Tee Ultrasound Probes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437637 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tee Ultrasound Probes Market Size

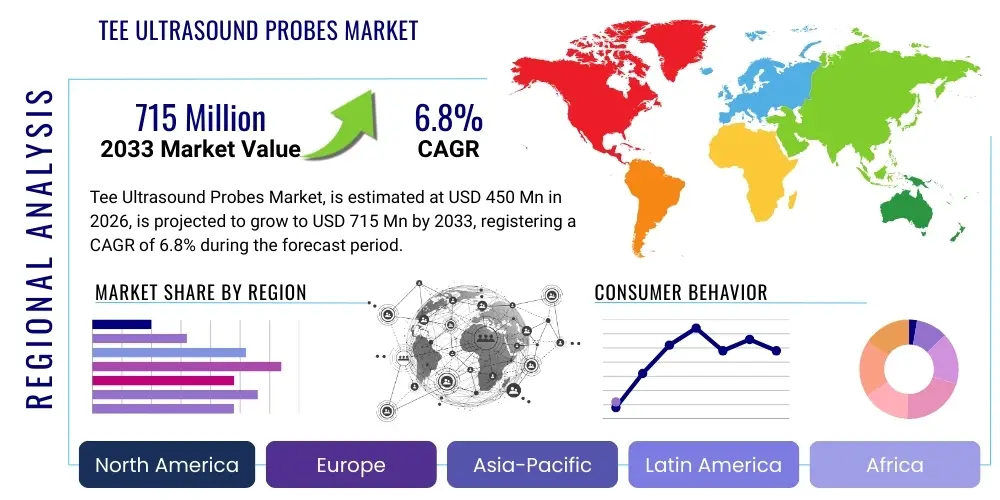

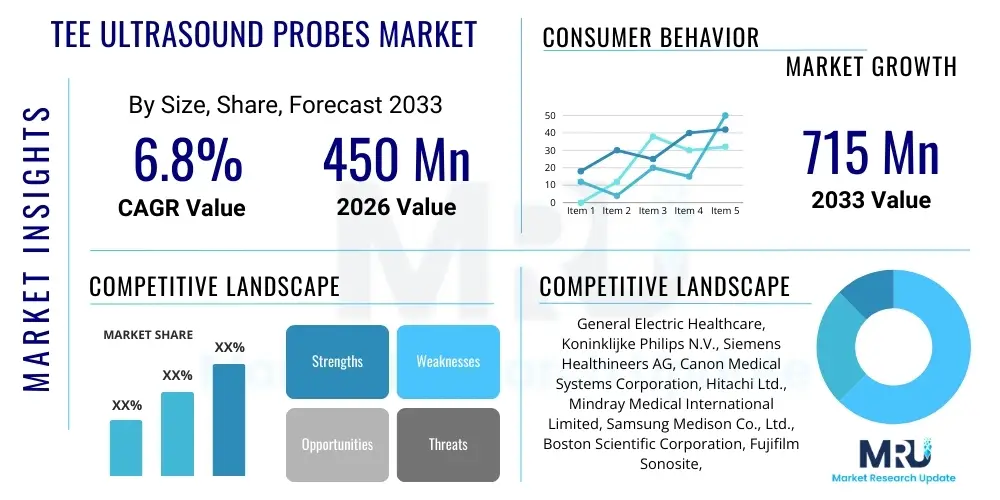

The Tee Ultrasound Probes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 715 Million by the end of the forecast period in 2033.

The continuous expansion of the Tee Ultrasound Probes Market is fundamentally driven by the escalating global incidence of cardiovascular diseases, coupled with technological advancements leading to the development of high-resolution, multi-plane transducers. These specialized probes, essential for Transesophageal Echocardiography (TEE), provide crucial real-time visualization of cardiac structures, particularly valuable during complex surgical procedures like mitral valve repair and structural heart interventions. The integration of 3D and 4D imaging capabilities into contemporary TEE probes significantly enhances diagnostic accuracy and procedural guidance, thereby expanding their utility across modern healthcare settings. This sustained demand from specialized clinical areas contributes substantially to the overall market valuation and anticipated growth trajectory, underscoring TEE's irreplaceable role in advanced cardiac care.

Tee Ultrasound Probes Market introduction

The Tee Ultrasound Probes Market encompasses devices specifically designed for Transesophageal Echocardiography (TEE), a diagnostic procedure where the transducer is placed in the esophagus to obtain clear, high-resolution images of the heart structures, circumventing the acoustic challenges presented by the chest wall. TEE probes are characterized by their specialized design, featuring flexible shafts and miniature transducer arrays capable of multi-plane imaging, including 2D, 3D, and increasingly 4D reconstruction. These probes are indispensable tools in cardiac anesthesiology, interventional cardiology, and cardiac surgery, offering superior visualization of valves, septa, and major vessels compared to transthoracic echocardiography (TTE). The inherent benefits of TEE, such as enhanced image clarity and real-time monitoring capabilities, position these probes as critical components of high-acuity medical procedures, fostering sustained market growth.

Major applications of TEE probes span across critical care monitoring, diagnosis of endocarditis, assessment of aortic pathologies, and, most prominently, guidance during complex structural heart procedures, including Transcatheter Aortic Valve Implantation (TAVI) and Left Atrial Appendage (LAA) closure. The ability to provide dynamic, precise feedback on device placement and cardiac function during these minimally invasive interventions makes TEE essential for procedural safety and efficacy. Furthermore, the market is benefiting from the shift towards disposable probes and smaller, more portable ultrasound systems, which enhance workflow efficiency and reduce the risk of cross-contamination, addressing key logistical concerns in hospital environments. This technological migration towards improved usability and safety acts as a primary driving factor for market adoption globally.

Key driving factors influencing the robust growth of the TEE Ultrasound Probes Market include the increasing global geriatric population, which is highly susceptible to cardiovascular disorders requiring advanced diagnostic imaging and intervention. Secondly, continuous technological refinement, particularly the introduction of miniaturized transducers capable of 3D real-time volumetric imaging, significantly expands the clinical utility of TEE, moving it beyond mere diagnosis into active procedural guidance. Lastly, rising healthcare expenditure in emerging economies and the expanding adoption of standardized clinical guidelines mandating TEE use in specific cardiac surgical scenarios ensure a stable and growing demand base. These factors collectively propel market expansion across various geographic regions and clinical specialties, solidifying TEE probe technology as a cornerstone of contemporary cardiac care.

Tee Ultrasound Probes Market Executive Summary

The Tee Ultrasound Probes Market exhibits dynamic shifts, characterized by strong business trends centered on strategic acquisitions and partnerships aimed at consolidating specialized technology and expanding geographic reach, particularly in high-growth Asia Pacific markets. Manufacturers are intensely focused on innovation, emphasizing the development of single-use, disposable TEE probes to mitigate infection control risks and optimize sterilization protocols, addressing stringent regulatory requirements. Concurrently, regional trends indicate that North America and Europe maintain market dominance due to established healthcare infrastructure, high procedural volumes, and favorable reimbursement policies, while the APAC region is rapidly emerging as a significant growth engine, fueled by improvements in healthcare access and increasing medical tourism focused on advanced cardiac procedures. This geographical diversification is a defining characteristic of the current market landscape.

Segment trends highlight the critical importance of the 3D/4D TEE technology segment, which is experiencing the fastest rate of adoption, driven by its unparalleled ability to provide detailed volumetric data essential for guiding complex interventional cardiology procedures. In terms of application, the cardiac surgery segment remains the largest consumer, but interventional cardiology procedures, particularly those involving valve replacements and structural defect repairs, are showing the most accelerated demand growth. Furthermore, end-user trends demonstrate a strong preference shift toward specialized cardiology centers and ambulatory surgical centers (ASCs) that seek highly specialized equipment offering efficiency gains and superior diagnostic outcomes. These centers prioritize advanced features, reliable performance, and comprehensive service agreements, influencing manufacturing strategies and product development cycles across the industry.

Overall, the market is poised for sustained growth, underpinned by fundamental demand drivers such as the global burden of cardiovascular disease and continuous advancements in imaging technology that enhance clinical outcomes and workflow efficiency. Despite facing restraints related to the high initial capital investment and the necessity for highly trained sonographers and physicians to operate the probes, the pervasive opportunity to integrate TEE into routine monitoring protocols during critical care and surgical settings ensures robust long-term potential. Strategic investment in training programs and the development of cost-effective, durable, and sophisticated probes will be critical for manufacturers seeking to maximize their market share and capitalize on emerging global clinical demands.

AI Impact Analysis on Tee Ultrasound Probes Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning algorithms will integrate with and enhance Transesophageal Echocardiography (TEE) procedures, focusing primarily on automating image analysis, improving diagnostic consistency, and streamlining procedural workflows. The consensus themes indicate a strong expectation that AI will move beyond simple measurement automation to encompass real-time feature extraction and quantitative assessment of complex cardiac motion and structure, such as mitral valve geometry or strain analysis. Concerns often revolve around the validation and regulatory approval of AI-driven diagnostic assistance tools, ensuring their reliability in acute clinical settings. Users are keen to understand if AI integration will reduce the dependence on highly specialized, manual interpretation skills, thereby potentially democratizing advanced TEE diagnostics across a wider range of healthcare facilities. This anticipated integration is expected to drastically cut down on post-processing time, allowing clinicians to focus more immediately on patient care and procedural decision-making.

The impact of AI on the TEE market is projected to be transformative, fundamentally shifting the paradigm of cardiac imaging interpretation from a subjective, operator-dependent skill toward an objective, data-driven science. AI algorithms are currently being trained to automatically identify and quantify common cardiac pathologies, such as thrombi in the left atrial appendage or specific types of structural heart defects, offering clinicians immediate quantitative metrics during a live procedure. This enhanced accuracy and speed are particularly relevant in emergency situations or complex interventional procedures where time is critical. Furthermore, AI systems are instrumental in quality assurance, automatically assessing image acquisition quality and suggesting optimal probe manipulation or plane alignment, which reduces variability between different operators and improves overall efficiency. The resulting demand will be for 'smart' TEE probes that can seamlessly integrate with vendor-specific AI platforms, making data connectivity and processing power essential future design specifications.

- AI enhances real-time image segmentation and structure identification, boosting diagnostic accuracy.

- Automated quantification of complex cardiac parameters reduces procedural time in the operating room.

- Machine learning algorithms assist in optimizing TEE probe placement and image acquisition quality.

- Predictive analytics based on TEE data may improve patient risk stratification for cardiac interventions.

- AI facilitates the development of automated reporting and documentation, improving clinical workflow efficiency.

DRO & Impact Forces Of Tee Ultrasound Probes Market

The TEE Ultrasound Probes Market operates under a complex set of dynamics defined by significant technological drivers and stringent operational restraints, balanced by substantial future opportunities. Key drivers include the rapidly increasing adoption of structural heart interventions (like TAVI and MitraClip), which heavily rely on TEE guidance for safe execution and optimal outcomes. Technological advancements, particularly in 3D/4D imaging and miniaturization, continually enhance the clinical utility of TEE probes, justifying high capital investments. Restraints primarily involve the substantial initial acquisition cost of high-end TEE systems and probes, alongside the critical shortage of certified and highly trained echocardiography specialists required for both probe operation and image interpretation. Additionally, challenges related to disinfection and potential cross-contamination require expensive and time-consuming reprocessing protocols, influencing operational costs and workflow.

Opportunities in the market center on the development and widespread adoption of disposable, single-use TEE probes, which eliminate the need for complex reprocessing and significantly mitigate infection risks, offering a compelling value proposition to healthcare providers globally. Furthermore, the expansion of portable and handheld ultrasound devices, often incorporating wireless connectivity, opens up TEE applications in non-traditional settings such as remote clinics and battlefield medicine, broadening the potential customer base. Impact forces shaping the market include the growing regulatory scrutiny over medical device safety and reprocessing protocols, pushing manufacturers toward disposable solutions. Economically, the shifting reimbursement landscape and pressure on healthcare costs necessitate the development of more durable or cost-efficient probe designs that offer superior clinical value, driving a competitive environment focused on long-term value delivery.

The interplay between these forces dictates market trajectory. While drivers related to cardiac disease prevalence provide a foundational demand, restraints related to cost and complexity necessitate innovation focused on simplification and efficiency. The crucial impact force of infection control mandates a significant shift toward single-patient use products, creating new revenue streams and necessitating changes in manufacturing scale and distribution logistics. Successful market penetration depends on manufacturers ability to balance high-fidelity imaging capabilities required for complex interventions with the operational demands of cost control, ease of use, and rigorous safety standards, ensuring that TEE remains accessible and economically viable across diverse healthcare systems worldwide.

Segmentation Analysis

The Tee Ultrasound Probes Market is meticulously segmented across multiple dimensions, allowing for granular analysis of demand patterns, technological preferences, and end-user behavior. Key segments include Product Type (e.g., Multiplane/Omniplane, Biplane, Single-plane, and 3D/4D Probes), Technology (e.g., Phased Array, Matrix Array), Application (e.g., Cardiac Surgery, Interventional Cardiology, Critical Care Monitoring), and End-User (e.g., Hospitals, Ambulatory Surgical Centers, Diagnostic Centers). This segmentation framework is vital for manufacturers to tailor product development and marketing strategies, recognizing the distinct requirements of a cardiac surgeon versus a critical care intensivist, or the differences in purchasing power and infrastructural readiness between major university hospitals and smaller community clinics. The 3D/4D segment, in particular, is experiencing rapid growth due to the superior depth perception and visualization required for guiding contemporary structural heart procedures, influencing the overall technological focus of the market.

Analyzing these segments reveals important insights: Phased array technology remains dominant due to its versatility and established use, but matrix array technology is gaining ground, particularly in 3D/4D probes, offering superior volumetric resolution. Geographically, segmentation highlights the dominance of developed markets in adopting the highest-end 3D/4D probes, driven by higher reimbursement rates and specialized procedural volumes. Conversely, emerging markets are initially prioritizing durable, reliable 2D or biplane probes suitable for general diagnostics and standard surgical support. Understanding these segment disparities is crucial for accurately forecasting regional adoption curves and optimizing supply chain logistics. The increasing demand from Ambulatory Surgical Centers (ASCs) for portable, efficient, and easily reprocessed or disposable units also creates a niche segment requiring targeted product offerings.

- By Product Type: Multiplane Probes, Biplane Probes, Single-plane Probes, 3D/4D Probes (Volumetric Imaging)

- By Technology: Phased Array Technology, Matrix Array Technology, Single Crystal Technology

- By Application: Cardiac Surgery, Interventional Cardiology, Critical Care Monitoring, Diagnostics

- By End User: Hospitals (Large & Small), Ambulatory Surgical Centers (ASCs), Specialized Cardiology Centers

Value Chain Analysis For Tee Ultrasound Probes Market

The value chain for the Tee Ultrasound Probes Market begins with highly specialized upstream activities involving the sourcing of piezoelectric materials (e.g., PZT or single crystals), sophisticated acoustic matching layers, and proprietary cabling systems, which are critical for transducer performance and image fidelity. Manufacturing is a high-precision, labor-intensive process requiring cleanroom environments for assembling the miniature acoustic elements and housing them within the flexible, sterile probe shell. Due to the high sensitivity and complexity of the electronics, stringent quality control and calibration are applied at every stage. This upstream reliance on scarce, high-performance materials and complex assembly techniques defines high barriers to entry and dictates a significant portion of the final product cost. Manufacturers often maintain tightly controlled relationships with specialized material suppliers to ensure consistency and technological superiority.

The downstream component of the value chain is dominated by highly specialized distribution channels. Given the high cost, technical complexity, and clinical criticality of TEE probes, distribution often involves direct sales teams rather than third-party distributors, ensuring that comprehensive technical support, application training, and installation services are provided. This direct channel facilitates the effective transfer of complex product knowledge and allows manufacturers to manage crucial post-sale service contracts and preventative maintenance schedules, which are vital due to the fragility and high cost of probe repair. Indirect distribution, where used, is typically reserved for accessories or less complex parts, maintaining strict control over the core probe sales process to ensure proper handling and minimize product damage during transit or installation.

The final consumption stage involves hospitals and specialized cardiology centers procuring TEE probes based not only on initial cost but heavily weighted towards image quality, compatibility with existing ultrasound systems, durability, and comprehensive service contracts. The reprocessing and maintenance segment is a significant part of the total cost of ownership (TCO) and thus forms a critical component of the value proposition. The development of specialized disinfection services, either in-house or outsourced, adds complexity to the downstream service ecosystem. The push toward disposable probes seeks to fundamentally simplify this downstream maintenance chain, potentially lowering TCO for end-users and reshaping the long-term service revenue models for manufacturers, driving efficiency and safety at the point of care.

Tee Ultrasound Probes Market Potential Customers

The primary consumers and buyers of Tee Ultrasound Probes are institutional healthcare providers specializing in acute cardiac care and complex surgical interventions. These include large university teaching hospitals, regional medical centers with dedicated cardiology departments, and specialized cardiac surgical facilities. These institutions purchase TEE probes as capital equipment, often bundled with high-end ultrasound systems, and their procurement decisions are highly influenced by factors such as clinical evidence supporting the probe's image quality, its compatibility with advanced procedural techniques (like 3D/4D guidance), and favorable total cost of ownership, including reliability and service contract details. Their clinical staff requires the most advanced features to handle high-acuity, complex patient cases, making them the segment focused on premium technology.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized outpatient diagnostic clinics, particularly those performing minimally invasive structural heart procedures or rapid pre-operative diagnostics. ASCs often prioritize operational efficiency, ease of use, and quick turnaround times. For this customer group, the adoption of disposable TEE probes is particularly appealing as it simplifies stringent infection control protocols and minimizes reprocessing time and associated labor costs, allowing for a higher volume of procedures. Their buying criteria often weigh heavily on cost-effectiveness and workflow integration, sometimes favoring less complex, yet highly reliable, biplane or multiplane models over the most advanced 4D systems, unless specific interventional services are provided.

Critical care units and intensive care units (ICUs) also represent a crucial end-user segment, utilizing TEE for immediate, bedside hemodynamic monitoring and diagnosing acute cardiac complications. For these buyers, portability, rapid deployment capabilities, and robust durability are key features. The expansion of TEE use into non-traditional settings, driven by portable and miniaturized ultrasound units, is broadening the customer base to include emergency departments and mobile surgical teams. Successful engagement with these diverse potential customers requires manufacturers to offer a tiered product portfolio that addresses distinct clinical needs, from highly specialized interventional guidance to efficient, routine monitoring applications, supported by comprehensive training and technical expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 715 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric Healthcare, Koninklijke Philips N.V., Siemens Healthineers AG, Canon Medical Systems Corporation, Hitachi Ltd., Mindray Medical International Limited, Samsung Medison Co., Ltd., Boston Scientific Corporation, Fujifilm Sonosite, Inc., Esaote S.p.A., CHISON Medical Technologies Co., Ltd., Konica Minolta, Inc., Trivitron Healthcare, Analogic Corporation, Terason Ultrasound, Zonare Medical Systems, Inc., Alpinion Medical Systems Co., Ltd., EDAN Instruments, Inc., TeleMed International, Inc., Prosonic Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tee Ultrasound Probes Market Key Technology Landscape

The technological landscape of the Tee Ultrasound Probes Market is rapidly evolving, driven by the demand for higher resolution, increased data acquisition speed, and improved ease of use, particularly in complex interventional procedures. The most significant technological leap is the widespread integration of 3D and 4D volumetric imaging capabilities, facilitated by high-density matrix array transducers. These matrix arrays utilize thousands of elements to acquire a pyramidal volume of data in real-time, enabling clinicians to visualize dynamic cardiac structures and device interactions (e.g., catheter movement) with unprecedented spatial accuracy. This move from planar 2D imaging to volumetric imaging is critical for guiding structural heart procedures, where precise measurement and orientation are non-negotiable for procedural success and safety. Continuous wave Doppler and advanced tissue harmonic imaging techniques are also being optimized within these probes to enhance signal quality and distinguish subtle pathological changes.

Another crucial technological development involves the materials used in transducer construction and the overall miniaturization of the probe head. Single-crystal technology is increasingly being adopted, replacing traditional polycrystalline ceramics (PZT) to offer superior bandwidth, improved signal-to-noise ratio, and greater acoustic efficiency. This results in clearer images with deeper penetration, particularly beneficial for imaging large patients or those with challenging anatomical structures. Furthermore, there is a strong emphasis on developing disposable or limited-reuse TEE probe models. This innovation requires engineering solutions that maintain high acoustic performance while meeting cost-effectiveness requirements for single-patient use, often involving sophisticated, yet cheaper, micro-electronic components and highly sterile protective sheaths, directly addressing the significant operational risk associated with device reprocessing.

The landscape is also defined by the increasing integration of connectivity and software intelligence. Modern TEE probes are designed to work seamlessly with advanced ultrasound platforms featuring sophisticated software for automated measurements, strain analysis, and fusion imaging capabilities (combining TEE data with fluoroscopy or CT scans). Wireless data transmission and enhanced ergonomics, reducing operator fatigue during long procedures, are becoming standard requirements. The move toward incorporating haptic feedback and real-time visualization cues directly into the probe handling interface represents the next frontier, aiming to further simplify complex procedural guidance and enhance the overall safety profile of Transesophageal Echocardiography in diverse clinical environments, solidifying the market's trajectory towards smart, connected imaging systems.

Regional Highlights

Regional dynamics are critical to understanding the distribution and growth drivers of the Tee Ultrasound Probes Market, reflecting variations in healthcare spending, disease prevalence, and technological adoption rates across the globe.

- North America: This region dominates the global market, driven by high procedural volumes related to cardiovascular diseases, rapid adoption of advanced interventional cardiology techniques, and the presence of major key players and sophisticated healthcare infrastructure. Favorable reimbursement policies for TEE procedures and the early uptake of high-end 3D/4D volumetric probes cement its leading position. The significant demand for disposable TEE probes, fueled by stringent infection control mandates, provides a sustained revenue stream.

- Europe: Europe represents a mature and technologically sophisticated market, characterized by high adoption rates in countries like Germany, the UK, and France. Growth is sustained by an aging population requiring complex cardiac care and strong regulatory emphasis on quality and safety. The market is particularly sensitive to government healthcare budgeting and centralized procurement, favoring providers offering robust service networks and proven reliability alongside competitive pricing strategies.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth over the forecast period. This rapid expansion is attributed to improving healthcare access, increasing medical infrastructure development in populous nations like China and India, and rising awareness regarding advanced diagnostic imaging techniques. While adoption of 3D/4D probes is currently concentrated in major metropolitan centers, the foundational demand for reliable 2D and biplane TEE probes in smaller clinics represents a vast, untapped market potential.

- Latin America: This region shows steady growth, constrained somewhat by varying economic conditions and disparate healthcare funding mechanisms. Market expansion is focused on specialized medical centers in Brazil and Mexico that serve as hubs for cardiac surgery and diagnostics. Demand is highly sensitive to price, emphasizing the need for cost-effective, durable TEE probe solutions and flexible financing options from manufacturers.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, supported by high government spending on modernizing medical infrastructure and attracting international medical expertise. The market primarily targets high-acuity hospitals seeking international-standard equipment, though logistical challenges and limited clinical expertise in certain African sub-regions pose significant market penetration hurdles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tee Ultrasound Probes Market.- General Electric Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Canon Medical Systems Corporation

- Hitachi Ltd.

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- Boston Scientific Corporation

- Fujifilm Sonosite, Inc.

- Esaote S.p.A.

- CHISON Medical Technologies Co., Ltd.

- Konica Minolta, Inc.

- Trivitron Healthcare

- Analogic Corporation

- Terason Ultrasound

- Zonare Medical Systems, Inc.

- Alpinion Medical Systems Co., Ltd.

- EDAN Instruments, Inc.

- TeleMed International, Inc.

- Prosonic Corporation

Frequently Asked Questions

Analyze common user questions about the Tee Ultrasound Probes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the TEE Ultrasound Probes Market?

The market growth is primarily propelled by the rising global incidence of cardiovascular diseases, the increasing volume of complex structural heart interventions (like TAVI), and continuous technological advancements, especially in 3D/4D volumetric imaging capabilities, which enhance procedural guidance and diagnostic accuracy, thus expanding TEE's clinical utility.

How does 3D/4D TEE technology differ and why is it essential for interventional cardiology?

3D TEE captures a static volumetric dataset of the heart, while 4D TEE captures this volume in real-time motion, offering dynamic, high-resolution visualization. This is essential for interventional cardiology procedures, as it allows clinicians to precisely measure complex anatomical structures, accurately position devices like catheters and valves, and monitor real-time functional changes, ensuring procedural safety and optimizing outcomes.

What role do single-use or disposable TEE probes play in the current market?

Disposable TEE probes are a rapidly growing segment designed to address critical challenges associated with infection control and probe reprocessing. They eliminate the time-consuming and costly high-level disinfection protocols, significantly reducing the risk of device-related cross-contamination and improving overall operational workflow efficiency in high-volume surgical settings.

Which geographical region holds the largest market share for TEE probes and why?

North America currently holds the largest market share, predominantly due to its established, advanced healthcare infrastructure, high reimbursement rates for sophisticated cardiac procedures, early and sustained adoption of cutting-edge TEE technologies (including 3D/4D systems), and the presence of a large patient pool requiring complex cardiac diagnostics and interventions.

What restraints are challenging the widespread adoption of advanced TEE technology?

The primary restraints include the significant high initial capital investment required for purchasing high-fidelity TEE systems and probes. Additionally, the market faces constraints due to the complexity of the equipment, necessitating a skilled workforce of highly trained sonographers and physicians, and the ongoing operational costs associated with stringent disinfection and maintenance protocols.

In the Value Chain, what is the most sensitive step impacting the final cost of a TEE probe?

The most sensitive step is the upstream manufacturing and component sourcing, specifically the assembly of the miniature, high-density transducer array using specialized piezoelectric or single-crystal materials and complex acoustics elements. This precision assembly requires cleanroom environments and stringent quality checks, driving up the production cost significantly due to the technological complexity and material scarcity.

How is AI expected to influence the daily use and functionality of TEE probes in the next five years?

AI will revolutionize TEE by enabling automated, real-time image analysis, measurement quantification, and automated report generation. This integration will improve diagnostic consistency, reduce the dependence on manual operator skill for image interpretation, and enhance workflow by automatically identifying and outlining cardiac structures during live procedures, leading to faster and more objective diagnostic decisions.

What specific cardiac procedures generate the highest demand for TEE probes?

The highest demand is generated by structural heart interventions, including Transcatheter Aortic Valve Implantation (TAVI), MitraClip procedures for mitral valve repair, Left Atrial Appendage (LAA) closure, and complex congenital heart defect repairs. TEE is mandatory in these procedures to provide crucial, high-resolution real-time guidance that cannot be achieved through external imaging methods.

What are the key technical specifications potential customers look for when purchasing TEE probes?

Customers prioritize image fidelity (especially 3D/4D resolution), system compatibility (integration with existing ultrasound machines), durability, and ergonomic design for ease of handling. Additionally, they assess the probe’s reprocessing requirements, favoring devices that minimize infection risk and reduce turnaround time between procedures, often leading to a preference for disposable options.

Why is the Asia Pacific market predicted to grow faster than North America?

The APAC market's accelerated growth is driven by substantial investments in healthcare infrastructure development, rapid urbanization, rising disposable incomes leading to better access to advanced medical treatment, and a large, aging population base increasingly susceptible to cardiovascular diseases, thus expanding the overall patient and procedural volume significantly over the forecast period.

How do technological advancements like single-crystal technology benefit TEE image quality?

Single-crystal technology, replacing traditional piezoelectric ceramics, offers improved acoustic efficiency, a wider frequency bandwidth, and reduced heat generation. These properties result in clearer, higher-resolution images with greater penetration depth and less image noise, crucial for accurately visualizing fine cardiac details and deep structures during critical procedures.

What is the main challenge related to the Total Cost of Ownership (TCO) for TEE probes?

The main challenge related to TCO is the cumulative cost and operational complexity associated with stringent reprocessing protocols (high-level disinfection). These procedures are time-consuming, labor-intensive, require expensive chemicals, and carry the inherent risk of probe damage during handling, which often necessitates costly repairs or replacement, significantly increasing the long-term expenditure.

In the segmentation by End User, why are Ambulatory Surgical Centers (ASCs) gaining prominence?

ASCs are gaining prominence because they focus on efficient, high-volume outpatient procedures, including many interventional cardiology and diagnostic TEE applications. Their need for streamlined workflows and strict infection control makes them ideal early adopters of disposable TEE probes, allowing them to minimize operational downtime related to equipment sterilization.

What are the primary functions of a multiplane TEE probe?

A multiplane TEE probe allows the operator to mechanically rotate the ultrasound beam across a 180-degree field of view using a motor located in the probe handle, generating multiple cross-sectional images (planes) of the heart without physically moving the probe shaft within the esophagus. This functionality is essential for comprehensive diagnostic evaluation of all cardiac chambers and valves.

How do regulatory mandates impact the innovation cycle within the TEE probe market?

Stringent regulatory mandates, particularly those concerning medical device reprocessing and patient safety, force manufacturers to invest heavily in research and development towards disposable solutions and improved sterilization validation techniques. This regulatory pressure directly accelerates innovation focused on risk mitigation and patient safety rather than solely on image quality enhancement.

Which market segment is forecasted to witness the fastest technological adoption?

The 3D/4D volumetric imaging segment is forecasted to witness the fastest technological adoption, driven by the escalating clinical need for superior spatial orientation and dynamic visualization required for guiding highly complex, image-intensive structural heart interventions, making these advanced capabilities increasingly standard for specialized centers.

What are the key technical challenges in designing a disposable TEE probe?

The main technical challenge is achieving high acoustic performance and image quality equivalent to reusable probes, while simultaneously using cost-effective materials and streamlined manufacturing processes necessary for a single-use device. Engineers must balance miniaturization, acoustic reliability, and cost constraints without compromising patient safety or diagnostic accuracy.

How do economic factors influence TEE probe procurement in regions like Latin America?

In Latin America, TEE probe procurement is heavily influenced by price sensitivity and budget constraints within national healthcare systems. Hospitals often prioritize durable, reliable 2D/biplane models with extensive warranties and require flexible payment or financing plans, focusing on lifetime value rather than immediate adoption of the most advanced, highest-cost 4D systems.

What defines the 'Downstream Analysis' in the TEE probe value chain?

Downstream analysis focuses on the distribution, sales, and end-user consumption of TEE probes. Key elements include the reliance on specialized direct sales forces, the provision of comprehensive post-sale training and service contracts (critical for maintenance), and the end-user procurement decisions based on complex clinical and economic evaluations.

What is the primary benefit of TEE over Transthoracic Echocardiography (TTE)?

The primary benefit is superior image resolution and clarity, as the TEE probe is positioned directly behind the heart in the esophagus, eliminating interference from the chest wall, ribs, lungs, and subcutaneous fat. This proximity provides unobstructed, high-frequency imaging essential for detailed visualization of small structures, particularly in perioperative or critical care settings.

Which end-user segment utilizes TEE primarily for continuous monitoring rather than surgical guidance?

Critical Care Units (CCUs) and Intensive Care Units (ICUs) utilize TEE probes primarily for continuous or intermittent hemodynamic monitoring, assessment of acute cardiac dysfunction, and early diagnosis of conditions like pulmonary embolism or pericardial tamponade, requiring rapid, non-invasive assessment at the patient's bedside.

How does the shortage of skilled sonographers affect the TEE market?

The shortage of skilled sonographers and cardiologists trained in TEE operation and interpretation acts as a significant restraint, limiting the procedural throughput and increasing reliance on automated features. This shortage drives market demand for AI-assisted interpretation tools and ergonomically simplified probes that lower the operational skill floor required for basic image acquisition.

What is meant by 'acoustic matching layers' in TEE probe construction?

Acoustic matching layers are specialized thin layers of material placed on the face of the piezoelectric elements within the transducer head. Their purpose is to optimize the transmission of acoustic energy from the transducer into the body tissues and, conversely, maximize the efficiency of reflected echo reception, minimizing signal loss and improving overall image quality and penetration depth.

How are environmental and sustainability concerns addressed in the TEE probe industry?

Sustainability concerns are addressed through the development of environmentally friendly disinfection protocols and, paradoxically, the rise of disposable probes. While disposables create waste, they eliminate the need for harsh, chemically intensive high-level disinfectants, which have significant water and chemical disposal footprints. Manufacturers are exploring biodegradable components and optimized packaging to mitigate the waste impact of single-use devices.

What distinguishes Phased Array technology from Matrix Array technology in TEE probes?

Phased Array technology uses a limited number of elements (typically 64-128) arranged in a single row to electronically steer and focus the beam, creating a 2D sector image. Matrix Array technology, used for 3D/4D imaging, utilizes a two-dimensional arrangement of thousands of elements, allowing for rapid volumetric data acquisition, which is essential for detailed spatial visualization of complex cardiac geometry.

Which application segment is showing the most rapid market demand acceleration?

The Interventional Cardiology application segment is showing the most rapid acceleration, fueled by the shift toward minimally invasive structural heart procedures. These complex interventions are entirely reliant on high-definition, real-time TEE guidance for precise device delivery, leading to an intense demand for the latest 3D/4D volumetric probes.

How do partnerships and collaborations among key players influence market growth?

Partnerships and collaborations, particularly between traditional imaging manufacturers and specialized interventional device companies (e.g., Boston Scientific, Medtronic), drive growth by integrating imaging hardware directly with procedural guidance software. This synergy creates seamless workflow solutions, enhancing the utility and adoption rate of TEE probes in complex operating environments.

What impact does the aging global population have on the TEE probe market?

The aging global population significantly drives the market by increasing the prevalence of age-related cardiovascular conditions such as valvular diseases, atrial fibrillation, and coronary artery disease. This heightened disease burden directly translates into a greater procedural volume for both diagnostic TEE assessments and TEE-guided surgical and interventional procedures.

What is the significance of the Base Year 2025 in the forecast analysis?

The Base Year 2025 serves as the reference point for calculating the projected Compound Annual Growth Rate (CAGR) and establishing the initial market valuation (Market Size in 2026). It incorporates the most recently available market data, economic indicators, and technological adoption rates to provide a reliable foundation for forecasting future market trends and trajectories through 2033.

How does the procurement process in large hospital systems typically differ from ASCs?

Large hospital systems typically involve complex, multi-departmental committees for TEE probe procurement, focusing on long-term capital equipment lifecycle management, comprehensive service contracts, and compatibility across various departments. ASCs, conversely, have quicker procurement cycles, prioritizing immediate operational cost savings, efficiency, and the simplified logistics offered by disposable probe solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager