Telescopic Boom Lift Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431716 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Telescopic Boom Lift Market Size

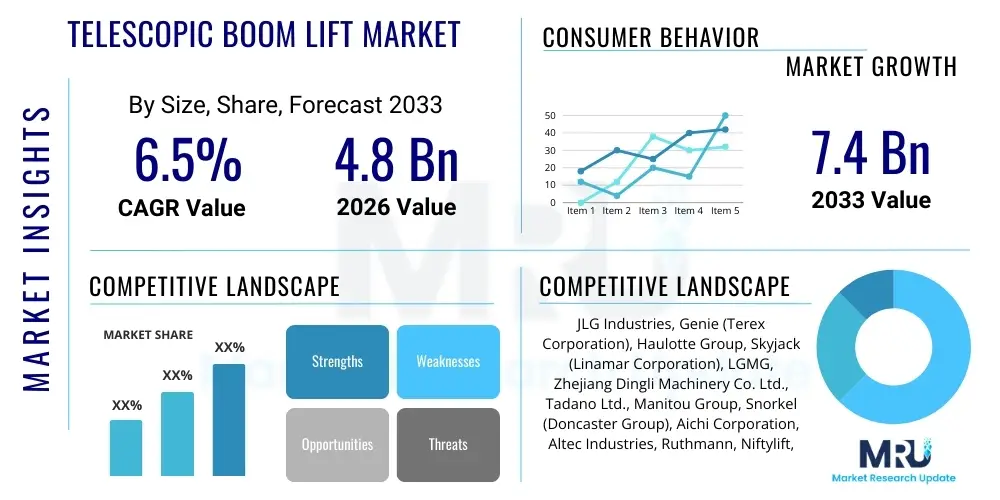

The Telescopic Boom Lift Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Telescopic Boom Lift Market introduction

The Telescopic Boom Lift Market encompasses the manufacturing, distribution, and rental of self-propelled aerial work platforms (AWPs) characterized by straight, multi-section booms that extend linearly, providing exceptional horizontal outreach capabilities. These specialized machines are fundamentally essential for safe and efficient height access across a wide array of vertical industries, predominantly spanning heavy construction, preventative maintenance, large-scale industrial operations, and utility service delivery. The operational efficiency of telescopic booms stems from their inherent ability to position personnel and materials accurately at significant heights and extensive horizontal distances, often surpassing the maneuverability limitations of articulating lifts in open-field or elevated access scenarios. The continuous demand for high-rise infrastructure, including commercial skyscrapers, power transmission towers, and expansive logistical warehouses, firmly establishes the telescopic boom lift as a crucial capital asset for global construction and infrastructure firms. Market growth is structurally linked to global GDP trends and capital expenditure allocations in civil engineering and renewable energy projects, demanding equipment with higher capacities and enhanced digital integration.

Product specifications and technological advancements within this market segment are increasingly driven by the need for regulatory compliance, enhanced worker safety, and reduced environmental impact. Modern telescopic boom lifts are designed with operational heights ranging from compact models suitable for warehouse work to 'super booms' capable of reaching heights exceeding 185 feet, catering to specialized tasks such as wind turbine maintenance and bridge inspection. Key features include integrated platform controls, sophisticated hydraulic systems ensuring smooth and precise movements, and robust chassis designs for superior stability on varied terrain. The core benefits derived from utilizing telescopic lifts include a tangible increase in site productivity due to quicker setup times and greater reach envelopes, minimized reliance on traditional scaffolding, and a verifiable improvement in worker safety achieved through advanced load-sensing technology and dynamic operating envelope restriction systems. Furthermore, the longevity and high residual value of these heavy machines make them attractive assets for large rental fleet operators, which dominate the distribution structure in mature markets.

Several macroeconomic and technological driving factors underpin the market's positive trajectory. Globally, the continuous governmental investment in infrastructure renewal, particularly evident in road network expansions and urban regeneration projects across emerging economies, is a primary catalyst for demand. Simultaneously, stricter international and regional safety standards (such as ANSI A92 standards in North America and European EN280 directives) compel contractors to phase out older, non-compliant equipment, accelerating the replacement cycle for newer, safer models. Technologically, the transition towards sustainable power sources—specifically the development of high-performance electric and hybrid telescopic lifts that meet stringent emissions requirements (e.g., Euro Stage V)—is significantly broadening market applicability, enabling deployment in sensitive urban and indoor environments. This integration of eco-friendly power and IoT-enabled predictive maintenance systems is revolutionizing fleet management practices and enhancing equipment durability and reliability in challenging operating conditions worldwide, driving both efficiency gains and operational excellence throughout the lifecycle of the assets.

Telescopic Boom Lift Market Executive Summary

The Telescopic Boom Lift Market is characterized by vigorous competition and technological innovation, exhibiting a CAGR of 6.5% through 2033, primarily sustained by persistent global infrastructure development and the increasing sophistication of aerial work platform regulations. Current business trends illustrate a strategic pivot among Original Equipment Manufacturers (OEMs) towards digitalization, emphasizing telematics integration, remote diagnostics, and data-as-a-service offerings to capture aftermarket revenue and improve customer loyalty. The rental segment continues to consolidate its position as the dominant distribution channel, particularly in mature markets like North America and Western Europe, leading major rental corporations to continually invest heavily in updating their fleets with electric and hybrid models to meet urban environmental mandates. Supply chain resilience remains a critical strategic focus, as global volatility in raw material costs, specifically high-strength steel and electronic components, requires manufacturers to diversify sourcing strategies and optimize manufacturing lead times to manage profitability and meet accelerating demand schedules, ensuring operational continuity despite macro-economic pressures.

Regionally, the market's growth engine is geographically asymmetric. Asia Pacific (APAC) constitutes the epicenter of growth, fueled by state-sponsored infrastructure mega-projects and the rapid expansion of manufacturing capabilities, positioning regional players as formidable global competitors offering competitive, performance-oriented equipment. Conversely, North America maintains its position as the largest market by value, characterized by high spending on fleet modernization and a premium placed on advanced safety features, driven by rigorous industry standards and sophisticated risk management practices. Europe, leveraging its advanced regulatory environment, is leading the technological shift towards environmentally sustainable access solutions, with hybrid technology achieving significant market penetration, influenced heavily by directives aiming for carbon neutrality in urban construction sites. This disparity necessitates regional customization of product offerings and market entry strategies based on local power source preferences and specific safety compliance requirements, underscoring the fragmented nature of global demand patterns.

Segmentation analysis clearly indicates that the mid-range height category (40 to 80 feet) remains the highest volume segment due to its versatility across standard commercial and residential construction tasks. However, the electric-powered segment is demonstrating the most significant expansion, projected to outpace the growth of traditional diesel counterparts, reflecting a structural transition driven by sustainability mandates and decreasing total cost of ownership (TCO) for electric machinery, primarily through reduced maintenance costs. Competitive strategies are increasingly focused on vertical integration and providing comprehensive after-sales support, including certified operator training and specialized maintenance contracts, transforming the procurement decision from merely a cost-based selection to a holistic investment in safety, operational uptime, and long-term asset value preservation. The persistent pressure to conform to stringent global standards regarding machine stability and operator control is simultaneously driving innovation and raising the technological barriers to entry for new market participants, favoring established OEMs with robust R&D capabilities.

AI Impact Analysis on Telescopic Boom Lift Market

Common user questions regarding AI's impact on the Telescopic Boom Lift Market often revolve around operational efficiency gains, autonomous capabilities, and safety improvements. Users frequently inquire if AI will enable fully autonomous boom lift operation, particularly in high-risk or repetitive tasks, and what timeline is anticipated for the commercial viability of such systems, recognizing the significant regulatory and safety hurdles involved, especially concerning interactions with human site workers. There is also substantial interest in how AI algorithms can optimize lift utilization within large, dynamic construction sites, improve maintenance scheduling through detailed predictive failure analysis based on complex operational parameters (e.g., hydraulic temperature spikes, excessive articulation forces), and enhance the effectiveness of operator training simulators by analyzing and correcting performance deficiencies in real-time. Specific concerns typically center on the regulatory hurdles for deploying autonomous equipment near human workers, the high initial cost of integrating specialized AI hardware (advanced sensors, edge computing units) into existing fleets, and the substantial need for upskilling maintenance and operational personnel to interact with these intelligent systems effectively. Overall, the market expects AI to transition the industry from reactive maintenance and traditional, manual operation to highly predictive, data-driven management frameworks that maximize equipment uptime, minimize human error through automated assistance, and dramatically improve overall safety metrics through continuous environmental monitoring and risk assessment.

The introduction of AI-powered solutions is not aimed at immediate full autonomy but rather at augmenting operator performance and optimizing fleet reliability, addressing critical industry pain points. AI is already being leveraged in advanced telematics platforms to conduct deep learning analysis on millions of hours of operational data, identifying subtle performance degradation patterns that precede catastrophic failures, thereby enabling just-in-time component replacement based on condition monitoring rather than arbitrary time intervals. This shift from time-based maintenance to condition-based maintenance is projected to yield significant reductions in TCO for fleet owners by preventing catastrophic failures and optimizing spare parts inventory. Furthermore, AI assists in dynamic stability management, using real-time sensor fusion from gyroscopes, load cells, and inclinometers to adjust boom movements automatically in response to external forces like wind shear, uneven ground instability, or sudden load shifts, thereby enforcing the operational envelope more precisely and rapidly than human oversight alone. This sophisticated level of control is fundamental to accessing complex or high-risk environments, extending the application scope of telescopic lifts in specialized industries such as bridge inspection or infrastructure repair.

The future trajectory involves integrating AI for cognitive task assistance and advanced planning. For example, systems could use high-resolution computer vision and spatial mapping to guide operators toward optimal boom positioning and extension sequences or recognize non-compliant safety behavior, providing instantaneous auditory or haptic feedback to prevent unsafe movements before they occur. This level of smart assistance significantly lowers the incidence of operational accidents attributable to fatigue or inexperience. However, the successful integration of AI relies heavily on establishing industry-wide protocols for data standardization, interoperability, and cybersecurity. Manufacturers must ensure that the AI models are robust, validated rigorously against varied real-world operating conditions and complex dynamic loadings, and transparent in their decision-making processes to build trust among operators and regulatory bodies. The long-term vision positions the telescopic boom lift as a fully connected, self-optimizing mobile workspace, capable of complex self-diagnostics and predictive safety interventions, fundamentally changing how work at height is executed and managed across large-scale construction sites globally.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on comprehensive telematics data (engine health, hydraulic pressure cycles, boom stress loads) to anticipate component failure with high accuracy, leading to scheduled maintenance intervention, minimizing costly unplanned downtime, and optimizing parts inventory management based on real-time component health.

- Autonomous Positioning and Navigation: Employing computer vision, precise GPS, and sensor fusion for semi-autonomous functionalities, allowing the lift to calculate and execute the most efficient, collision-free path to a designated work area, significantly enhancing speed and reducing human positioning errors, especially in confined or difficult access zones.

- Enhanced Safety Systems: Integrating AI to continuously monitor the lift’s operating envelope, environmental variables (wind speed, ground slope), and potential proximity hazards (power lines, adjacent structures) in real-time, enforcing geo-fencing and dynamic load limitations automatically through sophisticated, non-intrusive control overrides that prioritize stability and operator well-being.

- Optimized Fleet Management: Using advanced AI modeling to schedule lift usage, predict peak demand windows, manage complex charging cycles for electric models to minimize strain on the grid, and allocate the most appropriate machine specification for highly specific job site requirements, dramatically improving overall fleet utilization and minimizing asset idling time.

- Advanced Operator Training: Development of highly realistic, AI-powered simulation environments that adapt training difficulty based on trainee performance, providing granular, personalized feedback and accelerating proficiency in handling emergency scenarios and complex, high-reach maneuvers, thereby mitigating operational risk before deployment in live working environments.

- Data-driven Design Improvements: Leveraging the analysis of vast aggregated operational datasets collected via AI platforms to inform Research and Development (R&D) cycles, leading to future models with optimized structural integrity, reduced weight through material selection, improved power consumption profiles, and enhanced ergonomic design based on precise real-world usage patterns and operator feedback analysis.

- Remote Diagnostic and Repair Assistance: Implementing AI tools to guide remote technicians through complex diagnostic procedures via augmented reality overlays and natural language processing, dramatically speeding up mean time to repair (MTTR) and reducing the need for costly on-site expertise for routine issues, maximizing machine availability.

DRO & Impact Forces Of Telescopic Boom Lift Market

The market dynamics for Telescopic Boom Lifts are currently shaped by a powerful confluence of drivers emphasizing substantial global construction expenditure and stringent safety mandates, counterbalanced by significant restraints concerning high initial capital outlay and vulnerability to economic volatility. Key drivers include sustained global commitments to critical infrastructure projects, particularly in transport, energy generation (including renewable sources like wind and solar farms which rely heavily on high-reach equipment for construction and maintenance), and urban residential density expansion requiring vertical access. Furthermore, the global push towards occupational safety harmonization, primarily driven by organizations like IPAF (International Powered Access Federation) and stringent national enforcement bodies, creates an inherent driver for contractors to purchase or rent the latest models featuring compliance-critical safety innovations like dynamic stability control and load-sensing systems. The continuous, predictable replacement cycle of aging rental fleets, particularly in North America and Europe, provides a baseline demand for new equipment, ensuring market stability even during localized economic slowdowns, as rental companies must maintain modern, certified fleets.

Conversely, significant restraints hinder market growth potential and impact investment decisions. The most pronounced restraint is the exceptionally high initial capital expenditure (CAPEX) required for acquiring modern, high-capacity, telematics-equipped telescopic lifts. This cost barrier disproportionately affects smaller construction firms and independent rental houses, forcing them to rely on older, potentially less efficient machinery or increasing dependency on short-term rentals, thereby limiting direct sales growth. Compounding this is the persistent global shortage of skilled labor—both certified operators capable of safely maneuvering high-reach lifts and specialized maintenance technicians proficient in diagnosing and repairing complex integrated electronic and hydraulic systems. Economic headwinds, including volatile interest rates impacting equipment financing costs and persistent inflation driving up raw material (steel, components) and labor expenses, create market uncertainty, prompting end-users to delay large equipment acquisitions. Moreover, geopolitical instability and trade tariffs can severely disrupt the highly complex global supply chain for key components, affecting production timelines and increasing cost variability for OEMs, ultimately impacting consumer pricing and delivery schedules.

Opportunities for market stakeholders are heavily concentrated in technological adoption, environmental differentiation, and service expansion. The most promising opportunity lies in the accelerating adoption of sustainable power sources, specifically in expanding the performance and operational range of advanced battery-electric and hydrogen fuel cell telescopic lifts to match or exceed the operational endurance of diesel equivalents, strategically targeting zero-emission zones and corporate sustainability initiatives. Furthermore, the burgeoning field of digitalization offers lucrative, recurring service revenue streams: by selling subscriptions for AI-powered fleet management, predictive maintenance insights, utilization data analytics, and compliance tracking, manufacturers and rental companies can deepen customer engagement beyond the initial sale. Strategic market penetration into underserved, specialized segments, such as internal maintenance within sensitive mega-factories (e.g., semiconductor fabrication plants, food processing) requiring highly maneuverable, low-emission, and narrow-access telescopic platforms, also represents a significant growth vector. Success hinges on robust, continuous R&D spending aimed at reducing battery weight while maintaining power output and developing user-friendly digital interfaces that lower the operational barrier for diverse customer segments.

The primary impact forces acting upon the market are regulatory pressure and rapid technological evolution, influencing competition and product lifecycle. Regulatory forces, stemming from evolving safety standards (e.g., increased stability testing requirements) and stricter emission controls (e.g., mandatory particulate filter systems for diesel engines), exert a powerful, non-negotiable compulsion on OEMs to innovate and phase out legacy products, fundamentally shaping the future product roadmap towards sustainability and operator protection. Simultaneously, the accelerating pace of technological advancement, encompassing IoT, advanced sensor integration, and hydraulic system optimization, acts as a pivotal transformative force. This technological momentum dictates that competitive advantage is increasingly tied to the ability to offer smarter, safer, and more connected machinery, raising the performance benchmark and requiring continuous, substantial investment in research and development. Economic forces, driven by global financial conditions, currency fluctuations, and commodity pricing, directly influence the cost structure, purchasing power, and profitability margins across all regional markets, dictating market cyclicality and influencing the investment strategies of both manufacturers and large rental companies throughout the forecast period.

Segmentation Analysis

The Telescopic Boom Lift Market is meticulously segmented across key operational parameters—platform height, power source, and end-user application—each reflecting distinct market needs and investment priorities globally. Segmentation by platform height is crucial for determining functional capability and project suitability, ranging from lifts below 40 feet, often used in confined spaces or basic facility maintenance, up to the critical 80 to 120 feet range which is the workhorse for most large-scale commercial construction, offering optimal reach and maneuverability balance. The super-boom segment (over 120 feet) is highly specialized, serving niche, high-value markets such as petrochemical installations and large-scale wind energy infrastructure, requiring exceptionally advanced stability and control systems coupled with high payload capacity. Understanding the demand distribution across these height categories is essential for manufacturers to optimize production capacity and strategically allocate high-cost materials (like special high-yield steel) effectively, ensuring rigorous compliance with global stability standards at maximum extension and load.

Segmentation based on power source reveals the fundamental market shift underway, driven by environmental responsibility and operational cost savings. While robust, high-torque diesel-powered lifts continue to dominate heavy civil engineering and remote outdoor applications due to their sustained operational endurance, global environmental policies are driving a rapid adoption curve for electric and hybrid categories, particularly in North America and Europe. This growth in electric lifts is directly attributable to the regulatory environment favoring lower noise and zero tailpipe emissions, making electric models mandatory for many inner-city projects and sensitive institutional sites like hospitals or campuses. Hybrid models offer an appealing transitional solution, providing the fuel efficiency benefits of electric power with the backup capabilities of a diesel generator, effectively mitigating range anxiety and optimizing machine flexibility for diverse work environments. The significant strategic investment by major OEMs into proprietary battery management systems, specialized electric drivelines, and advanced charger compatibility underscores the competitive advantage sought in this rapidly expanding and technologically demanding segment.

The market is further segmented by end-user, illustrating that the rental fleet segment remains the largest single procurer of telescopic boom lifts globally, acting as a powerful determinant of equipment standardization and rapid feature adoption. Construction accounts for the highest final utilization, covering diverse applications from façade installation, structural steel erection, and heavy material lifting. The utilities sector, including electrical, gas, and telecommunications maintenance, constitutes a stable, non-cyclical demand base, often requiring specialized, insulated versions of the lifts for safety near energized lines. Industrial maintenance users, such as those in large manufacturing, aerospace maintenance facilities, and large petrochemical refineries, require lifts that prioritize high payload capacity, extreme durability in continuous operation, and often specific explosion-proof certifications. Detailed analysis of these end-user segments allows for highly targeted marketing and the development of application-specific features, such as enhanced maneuverability controls for tight industrial aisles or specialized telemetry systems for remote monitoring of utility assets in difficult terrains.

- By Platform Height:

- Under 40 Feet (Compact and light industrial use, indoor maintenance)

- 40 to 80 Feet (Mid-range segment, highest volume for commercial construction and general maintenance)

- 80 to 120 Feet (Heavy construction, structural work, high-rise facade access)

- Over 120 Feet (Super Booms for wind energy maintenance, bridge inspection, and ultra-high-rise structures)

- By Power Source:

- Diesel Powered (Dominant for heavy-duty, rough terrain, continuous outdoor use)

- Electric Powered (Fastest growing segment, preferred for urban centers and indoor zero-emission zones)

- Hybrid Powered (Versatile transitional solution offering optimal efficiency and range flexibility)

- By End User:

- Construction (Residential, Commercial, Civil Engineering, Structural Steel Erection)

- Utilities (Telecom, Power Generation, Transmission Line Maintenance, Solar/Wind Farms)

- Industrial Maintenance (Refineries, Shipyards, Aerospace, Manufacturing Plants, Warehousing Logistics)

- Rental Fleet Owners (Primary distribution channel, driving technology adoption and fleet investment cycles)

- By Lifting Capacity:

- Standard Capacity (Up to 600 lbs, accommodating two personnel and tools, common for mid-range lifts)

- High Capacity (Over 600 lbs, required for heavy tooling, large materials, and specialized equipment transport)

- By Drive Type:

- 2WD (Standard paved or flat, smooth industrial surfaces)

- 4WD (Rough terrain and uneven construction sites, dominant for outdoor telescopic boom lifts)

- Tracked/Crawler (Highly specialized models for extremely soft or steep terrain access)

- Strong Global Infrastructure Investment & Renewal Programs (Drivers)

- High Capital Expenditure & Complexity in Maintenance (Restraints)

- Electrification, Digitalization, and Service Expansion (Opportunities)

- Stringent Safety and Emissions Regulatory Compliance Pressure (Impact Forces)

- By Platform Height (Under 40 Feet, 40 to 80 Feet, 80 to 120 Feet, Over 120 Feet)

- By Power Source (Diesel Powered, Electric Powered, Hybrid Powered)

- By End User (Construction, Utilities, Industrial Maintenance, Rental Fleet Owners)

- By Lifting Capacity (Standard Capacity, High Capacity)

- By Drive Type (2WD, 4WD, Tracked/Crawler)

- North America (NA): Leading market value; characterized by high fleet replacement rates and dominance of sophisticated rental services; fastest adoption of advanced digital safety and telematics systems; strong regulatory enforcement via ANSI standards driving modernization.

- Europe: Technology leader in electrification and low-emission solutions (Hybrid/Electric); demand dictated by stringent urban emissions controls (Stage V directives); high emphasis on mandatory operator training and strict adherence to EN safety standards.

- Asia Pacific (APAC): Highest volume growth market globally; fueled by massive government infrastructure and rapid urbanization (China, India, Indonesia); rising prominence of localized manufacturing creating highly competitive pricing; growing demand for safety-compliant machinery.

- Latin America (LATAM): Growth tied closely to macroeconomic stability and commodity export revenues; primary demand for robust, reliable mid-range diesel lifts; focus on total cost of ownership (TCO) given local operational expenses.

- Middle East and Africa (MEA): Demand linked to large-scale energy sector investments (Oil & Gas infrastructure) and commercial real estate mega-projects; necessity for equipment designed to withstand extreme heat, dust, and continuous heavy-duty operation; rapid expansion of local rental markets, particularly in the GCC.

- JLG Industries

- Genie (Terex Corporation)

- Haulotte Group

- Skyjack (Linamar Corporation)

- LGMG

- Zhejiang Dingli Machinery Co. Ltd.

- Tadano Ltd.

- Manitou Group

- Snorkel (Doncaster Group)

- Aichi Corporation

- Altec Industries

- Ruthmann

- Niftylift

- Sinoboom Intelligent Equipment Co. Ltd.

- Teupen

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Palfinger AG

- CMC Lift

- Custom Equipment LLC

- IPAF (International Powered Access Federation)

- Multitel Pagliero

- Platform Basket

Value Chain Analysis For Telescopic Boom Lift Market

The Value Chain for the Telescopic Boom Lift Market is characterized by high integration and dependence on specialized global suppliers, commencing with the rigorous upstream procurement process. Upstream activities involve sourcing high-strength, lightweight steel alloys (e.g., quenched and tempered steel) essential for boom construction, crucial for achieving maximum reach without compromising safety or transport weight limits. Procurement also includes highly specialized hydraulic systems components—precision pumps, proportional control valves, and high-pressure cylinders—and complex electronic control units (ECUs) necessary for telemetry, safety protocols, and stability management. For electric variants, securing reliable supply chains for advanced lithium-ion batteries and sophisticated power management components is a defining upstream challenge, where geopolitical stability and commodity price indices (especially nickel, cobalt, and copper) directly influence final product cost and profitability. OEMs must strategically manage these relationships to ensure component quality adheres to demanding durability and performance specifications, mitigating risks associated with supply bottlenecks and inflationary pressures impacting input materials.

The core midstream process involves design, highly automated manufacturing, precise assembly, and rigorous testing mandated by international certification bodies such as CE (Europe) and ANSI (North America). Manufacturing complexity is significant, requiring specialized welding techniques and precision assembly for the multi-section telescopic boom structure and the seamless integration of complex hydraulic, electrical, and electronic sub-systems. Distribution channels primarily bifurcate into direct sales, typically reserved for large government contracts or highly specialized industrial users seeking bespoke configurations, and the dominant indirect channel, which flows overwhelmingly through global and regional rental fleet operators. These rental companies act as crucial market intermediaries, providing localized access, maintenance services, and financing flexibility to the vast majority of construction and utility clients. The effectiveness of the distribution network hinges on efficient global logistics for oversized equipment transport and the provision of localized, highly technical support and warranty services, directly impacting equipment uptime and long-term customer satisfaction metrics across the globe.

Downstream activities focus on the operational life cycle, servicing the end-user base—primarily construction firms, utilities, and industrial complexes—through equipment deployment, utilization tracking, and maintenance. The revenue generated in the downstream phase is heavily weighted toward high-margin aftermarket services, including spare parts sales, comprehensive preventative maintenance contracts, mandatory annual safety inspections and re-certifications, and specialized operator training programs. Potential customers, spanning general contractors to specialized maintenance providers, prioritize equipment reliability (uptime) and strict adherence to job-site safety specifications. Effective downstream management involves leveraging advanced telematics data to schedule preemptive, condition-based maintenance, thereby drastically reducing unexpected breakdowns, and providing comprehensive field support staffed by trained technicians. The eventual resale or decommissioning of the equipment closes the loop, where the high residual value of premium brands, often maintained by certified refurbishment programs offered by OEMs and major rental houses, reflects the quality and durability established earlier in the value chain, ensuring sustained economic viability for asset owners and fostering a robust secondary market.

Telescopic Boom Lift Market Potential Customers

The primary cohort of potential customers for telescopic boom lifts are those enterprises whose operational mandates require reliable, vertical, and horizontal access at significant heights, particularly where obstacles necessitate extended outreach capabilities. This group is dominated by large-scale General Contractors (GCs) involved in the construction of high-rise commercial towers, complex industrial facilities, transportation infrastructure like bridges, and large logistical warehouses, utilizing the lifts for tasks ranging from structural steel erection and heavy façade installation to mechanical systems placement and inspection. These customers typically operate on tight schedules and massive projects, prioritizing equipment that offers the highest reach capacity, maximum stability across diverse terrains (often demanding 4x4 rough-terrain capability), and integrated digital systems for regulatory reporting, real-time operational monitoring, and integrating lift performance data into overall project management systems.

A second crucial segment includes specialized utility providers, encompassing power transmission companies responsible for maintaining high-voltage lines, telecommunications infrastructure operators, and entities servicing renewable energy assets like large-scale wind and solar farms. These users require lifts with specific, non-negotiable safety features, such as insulated fiberglass booms for live-line work and enhanced durability for continuous operation in remote or environmentally challenging locations, often demanding specialized track systems or high-grade stability features. Their purchasing decisions are heavily influenced by equipment reliability under harsh conditions and adherence to specific national utility safety standards, often necessitating custom specifications beyond standard construction models. The massive global shift towards renewable energy projects is creating sustained, long-term, high-value demand for high-reach telescopic lifts capable of servicing massive modern wind turbine towers and large solar arrays.

The third, and often largest, transactional customer base is the global ecosystem of equipment rental companies, who function as the primary distributors and sophisticated fleet managers. Companies like United Rentals, Ashtead Group (Sunbelt), and various regional rental houses procure the vast majority of new lifts, acting as financial intermediaries and service

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | |

| Segments Covered | |

| Key Companies Covered | JLG Industries, Genie (Terex Corporation), Haulotte Group, Skyjack (Linamar Corporation), LGMG, Zhejiang Dingli Machinery Co. Ltd., Tadano Ltd., Manitou Group, Snorkel (Doncaster Group), Aichi Corporation, Altec Industries, Ruthmann, Niftylift, Sinoboom Intelligent Equipment Co. Ltd., Teupen, Zoomlion Heavy Industry Science and Technology Co. Ltd., Xuzhou Construction Machinery Group Co. Ltd. (XCMG), Palfinger AG, CMC Lift, Custom Equipment LLC, IPAF (International Powered Access Federation) Member Companies, Multitel Pagliero, Platform Basket. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telescopic Boom Lift Market Key Technology Landscape

The core technological advancement transforming the Telescopic Boom Lift market revolves around integrating sophisticated digital control and powertrain efficiency to meet demanding safety and sustainability criteria. Central to this is the evolution of telematics and IoT connectivity, moving beyond simple GPS tracking to encompass full machine health monitoring. Modern lifts incorporate hundreds of industrial-grade sensors monitoring hydraulic pressure, engine/battery temperature, load cell data, and boom deflection, feeding this complex operational information to an onboard Electronic Control Unit (ECU) and transmitting it wirelessly to fleet management dashboards via robust cellular or satellite connections. This dense data collection enables highly accurate, AI-driven predictive maintenance, fundamentally shifting the paradigm of equipment ownership and operation by maximizing uptime, anticipating component failure, and ensuring rigorous regulatory compliance through automated operational logging. Furthermore, advanced software enables remote troubleshooting, diagnostics, and over-the-air software updates, minimizing the need for expensive physical service calls for simple configuration changes or routine software fixes.

In the realm of power sources, the technology landscape is heavily influenced by the transition from fossil fuels. Leading manufacturers are investing heavily in advanced battery technology, utilizing high-density lithium-ion chemistries specifically engineered for the high transient power requirements of large hydraulic systems, alongside intelligent thermal management systems to ensure optimal performance, longevity, and safe operation in varied climates. Hybrid systems employ sophisticated regenerative braking, optimized energy recovery mechanisms, and start-stop technologies to maximize fuel efficiency, while simultaneously complying with strict global emission standards like EPA Tier 4 Final and EU Stage V for residual combustion engines. This pervasive push for electrification necessitates corresponding development in standardized fast-charging infrastructure compatibility, robust battery management systems (BMS), and advanced power management software that optimizes battery usage based on the specific operational tasks being performed (e.g., maximizing power output for lifting versus optimizing for low-speed driving and battery preservation).

Safety and control technologies represent another critical area of innovation, moving from reactive protection to proactive stability assurance. All new telescopic booms feature highly integrated Load Moment Indicator (LMI) and Dynamic Envelope Management Systems. These systems use complex mathematical models and real-time sensor inputs (from gyroscopes, load cells, and inclinometers) to dynamically define the safe operating window (the envelope) based on the boom angle, extension, platform load, and ground conditions. If the machine approaches the stability limit, the system automatically intervenes, smoothly slowing and halting potentially unsafe movements, far exceeding the capability of legacy manual safety systems. Furthermore, sophisticated proportional hydraulic controls, often electrically actuated, provide operators with millimeter-precision movement, crucial for high-altitude placement and delicate maintenance tasks. Future integration of Lidar and computer vision cameras promises to deliver semi-autonomous collision avoidance and enhanced proximity awareness, particularly useful when maneuvering large booms near complex structures or overhead obstructions like power lines, setting new benchmarks for operational safety, precision, and efficiency within the telescopic boom lift industry.

Regional Highlights

The regional landscape of the Telescopic Boom Lift Market presents a clear delineation between mature, replacement-driven economies and rapidly expanding, infrastructure-led markets, resulting in differing demand characteristics and competitive dynamics. North America (NA), comprising the United States and Canada, represents the largest single market by revenue value, characterized by advanced safety regulations (ANSI standards) and a highly consolidated rental industry structure. Demand here is dominated by premium, high-specification equipment, with a strong, accelerating preference for electric and hybrid models, driven by local governmental incentives, favorable tax structures, and large corporate sustainability commitments. NA construction projects often require large, high-capacity lifts (80+ feet) for commercial and utility applications, and the market supports a robust ecosystem of certified training, specialized maintenance, and sophisticated telematics usage, setting the global benchmark for equipment uptime, safety management, and efficient fleet operations.

Europe mirrors NA in technological sophistication but is far more heavily influenced by environmental directives, particularly the strict implementation of the EU's Stage V emissions standards, which effectively mandate the adoption of electric and low-emission equipment in urban centers and non-attainment zones. Western European markets like Germany, France, and the UK prioritize accelerated fleet replacement cycles to maintain environmental compliance, resulting in high demand for compact, efficient, hybrid telescopic lifts capable of navigating crowded urban construction sites and minimizing noise pollution. Eastern Europe is gradually increasing adoption as infrastructure investment rises, but purchasing decisions there remain more cost-sensitive, often favoring proven diesel robustness. The region as a whole leads innovation in safety certifications (EN 280) and operator professionalization through accredited programs promoted by influential organizations like IPAF, influencing global best practices for aerial work platform usage.

Asia Pacific (APAC) stands out with the highest projected growth rate, primarily fueled by the economic expansion and colossal infrastructure investments across China, India, and Southeast Asian nations. The demand profile in APAC is mixed: China and India are experiencing massive consumption of both locally manufactured, cost-competitive diesel lifts for massive civil projects and, increasingly, higher-specification imported equipment for specialized industrial maintenance and high-rise construction in major metropolitan areas. The emphasis is often on immediate availability, scalability, and competitive initial purchase price, although safety awareness and the adoption of telematics are rapidly increasing, driven by the presence of multinational contractors operating within the region. Latin America (LATAM) and the Middle East and Africa (MEA) represent highly volatile but growing markets, heavily reliant on commodity prices and large-scale government spending. LATAM's growth is concentrated in stable economies like Brazil and Mexico, while MEA relies on oil and gas-fueled infrastructure booms, demanding highly durable, high-reach diesel lifts capable of operating efficiently and reliably in arid, extreme temperature environments under harsh desert conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telescopic Boom Lift Market.Frequently Asked Questions

Analyze common user questions about the Telescopic Boom Lift market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for electric telescopic boom lifts?

The primary driver is increasingly strict environmental regulations, particularly in urban construction zones and indoor industrial settings, mandating the use of zero or low-emission equipment. Additionally, electric lifts offer reduced noise pollution and lower operating costs due to less maintenance and stable energy pricing compared to volatile diesel costs, contributing to a lower TCO.

How do telematics systems improve the operational efficiency of telescopic boom lifts?

Telematics systems provide comprehensive, real-time data on asset location, utilization rates, engine diagnostics, and safety incidents. This data enables highly effective AI-driven predictive maintenance scheduling, reduces equipment theft, minimizes unplanned downtime, and optimizes machine allocation based on specific project requirements, maximizing rental fleet ROI and operational continuity.

Which geographical region exhibits the highest growth rate in the Telescopic Boom Lift Market?

Asia Pacific (APAC) currently exhibits the highest growth rate, fueled by unprecedented governmental expenditure on massive civil infrastructure projects, rapid urbanization, and industrial expansion, particularly driven by high demand and expanding manufacturing capabilities in countries like China, India, and Indonesia.

What are the typical safety technologies mandatory in modern telescopic boom lifts?

Mandatory safety technologies include sophisticated load-sensing systems (monitoring platform weight), dynamic envelope management (restricting movement based on real-time stability limits), advanced tilt sensors, and redundant control systems. These systems are crucial for preventing tip-overs and ensuring strict compliance with global safety standards like ANSI A92 and EN 280, prioritizing operator protection.

Is purchasing or renting a telescopic boom lift more economically viable for contractors?

For most contractors, particularly those managing project-based or fluctuating demand, renting is generally more viable. It eliminates high upfront capital expenditure (CAPEX), transfers maintenance, storage, and complex regulatory compliance burdens to the rental company, and allows flexible access to the latest, highest-specification equipment without the risk of long-term depreciation.

How are hybrid models positioned strategically within the telescopic boom lift market?

Hybrid models are strategically positioned as highly versatile solutions, bridging the performance gap between traditional diesel and pure electric. They offer lower emissions and noise suitable for city use, while providing the robust power and extended runtime of a diesel backup, mitigating battery range anxiety and maximizing machine utilization across varied indoor, outdoor, and remote applications.

What is the primary restraint affecting the direct sales market for telescopic boom lifts?

The primary restraint is the exceptionally high initial capital expenditure (CAPEX) required for purchasing modern, technologically advanced lifts, coupled with rising interest rates impacting financing. This steep initial cost often pushes end-users, especially smaller and mid-sized construction companies, toward the rental market as a more financially manageable operating expense (OPEX) model.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager