Telecom Billing and Revenue Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432898 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Telecom Billing and Revenue Market Size

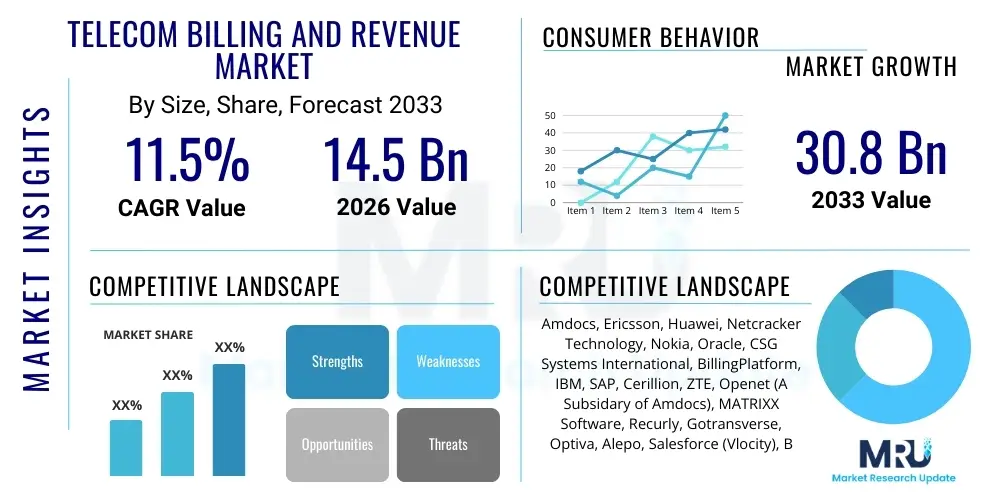

The Telecom Billing and Revenue Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $30.8 Billion by the end of the forecast period in 2033.

Telecom Billing and Revenue Market introduction

The Telecom Billing and Revenue Management (B/R M) Market encompasses the systems, software, and services utilized by Communication Service Providers (CSPs) to manage charging, invoicing, collections, and revenue assurance across their diverse service portfolios. These solutions are fundamental to modern telecom operations, shifting from traditional voice and data metering to complex, personalized service monetization, particularly driven by the rollout of 5G networks, which demand real-time, convergent billing capabilities. Key product offerings include convergent billing platforms, mediation systems, partner relationship management (PRM), and dedicated revenue assurance and fraud management tools designed to maximize profitability and minimize losses in a highly competitive digital landscape. The primary goal is to provide flexibility for creating new product bundles, managing intricate B2B and IoT contracts, and ensuring a seamless, transparent customer billing experience.

Major applications of B/R M systems span the entire customer lifecycle, from provisioning and service activation through usage tracking, rating, invoicing, and payment processing. Specifically, the introduction of sophisticated services such as network slicing, guaranteed Quality of Service (QoS) packages, and multi-partner ecosystems (e.g., in automotive or healthcare IoT) necessitates B/R M platforms capable of handling variable pricing models, dynamic discounts, and complex inter-carrier settlements. These systems are crucial for maintaining regulatory compliance, managing intricate tax regulations across different jurisdictions, and ensuring the accuracy of financial reporting, which directly impacts investor confidence and operational efficiency. The reliance on advanced analytics embedded within B/R M solutions is increasing to predict churn and identify optimal pricing strategies.

The market is primarily driven by the imperative for digital transformation among CSPs globally, pushing them towards cloud-native, microservices-based BSS (Business Support Systems) architectures that facilitate agility and scalability. Benefits include faster time-to-market for new 5G services, improved customer satisfaction due to accurate and transparent billing, enhanced operational efficiency through automation, and significant reductions in revenue leakage attributed to fraud or billing errors. The complexity introduced by Machine-to-Machine (M2M) communications, the burgeoning ecosystem of Over-The-Top (OTT) content providers, and the convergence of fixed, mobile, and cable services further cement the necessity for highly adaptable, future-proof billing and revenue management solutions that can handle unprecedented transaction volumes and data types seamlessly.

Telecom Billing and Revenue Market Executive Summary

The Telecom Billing and Revenue Market is experiencing robust expansion, fundamentally underpinned by two major business trends: the global deployment of 5G technology and the accelerated adoption of cloud-native Business Support Systems (BSS) architectures. CSPs are recognizing that legacy BSS platforms are inadequate for monetizing the nuances of 5G services—such as network slicing, low-latency applications, and complex B2B offerings—thus fueling demand for convergent and real-time charging solutions. Furthermore, the drive toward operational efficiency and reduced capital expenditure is compelling major operators to migrate their B/R M systems to public or hybrid cloud environments, facilitating unprecedented scalability and significantly decreasing the deployment time for new commercial models. This transition is redefining vendor competition, emphasizing specialized providers offering microservices-based platforms that integrate seamlessly with existing digital ecosystems.

Regionally, the market dynamics are highly differentiated, with North America and Europe leading in adopting advanced BSS solutions due to early 5G commercialization and sophisticated regulatory demands, particularly concerning data privacy and interconnectivity charges. The Asia Pacific (APAC) region, however, represents the fastest-growing segment, driven by massive subscriber growth, rapid urbanization, and significant government investment in digital infrastructure in countries like India, China, and Southeast Asian nations. This rapid expansion in APAC necessitates scalable, cost-effective B/R M solutions capable of handling massive transaction volumes from pre-paid and emerging digital services. Conversely, regions in Latin America and the Middle East and Africa (MEA) are seeing focused investments primarily in fraud management and revenue assurance tools, aiming to combat high instances of revenue leakage while gradually transitioning older 2G/3G infrastructures.

Segmentation trends indicate a pronounced shift towards outsourced B/R M services, encompassing Managed Services, which allows CSPs to offload non-core operations and focus on core network competencies and customer-facing innovation. In terms of deployment, cloud-based solutions are rapidly overshadowing traditional on-premise implementations, particularly among challenger CSPs and Mobile Virtual Network Operators (MVNOs) seeking lower total cost of ownership (TCO) and rapid deployment cycles. The solutions segment is dominated by Convergent Billing Systems, which are critical for unifying service offerings (voice, data, video, IoT) under a single customer invoice, enhancing transparency, and improving the overall customer experience, which is now a paramount differentiator in the saturated telecommunications industry.

AI Impact Analysis on Telecom Billing and Revenue Market

Common user questions regarding AI's influence on the Telecom Billing and Revenue Market often revolve around how Artificial Intelligence (AI) can minimize billing inaccuracies, predict and prevent revenue leakage, enhance customer experience through personalized offers, and automate complex settlement processes. Users are concerned about the implementation costs, data security implications, and the efficacy of AI in handling the sheer volume and diversity of data generated by 5G networks and IoT devices. The underlying theme is the expectation that AI and Machine Learning (ML) will transform B/R M systems from reactive processing tools into proactive, predictive strategic assets that not only ensure accuracy but also identify new revenue opportunities and drastically improve fraud detection capabilities.

AI is fundamentally revolutionizing the efficiency and effectiveness of revenue management functions, moving beyond simple automation to predictive modeling. For instance, AI algorithms can analyze historical billing data, usage patterns, and system logs to predict potential areas of revenue leakage or system failure before they occur, leading to proactive correction and significantly higher revenue assurance rates. This predictive capability is vital in the context of complex 5G network slicing, where billing must be dynamically adjusted based on real-time network conditions and Service Level Agreements (SLAs). By embedding ML models within the charging engine, CSPs can ensure that service quality directly correlates with accurate monetization, improving both profitability and compliance with contractual obligations.

Furthermore, AI plays a crucial role in customer-facing applications, particularly in personalizing offers and managing credit risk. ML algorithms assess customer payment history and interaction data to tailor specific payment plans or service bundles, optimizing customer lifetime value (CLV) and reducing churn rates. In fraud management, AI models are essential for detecting sophisticated, evolving fraud types—such as Wangiri calls or subscription fraud—by identifying anomalous patterns that traditional rule-based systems often miss. The seamless integration of AI-driven analytics into BSS dashboards provides real-time, actionable insights for decision-makers, optimizing operational costs (OpEx) associated with manual review processes and dispute resolution, thereby enhancing overall market competitiveness.

- AI-driven Predictive Revenue Assurance: Minimizing leakage by forecasting potential billing errors or fraud vulnerabilities.

- Enhanced Fraud Detection: Utilizing ML to analyze real-time traffic anomalies and behavioral patterns for sophisticated fraud prevention.

- Personalized Billing and Pricing: Implementing algorithms to customize service bundles and pricing based on individual customer usage profiles and credit risk.

- AIOps for BSS: Automating operations and maintenance of billing systems, improving system uptime, and reducing manual intervention.

- Automated Customer Dispute Resolution: Using Natural Language Processing (NLP) and AI to analyze billing inquiries and provide instant, accurate explanations, reducing call center load.

- Dynamic Credit and Collections Management: Optimizing collection strategies through predictive analytics regarding customer payment likelihood.

DRO & Impact Forces Of Telecom Billing and Revenue Market

The Telecom Billing and Revenue Market is shaped by powerful forces encompassing significant Drivers (D), Restraints (R), Opportunities (O), and overall Impact Forces. The market is primarily driven by the complexity and potential of 5G monetization, which necessitates advanced real-time charging and convergent billing systems capable of handling millions of unique B2B and IoT microtransactions simultaneously. The continuous pressure on CSPs to reduce operational expenditure (OpEx) and increase efficiency also fuels the adoption of sophisticated automation and cloud-based BSS solutions. Conversely, the market faces significant restraints, including the high initial capital expenditure (CapEx) required for migrating legacy systems to cloud-native architectures, coupled with complex interoperability challenges between new BSS platforms and existing network and Operation Support Systems (OSS). Data security concerns and strict regulatory compliance requirements, such as GDPR in Europe, also pose substantial barriers, demanding robust security features and audit trails within B/R M platforms.

The primary opportunities lie in the expanding ecosystem of digital services and the resultant need for sophisticated partner ecosystem management and settlement platforms. The shift toward specialized B2B service offerings—such as industry-specific IoT solutions, guaranteed bandwidth services, and network slicing—presents significant revenue streams for CSPs that can quickly adapt their billing models. This drives demand for B/R M solutions capable of handling multi-party settlements, dynamic pricing, and sophisticated Service Level Agreement (SLA) management. Furthermore, the emerging requirement for real-time BSS capabilities to support Mobile Edge Computing (MEC) applications and customized enterprise solutions represents a high-growth avenue, pushing vendors to incorporate artificial intelligence and machine learning for enhanced performance monitoring and revenue assurance.

The cumulative impact forces driving the evolution of this market stem from the relentless pace of digital transformation and the increasing maturity of cloud infrastructure. Competitive intensity among CSPs mandates a shift towards customer-centric billing, where transparency and flexibility are key differentiators, forcing B/R M systems to prioritize user experience alongside accuracy. The integration of advanced analytics, AI, and blockchain technology (for inter-carrier settlement) acts as a transformative force, enabling unprecedented levels of automation, reducing manual errors, and mitigating fraud, ultimately impacting the total cost of ownership (TCO) for telecom operators. This continuous technological integration reinforces the strategic importance of B/R M solutions as core revenue-generating assets rather than mere operational expenses.

Segmentation Analysis

The Telecom Billing and Revenue Market is comprehensively segmented based on Solution Type, Deployment Mode, End-User, and Service Type, reflecting the diversified needs of Communication Service Providers (CSPs) across the global landscape. The Solution segment differentiates between essential functions like billing and charging, mediation, and fraud management, with convergent billing systems holding the largest market share due to their necessity in unifying disparate service lines. The shift toward integrated BSS suites capable of supporting multiple technologies (2G/3G/4G/5G) and varied business models (prepaid, postpaid, subscription, usage-based) is the dominant trend across all sub-segments. This integration capability is vital for CSPs aiming to streamline operations and enhance the single-view experience for both customers and internal management teams, addressing the complexity introduced by hybrid service bundles and customized enterprise contracts.

In terms of deployment, the market shows a significant migration from traditional on-premise infrastructure towards cloud-based and hybrid deployment models. Cloud adoption is favored for its advantages in scalability, reduced upfront capital expenditure (CapEx), faster time-to-market for new service launches, and inherent flexibility needed to cope with unpredictable network traffic surges, especially related to video streaming and IoT device connectivity. While large Tier 1 operators may utilize hybrid models for maintaining control over sensitive data, Tier 2 and Tier 3 CSPs, along with MVNOs, are aggressively adopting SaaS and PaaS offerings for their core B/R M needs. This transition is also pushing B/R M vendors to re-architect their platforms using microservices and containerization to ensure platform independence and ease of integration into multi-vendor cloud environments, enhancing the resilience and maintenance simplicity of the overall architecture.

The segmentation by End-User is crucial, distinguishing the distinct requirements of Mobile Network Operators (MNOs) versus Fixed Service Providers (FSPs) and Mobile Virtual Network Operators (MVNOs). MNOs, being the largest consumers, require robust systems for managing complex mobility services, roaming settlements, and new 5G B2B use cases. FSPs focus more on bundled services (triple/quad-play) and high-volume data traffic management, while MVNOs prioritize agility, low TCO, and rapid integration capabilities, often relying exclusively on managed services. The Service Type segment includes consulting, integration, and managed services; the demand for managed services is rapidly accelerating as CSPs seek to outsource the operational complexity of system maintenance, patching, and regulatory updates, allowing them to redirect internal resources towards core innovation and customer acquisition strategies.

- By Solution Type:

- Billing and Charging

- Mediation

- Revenue Assurance

- Fraud Management

- Partner & Interconnect Management

- By Deployment Mode:

- Cloud-based

- On-premise

- Hybrid

- By Service Type:

- Professional Services (Consulting, System Integration, Implementation)

- Managed Services

- By End-User:

- Mobile Network Operators (MNOs)

- Fixed Service Providers (FSPs)

- Mobile Virtual Network Operators (MVNOs) and Enablers (MVNEs)

Value Chain Analysis For Telecom Billing and Revenue Market

The Value Chain for the Telecom Billing and Revenue Market begins with Upstream Analysis, focused primarily on core technology development, intellectual property, and system infrastructure. This stage involves specialized software providers (vendors) who invest heavily in R&D to create sophisticated, scalable BSS platforms, often leveraging technologies like AI/ML, cloud-native microservices, and blockchain for inter-carrier settlement. Key upstream activities include developing modular charging engines, advanced rating algorithms, and sophisticated data mediation layers capable of processing massive volumes of data from diversified network elements. Strategic partnerships at this level, particularly with major cloud infrastructure providers (AWS, Azure, GCP), are critical for ensuring platform resilience and global scalability, defining the technological capabilities passed down the chain.

Midstream activities involve system integration, customization, and implementation, typically executed by specialized third-party system integrators (SIs) or the vendor’s own professional services arm. This stage is crucial for tailoring the standardized B/R M software to the specific network architectures, commercial strategies, and regulatory environments of individual Communication Service Providers (CSPs). Effective integration ensures seamless connectivity between the BSS systems and the OSS (network management), CRM, and financial accounting systems. The complexity of integrating new 5G BSS platforms into legacy infrastructure significantly increases the importance of skilled integration services, demanding deep expertise in migrating historical data and ensuring business continuity during the transition phase.

The Downstream Analysis focuses on the deployment, distribution channels, and final end-user utilization of the B/R M solutions. Distribution channels are predominantly direct, involving direct sales teams and comprehensive contracts with Tier 1 and Tier 2 CSPs, especially for high-value, complex platform deployments. However, the indirect channel, via Value Added Resellers (VARs) and dedicated managed service providers, is growing, particularly when targeting smaller MVNOs or niche regional operators who prefer turnkey, outsourced solutions. The end-users (CSPs) leverage these systems to generate revenue (billing and invoicing), maintain compliance (regulatory reporting), and ensure profitability (revenue assurance and fraud management), completing the value loop by monetizing the services provided to their ultimate consumer and enterprise customers.

Telecom Billing and Revenue Market Potential Customers

Potential customers for Telecom Billing and Revenue Management systems are primarily entities that provide network connectivity and digital services, requiring robust solutions to accurately meter usage, generate invoices, manage partner settlements, and mitigate financial risk. The traditional core customer base remains the Mobile Network Operators (MNOs) globally, encompassing all Tier levels, who require highly scalable, real-time convergent systems to handle their immense subscriber volumes and evolving service complexity, especially as they transition to complex 5G network slicing and B2B monetization models. These MNOs are constantly seeking BSS solutions that offer flexibility in pricing models and rapid adaptation to market shifts, driving continuous demand for upgrades and replacements of legacy infrastructure, particularly focused on enhanced APIs for developer ecosystems.

A rapidly growing segment of potential customers includes Mobile Virtual Network Operators (MVNOs) and Mobile Virtual Network Enablers (MVNEs). These entities, often having lower internal IT budgets and a focus on speed to market, typically favor cloud-based, subscription-model B/R M solutions or fully outsourced managed services. Their demand is driven by the need for simplified, cost-effective systems that can rapidly integrate third-party services (e.g., specific content bundles or loyalty programs) without significant customization effort. Furthermore, Fixed Service Providers (FSPs) and Cable Operators remain key customers, requiring unified billing systems to manage bundled fixed-line, broadband, voice, and video services (Quad-Play packages), ensuring cross-service discounting and unified customer support across all mediums.

The emerging category of potential customers involves non-traditional telecom entities entering the digital service provisioning space, often facilitated by 5G and IoT. This includes large enterprises deploying private 5G networks, utility companies managing massive smart meter deployments, and automotive manufacturers providing connected car services. These entities require sophisticated B/R M functionality to manage complex service monetization for their internal ecosystems or end-user customers, driving demand for specialized, vertical-specific BSS modules, often delivered as Platform-as-a-Service (PaaS) to facilitate integration with existing operational technologies (OT). This expansion into enterprise B2B monetization significantly broadens the market opportunity beyond legacy telecom structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $30.8 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amdocs, Ericsson, Huawei, Netcracker Technology, Nokia, Oracle, CSG Systems International, BillingPlatform, IBM, SAP, Cerillion, ZTE, Openet (A Subsidary of Amdocs), MATRIXX Software, Recurly, Gotransverse, Optiva, Alepo, Salesforce (Vlocity), Boku |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecom Billing and Revenue Market Key Technology Landscape

The technological landscape of the Telecom Billing and Revenue Market is dominated by the transition to cloud-native architectures, leveraging Microservices, API gateways, and Containerization (e.g., Docker and Kubernetes). This shift enables CSPs to decompose monolithic BSS systems into smaller, independently deployable services, dramatically increasing agility and system resilience. Microservices facilitate rapid innovation by allowing CSPs to update specific billing functions—such as rating or invoicing—without impacting the entire system, essential for quickly launching and iterating new 5G-enabled services. This architectural evolution is crucial for supporting the massive scalability required to manage billions of Machine-to-Machine (M2M) transactions and handle dynamic B2B service contracts that require instant provisioning and modification, moving away from rigid, legacy database-centric systems.

Real-Time Charging and Policy Control are foundational technologies shaping the current market, ensuring that usage tracking, credit limits, and service entitlements are enforced and billed instantly. The convergence of Online Charging Systems (OCS) and Policy and Charging Rules Function (PCRF) is central to delivering personalized experiences, enabling features such as zero-rated content, customized data buckets, and granular quality of service (QoS) guarantees critical for premium 5G services like network slicing. The emphasis on real-time data processing is extending to revenue assurance and fraud management, where immediate detection and intervention capabilities are achieved through high-performance data processing pipelines and stream analytics engines that minimize revenue leakage before it can materialize, shifting these functions from periodic batch processes to continuous monitoring.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are being integrated directly into B/R M processes to automate decision-making and enhance system intelligence. Beyond fraud detection, AI is utilized for sophisticated demand forecasting, optimizing resource allocation, and predicting customer churn based on billing experience dissatisfaction. Blockchain technology is also emerging as a pivotal solution for addressing the complexities of inter-carrier settlement, roaming charges, and partner management. By providing a decentralized, immutable ledger, blockchain reduces disputes, enhances transparency, and dramatically speeds up reconciliation processes between partners in complex 5G value chains, promising significant efficiency gains in wholesale billing operations and eliminating manual audit requirements.

Regional Highlights

- North America: This region holds a leading position in market share, driven by aggressive investment in 5G infrastructure deployment and early adoption of cloud-native BSS solutions. High average revenue per user (ARPU) and sophisticated regulatory environments necessitate advanced B/R M systems capable of handling complex promotional bundles and strict compliance mandates. The market is characterized by Tier 1 operators prioritizing the monetization of enterprise-grade 5G services (e.g., private networks, MEC), fueling demand for advanced B2B billing and partner ecosystem management platforms.

- Europe: The European market is characterized by intense competition and rigorous regulatory oversight, including stringent data privacy laws like GDPR, which significantly influences BSS architectural requirements. Growth is spurred by the modernization of legacy systems and the migration to convergent billing to support competitive fixed-mobile convergence (FMC) offerings. Emphasis is placed on real-time assurance and sophisticated pricing mechanisms to navigate the fragmented regulatory landscape across member states and capture value from complex roaming and wholesale agreements.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR, primarily due to massive subscriber growth, rapid mobile penetration, and substantial government push toward digital economy initiatives, particularly in Southeast Asia and India. The demand centers on highly scalable, cost-effective B/R M solutions capable of managing vast volumes of prepaid subscribers and accommodating innovative mobile payment methods. China's and South Korea's advanced 5G rollouts drive demand for systems capable of handling multi-dimensional charging for emerging digital content and IoT services, often prioritizing cloud deployments for rapid scaling.

- Latin America (LATAM): The LATAM region presents a mix of high growth potential and significant challenges related to economic volatility and infrastructure gaps. Market focus is heavily concentrated on fraud management and revenue assurance solutions to mitigate leakage. CSPs are increasingly looking toward managed services and SaaS billing platforms to minimize CapEx while upgrading from older 3G/4G networks, with Brazil and Mexico leading the modernization efforts aimed at improving customer experience and enhancing revenue streams through digital services.

- Middle East and Africa (MEA): Growth in MEA is highly variable but robust, particularly in the Gulf Cooperation Council (GCC) countries, driven by significant oil wealth investments in smart city infrastructure and 5G deployment. The African segment is dominated by the need for simplified, mobile money-integrated billing systems catering to low-ARPU prepaid markets. The implementation of sophisticated revenue assurance is a critical priority across the region to protect emerging digital revenues and combat high rates of subscription and interconnect fraud.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecom Billing and Revenue Market.- Amdocs

- Ericsson

- Huawei

- Netcracker Technology

- Nokia

- Oracle

- CSG Systems International

- BillingPlatform

- IBM

- SAP

- Cerillion

- ZTE

- Openet (A Subsidary of Amdocs)

- MATRIXX Software

- Recurly

- Gotransverse

- Optiva

- Alepo

- Salesforce (Vlocity)

- Boku

Frequently Asked Questions

Analyze common user questions about the Telecom Billing and Revenue market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary impact of 5G on the Telecom Billing and Revenue Market?

The primary impact of 5G is the mandate for real-time, convergent billing systems capable of monetizing complex new services like network slicing and low-latency B2B applications. 5G necessitates B/R M platforms that can handle multi-party settlement, dynamic QoS pricing, and massive volumes of IoT transactions instantly, driving the shift toward cloud-native architectures.

Why are CSPs shifting from on-premise to cloud-based BSS solutions?

CSPs are shifting to cloud-based BSS solutions to achieve enhanced scalability, reduce high initial capital expenditure (CapEx), and accelerate the time-to-market for new service innovations. Cloud platforms offer the operational agility required to rapidly adapt pricing models and handle unpredictable data traffic surges associated with digital services and 5G deployment.

How does AI contribute to revenue assurance in telecommunications?

AI significantly contributes to revenue assurance by using Machine Learning (ML) models to analyze billing data, usage patterns, and network logs in real time. This allows for predictive identification and proactive prevention of potential revenue leakage, billing errors, and sophisticated fraud schemes that conventional rule-based systems often fail to detect promptly, maximizing profitability.

What is 'Convergent Billing' and why is it essential for modern CSPs?

Convergent billing is a system that allows Communication Service Providers to bill for all services—mobile, fixed-line, data, video, and IoT—on a single, unified platform and invoice. It is essential for modern CSPs because it improves customer transparency, enables sophisticated bundle creation, enhances the overall customer experience, and streamlines internal operations by eliminating separate billing silos.

Which segmentation segment is driving the fastest growth in the B/R M market?

The deployment mode segment, specifically cloud-based solutions, is driving the fastest growth, particularly within the Asia Pacific region. This growth is fueled by Tier 2/3 operators and MVNOs seeking cost-effective, scalable solutions that require minimal upfront investment and allow for rapid integration of services required for competitive digital transformation efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager