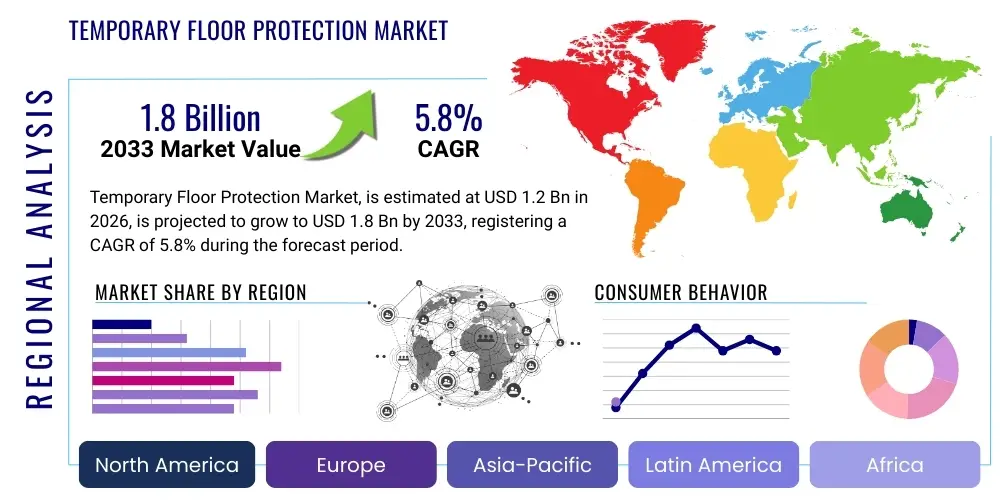

Temporary Floor Protection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436173 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Temporary Floor Protection Market Size

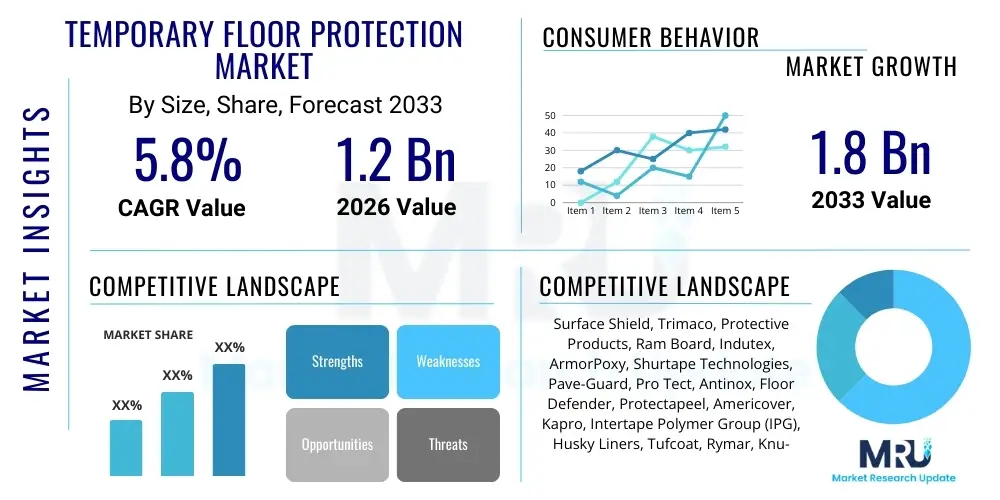

The Temporary Floor Protection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the escalating global volume of construction and renovation projects, coupled with increasingly stringent occupational safety and asset protection standards mandated across commercial, industrial, and residential sectors. The expansion of high-value construction, particularly in technology and healthcare infrastructure, necessitates premium, heavy-duty floor protection solutions, thereby enhancing overall market valuation.

Temporary Floor Protection Market introduction

The Temporary Floor Protection Market encompasses a range of specialized materials and products designed to shield finished flooring surfaces—including hardwood, tile, carpet, and concrete—from damage caused by construction activities, heavy equipment traffic, spills, paint, and general debris during building, remodeling, or maintenance phases. These products, which range from basic plastic films and builder’s paper to advanced reusable fiberboard and high-impact specialized mats, are crucial for maintaining site cleanliness, preventing costly repairs, and ensuring project timelines are met without delays stemming from surface damage remediation. Effective floor protection not only preserves the aesthetic and structural integrity of installed surfaces but also significantly contributes to site safety by offering non-slip properties and defined walkways, especially in high-traffic zones.

The primary applications of temporary floor protection extend across various construction environments, including large-scale commercial fit-outs, residential renovations, infrastructure projects, and industrial maintenance shutdowns. In commercial settings, where high-end finishes are common, specialized solutions offering superior liquid resistance and cushioning are preferred. Conversely, in light residential remodeling, lightweight, easily disposable options often dominate. The product selection is highly dependent on the duration of the protection required, the type of hazard anticipated (e.g., impact damage versus paint spills), and the underlying flooring material itself.

Major benefits driving the adoption of these solutions include cost savings associated with avoiding surface repair or replacement, enhanced professional reputation for contractors who prioritize site preservation, and compliance with increasingly rigorous site management protocols. Driving factors include the sustained boom in global residential and non-residential construction, particularly in developing economies, the rising sophistication of protective material science offering better performance characteristics (e.g., breathability for curing floors), and heightened awareness among property owners regarding liability risks associated with construction-related damage.

Temporary Floor Protection Market Executive Summary

The Temporary Floor Protection Market is characterized by robust resilience linked directly to global capital expenditure in real estate and infrastructure, manifesting several key business, regional, and segment trends. Business trends indicate a marked shift towards sustainable and reusable products, driven by corporate environmental responsibility mandates and rising costs associated with disposable waste. Manufacturers are actively investing in R&D to produce recycled content floor guards and biodegradable protective films, enhancing product lifecycles and reducing ecological footprint. This trend is particularly pronounced in Western European and North American markets where sustainability is a primary procurement criterion.

Regionally, the Asia Pacific (APAC) market maintains the highest growth momentum, fueled by unprecedented urbanization and massive governmental investments in residential, transportation, and energy infrastructure projects, particularly in China, India, and Southeast Asian nations. While North America and Europe remain key consumers of premium, technologically advanced floor protection due to established regulatory frameworks and high labor costs that necessitate efficient, damage-preventing tools, APAC’s sheer volume of construction activities positions it as the dominant region for material consumption. The Middle East also contributes significant demand, driven by large-scale commercial and hospitality developments requiring meticulous surface protection.

Segmentation trends highlight the increasing demand for heavy-duty fiberboard and non-woven material protections, especially in large commercial and industrial construction where heavy machinery and high impact risks are prevalent. While traditional plastic films remain critical due to their low cost and ease of application, the fastest-growing segment is expected to be high-performance, breathable materials, which are essential for protecting newly installed concrete and moisture-sensitive floors. Furthermore, the commercial application segment is projected to hold the largest market share, reflecting the higher average value and complexity of finishes used in offices, hospitals, and retail spaces, justifying the investment in specialized protection systems.

AI Impact Analysis on Temporary Floor Protection Market

Common user questions regarding AI's influence in the Temporary Floor Protection Market center on supply chain optimization, predictive inventory management, and automated site monitoring. Users are primarily interested in how AI can streamline the ordering and deployment of protective materials based on real-time project schedules (How can AI prevent material shortages?). There is also significant curiosity about leveraging machine vision for automated damage detection during construction (Can AI flag potential floor damage risks before they become costly?). Additionally, users question AI's role in waste management optimization (How can algorithms help minimize waste of single-use protective coverings?). The overarching themes involve maximizing operational efficiency, reducing material waste, and enhancing proactive risk mitigation related to floor damage.

The implementation of AI and related technologies, such as Computer Vision (CV) and sophisticated predictive analytics, offers transformative potential for the temporary floor protection sector. CV systems, utilizing site cameras, can continuously monitor high-traffic areas, identifying signs of degradation in protective layers or potential hazards (e.g., unsecured spills, misplaced heavy objects). This real-time damage assessment allows site managers to execute proactive maintenance or replacement of temporary protection, significantly minimizing the risk of expensive damage to permanent flooring beneath. Furthermore, predictive algorithms can analyze project schedules, material delivery times, and specific trade requirements to forecast the precise type and quantity of protection material needed for upcoming phases, thus optimizing inventory levels and reducing overstocking or delays.

Beyond logistics, AI tools can greatly enhance the customization and deployment of floor protection. By analyzing environmental factors, flooring material type, and site conditions (such as expected moisture levels or exposure to corrosive substances), AI models can recommend the optimal product characteristics—such as thickness, breathability, or specific slip resistance needed—for maximum effectiveness and minimal environmental impact. This shift from generic material use to precision protection reduces unnecessary expenditure on premium products where standard materials suffice, while simultaneously ensuring critical areas receive adequate safeguarding, ultimately improving profitability and adherence to project quality standards.

- AI-driven supply chain forecasting minimizes inventory holding costs and prevents project delays due to material shortages.

- Computer Vision systems enable real-time monitoring of protection material integrity and flag high-risk damage areas instantly.

- Predictive analytics optimize material selection based on construction phase, underlying surface type, and environmental variables.

- AI models assist in waste optimization by calculating optimal cutting patterns and predicting the end-of-life replacement schedule for reusable materials.

- Integration of AI with Building Information Modeling (BIM) facilitates automated planning for floor protection requirements across complex structures.

DRO & Impact Forces Of Temporary Floor Protection Market

The Temporary Floor Protection Market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (I), all summarized within the DRO framework. Key drivers include the exponential growth in global residential and non-residential construction activities, particularly large infrastructure and commercial projects requiring strict asset preservation. Furthermore, increasing regulatory emphasis on construction site safety, which mandates non-slip and well-defined protective walkways, strongly propels demand. However, the market faces significant restraints, chiefly related to sustainability concerns, as many traditional protective materials are single-use plastics contributing to landfill waste, leading to pushback from environmentally conscious developers and government bodies. Material price volatility, specifically for petroleum-derived products and raw pulp, also acts as a financial constraint on manufacturers.

Opportunities within this market are centered on technological advancements and sustainability pivots. There is substantial potential in the development and commercialization of advanced, high-performance materials such as fully biodegradable films, highly durable, multi-use fiberboard, and smart protection systems that offer integrated features like moisture sensing. Furthermore, expanding the application scope into niche areas, such as the protection of historical site flooring during restoration projects or specialized cleanroom environments, presents valuable market avenues. Manufacturers capable of providing comprehensive material recycling programs or closed-loop solutions will gain a distinct competitive advantage in mature markets like North America and Western Europe where regulatory pressure favors circular economy models.

Impact forces significantly affecting the market include the fluctuating cost of raw materials (a high-intensity external force), the pace of construction technology adoption (influencing demand for specialized versus generic protection), and international trade policies impacting the supply chain of both raw materials and finished goods. The rising adoption of prefabricated construction methods (a moderating force) could potentially reduce on-site activity and thereby lower demand for intensive protection in some segments, while increasing demand for protection during transportation and installation phases. Conversely, the high cost associated with damage remediation (a persistent internal driving force) ensures that protective measures remain a non-negotiable part of modern project management budgets, solidifying the market’s fundamental resilience.

Segmentation Analysis

The Temporary Floor Protection Market is meticulously segmented based on material composition, application area, product type, and thickness, allowing for precise market evaluation and targeted product development. Understanding these segments is crucial as procurement decisions often hinge on balancing cost, durability, and specific environmental requirements (e.g., breathability or chemical resistance). The Material segment is foundational, defining key product characteristics, with Plastics (Polyethylene and Polypropylene), Fabric (Non-Woven and Woven textiles), and Fiberboard/Cardboard materials forming the primary sub-segments. Each material type is tailored for different levels of protection intensity and reuse potential. For instance, high-density polyethylene films are favored for liquid containment and dust barriers, while thick fiberboard products are mandatory for heavy impact and equipment traffic.

The segmentation by Application—Residential, Commercial, and Industrial—highlights distinct consumer behavior and product needs. The Commercial segment currently dominates the market share due to the prevalence of expensive and vulnerable finishes in office buildings, hospitals, and retail environments, necessitating higher investment in premium, often reusable, protective solutions. Conversely, the Residential segment relies heavily on low-cost, disposable options for short-term remodeling projects. Analyzing growth rates across these segments reveals a disproportionate increase in demand from the Industrial sector, where large-scale machinery and harsh conditions require robust, specialized, chemical-resistant protective mats and coverings.

Further segmentation by Product Type (Rolls, Sheets, Boards, Mats) and Thickness (Thin, Standard, Heavy Duty) provides insight into operational preferences. Rolls offer speed and efficiency for large area coverage, whereas custom-cut mats provide superior targeted protection. The trend is moving towards heavy-duty products across all application sectors, reflecting contractors' risk-aversion and the need for protection that withstands multi-trade use over extended periods. This granular segmentation aids manufacturers in tailoring their product mix and distribution strategies to efficiently meet the specialized demands of general contractors and specialized subcontractors alike.

- By Material:

- Plastic Films (Polyethylene, Polypropylene)

- Fiberboard / Corrugated Cardboard

- Fabric / Non-Woven Materials

- Rubber and Foam Mats

- Others (Plywood, Specialized Composites)

- By Application:

- Residential Construction and Renovation

- Commercial Construction (Offices, Retail, Hospitality)

- Industrial Facilities and Infrastructure (Manufacturing, Utilities)

- By Product Type:

- Roll Goods

- Sheets and Panels

- Mats and Runners

- Tapes and Adhesives

- By Thickness/Durability:

- Light Duty (Short-term, low impact)

- Standard Duty (Medium duration, typical residential/commercial)

- Heavy Duty (High impact, long-term construction traffic)

Value Chain Analysis For Temporary Floor Protection Market

The value chain for the Temporary Floor Protection Market begins with the upstream sourcing of raw materials, primarily petrochemical derivatives (for plastics), wood pulp (for fiberboard/cardboard), and various synthetic or natural fibers (for non-woven fabrics and mats). Critical to this stage is the commodity market volatility, as input costs directly dictate manufacturing expenses. Manufacturers must maintain robust relationships with major chemical and paper suppliers while increasingly exploring partnerships with recycling facilities to secure high-quality recycled input materials, addressing the growing demand for sustainable products. Efficient procurement, leveraging bulk purchase agreements and diversified supplier bases, is essential for cost stabilization in this highly price-sensitive market.

The midstream involves the core manufacturing and conversion processes, including extrusion (for plastic films), lamination (combining layers for enhanced durability and liquid resistance), and specialized coating applications (e.g., non-slip or breathable treatments). Efficiency in this stage is paramount, focusing on lean manufacturing techniques to minimize waste and maximize output customization, especially for proprietary products like high-impact fiberboards. Companies often specialize in one material type (e.g., polymer films) or focus on broad conversion capabilities to produce a wide array of final forms (rolls, sheets, custom mats). Quality control, ensuring adherence to safety standards (e.g., fire ratings and non-slip coefficients), is a critical value-add at this stage.

The downstream distribution channel is highly diversified, utilizing both direct and indirect sales methods to reach the end-user. Indirect channels, which include large national and regional construction supply distributors, industrial hardware retailers (like The Home Depot or Lowe’s), and specialized B2B trade supply companies, form the bulk of market reach due to their capacity to handle high volumes and provide last-mile logistics to construction sites. Direct sales, conversely, target large institutional clients or major general contractors, offering customized protection solutions, bulk pricing, and specialized technical support. The effectiveness of the value chain is increasingly measured by how quickly and reliably products can be delivered to fast-moving construction sites, making robust logistics networks a key competitive differentiator.

Temporary Floor Protection Market Potential Customers

The primary customer base for temporary floor protection is multifaceted, spanning professional contractors, specialty trade workers, institutional facility managers, and individual homeowners engaging in DIY projects. General contractors (GCs) represent the largest volume purchasers, as they bear the overarching responsibility for site safety and asset protection across major construction projects. Their purchasing decisions are driven by durability, speed of application, compliance with safety regulations, and the long-term cost-effectiveness of reusable products, particularly on long-duration commercial sites. GCs typically procure large quantities of heavy-duty rolls and standardized mats through major industrial distributors or directly from manufacturers to benefit from economies of scale.

A second significant segment comprises specialized trade subcontractors, such as painters, plumbers, electricians, and HVAC installers. While these trades often require smaller quantities, they need highly specific protection, such as absorbent runners for wet work or highly adhesive films for dust protection during sanding. These buyers often prioritize ease of use, disposability, and immediate availability, frequently sourcing materials from local hardware stores or specialized trade outlets. Institutional buyers, including universities, hospitals, and corporate real estate management firms, are repeat customers, requiring protection during routine maintenance, renovations, and facility upgrades, emphasizing products that are easily stored, reusable, and meet high standards for non-slip safety in operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Surface Shield, Trimaco, Protective Products, Ram Board, Indutex, ArmorPoxy, Shurtape Technologies, Pave-Guard, Pro Tect, Antinox, Floor Defender, Protectapeel, Americover, Kapro, Intertape Polymer Group (IPG), Husky Liners, Tufcoat, Rymar, Knu-V-Tures, Covalence. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Temporary Floor Protection Market Key Technology Landscape

The technology landscape in the Temporary Floor Protection Market is primarily driven by material science innovation focused on enhancing durability, functional performance, and environmental sustainability. A key technological advancement is the development of advanced non-slip coatings and proprietary adhesive formulations that ensure the protective material stays firmly in place without leaving residue or damaging the underlying finish. These advancements are crucial for maintaining site safety and preventing costly damage from shifting protection. Furthermore, material engineering focuses on multi-layered lamination techniques, creating composite products that offer superior impact resistance and liquid containment capabilities while maintaining a manageable weight for ease of handling and installation by construction crews.

Another area of intense technological focus is the creation of breathable floor protection materials. These technologies, often utilizing specialized non-woven fabrics or micro-perforated films, allow moisture vapor to escape from newly installed or cured floors (like concrete, tile setting beds, or fresh wood finishes), preventing issues like efflorescence, warping, or trapped moisture that can compromise the final flooring system. This feature is particularly valued in high-end construction projects where curing time sensitivity is a major concern. Manufacturers are leveraging polymer science to develop membranes that effectively block liquid penetration from above while allowing controlled vapor transmission from below, offering a critical balance between protection and process facilitation.

In terms of sustainability, technological efforts are directed towards the incorporation of recycled content, specifically utilizing post-consumer and post-industrial plastic and paper waste to create new protective products. The challenge lies in ensuring that the recycled products maintain the same performance metrics—such as tear resistance and waterproofing—as virgin materials. Furthermore, the development of genuinely biodegradable or compostable polymers for single-use films represents a disruptive technology, directly addressing the environmental constraints facing the market. This technological push is not only reactive to regulation but also proactive in creating a circular economy model within the construction supply sector, enhancing brand equity for innovators in this space.

Regional Highlights

North America: The North American market, comprising the United States and Canada, is characterized by high adoption rates of premium, specialized floor protection solutions, driven by stringent occupational safety regulations and high labor costs that prioritize efficiency and damage prevention. The region exhibits a strong preference for durable, reusable products, such as high-impact fiberboard and thick rubber mats, particularly in commercial and institutional remodeling sectors. Key drivers include sustained investment in commercial real estate revitalization, data center construction, and a mature infrastructure maintenance market. Furthermore, sustainability mandates are prompting contractors to select products with certified recycled content and end-of-life take-back programs, establishing North America as a leader in premium and eco-friendly floor protection solutions.

Europe: Europe is defined by its proactive focus on sustainability, high material standards, and strong regulatory pressure concerning construction waste management. Countries in Western Europe, such as Germany, the UK, and France, lead in the consumption of biodegradable and fully recyclable temporary protection materials. The demand is heavily influenced by energy-efficient building standards and a large volume of historical building restoration, which requires delicate and highly specialized floor coverings. The market is fragmented, with local manufacturers often competing on material innovation and proximity to construction sites. Eastern European nations, while experiencing rapid infrastructure growth, generally prioritize cost-effectiveness, favoring traditional plastic and low-cost paper solutions, though the trend towards sustainability is gradually penetrating these markets.

Asia Pacific (APAC): The APAC region stands out as the highest growth market globally, primarily due to explosive urbanization rates and massive governmental spending on infrastructure, residential complexes, and commercial centers across China, India, and Southeast Asia. The market here is predominantly volume-driven, with cost-effectiveness being a critical purchasing criterion. While basic plastic films and builder’s paper dominate the mass market, the rapid influx of international contractors and the development of high-end commercial properties in major metropolitan areas are simultaneously increasing demand for high-performance, quality-certified floor protection. Japan and Australia represent mature markets within APAC, mirroring Western trends towards specialized and high-quality protective systems, acting as innovation hubs within the region.

Latin America (LATAM) and Middle East & Africa (MEA): LATAM’s market growth is volatile, tied to national economic stability and large, episodic infrastructure projects, with demand concentrated in Brazil and Mexico. The market is moderately mature but highly price-sensitive, often relying on imported protective materials. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits high demand fueled by mega-project construction in hospitality, residential, and entertainment sectors (e.g., UAE and Saudi Arabia). These projects frequently involve high-end finishes, driving the need for sophisticated, durable floor protection solutions. Africa presents significant long-term potential, driven by developing infrastructure needs, though the market currently favors basic, cost-efficient protective measures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Temporary Floor Protection Market.- Surface Shield

- Trimaco

- Protective Products

- Ram Board

- Indutex

- ArmorPoxy

- Shurtape Technologies

- Pave-Guard

- Pro Tect

- Antinox

- Floor Defender

- Protectapeel

- Americover

- Kapro

- Intertape Polymer Group (IPG)

- Husky Liners

- Tufcoat

- Rymar

- Knu-V-Tures

- Covalence

Frequently Asked Questions

Analyze common user questions about the Temporary Floor Protection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sustainable alternatives to traditional plastic floor protection?

The primary sustainable alternatives include fiberboard manufactured from recycled pulp (e.g., Ram Board), reusable non-woven synthetic fabrics, and advanced protective films made from biodegradable or compostable polymers. These alternatives address environmental concerns by reducing landfill waste and utilizing recycled content.

Which application segment holds the largest market share for temporary floor protection products?

The Commercial Construction and Renovation segment holds the largest market share. This is attributed to the high value and complexity of finishes in offices, retail spaces, and healthcare facilities, necessitating substantial investment in high-quality, durable protection solutions to mitigate risk and repair costs.

How does the choice of floor protection material impact new concrete curing?

For newly poured concrete floors, the material choice is critical. Breathable protection materials, such as specific non-woven membranes or porous fiberboards, are required. These materials allow the concrete to release moisture vapor during the curing process, preventing trapped moisture that can compromise the floor's integrity and finish.

What key regulations drive the demand for non-slip temporary floor protection in North America?

Demand for non-slip temporary floor protection in North America is strongly driven by OSHA (Occupational Safety and Health Administration) standards, which mandate safe working conditions. Contractors use non-slip protection to prevent slip-and-fall accidents, reduce liability, and ensure compliance with site safety protocols across high-traffic construction zones.

What differentiates heavy-duty temporary floor protection from light-duty options?

Heavy-duty protection is characterized by superior thickness, multi-layer lamination, and higher impact absorption capabilities, designed to withstand sustained traffic from heavy machinery, scaffolding, and prolonged exposure to trade work over many months. Light-duty options are typically thinner plastic films or paper, suitable only for dust mitigation and short-term light foot traffic.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager