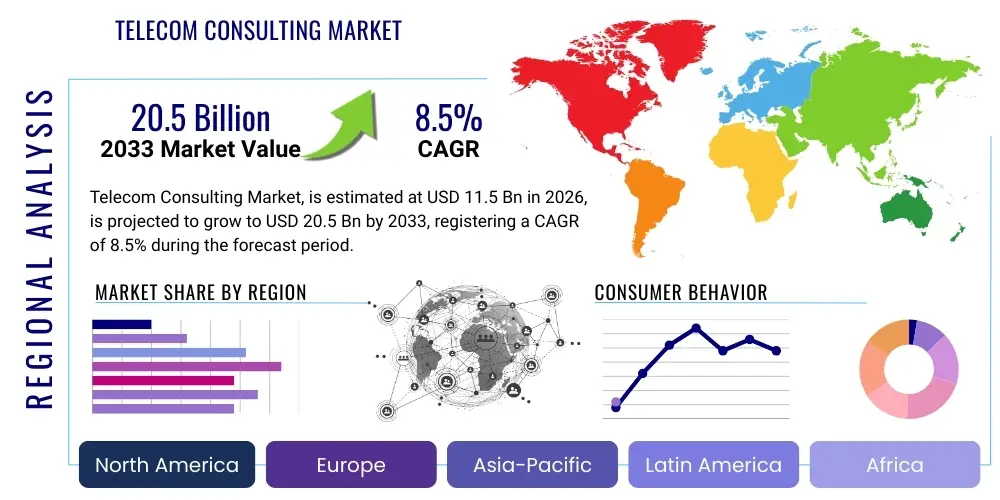

Telecom Consulting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437005 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Telecom Consulting Market Size

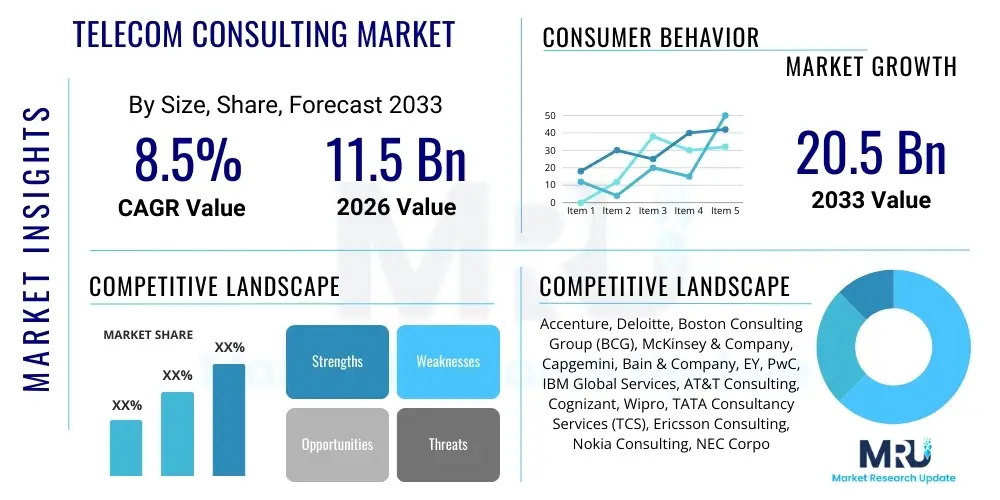

The Telecom Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 20.5 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the global deployment of 5G infrastructure, the increasing complexity of regulatory environments, and the critical need for operational efficiency improvement among Communication Service Providers (CSPs) navigating digital transformation initiatives. The need for specialized expertise in areas like network virtualization, cloud integration, and cybersecurity strategy further cements the market's trajectory.

Telecom Consulting Market introduction

The Telecom Consulting Market encompasses specialized advisory services provided to telecommunications companies, including mobile network operators, fixed-line providers, and digital infrastructure firms. These services span strategic planning, operational efficiency enhancement, technology implementation, regulatory compliance, and market entry strategy. The core product offering involves providing expert guidance on navigating technological shifts, such as the transition from 4G to 5G, the migration to cloud-native network architectures, and the adoption of advanced data analytics platforms. Major applications include network transformation projects, business support system (BSS) and operations support system (OSS) optimization, and strategic portfolio management aimed at maximizing return on digital investments and enhancing customer experience.

Key benefits derived from leveraging telecom consulting services include accelerated time-to-market for new services, significant reductions in capital expenditure (CapEx) and operating expenditure (OpEx) through optimization, and improved resilience against competitive pressures and cybersecurity threats. Consultants help CSPs define comprehensive digital strategies that align technological capabilities with business objectives, ensuring seamless integration of new technologies like IoT and edge computing into existing infrastructures. Furthermore, in an environment characterized by stringent global and local regulations, consulting firms provide crucial support in achieving and maintaining compliance, particularly concerning data privacy (e.g., GDPR, CCPA) and net neutrality rules.

Driving factors propelling market expansion include the exponential increase in global data traffic, necessitating continuous network upgrades and optimization; the intense pressure on CSPs to diversify revenue streams beyond traditional connectivity services; and the complex ecosystem of mergers, acquisitions, and strategic partnerships requiring expert management. The rapid commercialization of 5G technology demands specialized knowledge in network slicing, core network evolution, and monetization strategies, areas where internal expertise is often limited, thereby creating sustained demand for external consulting services. Furthermore, the pervasive trend toward hyper-scale cloud adoption across all elements of the telecom stack requires specialized integration and transformation planning, further fueling market growth.

Telecom Consulting Market Executive Summary

The Telecom Consulting Market is currently characterized by a fundamental shift toward digital and technology-led services, moving away from purely traditional strategy consulting. Business trends indicate a high demand for consultancies specializing in disruptive technologies such as network function virtualization (NFV), software-defined networking (SDN), and hybrid cloud implementation, reflecting the telecommunication industry's transition into a technology-as-a-service provider model. Consolidation within the consulting sector, driven by major firms acquiring specialized digital and engineering expertise, is shaping the competitive landscape, aiming to offer end-to-end transformation capabilities from strategic blueprinting to technical execution. Furthermore, sustainability consulting (ESG compliance) is emerging as a critical trend, influencing network deployment decisions and operational protocols, particularly in energy consumption management for large-scale data centers and network sites.

Regional trends highlight North America and Europe as mature markets demanding sophisticated, high-value consulting focused on regulatory compliance, cybersecurity hardening, and advanced 5G monetization strategies, particularly in private enterprise networks. Conversely, the Asia Pacific (APAC) region is demonstrating the fastest growth, primarily driven by massive infrastructure build-out projects, aggressive 5G deployment in countries like China, India, and South Korea, and the subsequent need for operational scaling and market penetration strategies. Latin America and the Middle East & Africa (MEA) are emerging areas focusing heavily on basic network modernization (fiber rollout, 4G/5G mixed environments) and governmental digital inclusion projects, creating demand for infrastructure planning and financing consulting.

Segment trends show the largest expenditure concentrating on network transformation consulting, specifically optimizing 5G rollout efficiency and integrating multi-vendor cloud solutions. Strategy consulting remains crucial, but its focus has narrowed towards digital operating models and customer experience (CX) improvements through advanced analytics. By service type, System Integration and Managed Services related to large-scale BSS/OSS transformations are seeing robust growth, indicating that CSPs prefer consultants who can not only advise but also implement and manage the transformed environment. The enterprise consulting segment, focused on helping telecom operators service their business clients with advanced services (e.g., IoT management platforms, private 5G networks), is projected to be the fastest-growing segment, reflecting CSPs' efforts to capture new enterprise revenue streams.

AI Impact Analysis on Telecom Consulting Market

Common user questions regarding AI's impact on the Telecom Consulting Market revolve primarily around three core themes: the disruption of traditional operational consulting tasks, the emergence of new high-value advisory services (e.g., AI strategy and governance), and the potential for AI tools to drastically enhance consultant productivity. Users frequently question whether AI will automate standard network optimization and diagnostic tasks, thereby reducing the need for human consultants in these specific areas. There is also significant interest in how consultants are leveraging AI themselves—for competitive analysis, market forecasting, and sophisticated risk modeling—to deliver superior, data-driven recommendations. The consensus expectation is that while AI may displace lower-level analytical work, it will simultaneously create massive demand for strategic consulting related to AI implementation, ethical AI governance, and maximizing AI-driven ROI across the CSP value chain.

The strategic deployment of Artificial Intelligence and Machine Learning (ML) is fundamentally altering the scope and delivery of telecom consulting. AI is not just a tool for consultants but is rapidly becoming the core subject of the consultation itself. CSPs require expert guidance on developing robust AI roadmaps for use cases ranging from predictive maintenance in the network to hyper-personalization in customer service interactions (e.g., advanced chatbots and virtual assistants). Consultants are now tasked with assessing the readiness of a client’s data infrastructure to support AI deployment, advising on data governance frameworks, and managing the integration of complex AI/ML models into legacy BSS/OSS platforms, ensuring scalability and compliance with emerging regulatory standards.

Furthermore, AI is enhancing the internal efficiency of consulting firms, allowing them to process vast amounts of unstructured telecom data—including network traffic logs, customer sentiment analysis, and competitor pricing models—at speeds previously impossible. This allows for faster identification of performance bottlenecks, more precise forecasting of capital expenditure needs, and highly optimized strategic recommendations. This efficiency gain shifts the consultant's role from data gatherer and analyst to strategic interpreter and change management expert. The consulting offering is evolving towards providing prescriptive, rather than just descriptive, intelligence, focusing on measurable business outcomes directly resulting from AI implementations such as churn reduction, fault prediction, and network power savings, demanding deeper technical and business process integration expertise.

- AI automates routine network performance management and optimization consulting tasks, focusing human consultants on strategic deployment.

- It drives new consulting demand for AI strategy development, ethical governance, and establishing scalable data monetization frameworks.

- AI enables predictive consulting models, offering CSPs proactive insights into customer churn and infrastructure failure.

- Consultants use AI/ML platforms to accelerate market research, competitive benchmarking, and scenario planning, enhancing recommendation accuracy.

- Increased focus on consulting services related to integrating AI into network functions (e.g., cognitive networks) and customer experience platforms.

- AI impacts human resource consulting by advising on reskilling and future workforce planning necessary for operating AI-driven telecom ecosystems.

DRO & Impact Forces Of Telecom Consulting Market

The Telecom Consulting Market is shaped by powerful Drivers (D) stemming from technological imperatives, significant Restraints (R) related to internal client structures and data security, and compelling Opportunities (O) arising from new service paradigms. These elements collectively form the Impact Forces that dictate market velocity and strategic priorities. The overwhelming global push towards 5G and fiber deployment acts as the primary driver, requiring massive, coordinated planning and execution consulting. However, resistance to large-scale, costly transformation projects within risk-averse CSP organizations often acts as a restraint, coupled with the ongoing challenge of integrating disparate legacy IT systems. The major opportunity lies in guiding operators through the complexities of cloudification (moving core networks to the public, private, or hybrid cloud) and developing enterprise-focused monetization strategies for advanced technologies like IoT, edge computing, and private 5G networks, transforming CSPs from simple connectivity providers into comprehensive digital service enablers.

The key drivers include the intensifying competition across regional markets, which forces operators to continuously seek external advice on cost optimization and accelerated service innovation. Furthermore, the regulatory environment is constantly shifting, particularly concerning spectrum auctions, infrastructure sharing agreements, and consumer data protection, making specialized compliance consulting essential. The imperative to achieve operational excellence through digitalization—standardizing processes, deploying robotics process automation (RPA), and adopting agile methodologies—creates sustained demand for operational and IT consulting services focused on reducing OpEx. This pressure for efficiency is amplified by the sheer volume of capital expenditures required for 5G network build-out, making strategic CapEx allocation consulting critical for financial viability.

Major restraints include the inherent complexity of telecommunication infrastructures, which often involve decades-old legacy systems (technical debt) that complicate transformation initiatives, leading to project delays and cost overruns. Moreover, concerns around data confidentiality and intellectual property when engaging external consultants, especially in highly competitive or national security-sensitive environments, can limit the scope of engagement. A significant impact force is the talent gap within CSPs concerning highly specialized fields like cloud-native networking and advanced cybersecurity. This internal skills deficit is a powerful driver for outsourcing consulting, as operators rely on external experts to bridge the knowledge gap immediately. Conversely, the high cost associated with premium, specialized consulting services can be a restraint, particularly for smaller or financially strained regional operators, forcing them to prioritize only the most critical strategic engagements over continuous improvement projects.

Segmentation Analysis

The Telecom Consulting Market is segmented based on the type of service offered, the area of functional focus, the organization size of the client, and the technological domain addressed. Segmentation allows consulting firms to tailor specialized value propositions to the unique challenges faced by different segments of the telecom ecosystem. The core segments reflect the most pressing needs of Communication Service Providers (CSPs), which range from high-level corporate strategy to highly technical, deep-dive engineering support for complex network transformations. Understanding these segments is vital for market players to focus their resource allocation and specialized talent acquisition efforts effectively, particularly concerning emerging high-growth areas like digital operating model transformation and dedicated 5G enterprise strategy formulation.

- By Service Type:

- Strategy Consulting (Corporate Strategy, Growth & Market Entry, Regulatory Advisory)

- Operations Consulting (Operational Efficiency, Supply Chain Optimization, Cost Reduction)

- Technology Consulting (Network Transformation, Cloud Migration, IT Infrastructure Modernization)

- Business Consulting (BSS/OSS Transformation, Customer Experience Management, Revenue Assurance)

- Managed Services and System Integration

- By Organizational Size:

- Large Enterprises (Tier 1 Global Operators)

- Small and Medium-sized Enterprises (Regional Operators, MVNOs)

- By Application/Functional Area:

- Network & Infrastructure Management

- Security & Risk Management (Cybersecurity Consulting)

- Data & Analytics (AI/ML Implementation)

- Customer and Channel Management (CRM & CEM)

- Billing and Revenue Management

- By Technology Focus:

- 5G and Next-Generation Networking

- Cloud and Edge Computing

- IoT and M2M Connectivity

- Digital Transformation (Software-Defined Environments)

Value Chain Analysis For Telecom Consulting Market

The Value Chain for the Telecom Consulting Market begins with the Upstream analysis, focusing on the specialized intellectual capital and human resources required to deliver advisory services. This phase involves talent acquisition, continuous professional development in niche technological areas (like cloud-native networking and specific vendor certifications), and the development of proprietary methodologies, toolkits, and data assets (e.g., benchmarking databases, AI simulation models). The core value creation lies in the ability to aggregate, interpret, and apply deep industry knowledge and technological foresight. Key suppliers in the upstream stage are specialized technology training providers, data vendors providing market intelligence, and recruitment agencies specializing in high-demand technical and managerial consulting talent.

The Midstream phase involves the core consulting engagement activities: project scoping, detailed diagnostics, solution design (e.g., network architecture planning, business process reengineering), and implementation management. The distribution channel structure dictates how these services reach the end customer. Direct channels involve large global consulting firms (e.g., the Big Four, specialized technology consultancies) leveraging their direct sales forces, existing relationships, and global frameworks to secure high-value, long-term transformation contracts. These direct engagements are critical for large-scale, strategic advisory services where trust and continuity are paramount. Indirect channels, though less common for high-level strategy, may involve partnerships with system integrators or technology vendors, where the consultant provides specialized expertise as part of a larger technology deployment project managed by the partner, often facilitating market entry into specific geographic or functional niches.

The Downstream phase focuses on the delivery, impact, and post-engagement relationship management with the client. This includes change management support, performance monitoring against agreed KPIs, and the institutionalization of new capabilities within the client organization. Successful downstream execution ensures repeat business and high client satisfaction. Potential customers (CSPs) evaluate consulting services based on proven ability to deliver measurable ROI—such as network efficiency improvements, subscriber growth, or cost reductions. Effective value chain management, from attracting top-tier talent (upstream) to institutionalizing change (downstream), is essential for consulting firms to maintain competitive advantage in a market increasingly demanding rapid, verifiable results.

Telecom Consulting Market Potential Customers

The primary end-users and buyers of specialized telecom consulting services are Communication Service Providers (CSPs) across various tiers and operational models. These include Tier 1 Global Mobile Network Operators (MNOs) and Fixed Network Operators (FNOs) who require extensive strategic and technical assistance for massive infrastructure projects, such as nationwide 5G rollouts, legacy network decommissioning, and sophisticated digital transformation initiatives aimed at overhauling their BSS/OSS stacks. These large enterprises demand long-term, high-value engagements covering corporate strategy, merger integration, regulatory navigation, and advanced cybersecurity defense, often utilizing multiple specialized consulting firms simultaneously for different workstreams.

Additionally, smaller and regional service providers, including Mobile Virtual Network Operators (MVNOs), alternative network providers (AltNets), and regional internet service providers (ISPs), form a significant customer base. Their purchasing drivers are centered around efficiency, market niche definition, and rapid deployment strategies. These smaller players often lack the internal resources for complex planning or technology evaluation, making them reliant on consultants for defining business plans, selecting vendor technology stacks (vendor management), and optimizing limited capital expenditure for maximum coverage and service quality. They typically prefer modular, results-oriented engagements rather than multi-year transformation contracts.

Other potential customers include infrastructure companies (tower companies, fiber optic providers), governmental and regulatory bodies seeking advice on spectrum allocation or digital policy development, and large enterprises that are exploring advanced connectivity solutions like Private 5G networks. These enterprise buyers require consulting to understand the feasibility, economic case, and technical architecture needed to deploy and manage their own specialized networks for industrial IoT, manufacturing automation, or campus connectivity. The consultants act as interpreters between the technical capabilities of the telecom sector and the operational needs of vertical industries, facilitating the expansion of telecom operators into adjacent market spaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 20.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Deloitte, Boston Consulting Group (BCG), McKinsey & Company, Capgemini, Bain & Company, EY, PwC, IBM Global Services, AT&T Consulting, Cognizant, Wipro, TATA Consultancy Services (TCS), Ericsson Consulting, Nokia Consulting, NEC Corporation, Tech Mahindra, Infosys Consulting, HPE, Cisco Consulting. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecom Consulting Market Key Technology Landscape

The Telecom Consulting Market's service delivery and subject matter are fundamentally dictated by the evolving technology landscape of the telecommunications industry, specifically centered around five major technological pillars: 5G/6G, Cloudification, Edge Computing, IoT/Massive M2M, and Advanced Cybersecurity. The rapid, global rollout of 5G necessitates extensive consulting in radio access network (RAN) planning, core network modernization using cloud-native principles, and designing specialized private networks for enterprise clients. Consultants must possess deep expertise in network slicing, ensuring that the infrastructure can dynamically support diverse service level agreements (SLAs) for various applications, ranging from high-speed mobile broadband to ultra-reliable low latency communication (URLLC), transforming capacity planning into a highly complex, software-driven task requiring external guidance.

The push for network virtualization, primarily through the adoption of Network Function Virtualization (NFV) and Software-Defined Networking (SDN), combined with the migration of BSS/OSS and core network functions to public, private, or hybrid cloud environments, demands specialized transformation consulting. Consultancies are crucial for navigating the vendor ecosystem (e.g., AWS, Azure, Google Cloud, specialized telecom cloud providers), managing migration risks, and ensuring robust integration of cloud infrastructure with existing physical network assets. Furthermore, the burgeoning field of Edge Computing requires consulting services focused on strategic location planning for edge data centers, developing monetization models for low-latency services, and ensuring the security and management of distributed compute resources, which is critical for industrial automation and autonomous vehicle support.

The proliferation of Internet of Things (IoT) devices across consumer and industrial sectors drives the need for consulting focused on massive machine-to-machine (M2M) connectivity management, service enablement platforms, and creating enterprise-specific IoT solutions. Telecom consultants help operators define their role in the IoT value chain, moving beyond connectivity to offering platform services and application enablement. Finally, the increasingly sophisticated threat landscape necessitates highly specialized cybersecurity consulting. This includes advising on security architecture for virtualized and cloud-native networks, ensuring compliance with global data protection laws, implementing zero-trust network access (ZTNA) models, and managing operational technology (OT) security risks inherent in critical national infrastructure managed by CSPs, ensuring robust resilience against state-sponsored and organized cyberattacks.

Regional Highlights

Regional dynamics significantly influence the type and scale of consulting demanded. North America (NA) and Europe remain the largest markets, characterized by advanced regulatory environments and high maturity in digital infrastructure. NA dominates in terms of high-value strategic consulting, particularly concerning M&A due diligence, cloud transformation planning, and complex 5G enterprise solution deployment. European demand is driven by regulatory compliance (GDPR, Digital Markets Act), fiber rollout acceleration, and the need for efficiency gains in highly competitive mobile markets. Consultancies in these regions focus heavily on translating advanced technology into profitable, sustainable business outcomes, emphasizing cybersecurity, and advanced data monetization models.

The Asia Pacific (APAC) region is the fastest-growing market globally due to massive government-led infrastructure investments, particularly in India, China, and Southeast Asia, focused on expanding broadband access and leapfrogging older network generations directly to 5G. Consulting demand here centers on large-scale CapEx optimization, project management for vast physical rollouts, and market entry strategy for international technology vendors seeking to penetrate these rapidly expanding markets. The focus is often on scaling operations rapidly and managing the complexities of diverse, rapidly evolving consumer behaviors. Latin America (LATAM) shows consistent growth, driven by privatization efforts, spectrum auction consulting, and network modernization projects aimed at improving connectivity in dense urban areas and underserved rural zones, often requiring expert advice on financing and economic viability modeling.

- North America: Leads in strategic consulting, focused on 5G private networks, massive cloud migration projects, and specialized regulatory advisory (e.g., net neutrality implications).

- Europe: High demand for compliance consulting (GDPR, NIS 2 Directive), operational transformation focused on OpEx reduction, and accelerating fiber-to-the-home (FTTH) deployments.

- Asia Pacific (APAC): The fastest-growing region; demand is centered on large-scale 5G infrastructure rollout planning, optimizing CapEx for rapid network expansion, and managing hyper-growth market complexities.

- Latin America (LATAM): Growth driven by network modernization, spectrum strategy, and financial viability assessment for infrastructure investment, often addressing market fragmentation.

- Middle East and Africa (MEA): Focuses on government-led digital initiatives, smart city development planning, and establishing resilient cybersecurity frameworks for emerging markets; requires expertise in infrastructure financing and managing joint ventures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecom Consulting Market.- Accenture

- Deloitte

- Boston Consulting Group (BCG)

- McKinsey & Company

- Capgemini

- Bain & Company

- EY

- PwC

- IBM Global Services

- AT&T Consulting

- Cognizant

- Wipro

- TATA Consultancy Services (TCS)

- Ericsson Consulting

- Nokia Consulting

- NEC Corporation

- Tech Mahindra

- Infosys Consulting

- HPE

- Cisco Consulting

Frequently Asked Questions

Analyze common user questions about the Telecom Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Telecom Consulting Market?

The primary growth drivers are the global imperative to deploy 5G and fiber networks, the need for Communication Service Providers (CSPs) to implement complex digital transformation programs (cloudification, virtualization), and the escalating requirement for specialized cybersecurity and regulatory compliance advice.

How is 5G impacting the demand for specialized consulting services?

5G necessitates highly specialized consulting in areas such as network slicing strategy, core network migration to cloud-native architectures, designing specialized private enterprise networks, and developing new monetization models for ultra-low latency services, moving beyond traditional connectivity planning.

Which consulting segment is expected to show the highest growth rate?

Technology Consulting, specifically within Cloud Migration and Digital Transformation (focused on BSS/OSS modernization and AI implementation), is projected to exhibit the highest growth, driven by the shift from traditional network hardware to software-defined, cloud-based infrastructure.

What is the greatest restraint facing the Telecom Consulting Market?

The greatest restraint is the significant technical debt and complexity associated with integrating new digital solutions (like cloud-native core) with extensive legacy IT and network infrastructure, often leading to protracted, high-cost transformation projects and internal resistance to change within client organizations.

How are consulting firms incorporating AI into their service delivery?

Consulting firms utilize AI internally to enhance forecasting, automate complex data analysis, and improve prescriptive recommendation quality. Externally, they offer advisory services on developing ethical AI roadmaps, managing AI governance, and implementing AI/ML models for network optimization and customer experience enhancement for CSPs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager