Telecommunication Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438668 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Telecommunication Services Market Size

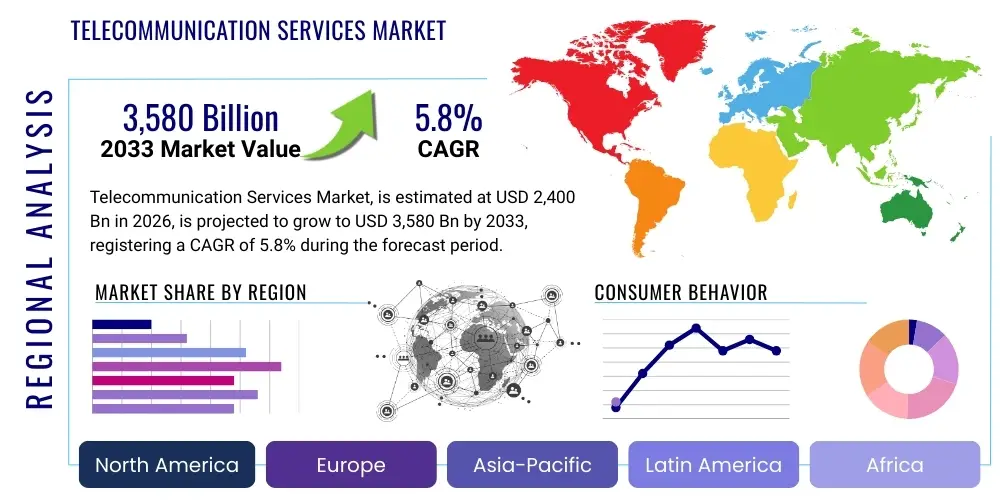

The Telecommunication Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2,400 Billion in 2026 and is projected to reach $3,580 Billion by the end of the forecast period in 2033.

Telecommunication Services Market introduction

The Telecommunication Services Market encompasses the infrastructure, services, and operations related to the transfer of voice, data, text, and video across vast distances globally. This sector is foundational to the modern digital economy, providing essential connectivity that underpins governmental operations, commercial transactions, and social interaction. Key product offerings include fixed-line services, mobile services (cellular), internet access, and enterprise network solutions, which are continually evolving with the deployment of advanced technologies like 5G, Fiber-to-the-Home (FTTH), and satellite connectivity. The market’s primary objective is to deliver high-speed, reliable, and secure communication channels, transitioning from traditional voice-centric models to sophisticated, data-intensive platforms required for the Internet of Things (IoT) and cloud computing.

Major applications of telecommunication services span across various verticals, including banking, healthcare, manufacturing, and retail, utilizing services such as Software-Defined Networking (SDN), Network Function Virtualization (NFV), and managed security services to enhance operational efficiency and facilitate digital transformation. The direct benefits derived from these services include enhanced global collaboration, enabling remote work capabilities, fostering innovation through rapid data exchange, and providing critical infrastructure for emergency services. The shift towards ubiquitous high-speed broadband access and the increasing demand for mobile data consumption are major benefits driving continuous infrastructure investment.

The market is primarily driven by the exponential growth in mobile data traffic, fueled by video streaming, social media consumption, and the proliferation of connected devices. Furthermore, the global rollout of 5G technology, which offers ultra-low latency and massive connectivity, is compelling carriers to modernize their networks, presenting a significant growth catalyst. Other important driving factors include favorable governmental initiatives aimed at bridging the digital divide, especially in emerging economies, and the enterprise demand for private network solutions and specialized cloud connectivity services to support distributed operations and real-time analytics.

Telecommunication Services Market Executive Summary

The Telecommunication Services Market is characterized by intense competition, rapid technological convergence, and significant capital expenditure required for 5G deployment and fiber optic expansion. Business trends indicate a strong move toward infrastructure sharing models, tower sales, and the establishment of independent fiber companies (FiberCos) to optimize capital allocation and reduce debt burdens. Service providers are increasingly focusing on diversification into adjacent high-growth areas, particularly cloud services, enterprise IoT platforms, and digital content distribution, moving beyond simple connectivity provision to become integrated digital service providers. Consolidation among smaller regional carriers and major mergers among incumbent players continue to reshape the competitive landscape, aimed at achieving economies of scale necessary to fund next-generation network upgrades and fend off competition from hyperscalers entering the connectivity space.

Regionally, the market exhibits highly disparate growth trajectories. Asia Pacific (APAC) stands out as the primary engine of growth, driven by massive subscriber base expansion in India and Southeast Asia, coupled with aggressive 5G deployments in mature markets like South Korea, Japan, and China. North America and Europe, while having higher average revenue per user (ARPU), face slower subscriber growth and are focused more on network densification, fiber rollout completion, and monetizing enterprise 5G use cases, such as private 5G networks for industrial applications. The Middle East and Africa (MEA) are experiencing high growth rates in mobile broadband adoption, supported by government efforts to enhance digital inclusion and attract foreign investment for infrastructure build-out, though regulatory hurdles and infrastructural deficiencies remain persistent challenges in certain regions.

Segment trends highlight the dominance of mobile services, which continue to capture the largest share of market revenue, driven by increased data consumption and the shift from 4G to 5G. Fixed broadband services, particularly fiber optics, are gaining prominence due to the sustained demand for high-bandwidth, reliable connections necessitated by remote work and high-definition streaming. Within enterprise services, the adoption of managed services, including cybersecurity, Unified Communications as a Service (UCaaS), and connectivity tailored for massive IoT deployments, is demonstrating above-average growth rates. Furthermore, the wholesale segment is benefiting from the need for connectivity backhaul and the increasing volume of interconnection agreements required to handle global data traffic across subsea cables and terrestrial networks, necessitating advanced infrastructure management solutions.

AI Impact Analysis on Telecommunication Services Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Telecommunication Services Market reveals a central theme focused on operational efficiency, network optimization, and the personalization of customer experience. Users frequently inquire about how AI can mitigate the complexity of managing highly dense 5G networks, predict equipment failures before they occur, and automate intricate network slicing processes. A significant concern revolves around the security implications of utilizing AI in network operations and the skills gap required for carriers to effectively deploy and manage sophisticated machine learning models. Expectations are high regarding AI's ability to drive down operating expenses (OPEX) by automating routine tasks, enhance quality of service (QoS) through real-time traffic management, and create hyper-personalized service bundles that reduce customer churn and maximize ARPU, thereby fundamentally transforming the role of the telecom operator from a passive connectivity provider to an intelligent digital facilitator.

AI is set to revolutionize network operations through predictive maintenance and cognitive network management. By processing vast quantities of network data in real-time, AI algorithms can identify anomalies, forecast capacity requirements, and automatically adjust network parameters to ensure optimal performance and resource utilization. This shift towards self-optimizing networks (SON) is critical for managing the complexity inherent in distributed 5G and future 6G architectures, where manual intervention is economically and technically unfeasible. Furthermore, AI tools are essential for handling the increasing sophistication of cyber threats, enabling rapid detection and response mechanisms that surpass traditional rule-based security systems, securing both the network infrastructure and customer data.

On the customer service front, AI deployment is centered on enhancing the digital user journey. This includes implementing advanced Natural Language Processing (NLP) models for customer interaction via sophisticated chatbots and virtual assistants, providing instant, 24/7 support, and automating the resolution of common technical issues, significantly reducing call center volumes. Moreover, AI-driven analytics are leveraged for advanced churn prediction models, allowing carriers to proactively identify at-risk customers and offer targeted retention incentives. This application of AI moves telcos towards a data-driven marketing approach, enabling them to design and deploy bespoke services, such as specialized low-latency connections for gaming or dedicated enterprise IoT plans, maximizing the value extracted from their digital infrastructure investments.

- AI enables intelligent network slicing and resource allocation in 5G networks, optimizing bandwidth for specific user groups or applications.

- Predictive maintenance driven by machine learning reduces network downtime and capital expenditure by anticipating hardware failures.

- AI-powered chatbots and virtual assistants automate customer support, resolving queries and improving first-call resolution rates.

- Enhanced Fraud Detection and Security Operations (SecOps) utilize AI to identify zero-day threats and behavioral anomalies in real-time.

- Cognitive network management facilitates Self-Optimizing Networks (SON), balancing load and maximizing energy efficiency autonomously.

- AI analyzes usage patterns for highly precise churn prediction, enabling targeted marketing and customer retention strategies.

- Automated Service Orchestration streamlines the deployment and management of complex enterprise services, such as SD-WAN and private networks.

- AI drives hyper-personalization of service bundles and pricing, increasing ARPU and customer lifetime value.

DRO & Impact Forces Of Telecommunication Services Market

The Telecommunication Services Market is shaped by powerful and competing dynamics that simultaneously propel growth and impose significant constraints. The primary Drivers revolve around the global imperative for high-speed connectivity, particularly the ubiquitous deployment of 5G, and the surging demand for fixed broadband fueled by remote work and digital entertainment consumption. These drivers are amplified by government initiatives supporting digital transformation and infrastructure build-out. However, the market faces critical Restraints, including the escalating capital expenditure required for network upgrades, particularly in dense urban environments, the intense regulatory scrutiny surrounding net neutrality and data privacy, and the fierce price competition that constantly pressures ARPU, diminishing returns on large-scale infrastructure investments.

Opportunities in the sector lie predominantly in the monetization of advanced network capabilities beyond basic connectivity. The proliferation of the Internet of Things (IoT) provides vast potential for carriers to offer managed connectivity solutions across industrial, smart city, and automotive sectors. Furthermore, the enterprise segment presents lucrative opportunities through offering specialized services such as multi-access edge computing (MEC) and private 5G networks, which enable ultra-low latency applications previously unavailable. Another significant opportunity is the leveraging of AI and analytics to optimize operations, create new value-added services, and reduce operating expenditure, allowing telcos to compete more effectively against platform giants in the digital ecosystem.

The core Impact Forces dictating the market's evolution are the technological shift towards virtualization (NFV and SDN), which reduces reliance on proprietary hardware; the competitive intensity driven by Over-The-Top (OTT) content providers and hyperscalers (Amazon, Google, Microsoft) who are entering connectivity and cloud adjacent markets; and the ongoing societal demand for environmental sustainability, forcing carriers to invest in energy-efficient networks and operations. These forces necessitate a fundamental transformation in carrier business models, moving from legacy network operation to being agile, software-defined digital infrastructure providers capable of rapid service deployment and vertical specialization. Failure to adapt to these technological and competitive pressures results in stagnation and reduced market share, whereas successful strategic adjustments position carriers for sustained growth in the data-centric future.

Segmentation Analysis

The Telecommunication Services Market is meticulously segmented based on the type of service offered, the technology utilized, the network access medium, and the end-user base served. This comprehensive segmentation is crucial for understanding the varied revenue streams and technological investment priorities within the industry. The primary segments include Mobile Services, Fixed-Line Services (Voice and Data), and Satellite Services. Further granularity is applied through distinguishing between consumer, enterprise, and wholesale customer segments, each requiring tailored network solutions, pricing models, and service level agreements (SLAs). The segmentation analysis reveals that while Mobile Data remains the largest revenue generator globally, the fastest growth is observed in fiber-based fixed broadband and enterprise managed services centered around cloud and security connectivity solutions.

The technological segmentation highlights the critical transition from 4G/LTE to 5G, which dictates capital expenditure planning and service innovation pipelines across all major carriers. Furthermore, the emerging role of satellite technology, particularly Low Earth Orbit (LEO) constellations, is creating a new segment focused on providing connectivity to previously unserved or underserved remote areas, challenging traditional terrestrial network dominance. Understanding these segments is vital for investors and market players, as it dictates where the next wave of infrastructure investment will be targeted, focusing increasingly on network virtualization (SDN/NFV) platforms that enable the flexible deployment and management of heterogeneous network components across the various service lines.

- By Service Type:

- Mobile Services (Voice, Data, Messaging)

- Fixed Services (Fixed Broadband, Fixed Voice)

- Managed Services (Cloud Connectivity, Security Services, IoT Platforms)

- Wholesale Services (Interconnection, Roaming, Leased Lines, Tower Infrastructure)

- By Technology:

- 2G/3G

- 4G/LTE

- 5G

- Fiber Optic (FTTx)

- Satellite Communication (GEO, MEO, LEO)

- By End-User:

- Consumer

- Enterprise (SMEs, Large Enterprises)

- Government

- By Network Type:

- Wireline

- Wireless

- By Infrastructure Deployment:

- Public Networks

- Private Networks (Private 5G, Dedicated Fiber)

Value Chain Analysis For Telecommunication Services Market

The value chain of the Telecommunication Services Market is complex and multi-layered, beginning with Upstream Analysis centered on the procurement of essential network infrastructure. This segment involves vendors specializing in core network equipment (e.g., routers, switches, servers), Radio Access Network (RAN) equipment (base stations, antennas), and software solutions (OSS/BSS systems). Key upstream suppliers include technology companies that develop semiconductor chips, optical fiber cables, and sophisticated virtualization software crucial for modern network architectures. Efficiency and resilience in the upstream phase are paramount, as global supply chain disruptions significantly impact carrier deployment timelines and capital expenditure budgets. Carriers rely heavily on strategic partnerships with these technology providers to gain access to cutting-edge 5G and fiber technology, fostering deep integration in research and development.

Moving through the value chain, the core activities involve network operations and service provision. Carriers design, build, and maintain the complex network infrastructure, including towers, data centers, and cable landing stations. Service orchestration and delivery are mediated through sophisticated billing and customer relationship management (CRM) systems. The market features highly concentrated distribution channels, categorized broadly into direct and indirect methods. Direct channels involve carrier-owned retail stores, dedicated corporate sales teams managing enterprise accounts, and comprehensive online portals for customer self-service, ensuring control over the customer experience and data collection. Indirect channels utilize third-party distributors, authorized resellers, and mobile virtual network operators (MVNOs) who purchase wholesale capacity and resell services under their own brand, extending market reach without the associated infrastructure burden.

The Downstream Analysis focuses on the end-user consumption and the growing ecosystem of applications that utilize the underlying connectivity. Downstream participants include consumers utilizing voice and data services, enterprises leveraging managed connectivity solutions (SD-WAN, security), and hyperscalers requiring vast network capacity for their cloud operations. The distribution channel dynamics are heavily influenced by digital transformation; increasingly, customer acquisition and service management are migrating to online platforms and mobile applications, reducing reliance on physical retail presence. The value extracted downstream is increasingly tied not just to connection quality but also to the value-added services provided, such as secure edge computing capabilities and dedicated IoT connectivity platforms, transitioning the carrier's role from a utility provider to a platform enabler.

Telecommunication Services Market Potential Customers

The potential customer base for the Telecommunication Services Market is extraordinarily broad, encompassing nearly every individual and organization globally, segmented primarily into Consumer, Enterprise, and Wholesale/Other categories. Consumers constitute the largest volume segment, requiring essential mobile and fixed broadband connectivity for personal communication, entertainment (streaming services), and remote learning/working capabilities. The shift towards multi-device ownership and the increasing demand for high-definition content mean that consumers consistently drive the need for higher bandwidth and reliable 5G coverage, making this segment highly sensitive to pricing and perceived quality of service.

The Enterprise segment represents the highest value per customer, demanding complex, tailored, and mission-critical services. Potential buyers here include Small and Medium Enterprises (SMEs) requiring bundled internet and voice solutions, and Large Enterprises and Corporations needing sophisticated private networks, Dedicated Internet Access (DIA), global MPLS/SD-WAN solutions, and comprehensive managed security services. Key verticals such as finance, manufacturing, healthcare, and logistics are increasingly adopting specialized solutions like private 5G networks for industrial automation and reliable IoT connectivity, requiring deep technical expertise and guaranteed Service Level Agreements (SLAs) from their providers, focusing less on price and more on reliability and advanced capabilities.

Finally, the Wholesale and Governmental sector includes other carriers (MVNOs), international exchange operators, content delivery networks (CDNs), and state/federal governmental bodies. Wholesale customers purchase bulk capacity, often dark fiber or bulk minutes/data, for resale or internal network backhaul, prioritizing cost-efficiency and large-scale capacity. Governmental entities require resilient and secure communication infrastructure for public safety networks, defense applications, and fulfilling universal service obligations (USOs). These buyers prioritize network resilience, security certifications, and the ability to rapidly scale services, often through long-term, highly regulated contracts that necessitate specialized compliance and technical capabilities from the telecommunication service provider.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,400 Billion |

| Market Forecast in 2033 | $3,580 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Communications Inc., AT&T Inc., China Mobile Ltd., Deutsche Telekom AG, Vodafone Group Plc, Orange S.A., Telefónica S.A., SoftBank Group Corp., Nippon Telegraph and Telephone Corporation (NTT), T-Mobile US, América Móvil S.A.B. de C.V., Bharti Airtel Ltd., Reliance Jio Infocomm Ltd., SK Telecom Co. Ltd., Saudi Telecom Company (stc), Etisalat (e&), Telstra Corporation Ltd., KT Corporation, Singtel, Rogers Communications Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecommunication Services Market Key Technology Landscape

The technological landscape of the Telecommunication Services Market is undergoing a radical transformation driven by the need for increased capacity, reduced latency, and greater operational flexibility. The most pivotal technology currently shaping the market is 5G, which is moving beyond simple enhanced mobile broadband (eMBB) to encompass mission-critical services through ultra-reliable low-latency communication (URLLC) and support for massive machine-type communications (mMTC). This shift necessitates significant upgrades in core networks and radio infrastructure, requiring carriers to deploy sophisticated Massive MIMO antenna arrays and adopt higher frequency spectrum bands. Furthermore, the deployment of Multi-access Edge Computing (MEC) is critical, pushing computing resources closer to the end-user to capitalize on 5G's low latency capabilities for applications such as autonomous vehicles and real-time industrial automation, representing a major convergence point between telecom and cloud infrastructure.

Network Function Virtualization (NFV) and Software-Defined Networking (SDN) are foundational technologies enabling the modern, agile telecom network. NFV allows network functions (like firewalls or routing) to run as software on standard servers, moving away from specialized proprietary hardware, significantly reducing capital expenditure and facilitating rapid deployment of new services. SDN separates the network control plane from the data forwarding plane, providing centralized control and programmability, which is essential for implementing complex services like network slicing in a 5G environment. The combination of SDN and NFV enables hyperscalers and carriers alike to manage massive data volumes with unprecedented scalability and efficiency, driving down the overall cost of network ownership and operation while improving responsiveness to market demands.

Fiber Optic technology, specifically Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB), remains the cornerstone of fixed broadband connectivity and network backhaul. Continuous innovation in fiber technology, such as the deployment of XGS-PON and GPON standards, allows for multi-gigabit symmetrical speeds, satisfying the exponentially growing bandwidth requirements of residential and business customers. Complementing this terrestrial infrastructure are advanced satellite communication systems, notably Low Earth Orbit (LEO) constellations like Starlink and OneWeb. LEO technology provides a globally accessible, low-latency alternative, especially vital for aviation, maritime, and remote industrial applications, ensuring ubiquitous connectivity and posing a potential disruptive challenge to traditional fixed and mobile operators in specific geographic niches, thereby expanding the overall technological reach of telecommunication services worldwide.

Regional Highlights

- North America: The North American market is characterized by high ARPU and robust capital investment, primarily focused on the expansion and densification of 5G networks and the completion of fiber rollout, particularly in the United States and Canada. The region is a global leader in enterprise adoption of advanced services, including private 5G networks, cloud integration, and advanced cybersecurity solutions. Regulatory emphasis is placed on securing critical infrastructure and expanding rural broadband access, necessitating significant public-private partnerships. The region also hosts leading global hyperscalers, driving massive demand for wholesale data center and interconnection services.

- Europe: The European market is highly fragmented, necessitating ongoing cross-border consolidation and infrastructure sharing to achieve the necessary scale for 5G investment. Key growth is driven by regulatory pressures for gigabit society targets, promoting aggressive FTTH deployment across the EU. The region is a pioneer in regulatory standards, especially regarding data privacy (GDPR), which shapes global best practices. Carriers are heavily focused on monetizing 5G through industrial and automotive vertical applications, leveraging Europe’s strong manufacturing base.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market in terms of subscriber volume, driven primarily by India, China, and Indonesia. China leads global 5G deployment, both in terms of subscriber count and infrastructure build-out. Southeast Asia is experiencing a massive leapfrog effect, skipping older technologies to adopt 4G and 5G directly, fueled by competitive mobile data pricing. Infrastructure build-out remains a major focus, encompassing extensive terrestrial fiber and new submarine cable systems necessary to support regional data flow and connectivity demands.

- Latin America (LATAM): The LATAM market is defined by high mobile penetration but lower fixed broadband penetration compared to developed regions. Growth is primarily driven by mobile data services and the rapid urbanization fueling demand for reliable connectivity in metropolitan areas. Countries such as Brazil and Mexico are seeing increased foreign investment in fiber and 5G deployment, although challenges related to spectrum auction costs, regulatory uncertainty, and varying economic stability across the region persist.

- Middle East and Africa (MEA): The MEA region shows significant heterogeneity, with the Middle East leading in early 5G adoption and high ARPU, driven by wealthy Gulf nations investing heavily in smart city initiatives and digital government services. Africa, conversely, is characterized by high growth in basic mobile services and mobile money platforms, with investment focused on expanding 4G coverage and securing international bandwidth access. The increasing availability of affordable smartphones and targeted governmental strategies for digital inclusion are major growth accelerators in sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecommunication Services Market.- Verizon Communications Inc.

- AT&T Inc.

- China Mobile Ltd.

- Deutsche Telekom AG

- Vodafone Group Plc

- Orange S.A.

- Telefónica S.A.

- SoftBank Group Corp.

- Nippon Telegraph and Telephone Corporation (NTT)

- T-Mobile US

- América Móvil S.A.B. de C.V.

- Bharti Airtel Ltd.

- Reliance Jio Infocomm Ltd.

- SK Telecom Co. Ltd.

- Saudi Telecom Company (stc)

- Etisalat (e&)

- Telstra Corporation Ltd.

- KT Corporation

- Singtel

- Rogers Communications Inc.

Frequently Asked Questions

Analyze common user questions about the Telecommunication Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the telecommunication services market?

The primary factor driving growth is the mass deployment and increasing consumer adoption of 5G technology, which necessitates significant infrastructure upgrades and enables high-speed mobile data consumption, fostering new services such as fixed wireless access (FWA) and advanced enterprise IoT applications across diverse industries.

How is network virtualization (SDN/NFV) impacting telecom carriers' operational expenditure?

Network virtualization drastically reduces operational expenditure (OPEX) by allowing carriers to replace specialized, proprietary hardware with general-purpose servers running software-defined network functions. This transition enables automated scaling, faster service deployment, and lower maintenance costs, maximizing resource utilization across the network infrastructure.

What are the most significant constraints currently challenging the global telecommunication services sector?

The most significant constraints include the immense capital expenditure (CAPEX) required for pervasive 5G and fiber network build-outs, coupled with persistent price competition, which limits Average Revenue Per User (ARPU) growth. Additionally, stringent regulatory requirements concerning spectrum licenses and data privacy continue to impose complexity and operational costs on carriers.

Which geographical region is expected to exhibit the highest growth rate for telecommunication services?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, predominantly driven by market expansion in large emerging economies like India and Indonesia, where 4G and 5G subscriber penetration is rapidly increasing, supported by massive governmental and private investments aimed at digital transformation and enhanced connectivity access.

How are telecom companies leveraging Multi-access Edge Computing (MEC) to monetize 5G capabilities?

Telecom companies utilize MEC by deploying localized cloud computing resources at the network edge, closer to the end-user or device. This allows them to offer ultra-low latency services necessary for autonomous systems, industrial robotics, and high-quality cloud gaming, creating specialized, high-value enterprise service offerings that command premium pricing beyond basic connectivity provision.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager