Telecommunications, Mobile and Broadband Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433325 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Telecommunications, Mobile and Broadband Market Size

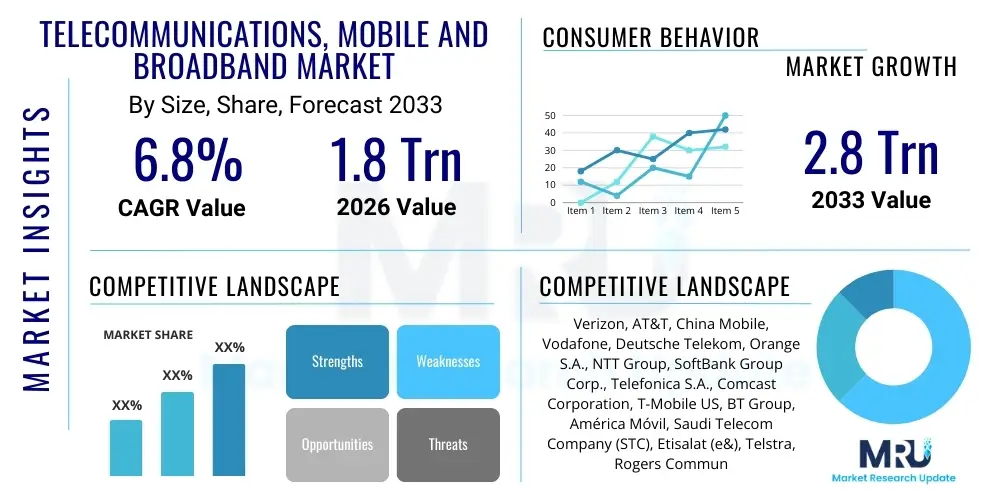

The Telecommunications, Mobile and Broadband Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Trillion in 2026 and is projected to reach USD 2.8 Trillion by the end of the forecast period in 2033.

Telecommunications, Mobile and Broadband Market introduction

The Telecommunications, Mobile, and Broadband Market constitutes the foundational infrastructure and service provision for global digital connectivity. This massive ecosystem encompasses traditional voice and messaging services, high-speed fixed and mobile internet access, data center services, and advanced enterprise connectivity solutions. The core product offering has fundamentally shifted from circuit-switched voice communication to packet-switched data services, driven by exponential growth in video streaming, cloud computing, and the proliferation of connected devices. Major applications span across residential consumption, including entertainment and remote work, critical enterprise applications such as managed services and private networks, and massive government initiatives focusing on smart city development and nationwide digital inclusion. The fundamental structure of this market is defined by continuous, heavy capital expenditure (CapEx) in spectrum acquisition and infrastructure deployment, primarily focused on 5G and fiber-to-the-home (FTTH) technologies.

The primary benefit derived from this market is ubiquitous, high-speed connectivity, which serves as the indispensable backbone for the modern economy. For consumers, benefits include enhanced mobile productivity, access to digital health services, and superior home entertainment experiences. For businesses, advanced connectivity facilitates digital transformation, enables real-time data analytics, supports sophisticated IoT deployments, and ensures operational resilience through high-availability networking solutions. Furthermore, the market acts as a catalyst for innovation in adjacent sectors, including automotive (V2X communication), manufacturing (Industry 4.0), and healthcare (telemedicine), thereby amplifying its overall societal and economic impact. The integration of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) is enhancing service agility and reducing operational costs (OpEx), allowing providers to launch tailored services rapidly.

Key driving factors accelerating market expansion include the explosive growth of global mobile data traffic, necessitated by richer content formats and increased usage intensity. The global deployment and monetization of 5G technology, which offers ultra-low latency and massive machine-type communications (mMTC), is creating entirely new market segments, particularly in industrial IoT and edge computing. Furthermore, government mandates in numerous regions promoting universal broadband access and investing heavily in rural connectivity projects are bolstering demand for fixed infrastructure expansion. The rising adoption of cloud services necessitates higher bandwidth and lower latency connections, pushing both fixed and mobile operators to continuously upgrade their core networks and last-mile infrastructure to meet stringent quality of service (QoS) requirements imposed by hyperscale cloud providers and demanding enterprise clients.

Telecommunications, Mobile and Broadband Market Executive Summary

Global business trends in the telecommunications market are characterized by intense competition, resulting in significant industry consolidation and a strategic pivot toward infrastructure separation and monetization. Operators are increasingly adopting a "Telco-as-a-Platform" model, moving beyond basic connectivity provision to offering advanced vertical solutions, particularly in cybersecurity, cloud aggregation, and specialized IoT platforms for enterprise customers. A critical trend is the rise of Fixed-Mobile Convergence (FMC), where seamless handovers and unified billing simplify user experience and increase customer loyalty, thereby reducing churn. Moreover, the imperative for sustainability and energy efficiency is driving investment in greener network technologies and AI-driven power management systems, optimizing vast network footprints.

Regional dynamics highlight stark contrasts in market maturity and growth potential. The Asia Pacific (APAC) region, led by China, India, and Southeast Asia, remains the dominant growth engine, driven by rapidly increasing mobile subscriber penetration in developing nations and massive 5G infrastructure rollout in developed economies like South Korea and Japan. North America and Europe, characterized by high saturation, focus instead on yield maximization through premium 5G services (e.g., millimeter wave deployment) and strategic fiber densification, particularly targeting competitive residential broadband markets. Emerging markets in Latin America and the Middle East and Africa (MEA) are seeing significant governmental and private investment aimed at closing the digital divide, making them attractive for equipment vendors and greenfield infrastructure developers, often leveraging satellite broadband for remote coverage.

Segmentation trends reveal that Mobile Data Services, specifically high-speed 4G and 5G connections, account for the largest share of market revenue, driven by pervasive smartphone use and streaming demands. Within the fixed segment, Fiber Optic Broadband is rapidly replacing legacy copper and HFC networks, becoming the gold standard for residential and small business connectivity due to its superior capacity and reliability. The enterprise segment shows the fastest growth, primarily fueled by demand for dedicated private 5G networks, specialized vertical application services, and high-margin managed security services designed to support distributed workforces and complex industrial operations. The convergence of IT and network services further blurs segment boundaries, leading to new cooperative models between traditional telecom operators and hyperscale technology companies.

AI Impact Analysis on Telecommunications, Mobile and Broadband Market

User queries regarding the intersection of Artificial Intelligence (AI) and the telecommunications sector frequently center on immediate tangible benefits, focusing heavily on how AI can streamline network operations, enhance customer experience, and secure digital assets. Common themes include "How does AI improve 5G network performance and capacity?", "What role does machine learning play in predicting and preventing network outages?", and "Are AI-powered chatbots replacing human customer service representatives in telcos?". Users are highly concerned with the implementation challenges associated with AIOps (AI for IT Operations), including data quality requirements and the necessity for specialized workforce training. The expectation is that AI will be the central tool enabling the complexity management inherent in virtualized and multi-layered 5G networks, transforming operations from reactive maintenance to predictive, autonomous management.

The primary influence of AI is observed in the optimization and automation of complex, geographically distributed network infrastructure. AI algorithms are deployed extensively in AIOps platforms to analyze vast streams of operational data in real-time, identify patterns indicative of potential failures, and proactively adjust network resources—such as shifting load balancing or allocating spectrum—to prevent service degradation. This predictive maintenance significantly reduces downtime, enhances the reliability of mission-critical services, and optimizes CapEx utilization by providing data-driven insights into equipment performance and necessary upgrades. Moreover, AI is crucial for dynamic spectrum management, ensuring maximum spectral efficiency across diverse frequency bands used by 4G, 5G, and IoT devices simultaneously, maximizing throughput and capacity utilization within fixed infrastructure.

Beyond technical network optimization, AI is profoundly reshaping the customer journey and overall service profitability. Machine Learning (ML) models are integral to customer relationship management (CRM) systems, predicting churn risk with high accuracy and facilitating highly personalized marketing offers based on individual usage patterns and preferences. AI-driven virtual assistants and chatbots handle the majority of routine customer inquiries, improving response times and reducing the cost associated with human call centers, while escalating complex issues seamlessly. Furthermore, in the critical area of security and revenue assurance, AI is deployed to detect sophisticated fraud schemes, identify unauthorized network access, and analyze traffic anomalies indicative of cyber threats, thereby protecting both operator assets and customer data integrity against increasingly complex attack vectors.

- AI-Driven AIOps: Enables predictive maintenance, reducing network outages by up to 30%.

- Network Resource Optimization: Optimizes dynamic spectrum sharing and capacity allocation in real-time for 5G networks.

- Enhanced Customer Experience (CX): Powers virtual agents and personalized service recommendations, improving Net Promoter Scores (NPS).

- Fraud and Security Detection: Utilizes ML to identify and mitigate complex signaling and revenue fraud patterns instantaneously.

- Energy Efficiency: Optimizes power consumption across cell sites and data centers, reducing operational carbon footprint.

DRO & Impact Forces Of Telecommunications, Mobile and Broadband Market

The Telecommunications, Mobile, and Broadband Market is subject to robust and conflicting dynamics, fundamentally shaped by insatiable data consumption (Drivers), high infrastructural investment requirements (Restraints), and the emergence of specialized private network ecosystems (Opportunities). The primary driving forces include the exponential demand for high-definition video, the massive rollout of IoT devices across industrial and consumer sectors, and the global shift towards remote work and education models requiring high-availability broadband access. Restraints are predominantly financial and regulatory, involving the colossal capital expenditure required for continuous 5G and fiber deployments, the significant debt burden carried by many legacy operators, and complex regulatory compliance across diverse geographic markets, particularly concerning net neutrality and data privacy. Opportunities are centered around the monetization of edge computing, the development of lucrative private industrial 5G networks, and strategic expansion into adjacent B2B technology services, allowing operators to move up the value stack beyond simple connectivity provision and capture higher margins.

The impact forces influencing the market are multifaceted, combining technological acceleration with shifting consumer behaviors and geopolitical risk. Technological force is dominated by the rapid maturation of 5G Standalone (SA) architecture, which unlocks true network slicing capabilities crucial for enterprise-grade services, and the continuous innovation in fiber optics technology (e.g., 10G PON) that pushes fixed broadband speeds to multi-gigabit levels. Economic forces involve persistent inflationary pressure affecting equipment costs and spectrum auction prices, alongside the global macroeconomic climate dictating consumer spending on premium data services. Social forces reflect the increasing societal reliance on connectivity as a utility, leading to regulatory pressure for universal service obligations and affordability mandates, while political forces include increasing scrutiny on vendor selection for critical infrastructure and international regulatory harmonization efforts regarding cross-border data traffic.

The interplay between these forces creates strategic tensions for operators. For instance, the demand (Driver) for high-speed, low-latency applications like augmented reality (AR) mandates massive CapEx (Restraint) but simultaneously creates the Opportunity for high-value edge computing services. Furthermore, disruptive forces such as Low Earth Orbit (LEO) satellite broadband (e.g., Starlink) introduce significant competition to terrestrial fixed broadband providers, especially in rural areas, forcing established carriers to accelerate fiber deployment plans or face market erosion. Successfully navigating this landscape requires operators to engage in strategic partnerships, particularly with cloud providers (Hyperscalers), to share costs, co-develop edge services, and manage the transition to fully virtualized network operations efficiently, maximizing return on investment in a capital-intensive environment.

Segmentation Analysis

The segmentation of the Telecommunications, Mobile, and Broadband Market is crucial for understanding revenue dynamics and strategic focus areas for major players. The market is primarily dissected based on Service Type, Technology, and End-User. Analysis of Service Type reveals that mobile data services, encompassing both consumer and enterprise mobility, hold the largest market share due to the global dominance of smartphones and the pervasive need for connectivity outside fixed locations. However, the fixed broadband segment, fueled by the accelerating rollout of high-capacity Fiber-to-the-Home (FTTH) and Fiber-to-the-Curb (FTTC) infrastructure, represents significant and stable revenue streams, particularly supporting the surge in home working and high-definition media consumption globally.

Technology-wise, the transition from legacy 3G/4G to 5G infrastructure dictates investment priorities across the industry. 5G technology, especially the Standalone (SA) version, is not just a faster iteration of previous standards; it is an enabling technology for entirely new market verticals, including massive IoT and ultra-reliable low-latency communications (URLLC) essential for industrial automation and remote medical procedures. Concurrently, fiber optics remains the essential backbone technology for all modern terrestrial connectivity, supporting the immense backhaul requirements generated by dense 5G networks and directly serving high-demand residential areas. The End-User segmentation highlights the fast-growing enterprise sector, which demands bespoke connectivity solutions, including SD-WAN and private network deployments, offering higher profitability margins compared to the highly commoditized residential consumer segment.

- Service Type

- Mobile Services (Voice, Messaging, Data)

- Fixed Broadband (DSL, Cable, Fiber, Satellite)

- Pay-TV Services (Cable, IPTV, OTT Aggregation)

- Enterprise and Wholesale Services (Managed Networks, Cloud Connectivity, Data Center Services)

- Technology

- 5G (Sub-6 GHz, mmWave)

- 4G/LTE

- Fiber Optics (FTTH, FTTB)

- Satellite Communication (GEO, MEO, LEO)

- IoT Connectivity Platforms

- End-User

- Residential

- Commercial/Enterprise (SMEs, Large Corporations)

- Government and Public Sector

- Deployment Type

- Public Networks

- Private Networks

Value Chain Analysis For Telecommunications, Mobile and Broadband Market

The telecommunications value chain is complex and involves multiple highly specialized layers, ranging from core infrastructure manufacturing to retail service delivery. The upstream segment is dominated by network equipment vendors (NEVs) and component suppliers responsible for manufacturing critical hardware, including radio access network (RAN) equipment, core networking gear, optical fiber cables, and specialized semiconductors. This segment is characterized by high research and development (R&D) expenditure due to the rapid evolution of standards like 5G and the increasing need for software-defined, virtualized equipment (SDN/NFV). Key activities here include hardware engineering, software development for network management, and supply chain logistics for massive-scale deployment projects globally. Successful upstream players maintain strong intellectual property rights and often work in deep partnership with standard-setting bodies and major operators to ensure product compatibility and performance integration, often facing geopolitical pressures regarding security standards and vendor sourcing.

The midstream comprises the core service providers—the Mobile Network Operators (MNOs) and Fixed Network Operators (FNOs)—who acquire spectrum and infrastructure, deploy and maintain the networks, and aggregate the services. These operators form the central pillar of the value chain, handling complex network management, billing, and customer provisioning. Downstream activities involve the distribution channels and end-user engagement, encompassing direct sales through operator-owned retail stores, indirect sales through third-party distributors and agents, and digital channels for self-service and subscription management. The rise of Over-The-Top (OTT) content providers and hyperscale cloud companies has intensified competition in the downstream, pushing operators to adopt a more platform-centric model. Operators often bundle direct and indirect channels to maximize reach, particularly for enterprise sales where complex contracts often require specialized indirect system integrators for deployment and ongoing support, linking core network capabilities to customized client solutions.

Telecommunications, Mobile and Broadband Market Potential Customers

The potential customer base for the Telecommunications, Mobile, and Broadband Market is vast, segmented broadly into Residential Consumers, Commercial Enterprises, and Government Entities, each presenting unique service demands and revenue opportunities. Residential consumers constitute the largest volume segment, requiring reliable fixed broadband access for smart homes, entertainment streaming, and remote productivity, alongside high-speed mobile connectivity for personal communication and mobility. This segment is highly price-sensitive but increasingly demanding concerning speed and service reliability, often responding well to bundled offers (quad-play) that integrate mobile, fixed broadband, television, and utility services. Operators must focus on customer experience (CX) and churn reduction in this space, leveraging personalized pricing and proactive fault resolution tools to maintain a competitive edge against converging technology platforms.

The Commercial/Enterprise segment represents the highest potential for high-margin growth, demanding specialized connectivity and managed services tailored to industry-specific needs. Key buyers range from Small and Medium-sized Enterprises (SMEs) requiring simple fixed-line and mobile voice/data packages to large multinational corporations requiring highly complex, dedicated infrastructure, such as global MPLS networks, SD-WAN deployments, and bespoke Private 5G networks for campus or factory automation. Potential customers in high-growth sectors like healthcare, manufacturing (Industry 4.0), and finance are increasingly purchasing sophisticated security, cloud connectivity, and IoT enablement platforms directly from telecom operators who are transforming into technology solution providers. This requires operators to engage highly skilled sales and engineering teams capable of consultative selling and complex solution integration, moving the relationship beyond basic utility provision into strategic partnership territory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Trillion |

| Market Forecast in 2033 | USD 2.8 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon, AT&T, China Mobile, Vodafone, Deutsche Telekom, Orange S.A., NTT Group, SoftBank Group Corp., Telefonica S.A., Comcast Corporation, T-Mobile US, BT Group, América Móvil, Saudi Telecom Company (STC), Etisalat (e&), Telstra, Rogers Communications, Singtel, Reliance Jio Infocomm Ltd., Telecom Italia |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecommunications, Mobile and Broadband Market Key Technology Landscape

The technology landscape of the Telecommunications, Mobile, and Broadband market is defined by continuous disruption, primarily centered around network virtualization and the transition to software-centric architectures. Key innovations include Software-Defined Networking (SDN) and Network Function Virtualization (NFV), which allow operators to decouple network functions (such as firewalls, routing, and mobile core elements) from proprietary hardware and run them as software on standard, commercial off-the-shelf (COTS) servers. This transition is essential for achieving the agility and scalability required by 5G services and significantly reduces both the dependence on specific hardware vendors and the total cost of ownership (TCO) over the network lifecycle. Furthermore, the development of Open RAN (Radio Access Network) aims to introduce greater diversity and competition in the historically closed RAN equipment market by standardizing interfaces, allowing operators to mix and match components from different vendors, promoting innovation and faster deployment cycles.

The physical layer infrastructure is simultaneously undergoing a profound transformation. Fiber Optic technology continues its relentless march, with next-generation Passive Optical Networks (PON), such as XGS-PON and 25G-PON, driving multi-gigabit broadband speeds to residential and small business premises, establishing a decade-long investment foundation. In the mobile sphere, the deployment of 5G Standalone (SA) architecture, which utilizes a cloud-native core independent of the 4G network, is vital for realizing the full potential of network slicing and ultra-low latency services crucial for industrial IoT applications and advanced vehicle-to-everything (V2X) communication. Looking ahead, the exploration of edge computing architectures, where computing power is geographically distributed closer to the end-user, is leveraging the low latency of 5G to enable real-time processing and hosting of mission-critical applications, further integrating the telecom infrastructure with cloud computing platforms offered by hyperscalers, defining the future operational model of the industry.

Regional Highlights

Regional dynamics within the Telecommunications, Mobile, and Broadband Market reflect diverse stages of infrastructure maturity, regulatory environments, and consumer behaviors, resulting in varied growth trajectories and investment priorities across major geographical segments.

- Asia Pacific (APAC): This region is the undisputed leader in subscriber growth and new technology adoption, primarily driven by massive populations and government mandates favoring digital inclusion. Countries like China and South Korea are pioneers in 5G deployment, featuring the highest density of commercial 5G sites and the highest subscriber penetration globally. India and Southeast Asian nations are focused on rapidly expanding 4G coverage and initiating large-scale fiber deployments to address surging mobile data demand and transition rural populations into the digital economy. The competitive intensity in APAC often leads to aggressive pricing strategies, balancing volume growth with increasing Average Revenue Per User (ARPU) through bundled data packages and specialized enterprise services.

- North America: Characterized by high ARPU and established fiber and cable infrastructure, the focus here is on 5G monetization, particularly leveraging millimeter-wave (mmWave) technology for high-density urban areas and enterprise applications. Operators in the U.S. and Canada are heavily investing in fixed wireless access (FWA) as a rapid broadband alternative and in acquiring substantial spectrum assets. Regulatory debates often center on infrastructure sharing, net neutrality, and closing the remaining pockets of the digital divide through federal subsidy programs, such as those encouraging rural fiber builds.

- Europe: The market is often fragmented by complex national regulations, but is prioritizing fiber deployment (FTTH) and 5G mid-band rollout. The European Union encourages cross-border infrastructure investment and consolidation to create stronger pan-European operators capable of competing globally. Key challenges include slow fiber adoption in certain legacy markets and the significant investment required to densify networks in historically high-cost urban environments. Fixed-Mobile Convergence (FMC) is a strategic priority for maintaining customer loyalty and bundling diverse communication services effectively.

- Latin America (LATAM): Growth is primarily driven by mobile data services and the rapid urbanization of populations. Infrastructure challenges remain significant, necessitating investment in resilient fiber backbones and addressing regulatory inconsistencies across countries. 5G deployment is accelerating, but often focused initially on major metropolitan areas. Satellite broadband solutions are gaining traction to address the vast, low-density rural regions where traditional terrestrial deployments are economically unviable, representing a major opportunity for LEO providers.

- Middle East and Africa (MEA): The Gulf Cooperation Council (GCC) nations are leaders in the MEA region, demonstrating rapid, state-backed deployment of advanced 5G networks and smart city initiatives, often achieving some of the world's highest average mobile speeds. In contrast, the African continent is focused on increasing mobile penetration and leveraging mobile money platforms, with fiber deployment concentrated on submarine cable landings and essential backhaul links to support booming mobile usage. Governments are actively seeking foreign direct investment (FDI) to modernize legacy infrastructure and support economic diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecommunications, Mobile and Broadband Market.- Verizon Communications Inc.

- AT&T Inc.

- China Mobile Limited

- Vodafone Group Plc

- Deutsche Telekom AG

- Orange S.A.

- Nippon Telegraph and Telephone Corporation (NTT Group)

- SoftBank Group Corp.

- Telefónica S.A.

- Comcast Corporation

- T-Mobile US, Inc.

- BT Group Plc

- América Móvil, S.A.B. de C.V.

- Saudi Telecom Company (STC)

- Emirates Telecommunication Group Company PJSC (e&)

- Telstra Corporation Limited

- Rogers Communications Inc.

- Singapore Telecommunications Limited (Singtel)

- Reliance Jio Infocomm Ltd.

- Telecom Italia S.p.A.

Frequently Asked Questions

Analyze common user questions about the Telecommunications, Mobile and Broadband market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving capital expenditure (CapEx) in the Telecommunications Market currently?

The primary driver for CapEx is the extensive deployment and densification of 5G infrastructure, particularly the rollout of 5G Standalone (SA) architecture, combined with ongoing investment in Fiber-to-the-Home (FTTH) networks necessary to handle the escalating backhaul requirements and consumer demand for multi-gigabit fixed broadband speeds globally. These two technologies represent the core foundational upgrade cycle.

How is Fixed-Mobile Convergence (FMC) reshaping operator strategy and customer retention?

FMC is strategically vital as it allows operators to bundle mobile and fixed services under a unified bill and offer seamless service experiences (e.g., Wi-Fi calling transitioning to cellular). This approach significantly increases customer switching costs and dramatically lowers customer churn rates, ensuring greater revenue stability and maximizing the lifetime value derived from each subscriber relationship.

What is the significance of Open RAN technology for the future of network deployment?

Open RAN promotes disaggregation by enabling the use of software and hardware components from different vendors via open, standardized interfaces. This is expected to reduce vendor lock-in, decrease equipment procurement costs, accelerate innovation by introducing new players, and allow operators greater flexibility in customizing their networks for specific 5G applications and private industrial deployments.

Which regional market is exhibiting the fastest growth in terms of subscriber base and data traffic?

The Asia Pacific (APAC) region, driven primarily by India and Southeast Asia, exhibits the fastest growth in terms of subscriber additions due to expanding digital inclusion efforts and rapid migration from 2G/3G to 4G/5G mobile services. This demographic transition, coupled with the dense 5G commercialization in East Asian economies, solidifies APAC's position as the key volume and growth market.

What are the key monetization strategies for 5G beyond enhanced mobile broadband (eMBB)?

Monetization beyond traditional enhanced mobile broadband focuses on high-margin enterprise services utilizing 5G's specific characteristics, including network slicing for guaranteed Quality of Service (QoS), deployment of dedicated Private 5G networks for industrial IoT and manufacturing (Industry 4.0), and co-location of Mobile Edge Computing (MEC) services for ultra-low latency applications like AR/VR and autonomous vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager