Telecom Towers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432353 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Telecom Towers Market Size

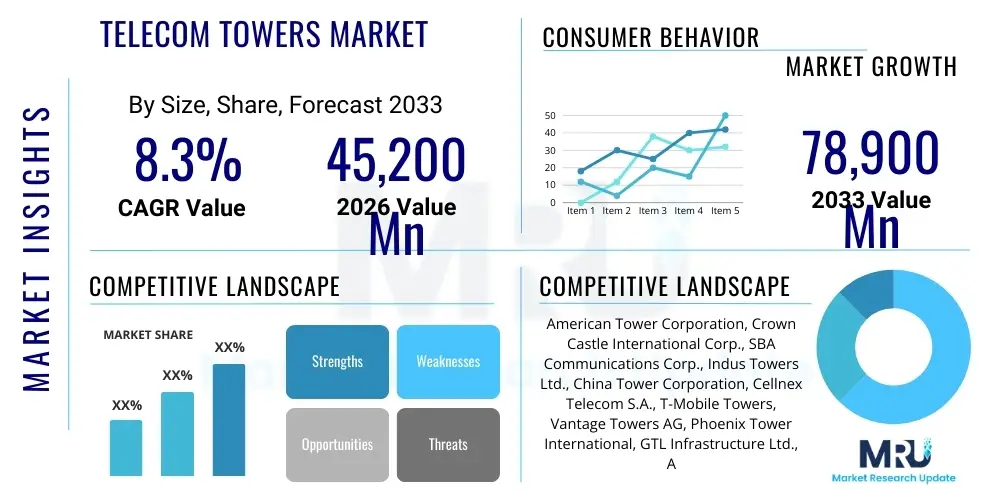

The Telecom Towers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at $45.2 Billion in 2026 and is projected to reach $78.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global imperative to enhance digital connectivity, particularly through the mass deployment of 5G infrastructure and the rising demand for efficient data transmission capabilities across densely populated urban centers and underserved rural areas.

Telecom Towers Market introduction

The Telecom Towers Market encompasses the planning, construction, management, and leasing of physical infrastructure supporting wireless communication services, including cellular networks, radio, and television broadcasting. These essential structures, ranging from traditional lattice towers and guyed masts to modern monopoles and aesthetically integrated stealth towers, serve as critical platforms for mounting antennas, transceivers, and related electronic equipment necessary for mobile network operators (MNOs) to establish and maintain comprehensive coverage. The primary application of telecom towers is enabling robust cellular connectivity, acting as the backbone for voice, data, and video transmission, thereby facilitating economic activity and social communication globally. The continued evolution toward higher data speeds, such as 5G and future 6G standards, necessitates increased tower density and modernization, driving significant investment in this sector.

Major applications of telecom tower infrastructure extend beyond basic cellular service to include support for Internet of Things (IoT) devices, smart city initiatives, public safety communication systems, and fixed wireless access (FWA). The benefits derived from a well-established tower infrastructure are multifaceted, providing MNOs with the necessary reach and capacity while offering inherent efficiencies through infrastructure sharing models. Tower companies (Towercos) specialize in acquiring, owning, and operating this passive infrastructure, allowing MNOs to concentrate capital expenditure on active network components and core service delivery, leading to reduced operational costs and accelerated network deployment timelines across diverse geographical landscapes. This specialization has fostered a vibrant ecosystem where shared access promotes competition and widespread service availability.

The market is predominantly driven by sustained data consumption growth, catalyzed by streaming services, mobile gaming, and enterprise digitalization. Furthermore, government mandates prioritizing universal access and digital inclusion act as significant market accelerators, compelling infrastructure providers to expand coverage in previously uneconomical regions. The inherent shift towards infrastructure separation—where MNOs divest passive assets to independent Towercos—further stimulates market activity, ensuring continuous investment in maintenance, upgrade, and new site acquisition. The move towards highly dense networks, especially in metropolitan areas requiring micro-cell deployments and small cell installations supported by existing vertical structures, reinforces the foundational role of tower assets in modern communication architecture.

- Product Description: Passive vertical infrastructure (Lattice, Monopole, Guyed) used for hosting active communication equipment.

- Major Applications: Cellular network deployment (2G/3G/4G/5G/6G), IoT backbone, fixed wireless access, public safety networks.

- Benefits: Reduced operational costs for MNOs, faster network rollout, enhanced infrastructure sharing, improved coverage and capacity.

- Driving Factors: Exponential growth in mobile data traffic, global 5G network rollout, regulatory support for infrastructure sharing, and increasing digitalization.

Telecom Towers Market Executive Summary

The Telecom Towers Market is characterized by robust consolidation and a strategic shift towards asset monetization, driven by major business trends where mobile network operators (MNOs) continue to divest their tower portfolios to specialized independent tower companies (Towercos). This trend creates significant liquidity and allows MNOs to focus capital on spectrum acquisition and advanced network electronics necessary for 5G deployment. Financial models are increasingly leaning towards high tenancy ratios and long-term Master Service Agreements (MSAs), providing predictable, recurring revenue streams for Towercos, positioning them as stable investments within the infrastructure segment. Key strategies involve portfolio diversification to include emerging infrastructure assets such as small cells, Distributed Antenna Systems (DAS), and fiber backhaul connectivity, crucial for supporting the latency and capacity requirements of advanced 5G networks, thus future-proofing asset utilization.

Regionally, the market exhibits heterogeneity, with Asia Pacific (APAC) demonstrating the most rapid expansion, fueled by massive population density, government-led digital transformation initiatives, and the ongoing transition of hundreds of millions of users from 4G to 5G technologies, particularly in India and China. North America and Europe, while having mature markets, focus heavily on network densification, tower augmentation for increased load capacity, and the deployment of advanced small cell networks to enhance coverage in dense urban environments. Latin America and the Middle East & Africa (MEA) represent high-growth potential markets, where low tower density and rapid subscriber growth provide ample opportunities for new site construction and greenfield infrastructure development, often supported by international Towercos seeking geographical expansion and diversification benefits. Regulatory clarity regarding infrastructure sharing is a critical determinant of growth rates across all developing regions.

Segmentation trends highlight the increasing importance of Monopole and Stealth towers, particularly in urban and aesthetically sensitive areas, reducing visual clutter compared to traditional Lattice structures. In terms of deployment, ground-based towers remain essential for wide-area coverage, but rooftop installations and other non-traditional vertical structures are gaining prominence for localized densification and small cell integration. The ownership segment is witnessing a clear dominance shift towards independent Towercos, which manage larger and more diverse portfolios than MNO-captive tower divisions. Furthermore, the segmentation by technology (5G-ready vs. legacy) indicates a powerful demand for infrastructure capable of supporting the heavier equipment, increased power demands, and stringent backhaul requirements mandated by advanced 5G deployments, driving a cycle of modernization and capital expenditure across the existing tower fleet.

AI Impact Analysis on Telecom Towers Market

Common user questions regarding AI’s influence on the Telecom Towers Market typically center on how artificial intelligence can optimize infrastructure management, reduce operating expenditures (OpEx), and enhance predictive maintenance capabilities to ensure maximum uptime. Users are keenly interested in the application of machine learning algorithms for real-time energy consumption monitoring, predictive failure detection of critical tower components like cooling systems and power generators, and optimizing site location selection based on anticipated traffic patterns and topographical data. Key concerns revolve around the integration challenges with legacy monitoring systems, the security implications of utilizing AI in critical infrastructure, and the necessity of upskilling the existing workforce to manage and interpret complex AI-generated insights. Users anticipate that AI integration will fundamentally shift the operational model from reactive maintenance to proactive, automated management, making tower infrastructure significantly more efficient and reliable in supporting high-density 5G and IoT traffic.

The integration of Artificial Intelligence and Machine Learning (AI/ML) algorithms represents a paradigm shift in the operational management of telecom tower assets. AI-powered platforms are increasingly utilized to analyze vast datasets collected from tower sensors, enabling precise optimization of power usage—a major operational cost factor—by dynamically managing heating, ventilation, and cooling (HVAC) systems and generator cycling based on actual load and environmental conditions. This intelligent energy management not only lowers OpEx but also contributes significantly to the industry’s sustainability goals. Furthermore, AI enhances network quality by optimizing the tilt and azimuth of antennas, ensuring optimal signal propagation based on real-time traffic demand, a crucial capability for managing complex 5G network slicing requirements.

Beyond operational efficiencies, AI plays a pivotal role in augmenting the security and physical integrity of tower sites. AI-enabled surveillance systems utilize image recognition to detect unauthorized access, potential vandalism, or the encroachment of construction near sensitive sites, mitigating risks before they result in service disruptions. Predictive maintenance represents the most transformative application; by analyzing historical performance data, environmental factors, and sensor readings, AI models can forecast the probability of equipment failure, allowing maintenance teams to intervene proactively. This shifts maintenance from fixed schedules to condition-based intervention, dramatically reducing unexpected downtime, minimizing costly emergency repairs, and extending the lifespan of high-value components hosted on the tower structure.

- AI Impact on Efficiency: Real-time energy optimization, reducing tower site OpEx by up to 15-20% through intelligent power management.

- Predictive Maintenance: Utilization of machine learning for forecasting equipment failure (e.g., batteries, generators) to ensure 99.99% network uptime.

- Network Optimization: Automated antenna optimization (tilt and azimuth) based on traffic prediction and capacity requirements, crucial for high-performance 5G networks.

- Site Planning and Acquisition: Use of geospatial AI to identify optimal new tower locations, minimizing time-to-market and maximizing tenancy potential.

- Security and Monitoring: AI-powered video analytics for advanced physical security, unauthorized access detection, and infrastructure integrity checks.

DRO & Impact Forces Of Telecom Towers Market

The Telecom Towers Market dynamics are primarily governed by the aggressive global deployment of 5G technology, serving as the strongest driver, which mandates significant infrastructure upgrades and densification. However, these expansion efforts are heavily restrained by complex regulatory hurdles regarding zoning laws, prolonged permitting processes, and the Not In My Backyard (NIMBY) sentiment from local communities concerned about aesthetics and perceived health risks. Opportunities abound in the burgeoning demand for edge computing infrastructure, where tower sites can evolve into micro data centers (MDCs), enhancing service delivery speed and latency. The interplay of these forces—drivers compelling growth, restraints inhibiting speed, and opportunities offering diversification—creates a complex market environment where strategic positioning and effective stakeholder management are essential for success, leading to high impact forces centered around capital expenditure intensity and regulatory compliance.

Key drivers include the insatiable appetite for mobile data, which grows exponentially annually, pushing MNOs to consistently increase network capacity, achieved primarily through adding new cells and enhancing existing tower capacity. Furthermore, the structural separation trend, where MNOs spin off tower assets into independent entities, liberates capital and creates dedicated, efficient infrastructure operators focused solely on passive asset utilization and tenancy maximization. Government initiatives promoting digital inclusion and rural connectivity also act as powerful market stimulants, often providing subsidies or expedited approvals for tower construction in underserved areas, ensuring broad geographical market penetration and equitable access to high-speed communication services.

Restraints fundamentally challenge the pace of market expansion. High capital expenditure requirements for greenfield site development, coupled with extended return on investment periods, pose financial risks, particularly in less densely populated markets. Furthermore, the significant environmental impact associated with tower construction and operation, including energy consumption, necessitates costly compliance with increasingly strict global environmental standards. Regulatory unpredictability, especially concerning spectrum allocation and infrastructure sharing mandates, can create uncertainty for long-term strategic planning. Opportunities, conversely, center on innovation: the shift towards renewable energy solutions (solar, wind) for powering remote tower sites offers sustainability benefits and OpEx reduction; the integration of small cells and DAS provides new revenue streams; and the provision of specialized infrastructure for critical sectors like defense and emergency services broadens the addressable market beyond traditional MNO tenants.

- Drivers: Rapid proliferation of 5G technology requiring dense network coverage; exponential growth in mobile data consumption; increasing prevalence of infrastructure sharing models; favorable government policies promoting digital connectivity.

- Restraints: High capital investment and maintenance costs; complex and often lengthy local zoning and permitting regulations; public opposition (NIMBY); increasing scarcity of prime urban real estate for new sites.

- Opportunities: Integration of Edge Computing capabilities at tower sites; deployment of small cell and DAS technologies; utilization of renewable energy sources to reduce carbon footprint and OpEx; potential expansion into non-telecom vertical services (e.g., surveillance, IoT hosting).

- Impact Forces: High Capital Expenditure Intensity (CAPEX) due to 5G requirements; Strong Regulatory Influence shaping deployment timelines and sharing agreements; Consolidation of the Towerco industry creating regional giants; Technological evolution accelerating asset obsolescence risk for legacy towers.

Segmentation Analysis

The Telecom Towers Market is comprehensively segmented based on the tower type, the nature of deployment, and the ownership model, each reflecting distinct operational characteristics and investment landscapes. Analysis across these segments reveals specific growth vectors, with modern tower types and densification strategies gaining traction in mature markets, while traditional ground-based lattice towers continue to dominate expansive, rural deployments in emerging economies. Understanding these segment dynamics is crucial for Towercos and MNOs alike to optimize their infrastructure investment strategies, ensuring compatibility with evolving network requirements, especially those driven by high-frequency 5G spectrum needing closer proximity to end-users.

The segmentation by tower type highlights the trade-off between structural capacity and aesthetic integration, defining procurement decisions across urban and rural landscapes. Deployment type segmentation distinguishes between large-scale coverage solutions (ground-based) and capacity enhancement strategies (rooftop/small cell). The ownership structure dictates market competition and tenancy dynamics, with independent Towercos capitalizing on economies of scale and expertise in passive infrastructure management, contrasting with MNO-captive entities focused primarily on internal network needs. These segmentations collectively provide a granular view of market structure, allowing stakeholders to identify niche opportunities, such as providing specialized infrastructure for private 5G networks or facilitating the rapid deployment of temporary mobile infrastructure for large events, thereby addressing varied connectivity demands effectively.

- By Type: Lattice Towers, Monopole Towers, Guyed Masts, Stealth Towers (Aesthetic/Camouflaged).

- By Deployment: Ground-Based Towers, Rooftop Towers, Small Cell/Street Furniture (for densification).

- By Ownership: MNO-Captive Towers (Owned by Mobile Network Operators), Independent Tower Companies (Towercos), Joint Ventures.

- By Technology: 5G-Ready Towers, Legacy (4G/3G/2G) Towers.

Value Chain Analysis For Telecom Towers Market

The Telecom Towers value chain is structurally organized into distinct phases, beginning with upstream activities focused on raw material procurement, tower manufacturing, and specialized component production. Upstream suppliers are responsible for providing high-strength steel, advanced composite materials for stealth applications, power generation equipment (e.g., generators, batteries, solar panels), and foundational civil engineering services. The quality and cost effectiveness of these upstream inputs directly influence the final cost and longevity of the physical tower structure. Efficient supply chain logistics are critical in this phase, particularly given the often remote location of construction sites and the need for large, heavy components to be transported, requiring specialized handling and coordination between manufacturers and construction contractors.

The core midstream activities revolve around tower ownership, construction, installation, and asset management, primarily executed by Towercos. This phase involves site acquisition, securing regulatory permits, constructing the physical foundation and tower, and integrating necessary passive infrastructure (power, security, climate control). The subsequent key activity is co-location management—marketing tower space to multiple MNO tenants to maximize tenancy ratios and optimize return on capital. The efficiency of the Towerco in securing and managing these leases is central to market profitability, as revenue generation is directly linked to the number of tenants hosted on a single vertical asset. Operational excellence in maintenance and rapid fault resolution is vital during this stage to ensure maximum uptime and meet stringent service level agreements (SLAs) with MNOs.

Downstream activities predominantly involve the end-use and service delivery aspects, where MNOs install their active network equipment (antennas, radios, baseband units) and utilize the tower infrastructure to transmit wireless signals to end-users. Distribution channels are predominantly direct, characterized by long-term Master Service Agreements (MSAs) established directly between the MNO (the buyer/tenant) and the Towerco (the owner/lessor). Indirect distribution is minimal but can include third-party consultants or site acquisition specialists who facilitate the initial leasing and co-location process. The stability of this downstream relationship, secured through multi-year contracts, underpins the financial predictability and attractiveness of the entire telecom infrastructure sector to global investors.

Telecom Towers Market Potential Customers

The primary and most significant potential customers in the Telecom Towers Market are Mobile Network Operators (MNOs) who require access to high-quality, strategically located vertical real estate to mount their active communication equipment and ensure comprehensive network coverage. MNOs, regardless of size or geographic focus, represent the foundational revenue stream for Towercos. The demand from these entities is driven by cyclical network upgrades (e.g., migration from 4G to 5G), ongoing densification efforts to manage urban capacity demand, and regulatory obligations to expand coverage into rural or previously underserved areas. Their decision-making process is heavily influenced by factors such as tower height, load capacity, backhaul connectivity options, and the total cost of tenancy (TCO), making reliability and efficient site management critical differentiators for Towerco providers.

Beyond traditional MNOs, the customer base is diversifying to include entities involved in specialized or emerging communication sectors. This diversification includes wireless internet service providers (WISPs), who utilize tower space to deliver fixed wireless access (FWA) services, often targeting residential or small business customers in suburban or rural environments. Furthermore, large enterprise organizations setting up private 5G networks for industrial applications (e.g., manufacturing, mining, ports) are becoming niche, yet valuable, tenants, requiring small cell deployments or specialized micro-tower infrastructure on their property. This segment prioritizes low latency and guaranteed capacity, driving Towerco innovation towards localized infrastructure solutions.

An increasingly important customer segment comprises government and public sector entities, including public safety agencies and defense organizations, which require dedicated tower space for mission-critical communication networks, such as TETRA or specialized emergency response systems. Utility companies and transportation authorities also lease tower space for monitoring remote infrastructure, facilitating smart grid connectivity, or supporting railway communication systems. These non-MNO customers typically offer highly stable, long-term contracts, adding resilience and diversification to the Towerco revenue portfolio, underscoring the shift of towers from purely cellular assets to multi-purpose vertical digital infrastructure hubs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $45,200 Million |

| Market Forecast in 2033 | $78,900 Million |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Tower Corporation, Crown Castle International Corp., SBA Communications Corp., Indus Towers Ltd., China Tower Corporation, Cellnex Telecom S.A., T-Mobile Towers, Vantage Towers AG, Phoenix Tower International, GTL Infrastructure Ltd., ATC Telecom Infrastructure Pvt. Ltd., Telxius Telecom S.A., Helios Towers plc, BT Group plc (EE towers), Reliance Jio Infocomm Ltd., Telecom Italia Mobile (TIM Towers), Deutsche Funkturm GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecom Towers Market Key Technology Landscape

The technological landscape of the Telecom Towers Market is undergoing profound transformation, primarily driven by the requirements of fifth-generation (5G) mobile technology and the widespread adoption of the Internet of Things (IoT). 5G mandates significant changes, shifting network architecture from macro-cell reliance towards a highly dense, integrated environment utilizing thousands of small cells and distributed antenna systems (DAS), often mounted on existing street furniture or smaller vertical structures near the end-user. This densification strategy requires tower infrastructure to support higher power consumption equipment, advanced cooling solutions, and seamless fiber backhaul integration to handle massive data throughput and maintain the ultra-low latency promised by 5G applications, compelling Towercos to invest heavily in fiber connectivity and modernizing power systems across their portfolios.

Furthermore, technology advancements are focusing heavily on operational efficiency and passive infrastructure virtualization. Remote monitoring systems, powered by advanced sensors and AI analytics, are becoming standard, enabling Towercos to manage environmental controls, energy consumption, and structural health from a centralized location, minimizing site visits and improving the mean time to repair (MTTR). The move towards virtualization and network slicing also impacts tower design, requiring infrastructure capable of hosting multi-tenant, multi-technology equipment in a flexible and secure manner. The ability of the tower to support edge computing—hosting micro data centers (MDCs) at the base of the tower to process data locally—is emerging as a critical technological differentiator, transforming the tower from a simple signal support structure into a vital node in the distributed computing architecture.

The market is also witnessing increasing adoption of green technology to power towers, particularly in remote regions where grid power is unreliable or unavailable. Solar and wind hybrid power solutions are integrating with advanced battery storage systems to ensure continuous operation and minimize reliance on diesel generators, aligning technological innovation with sustainability objectives. Additionally, the development of lightweight, composite materials for tower construction and specialized camouflaging techniques (Stealth Towers) leverages technological progress to address aesthetic concerns in urban environments, facilitating easier permitting and faster deployment cycles essential for 5G network buildouts. These materials often offer superior corrosion resistance and reduced maintenance overhead, contributing to a lower total cost of ownership over the tower’s lifecycle.

Regional Highlights

- North America (USA and Canada): This region represents a highly mature market characterized by exceptionally high tenancy ratios and a strong focus on network densification to accommodate high-volume mobile data usage. Key activities center on upgrading existing macro towers to support heavier 5G equipment and deploying extensive small cell infrastructure in metropolitan and suburban areas, often managed by three large, dominant independent Towercos. The market is driven by sustained investment in fiber backhaul connectivity to towers, ensuring ultra-low latency for advanced 5G use cases like augmented reality and autonomous systems. Regulatory stability and the consolidation of assets are major features of this market landscape.

- Europe (Germany, UK, France, Spain, Italy): The European market is defined by a fragmentation of national markets and a relatively recent acceleration in the MNO asset separation trend, leading to the rapid growth of large multinational Towercos like Cellnex and Vantage Towers. Growth is heavily influenced by cross-border consolidation and the need to harmonize 5G deployment standards across the continent. Focus is placed on minimizing the visual impact of new infrastructure, driving demand for innovative monopole and stealth tower solutions, while government initiatives push for coverage expansion in rural zones to meet European Union connectivity targets.

- Asia Pacific (APAC) (China, India, Japan, Southeast Asia): APAC is the fastest-growing region, driven by sheer scale, population density, and the ongoing mass transition to 5G, particularly in emerging economies. China Tower Corporation dominates globally in terms of tower count, supporting the world's largest 5G deployment. India is experiencing immense growth fueled by infrastructure sharing mandates and competitive MNOs rapidly expanding coverage. The regional trend is characterized by high demand for new site builds (greenfield deployment) in Tier 2 and Tier 3 cities, coupled with significant investment in energy-efficient power solutions due to grid challenges in remote areas.

- Latin America (Brazil, Mexico, Argentina): This region offers substantial long-term growth potential due to low existing tower density relative to subscriber penetration and a rapidly increasing rate of mobile data consumption. The market is primarily driven by international Towercos expanding their footprint, capitalizing on MNO divestitures and the need for new infrastructure to cover vast geographical areas. Regulatory challenges and currency volatility remain key factors, but the underlying demographic momentum and improving political stability in key markets drive consistent infrastructure investment.

- Middle East and Africa (MEA): MEA is witnessing dynamic growth, particularly in the African segment, where rapidly increasing smartphone adoption and favorable demographics are driving the need for new macro towers. Infrastructure sharing is often mandated or highly encouraged to reduce deployment costs in challenging environments. The Middle East focuses on delivering cutting-edge, high-capacity 5G networks, often integrating smart city concepts directly into their tower strategy. Energy supply and site security are paramount operational challenges in many African sub-markets, leading to a strong demand for robust, autonomous power and monitoring solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecom Towers Market.- American Tower Corporation

- Crown Castle International Corp.

- SBA Communications Corp.

- Indus Towers Ltd.

- China Tower Corporation

- Cellnex Telecom S.A.

- Vantage Towers AG

- Phoenix Tower International

- GTL Infrastructure Ltd.

- ATC Telecom Infrastructure Pvt. Ltd.

- Telxius Telecom S.A.

- Helios Towers plc

- BT Group plc (EE towers)

- Reliance Jio Infocomm Ltd. (Jio towers)

- Deutsche Funkturm GmbH

- TIM Towers S.p.A.

- MTS Towers (Mobile TeleSystems)

- Globale Tower Limited

- Infratel Italia S.p.A.

- Protelindo Group

Frequently Asked Questions

Analyze common user questions about the Telecom Towers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high valuation and investment in the Telecom Towers Market?

The high valuation is fundamentally driven by the predictable, inflation-linked, and long-term recurring revenue streams secured through Master Service Agreements (MSAs) with creditworthy Mobile Network Operators (MNOs). Global 5G rollout mandates significant network densification and capacity upgrades, necessitating continuous high capital expenditure from Towercos, making these assets essential infrastructure with utility-like stability and growth potential.

How will 5G technology specifically impact the design and deployment of telecom towers?

5G requires increased network density to utilize high-frequency spectrum effectively, leading to a proliferation of small cells and Distributed Antenna Systems (DAS) often mounted on smaller structures or street furniture. Macro towers must be upgraded to support heavier antenna loads, higher power consumption, and seamless fiber optic backhaul integration to meet the stringent latency and capacity demands of advanced 5G services.

What is the role of independent Towercos, and why are MNOs selling their tower assets?

Independent Towercos specialize in owning, operating, and leasing passive infrastructure, maximizing asset utilization through high tenancy ratios. MNOs divest assets (structural separation) to unlock significant capital, reduce operational expenditures, and focus resources solely on core competencies like spectrum acquisition, customer experience, and active network technology deployment, thereby enhancing shareholder value.

What are the primary operational challenges faced by Towercos in emerging markets?

Operational challenges in emerging markets include unreliable power grids necessitating expensive backup generation solutions (generators and batteries), increased requirements for physical site security due to higher risks of theft or vandalism, and managing complex or lengthy bureaucratic processes for site acquisition and permitting in diverse regulatory environments.

How is Edge Computing influencing the future revenue streams for tower companies?

Edge Computing transforms tower sites into strategic micro data centers (MDCs), enabling Towercos to host computing infrastructure closer to the end-user. This provides a lucrative new revenue stream beyond traditional co-location fees by offering low-latency processing capabilities, essential for real-time applications like autonomous vehicles, industrial IoT, and specialized enterprise applications, capitalizing on the tower’s localized power and security infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Telecom Towers Market Statistics 2025 Analysis By Application (Rooftop, Ground-based, The rooftop holds an important share in terms of applications, and accounts for 82% of the market share.), By Type (Lattice Tower, Guyed Tower, Monopole Tower, Stealth Tower, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Telecom Towers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (4G and 5G, Fiber, Small Cells, Others), By Application (Communication, Infrastructure, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager