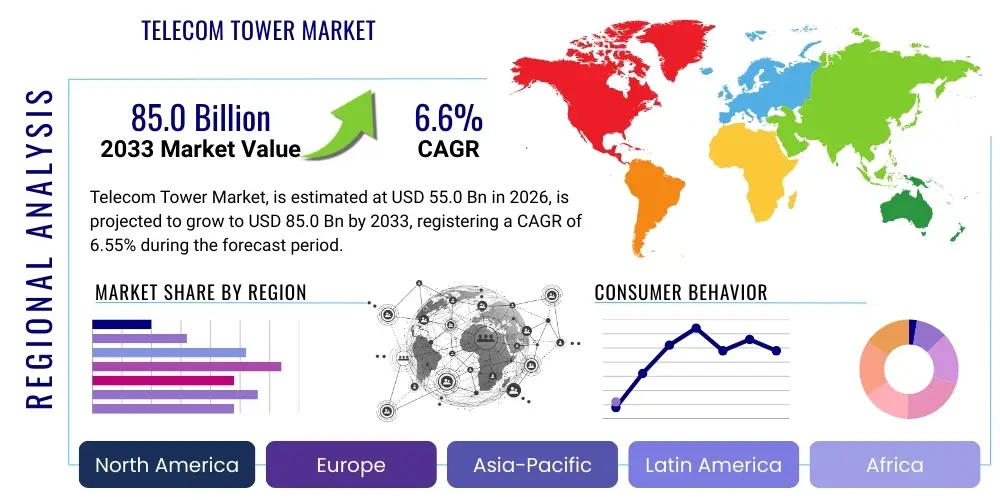

Telecom Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437246 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Telecom Tower Market Size

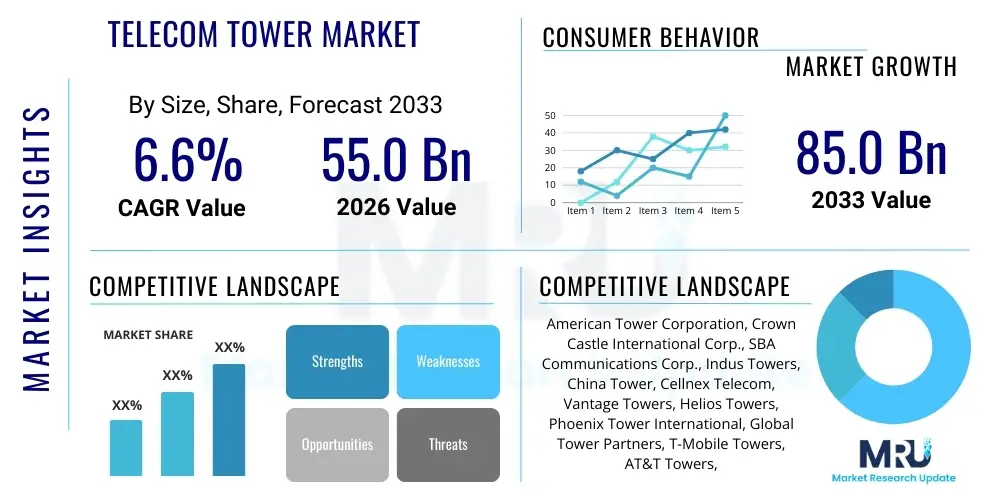

The Telecom Tower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.55% between 2026 and 2033. The market is estimated at USD 55.0 Billion in 2026 and is projected to reach USD 85.0 Billion by the end of the forecast period in 2033.

Telecom Tower Market introduction

The Telecom Tower Market encompasses the construction, maintenance, and leasing of passive telecommunications infrastructure necessary for housing network equipment such as antennas, transceivers, and base stations. These towers serve as the critical backbone for wireless connectivity, facilitating the transmission of cellular signals across vast geographical areas. The product description primarily includes various structural forms like lattice towers, monopole towers, guyed towers, and increasingly, specialized infrastructure such as distributed antenna systems (DAS) and small cells, which are crucial for high-density urban coverage and 5G network performance. The inherent benefits of this market model, particularly infrastructure sharing, include reduced capital expenditure (CapEx) for Mobile Network Operators (MNOs), faster network deployment times, and enhanced environmental sustainability due to minimized structural duplication.

Major applications for telecom towers span across providing connectivity for 2G, 3G, 4G LTE, and the rapidly expanding 5G networks, alongside supporting emerging technologies like the Internet of Things (IoT) and machine-to-machine (M2M) communications. The shift towards higher frequency bands, characteristic of 5G, necessitates increased site density, thereby driving demand for new tower builds and significant upgrades to existing infrastructure to accommodate heavier, more complex equipment. Furthermore, the integration of fiber backhaul capabilities into tower sites is becoming mandatory to handle the massive data throughput requirements of next-generation networks, fundamentally transforming towers from simple physical structures into sophisticated digital hubs.

Key driving factors accelerating market growth include the exponential rise in mobile data consumption globally, fueled by video streaming and social media usage, which necessitates continuous network capacity expansion. Government initiatives promoting rural connectivity and digital inclusion, especially in emerging economies, further boost tower deployment. The structural separation of tower assets from MNO balance sheets into independent tower companies (TowerCos) allows MNOs to focus capital on core service delivery and spectrum acquisition, making independent ownership a dominant and highly efficient operational model across the globe, ensuring sustained investment in passive infrastructure development.

Telecom Tower Market Executive Summary

The Telecom Tower Market is experiencing robust growth driven primarily by unprecedented global 5G rollout campaigns and the critical shift towards infrastructure monetization through passive infrastructure sharing. Business trends indicate a continued consolidation among major TowerCos, seeking scale advantages and higher tenancy ratios, particularly in dense urban and high-value suburban areas. Independent TowerCos are aggressively expanding their portfolios, acquiring assets from MNOs looking to unlock capital, leading to a professionalization of asset management and optimized site operations. Technological advancements focusing on efficiency, such as the deployment of hybrid power solutions and advanced remote monitoring systems, are becoming standard practices to reduce operational expenditure (OpEx) and enhance network reliability in diverse environments.

Regionally, the market is highly dynamic. Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive population sizes, rapidly increasing smartphone penetration, and aggressive government mandates for 5G deployment in countries like India and Southeast Asia. North America and Europe, while more mature, are focused on densification—deploying small cells and specialized urban infrastructure to maximize 5G performance and capacity, especially in millimeter wave (mmWave) band environments. Conversely, the Middle East and Africa (MEA) region shows strong potential due to low initial penetration rates and ongoing investments aimed at universal connectivity, often leapfrogging older technologies directly to 4G and 5G infrastructure.

Segment trends reveal a pronounced shift in tower construction methodology. While traditional lattice towers remain relevant for macro coverage, the Monopole Tower segment and the deployment of small cell infrastructure are witnessing the highest growth rates, reflecting the need for aesthetically acceptable and rapidly deployable structures in urban cores. Furthermore, the ownership structure is increasingly dominated by independent TowerCos, which are proving highly effective at maximizing tenancy and managing multi-tenant sites efficiently, thereby creating substantial enterprise value. The integration of renewable energy sources, addressing environmental, social, and governance (ESG) mandates, is driving the Hybrid Power Source segment, aligning market growth with global sustainability goals.

AI Impact Analysis on Telecom Tower Market

Common user questions regarding AI's impact on the Telecom Tower Market predominantly revolve around optimizing site selection, predictive maintenance capabilities, and improving energy efficiency across large tower portfolios. Users are keen to understand how AI algorithms can reduce operational costs, minimize downtime by anticipating equipment failures, and automate complex network optimization tasks that traditionally require manual intervention. Furthermore, there is significant interest in how AI can inform infrastructure investment decisions, particularly in identifying optimal locations for new small cell deployments based on real-time traffic demand patterns and propagation analysis. The key themes summarized from user inquiries emphasize operational automation, enhanced site security, and leveraging data-driven insights to manage the transition from traditional macro towers to a heterogeneous network (HetNet) environment characterized by high site density and complexity.

The deployment of AI and machine learning (ML) models is fundamentally transforming tower operations from reactive maintenance schedules to proactive, condition-based monitoring. AI-powered diagnostic tools analyze sensor data (temperature, vibration, power consumption) to predict component failure well before it occurs, significantly extending equipment lifespan and improving network reliability metrics crucial for high-service-level agreements (SLAs). In terms of energy management, AI algorithms dynamically manage power consumption across remote sites, optimizing the usage of hybrid power sources (grid, generator, solar) based on weather forecasts, load profiles, and tariff structures, leading to substantial savings in fuel and electricity costs, especially in off-grid locations.

Beyond operational maintenance, AI is also a powerful tool in strategic planning. By analyzing massive datasets comprising demographic shifts, mobile usage patterns, existing network performance, and geographical constraints, AI models generate highly accurate predictions for future capacity demand. This allows TowerCos to prioritize infrastructure investment, ensuring new towers or fiber connections are deployed precisely where they yield the maximum return on investment and effectively meet the capacity needs of MNO tenants. The ability to simulate network performance under various traffic loads using AI is accelerating the complexity and precision of network rollouts, making the passive infrastructure market highly technologically sophisticated.

- AI optimizes site acquisition by analyzing geolocation data and predicting traffic demand, improving Return on Investment (ROI).

- Predictive maintenance using ML algorithms reduces tower downtime and operational expenditure (OpEx) by anticipating equipment failures.

- Energy Management Systems (EMS) powered by AI dynamically control hybrid power sources, leading to enhanced energy efficiency and lower carbon footprints.

- Automated anomaly detection enhances site security and prevents unauthorized access or tampering with sensitive equipment.

- AI-driven network orchestration facilitates the seamless integration and management of complex heterogeneous networks (HetNets), including small cells and DAS.

DRO & Impact Forces Of Telecom Tower Market

The Telecom Tower Market is currently shaped by significant structural forces, encapsulated by strong Drivers and vast Opportunities, balanced by persistent Restraints. The principal driver is the globally pervasive rollout of 5G technology, which mandates increased site density and the integration of substantial fiber backhaul infrastructure to support high throughput and low latency. This is amplified by the continuous growth in mobile data traffic, forcing MNOs to seek immediate capacity solutions, which independent TowerCos are uniquely positioned to provide through efficient infrastructure sharing models. This demand cycle creates powerful positive impact forces that ensure sustained investment in both macro and micro infrastructure deployments globally.

However, the market faces notable restraints that temper growth expectations. Regulatory complexities regarding site acquisition, stringent zoning laws, and often lengthy environmental clearances significantly prolong the tower deployment timeline, particularly in densely populated urban centers where suitable real estate is scarce. Furthermore, the substantial initial capital expenditure required for deploying modern, 5G-ready infrastructure—which often includes fiber optics and specialized power solutions—poses financial hurdles, especially for smaller market players. The reliance on MNO tenancy creates a degree of counterparty risk, although this is mitigated by long-term master service agreements (MSAs).

Opportunities in this sector are highly attractive and revolve around technological convergence and geographic expansion. The potential for monetizing tower sites beyond cellular services—including hosting IoT gateways, edge computing infrastructure, and utilizing tower structures for smart city applications—offers diversification avenues. Geographically, emerging markets in Africa and Latin America present significant white space opportunities for greenfield deployment, where mobile connectivity remains the primary, and often only, form of internet access. Furthermore, the global trend of MNOs divesting non-core assets continues to provide substantial portfolios for TowerCos to acquire, consolidate, and optimize for efficiency, acting as a major catalyst for market expansion and scale optimization.

Segmentation Analysis

The Telecom Tower Market is comprehensively segmented based on several key operational and structural parameters, allowing for detailed analysis of market dynamics across different ownership models, technologies, and applications. Primary segmentation revolves around Ownership Type, distinguishing between MNO-owned, Joint Venture, and Independent Tower Company models, reflecting the varying operational strategies and asset monetization goals of market participants. Further segmentation by Tower Type (Lattice, Monopole, Guyed, Stealth) provides insight into deployment methods adapted for different terrains and aesthetic requirements, while segmentation by Fuel Type addresses operational sustainability and efficiency in energy provisioning.

Analyzing these segments reveals important trends. The Independent Tower Company segment holds the dominant market share and exhibits the highest growth trajectory due to its professional asset management focus and high tenancy ratios, which are critical for maximizing shareholder returns. Within Tower Type, the Monopole segment is rapidly gaining ground, especially in urban areas, balancing capacity needs with reduced visual impact. The application segmentation clearly highlights the substantial shift towards 5G deployment, which is the singular largest driver of capital spending, moving the market focus away from legacy 3G/4G optimization towards intensive densification efforts required by high-band 5G deployment.

- By Ownership Type:

- Operator-Owned Towers

- Joint Venture Towers

- Independent Tower Companies (TowerCos)

- By Tower Type:

- Lattice Towers

- Monopole Towers

- Guyed Towers

- Stealth Towers and Rooftops

- Small Cells and Distributed Antenna Systems (DAS)

- By Fuel Type:

- Non-renewable Energy Sources (Diesel Generators, Grid)

- Renewable/Hybrid Energy Sources (Solar, Wind, Battery Storage)

- By Application:

- 3G and 4G Network Support

- 5G Network Deployment

- IoT and M2M Communications

- Others (Private Networks, Enterprise Solutions)

Value Chain Analysis For Telecom Tower Market

The Telecom Tower Market value chain is a multi-layered structure starting with upstream activities involving equipment manufacturing and raw material supply, extending through midstream infrastructure deployment, and culminating in downstream services and end-user engagement. Upstream analysis focuses on steel manufacturers, fabrication companies supplying tower components, power equipment suppliers (generators, batteries, solar panels), and specialized telecom equipment vendors (antennas, feeders, remote radio units). Price volatility in commodities like steel and copper, and dependency on specialized electronic components, significantly influence the initial capital expenditure for tower construction and maintenance, requiring robust global supply chain management.

Midstream activities are characterized by site acquisition, regulatory approval processes, construction, and fiber backhaul connectivity integration. This stage is dominated by specialized contractors and construction firms working closely with TowerCos. The efficiency of the site acquisition and zoning approval process critically determines the speed of network rollout. Independent TowerCos play a pivotal role here, managing the passive infrastructure assets and leasing co-location space to MNOs and other wireless service providers, maximizing asset utilization and tenancy ratios. This core function defines the profitability of the TowerCo business model.

Downstream analysis primarily involves the distribution channel, which is inherently indirect but relies heavily on long-term leasing contracts with Mobile Network Operators (MNOs). Direct interaction with the end consumer (the wireless subscriber) is minimal for the TowerCo itself, but the success of the TowerCo is intrinsically linked to the MNO’s ability to provide quality service. Distribution of tower capacity is facilitated through Master Service Agreements (MSAs), often spanning 10 to 15 years, securing stable, long-term revenue streams. Indirect channels also include leasing space to broadcasters, security providers, and emerging edge computing operators who require high-altitude or widely distributed sites for data processing or transmission.

Telecom Tower Market Potential Customers

The primary customers and end-users of the Telecom Tower Market are overwhelmingly Mobile Network Operators (MNOs) who require extensive infrastructure to transmit and receive cellular signals across their licensed spectrum. These MNOs, such as Verizon, Vodafone, China Mobile, and Bharti Airtel, leverage the tower infrastructure provided by TowerCos to host their active network equipment, ensuring broad geographic coverage and sufficient network capacity to serve their massive subscriber bases. The outsourcing of tower management allows these MNOs to shift from a capital-intensive ownership model (CapEx) to an operational expenditure model (OpEx), freeing up significant capital for spectrum purchases and core network software development.

Beyond traditional MNOs, the customer base is expanding to include emerging telecommunications entities and specialized service providers. This includes smaller, regional Wireless Internet Service Providers (WISPs) who use tower sites for fixed wireless access (FWA) deployments, especially in rural or underserved regions. Furthermore, the advent of 5G and IoT is attracting new segments such as enterprise customers looking to build private 5G networks, utility companies requiring infrastructure for smart grid monitoring, and specialized data center operators needing proximity to network endpoints for edge computing services. These diversified tenants enhance the TowerCo's revenue streams and increase the overall site tenancy ratio.

The value proposition for these potential customers lies in the rapid, reliable access to pre-built, maintained, and geographically optimized infrastructure. TowerCos provide neutral host capabilities, ensuring that multiple competing tenants can co-locate their equipment efficiently and securely on a single structure. This infrastructure-sharing paradigm is economically superior for all parties involved, ensuring that the heavy capital burden of passive infrastructure is distributed, promoting faster network upgrades and ultimately benefiting the end consumer through improved service quality and capacity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Billion |

| Market Forecast in 2033 | USD 85.0 Billion |

| Growth Rate | CAGR 6.55% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Tower Corporation, Crown Castle International Corp., SBA Communications Corp., Indus Towers, China Tower, Cellnex Telecom, Vantage Towers, Helios Towers, Phoenix Tower International, Global Tower Partners, T-Mobile Towers, AT&T Towers, Vodafone Towers, GTL Infrastructure, Tower Bersama Infrastructure, Telesites, Prolific Tower Corporation, Infratel Italia, Mitratel, Edotco Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecom Tower Market Key Technology Landscape

The technological landscape of the Telecom Tower Market is rapidly evolving, driven by the demands of 5G, enhanced network efficiency, and sustainability mandates. The foundational technological shift is the transition from standard macro sites to a heterogeneous network (HetNet) architecture, which integrates traditional towers with thousands of smaller infrastructure elements, including small cells, DAS nodes, and street furniture deployments. This densification strategy necessitates advanced technological solutions for seamless handoff and centralized coordination, often relying on centralized or cloud radio access network (C-RAN) architectures that shift processing power away from the tower base and into centralized hubs, reducing the equipment footprint and complexity at the tower site itself.

A second crucial technological element is the mandatory requirement for advanced fiber optic backhaul connectivity. While legacy 3G/4G networks often relied on microwave links, the extreme bandwidth demands of 5G require dedicated fiber connections directly to the tower base station (or small cell location) to prevent data bottlenecks. TowerCos are therefore increasingly investing in fiber infrastructure, often becoming dual-asset players managing both passive infrastructure and fiber lines. Furthermore, technological innovation in power management is paramount; this includes high-efficiency rectifier systems, sophisticated battery backup solutions (often using lithium-ion technology for longevity and performance), and the integration of smart monitoring systems (IoT sensors) to optimize power consumption and ensure uptime across remote sites.

Finally, the operational technology stack is being transformed by digital tools and virtualization. This includes using drones and sophisticated geospatial mapping (GIS) for site inspection and inventory management, significantly reducing the time and cost associated with manual audits. Moreover, the deployment of Multi-access Edge Computing (MEC) infrastructure directly at or adjacent to tower sites represents a massive technological opportunity. MEC allows for low-latency processing of data, enabling applications like autonomous vehicles and industrial IoT. TowerCos that successfully integrate MEC capabilities into their infrastructure portfolio will secure a significant competitive advantage by hosting highly valuable active components for network operators and hyperscalers.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in telecom tower volume and growth, driven by unprecedented 5G adoption in China, South Korea, and the massive ongoing expansion in India and Southeast Asian nations like Indonesia and Vietnam. Regulatory support, high population density leading to massive mobile subscriber bases, and strong government push for digital connectivity are key accelerators. Investment here focuses heavily on both macro tower expansion in rural areas and dense small cell deployment in megacities.

- North America: This region, comprising the U.S. and Canada, is characterized by a highly consolidated market dominated by large, publicly traded TowerCos. Growth is focused less on new greenfield macro towers and more on network densification, antenna augmentation, and significant investment in fiber infrastructure (fiber-to-the-tower, FTTT) to support mid-band and millimeter-wave 5G deployments. Edge computing integration is a major theme, leveraging tower sites for latency-sensitive applications.

- Europe: The European market is rapidly transitioning from MNO-owned towers to the Independent TowerCo model, led by major players like Cellnex and Vantage Towers. Fragmentation across national borders complicates unified deployment, but the primary drivers are consolidating MNO assets and deploying 5G, particularly leveraging centralized platforms for cross-border asset management and optimization. Focus is also strong on regulatory compliance and ESG mandates regarding energy efficiency.

- Latin America (LATAM): LATAM is a high-growth region marked by lower existing penetration rates and significant opportunities for both greenfield tower builds and MNO divestitures (sale-leaseback transactions). Market dynamics are influenced by economic stability and regulatory frameworks across key countries such as Brazil and Mexico. The adoption of 4G and 5G is driving continuous capacity upgrades, particularly prioritizing reliable power solutions due to grid instability in many areas.

- Middle East and Africa (MEA): This region offers immense potential, particularly in Africa, where mobile broadband penetration is rapidly increasing, often bypassing fixed-line infrastructure entirely. Investment is concentrated on expanding network reach, often utilizing rugged, easy-to-deploy tower types, and critically, implementing advanced hybrid power solutions (solar and battery storage) to manage remote, off-grid sites efficiently. MEA is heavily dependent on infrastructure sharing models to make rural deployments economically viable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecom Tower Market.- American Tower Corporation

- Crown Castle International Corp.

- SBA Communications Corp.

- Indus Towers

- China Tower

- Cellnex Telecom

- Vantage Towers

- Helios Towers

- Phoenix Tower International

- Global Tower Partners

- T-Mobile Towers

- AT&T Towers

- Vodafone Towers

- GTL Infrastructure

- Tower Bersama Infrastructure

- Telesites

- Prolific Tower Corporation

- Infratel Italia

- Mitratel

- Edotco Group

Frequently Asked Questions

Analyze common user questions about the Telecom Tower market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards Independent Tower Companies?

The shift is driven by Mobile Network Operators (MNOs) seeking to unlock significant capital from non-core assets (towers) to invest in core services, spectrum, and 5G technology rollout. Independent TowerCos specialize in maximizing site utilization through higher tenancy ratios, leading to greater operational efficiency and enhanced shareholder value compared to MNO-owned models.

How is 5G technology influencing telecom tower design and deployment?

5G necessitates network densification, requiring more tower sites in close proximity, especially for high-band (mmWave) frequencies. This has spurred the growth of small cells, Distributed Antenna Systems (DAS), and aesthetically pleasing monopole or stealth towers in urban environments, supplementing traditional macro tower coverage. Fiber backhaul integration is also becoming mandatory for 5G readiness.

What are the primary operational challenges faced by TowerCos in emerging markets?

In emerging markets, primary challenges include unreliable power grids, making the transition to hybrid power solutions critical; complex land acquisition and regulatory hurdles; and security concerns for remote site assets. TowerCos in these regions prioritize rugged tower design and advanced remote monitoring systems to mitigate operational risks.

What role does passive infrastructure sharing play in market growth?

Passive infrastructure sharing is foundational to market growth, significantly lowering the overall capital expenditure (CapEx) for MNOs by allowing multiple operators to co-locate equipment on a single structure. This accelerates network deployment speed, improves environmental sustainability, and ensures higher utilization rates (tenancy ratio) for the TowerCos.

How are telecom towers being utilized for edge computing services?

Tower sites are strategically positioned to act as ideal locations for Multi-access Edge Computing (MEC) nodes. By hosting small, localized data processing units at the tower base, TowerCos facilitate ultra-low latency services necessary for autonomous systems, industrial IoT, and enhanced virtual reality applications, expanding the tower's utility beyond traditional cellular transmission.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Telecom Tower Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Lattice Tower, Guyed Towers, Monopole Towers, Stealth Towers, Others), By Application (Ground-based, Rooftop, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Telecom Tower Power Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Unreliable grid, Reliable grid, Off-grid), By Application (Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager