Terahertz Imaging System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435309 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Terahertz Imaging System Market Size

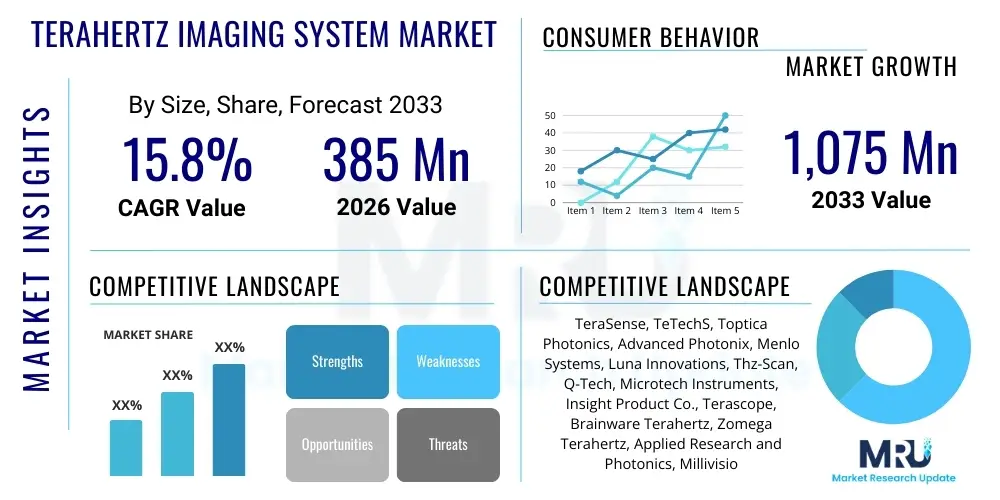

The Terahertz Imaging System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $385 Million in 2026 and is projected to reach $1,075 Million by the end of the forecast period in 2033.

Terahertz Imaging System Market introduction

The Terahertz (THz) Imaging System Market encompasses advanced technologies utilizing electromagnetic radiation in the range between microwaves and infrared light (0.1 THz to 10 THz). These systems offer unique advantages over conventional imaging methods, particularly due to the non-ionizing nature of T-rays, allowing for safe penetration through opaque materials such as plastics, ceramics, and textiles, while being highly sensitive to water content and chemical composition. This capability positions THz systems as crucial tools for non-destructive testing (NDT), quality control, and concealed threat detection across diverse industries. The technology is rapidly maturing, moving from highly specialized laboratory instruments to robust, compact commercial units suitable for integration into industrial production lines.

Products within this domain include pulsed time-domain spectroscopy (TDS) systems, continuous-wave (CW) imaging systems, and quantum cascade laser (QCL) based sources. Major applications span security screening (detecting weapons or explosives concealed under clothing), pharmaceutical quality control (analyzing tablet coatings and crystal structures), industrial inspection (identifying flaws in composites and polymers), and medical diagnostics (imaging skin cancer or dental issues). The inherent ability of THz waves to provide both morphological and spectroscopic information simultaneously offers a distinct advantage in material characterization, driving adoption in high-stakes manufacturing and defense sectors.

Market growth is predominantly driven by increasing global mandates for enhanced security screening at airports and critical infrastructure points, coupled with the rising demand for sophisticated quality assurance tools in advanced manufacturing, particularly in aerospace and automotive composites. Furthermore, significant investment in research and development aimed at miniaturizing THz components, improving system speed, and reducing overall cost is lowering the barriers to entry for smaller enterprises and expanding the application scope into consumer electronics testing and food inspection. The exceptional material contrast provided by THz frequencies, which often surpasses X-ray capabilities for organic materials, solidifies its indispensable role in future inspection protocols.

- Product Description: Systems utilizing electromagnetic radiation between 0.1 THz and 10 THz for non-contact, non-ionizing material inspection and imaging.

- Major Applications: Security screening, non-destructive testing (NDT), pharmaceutical quality control, biomedical imaging, and industrial process monitoring.

- Key Benefits: Non-ionizing radiation, high penetration depth through non-polar materials, spectroscopic capability for chemical identification, and enhanced material contrast compared to visible or infrared light.

- Driving Factors: Increasing demand for high-speed, accurate NDT in manufacturing; growing global security concerns necessitating advanced threat detection; and technological breakthroughs leading to miniaturized and cost-effective THz sources.

Terahertz Imaging System Market Executive Summary

The Terahertz Imaging System Market is experiencing robust expansion fueled by cross-sectoral adoption, transitioning from niche academic use to essential industrial deployment. Current business trends indicate a strong shift towards developing integrated, real-time THz imaging solutions compatible with Industry 4.0 environments, emphasizing automation and data analytics. Key stakeholders are focusing R&D efforts on improving detector sensitivity and increasing the overall throughput of systems, addressing the historical limitation of slow acquisition speed. Furthermore, strategic alliances between system manufacturers and semiconductor developers are accelerating the commercialization of chip-scale THz components, which are vital for portable and handheld devices, thereby significantly broadening market accessibility and applicability.

Regionally, North America and Europe maintain dominance, driven by substantial defense budgets, stringent quality standards in aerospace, and mature research infrastructure. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, primarily attributed to rapid industrialization in countries like China, Japan, and South Korea, particularly in semiconductor manufacturing and consumer electronics testing, where defect detection is critical at micron levels. Government initiatives supporting technological advancements in these developing economies, coupled with increasing investments in smart factory implementations, are creating fertile ground for the deployment of advanced THz inspection equipment.

In terms of segmentation, the market for Active THz Systems (which use an internal radiation source) holds a significant share due to their superior signal-to-noise ratio and control, making them suitable for demanding industrial NDT applications. Conversely, the high potential application segment remains NDT & Quality Control, specifically for multilayered structures and advanced composite materials, followed closely by the fast-growing security segment. The shift from stand-alone laboratory instruments to in-line monitoring systems represents a crucial segmental trend, indicating market maturity and the successful adaptation of THz technology for high-volume, continuous manufacturing environments.

- Business Trends: Focus on integrating THz systems with robotics and automated inspection platforms; increased investment in developing high-speed, compact THz components; growing emphasis on real-time data processing and spectral analysis capabilities.

- Regional Trends: Dominance of North America and Europe due to high defense and R&D spending; fastest growth anticipated in APAC, driven by electronics manufacturing and pharmaceutical stringent quality standards.

- Segments Trends: Active THz systems segment maintaining leadership; NDT & Quality Control remaining the primary application area, witnessing a surge in pharmaceutical and composite material analysis.

AI Impact Analysis on Terahertz Imaging System Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Terahertz Imaging System Market revolve primarily around three core themes: enhancement of image resolution and defect classification, acceleration of data analysis throughput, and the automation of decision-making processes in high-speed inspection environments. Users are concerned with how AI, specifically deep learning, can overcome inherent technical challenges such as image noise and scattering effects often present in THz data. There is a high expectation that AI will standardize and simplify the interpretation of complex spectral data, making THz technology accessible to non-expert operators. Additionally, stakeholders frequently inquire about the feasibility of developing self-calibrating THz systems powered by AI algorithms, reducing the need for continuous manual system tuning.

The integration of AI, particularly Convolutional Neural Networks (CNNs) and other deep learning models, is fundamentally transforming the utility and efficiency of Terahertz imaging. Historically, the processing and interpretation of the massive datasets generated by THz spectroscopy and imaging systems were bottlenecks. AI algorithms now allow for automated feature extraction, rapid anomaly detection, and highly accurate classification of defects, chemical contaminants, or structural variations within tested materials. This shift moves THz systems from being mere data generators to intelligent diagnostic tools, dramatically improving efficiency in applications like pharmaceutical tablet inspection or identifying subtle delaminations in carbon fiber composites.

Furthermore, AI is instrumental in enhancing the quality of the raw THz images themselves. Techniques such as AI-driven image reconstruction and super-resolution algorithms are being deployed to mitigate signal degradation and improve spatial resolution beyond the physical limits of the hardware. This computational enhancement is critical for micro-level defect detection in semiconductor packaging and advanced electronics. Moreover, predictive maintenance and operational optimization are achieved by using machine learning to monitor the performance of THz system components (sources, detectors), ensuring prolonged uptime and reliable performance in demanding industrial settings, thus cementing AI's role as a critical enabler for the next generation of THz commercial viability.

- Improved Defect Classification: AI algorithms (e.g., CNNs) enable automated, rapid, and highly accurate identification and classification of defects, chemical impurities, and structural anomalies in complex materials.

- Enhanced Data Processing Speed: Machine learning significantly accelerates the interpretation of large spectral and spatial datasets generated by high-resolution THz systems, enabling real-time industrial deployment.

- Super-Resolution Imaging: AI-driven image reconstruction techniques enhance the spatial resolution of THz images, overcoming limitations related to diffraction and hardware constraints.

- Automated Quality Control (AQC): Facilitates the transition of THz systems into fully autonomous inspection lines, reducing reliance on manual oversight and minimizing operator variability.

- Predictive Maintenance: ML models monitor system health (sources, detectors) to predict potential failures, maximizing system uptime and reducing operational costs.

DRO & Impact Forces Of Terahertz Imaging System Market

The Terahertz Imaging System market dynamics are characterized by significant technological opportunities balanced against substantial cost and complexity restraints. The primary market driver is the unique capability of THz waves to simultaneously provide depth profiling (tomography) and chemical signature analysis (spectroscopy) in a non-destructive manner, a combination unmatched by conventional methods like X-ray or ultrasound for organic materials. This singular feature is crucial for industries requiring extreme precision in quality assurance, such as pharmaceuticals, where polymorphic forms and coating uniformity must be verified, and defense, where explosive detection requires detailed chemical profiling. The constant pressure for enhanced security measures globally also acts as a forceful driver for rapid adoption in perimeter and baggage screening.

Conversely, the high capital cost associated with advanced THz sources (like QCLs) and sophisticated detectors, coupled with the complexity of integrating these specialized systems into existing industrial infrastructure, acts as a significant restraint. Furthermore, despite recent advancements, THz systems often suffer from slower imaging speeds compared to optical or X-ray counterparts, limiting their application in extremely high-volume, high-throughput manufacturing lines. These technical hurdles require significant optimization efforts to fully unlock the market’s potential. Overcoming signal attenuation, especially in humid environments, also presents a persistent technical challenge that limits outdoor or non-climate-controlled applications.

The key opportunities lie in the expansion into new, high-growth sectors, particularly 5G/6G electronics and next-generation battery manufacturing, where THz technology is uniquely suited for quality inspection of microelectronic components and lithium-ion battery electrode uniformity. The ongoing miniaturization efforts, driven by CMOS compatibility research, promise to create affordable, portable, and array-based THz systems, thereby democratizing the technology and opening up mass-market applications in consumer health and point-of-care diagnostics. Impact forces, which are currently moderate but increasing, are primarily driven by rapid technological advancements in solid-state THz sources and the maturing ecosystem of signal processing algorithms (often AI-enhanced) that enhance image clarity and operational speed, ultimately mitigating key restraints and amplifying market drivers.

- Drivers (D): Unique non-destructive testing capabilities (spectroscopic and spatial); increasing stringency in pharmaceutical quality control (ICH guidelines compliance); rising global threat levels necessitating advanced security screening technologies; government funding for THz research and development.

- Restraints (R): High initial system cost and complexity of deployment; relatively slow imaging speeds in comparison to competing technologies; signal attenuation in high-humidity environments; limited availability of trained technical personnel for system operation and maintenance.

- Opportunities (O): Development of high-volume, low-cost commercial THz sensors using CMOS technology; expansion into advanced battery and semiconductor defect detection; emerging applications in medical diagnostics (e.g., burn depth, skin cancer detection); integration with robotics for fully automated inspection.

- Impact Forces: Moderate to High. Driven by technological breakthroughs in solid-state emitters and sophisticated AI/ML algorithms enhancing data interpretation and operational speed.

Segmentation Analysis

The Terahertz Imaging System Market is meticulously segmented based on components, type, application, and region, reflecting the diverse technological architecture and end-user requirements across the industrial, security, and medical domains. Analyzing these segments provides a clear pathway for market stakeholders to tailor product development and deployment strategies. The core segmentation by component highlights the critical distinction between high-cost, specialized sources and detectors—which drive technology innovation—and the software/control systems required for practical implementation and data analysis. The division into active and passive systems reflects fundamentally different operational principles and suitability for varying environments, with active systems dominating industrial quality control and passive systems often favored for high-sensitivity, long-range applications like astronomy and defense surveillance.

Application segmentation reveals the current commercial prioritization, with Non-Destructive Testing (NDT) and Quality Control holding the largest market share due to the immediate, high value generated in high-cost manufacturing sectors such as aerospace composites and microelectronics. The security screening sector, although facing cyclical investment trends, remains a significant segment fueled by governmental mandates for safety. Technological segmentation, primarily into Time Domain Spectroscopy (TDS) and Continuous Wave (CW) systems, denotes the trade-off between spectral resolution (TDS) and system simplicity/cost (CW). Future growth is highly dependent on the medical and biomedical sector, which currently represents a smaller share but promises high-impact growth once clinical trial hurdles are overcome and regulatory pathways are solidified.

- By Component:

- Sources (Quantum Cascade Lasers (QCLs), Photoconductive Antennas, Traveling-Wave Tubes (TWTs), Electronic Oscillators)

- Detectors (Microbolometers, Schottky Diodes, Electro-optic Crystals, Cryogenic Detectors)

- Optics and Beam Steering

- Software and Control Units

- By Type:

- Active Terahertz Imaging Systems (Requires dedicated THz source)

- Passive Terahertz Imaging Systems (Detects naturally emitted THz radiation)

- By Application:

- Non-Destructive Testing (NDT) & Quality Control (QC)

- Aerospace and Defense (Composite inspection, thermal protection systems)

- Pharmaceutical and Biomedical (Tablet coating, polymorphism analysis, wound diagnostics)

- Automotive (Paint thickness, carbon fiber integrity)

- Semiconductor and Electronics (Packaging defects, integrated circuit analysis)

- Security and Defense (Concealed weapon/explosive detection, border control)

- Research and Development (Spectroscopy, material science)

- Medical and Healthcare (Skin imaging, oncology)

- Telecommunications (6G components testing)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Terahertz Imaging System Market

The value chain of the Terahertz Imaging System Market is complex, beginning with highly specialized component manufacturing and culminating in customized system integration and post-sales maintenance. The upstream segment is dominated by R&D institutions and specialized component manufacturers focusing on high-precision THz sources and detectors, such as cryogenic sensors and advanced nonlinear crystal materials. Innovation at this stage is crucial, as the performance and cost of the final system are highly dependent on the efficiency and miniaturization achievable at the component level. Key challenges include overcoming the "THz gap" (the difficulty in generating and detecting coherent radiation efficiently in this band) and achieving mass production scalability for highly sophisticated components like QCLs or specific semiconductor antennas, which requires substantial capital investment and deep expertise in physics and material science.

The midstream section involves system integrators and original equipment manufacturers (OEMs). These entities take the high-tech components and assemble them into functional imaging platforms, developing proprietary software for image acquisition, reconstruction, and analysis—often incorporating AI algorithms for defect classification. This stage adds significant value through system engineering, calibration, and ensuring the final product meets industrial robustness and regulatory compliance standards. Distribution channels are typically a hybrid model. Direct sales are common for high-value, custom industrial installations (e.g., aerospace NDT lines), ensuring deep technical support and integration consulting. Indirect sales, leveraging specialized distributors or system integrators with strong regional footprints, are used to penetrate smaller R&D labs and generalized industrial segments.

The downstream segment encompasses the end-users—ranging from government security agencies and major pharmaceutical companies to academic research institutions. Value delivery at this stage focuses heavily on application support, training, and maintenance contracts, particularly because THz technology is relatively new and complex compared to established imaging modalities. The feedback loop from downstream users back to upstream R&D is vital for continuous product improvement, guiding manufacturers to address real-world constraints such as speed requirements, environmental resilience, and ease of operation. The dominance of direct channels in high-stakes industries highlights the need for deep collaboration between the manufacturer and the customer to ensure successful adoption and maximized ROI.

Terahertz Imaging System Market Potential Customers

Potential customers for Terahertz Imaging Systems are fundamentally categorized by their need for non-contact, non-destructive material inspection, particularly concerning internal structure, chemical composition, or concealed items. The primary buying segment is the industrial quality control sector, comprising large manufacturers in aerospace, automotive, and electronics, who rely on THz systems to ensure the structural integrity of advanced composite materials (e.g., carbon fiber prepregs) and the flawless assembly of microelectronic components. These buyers prioritize high throughput, integration capability with automated lines (Industry 4.0), and ultra-high-resolution imaging necessary for compliance and warranty reduction. Their purchase decisions are driven by the cost of failure in critical components and the need for 100% inspection rates.

A second crucial segment includes government and defense agencies responsible for national security, border protection, and aviation safety. These customers utilize THz body scanners for personnel screening and specialized handheld devices for inspecting packages and cargo for concealed threats like explosives, narcotics, or non-metallic weapons. For this segment, the buying criteria are reliability, low false-alarm rates, speed of detection, and compliance with stringent national security standards. The move towards passive THz imaging systems is particularly appealing to this customer base for long-range surveillance and covert operations due to its ability to detect naturally emitted radiation.

Finally, the pharmaceutical and biomedical sectors represent high-growth potential customers. Pharmaceutical manufacturers use THz time-domain spectroscopy (THz-TDS) to analyze tablet coating thickness, content uniformity, and the crystal structure (polymorphism) of active pharmaceutical ingredients (APIs), which directly impacts drug efficacy and patent protection. In the biomedical field, potential buyers include specialized research hospitals and clinical diagnostic labs interested in non-invasive imaging for diagnostics, such as burn depth assessment or early-stage skin cancer detection. These customers prioritize high sensitivity, specificity, and regulatory approval (e.g., FDA/EMA), driving a rigorous and often lengthy adoption cycle focusing heavily on clinical evidence and reproducibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385 Million |

| Market Forecast in 2033 | $1,075 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TeraSense, TeTechS, Toptica Photonics, Advanced Photonix, Menlo Systems, Luna Innovations, Thz-Scan, Q-Tech, Microtech Instruments, Insight Product Co., Terascope, Brainware Terahertz, Zomega Terahertz, Applied Research and Photonics, Millivision. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Terahertz Imaging System Market Key Technology Landscape

The technological landscape of the Terahertz Imaging System market is defined by continuous innovation in source generation and detection methods, striving to bridge the "THz gap" effectively. The primary technologies employed currently fall into two main categories: Time-Domain Spectroscopy (TDS) and Continuous-Wave (CW) systems. THz-TDS systems utilize ultrafast pulsed lasers and photoconductive antennas to generate and detect broadband THz pulses. These systems offer superior spectral resolution, enabling precise material identification and depth profiling (tomography). While THz-TDS offers high information content, its cost and complexity, relying on expensive femtosecond lasers, often restrict its use to R&D and high-end industrial labs. Efforts are now focused on making these pulsed systems more compact and rugged for industrial environments.

Continuous-Wave (CW) systems, conversely, use dedicated solid-state electronic sources (like frequency multipliers or resonant tunneling diodes) or photonic sources (like Quantum Cascade Lasers - QCLs) to generate narrowband radiation. CW systems are generally simpler, more cost-effective, and provide faster image acquisition, making them highly suitable for high-throughput security screening and industrial monitoring applications where spectral detail can be sacrificed for speed. The ongoing development of high-power, room-temperature QCLs is a crucial enabler for this segment, promising affordable and powerful THz sources that can replace bulky, low-efficiency gas lasers. Miniaturization through CMOS and SiGe technologies is also rapidly gaining traction, aiming to integrate THz components onto microchips for mass production.

A significant trend involves the development of large-area detector arrays, specifically uncooled microbolometers, which are driving down the cost of imaging. These arrays allow for parallel data acquisition, drastically improving frame rates and making real-time inspection feasible. Furthermore, advanced computational methods, including digital holography and synthetic aperture radar (SAR) techniques adapted for the THz band, are being integrated to enhance image quality and spatial resolution. This synergy between hardware innovation (efficient sources/detectors) and sophisticated software processing (AI-driven reconstruction) is the current technological frontier, propelling THz systems toward pervasive commercial deployment and overcoming long-standing limitations related to image clarity and acquisition speed in industrial settings.

- Time-Domain Spectroscopy (TDS): Utilizes femtosecond lasers and photoconductive antennas for broadband THz pulse generation, offering high spectral and temporal resolution, crucial for material characterization and tomography.

- Continuous-Wave (CW) Imaging: Employs electronic oscillators, multipliers, or Quantum Cascade Lasers (QCLs). CW systems are simpler, faster, and more cost-effective for high-speed industrial imaging applications.

- Advanced Sources: Focus on developing high-power, room-temperature Quantum Cascade Lasers (QCLs) and Resonant Tunneling Diode (RTD) oscillators to achieve practical, commercial source viability.

- Detector Technology: Increasing use of uncooled microbolometer arrays and Schottky diode mixers to enable fast, real-time image acquisition and reduce system operational costs compared to cryogenic systems.

- Computational Imaging: Integration of signal processing techniques, including compressive sensing, Synthetic Aperture Radar (SAR) methods, and AI/ML algorithms, to improve image reconstruction, reduce noise, and enhance resolution.

- Miniaturization: Research into CMOS and SiGe integration technologies to develop chip-scale THz components, leading to portable, handheld devices for field deployment.

Regional Highlights

North America currently dominates the Terahertz Imaging System Market, driven by robust governmental spending on defense and homeland security, particularly in the United States. Stringent regulations necessitating advanced airport and critical infrastructure screening technologies, coupled with high adoption rates in the aerospace and defense manufacturing sectors for NDT of composites, solidify the region's leading position. Furthermore, North America possesses a mature ecosystem of highly specialized component manufacturers and research universities, fueling continuous innovation in source and detector technologies. The presence of major pharmaceutical companies that adopt advanced THz-TDS for quality assurance and drug development further contributes to market concentration, as these corporations leverage THz technology to ensure compliance with strict FDA quality mandates.

Europe represents the second-largest market, characterized by significant R&D collaboration initiatives and strong industrial sectors, particularly in Germany (automotive and manufacturing) and the UK (aerospace and defense). European initiatives, often supported by EU funding frameworks, focus heavily on the industrial application of THz technology for non-destructive inspection of advanced materials, particularly in the context of the region's commitment to sustainable manufacturing and circular economy initiatives that demand precise material characterization. The European Union's focus on technological sovereignty also drives investment in homegrown THz source and system development, reducing reliance on external suppliers and fostering robust domestic competition.

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributable to massive investments in electronics, semiconductor fabrication, and consumer goods manufacturing in countries like China, South Korea, and Japan. The need for precise, non-contact inspection of integrated circuits, battery electrodes, and multilayered electronic packaging materials drives the adoption of high-resolution THz systems. Government support for industrial automation and smart factory concepts (Industry 4.0 adoption) further accelerates this trend. While APAC’s initial base market size is smaller than North America, the rapid pace of industrial scaling and increasing regional focus on security infrastructure development positions it as the key growth engine for the future market.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but present emerging opportunities. In MEA, market growth is primarily fueled by increasing expenditures on national security, especially for border control and critical infrastructure protection (e.g., oil and gas pipelines). The rising need for advanced detection capabilities for contraband and explosives drives procurement of THz screening systems by government bodies. Latin America's growth is more nascent, centering on academic research and pilot programs in industries like agriculture (food quality inspection) and regional security efforts, depending heavily on imported technology and regional economic stability for sustained expansion. The limited local manufacturing base for complex THz components necessitates reliance on international vendors, influencing pricing and deployment timelines across both regions.

- North America: Market leader; driven by defense budgets, aerospace NDT, stringent pharmaceutical quality standards, and a mature research ecosystem. High adoption of THz-TDS systems.

- Europe: Strong second market; bolstered by automotive and advanced manufacturing sectors, EU-funded R&D consortia, and focus on industrial NDT integration across high-value materials.

- Asia Pacific (APAC): Fastest growing region; driven by electronics, semiconductor manufacturing expansion, rapid industrial automation (Industry 4.0), and increasing regional security demands.

- Middle East and Africa (MEA): Emerging market; growth tied to national security investment, border control upgrades, and critical infrastructure protection in the energy sector.

- Latin America: Nascent market; concentrated in academic research, agricultural quality assurance pilot projects, and initial deployment in security screening based on governmental funding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Terahertz Imaging System Market.- TeraSense Ltd.

- TeTechS Inc.

- Toptica Photonics AG

- Advanced Photonix, Inc. (Luna Innovations)

- Menlo Systems GmbH

- Insight Product Co.

- Brainware Terahertz Information Technology Co., Ltd.

- Zomega Terahertz Corp.

- Applied Research and Photonics, Inc. (ARP)

- Microtech Instruments Inc.

- Terascope Ltd.

- Q-Tech Systems

- Millivision Technologies

- Keysight Technologies

- Advantest Corporation

- Bruker Corporation

- Hamamatsu Photonics K.K.

- Canon Inc. (through subsidiaries)

- EMCORE Corporation

- LongWave Photonics LLC

Frequently Asked Questions

Analyze common user questions about the Terahertz Imaging System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Terahertz imaging over traditional X-ray or optical methods?

Terahertz imaging is non-ionizing, making it safe for biological samples and personnel screening. It uniquely offers both internal structural information (tomography) and chemical identification (spectroscopy), providing high material contrast, especially for non-polar materials like plastics, composites, and textiles, where X-rays are often ineffective.

How does the high cost of THz systems affect market adoption?

The high capital investment, primarily driven by specialized THz sources (like QCLs) and advanced detectors, currently restricts widespread adoption to high-value industrial sectors (aerospace, pharma) and government defense agencies. However, ongoing R&D in solid-state and CMOS-based components is expected to significantly reduce costs and expand accessibility in the forecast period.

What role does Artificial Intelligence (AI) play in enhancing Terahertz Imaging?

AI, specifically deep learning, is crucial for improving system performance by accelerating the processing of massive THz datasets, enabling real-time inspection, enhancing image resolution (super-resolution techniques), and automating defect classification and spectral analysis, thereby reducing operator error and increasing throughput.

Which application segment currently generates the most demand for THz imaging systems?

The Non-Destructive Testing (NDT) and Quality Control (QC) segment generates the highest demand. This is driven by industries requiring critical integrity checks, such as aerospace (composite inspection) and pharmaceuticals (tablet coating uniformity and polymorphism analysis), where the unique spectroscopic capabilities of THz waves are indispensable.

What are the main technical hurdles limiting the mass commercialization of THz technology?

Key hurdles include the relatively slow imaging speed compared to optical technologies, significant signal attenuation in humid air, and the historical reliance on bulky and expensive components. Addressing these requires continuous innovation in higher-power, room-temperature THz sources and more efficient detector arrays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Terahertz Imaging System Market Statistics 2025 Analysis By Application (Transportation & Public Security, Industrial, Pharmaceutical & BioMedical, Others), By Type (Passive Terahertz Imaging, Active Terahertz Imaging), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Terahertz Imaging System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Passive Terahertz Imaging, Active Terahertz Imaging), By Application (Transportation and Public Security, Industrial, Pharmaceutical and BioMedical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager