Tension Controllers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434209 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Tension Controllers Market Size

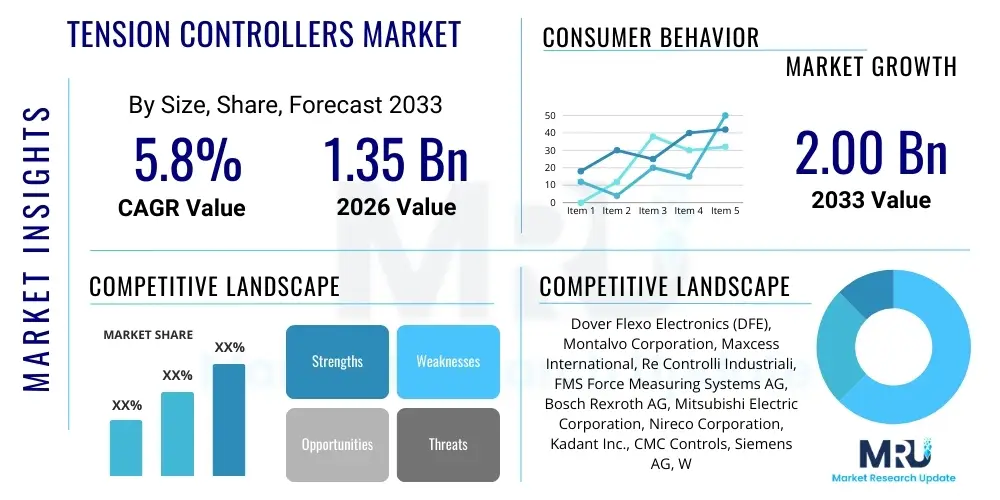

The Tension Controllers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.00 Billion by the end of the forecast period in 2033. This growth trajectory is primarily fueled by the increasing demand for high-speed, precision manufacturing processes across various industries, including packaging, printing, and converting. Modern manufacturing necessitates superior web handling capabilities to minimize material waste and optimize production throughput, making advanced tension control systems indispensable.

Tension Controllers Market introduction

The Tension Controllers Market encompasses devices and systems crucial for maintaining a precise, constant level of tension in continuous material webs, such as paper, film, foil, textiles, and wire, during processing. These controllers are essential components in machinery used for winding, unwinding, and intermediate material transport, ensuring optimal product quality, dimensional stability, and efficient machine operation. They regulate torque output to brakes or clutches, or the speed of motors, based on real-time feedback from tension sensors or load cells. The primary objective is to prevent material breaks, wrinkling, stretching, or telescoping, which are common issues in high-speed web processing.

Major applications of tension control systems span the packaging industry, where they are vital for lamination and slitting; the printing sector, particularly in flexographic and gravure printing machines; and the converting industry, which involves processes like coating, drying, and calendering. Furthermore, they are widely adopted in the production of non-woven fabrics, metal foils, and optical films, where thickness uniformity and surface quality are paramount. The benefits derived from deploying sophisticated tension controllers include significant reduction in scrap material, enhanced machine efficiency, increased production speeds, and consistent end-product quality, directly contributing to operational profitability.

The market is currently driven by several factors, notably the rapid expansion of the flexible packaging sector, demanding faster and more complex web handling capabilities. The global shift toward automation and Industry 4.0 principles, integrating smart sensors and predictive maintenance capabilities into control systems, further propels demand. Technological advancements, such as the introduction of digital signal processing (DSP) and microprocessor-based controllers offering superior accuracy and responsiveness, are also key market drivers. These modern controllers often include advanced diagnostics and remote monitoring features, aligning with smart factory initiatives worldwide.

Tension Controllers Market Executive Summary

The Tension Controllers Market is experiencing robust expansion, driven primarily by the escalating demand for high-precision manufacturing across Asia Pacific’s rapidly industrializing economies, coupled with significant technological advancements in system integration within North America and Europe. Business trends indicate a strong move towards fully automatic, closed-loop tension control systems, replacing older manual and semi-automatic systems to achieve tighter tolerances and higher operating speeds. Key market players are focusing on developing intelligent controllers equipped with adaptive algorithms capable of handling varied material characteristics and dynamic operating conditions without manual intervention, thereby enhancing overall equipment effectiveness (OEE).

Regionally, Asia Pacific maintains market dominance due to its massive manufacturing base, particularly in flexible packaging, textiles, and electronics production, offering substantial opportunities for market penetration. North America and Europe, while mature, are characterized by high adoption rates of premium, technologically advanced controllers that integrate seamlessly with existing PLC and SCADA systems, focusing heavily on predictive analytics and energy efficiency. Segment trends highlight that closed-loop systems, utilizing high-accuracy load cells and sophisticated proportional-integral-derivative (PID) control mechanisms, are the fastest-growing segment, owing to their unparalleled accuracy and stability necessary for sensitive materials like thin plastic films and specialized papers.

Furthermore, the converting and flexible packaging application segments are forecasted to exhibit the highest CAGR, spurred by consumer preference shifts towards convenience packaging and increasing e-commerce activities necessitating protective wrapping materials. The market structure remains competitive, with major global players leveraging their comprehensive product portfolios and strong global distribution networks, while niche specialists focus on offering highly customized solutions for specific high-tolerance applications, such as medical device manufacturing or specialized technical film production. Strategic mergers, acquisitions, and collaborations focused on integrating software capabilities and sensor technologies are key competitive strategies observed across the industry landscape.

AI Impact Analysis on Tension Controllers Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move tension control beyond simple reactive feedback loops, asking if AI can predict material defects before they occur and how it can optimize setpoints for complex, multi-zone web processes. Key themes revolve around the integration of predictive analytics for preemptive maintenance, the development of self-tuning controllers that adapt instantaneously to material changes (e.g., splices, temperature variations, or humidity shifts), and the application of cognitive control systems for waste reduction. Users expect AI to reduce commissioning time and operational complexity by automatically learning optimal torque curves and deceleration profiles, thereby minimizing dependence on highly skilled operators and achieving unprecedented levels of process stability in demanding environments.

- AI-powered predictive maintenance reduces downtime by analyzing load cell data, motor current, and speed fluctuations to anticipate component failures, such as bearing wear or brake degradation, ensuring continuous operation.

- Machine learning algorithms enable self-tuning capabilities, automatically adjusting PID loop parameters in real-time based on observed web behavior and external environmental variables, optimizing tension accuracy across various speeds and ramp rates.

- Cognitive tension control systems utilize ML models to predict material behavior (e.g., elasticity, elongation) dynamically, allowing for preemptive adjustments to avoid web breaks or wrinkling during high-acceleration/deceleration cycles.

- AI integration facilitates optimal setup creation by analyzing historical production data, automatically calculating ideal tension setpoints for new material recipes or complex multi-ply laminations, speeding up changeovers.

- Advanced image processing combined with ML enables non-contact tension measurement and defect detection, correlating minute tension variations with surface quality issues (e.g., mottle, uneven coating), leading to immediate process correction.

- AI optimizes energy consumption by predicting required torque with higher accuracy, minimizing excessive power draw in brake or motor systems, contributing to sustainability targets.

- Enhanced operator interface and decision support systems use AI to diagnose complex process issues quickly, providing recommended corrective actions based on pattern recognition from thousands of operational hours.

- AI-driven simulation tools allow manufacturers to model complex web dynamics and test controller responses virtually before physical deployment, reducing commissioning risk and time.

- Integration with enterprise resource planning (ERP) systems permits AI to link tension quality data directly to material batch quality reports, enabling comprehensive quality assurance and traceability across the supply chain.

- Implementation of reinforcement learning allows controllers to continuously improve their performance over time through trial and error within predefined safety parameters, surpassing the capabilities of traditional fixed-logic control systems.

DRO & Impact Forces Of Tension Controllers Market

The Tension Controllers Market is profoundly influenced by the twin forces of stringent quality demands and accelerating production speeds across the converting and packaging sectors (Drivers), balanced against significant barriers related to high initial investment costs for advanced closed-loop systems and the complexity of integration with legacy machinery (Restraints). Opportunities lie predominantly in emerging economies where manufacturing capacity is rapidly expanding, alongside the development of specialized sensors and IoT-enabled monitoring solutions tailored for smart factory environments. These forces collectively shape the market's trajectory, driving innovation toward more intelligent, precise, and user-friendly control platforms that must satisfy the growing need for minimal material wastage and maximized throughput in a highly competitive global manufacturing landscape.

Drivers: A primary driver is the pervasive demand for flawless, defect-free products, especially in high-value sectors like medical packaging, lithium-ion battery production, and high-performance optical films, where even minor tension inconsistencies are unacceptable. This demand mandates the use of highly accurate digital tension controllers. Furthermore, the global trend towards thinner, lighter, and more specialized materials, such as bio-plastics and ultra-thin foils, necessitates extremely precise and responsive control mechanisms, as these materials are inherently more sensitive to tension fluctuations. The increasing automation adoption in industrial processes worldwide, spurred by labor cost optimization and the pursuit of operational consistency, actively drives the integration of automatic tension control systems capable of 24/7 autonomous operation.

Restraints: The most significant restraint is the high capital expenditure associated with installing advanced, closed-loop tension control systems, including sophisticated load cells, advanced PLCs, and high-performance proportional valves or servo drives. For small and medium enterprises (SMEs), particularly in developing regions, this investment can be prohibitive. Another key constraint is the technical complexity involved in retrofitting modern digital tension controllers onto older mechanical or hydraulic machinery, requiring specialized engineering expertise and significant customization, often leading to prolonged installation and commissioning times. Market maturity in certain traditional manufacturing sectors in developed economies also limits explosive growth, relying instead on replacement cycles and incremental technology upgrades.

Opportunities: Substantial opportunities are emerging from the rise of specialized applications requiring ultra-high precision, such as in the manufacturing of flexible electronics, solar cell backsheets, and advanced composite materials, demanding innovation in non-contact sensing and control algorithms. The growth of industrial IoT (IIoT) platforms presents an opportunity to integrate tension controllers into comprehensive digital ecosystems, enabling remote diagnostics, real-time performance monitoring, and secure data transfer for analytical purposes. Additionally, the underserved market segment of manual systems conversion to cost-effective, semi-automatic or entry-level closed-loop solutions in developing nations represents a fertile ground for simplified, robust product offerings, expanding the total addressable market beyond premium applications.

Segmentation Analysis

The Tension Controllers Market is systematically segmented based on the level of automation, control loop type, component utilized, and the specific application industry, allowing for targeted product development and market penetration strategies. The primary segmentation distinguishes between Manual, Semi-Automatic, and Automatic controllers, reflecting varying levels of sophistication and operator involvement. The choice of controller heavily depends on the required precision, operational speed, and the inherent value of the material being processed. Manual systems, while cost-effective, are increasingly being phased out in favor of automated systems that offer consistency and integrate with modern production management systems to meet strict quality standards.

Further critical segmentation is based on the control mechanism, differentiating between Open Loop and Closed Loop systems. Closed Loop systems, which utilize precise load cell sensors to measure actual web tension in real-time and continuously adjust the actuator (brake, clutch, or motor), dominate the high-precision end of the market due to their superior dynamic response and ability to maintain tension stability regardless of changes in roller speed or material diameter. Conversely, Open Loop systems, which rely on inferred tension calculated from diameter measurements and predefined torque curves, remain relevant for cost-sensitive, less demanding applications where precise tension tolerance is not the utmost priority.

Application-wise, the Converting and Packaging industries constitute the largest segments, utilizing controllers for processes such as slitting, winding, laminating, and coating of plastic films and paper products. However, emerging high-growth segments include the battery manufacturing industry (handling electrode foils and separators) and the high-tech electronics sector (handling flexible substrates), both demanding extreme precision and highly specialized tension control solutions capable of managing ultra-thin and delicate materials without induced stress or damage. Understanding these segmental dynamics is vital for manufacturers to allocate resources effectively and tailor their technological offerings to specific industrial needs and regulatory requirements.

- By Type:

- Manual Tension Controllers: Basic, operator-dependent systems used primarily for low-speed, non-critical applications.

- Semi-Automatic Tension Controllers: Systems incorporating basic feedback mechanisms, often using dancer rolls or diameter sensors, requiring periodic operator input.

- Automatic Tension Controllers (Fully Automated): High-precision systems utilizing load cells or advanced ultrasonic sensors for continuous, real-time closed-loop control, highly adopted in high-speed converting.

- By Control Loop:

- Open Loop Tension Controllers: Control based on diameter changes or speed changes, relying on predefined torque settings, suitable for coarse tension regulation.

- Closed Loop Tension Controllers: Control based on direct tension measurement via load cells, providing superior accuracy and dynamic response, essential for sensitive materials.

- By Component:

- Tension Sensors/Load Cells: Devices measuring actual web tension; critical for closed-loop accuracy.

- Controllers/Indicators: Electronic brains that process sensor feedback and generate actuator commands.

- Actuators (Brakes, Clutches, Motors): Devices that apply the required torque (e.g., Pneumatic Brakes, Magnetic Powder Clutches, Servo Motors).

- Dancer Systems/Ultrasonic Sensors: Used for indirect or non-contact tension measurement and web position feedback.

- By Application Industry:

- Printing Industry: Used in rotogravure, flexography, and offset printing presses for high-quality registration.

- Packaging Industry: Essential for flexible packaging film converting, slitting, and lamination processes.

- Converting Industry: Includes coating, laminating, slitting, and winding of paper, film, and foil.

- Textile Industry: Used in weaving, winding, and finishing processes to prevent yarn breakage and ensure fabric consistency.

- Wire and Cable Manufacturing: Vital for ensuring precise wire diameter and uniform spool winding tension.

- Non-Woven and Technical Films: Specialized applications requiring extremely stable low-tension control.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Tension Controllers Market

The value chain for the Tension Controllers Market begins with upstream activities involving the sourcing and refinement of high-performance electronic components, sensor materials (such as strain gauges for load cells), and specialized mechanical parts necessary for actuators and robust chassis construction. Key upstream suppliers include manufacturers of microprocessors, power electronics (IGBTs, MOSFETs), and specialized magnetic powders for clutches and brakes. Differentiation at this stage relies heavily on the quality and reliability of these core components, as controller accuracy and longevity are directly tied to the performance of the embedded hardware. Suppliers often face pressure to deliver miniaturized, high-efficiency components that can withstand harsh industrial environments, characterized by vibration, heat, and contaminants.

The core manufacturing and assembly phase involves the integration of these sophisticated components into the final tension controller unit, tension sensors, and web handling systems. Midstream activities focus on software development for control algorithms, calibration, and user interface design—a crucial differentiator in the modern market. Direct distribution channels, where manufacturers sell directly to large Original Equipment Manufacturers (OEMs) of converting, printing, and textile machinery, are prevalent for complex, high-volume orders. These direct relationships involve significant technical support, customized integration services, and long-term service contracts, establishing strong partnerships necessary for integrated machinery solutions.

Conversely, indirect distribution channels rely heavily on system integrators, regional distributors, and specialized industrial equipment resellers to reach End-Users for aftermarket sales, retrofitting projects, and smaller scale upgrades. These indirect partners provide local inventory, application expertise, and immediate technical assistance, which are critical for maximizing customer reach, particularly in geographically diverse markets like Asia Pacific. The final downstream link involves providing extensive post-sale services, including calibration, software updates, predictive maintenance services, and training, which contribute significantly to the total lifetime value of the tension control solution and ensure long-term customer satisfaction and operational efficiency.

Tension Controllers Market Potential Customers

Potential customers for tension control systems are predominantly large-scale industrial processors and machinery manufacturers involved in continuous web handling operations. The primary end-users or buyers include converting companies that specialize in modifying materials like plastic films, paper, and aluminum foil through processes such as coating, slitting, laminating, and metallizing. These customers require highly accurate tension control to ensure consistent material layering, precise width tolerance after slitting, and defect-free roll formation, directly impacting the quality and saleability of their finished goods, such as flexible packaging films or adhesive tapes.

Another major segment of potential customers comprises Original Equipment Manufacturers (OEMs) of printing presses, particularly flexographic and gravure printing machine builders. These OEMs integrate tension control systems as standard components within their machinery to guarantee accurate color-to-color registration and high-speed operation, which are non-negotiable requirements for quality graphic reproduction. These buyers typically seek high-reliability, standard components that are easily integrated via industrial fieldbuses (like EtherCAT or PROFINET) and offer robust global support and availability for their machine installations worldwide.

Furthermore, specialized manufacturing sectors, including producers of technical textiles (such as carbon fiber prepregs or non-woven medical fabrics) and battery manufacturers (handling anodes, cathodes, and separators), represent high-value potential customers. These industries operate under extremely tight quality control parameters and require bespoke, highly sensitive tension controllers capable of managing extremely delicate and expensive materials. Their buying decisions are influenced not merely by cost, but primarily by system precision, traceability features, and compliance with specialized industrial standards and safety certifications, necessitating a deeper technical collaboration with the tension control supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.00 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dover Flexo Electronics (DFE), Montalvo Corporation, Maxcess International, Re Controlli Industriali, FMS Force Measuring Systems AG, Bosch Rexroth AG, Mitsubishi Electric Corporation, Nireco Corporation, Kadant Inc., CMC Controls, Siemens AG, Web Controls, Nexen Group, Inc., Tidland Corporation, ABB Ltd., Erhardt+Leimer GmbH, Eaton Corporation, Magnomatics Ltd., KEB Automation KG, Fife Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tension Controllers Market Key Technology Landscape

The technological landscape of the Tension Controllers Market is characterized by a strong shift toward digital, sensor-driven control mechanisms, moving away from older pneumatic and purely mechanical systems. A foundational technology remains the use of high-accuracy load cells, often based on strain gauge technology, which directly measure the tension force exerted by the web material. Modern advancements in this area focus on reducing sensor drift due to temperature variations and enhancing response time, enabling controllers to react within milliseconds to maintain stability during high-speed transients, such as emergency stops or rapid speed changes. Furthermore, the increasing adoption of non-contact tension sensing technologies, utilizing specialized proximity or ultrasonic sensors, is emerging for handling ultra-sensitive or sticky materials that cannot tolerate physical contact, particularly crucial in medical film production and high-purity coating lines.

Central to modern tension control is the microprocessor-based digital controller, which employs sophisticated Digital Signal Processing (DSP) and advanced control algorithms, most commonly highly optimized Proportional-Integral-Derivative (PID) control loops, often incorporating feedforward control elements. The latest generation of controllers features high-speed communication interfaces (e.g., industrial Ethernet protocols like EtherCAT, PROFINET, and Ethernet/IP) for seamless integration into industrial automation networks (IIoT architectures). This connectivity enables centralized monitoring, data logging for quality assurance, and remote diagnostics, aligning the control systems with Industry 4.0 paradigms and enabling predictive performance optimization based on real-time operational data aggregated from across the entire manufacturing floor.

Actuator technology has also seen significant evolution. While electromagnetic clutches and brakes remain standard for many unwind/rewind stations, there is a growing trend towards using high-performance, precision servo motors and drives in closed-loop systems, offering superior torque control, higher efficiency, and regenerative braking capabilities. These servo systems provide exceptional control over tension, independent of speed, making them ideal for zero-speed tension holding and high-acceleration applications. Another key area is the refinement of web guiding and alignment technologies, which, while distinct from tension control, work synergistically to maintain the overall stability and quality of the web material, ensuring that tension forces are distributed evenly across the material width, preventing wrinkling and tears during complex operations.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC represents the largest and fastest-growing regional market for tension controllers, primarily driven by substantial investments in manufacturing infrastructure, especially in China, India, South Korea, and Southeast Asian nations. The region's dominance is underpinned by the massive scale of its flexible packaging, textile, and electronics manufacturing sectors, all of which rely heavily on precise web handling. The shift from manual to automatic systems is accelerating, fueled by increasing quality mandates for exported goods and domestic consumer demand for high-quality packaged products. Market growth is particularly robust in countries rapidly building capacity for lithium-ion battery components and specialized display films, demanding high-end closed-loop systems.

- North America (NA) Technological Leadership: North America is characterized by high adoption rates of advanced, high-cost tension control solutions, prioritizing integration, data analytics, and high reliability. The market here is mature but driven by replacement cycles and the strong presence of specialized manufacturing, including aerospace composites, pharmaceutical packaging, and high-performance films. Key demand drivers include regulatory compliance requiring superior process validation and the need for seamless integration into complex MES (Manufacturing Execution Systems) and ERP platforms, fostering demand for controllers with open communication protocols and comprehensive diagnostic capabilities.

- Europe Market Maturity and Standardization: Europe holds a significant market share, characterized by its focus on precision engineering, energy efficiency, and adherence to rigorous EU standards for machinery and safety. Countries like Germany and Italy, being hubs for high-end printing and converting machinery manufacturing, dictate key technological trends. The European market exhibits strong demand for highly energy-efficient actuators (e.g., permanent magnet motors) and controllers capable of detailed energy monitoring. The emphasis is on modernization, replacing older mechanical systems with digital closed-loop controls to enhance sustainability and manufacturing agility.

- Latin America (LATAM) and Middle East & Africa (MEA) Emerging Markets: These regions represent emerging markets with increasing potential, driven by regional industrialization and localized manufacturing growth, particularly in packaging and basic textiles. LATAM, led by Brazil and Mexico, is seeing steady demand for semi-automatic and entry-level closed-loop controllers as local companies upgrade facilities to compete globally. MEA market growth is concentrated in the Gulf Cooperation Council (GCC) states due to diversification efforts away from oil, focusing on food processing and basic converting operations, creating opportunities for robust, cost-effective tension control solutions that offer ease of maintenance and reliable local support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tension Controllers Market.- Dover Flexo Electronics (DFE)

- Montalvo Corporation

- Maxcess International (including Tidland, Fife, and Magpowr brands)

- Re Controlli Industriali

- FMS Force Measuring Systems AG

- Bosch Rexroth AG

- Mitsubishi Electric Corporation

- Nireco Corporation

- Kadant Inc. (Focusing on web handling components)

- CMC Controls

- Siemens AG

- Web Controls

- Nexen Group, Inc.

- ABB Ltd.

- Erhardt+Leimer GmbH

- Eaton Corporation

- A&D Weighing

- KEB Automation KG

- Wichita Clutch (A Regal Rexnord Brand)

- Comptrol Incorporated

Frequently Asked Questions

Analyze common user questions about the Tension Controllers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between open-loop and closed-loop tension controllers?

Closed-loop tension controllers offer superior accuracy by utilizing load cells to directly measure the actual web tension in real-time, continuously adjusting actuator torque based on immediate feedback. Open-loop systems, conversely, estimate tension based on calculated parameters like roll diameter and speed, making them less precise and suitable primarily for non-critical, lower-speed applications.

Which industry applications drive the highest demand for advanced tension control systems?

The highest demand for advanced systems stems from the converting and flexible packaging industries, particularly for processes involving lamination, high-speed slitting, and coating of thin films. Additionally, specialized manufacturing sectors like lithium-ion battery component production and high-tech display film manufacturing require ultra-precise tension stability due to the sensitivity and value of the materials used.

How does the integration of Industry 4.0 affect the functionality of modern tension controllers?

Industry 4.0 integration enables tension controllers to utilize high-speed industrial Ethernet protocols for seamless communication with MES and ERP systems, facilitating centralized monitoring, remote diagnostics, and real-time data logging. This connectivity supports predictive maintenance and allows for the application of AI/ML algorithms to achieve self-tuning and dynamic process optimization.

What are the typical components required for a complete automatic closed-loop tension control system?

A complete automatic closed-loop system generally requires three core components: high-accuracy tension sensors (load cells) installed near the roller; a digital controller unit to process the sensor signal and execute control algorithms; and an actuator (such as a precision pneumatic brake, magnetic clutch, or servo motor/drive) to apply the calculated torque to the web roll.

What major restraining factors impede market growth in developing regions?

Market growth in developing regions is often restrained by the high initial capital expenditure required for advanced closed-loop systems, limiting adoption among SMEs. Furthermore, the lack of widespread specialized technical expertise for sophisticated system commissioning, calibration, and maintenance acts as a significant barrier compared to the availability of such services in established markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tension Controllers Market Statistics 2025 Analysis By Application (Paper Industry, Printing Industry, Textile Industry, Others), By Type (Automatic Tension Controller, Semi- Automatic Tension Controller, Manual Tension Controller), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Tension Controllers Market Statistics 2025 Analysis By Application (Paper Industry, Printing Industry, Textile Industry), By Type (Automatic Tension Controller, Semi- Automatic Tension Controller, Manual Tension Controller), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager