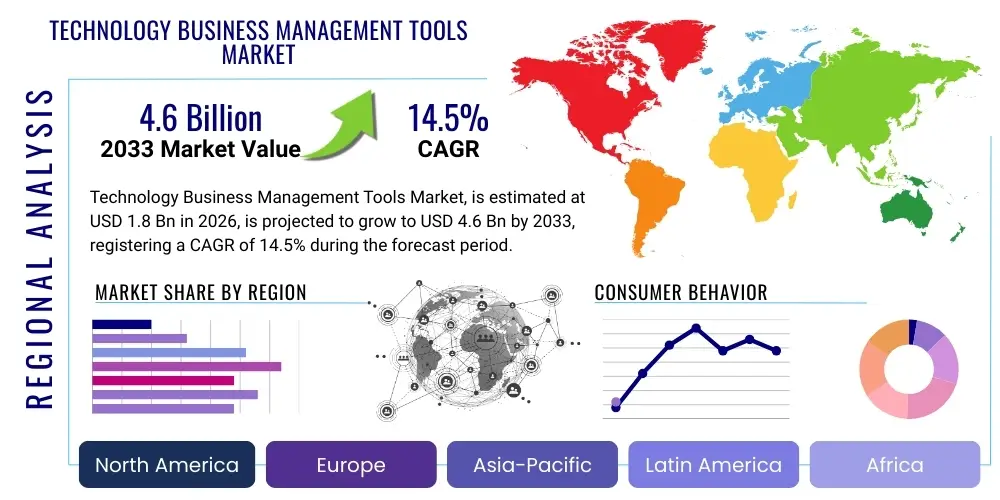

Technology Business Management Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435968 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Technology Business Management Tools Market Size

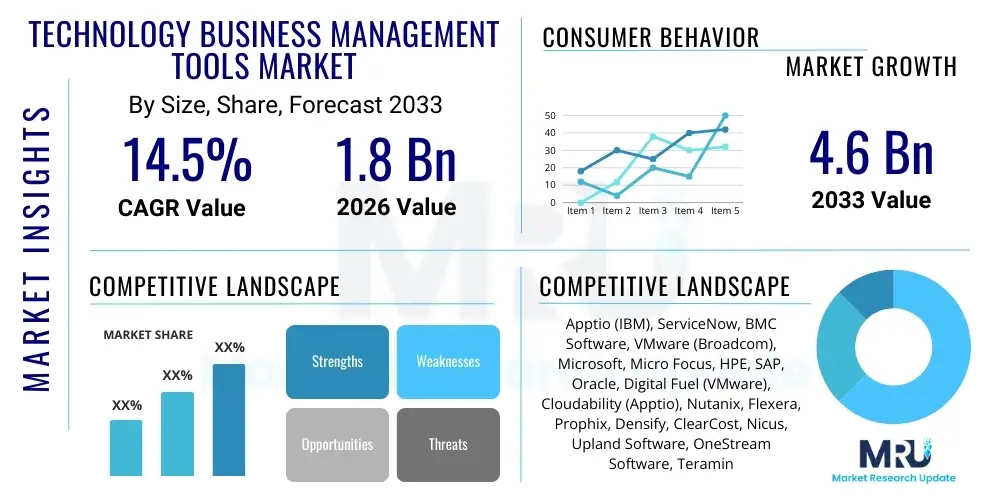

The Technology Business Management Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.6 Billion by the end of the forecast period in 2033.

Technology Business Management Tools Market introduction

The Technology Business Management (TBM) Tools Market encompasses sophisticated software solutions designed to provide IT leaders with comprehensive transparency into the cost, quality, and value of IT services and investments. These platforms facilitate data aggregation from disparate IT systems, including finance, operations, and cloud environments, enabling organizations to manage technology as a business rather than merely a cost center. Key product offerings typically include modules for IT financial planning, cost transparency, demand management, and performance benchmarking, allowing CIOs to align technology spending directly with strategic business outcomes. This operational transparency is crucial in an era dominated by hybrid cloud adoption and accelerated digital transformation initiatives.

Major applications of TBM tools span across various organizational departments, notably in budgeting, forecasting, and investment prioritization within the IT function. These tools are indispensable for achieving FinOps objectives, ensuring that cloud spending is optimized and resources are utilized efficiently across multi-cloud architectures. Benefits derived from the implementation of TBM solutions include improved resource allocation, enhanced communication between IT and business stakeholders, and the ability to demonstrate the tangible Return on Investment (ROI) of technology projects. By institutionalizing data-driven decision-making, TBM tools transform IT from a reactive service provider into a proactive strategic partner.

The primary driving factors accelerating market expansion include the exponential growth in enterprise cloud spending, which necessitates precise financial governance and cost optimization. Furthermore, increasing regulatory scrutiny requiring detailed financial reporting on IT assets and the ongoing pressure on CIOs to reduce operational costs while simultaneously funding innovation are fueling the adoption of these specialized management platforms. The complexity inherent in managing decentralized IT landscapes, coupled with the desire for accurate consumption-based costing models, strongly supports sustained market growth throughout the forecast period.

Technology Business Management Tools Market Executive Summary

The Technology Business Management Tools Market is characterized by robust business trends centered on the integration of artificial intelligence for predictive forecasting and prescriptive recommendations, alongside a strong shift towards Software-as-a-Service (SaaS) delivery models. Market participants are heavily focused on enhancing integration capabilities with specialized FinOps platforms and enterprise resource planning (ERP) systems to provide end-to-end visibility into the financial lifecycle of technology. Regional trends indicate North America maintaining market dominance due to early adoption across large enterprises and a mature ecosystem of technological innovation, while the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by rapid digital infrastructure build-out and increasing foreign direct investment in technology sectors. Segmentation trends highlight the substantial growth in the Cloud Cost Management segment, reflecting the urgent need for optimizing expenditure in dynamic cloud environments, and the continued necessity for sophisticated IT Financial Management tools to handle complex internal chargeback models and service catalog creation. The market exhibits high fragmentation, though key players are strategically acquiring niche solution providers to consolidate their offerings and expand geographic reach, emphasizing solutions that seamlessly connect IT spending data with tangible business value.

AI Impact Analysis on Technology Business Management Tools Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can automate the highly manual processes associated with data aggregation, normalization, and allocation within TBM frameworks. Common concerns revolve around the accuracy of AI-driven cost forecasting, the potential for AI to identify non-obvious cost anomalies, and whether these systems can offer truly actionable, prescriptive recommendations for optimization, moving beyond simple descriptive analytics. Expectations are high regarding AI's ability to seamlessly integrate FinOps practices by automatically identifying idle or underutilized cloud resources, suggesting optimization strategies based on historical consumption patterns, and significantly reducing the time spent on monthly budget reconciliation cycles. The consensus anticipates AI will transform TBM tools from passive reporting mechanisms into active, strategic financial guidance platforms.

The core challenge for vendors is effectively leveraging AI to handle the vast, heterogeneous data sets generated across modern hybrid IT environments. Successful implementation requires algorithms that can parse complex metadata and apply predictive models to scenarios such as fluctuating cloud reserved instance utilization or variable project demands. AI integration is vital for the next generation of TBM tools, promising higher accuracy in usage-based cost allocation and providing IT leadership with forward-looking financial insights that directly support strategic prioritization. This integration elevates the function of TBM from mere cost tracking to predictive financial modeling and risk assessment.

Furthermore, AI significantly enhances the value proposition of TBM tools by enabling proactive identification of budget overruns and offering automated scenario planning. For example, ML algorithms can analyze the relationship between IT investments and business KPIs, offering insights into which technology portfolios deliver the highest value, thereby aiding in divestment or reinvestment decisions. This algorithmic support is essential for large enterprises striving to maintain agility and cost efficiency in a fast-paced technology landscape, ensuring that TBM platforms remain central to corporate financial governance strategies.

- Automated Data Normalization and Allocation: AI significantly reduces manual effort in harmonizing disparate financial and operational data sources.

- Predictive Cost Forecasting: Machine learning models enhance the accuracy of future IT spend predictions, factoring in consumption variability and market changes.

- Anomaly Detection: AI identifies unusual spending patterns or deviations from baseline budgets in real-time, particularly critical for volatile cloud environments.

- Prescriptive Optimization Recommendations: Systems provide specific, actionable advice on where and how to reduce costs or reallocate resources (e.g., cloud instance rightsizing).

- Enhanced Service Benchmarking: AI facilitates the comparison of internal IT service costs against external industry benchmarks, enabling data-driven negotiations.

- Intelligent Scenario Planning: Automated modeling of budget impacts under different strategic IT investment choices.

- Improved Alignment with Business Value: Algorithms correlate IT spending directly to measured business outcomes, reinforcing the strategic role of technology investments.

DRO & Impact Forces Of Technology Business Management Tools Market

The Technology Business Management (TBM) market growth is powerfully driven by the imperative for IT cost transparency and the complex financial dynamics introduced by hybrid and multi-cloud architectures, which demand rigorous financial operational oversight (FinOps). Restraints on this growth predominantly include the high initial implementation costs associated with integrating these tools across legacy systems, the complexity of organizational change management required to adopt TBM processes, and the shortage of skilled professionals capable of effectively utilizing the platforms. Significant opportunities reside in expanding the use cases of TBM tools to encompass sustainability reporting (Green IT) and incorporating deeper integration with cybersecurity investment tracking to quantify resilience. These factors generate a substantial impact force, propelling major enterprises towards standardized TBM adoption as a critical component of modern digital governance, ensuring that technology expenditure is consistently justified, optimized, and strategically aligned with overarching corporate objectives.

A key driver is the transition from capital expenditure (CapEx) to operational expenditure (OpEx) models, particularly through the use of subscription and usage-based services provided by hyperscale cloud providers. This shift mandates real-time financial tracking and accountability that traditional accounting methods cannot provide, making TBM tools essential for accurate forecasting and chargeback mechanisms. Furthermore, the pressure from executive leadership and boards for IT departments to demonstrate clear business value from substantial digital investments acts as a strong positive impact force, transforming TBM from a specialized finance tool into a strategic reporting mechanism used across the C-suite for investment decisions and risk management.

Conversely, the primary restraining force involves data integration challenges. Modern IT environments generate vast amounts of disparate data—spanning on-premise assets, multiple cloud providers, and SaaS applications—and consolidating this data into a single, cohesive TBM model requires extensive data normalization and cleansing efforts. These integration projects are often time-consuming, costly, and require specialized consulting services, which can deter mid-sized organizations with limited IT budgets. Despite these hurdles, the long-term benefit of optimized IT spend and improved organizational accountability generally outweighs the initial friction, positioning the overall impact force as highly positive and reinforcing mandatory adoption among global 2000 companies.

Segmentation Analysis

The Technology Business Management Tools Market is segmented based on component, deployment model, organization size, application, and industry vertical, providing a granular view of adoption patterns and demand drivers. The component segmentation includes solutions (software platforms) and services (implementation, consulting, managed services), with the services segment showing rapid growth due to the complexity of initial setup and the ongoing need for optimization support. Deployment models are dominated by the SaaS model, reflecting the overall industry preference for flexible, scalable, and subscription-based software delivery. Large enterprises remain the primary adopters, although the mid-market segment is increasingly adopting tailored, lightweight TBM solutions. Application-wise, IT Financial Management and Cloud Cost Management are the most prominent segments, underpinning the fundamental need for cost transparency and optimization.

- By Component:

- Solutions (Software Platform)

- Services (Consulting, Implementation, Support, Managed Services)

- By Deployment Model:

- On-Premise

- Cloud (SaaS)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- IT Financial Management (ITFM)

- Cloud Cost Management & Optimization (FinOps)

- IT Portfolio Management (ITPM)

- Vendor Management

- IT Benchmarking and Reporting

- By Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunications

- Healthcare

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

Value Chain Analysis For Technology Business Management Tools Market

The value chain for the Technology Business Management Tools Market begins with upstream activities focused on platform development, which involves significant investment in R&D, data modeling expertise, and advanced cloud integration capabilities. Key upstream suppliers include data infrastructure providers, specialized analytics vendors, and AI/ML component developers who supply the core technology necessary for data ingestion and processing. The critical phase in the middle of the value chain is the core TBM solution provider, which aggregates these technologies to build the robust platform, focusing heavily on user interface (UI) design, reporting sophistication, and maintaining deep integration connectors to various enterprise IT and financial systems such as CMDBs, ERPs, and public cloud APIs. Efficiency in this stage is determined by the platform's ability to handle massive, heterogeneous data sets securely and accurately.

Downstream activities involve the crucial steps of deployment, customization, and ongoing managed services. Distribution channels are typically a mix of direct sales channels, targeting large enterprises with complex, high-value contracts, and indirect channels through system integrators (SIs) and value-added resellers (VARs). SIs play a vital role in integrating TBM platforms into existing enterprise landscapes, tailoring the solution to specific organizational cost structures, and managing the inevitable organizational change required for successful adoption. The reliance on indirect channels is growing, particularly for reaching SME customers and for specialized regional implementation requirements where local expertise is essential.

Customer engagement post-purchase is centered on maximizing the platform's utility through continuous advisory and support services, often bundled as managed services. This downstream service component is highly lucrative and critical for retaining customers, as TBM maturity is an ongoing journey. Direct engagement ensures that vendors can rapidly incorporate user feedback and evolving market needs, such as new cloud services or regulatory changes, into their product roadmaps. This cyclical feedback loop between downstream support and upstream development drives continuous innovation and is essential for maintaining competitive advantage and high customer lifetime value in this sophisticated software segment.

Technology Business Management Tools Market Potential Customers

Potential customers for Technology Business Management tools are primarily organizations facing complexity in IT financial management, typically driven by significant technology spending, reliance on multi-cloud environments, and regulatory pressure to demonstrate accountability for digital investments. The core audience comprises CIOs, CTOs, IT Finance Controllers, and C-level executives (CFOs and CEOs) who require transparent reporting on the value derived from IT services. Large enterprises across virtually all verticals, particularly those with annual IT budgets exceeding USD 50 million, are prime customers, as they possess the scale and complexity necessary to justify the investment in enterprise-grade TBM platforms. These organizations seek to shift IT cost discussions from simple budget containment to strategic value alignment.

The most active end-users are concentrated within the BFSI, IT and Telecommunications, and Healthcare sectors. BFSI institutions utilize TBM tools extensively to manage the complex costs associated with massive legacy systems modernization projects, regulatory compliance reporting (e.g., Basel III, GDPR), and optimizing spending on data centers and security infrastructure. IT and Telecom companies, characterized by high operational expenditures and complex infrastructure provisioning, leverage TBM to optimize resource allocation, manage vendor contracts, and accurately cost services before market launch. Healthcare providers use these tools to justify IT investments aimed at improving patient care, managing electronic health records (EHR) costs, and ensuring compliance while rationalizing spending.

Beyond the traditionally large adopters, SMEs represent a significant and expanding segment of potential customers, driven by the affordability and accessibility of cloud-native TBM solutions delivered via SaaS models. While SMEs may not require the full complexity of enterprise platforms, they increasingly need streamlined tools to manage rapid cloud spend growth and ensure compliance with basic financial governance standards. The common denominator among all potential buyers is the organizational recognition that IT is a strategic asset whose financial performance must be measured, managed, and communicated using standardized, defensible methodologies, which TBM tools provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apptio (IBM), ServiceNow, BMC Software, VMware (Broadcom), Microsoft, Micro Focus, HPE, SAP, Oracle, Digital Fuel (VMware), Cloudability (Apptio), Nutanix, Flexera, Prophix, Densify, ClearCost, Nicus, Upland Software, OneStream Software, Teramind |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Technology Business Management Tools Market Key Technology Landscape

The core technology underpinning the Technology Business Management Tools Market is built upon robust data ingestion and modeling capabilities, designed to normalize and allocate financial data originating from highly distributed sources. At the foundation are advanced Extract, Transform, Load (ETL) mechanisms optimized for connecting to diverse systems—including general ledger (GL) systems, IT service management (ITSM) platforms, configuration management databases (CMDBs), and APIs from major public cloud providers (AWS, Azure, GCP). These mechanisms are crucial for creating a single source of truth regarding technology spending. Furthermore, sophisticated financial modeling engines are essential; these engines handle complex allocation methodologies, such as Activity-Based Costing (ABC) or consumption-based models, allowing IT leaders to accurately map infrastructure costs to the specific business services they support.

The market is increasingly defined by the integration of emerging technologies, most notably Artificial Intelligence (AI) and Machine Learning (ML). AI is being leveraged for predictive analytics, enabling TBM platforms to forecast future resource needs and potential budget variances with high accuracy, moving beyond historical reporting. ML algorithms are deployed for automated anomaly detection in spending patterns and for providing prescriptive recommendations, especially in the Cloud Cost Management segment (FinOps). For instance, ML can autonomously suggest the optimal instance type or reserved capacity purchase timing based on observed usage elasticity, significantly enhancing cost optimization efforts without requiring constant manual oversight from financial analysts.

Another critical technological development is the shift towards open standards and enhanced integration frameworks, ensuring TBM tools can operate seamlessly within hybrid IT landscapes. Many vendors are now aligning with the FinOps Foundation frameworks, promoting standardized terminology and practices for cloud financial management. Furthermore, the use of visualization and reporting dashboards built on Business Intelligence (BI) technologies remains paramount. These interfaces must translate complex financial models and raw data into intuitive, actionable insights for both technical and non-technical stakeholders, ensuring high user adoption and facilitating strategic dialogue between IT and business units regarding investment prioritization and service consumption.

Regional Highlights

- North America: This region holds the largest market share, driven by the presence of numerous large enterprises with complex, high-volume IT operations and a mature adoption rate of both cloud services and sophisticated financial governance frameworks. Early and widespread implementation of TBM methodologies, coupled with a highly competitive vendor landscape and significant R&D investment, ensures continued leadership. The demand is heavily focused on comprehensive FinOps solutions and integration with high-level strategic portfolio management.

- Europe: Europe represents the second-largest market, characterized by stringent data governance and regulatory requirements (e.g., GDPR, DORA) that necessitate robust, auditable cost allocation and reporting features. Market growth is stable, fueled by large-scale digital transformation projects across the banking and manufacturing sectors and a strong focus on demonstrating sustainability in IT operations (Green IT initiatives).

- Asia Pacific (APAC): APAC is forecast to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid industrialization, massive investment in digital infrastructure (particularly in China, India, and Southeast Asia), and the rapid transition of local enterprises to public cloud platforms. The high growth rate is supported by a large, untapped market of emerging mid-sized and large enterprises initiating their TBM journeys to handle increasing IT complexity and global competition.

- Latin America (LATAM): The LATAM market is expanding steadily, primarily focused on improving operational efficiency and cost control amid economic volatility. Adoption is concentrated in multinational subsidiaries and large regional telecommunications and financial services providers seeking standardized tools to manage their distributed operations and optimize infrastructure spending.

- Middle East and Africa (MEA): Growth in MEA is moderate but significant, primarily centered around major economic hubs (UAE, Saudi Arabia, South Africa). Market demand is concentrated on government-led digital initiatives and large-scale projects in the energy and finance sectors that require strong governance and transparency tools to manage large public and private cloud contracts efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Technology Business Management Tools Market.- Apptio (IBM)

- ServiceNow

- BMC Software

- VMware (Broadcom)

- Microsoft

- Micro Focus

- HPE

- SAP

- Oracle

- Digital Fuel (VMware)

- Cloudability (Apptio)

- Nutanix

- Flexera

- Prophix

- Densify

- ClearCost

- Nicus

- Upland Software

- OneStream Software

- Teramind

- CloudSphere

- Veeam Software

- Snow Software

- LeanIX

- Digitate (TCS)

- Zluri

- KPMG (Consulting Services focused on TBM Implementation)

- Tricentis

Frequently Asked Questions

What is the primary function of Technology Business Management (TBM) tools?

The primary function of TBM tools is to provide comprehensive financial transparency into IT costs, quality, and value, enabling CIOs to manage IT like a business. They achieve this by aggregating cost data across infrastructure, applications, and cloud services and mapping those costs to specific business services and outcomes, facilitating strategic decision-making and optimal resource allocation.

How does TBM relate to FinOps and Cloud Cost Management?

TBM provides the overarching framework for managing the business of technology, while FinOps (Cloud Financial Operations) is a specific application of TBM focused exclusively on optimizing cloud spending. TBM tools include dedicated modules for FinOps, providing the necessary visibility and optimization features to manage multi-cloud consumption, ensuring governance and financial accountability in dynamic cloud environments.

Which deployment model is dominating the TBM Tools Market?

The Cloud (SaaS) deployment model is significantly dominating the TBM Tools Market. SaaS solutions offer scalability, lower upfront costs, faster implementation timelines, and automatic updates, which are highly attractive to enterprises seeking flexibility and continuous feature improvements in managing their increasingly cloud-centric IT landscapes.

What are the main restraints impacting the growth of the TBM Market?

The main restraints include the high complexity and cost associated with initial data integration across diverse legacy systems, and the significant organizational change management required for IT and finance teams to adopt the new TBM processes and cost structures. Successfully overcoming the data normalization challenge is critical for widespread adoption.

How is AI transforming the capabilities of TBM tools?

AI is transforming TBM tools by enabling advanced predictive cost forecasting, automating anomaly detection in spending, and providing prescriptive optimization recommendations (e.g., rightsizing cloud resources). This shift moves TBM capabilities beyond historical reporting to proactive, data-driven financial guidance, enhancing the strategic value of the platform for IT leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager