Temperature And Humidity Logger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432649 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Temperature And Humidity Logger Market Size

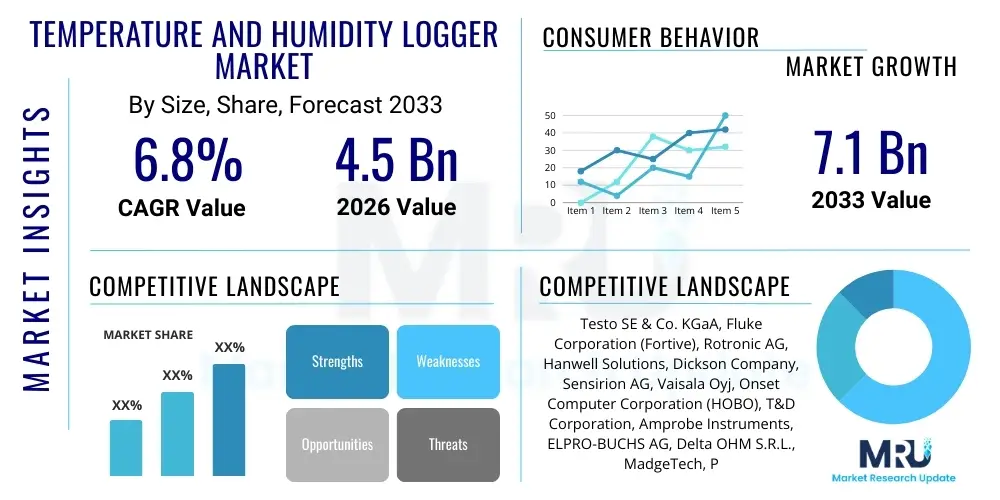

The Temperature And Humidity Logger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for stringent monitoring protocols across sensitive supply chains, particularly within the pharmaceutical and food sectors where maintaining specific environmental conditions is critical for product integrity and regulatory compliance. Furthermore, the advancements in wireless and IoT-enabled logging solutions are lowering the barrier to entry and enhancing the utility of these devices in complex, geographically dispersed environments, contributing significantly to the overall market valuation increase throughout the forecast horizon.

Temperature And Humidity Logger Market introduction

The Temperature and Humidity Logger Market encompasses the manufacturing, distribution, and utilization of devices designed to automatically measure and record temperature and humidity conditions over time. These instruments, ranging from simple standalone data loggers to sophisticated multi-channel wireless monitoring systems, are essential tools for ensuring quality control, safety, and regulatory adherence in environments where environmental stability is paramount. The primary product description involves high-precision sensors paired with internal memory and often communication capabilities (USB, Ethernet, Wi-Fi, or proprietary wireless protocols) to store and transmit data for analysis and reporting. The data generated by these loggers provides an unalterable audit trail necessary for validation purposes in highly regulated industries.

Major applications of temperature and humidity loggers span critical sectors such as pharmaceutical storage and transportation, food processing and cold chain logistics, climate-controlled warehousing, industrial HVAC monitoring, and laboratory research. The core benefits derived from their use include mitigating product spoilage, preventing costly equipment failure due to adverse conditions, optimizing energy consumption in climate-controlled spaces, and achieving compliance with international standards like FDA 21 CFR Part 11, HACCP, and ISO guidelines. The driving factors behind market growth are multi-faceted, notably including increasing global regulatory pressure demanding verifiable environmental monitoring, the expansion of the global cold chain infrastructure driven by perishable goods trade, and the transition toward smart, interconnected IoT monitoring systems that enhance real-time data accessibility and proactive alert mechanisms. The integration of advanced features such as cloud storage and predictive analytics further solidifies the essential nature of these devices across various industrial landscapes.

Temperature And Humidity Logger Market Executive Summary

The global Temperature And Humidity Logger Market is experiencing robust growth, characterized by significant technological shifts favoring wireless connectivity and cloud-based data management solutions. Business trends indicate a strong move toward "Logging as a Service" (LaaS) models, where vendors offer integrated hardware, software, and subscription-based cloud platforms, moving beyond simple device sales. Manufacturers are focusing heavily on developing miniaturized, low-power consumption loggers suitable for highly distributed monitoring, particularly within last-mile logistics and pharmaceutical clinical trials. Furthermore, partnerships between sensor manufacturers and supply chain management software providers are creating integrated solutions that provide seamless environmental tracking from production to consumer, enhancing overall operational efficiency and reducing data silos.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure investments in cold chain development, rapid industrialization, and the burgeoning pharmaceutical manufacturing base in countries like China and India. North America and Europe, while mature, maintain leadership in terms of technology adoption and high regulatory standards, driving demand for advanced, calibration-compliant loggers. Segment trends highlight that wireless and disposable loggers are exhibiting the highest growth rates, reflecting the industry's need for flexibility, ease of deployment, and cost-effective monitoring for short-duration shipments. The pharmaceutical and biotechnology segment remains the highest revenue generator due to the high value and extreme sensitivity of biopharmaceutical products, mandating the highest level of monitoring precision and auditability throughout their lifecycle.

AI Impact Analysis on Temperature And Humidity Logger Market

User queries regarding the impact of Artificial Intelligence (AI) on the Temperature and Humidity Logger Market commonly revolve around the potential for predictive maintenance, enhanced data analysis capabilities, and the automation of compliance reporting. Users frequently ask if AI can anticipate equipment failure based on subtle environmental fluctuations, how machine learning algorithms can detect anomalies that human operators might miss, and whether AI integration will replace traditional data logging software. The key themes emerging from this analysis confirm high expectations for AI to transform passive data collection into proactive, intelligent environmental management. Users anticipate AI will dramatically reduce false alarms, optimize climate control systems in real-time to save energy, and automatically generate sophisticated compliance reports by contextualizing logger data with external variables like weather patterns or HVAC performance. This shift transforms loggers from mere recorders into critical data sources for smart operational decision-making platforms.

- AI enables predictive failure analysis of climate control systems by correlating temperature logger data with equipment run times and historical performance metrics.

- Machine learning algorithms enhance anomaly detection, identifying subtle environmental deviations that precede product degradation or non-compliance events much faster than manual inspection.

- Integration of AI facilitates dynamic environmental control, allowing HVAC and refrigeration units to adjust parameters automatically based on predicted load and external conditions, optimizing energy use.

- AI simplifies compliance by automating the categorization and flagging of temperature excursions, generating audit-ready reports without extensive manual data processing.

- AI tools are used for sensor drift compensation and calibration scheduling, predicting when a logger's readings might become inaccurate, thus ensuring data integrity proactively.

DRO & Impact Forces Of Temperature And Humidity Logger Market

The Temperature And Humidity Logger Market is shaped by a confluence of accelerating drivers, stringent restraints, and expansive opportunities, all contributing to significant market impact forces. Key drivers include the mandatory increase in cold chain validation across pharmaceuticals, biologics, and specialized foodstuffs, driven by global regulatory bodies enforcing stricter storage and transit conditions. The global expansion of COVID-19 vaccine logistics and other temperature-sensitive therapeutics has dramatically raised the baseline requirement for robust logging infrastructure. Restraints primarily involve the high initial investment cost associated with implementing comprehensive wireless monitoring systems, especially in smaller enterprises, and challenges related to data security and interoperability among diverse logger technologies and proprietary software platforms. Data logger calibration, maintenance, and the need for skilled personnel to interpret complex data sets also pose ongoing market friction.

Opportunities are strongly rooted in technological innovation, specifically the proliferation of cost-effective IoT sensors, advanced battery life capabilities, and cloud computing solutions that make real-time, global monitoring scalable and affordable. The emergence of specialized applications in sectors such as smart agriculture (precision farming) and historical preservation (museums and archives) presents untapped revenue streams beyond traditional industrial use. Furthermore, the global push toward sustainability and energy efficiency mandates the use of environmental monitoring systems to optimize resource consumption in buildings and logistics, creating an indirect but powerful driver for logger adoption. The inherent impact forces are overwhelmingly positive, driven by non-negotiable regulatory requirements that mandate monitoring as a prerequisite for market participation in sensitive sectors, ensuring sustained investment in advanced logging solutions irrespective of minor economic downturns.

Segmentation Analysis

The Temperature And Humidity Logger Market segmentation provides a granular view of diverse product capabilities and application needs, allowing manufacturers to tailor solutions effectively. The market is typically segmented based on product type, which dictates deployment flexibility and data retrieval methods; technology, which distinguishes between basic recording devices and sophisticated real-time monitoring ecosystems; and end-use, which reflects regulatory and precision requirements of different vertical industries. Understanding these segments is crucial as the requirements for a logger used in a warehouse (long battery life, high capacity) differ significantly from one used in clinical trial transportation (small form factor, highly accurate, single-use capabilities). The evolution of these segments shows a clear preference for integrated solutions that combine high-quality sensor hardware with intuitive, cloud-based software platforms that offer data visualization and alerting services.

- By Product Type:

- Standalone Loggers (Non-connected, manual data retrieval via USB or interface)

- Wireless Loggers (Wi-Fi, Bluetooth, RFID, LoRaWAN)

- USB Loggers (Plug-and-play simplicity)

- Multi-channel Loggers (Used for monitoring several points simultaneously)

- Disposable Loggers (Often single-use for cold chain validation)

- By Technology:

- Sensor Types (Thermistor, RTD, Capacitive Sensors)

- Data Acquisition Systems (Hardware and Firmware)

- Software and Cloud Platforms (Data analysis, reporting, alerting)

- By End-Use Industry:

- Pharmaceutical and Biotechnology (High-precision, regulatory compliance)

- Food and Beverage (Cold Chain logistics, storage, processing)

- Logistics and Transportation (Shipping containers, trucks, warehouses)

- Industrial and Manufacturing (HVAC monitoring, calibration labs)

- Healthcare (Blood banks, vaccine storage, laboratories)

- Others (Museums, Agriculture, Environmental Monitoring)

- By Component:

- Hardware (Logger Devices, Sensors)

- Software (PC software, Mobile Apps, Cloud Services)

- Services (Calibration, Validation, Maintenance)

Value Chain Analysis For Temperature And Humidity Logger Market

The value chain for the Temperature And Humidity Logger Market begins with upstream activities focused on the procurement of raw materials, particularly high-precision sensor components, microprocessors, battery technology, and robust casing materials. Upstream analysis reveals a high reliance on specialized sensor manufacturers, often based in technologically advanced regions, who provide calibrated thermistors, RTDs (Resistance Temperature Detectors), and capacitive humidity sensors. The quality and stability of these components directly determine the accuracy and reliability of the final logger product. Manufacturers focus on optimizing component integration and minimizing production costs while adhering to stringent quality control standards required for medical and food-grade devices. Strategic relationships with key electronic component suppliers are vital for maintaining competitive advantage and managing supply chain resilience, especially given the global volatility in semiconductor markets.

Downstream analysis centers on market distribution and end-user adoption. The distribution channel is often bifurcated between direct sales for large-scale enterprise monitoring solutions (e.g., pharmaceutical companies buying validated fixed systems) and indirect sales through specialized distributors and calibration houses for smaller, off-the-shelf loggers. Direct channels allow for customized integration and provide comprehensive validation services, which are critical in regulated industries. Indirect channels leverage established distribution networks to reach diverse end-users globally, offering localized support and faster fulfillment. The rise of e-commerce platforms has also created a significant distribution channel for standard, non-validated USB and standalone loggers. Effective downstream execution requires robust service networks for post-sale calibration and maintenance, ensuring the long-term operational integrity of the installed logging base.

Temperature And Humidity Logger Market Potential Customers

The potential customers and end-users of temperature and humidity loggers represent a broad spectrum of industries united by the critical need to preserve product quality, ensure compliance, and optimize environmental conditions. The pharmaceutical and biotechnology sector constitutes the most demanding customer base, requiring high-accuracy, validated loggers for monitoring everything from active pharmaceutical ingredients (APIs) storage and clinical trial material shipment to final vaccine refrigeration (the cold chain). These buyers prioritize data security, audit trail capability, and regulatory compliance (e.g., FDA, EMA standards) over initial device cost. They typically require full system validation and ongoing calibration services.

Another major segment includes the food and beverage industry, particularly entities involved in the cold chain—farmers, processors, distributors, and large retail chains. These customers utilize loggers to comply with food safety standards (like HACCP) and minimize spoilage of perishable goods such as meat, dairy, frozen foods, and produce during transit and storage. While cost sensitivity is higher than in the pharma sector, the primary drivers are loss prevention and quality assurance. Furthermore, logistics and transportation providers, including specialized cold storage warehousing companies and third-party logistics (3PL) providers, are significant buyers, integrating loggers into fleet management systems to offer verifiable environmental conditions as part of their service offering. The diverse needs of these end-users, ranging from highly robust industrial loggers to simple, short-term disposable units, necessitate a comprehensive product portfolio from market vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Testo SE & Co. KGaA, Fluke Corporation (Fortive), Rotronic AG, Hanwell Solutions, Dickson Company, Sensirion AG, Vaisala Oyj, Onset Computer Corporation (HOBO), T&D Corporation, Amprobe Instruments, ELPRO-BUCHS AG, Delta OHM S.R.L., MadgeTech, Pace Scientific Inc., Gemini Data Loggers (Tinytag), ETI Ltd., Dwyer Instruments Inc., ACR Systems Inc., Berlinger & Co. AG, Escort Data Loggers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Temperature And Humidity Logger Market Key Technology Landscape

The technology landscape of the Temperature And Humidity Logger Market is rapidly evolving, moving beyond simple microprocessors and memory chips toward fully integrated, highly connected solutions. A significant technological shift involves the transition from traditional wired systems to advanced wireless communication protocols such as LoRaWAN (Long Range Wide Area Network), Bluetooth Low Energy (BLE), and Wi-Fi Mesh networks. These wireless technologies dramatically improve deployment flexibility, allowing loggers to be placed in inaccessible or remote areas without extensive cabling infrastructure. Furthermore, the integration of cellular connectivity (3G/4G/5G) is crucial for real-time monitoring of goods in transit across international borders, ensuring data continuity even when outside local network coverage. The core sensor technology is also seeing advancements, with MEMS (Micro-Electro-Mechanical Systems) sensors becoming smaller, more accurate, and more cost-effective, driving miniaturization across the product range.

The second major technological pillar is the evolution of data management software and cloud infrastructure. Modern loggers are designed to communicate directly with dedicated cloud platforms that offer enhanced data storage security, scalable processing power for large datasets, and sophisticated web-based user interfaces. These platforms utilize advanced APIs to integrate logger data with enterprise resource planning (ERP) systems and supply chain management (SCM) software, creating a holistic view of operations. Furthermore, battery technology, particularly the use of high-density lithium batteries and improved power management firmware, is enabling loggers to operate autonomously for months or even years, minimizing maintenance cycles and ensuring continuous data logging throughout extended monitoring periods. The development of disposable loggers, utilizing cheap, printed electronics and non-rechargeable power sources, represents a niche but highly impactful technological advancement for single-trip cold chain applications where device retrieval is impractical.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and technological maturity of the Temperature And Humidity Logger Market. North America, specifically the United States and Canada, represents a leading market characterized by stringent regulatory environments imposed by agencies like the FDA and USDA. This region demonstrates high adoption rates for sophisticated, validated wireless systems and cloud-based monitoring solutions, driven by major pharmaceutical and biotechnology hubs and a mature cold chain logistics industry. Investment in compliance-driven infrastructure and early adoption of AI analytics for predictive maintenance are hallmarks of the North American market, focusing on data integrity and security.

Europe closely follows North America in terms of maturity and regulatory stringency, particularly under EU guidelines such as Good Distribution Practice (GDP). Countries like Germany, Switzerland, and the UK are major centers for logger manufacturing and end-use, particularly within the pharmaceutical manufacturing and high-end food export sectors. The European market shows a strong preference for certified and calibrated devices, emphasizing long-term reliability and adherence to international quality standards. Furthermore, the adoption of IoT communication standards like LoRa is highly integrated across many European urban logistics centers.

Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is primarily attributed to large-scale investment in new cold chain facilities driven by expanding populations, rising standards of living, and increased government focus on food safety and public health infrastructure across China, India, and Southeast Asian nations. While the market initially focused on low-cost standalone loggers, there is a swift transition toward wireless and real-time monitoring solutions, propelled by international trade demands and the need to monitor vaccine distribution across vast geographic areas. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in major urban and industrial centers, driven largely by perishable goods imports and localized pharmaceutical distribution networks, with increasing adoption of basic USB loggers before transitioning to more complex systems.

- Highlight key countries or regions and their market relevance

- North America (USA, Canada): Market leaders in advanced wireless and cloud solutions; driven by high FDA regulatory standards for biopharma cold chain validation and compliance technology.

- Europe (Germany, Switzerland, UK): Strong emphasis on calibration and GDP compliance; major hub for high-precision sensor manufacturing and implementation in clinical trials logistics.

- Asia Pacific (China, India, Japan): Fastest-growing region; fueled by massive infrastructural investments in cold chain logistics, expanding domestic pharmaceutical manufacturing, and increasing consumer demand for food safety.

- Latin America (Brazil, Mexico): Emerging growth driven by modernization of perishable food logistics and increasing investment in healthcare infrastructure; focused on balancing cost and capability.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): Growth focused on food security, import requirements, and the necessity to manage extreme ambient temperature challenges through robust logging technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Temperature And Humidity Logger Market.- Testo SE & Co. KGaA

- Fluke Corporation (Fortive)

- Rotronic AG

- Hanwell Solutions

- Dickson Company

- Sensirion AG

- Vaisala Oyj

- Onset Computer Corporation (HOBO)

- T&D Corporation

- Amprobe Instruments

- ELPRO-BUCHS AG

- Delta OHM S.R.L.

- MadgeTech

- Pace Scientific Inc.

- Gemini Data Loggers (Tinytag)

- ETI Ltd.

- Dwyer Instruments Inc.

- ACR Systems Inc.

- Berlinger & Co. AG

- Escort Data Loggers

Frequently Asked Questions

Analyze common user questions about the Temperature And Humidity Logger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Temperature and Humidity Logger Market?

Market growth is primarily driven by stricter global regulations in the pharmaceutical and food industries (mandating validated cold chain monitoring), the rapid expansion of the biologics and vaccine markets, and the transition toward real-time, automated monitoring systems utilizing IoT and cloud connectivity to minimize product loss and ensure verifiable audit trails.

How is AI impacting the functionality of temperature and humidity loggers?

AI is transforming passive data collection into proactive environmental management. Key impacts include predictive maintenance (anticipating HVAC failures based on data fluctuations), advanced anomaly detection, automated compliance reporting generation, and dynamic optimization of climate control systems for energy efficiency.

What is the significance of the shift from standalone loggers to wireless logger systems?

The shift to wireless systems (Wi-Fi, LoRaWAN) is significant because it enables real-time data access, immediate alerting upon temperature excursions, centralized monitoring across large facilities or global supply chains, and removes the necessity for manual data retrieval, thereby enhancing compliance efficiency and operational responsiveness.

Which end-use industry holds the largest market share for temperature and humidity loggers?

The Pharmaceutical and Biotechnology industry currently holds the largest revenue share. This dominance is due to the extreme value and sensitivity of pharmaceutical products, requiring highly accurate, validated, and regulatory-compliant logging systems, which typically translates to higher investment per monitoring point.

What technical features should be prioritized when selecting a logger for cold chain logistics?

For cold chain logistics, key technical features to prioritize are long battery life, robust casing (IP rating), high measurement accuracy and resolution, secure data encryption, clear alarm indicators, and seamless integration with cloud platforms for real-time GPS-linked tracking and data reporting across transportation stages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager