI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TEC Controller Market Key Technology Landscape

The technological landscape of the TEC Controller market is rapidly evolving, driven by the need for enhanced precision, miniaturization, and improved system connectivity. The transition from legacy analog control methods to advanced digital PID control, often implemented using high-speed microcontrollers or dedicated Digital Signal Processors (DSPs), is the most significant technological shift. Digital controllers offer superior accuracy, faster response times, and the ability to implement sophisticated anti-windup algorithms and non-linear control strategies, thereby minimizing temperature drift and overshoot critical for sensitive optical components. Furthermore, many modern controllers feature integrated data logging and remote calibration functionalities, allowing users to fine-tune performance parameters without physical access, a crucial feature for embedded systems in remote or harsh environments.

Another pivotal technological advancement involves the integration of high-efficiency power management systems. Since the Peltier module requires significant current (often bi-directionally for heating and cooling), controller manufacturers are integrating synchronous rectification and high-frequency pulse-width modulation (PWM) techniques to reduce power loss and minimize electromagnetic interference (EMI). Minimizing noise is particularly critical in applications where the TEC controller operates near high-gain analog sensors or sensitive RF circuits. Innovations in current limiting and ramp control technology are essential for protecting the fragile Peltier modules and the thermally managed components from thermal shock during startup and temperature changes.

Connectivity and interface standards define the modern controller environment. The market is increasingly adopting universal communication protocols such as USB, Ethernet, RS-232, and high-speed industrial buses like CAN bus, facilitating seamless integration into complex data acquisition and control systems. The development of modular TEC control systems, often utilizing plug-and-play architecture, allows OEMs to scale thermal solutions rapidly based on specific application needs. Future technological developments are anticipated to focus heavily on incorporating advanced self-diagnostics and firmware capable of running AI/ML algorithms directly on the edge controller (Edge Computing) to enable real-time predictive thermal optimization and component health monitoring, drastically improving overall system reliability.

Regional Highlights

- North America: North America represents a mature and high-value market segment, characterized by significant R&D spending in aerospace, defense, and advanced medical device manufacturing. The demand here is driven by the need for controllers meeting stringent military and FDA regulatory standards, emphasizing reliability and certification. The region hosts major technology hubs demanding high-end thermal management solutions for data centers and quantum research. The presence of large defense contractors and leading medical equipment manufacturers ensures a continuous flow of demand for highly precise, custom-engineered TEC controllers. Market growth is sustained by continuous innovation in laser systems and LiDAR technology for autonomous driving research originating from Silicon Valley and surrounding tech centers.

- Europe: Europe maintains a strong position, particularly in industrial automation, photonics manufacturing (especially Germany and Switzerland), and scientific instrumentation. The market is heavily influenced by the adoption of Industry 4.0 principles, pushing demand for integrated, digitally controllable TEC solutions that can interface seamlessly with centralized factory control systems. Strict environmental regulations also drive manufacturers to favor energy-efficient TEC controller designs. Countries like Germany and the UK are major hubs for biomedical research, creating robust demand for high-accuracy thermal control in laboratory and diagnostic equipment. Strategic investment in fusion energy research and high-power laser facilities further bolsters the demand for specialized, high-power TEC controls.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by unparalleled expansion in telecommunications infrastructure, consumer electronics assembly, and semiconductor fabrication, primarily led by China, Japan, South Korea, and Taiwan. The region’s massive investment in 5G and optical fiber deployment has created enormous demand for optical transceiver thermal stabilization. Furthermore, rapid industrialization and the growing medical tourism sector fuel the need for advanced diagnostic equipment. While price sensitivity is higher than in Western markets, the sheer volume of production and deployment across these sectors ensures substantial market growth, often focusing on standardized, cost-effective digital controllers suitable for mass manufacturing integration.

- Latin America (LATAM): The LATAM market is emerging, characterized by localized growth in medical diagnostics and basic industrial automation. Adoption rates for highly advanced TEC controllers are slower, mainly concentrated in specialized research and high-value industrial sectors (e.g., oil and gas instrumentation). Market penetration is often dependent on imports, with regional distributors playing a key role in serving smaller, fragmented industrial bases. Brazil and Mexico lead regional demand due to their relatively robust manufacturing and scientific communities. The primary focus remains on standard, reliable controllers rather than highly customized solutions.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. Growth is concentrated in high-capital sectors such as oil and gas exploration (which requires ruggedized instrumentation and sensor stabilization), defense technology imports, and nascent healthcare development in the Gulf Cooperation Council (GCC) states. Extreme environmental conditions in parts of the MEA necessitate highly reliable and robust TEC controllers with wide operating temperature ranges. The market relies heavily on foreign expertise and imported technology, focusing on mission-critical applications where failure is highly consequential. Investment in solar energy also presents future opportunities for advanced thermal management requirements in photovoltaic efficiency optimization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TEC Controller Market.- Meerstetter Engineering

- Wavelength Electronics

- Thorlabs

- TE Technology

- RMT Ltd.

- Advanced Thermal Solutions, Inc.

- Laird Thermal Systems

- Oven Industries

- Analog Devices

- TDK Lambda

- Sensata Technologies

- MKS Instruments (Newport)

- Alpha Omega Instruments

- Custom Thermoelectric

- II-VI Incorporated (Coherent)

- AMS Technologies

- Micron Semiconductor

- HiTek Power

- Caliente LLC

- National Instruments (NI)

Frequently Asked Questions

Analyze common user questions about the TEC Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Analog and Digital TEC Controllers?

Analog TEC controllers use op-amps and resistors for control, offering basic stability and lower cost but limited flexibility. Digital controllers use microprocessors (DSPs) to implement highly precise PID algorithms, offering superior stability, remote programmability, and advanced features like data logging and complex thermal profiling, which is essential for modern photonics and medical systems.

Which application segment drives the highest growth rate for TEC Controllers?

The automotive sensor and LiDAR segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid global adoption of autonomous vehicle technology and Advanced Driver-Assistance Systems (ADAS), which rely heavily on robust, stable thermal management for ensuring the reliability of embedded optical and infrared sensors in varying environmental conditions.

How does the integration of AI improve TEC controller performance?

AI significantly enhances performance by moving thermal management from reactive PID loops to predictive control. Machine learning algorithms analyze historical system data and dynamic thermal loads to proactively adjust parameters, resulting in enhanced temperature stability, minimized power consumption, and improved component longevity through predictive maintenance scheduling.

What are the primary factors restraining the global TEC Controller market?

The key restraints include the relatively high manufacturing cost associated with producing high-precision, low-noise digital electronics, and the inherent energy inefficiency of the Peltier (TEC) modules themselves compared to traditional vapor compression cooling, limiting their adoption in large-scale, high heat flux cooling applications where power efficiency is the primary constraint.

Which geographical region holds the largest market share and why?

North America and Europe currently hold the largest market share in revenue terms due to established, high-value end-user industries such as aerospace, defense, and high-end medical equipment manufacturing. These sectors demand premium, certified controllers with ultra-high precision, leading to higher average selling prices and greater market value concentration in these developed regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager