Teen Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434557 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Teen Health Insurance Market Size

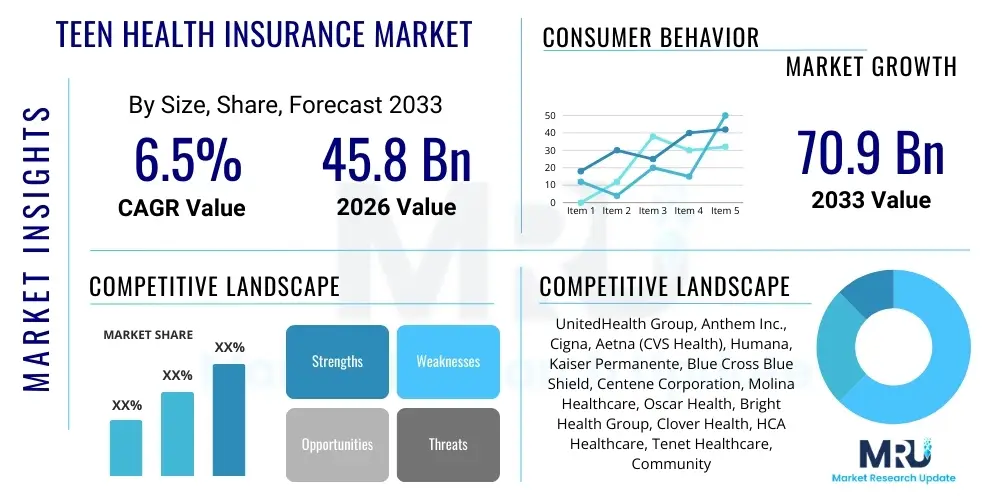

The Teen Health Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 70.9 Billion by the end of the forecast period in 2033. This growth trajectory is fueled primarily by mandatory coverage requirements under various national healthcare reforms, increasing awareness regarding preventive care, and the rising prevalence of mental health and behavioral disorders among adolescent populations, necessitating robust insurance coverage.

Teen Health Insurance Market introduction

The Teen Health Insurance Market encompasses specialized health insurance plans and coverage provisions designed specifically for adolescents, typically ranging from ages 13 to 18, though coverage often extends through age 26 under parental plans in many jurisdictions. This market is characterized by a unique focus on preventive services, mental health parity, substance abuse treatment, and primary care access, addressing the distinct developmental and risk factors associated with this demographic. Key driving factors include increased legislative mandates requiring comprehensive coverage for dependents, shifts in adolescent lifestyle contributing to higher rates of chronic conditions like obesity and anxiety, and the continuous innovation within digital health platforms that facilitate easier access to care management and virtual services for teens and their families.

Product descriptions within this segment often highlight flexibility, low deductibles for essential services, and extensive provider networks, particularly those specializing in pediatric and adolescent medicine. Major applications span routine physicals, vaccinations, acute illness management, chronic condition management (such as diabetes or asthma), and crucial behavioral health support. The primary benefits provided by specialized teen insurance plans include enhanced coverage for specific adolescent needs like sports injury rehabilitation and mental wellness programs, often surpassing the standard coverage limits found in general family plans. The market environment is highly sensitive to policy changes, economic stability, and technological advancements aimed at improving care delivery effectiveness.

Teen Health Insurance Market Executive Summary

The Teen Health Insurance Market is experiencing rapid expansion driven by favorable governmental policies, particularly those emphasizing young adult coverage and mandates for essential health benefits, including mental healthcare. Business trends indicate a strong move toward integrated care models where physical, behavioral, and virtual health services are consolidated under a single plan, appealing to modern families seeking comprehensive solutions. Insurers are increasingly leveraging data analytics to personalize risk assessments and develop targeted preventive programs specifically for the adolescent population, focusing on areas such as nutrition, substance use prevention, and early intervention for mental health conditions, thereby optimizing both clinical outcomes and operational efficiency within the market.

Regionally, North America remains the dominant market, primarily due to the established and highly regulated insurance infrastructure in the United States and Canada, coupled with high per capita healthcare spending. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by rising middle-class disposable incomes, expanding private insurance penetration, and increasing government focus on public health programs catering to the youth. Segmentation trends highlight the surging demand for Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans, alongside a noticeable rise in the uptake of high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) among financially savvy families seeking tax advantages and greater control over non-routine expenditures.

Overall, the competitive landscape is shifting towards technological integration, with key players focusing on mobile applications and telehealth services tailored for teens, ensuring compliance with privacy regulations like HIPAA while offering accessible and confidential care options. The market is poised for significant innovation in pricing strategies and preventative service offerings, reinforcing its resilience against economic fluctuations and ensuring long-term sustainable growth throughout the forecast period.

AI Impact Analysis on Teen Health Insurance Market

User inquiries regarding AI's influence in the Teen Health Insurance Market primarily center on three areas: personalized risk assessment, efficiency in claims processing, and the deployment of AI-driven mental health support tools. Users frequently ask if AI can accurately predict adolescent health risks, such as the likelihood of developing chronic conditions or needing behavioral health intervention, and how this prediction impacts premium pricing and policy accessibility. A significant concern revolves around data privacy and algorithmic bias, questioning whether AI tools might unfairly categorize or exclude vulnerable teen populations. Furthermore, there is substantial interest in how AI can streamline administrative burdens, particularly concerning the complexity of claims related to specialized adolescent services like therapeutic interventions and specialized rehabilitation programs, driving the need for sophisticated, yet ethical, AI integration.

The integration of Artificial Intelligence (AI) is fundamentally transforming the operational and clinical delivery aspects of teen health insurance. AI-powered predictive modeling is utilized to identify adolescents at high risk of specific health issues, allowing insurers to proactively offer targeted preventive interventions, such as digital therapeutics for anxiety or personalized coaching for nutritional management. This proactive approach shifts the insurance model from reactive payout to preventative care management, which ultimately aims to reduce long-term healthcare expenditure while improving patient outcomes. Machine learning algorithms are analyzing vast datasets, including electronic health records (EHRs) and social determinants of health (SDoH), to refine underwriting processes, ensuring fairer and more accurate premium calculations that reflect individual and regional risk profiles.

Beyond risk and premium optimization, AI is critically enhancing the user experience for both parents and teens. Chatbots and virtual assistants provide 24/7 support for navigating benefits, finding in-network providers, and scheduling appointments, which is particularly beneficial for services requiring sensitive handling, such as mental health inquiries. Moreover, AI aids in automating complex claim adjudication, significantly reducing processing times and minimizing human error. This administrative efficiency allows insurers to allocate more resources toward enhancing service quality and developing innovative coverage options tailored specifically to evolving adolescent health needs, reinforcing market competitiveness and consumer satisfaction.

- AI-driven predictive analytics optimize risk modeling for specific adolescent health challenges (e.g., behavioral health).

- Automated claim processing utilizing Machine Learning (ML) reduces operational costs and turnaround times.

- Natural Language Processing (NLP) enhances customer service through specialized chatbots for benefits explanation and provider search.

- AI facilitates the personalization of preventive programs, improving engagement in digital mental health and wellness platforms.

- Advanced fraud detection algorithms protect against improper billing, particularly in complex specialty care claims.

DRO & Impact Forces Of Teen Health Insurance Market

The Teen Health Insurance Market is shaped by a robust combination of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (I). Key drivers include stringent legislative mandates requiring comprehensive coverage for young dependents up to specified ages, the undeniable rise in awareness and diagnosis rates for adolescent mental health disorders (e.g., anxiety, depression), and increasing disposable income globally enabling greater uptake of private insurance plans offering specialized teen benefits. These drivers collectively necessitate greater investment from insurers in developing specialized product portfolios that meet both legal requirements and consumer expectations for high-quality, accessible care.

Restraints primarily encompass the high cost of premiums, particularly for specialized plans offering extensive behavioral health coverage, which can limit affordability for low and middle-income families. Furthermore, the complexity of navigating diverse regulatory environments across different geographic regions poses a significant operational challenge for multi-national providers. Another substantial restraint is the persistent shortage of healthcare providers specializing in adolescent mental health and substance abuse treatment, limiting the utility of even the most comprehensive insurance plans. These restraints require strategic market entry planning and advocacy for regulatory harmonization to mitigate adverse impact on market growth.

Opportunities for growth are abundant, notably through the expansion of telehealth and digital health services tailored for the younger generation, enhancing access and convenience while potentially reducing delivery costs. The market is also ripe for innovation in integrated wellness programs focusing on preventive care and lifestyle management, using technology to drive better engagement. The impact forces acting upon this market include dynamic socio-cultural shifts emphasizing mental wellness and equity, rapid technological advancement in digital health delivery, and sustained governmental influence through mandates and subsidies aimed at maximizing health coverage for youth populations, collectively ensuring continuous, albeit regulated, market evolution.

Segmentation Analysis

Segmentation of the Teen Health Insurance Market provides critical insights into purchasing patterns, coverage preferences, and areas of high growth potential, classifying the market based on Type of Plan, Funding Mechanism, Age Group, and Distribution Channel. The diversity in plan types—such as PPOs, HMOs, and HDHPs—reflects the varied needs for flexibility and cost control among policyholders. Understanding these segments is vital for insurers looking to design competitive products that align with the affordability and access requirements of target consumers, ranging from families prioritizing extensive specialist access to those focusing on lower monthly premiums coupled with catastrophic coverage.

- By Type of Plan:

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Exclusive Provider Organization (EPO)

- Point-of-Service (POS)

- High-Deductible Health Plans (HDHP)

- Catastrophic Plans

- By Funding Mechanism:

- Private Health Insurance (Employer-Sponsored, Individual Market)

- Public/Government Funded Insurance (Medicaid, SCHIP)

- By Age Group:

- Early Adolescence (13–15 Years)

- Mid-Adolescence (16–18 Years)

- Young Adult Coverage (19–21 Years)

- By Distribution Channel:

- Insurance Agents/Brokers

- Direct Sales (Online Portals, Telemarketing)

- Aggregators/Exchanges (Governmental and Private)

Value Chain Analysis For Teen Health Insurance Market

The value chain for the Teen Health Insurance Market starts with upstream activities, primarily involving the collection and analysis of demographic, epidemiological, and actuarial data necessary for risk underwriting and product development. Key upstream providers include data analytics firms, risk modeling consultants, and specialized healthcare actuaries who determine the financial viability and required premiums for specific teen coverage packages. Efficient and ethical data utilization in this phase is paramount, as it directly influences premium competitiveness and regulatory compliance, particularly concerning privacy standards governing minor data.

Midstream activities involve the core functions of insurance carriers, including product design, regulatory compliance adherence, marketing, sales through various distribution channels (brokers, online platforms), and claims processing. The efficiency of the claims processing sub-segment, increasingly utilizing AI and automated systems, is a critical determinant of customer satisfaction and operational cost control. Distribution channels, both direct and indirect, play a crucial role in making complex plan options accessible and understandable to parents and guardians, requiring specialized training for agents on teen-specific benefits like mental health parity and dependent coverage laws.

Downstream activities focus on the provision of healthcare services and ongoing policyholder support. This includes the vast network of hospitals, specialized pediatric and adolescent clinics, behavioral health specialists, and telehealth providers. Effective coordination between the payer (insurer) and the providers ensures quality care delivery and cost management. Customer relationship management, ongoing health education, and preventative outreach programs, often delivered digitally, complete the downstream value chain, closing the loop by influencing future risk profiles and renewal rates. The integration of digital tools across all stages ensures streamlined operations and improved service delivery.

Teen Health Insurance Market Potential Customers

The primary end-users and buyers in the Teen Health Insurance Market are multifaceted, encompassing not only the covered adolescents but primarily their parents, legal guardians, and, in many cases, government entities. For the vast majority of private insurance policies, parents making healthcare decisions and managing financial contributions are the direct buyers. These buyers prioritize comprehensive coverage that includes robust mental health benefits, extensive provider networks specializing in pediatric care, and low out-of-pocket costs for essential or emergency services, reflecting a generational focus on preventative wellness and immediate accessibility to care.

A significant segment of the market involves governmental bodies utilizing public programs like Medicaid and the Children’s Health Insurance Program (CHIP) to insure lower-income adolescents. These entities act as large-scale buyers, negotiating bulk contracts and setting essential benefit standards that influence the entire market. Educational institutions, especially colleges and universities extending coverage to older teens and young adults (ages 18-21), also represent a niche customer segment, often requiring plans that accommodate transitional healthcare needs and off-campus care access.

Furthermore, employers who provide sponsored health benefits are indirect but highly influential customers. Their selection of group plans dictates the options available to millions of families with teen dependents. These employers seek plans that offer high-value benefits, strong administrative support, and cost-effective premiums, recognizing that quality family coverage is a key component of employee retention and satisfaction. The market requires specialized marketing efforts that address the distinct concerns of each buyer group, from the cost-sensitivity of government programs to the quality-driven mandates of affluent private consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 70.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UnitedHealth Group, Anthem Inc., Cigna, Aetna (CVS Health), Humana, Kaiser Permanente, Blue Cross Blue Shield, Centene Corporation, Molina Healthcare, Oscar Health, Bright Health Group, Clover Health, HCA Healthcare, Tenet Healthcare, Community Health Systems, Alignment Healthcare, SelectHealth, USI Insurance Services, Fidelis Care, Magellan Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Teen Health Insurance Market Key Technology Landscape

The technology landscape supporting the Teen Health Insurance Market is undergoing rapid modernization, primarily centered on digitalizing interactions and enhancing data security. Key technologies include advanced data analytics platforms used for risk segmentation and underwriting, crucial for accurately pricing policies based on age-specific epidemiological data, such as rates of sports injuries, chronic diseases, and mental health episodes. Insurers are heavily investing in robust cloud infrastructure to manage the high volume of claims and protected health information (PHI), ensuring scalability while maintaining strict compliance with HIPAA and GDPR regulations across different operational jurisdictions.

Furthermore, the reliance on telemedicine and virtual care platforms has become a cornerstone of service delivery for the adolescent demographic. Mobile applications offering features like provider directories, symptom checkers, appointment scheduling, and confidential secure messaging with healthcare professionals are highly valued, addressing the teen preference for digital communication and minimizing the need for physical office visits for routine consultations. These apps often incorporate gamification and behavioral economics principles to encourage engagement in wellness programs, tracking activity and mental well-being metrics that inform preventative care strategies.

Blockchain technology is beginning to gain traction within this sector, primarily explored for enhancing the security and immutability of health records and streamlining the interoperability of claims data between providers and payers. This technology promises to reduce administrative overhead associated with verifying eligibility and managing complex referral networks. Overall, the key technological imperative is seamless integration—connecting the insurer’s core administrative systems (policy administration, billing) with consumer-facing digital tools and provider EHRs—to create a holistic, efficient, and user-friendly experience tailored for modern families managing teen health coverage.

Regional Highlights

Regional analysis reveals stark differences in market maturity, regulatory influence, and consumer expenditure patterns across the globe, significantly impacting the penetration and structure of Teen Health Insurance products.

- North America (NA): Dominates the market share due to highly structured insurance markets (US, Canada) and legislative mandates, such as the Affordable Care Act (ACA) in the US, which ensures young adults up to age 26 can remain on parental plans. This region features mature private insurance markets and high utilization of PPO and HMO models, with substantial investment in specialty care, including advanced behavioral health services.

- Europe: Characterized by mixed public and private systems. Countries with strong social security systems (e.g., UK, Germany, France) integrate adolescent health coverage heavily into national schemes, while private insurance often supplements coverage for faster access or specialized treatments. Focus areas include comprehensive mental health coverage and preventative physical health programs across school-age populations.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR. Growth is driven by burgeoning middle-class populations in India and China, increasing private insurance penetration spurred by economic growth, and governmental efforts to expand basic health coverage. The market is developing rapidly, focusing on affordability and integrating digital distribution channels to reach vast, geographically dispersed populations.

- Latin America (LATAM): Market growth is moderate, challenged by economic volatility and reliance on public systems. Private insurance adoption is concentrated among higher-income brackets in countries like Brazil and Mexico, focusing on supplemental coverage that guarantees access to private hospital networks and specialized pediatric clinics, often bypassing crowded public health services.

- Middle East and Africa (MEA): Growth is primarily confined to the Gulf Cooperation Council (GCC) nations due to compulsory employer-sponsored insurance mandates and high standards of medical care investment. In Africa, the market remains nascent, with international aid and localized micro-insurance schemes playing a critical role in supplementing public health provisions for youth populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Teen Health Insurance Market.- UnitedHealth Group

- Anthem Inc.

- Cigna

- Aetna (CVS Health)

- Humana

- Kaiser Permanente

- Blue Cross Blue Shield (Association and affiliated independent companies)

- Centene Corporation

- Molina Healthcare

- Oscar Health

- Bright Health Group

- Clover Health

- HCA Healthcare

- Tenet Healthcare

- Community Health Systems

- Alignment Healthcare

- SelectHealth

- USI Insurance Services

- Fidelis Care

- Magellan Health

Frequently Asked Questions

Analyze common user questions about the Teen Health Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between HMO and PPO plans for teens?

HMO (Health Maintenance Organization) plans generally offer lower premiums and out-of-pocket costs but require members to use a specific network of doctors and obtain referrals from a Primary Care Physician (PCP) for specialist visits. PPO (Preferred Provider Organization) plans offer greater flexibility, allowing access to out-of-network providers (at a higher cost) without requiring a PCP referral, which is often preferred for teens needing specialized mental health or orthopedic care.

How does the Affordable Care Act (ACA) impact health coverage for young adults?

The ACA significantly impacts teen health insurance by mandating that children can remain on a parent's health insurance plan until they turn 26 years old, regardless of whether they are married, living at home, attending school, or financially dependent. This provision provides continuous coverage during the critical transition period from adolescence into young adulthood.

Are mental health services fully covered under teen health insurance plans?

Due to Mental Health Parity Laws in many regions, including the U.S., mental health and substance abuse services must be covered at the same level as physical health conditions. However, the specific extent (e.g., number of therapy sessions, inpatient days) varies by plan type (HMO, PPO) and specific carrier, requiring careful review of the policy's Schedule of Benefits.

What role does technology, such as telehealth, play in adolescent health insurance?

Telehealth is crucial for adolescent health insurance, increasing access to behavioral health services and routine medical care, especially in underserved areas. Insurers are integrating virtual care platforms and mobile apps for confidential communication, appointment scheduling, and chronic condition management, making care more convenient and discreet for teens.

What factors are driving the projected high growth rate in the Asia Pacific Teen Health Insurance Market?

High growth in APAC is fueled by expanding middle-class populations with increased purchasing power, leading to higher adoption of private health insurance. Furthermore, rapid urbanization, growing awareness of chronic and lifestyle-related diseases among youth, and government initiatives promoting private sector investment in healthcare infrastructure are strong market accelerators.

The Teen Health Insurance Market remains a vital and rapidly evolving segment within the global healthcare economy. Its future growth is inextricably linked to legislative stability, technological innovation in digital health, and the continuous need for specialized coverage addressing the complex physical and behavioral health needs of adolescents. Insurers who strategically integrate advanced data analytics and user-centric digital platforms—while remaining compliant with stringent privacy and parity regulations—are best positioned to capture market share and drive positive health outcomes for this critical demographic.

Investment trends suggest a strong pivot towards preventative care financing, utilizing sophisticated risk stratification models to intervene before acute episodes occur. This shift necessitates partnerships between payers, digital health startups, and specialized provider groups focused on areas like school-based health programs, pediatric behavioral telemedicine, and substance use prevention. The long-term viability of the market is contingent upon balancing comprehensive coverage mandates with premium affordability, ensuring that vulnerable teen populations receive necessary care regardless of socio-economic status. Continuous monitoring of regulatory changes and consumer preferences regarding health plan transparency will be crucial for sustained success in this competitive and sensitive market environment. Future market reports will likely focus on the performance metrics of AI-driven preventative programs and the economic impact of global dependent coverage extension policies.

The segmentation analysis reinforces that customization is key. The demand for flexible PPO structures in affluent markets contrasts sharply with the reliance on government-subsidized public plans (HMO models) in lower-income demographics. Successful market penetration strategies must account for these regional and socio-economic variances. For instance, in developing regions like APAC, the introduction of micro-insurance products tailored for specific conditions prevalent among teenagers (such as infectious diseases or injuries) represents a significant opportunity. Conversely, North American and European markets demand high integration with established provider networks and robust, seamless digital engagement tools for both policyholders and medical practitioners, reflecting a maturity characterized by demands for convenience and comprehensive specialization. The integration of mental health specialists within primary care networks, facilitated by tiered insurance coverage, is emerging as a non-negotiable expectation across all mature markets.

Further examination of the value chain highlights the increasing influence of specialized third-party administrators (TPAs) and health technology vendors who optimize claims processing and eligibility verification, allowing carriers to focus resources on product innovation and compliance. The move towards interoperability of health data, while presenting regulatory hurdles, promises substantial long-term gains in efficiency, directly impacting the profitability of teen insurance portfolios. As digital distribution channels continue to mature, the reliance on traditional brokers may diminish, especially for straightforward, standardized plans. However, brokers will retain influence for complex, customized, and high-value group insurance offerings to employers, advising on compliance related to dependent coverage mandates and complex multi-state regulations concerning adolescent privacy rights in healthcare decision-making.

The convergence of advanced analytics, virtual care delivery, and targeted preventative outreach defines the technological edge in the Teen Health Insurance Market. Carriers utilizing machine learning for dynamic network management—identifying provider gaps in adolescent-specific care (e.g., eating disorders, specialized rehabilitation)—and contracting accordingly, gain a significant competitive advantage. The focus on cybersecurity is paramount; protection against breaches of sensitive adolescent health data is a major operational cost and risk factor. Successful market participants are those who treat cybersecurity not merely as a compliance necessity but as a core value proposition, assuring families that their children's confidential health information is safeguarded, particularly concerning delicate matters like behavioral health visits and reproductive health consultations, thereby fostering essential trust in the insurance ecosystem.

The competitive landscape is characterized by both global giants seeking economies of scale and specialized niche players focusing on tailored, regional benefits. Strategic mergers and acquisitions often target smaller, technologically adept companies that have successfully developed highly engaging digital wellness platforms or specialized provider networks for the youth market. Large payers are increasingly offering tiered product lines: basic, compliant plans for regulatory satisfaction, and premium, specialized plans that include extensive mental health coverage, international travel insurance for students, and innovative digital therapeutics, catering to the full spectrum of consumer purchasing power and healthcare expectations. These multi-tiered strategies are essential for maintaining relevance and market share against disruptive, digitally native competitors entering the highly competitive sector.

Regulatory dynamics, particularly around the definition of essential health benefits for adolescents and ongoing debates regarding prescription drug coverage for mental health medications, remain central to market risk assessment. Payers must constantly adapt pricing and benefit structures to absorb new mandates while striving to maintain attractive premium rates. International comparisons show a growing trend towards incorporating educational support services and family counseling as covered benefits, moving beyond strictly clinical definitions of care. This holistic approach recognizes the interconnectedness of adolescent well-being, driving product innovation towards inclusive, preventative, and supportive insurance models that appeal strongly to modern, health-conscious parents and guardians. This evolving regulatory and consumer expectation environment ensures the Teen Health Insurance Market will remain dynamic and heavily scrutinized by policymakers and consumer advocacy groups throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager