Terahertz Imaging Detection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432181 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Terahertz Imaging Detection Market Size

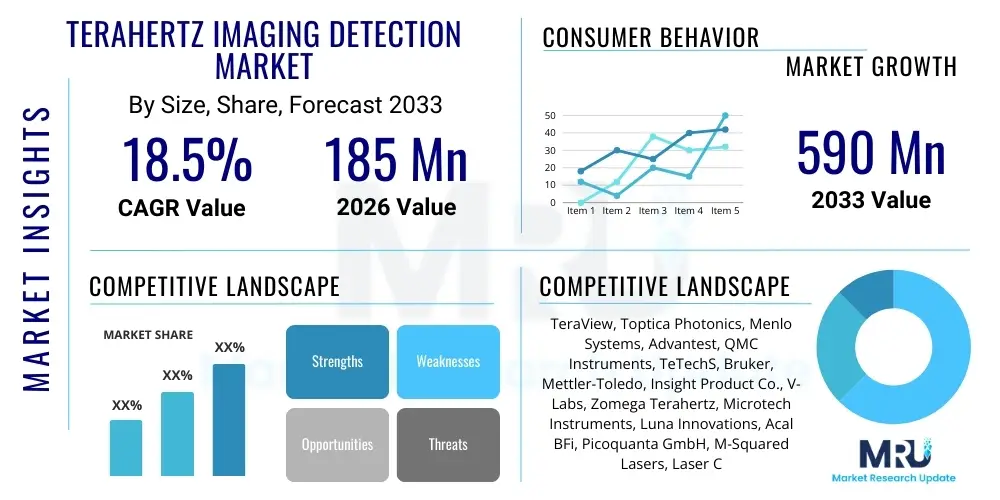

The Terahertz Imaging Detection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 590 Million by the end of the forecast period in 2033.

Terahertz Imaging Detection Market introduction

The Terahertz (THz) Imaging Detection Market encompasses technologies utilizing electromagnetic radiation in the range between microwaves and infrared light (0.1 THz to 10 THz) for generating images and spectral data. This unique spectral region, often termed the "THz gap," offers distinct advantages, particularly its non-ionizing nature, making it safe for biological tissues and sensitive materials, and its ability to penetrate common non-polar dielectric materials like plastics, fabrics, and ceramics. The core products include sophisticated THz sources (such as Quantum Cascade Lasers and Photoconductive Antennas), high-sensitivity detectors (like bolometers and Schottky diodes), and fully integrated imaging systems designed for specific vertical applications.

Major applications driving market expansion span several high-stakes sectors, including Nondestructive Testing (NDT) and quality control in manufacturing, advanced security screening for concealed items, biomedical diagnostics, and pharmaceutical inspection for content uniformity and coating thickness. The inherent capabilities of THz waves to characterize material properties—identifying crystalline structures, moisture content, and layered defects—position this technology as a critical tool for inspection where conventional X-ray or optical methods are insufficient or detrimental. The primary benefit of adopting THz technology lies in its combination of high spatial resolution, material specificity via spectroscopy, and operational safety.

Driving factors propelling market growth include increasing global concerns regarding homeland security necessitating advanced screening solutions, stringent quality assurance requirements in the electronics and aerospace industries, and the continuous miniaturization and cost reduction of THz components. Furthermore, significant research and development investments aimed at overcoming technical limitations, such as the low power output of ambient temperature THz sources and the complexity of real-time data processing, are accelerating commercial viability and industrial adoption across diverse end-use sectors globally.

Terahertz Imaging Detection Market Executive Summary

The Terahertz Imaging Detection Market is undergoing rapid commercialization, moving from niche laboratory usage to integrated industrial solutions, characterized by significant investment in improving system portability and robustness. Business trends indicate a strategic shift among key players toward developing more affordable, high-power solid-state sources and integrating advanced computational imaging techniques to enhance resolution and speed. A primary focus remains on standardizing protocols for Non-Destructive Testing (NDT) in composite materials, electronics packaging inspection, and real-time pharmaceutical quality control. Mergers, acquisitions, and strategic partnerships between THz component manufacturers and industrial automation providers are defining the competitive landscape, aiming to deliver turnkey inspection systems ready for high-volume manufacturing environments. This drive towards automation integration is critical for overcoming the initial high cost barrier associated with early-generation THz systems.

Regionally, North America maintains market leadership, largely due to extensive governmental funding for advanced security screening technologies and robust R&D infrastructure supporting fundamental THz physics and engineering advancements. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by rapidly expanding manufacturing bases (especially in consumer electronics, automotive components, and pharmaceuticals) in countries like China, Japan, and South Korea, which necessitate cutting-edge, non-contact quality inspection methods. Europe demonstrates sustained growth, driven primarily by strong regulatory requirements for drug quality (e.g., uniform coating inspection) and significant academic contributions toward applying THz technology in advanced biomedical diagnostics and material science research. The regional market dynamic is increasingly defined by the ability of local manufacturers to customize systems for specific industrial process requirements.

Segmentation trends highlight the imaging segment's dominance over pure spectroscopy, primarily due to high demand from security and NDT applications that require spatial mapping of defects or concealed items. Component-wise, the detector segment is experiencing rapid innovation, focusing on developing room-temperature, high-sensitivity arrays to replace costly cryogenic or high-maintenance systems, thereby improving operational efficiency. Within applications, homeland security remains a stable consumer, but the Nondestructive Testing segment, particularly for aerospace composites and semiconductor defects, is projected to exhibit the steepest growth trajectory, reflecting the increasing material complexity in high-value manufacturing sectors and the intrinsic capability of THz waves to probe dielectric material interiors.

AI Impact Analysis on Terahertz Imaging Detection Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Terahertz Imaging Detection Market predominantly focus on four areas: achieving real-time automated threat detection in security screening, enhancing image quality and signal interpretation in noisy industrial environments, automating defect classification in NDT, and integrating multispectral THz data with other modalities (data fusion). Users are keenly interested in how machine learning can overcome the inherent challenges of low signal-to-noise ratios (SNR) typical of some THz systems and how deep learning algorithms can drastically reduce the false alarm rate (FAR) in high-throughput applications, which is currently a bottleneck for widespread deployment. The collective expectation is that AI will transform THz systems from complex analytical tools requiring expert interpretation into robust, autonomous detection and classification platforms.

The application of AI, particularly deep convolutional neural networks (CNNs), is fundamentally altering the data processing pipeline within THz imaging systems. By training algorithms on large datasets of spectroscopic and spatial data, systems can now automatically differentiate between subtle material variations, detect subsurface flaws in composite materials with unprecedented accuracy, and rapidly identify specific chemical signatures (e.g., explosives, counterfeits) without manual analysis. This shift significantly reduces operational complexity, making THz technology accessible to non-expert operators and enabling its deployment in high-speed production lines. Furthermore, AI is crucial for reconstructing high-resolution images from sparsely collected data (compressive sensing), drastically cutting down the required acquisition time and data volume, which is vital for developing portable, battery-operated devices.

The integration of advanced machine learning techniques facilitates predictive maintenance and self-calibration for THz hardware, optimizing system performance and longevity. Specifically, Reinforcement Learning (RL) can be employed to automatically adjust THz pulse parameters (power, frequency range) in real-time to maximize penetration depth or spectral specificity based on the material being inspected, a capability impossible to manage manually. This level of autonomy ensures optimal performance in variable environmental conditions and accelerates the development cycle of application-specific THz routines, solidifying AI as an enabling technology that transitions THz imaging from scientific novelty to practical, commercially viable industrial standard.

- AI-powered enhancement of image resolution and removal of artifacts in real-time industrial inspection.

- Deep Learning models enabling automated, high-speed classification of materials and identification of subsurface defects (e.g., delamination, voids) in composite structures.

- Reduction of False Alarm Rates (FAR) in airport security screening through trained neural networks analyzing spectral signatures of concealed items.

- Accelerated data processing for Terahertz Time-Domain Spectroscopy (THz-TDS) to extract specific material parameters (thickness, density) instantaneously.

- Implementation of AI for computational imaging and sparse data reconstruction, leading to faster data acquisition and miniaturized system design.

- Predictive maintenance and self-calibration of THz sources and detectors using machine learning algorithms.

DRO & Impact Forces Of Terahertz Imaging Detection Market

The Terahertz Imaging Detection Market is dynamically shaped by a balance of powerful drivers, significant restraints, and emerging opportunities. The primary driver is the unique ability of THz radiation to penetrate opaque non-conducting materials while offering spectroscopic identification, making it indispensable for non-contact, non-destructive quality control in high-tech manufacturing and complex security environments. Simultaneously, a key restraint remains the high cost and complexity of current high-power, room-temperature THz sources, coupled with the difficulty in obtaining sensitive, wide-area focal plane arrays that operate outside of cryogenic temperatures. The market's potential opportunity lies in the rapid expansion of 5G/6G technology components and additive manufacturing (3D printing), both of which require precise, in-line inspection of internal structures and defects at the micron level, a niche perfectly suited for THz technology.

Impact forces currently influencing the market trajectory include technological maturity and regulatory acceptance. The shift towards solid-state sources, such as resonant tunneling diodes (RTDs) and micro-electro-mechanical systems (MEMS)-based emitters, is improving system integration and reducing size, thereby making portable and handheld THz systems feasible—a major force enhancing market accessibility. However, standardization is lagging; the lack of universally accepted industrial standards and regulatory frameworks for THz inspection protocols hinders rapid adoption, particularly in highly regulated sectors like pharmaceuticals and aerospace, acting as a frictional force. The ongoing global tension concerning homeland security and contraband detection provides a consistent, high-impact external driver for research and deployment of advanced THz screening systems in critical infrastructure.

Furthermore, the competitive dynamic is heavily influenced by intellectual property surrounding novel detection schemes (e.g., highly sensitive plasmonic detectors) and advanced computational algorithms necessary for effective image interpretation, which dictate market share among specialized component manufacturers. The market's resilience against economic downturns is supported by its essential role in quality assurance, particularly in high-value goods like advanced composites and electronics. Addressing the restraint of high system cost through mass production of components and leveraging economies of scale for THz chip manufacturing will be crucial for unlocking the massive latent demand present in the broader industrial inspection sector, transforming the market structure from specialized niche to standardized industrial tool.

Segmentation Analysis

The Terahertz Imaging Detection Market is systematically segmented based on Component, Type, Application, and End-Use Industry, reflecting the varied technological deployments and end-user requirements across the global economy. Analyzing these segments is critical for understanding market dynamics and strategic resource allocation. The Component segmentation highlights the technological arms race in developing more powerful, compact, and energy-efficient THz sources and detectors, which directly dictate system performance and cost. The Type segmentation reveals the balance between systems focusing on broad-area imaging (essential for security and NDT) versus those emphasizing high-resolution material identification (spectroscopy, critical for pharma and research). This diverse segmentation landscape underscores the technology’s versatility and its ability to adapt to specialized analytical requirements across numerous vertical markets.

The Application segmentation—covering homeland security, nondestructive testing, biomedical imaging, and pharmaceuticals—demonstrates where the current and projected growth hotspots reside. While homeland security provides a robust foundational market driven by continuous governmental procurement, NDT and advanced materials inspection are becoming the fastest-growing application areas due to the increasing complexity of engineered materials requiring internal defect analysis. Simultaneously, the End-Use Industry segmentation delineates the primary consumers, with Aerospace & Defense demanding high-precision NDT for composite structures, Healthcare driving innovation in non-invasive diagnostics (e.g., skin cancer detection), and Electronics requiring high-resolution inspection of semiconductor packaging and integrated circuits. This segmentation reveals a clear trend of migration from traditional research and security applications towards mainstream industrial quality control processes.

Specific market growth strategies are dependent on successful targeting of these segmented areas. For instance, players focusing on the component segment must prioritize miniaturization and room-temperature operation to enable growth in the portable systems sub-segment. Conversely, solution providers targeting the pharmaceutical end-user must integrate spectral analysis capabilities for robust chemical quantification and homogeneity mapping, ensuring compliance with stringent regulatory standards. The market's overall expansion hinges on component suppliers achieving cost parity with existing inspection technologies (like high-frequency ultrasound or industrial X-ray) while maintaining the superior penetration and specificity offered by THz radiation, thereby maximizing market penetration across all key segments and overcoming historical barriers to mass adoption.

- By Component:

- Terahertz Sources (Quantum Cascade Lasers, Photoconductive Antennas, Backward Wave Oscillators, Electronic Devices)

- Terahertz Detectors (Bolometers, Schottky Diodes, High-Electron-Mobility Transistors, Photomixers)

- Integrated Systems (Active Imaging Systems, Passive Imaging Systems, Spectrometers)

- By Type:

- Terahertz Imaging

- Terahertz Spectroscopy (Time-Domain Spectroscopy, Frequency-Domain Spectroscopy)

- By Application:

- Homeland Security & Defense (Body Scanners, Contraband Detection, Surveillance)

- Nondestructive Testing (NDT) & Quality Control (Composite Inspection, Electronics Inspection, Packaging Integrity)

- Medical & Healthcare (Dermatology, Cancer Diagnostics, Dental Imaging)

- Pharmaceutical & Biotechnology (Pill Coating Analysis, Content Uniformity, Counterfeit Detection)

- Research & Development

- By End-Use Industry:

- Aerospace & Defense

- Automotive

- Electronics & Semiconductors

- Healthcare & Life Sciences

- Food & Agriculture

- Manufacturing & Industrial

Value Chain Analysis For Terahertz Imaging Detection Market

The Terahertz Imaging Detection market value chain begins with highly specialized upstream research and component manufacturing, focusing heavily on materials science and semiconductor fabrication. This initial phase involves the production of exotic materials required for high-performance THz sources (like specialized compound semiconductors for QCLs or low-temperature grown GaAs for PCA antennas) and the delicate fabrication of high-sensitivity detectors (such as microbolometer arrays or advanced HEMT sensors). Due to the high intellectual property content and limited number of specialized fabrication facilities (fabs), this upstream segment is characterized by high R&D intensity, significant capital investment, and specialized, often academic, expertise. Success at this stage relies on improving output power, noise characteristics, and developing room-temperature operational capability for mass-market integration, which dictates the performance ceiling and baseline cost of the final systems.

The middle segment involves system integration and software development. Here, core components are assembled into functional imaging systems, ranging from bench-top spectrometers to complex security portals or in-line industrial inspection modules. This phase demands sophisticated engineering expertise to ensure precise optical alignment, thermal management, and robust electronic control. Crucially, the differentiation occurs through software—the development of advanced image reconstruction algorithms, proprietary spectral libraries for material identification, and user-friendly interfaces (often incorporating AI/ML for automated analysis). System integrators often act as the critical link, tailoring generalized THz technology to specific end-user applications, such as optimizing a system for detecting internal flaws in aerospace carbon fiber or tuning it for mapping tablet coating uniformity in a pharmaceutical cleanroom environment.

The downstream analysis involves distribution, installation, and after-sales service, primarily catering to end-user industries such as security, manufacturing, and healthcare. Distribution channels are typically specialized: direct sales channels are employed for large, custom-engineered systems (e.g., airport scanners or production-line NDT equipment), ensuring detailed technical consultation and installation support. Indirect channels, utilizing regional distributors and system integrators with specific domain expertise (e.g., NDT specialists), handle smaller, standardized laboratory or quality control instruments. Successful downstream operations require highly trained technical support teams capable of maintaining complex hardware and updating sophisticated software algorithms, ensuring high system uptime and maximizing customer return on investment in this advanced capital equipment sector. This reliance on specialized post-sale support emphasizes the complexity and high-value nature of the final product.

Terahertz Imaging Detection Market Potential Customers

The primary potential customers for Terahertz imaging and detection systems are concentrated in sectors requiring non-contact, non-destructive internal inspection or material characterization where visible light is ineffective and ionizing radiation (X-rays) is undesirable. High-value manufacturers, particularly within the Aerospace and Defense industry, represent significant buyers. They utilize THz systems for quality assurance of carbon fiber reinforced polymers (CFRPs), inspecting for critical manufacturing defects like porosity, foreign inclusions, or delaminations that compromise structural integrity. These customers prioritize high resolution, rapid scanning capabilities, and reliability, as system failures can have catastrophic operational and financial consequences. The procurement cycle in this sector is long, involving rigorous testing and certification against stringent regulatory standards before deployment.

Another major segment of buyers includes Homeland Security and Border Control agencies globally. These entities procure high-throughput THz body scanners and parcel inspection systems to detect concealed non-metallic weapons, explosives, narcotics, and other contraband. For these customers, the critical purchasing drivers are minimal false alarm rates (FAR), high throughput speed to maintain operational efficiency, and non-ionizing safety features suitable for large-scale public deployment. The shift toward passive THz imaging (detecting ambient THz radiation) is increasingly favored by security agencies for covert surveillance and long-range detection, reflecting the need for less intrusive, always-on monitoring solutions in complex security environments.

The third substantial customer base resides within the Healthcare and Pharmaceutical industries. Pharmaceutical companies purchase THz spectrometers and imaging systems to perform critical quality control checks, such as verifying the thickness and uniformity of tablet coatings, analyzing the crystalline structure of active pharmaceutical ingredients (APIs), and detecting counterfeit medications. In healthcare, biomedical researchers and specialized clinics are emerging buyers, utilizing THz technology for non-invasive diagnostics, particularly in ophthalmology and dermatology (e.g., burn depth assessment, early-stage skin cancer margin delineation). These customers value the system's ability to provide label-free, chemically specific information without damaging delicate biological samples, necessitating systems that offer high spectral resolution and excellent water absorption compensation capabilities for biological applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 590 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TeraView, Toptica Photonics, Menlo Systems, Advantest, QMC Instruments, TeTechS, Bruker, Mettler-Toledo, Insight Product Co., V-Labs, Zomega Terahertz, Microtech Instruments, Luna Innovations, Acal BFi, Picoquanta GmbH, M-Squared Lasers, Laser Components GmbH, Gentec Electro-Optics, BATOP GmbH, and AEM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Terahertz Imaging Detection Market Key Technology Landscape

The technology landscape of the Terahertz Imaging Detection Market is defined by intense innovation across source generation, detection schemes, and integration capabilities, primarily aimed at bridging the "THz gap" efficiently and affordably. Currently, THz sources rely on both electronic and photonic methods. Photonic sources, such as Terahertz Time-Domain Spectroscopy (THz-TDS) systems based on femtosecond lasers driving photoconductive antennas (PCAs), offer excellent bandwidth and high spectral resolution, making them dominant in research and detailed spectroscopy applications. Conversely, electronic sources, including resonant tunneling diodes (RTDs) and electronic multipliers, are increasingly favored for high-power, continuous-wave (CW) imaging applications, especially in industrial settings and security portals, due to their potential for room-temperature operation, robustness, and lower long-term maintenance costs. The transition toward solid-state, high-power sources like Quantum Cascade Lasers (QCLs), particularly those operating at or near room temperature, is a major technological focus, promising the miniaturization and cost reduction necessary for truly widespread commercial adoption.

Detection technology is equally crucial, with advancements focusing on maximizing sensitivity and enabling rapid, large-area imaging. Traditional approaches use sensitive, often cryogenically cooled bolometers, providing high performance but imposing significant operational overhead. The market is aggressively pursuing alternatives, including room-temperature microbolometer arrays (adapted from thermal imaging), Schottky diode detectors, and specialized high-electron-mobility transistor (HEMT) arrays, which are compatible with standard semiconductor fabrication processes. These innovations directly address the industrial requirement for fast, real-time imaging systems capable of integration into production lines operating at hundreds of units per minute. Furthermore, plasmon-enhanced detection methods and novel metamaterial-based sensors are being researched to significantly enhance the interaction between THz waves and the sensing element, promising a paradigm shift toward ultra-sensitive, chip-scale detectors that can operate effectively even with low-power THz illumination.

A third, highly impactful technological pillar is the evolution of computational THz imaging (CTHI) and system integration. Since THz lenses and optics are often large and expensive, computational methods, including synthetic aperture imaging and various phase retrieval algorithms, are used to enhance spatial resolution beyond the physical limits of the optics, or to construct high-quality images from minimal data acquisition points. This computational shift is vital for developing compact and handheld THz systems. Furthermore, integrating THz modules onto flexible substrates and developing robust packaging to protect sensitive components from industrial environments (dust, temperature fluctuations) is critical for system reliability. The convergence of AI algorithms with these advanced CTHI techniques is establishing a new standard, where the system’s ability to generate high-fidelity, actionable data relies more on sophisticated signal processing than purely on hardware performance, thereby democratizing access to high-performance THz analysis.

Regional Highlights

- North America: This region holds the largest market share, driven primarily by extensive defense and security investments. The US government and Department of Homeland Security are major consumers, funding massive R&D projects through institutions like DARPA and NIST, focusing on advanced concealed weapons detection and bio-chemical sensing. The market benefits from a mature ecosystem of highly specialized component manufacturers, research universities, and strong venture capital support targeting commercialization in the aerospace, NDT, and semiconductor inspection sectors. The presence of key players and early adoption of THz-TDS in pharmaceutical R&D labs solidify its leading position, emphasizing high-performance, high-cost solutions.

- Europe: Europe represents a mature market with significant growth opportunities, particularly in industrial quality control and biomedical applications. Strict pharmaceutical regulations drive the adoption of THz spectroscopy for quality assurance (e.g., coating thickness measurement). Germany, the UK, and France are hubs for THz technology, supported by strong institutional funding (e.g., Horizon Europe programs) promoting industrial automation and smart factory integration. European focus leans heavily towards precision engineering, resulting in high demand for accurate NDT systems for automotive lightweight composites and advanced electronics packaging inspection. The market is characterized by a high degree of collaboration between academic research centers and industrial manufacturing end-users.

- Asia Pacific (APAC): APAC is the fastest-growing market, projected to capture substantial market share over the forecast period. This growth is fueled by rapidly expanding high-volume manufacturing sectors, particularly in China, South Korea, and Japan, which require sophisticated quality control. Key drivers include massive production of consumer electronics, automotive components, and the expanding semiconductor industry, necessitating high-speed, non-contact inspection of integrated circuits and complex multilayer assemblies. Governments in this region are actively investing in domestic security infrastructure and domestic component manufacturing capabilities, shifting the regional dynamics from primarily importing systems to developing localized, cost-effective THz solutions tailored for high-throughput factory environments.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets for THz technology. Growth is sporadic but concentrated in areas requiring advanced security infrastructure (airports, critical energy infrastructure) and specialized mining/petrochemical applications. MEA, particularly the GCC countries, shows high potential due to investments in modernizing defense and security systems. Latin America's adoption is slower, focusing mainly on agricultural and specific industrial quality control applications. The limited availability of specialized technical expertise and high import duties currently restrain rapid market penetration, but ongoing infrastructure modernization projects are paving the way for future system integration, initially focusing on standardized security screening systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Terahertz Imaging Detection Market.- TeraView

- Toptica Photonics AG

- Menlo Systems GmbH

- Advantest Corporation

- QMC Instruments Ltd.

- TeTechS Inc.

- Bruker Corporation

- Mettler-Toledo International Inc. (Through product lines)

- Insight Product Company

- V-Labs SAS

- Zomega Terahertz Corp.

- Microtech Instruments Inc.

- Luna Innovations Incorporated

- Acal BFi

- Picoquanta GmbH

- M-Squared Lasers Ltd.

- Laser Components GmbH

- Gentec Electro-Optics, Inc.

- BATOP GmbH

- AEM (Advanced Electronic Materials)

Frequently Asked Questions

Analyze common user questions about the Terahertz Imaging Detection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Terahertz imaging over traditional X-ray or optical inspection methods?

Terahertz (THz) imaging is non-ionizing, ensuring safety for biological samples and personnel, unlike X-rays. Unlike optical methods, THz waves penetrate common non-polar opaque materials (plastics, ceramics, cardboard, clothing), allowing for subsurface defect detection, internal structure analysis, and material characterization based on specific spectral signatures.

How is Artificial Intelligence (AI) influencing the commercial viability of Terahertz systems?

AI, specifically deep learning, enhances commercial viability by enabling high-speed, automated interpretation of complex THz data, overcoming the challenge of low signal-to-noise ratios. AI algorithms automate defect classification, significantly reduce false alarm rates in security, and are essential for real-time computational image reconstruction in portable systems, making the technology user-friendly and faster.

Which component segment is experiencing the most significant innovation for market expansion?

The Terahertz Sources segment is undergoing intense innovation, particularly focusing on developing compact, solid-state, room-temperature sources like Quantum Cascade Lasers (QCLs) and specialized electronic emitters. Success in this area is critical for reducing the high cost, improving portability, and increasing the power output required for mainstream industrial and security applications.

What is the main application of Terahertz technology in the pharmaceutical industry?

In the pharmaceutical industry, the primary application is quality control (QC), specifically Terahertz Pulsed Imaging (TPI) for analyzing the thickness and homogeneity of tablet coatings and capsular shells. It is also vital for non-contact, non-destructive analysis of Active Pharmaceutical Ingredient (API) polymorphism and content uniformity within formulations, ensuring compliance with regulatory standards.

What major restraint must be overcome for Terahertz systems to achieve mass industrial adoption?

The major restraint is the high capital cost of fully integrated THz systems, largely driven by the expense and complexity of high-power, broadband THz sources and sensitive detectors. Overcoming this requires achieving economies of scale in component manufacturing and standardizing industrial protocols to ensure reliable, verifiable performance in harsh factory environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager