Telematics Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436469 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Telematics Software Market Size

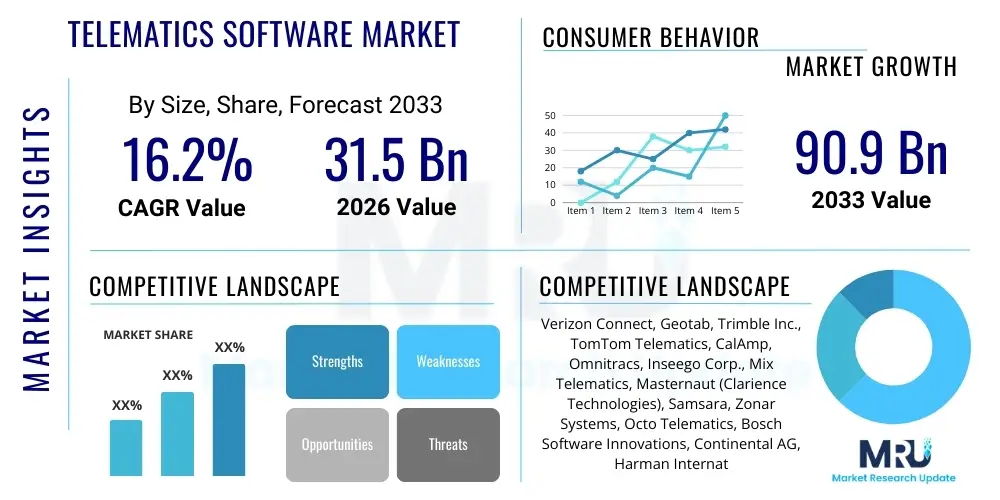

The Telematics Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.2% between 2026 and 2033. The market is estimated at USD 31.5 Billion in 2026 and is projected to reach USD 90.9 Billion by the end of the forecast period in 2033.

Telematics Software Market introduction

The Telematics Software Market encompasses solutions designed to manage, process, and analyze data derived from connected vehicles and assets using GPS, diagnostics, and wireless communication technologies. Telematics software serves as the central nervous system for fleet management, asset tracking, and Usage-Based Insurance (UBI) programs, providing critical insights into operational efficiency, safety compliance, and predictive maintenance requirements. These sophisticated platforms translate raw sensor data into actionable business intelligence, driving significant improvements across logistical and automotive sectors globally.

Key applications of telematics software include advanced fleet optimization, real-time location tracking, driver behavior monitoring, and regulatory compliance (such as Electronic Logging Device or ELD mandates). The rapid adoption of IoT devices in commercial vehicles, coupled with the necessity for enterprises to reduce fuel consumption and minimize downtime, acts as a primary driving factor for market expansion. Furthermore, the proliferation of electric vehicles (EVs) is creating new demands for telematics solutions capable of monitoring battery health, charging infrastructure utilization, and route planning tailored to electric range.

The market is defined by a continuous evolution towards cloud-based architectures, enhancing scalability and integration capabilities with enterprise resource planning (ERP) systems and supply chain management tools. Benefits derived from deploying this software include enhanced visibility into mobile assets, substantial reduction in operational costs, improved driver safety scores leading to lower insurance premiums, and superior customer service through accurate delivery estimates. The shift towards connectivity as a standard feature in both commercial and passenger vehicles is fundamentally reshaping the competitive landscape and technological roadmap for telematics software providers.

Telematics Software Market Executive Summary

The Telematics Software Market is experiencing robust growth fueled by mandatory regulatory adoption across key regions and the increasing complexity of global supply chains demanding real-time visibility. Business trends highlight a strong shift toward highly integrated platforms that offer end-to-end solutions, moving beyond basic tracking to incorporate sophisticated artificial intelligence (AI) for predictive analytics, risk assessment, and autonomous driving readiness. Key industry verticals, particularly logistics, transportation, and construction, are the early and dominant adopters, viewing telematics as a foundational tool for digital transformation and competitive advantage. Strategic partnerships between established automotive OEMs and specialized software providers are accelerating the deployment of factory-installed (embedded) telematics systems, threatening the dominance of aftermarket solutions.

Regional trends indicate North America maintaining its leadership position due to stringent safety regulations and the large, highly structured logistics industry, complemented by rapid innovation in connected car technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, driven by massive infrastructure investments, increasing urbanization, and the explosive growth of e-commerce necessitating optimized last-mile delivery. Europe continues its strong adoption trajectory, largely motivated by environmental regulations aimed at optimizing vehicle routes to reduce carbon emissions and ensure compliance with various pan-European transport mandates.

Segment trends underscore the dominance of the Fleet Management application segment, focusing heavily on reducing operational expenses and enhancing driver accountability. Within the component segment, software and services are growing faster than hardware, reflecting the market’s maturity where data processing and analytical capabilities are now the primary value proposition. Furthermore, cloud-based deployment models are overwhelmingly preferred over on-premise solutions due to their flexibility, lower upfront costs, and superior scalability necessary to handle the enormous data streams generated by large vehicle fleets.

AI Impact Analysis on Telematics Software Market

User inquiries regarding the impact of AI on the Telematics Software Market frequently revolve around topics such as the feasibility of fully autonomous fleet operations, the accuracy of predictive maintenance alerts, and the potential for AI-driven risk scoring to dramatically reduce insurance costs. Users are concerned about data privacy implications when AI algorithms analyze granular driver behavior and the necessary computational infrastructure needed to support real-time machine learning processing within vehicles. The core expectation is that AI will transform telematics from a reactive reporting tool into a proactive, prescriptive operational engine, generating precise recommendations for route optimization, fuel efficiency, and critical safety interventions.

AI is fundamentally reshaping the value proposition of telematics software by enabling the transition from descriptive data reporting to highly accurate predictive and prescriptive analytics. Machine learning algorithms analyze historical patterns, real-time sensor inputs, and external factors (like weather or traffic density) to forecast vehicle component failures, anticipate maintenance needs before breakdowns occur, and dynamically adjust routes to mitigate congestion. This level of predictive intelligence drastically reduces unplanned downtime, significantly extending the lifespan and reliability of commercial assets while maximizing vehicle utilization rates across the fleet.

Furthermore, AI plays a crucial role in enhancing driver safety and performance monitoring. Computer vision and AI-enabled dashcams use algorithms to detect fatigue, distraction, and unsafe driving behaviors (such as hard braking or aggressive cornering) in real-time, providing immediate alerts to the driver and fleet manager. This sophisticated analysis moves beyond simple speed violation reporting, creating highly personalized coaching profiles for drivers, thereby fostering a culture of safety and directly impacting the cost-effectiveness of Usage-Based Insurance (UBI) models which rely heavily on AI-derived risk assessments.

- Enhanced Predictive Maintenance: AI analyzes engine diagnostics and operational patterns to predict component failures accurately.

- Real-Time Risk Assessment: Machine learning models evaluate driver behavior for personalized safety coaching and dynamic insurance pricing.

- Optimized Route Planning: AI algorithms calculate the most efficient routes considering real-time traffic, delivery windows, and environmental factors.

- Computer Vision Integration: AI processes video data from telematics devices to detect driver distraction, drowsiness, and road hazards.

- Autonomous Fleet Readiness: AI infrastructure provides the necessary sensor fusion and decision-making capabilities for future Level 4 and Level 5 autonomous vehicles.

- Natural Language Processing (NLP): Used to process unstructured driver feedback and support tickets, improving service delivery efficiency.

DRO & Impact Forces Of Telematics Software Market

The Telematics Software Market is powerfully driven by stringent governmental regulations mandating the use of electronic logging devices (ELDs) and other safety mechanisms, particularly in North America and Europe, which necessitates immediate software adoption. Concurrently, the increasing complexity and cost associated with managing large-scale commercial fleets push organizations towards software solutions that guarantee operational cost reduction through fuel efficiency monitoring and enhanced asset utilization. These drivers are tempered by significant restraints, primarily high initial deployment costs, integration challenges with legacy enterprise systems, and persistent concerns regarding data privacy and cybersecurity vulnerabilities inherent in transmitting sensitive location and operational data over wireless networks.

Opportunities for profound market expansion exist in the burgeoning fields of Usage-Based Insurance (UBI), where accurate driving data enables highly customized and profitable premium structuring, and in the growing specialization of telematics solutions for non-traditional sectors like agriculture, mining, and rental equipment. The transition to 5G technology presents a major opportunity, promising lower latency and greater bandwidth crucial for supporting high-volume, real-time data transmission required for advanced applications like V2X (Vehicle-to-Everything) communication and enhanced AI processing. The interplay of these forces dictates market trajectory, favoring scalable, secure, and highly adaptable cloud-based platforms.

The impact forces within this ecosystem operate strongly, particularly the intensity of competitive rivalry driven by technology innovation, leading to rapid feature parity and constant pressure on pricing models. Supplier power remains moderate, as hardware components become commoditized, shifting bargaining power toward sophisticated software and analytics providers. Buyer power is high due to the standardized nature of many basic tracking features, allowing large fleet operators to negotiate favorable terms, while the threat of substitution remains low, as there are few viable alternatives to connected, data-driven fleet management in modern logistics.

Segmentation Analysis

The Telematics Software Market is meticulously segmented across several critical dimensions including deployment type, component, application, and vertical, reflecting the diverse needs of end-users ranging from small delivery services to massive international logistics corporations. Analyzing these segments provides strategic insights into which areas are experiencing the fastest technological adoption and highest spending volumes. Deployment type highlights the continuing migration towards highly flexible cloud solutions, while the component analysis emphasizes the increasing value placed on sophisticated analytical services rather than simple software licensing.

Application segmentation reveals that core fleet management functions, such as vehicle tracking and diagnostics, remain the foundational drivers of revenue, though emerging applications like Usage-Based Insurance and regulatory compliance management are seeing exponential growth fueled by specific industry mandates. Vertical segmentation underscores the dominance of transportation and logistics, alongside rapidly integrating sectors such as construction and healthcare, where real-time asset tracking is becoming essential for productivity and regulatory adherence. Understanding the nuanced demand across these segments is vital for vendors aiming to tailor their product development and marketing strategies effectively.

The continuous push for customized solutions is making cross-segment integration a key trend. For instance, an application tailored for a specific vertical (e.g., cold chain monitoring in healthcare logistics) requires a specialized component set and often mandates a secure, private cloud deployment model. This complexity underscores the market's evolution from providing generic tracking services to offering highly specialized, industry-specific operational intelligence platforms capable of delivering measurable ROI in highly regulated environments.

- Component: Solution (Software), Services (Professional Services, Managed Services)

- Deployment Type: Cloud, On-Premise

- Application: Fleet Management, Satellite Navigation, Usage-Based Insurance (UBI), Vehicle-to-Everything (V2X), Telehealth, Emergency Services

- Vertical: Transportation and Logistics, Automotive Manufacturing, Healthcare, Construction, Government and Utilities, Insurance

- Connectivity Technology: Cellular (2G/3G/4G/5G), Satellite, Short-Range Communication

Value Chain Analysis For Telematics Software Market

The value chain for the Telematics Software Market begins with upstream activities centered on the development and manufacturing of specialized hardware components, including GPS modules, onboard diagnostics (OBD-II) devices, modems, and sophisticated sensor arrays. Key players in this phase include semiconductor manufacturers and specialized hardware integrators who provide the foundational technology for data acquisition. This upstream phase is characterized by intense R&D investment focused on miniaturization, enhanced processing power, and greater durability to withstand harsh operating environments, setting the stage for software functionality and data quality downstream.

The midstream phase focuses on software development and platform integration. This is where telematics software providers create the core application logic, data processing pipelines, cloud infrastructure, and user interfaces. This phase involves transforming raw vehicle data into actionable intelligence through complex algorithms for fleet tracking, vehicle health monitoring, and regulatory reporting. Distribution channels are highly critical here, encompassing direct sales teams targeting large enterprise fleets, indirect partnerships with automotive dealerships and insurance carriers, and strategic collaborations with mobile network operators (MNOs) who provide the necessary cellular connectivity infrastructure.

Downstream activities involve the delivery of professional and managed services to end-users, ensuring successful deployment, system integration with existing ERP/SCM systems, ongoing technical support, and data consultation services. Direct channels are typically employed for highly customized enterprise deployments, guaranteeing tailored integration and dedicated customer success management. Indirect channels, such as authorized resellers, system integrators, and independent software vendors (ISVs), broaden market reach, particularly targeting Small and Medium-sized Enterprises (SMEs) that require off-the-shelf or easily scalable solutions, thereby maximizing market penetration across diverse geographical and operational scales.

Telematics Software Market Potential Customers

Potential customers for telematics software span a vast ecosystem of organizations dependent on mobile assets and efficient logistics, with the primary end-users being commercial fleet operators who utilize the software to optimize their expansive networks of trucks, vans, and specialty vehicles. These buyers are primarily motivated by measurable ROI derived from cost reduction (fuel, maintenance) and compliance adherence (driver hours, safety standards). Additionally, insurance providers represent a rapidly expanding customer segment, utilizing telematics data through Usage-Based Insurance models to accurately assess risk profiles of drivers and vehicles, fundamentally transforming traditional underwriting practices.

Governmental and municipal entities constitute significant buyers, deploying telematics for managing public service fleets, emergency response vehicles, and utility maintenance crews, focusing on maximizing resource allocation and ensuring timely service delivery during critical events. The construction and heavy equipment industry is another key consumer, leveraging telematics for geo-fencing, anti-theft measures, and monitoring the utilization and health of high-value non-road mobile machinery (NRMM), optimizing complex construction schedules and reducing equipment theft losses.

Automotive OEMs are critical indirect customers, increasingly embedding telematics solutions directly into new vehicles to offer subscription-based services post-sale, enhancing customer loyalty and creating recurring revenue streams. Retail and e-commerce companies, facing intense pressure for rapid last-mile delivery, rely heavily on sophisticated telematics software to manage vast networks of delivery partners, track goods in transit, and ensure customer satisfaction through precise estimated times of arrival (ETAs), making efficient delivery logistics a critical competitive differentiator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 31.5 Billion |

| Market Forecast in 2033 | USD 90.9 Billion |

| Growth Rate | CAGR 16.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Connect, Geotab, Trimble Inc., TomTom Telematics, CalAmp, Omnitracs, Inseego Corp., Mix Telematics, Masternaut (Clarience Technologies), Samsara, Zonar Systems, Octo Telematics, Bosch Software Innovations, Continental AG, Harman International, Sierra Wireless, Navman Wireless, Teletrac Navman, Pointer Telocation, Teltonika Telematics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telematics Software Market Key Technology Landscape

The technology landscape of the Telematics Software Market is defined by the convergence of high-speed wireless communication, advanced sensor technology, and sophisticated data processing techniques. The foundational technology remains the Global Positioning System (GPS) for location tracking, combined with cellular networks (increasingly 4G LTE and 5G) for reliable data transmission from the vehicle to the cloud platform. The transition to 5G is paramount, as it facilitates the ultra-low latency and massive connectivity required for real-time applications such as V2X communications and remote diagnostic updates, which are essential for enabling autonomous capabilities and enhancing safety critical systems.

Crucial technological advancements include the widespread adoption of standardized APIs and middleware that enable seamless integration between different fleet hardware devices (OBD dongles, cameras, sensors) and the central management software. Cloud computing infrastructure, particularly specialized automotive and IoT cloud platforms provided by major hyperscalers, underpins the market, providing the necessary scalability for data storage and the computational power required for running machine learning models in real-time. Edge computing is also becoming prominent, allowing preliminary data processing and filtering to occur within the vehicle itself, reducing transmission costs and enhancing response times for immediate safety alerts.

Furthermore, the focus is heavily shifting towards software-defined vehicle architectures, where over-the-air (OTA) update capabilities become standard, allowing telematics providers to remotely push software patches, feature upgrades, and critical security updates without requiring physical vehicle access. Cybersecurity technology, including robust encryption protocols and secure boot mechanisms, is integral to the landscape, addressing the inherent risks associated with connected vehicles and protecting highly sensitive operational and personal data transmitted by the telematics unit. This continuous integration of cutting-edge technologies ensures the telematics platform remains resilient, intelligent, and capable of supporting future mobility paradigms.

Regional Highlights

- North America: This region dominates the Telematics Software Market, primarily driven by stringent safety and Hours-of-Service (HOS) regulations, such as the ELD mandate in the US and Canada. The large, mature logistics and transportation sector, coupled with high disposable income and rapid adoption of connected car technology by major automotive OEMs, ensures sustained growth. Innovation is centered around integrating AI for advanced driver assistance systems (ADAS) and preparing infrastructure for future autonomous heavy-duty trucking.

- Europe: Europe holds a significant market share, characterized by high adoption rates spurred by environmental regulations targeting reduced carbon emissions and fuel efficiency. The region exhibits high uptake of UBI and cross-border fleet management solutions necessitated by the unified European market. Regulatory frameworks like GDPR also heavily influence software design, placing a high emphasis on data privacy and security compliance, making secure data handling a core competitive factor.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, massive investments in transportation infrastructure (e.g., China’s Belt and Road initiative), and the explosive growth of e-commerce requiring efficient logistics networks. While regulatory uniformity is lower than in the West, market growth is driven by sheer volume and the need for basic asset tracking and theft prevention across large developing economies like India and China.

- Latin America (LATAM): Growth in LATAM is primarily driven by the urgent need for robust security features, including advanced geo-fencing and vehicle immobilization solutions, due to high rates of cargo theft and vehicle crime. The market is increasingly adopting sophisticated fleet management systems to improve efficiency in resource-intensive sectors like mining and agriculture, where operational visibility in remote areas is crucial.

- Middle East and Africa (MEA): The MEA market is accelerating due to large-scale government infrastructure projects and significant investments in logistics hubs, particularly in the GCC countries. Telematics adoption is strong in the oil and gas sector and public transportation systems, driven by high demand for operational efficiency and monitoring standards compliance in harsh climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telematics Software Market.- Verizon Connect

- Geotab

- Trimble Inc.

- TomTom Telematics (Bridgestone Mobility Solutions)

- CalAmp

- Omnitracs (Solera)

- Inseego Corp.

- Mix Telematics

- Masternaut (Clarience Technologies)

- Samsara

- Zonar Systems

- Octo Telematics

- Bosch Software Innovations

- Continental AG

- Harman International

- Sierra Wireless

- Navman Wireless

- Teletrac Navman

- Pointer Telocation

- Teltonika Telematics

Frequently Asked Questions

Analyze common user questions about the Telematics Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between embedded, tethered, and smartphone telematics deployment?

Embedded telematics involves hardware factory-installed by the OEM, offering the deepest integration with vehicle systems for comprehensive data access. Tethered solutions use external devices connected to the OBD-II port, offering flexibility and ease of installation in aftermarket scenarios. Smartphone-based telematics utilizes mobile apps and sensors to collect data, primarily serving light-duty fleets or Usage-Based Insurance (UBI) programs where cost efficiency and simple tracking are prioritized, though data granularity may be limited compared to embedded systems.

How is the adoption of 5G technology specifically influencing telematics software capabilities?

5G fundamentally influences telematics by providing significantly lower latency, higher bandwidth, and improved reliability. This enables real-time processing of massive datasets crucial for advanced applications like high-definition video telematics, remote vehicle diagnostics, and Vehicle-to-Everything (V2X) communication, moving beyond simple location tracking to facilitating mission-critical data exchange necessary for autonomous driving decision-making and immediate accident reconstruction.

What are the key cybersecurity challenges facing modern telematics software?

The primary cybersecurity challenges include securing data transmission channels against interception, preventing unauthorized access to the vehicle's internal network (CAN bus) through the telematics unit, and ensuring the integrity of Over-The-Air (OTA) software updates. Telematics providers must employ advanced encryption, intrusion detection systems, and secure authentication protocols to mitigate risks associated with data breaches and potential vehicle hacking, which could compromise operational safety and sensitive business intelligence.

Which application segment provides the highest growth opportunity beyond traditional fleet management?

The Usage-Based Insurance (UBI) application segment offers the highest growth opportunity outside core operational fleet management. UBI models, leveraging telematics data on driver behavior, mileage, and vehicle use patterns, allow insurance carriers to customize premiums precisely based on risk. This provides compelling cost savings for safe drivers and creates new revenue streams for telematics vendors through partnerships with major insurance companies seeking advanced data analytics platforms.

How do regulatory mandates, such as the ELD rule, drive market expansion in developed regions?

Regulatory mandates, such as the Electronic Logging Device (ELD) rule in North America, drive compulsory market expansion by making the adoption of compliant telematics software a legal requirement for commercial vehicle operators. These rules eliminate manual record-keeping, ensuring accountability for driver Hours-of-Service (HOS) and safety compliance. This institutionalized demand guarantees a baseline level of market uptake and accelerates the replacement cycle of older, non-compliant systems with sophisticated, integrated software platforms.

What role does predictive maintenance, powered by telematics software, play in fleet optimization?

Predictive maintenance utilizes machine learning algorithms within telematics software to analyze real-time diagnostic trouble codes (DTCs), sensor data, and historical performance trends to forecast when a critical vehicle component is likely to fail. This proactive approach allows fleet managers to schedule maintenance precisely before an actual breakdown occurs, drastically reducing unexpected downtime, minimizing costly emergency repairs, and optimizing vehicle utilization rates across the entire operational lifecycle, leading to significant measurable cost savings.

Why is the Cloud deployment model increasingly preferred over On-Premise solutions in the Telematics Market?

The Cloud deployment model is preferred due to its superior scalability, flexibility, and cost-efficiency, particularly crucial for managing the exponential growth in vehicle data volume. Cloud solutions eliminate the need for significant upfront infrastructure investment, offer easy access to real-time data from any location, and facilitate rapid integration of new features such as advanced AI analytics and OTA updates, making them ideal for dynamic, geographically dispersed fleet operations compared to rigid On-Premise setups.

What are the primary factors contributing to the high market growth rate observed in the Asia Pacific (APAC) region?

The high growth rate in the APAC region is primarily attributed to rapid urbanization, massive infrastructure development initiatives, and the surging demand for highly efficient logistics driven by the booming e-commerce sector. Furthermore, increased government focus on implementing intelligent transportation systems (ITS) in major economic hubs, coupled with a growing awareness of asset security and operational efficiency among emerging commercial fleets, fuels substantial investment in telematics software solutions.

How do telematics solutions support sustainability goals for transportation companies?

Telematics software supports sustainability goals by providing precise data on fuel consumption, enabling algorithms to optimize driving behaviors (e.g., reducing idling and harsh acceleration) and calculating the shortest, most efficient routes. This leads to reduced fuel usage, lower carbon emissions, and compliance with increasingly stringent environmental regulations. Furthermore, telematics is vital for managing electric vehicle (EV) fleets, optimizing charging schedules and monitoring battery health to maximize range and efficiency.

What differentiates modern advanced telematics software from traditional GPS tracking systems?

Traditional GPS systems offer basic location and historical route data, functioning primarily as descriptive tools. Modern advanced telematics software, however, integrates complex sensor data (engine diagnostics, driver inputs, camera feeds), utilizes AI for predictive analytics, and offers prescriptive recommendations for operational improvements, maintenance scheduling, and safety interventions. It is a comprehensive, integrated operational intelligence platform, not just a simple tracking device.

What is the importance of integration capabilities between telematics software and Enterprise Resource Planning (ERP) systems?

Integration between telematics software and ERP systems is crucial for achieving true operational synergy. It allows real-time data from vehicles (such as mileage, fuel consumption, and delivery status) to flow directly into corporate planning systems, streamlining billing, inventory management, maintenance scheduling, and payroll processes. This eliminates manual data entry, enhances data accuracy, and provides a unified view of fleet performance within the overall business context, maximizing efficiency across the supply chain.

How does telematics contribute to improving driver behavior and safety?

Telematics systems continuously monitor and score driver behavior metrics such as speeding, harsh braking, aggressive cornering, and rapid acceleration. Sophisticated systems, often incorporating AI and video, provide instant in-cab alerts and detailed performance reports for personalized coaching. This data-driven feedback mechanism allows fleet managers to proactively address risky behaviors, significantly reducing accident frequency and severity, thereby improving overall road safety and lowering insurance liabilities.

What specific challenges do Small and Medium-sized Enterprises (SMEs) face when adopting telematics software?

SMEs primarily face challenges related to the perceived high upfront cost of implementation and the lack of dedicated IT resources necessary for system integration and data analysis. Furthermore, smaller fleets often require scalable, simple-to-use solutions that demonstrate quick ROI, demanding that vendors offer flexible subscription models and easy-to-install, often plug-and-play, hardware and cloud-based software that requires minimal maintenance and specialized technical expertise.

In the context of telematics, what is Vehicle-to-Everything (V2X) communication?

V2X communication is a crucial component of future mobility, allowing vehicles to wirelessly exchange information with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and the network (V2N). Telematics software provides the secure, low-latency framework necessary for processing and utilizing this data exchange, enhancing situational awareness, coordinating traffic flow, and providing critical safety warnings, thus laying the groundwork for highly automated and autonomous driving environments.

How has the rise of electric vehicles (EVs) altered the requirements for telematics software?

The rise of EVs necessitates specialized telematics requirements focused on monitoring battery health, state of charge (SOC), range optimization, and efficient management of charging infrastructure utilization. EV telematics software must integrate data on energy consumption and regenerative braking, assisting fleet operators in route planning that accounts for charging stops and ensuring optimal battery longevity, a distinct shift from traditional internal combustion engine diagnostics.

What role do specialized professional services play in the overall telematics market value?

Specialized professional services, including system integration, customized data analytics consulting, bespoke solution development, and post-implementation training, significantly enhance the overall market value. These services ensure that the telematics solution is fully optimized for the client’s unique operational environment and integrated seamlessly with their existing enterprise architecture, maximizing the return on investment and facilitating the adoption of complex AI-driven features.

Which component segment—Software or Services—is currently exhibiting faster market growth and why?

The Services component segment (including consulting, system integration, and managed services) is currently exhibiting faster growth than the core Software licensing segment. This acceleration is due to the increasing complexity of telematics data, the need for customized integration with diverse ERP systems, and the rising demand for expert interpretation of advanced analytics (AI/ML) to derive actionable business intelligence, driving higher spending on specialized external expertise.

How does geo-fencing functionality provided by telematics software benefit the construction industry?

Geo-fencing allows construction companies to digitally define virtual boundaries around job sites, material yards, or restricted areas. Telematics software triggers automatic alerts when heavy equipment or vehicles enter or exit these boundaries without authorization. This functionality is crucial for theft prevention, monitoring vehicle utilization on specific projects for accurate billing, and ensuring compliance with operational regulations specific to designated work zones.

What measures are telematics providers taking to ensure data privacy compliant with regulations like GDPR?

Telematics providers ensure GDPR compliance through several measures, including rigorous data minimization (only collecting necessary data), implementing advanced anonymization and pseudonymization techniques, obtaining explicit consent for processing personal driving data, providing individuals with the right to access and rectify their data, and utilizing robust, security-by-design architectures to protect data integrity throughout the entire lifecycle from collection to storage and processing.

What defines the upstream segment of the telematics software value chain?

The upstream segment of the telematics software value chain is defined by the core manufacturing and supply of hardware components essential for data capture and transmission. This includes the development and production of specialized microprocessors, GPS receivers, cellular modems, diagnostic interface units (e.g., OBD-II devices), and various high-precision sensors required to collect raw operational and environmental data from vehicles and mobile assets before it reaches the software platform for analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager