Tetrabutyl Orthosilicate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438210 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Tetrabutyl Orthosilicate Market Size

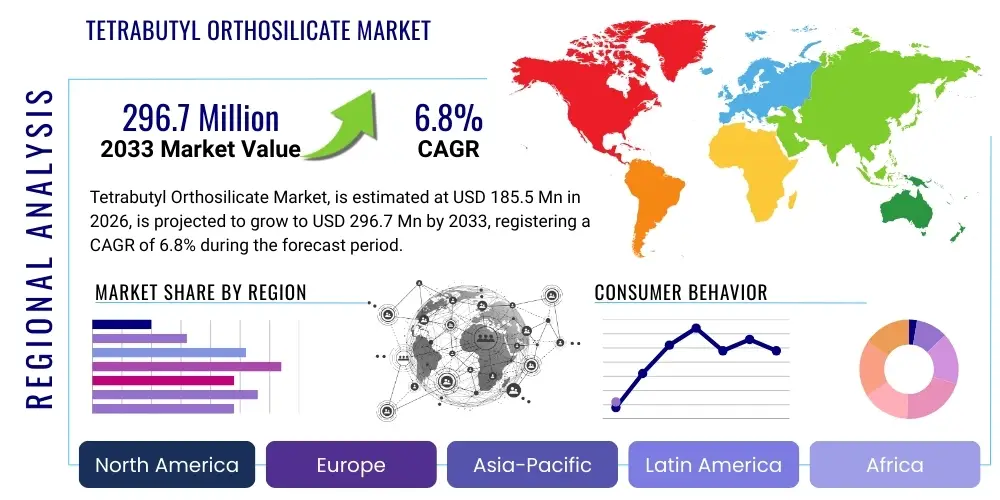

The Tetrabutyl Orthosilicate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $296.7 million by the end of the forecast period in 2033.

Tetrabutyl Orthosilicate Market introduction

Tetrabutyl Orthosilicate (TBOS), also chemically known as Tetra-n-butyl silicate, is a colorless, highly pure organosilicon compound primarily utilized as a precursor for silicon dioxide (silica) deposition, a cross-linking agent in various polymer systems, and a crucial intermediate in the synthesis of specialized silanes and siloxanes. Its high thermal stability and predictable hydrolysis characteristics make it indispensable across advanced manufacturing sectors. The core market dynamics are driven by its efficacy in producing high-performance coatings, particularly anti-corrosive and heat-resistant formulations, and its role as a key component in precision casting investment binders. The inherent versatility of TBOS allows manufacturers to achieve superior material properties, positioning it favorably within demanding industrial applications where quality and durability are paramount.

The principal applications driving the adoption of TBOS include its function as a binder in zinc-rich primers for marine and protective coatings, which require exceptional adhesion and environmental resistance. Furthermore, in the field of advanced materials, TBOS serves as a critical silicon source in Sol-Gel processing to create porous silica materials, thin films, and specialized ceramic composites utilized in electronics and aerospace. The growing demand for higher purity electronic-grade silanes and sophisticated catalytic supports further accentuates the need for high-specification TBOS, pushing producers towards optimized synthesis and purification processes. Regulatory frameworks concerning Volatile Organic Compounds (VOCs) are also indirectly benefiting TBOS, as its derivatives often offer improved environmental profiles compared to traditional organic solvents and binders.

Key market driving factors include the substantial growth of the global construction and protective coatings industries, particularly in Asia Pacific, where infrastructure development is accelerating. The rising need for effective corrosion protection in industrial equipment, pipelines, and offshore structures mandates the use of high-quality silica binders derived from TBOS. Additionally, advancements in semiconductor manufacturing and the steady expansion of the specialty chemicals sector contribute significantly to market expansion. The continuous innovation in synthesis technology aimed at increasing the yield and purity of TBOS, coupled with expanding end-user base recognition of its superior performance characteristics compared to alternative silicon sources, collectively solidifies the compound's integral position in the specialty chemical landscape and sustains its robust growth trajectory.

Tetrabutyl Orthosilicate Market Executive Summary

The Tetrabutyl Orthosilicate market exhibits strong resilience, underpinned by robust demand from the protective coatings and precision casting industries, navigating macroeconomic fluctuations through strategic diversification. Current business trends indicate a definitive shift toward higher purity grades, driven by stringent quality requirements in semiconductor manufacturing and advanced ceramics. Key players are prioritizing vertical integration to secure stable access to upstream raw materials, such as n-butanol and silicon tetrachloride, mitigating supply chain volatility and enhancing cost competitiveness. Furthermore, sustained mergers and acquisitions activity is concentrating market share among established global chemical manufacturers, fostering an environment of increased operational efficiency and technological collaboration aimed at sustainable production methodologies and novel application development, particularly in high-solid and solvent-free coating systems.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, largely fueled by aggressive infrastructure investment and the rapid expansion of industrial manufacturing sectors in China, India, and Southeast Asia. APAC serves as both the largest consumer and the primary manufacturing hub for TBOS, benefiting from lower production costs and proximity to major end-use markets, though increasing environmental compliance standards are beginning to elevate operational expenses. Conversely, North America and Europe demonstrate mature market characteristics, focusing intensely on high-value applications, such as aerospace coatings and advanced catalytic materials. Growth in these Western markets is primarily driven by R&D investments aimed at developing TBOS derivatives with enhanced functionality, adhering to strict regulatory protocols governing chemical safety and environmental impact, and favoring localized, high-purity supply chains.

Segment trends underscore the supremacy of the coatings application segment, which accounts for the largest market share due to its widespread use in corrosion protection and anti-fouling treatments across marine and industrial settings. However, the investment casting segment is poised for the highest growth rate, propelled by increasing demand for lightweight, complex metal components in automotive and aerospace applications that necessitate high-precision ceramic molds utilizing TBOS as a binder. From a grade perspective, industrial grade TBOS maintains market volume leadership, but electronic and high-purity grades are experiencing disproportionately high revenue growth, reflecting the intensifying technological demands for ultra-clean processing agents and precursors required by the rapidly expanding global electronics and display manufacturing industries.

AI Impact Analysis on Tetrabutyl Orthosilicate Market

Analysis of common user questions regarding AI's influence on the Tetrabutyl Orthosilicate market reveals significant interest centered on optimizing complex chemical synthesis processes, predicting raw material cost volatility, and enhancing product quality assurance. Users frequently inquire about AI models that can simulate reaction kinetics and identify optimal temperature and pressure profiles to maximize TBOS yield and purity, thereby reducing manufacturing waste and energy consumption. Concerns also revolve around the integration of AI-driven predictive maintenance systems to minimize downtime in high-temperature chemical reactors, a critical factor given the capital-intensive nature of TBOS production facilities. The consensus expectation is that AI tools will primarily serve to accelerate R&D cycles for novel TBOS derivatives and establish more resilient, cost-effective global supply chain logistics, allowing manufacturers to better respond to dynamic shifts in end-user demand from sectors like construction and microelectronics.

The application of Artificial Intelligence and Machine Learning algorithms is fundamentally transforming the R&D trajectory within the TBOS market by enabling high-throughput virtual screening of potential reaction pathways and catalyst selection. These analytical tools can process vast datasets related to chemical thermodynamics, kinetics, and material interaction, drastically reducing the time required for lab-based experimentation and scaling up successful formulations. Specifically, AI-driven predictive modeling is critical for understanding the parameters affecting the shelf-life and stability of TBOS under various storage conditions, which is essential for ensuring product quality for specialized, international shipments. This technological integration not only accelerates product development but also introduces a new layer of control over the consistency of large-scale chemical batches, moving the industry toward a zero-defect manufacturing paradigm.

Furthermore, AI is increasingly leveraged in supply chain management and demand forecasting for TBOS and its precursors. By analyzing global economic indicators, commodity prices, seasonal demand patterns from end-user industries (e.g., Q4 peak for construction coatings), and geopolitical risks, AI models can provide highly accurate forecasts that inform procurement strategies. This precision allows manufacturers to optimize inventory levels, reducing carrying costs while ensuring sufficient stock to meet sudden spikes in demand from sectors such as specialized aerospace components or investment casting foundries. The implementation of AI for quality control involves real-time analysis of spectroscopy and chromatography data during synthesis, immediately flagging deviations from optimal purity standards, thereby ensuring that specialized electronic-grade TBOS meets the extremely strict specifications demanded by advanced technology markets.

- AI-driven optimization of TBOS synthesis reaction conditions (temperature, pressure, catalyst concentration) to maximize yield and minimize side product formation.

- Predictive maintenance analytics applied to chemical reactors and distillation columns, reducing unplanned operational downtime and extending asset lifespan.

- Enhanced supply chain resilience through machine learning models forecasting demand shifts and optimizing raw material procurement (e.g., Silicon Tetrachloride).

- Acceleration of new specialty silane derivative development via high-throughput virtual screening and modeling of molecular interactions.

- Real-time quality control (QC) utilizing computer vision and data analytics to ensure ultra-high purity required for electronic and semiconductor applications.

DRO & Impact Forces Of Tetrabutyl Orthosilicate Market

The Tetrabutyl Orthosilicate market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive and operational landscape. A primary driver is the escalating global demand for high-performance protective coatings, particularly those offering superior corrosion resistance and longevity in harsh environments like marine and industrial infrastructure, where TBOS serves as a critical silica binder precursor. Coupled with this is the robust expansion of the investment casting industry, which relies heavily on TBOS-derived binders for manufacturing complex, precise components for aerospace and automotive sectors. Restraints, however, include the volatility and high cost of key raw materials, namely n-butanol and high-purity silicon tetrachloride, which directly impacts production economics and pricing stability. Furthermore, stringent environmental regulations surrounding certain chemical manufacturing processes and waste disposal present ongoing compliance challenges, necessitating significant capital investment in emission control technologies.

Impact forces on the market demonstrate that technology and regulatory pressure are the most potent influences. Technological advancements, particularly in Sol-Gel processing and low-VOC coating formulation, consistently create opportunities for TBOS market penetration into new sophisticated applications, such as optical materials and advanced composite manufacturing. Opportunities also arise from emerging markets, specifically rapid industrialization in Southeast Asia and parts of Africa, which are accelerating infrastructure projects and boosting the need for protective materials. Conversely, the market faces intense competitive rivalry, particularly from alternative silicate compounds like Tetraethyl Orthosilicate (TEOS), which offers lower molecular weight and sometimes lower cost, requiring TBOS manufacturers to continually demonstrate superior performance characteristics, especially regarding thermal stability and hydrolysis control, to maintain market differentiation and premium pricing.

The long-term growth trajectory of the TBOS market is fundamentally supported by its high utility in creating durable, high-adhesion materials, which aligns with global trends favoring sustainable and long-lasting industrial assets. The key opportunities lie in innovating green synthesis methods that reduce environmental footprints, thereby alleviating regulatory pressures, and in developing specialized, functionalized TBOS derivatives optimized for niche high-growth applications, such as 3D printing binders and advanced electronic encapsulants. Addressing the primary restraint—raw material cost instability—will require strategic long-term supply contracts and further exploration of bio-based or recycled input materials, securing economic viability and mitigating supply chain risks in the forecast period.

Segmentation Analysis

The Tetrabutyl Orthosilicate market segmentation provides a granular view of consumption patterns, driven primarily by product purity and specific end-use application requirements. The market is broadly categorized by Grade (Industrial Grade and Electronic Grade), Application (Protective Coatings, Investment Casting, Catalysts & Chemical Intermediates, Sol-Gel Processing, and Others), and Geography. The disparity in purity requirements heavily influences pricing and market dynamics; for instance, the Industrial Grade accounts for the highest volume consumption, predominantly in high-volume protective coating formulations, while the Electronic Grade, characterized by ultra-low metal ion content and minimal particulate matter, commands significantly higher margins due to its essential role in sensitive semiconductor manufacturing processes and optical fiber production.

Analysis by application clearly identifies the Protective Coatings sector as the dominant revenue generator. Within this segment, the marine, oil and gas, and heavy machinery sub-sectors rely on TBOS-derived zinc primers for superior corrosion resistance and adherence under extreme conditions. The Investment Casting segment, although smaller in volume, is projected to achieve the highest CAGR, propelled by the demand for complex, high-precision metal parts utilized in efficiency-critical technologies such as aerospace engines and high-end automotive turbochargers. This trend highlights a fundamental shift in market value, moving away from simple bulk applications towards specialized, performance-intensive uses where the quality and technical specification of the TBOS binder directly impact the performance and safety of the final component.

Furthermore, the chemical intermediates and catalyst segment represent a crucial, though sometimes overlooked, aspect of the market, where TBOS is instrumental in synthesizing proprietary silicone polymers, functional fluids, and novel heterogeneous catalysts required for various chemical reactions. The geographical segmentation underscores the strategic importance of the Asia Pacific region, which leverages its colossal manufacturing capacity and rapidly expanding construction market to lead global consumption. Understanding these intricate segment dynamics is critical for manufacturers to align their production capacity, R&D focus, and distribution networks to effectively capitalize on the differential growth rates and evolving quality demands across diverse end-user industries.

- By Grade:

- Industrial Grade

- Electronic Grade (High Purity)

- By Application:

- Protective Coatings and Paints (Marine, Industrial, Architectural)

- Investment Casting Binders (Aerospace, Automotive, Energy)

- Chemical Intermediates and Synthesis (Silane coupling agents, Specialty Siloxanes)

- Sol-Gel Processing (Advanced Ceramics, Thin Films)

- Others (Adhesives, Sealants, Additives)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Tetrabutyl Orthosilicate Market

The value chain for Tetrabutyl Orthosilicate commences with the complex upstream procurement of essential raw materials, primarily Silicon Tetrachloride (SiCl4) and n-Butanol. The reliability and cost of these inputs are significant determinants of the final product's cost structure, as SiCl4 manufacturing is often energy-intensive and subject to strict handling regulations, while n-Butanol prices fluctuate with petrochemical market dynamics. Manufacturers in the midstream chemical synthesis phase perform the controlled reaction to produce TBOS. This process requires specialized, high-pressure equipment and rigorous purification stages, particularly for electronic-grade material, ensuring minimal trace metal impurities. Efficiency in this synthesis stage, often utilizing continuous flow or batch processing, determines the operational profitability and scalability for TBOS producers.

Moving downstream, the distribution channel is bifurcated into direct sales to large, strategic end-users and indirect sales facilitated by specialized chemical distributors and regional agents. Direct sales typically cater to major protective coating formulators and multinational investment casting foundries that require large, recurring volumes and specific technical support tailored to their formulation needs. These relationships often involve long-term contracts and dedicated technical service agreements. Conversely, the indirect channel targets smaller, geographically dispersed users, such as specialty chemical labs, smaller ceramic manufacturers, and regional paint producers. Distributors play a crucial role in maintaining inventory, providing just-in-time delivery, and handling regulatory documentation across diverse jurisdictions, absorbing some of the logistical complexity inherent in global chemical trade.

The highest value addition occurs in the application stage, where TBOS is formulated into finished products, such as zinc-rich primers, high-performance ceramic slurries, or specialty silicone monomers. For example, in the investment casting industry, the technical know-how in creating the precise binder slurry and curing process based on TBOS hydrolysis is proprietary and critical for achieving mold stability and dimensional accuracy. Therefore, downstream application technology significantly influences the perceived value and demand for specific grades of TBOS. Effective value chain management requires robust quality assurance across all stages, from raw material sourcing (upstream analysis) to final product formulation (downstream analysis), ensuring that the high-purity specifications of TBOS are preserved until final consumption.

Tetrabutyl Orthosilicate Market Potential Customers

The primary end-users and buyers of Tetrabutyl Orthosilicate span several high-value industrial sectors requiring materials with exceptional thermal, chemical, and mechanical stability. Key customers include large global manufacturers of protective and marine coatings that incorporate TBOS derivatives into their high-performance zinc-rich primers, essential for safeguarding infrastructure assets like bridges, ships, offshore oil platforms, and industrial storage tanks against harsh corrosive environments. These customers require bulk industrial grades with consistent reactivity and long-term stability in formulation. Another critical customer segment is the investment casting foundry industry, which utilizes TBOS as a high-strength, high-purity binder in ceramic mold production, essential for creating geometrically complex and highly accurate metal components, particularly those made from superalloys for aerospace turbine blades and medical prosthetics.

Beyond the high-volume coating and casting industries, potential customers are highly diversified and include specialty chemical synthesis companies that utilize TBOS as a crucial intermediate for manufacturing functionalized silane coupling agents and advanced silicone polymers, which are later deployed in adhesives, sealants, and high-temperature lubricants. Furthermore, electronics manufacturers, particularly those involved in semiconductor fabrication and optical fiber production, represent a growing customer base for ultra-high purity, electronic-grade TBOS. These buyers demand stringent quality specifications—often measured in parts per billion (ppb) for metal contaminants—for use in deposition processes (e.g., Chemical Vapor Deposition precursors) where purity directly affects device performance and yield. Procurement cycles among these high-tech customers are often complex, involving detailed technical qualification processes and long-term strategic supply partnerships to ensure continuous quality control and supply certainty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $296.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Dow Inc., Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Gelest Inc., Momentive Performance Materials Inc., Jiangxi Chenguang New Materials Co., Ltd., Nanjing Union Chemical Co., Ltd., Guangzhou Qianyi Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Reagent Chemical & Research, Inc., K. O. Chemicals Co., Ltd., Merck KGaA, BASF SE, PCC Group, Alfa Aesar (Thermo Fisher Scientific), Hangzhou Qianfu Chemical Co., Ltd., Zhangjiagang Xinya Chemical Co., Ltd., Runhe Chemical Industry Co., Ltd., Inner Mongolia Baotou Zhongke Specialty Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tetrabutyl Orthosilicate Market Key Technology Landscape

The technological landscape of the Tetrabutyl Orthosilicate market is dominated by synthesis methods aimed at achieving high purity and efficiency, primarily through the controlled reaction of silicon tetrachloride with n-butanol. The classical industrial synthesis route involves esterification in the presence of an inert solvent, followed by distillation and purification. Current technological advancements focus heavily on optimizing this esterification process, employing highly selective catalysts and precise temperature control systems to maximize the yield of the tetra-ester and minimize the formation of undesirable partial esters and byproducts like butyl chloride and hydrochloric acid (HCl), which require subsequent intensive neutralization and separation. The shift towards continuous flow reactors, as opposed to traditional batch processes, is gaining traction for large-scale production, offering advantages in thermal management, uniformity of product quality, and significantly improved reaction throughput, directly impacting manufacturing cost effectiveness.

Purity enhancement technologies represent another crucial area of innovation, particularly for satisfying the stringent demands of the electronic-grade segment. This involves utilizing advanced, multi-stage fractional distillation techniques under high vacuum to effectively separate TBOS from trace impurities and residual solvents. Furthermore, ion exchange resins and proprietary adsorption processes are being integrated downstream to scavenge trace metal ions (e.g., Fe, Na, K, Ca) that are detrimental to semiconductor performance. Manufacturers are increasingly adopting sophisticated analytical instruments, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS), for real-time trace element analysis, ensuring that purity levels consistently meet the parts-per-billion specifications required by advanced microelectronics fabrication plants (fabs). The continuous optimization of these purification trains is essential for competitive advantage in the high-value market segments.

Finally, there is growing technological emphasis on integrating green chemistry principles into TBOS production. This includes exploring environmentally benign synthesis methods that minimize the use of hazardous solvents and reduce the generation of acidic waste. Research is underway to develop novel catalytic systems that operate under milder conditions, potentially utilizing milder alcoholysis agents or solid acid catalysts that can be easily recovered and recycled, reducing waste disposal costs and environmental impact. Furthermore, process integration and energy recovery systems are being deployed to make the overall manufacturing cycle more sustainable and cost-efficient, aligning the TBOS industry with broader corporate sustainability goals and responding proactively to tightening global environmental legislation.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the Tetrabutyl Orthosilicate market, both in terms of production volume and consumption, driven by massive investments in infrastructure development, maritime transport, and heavy manufacturing in countries like China, India, South Korea, and Japan. The region benefits from established, large-scale chemical manufacturing hubs and a high concentration of end-use industries, including automotive assembly and electronics fabrication. The demand for industrial-grade TBOS for corrosion protection coatings in coastal and industrial areas, coupled with increasing requirements for high-purity grades in the burgeoning semiconductor and display panel industries, solidifies APAC's position as the primary growth engine for the global market, experiencing the fastest growth rate throughout the forecast period.

- North America: The North American market is characterized by high demand for specialty and high-purity TBOS, predominantly driven by the aerospace and defense sectors, which utilize investment casting for critical components requiring superior material integrity and precision. While the volume market for general industrial coatings is mature, growth is sustained by rigorous maintenance cycles for oil and gas infrastructure and increasing adoption of Sol-Gel technologies in specialized optical and thermal insulation applications. Innovation in the US chemical sector, focusing on low-VOC, high-solids coating formulations, ensures a steady, albeit slower, expansion of the TBOS market, with a strong emphasis on domestic production complying with stringent environmental and safety standards.

- Europe: The European market maintains a robust demand for TBOS, primarily centered in Western European nations like Germany, Italy, and the UK, due to their advanced manufacturing base in high-end automotive, precision machinery, and specialized chemical synthesis. European consumption is highly focused on quality and regulatory compliance, favoring high-performance applications such as advanced anti-corrosion coatings and the use of TBOS as an intermediate in creating specialty chemicals and pharmaceutical precursors. Market growth is closely tied to the region’s commitment to sustainable and green chemistry, pressuring manufacturers to adopt environmentally friendly production techniques and ensuring that derived products meet REACH regulations.

- Latin America (LATAM): The LATAM market represents an emerging opportunity for TBOS, with demand primarily concentrated in industrial coatings and infrastructure protection, particularly in Brazil and Mexico, fueled by expanding energy projects and urban development. Market penetration is often challenging due to economic volatility and complex logistics, but the increasing requirement for reliable protective solutions in mining and petrochemical sectors is gradually boosting consumption. Localized manufacturing is minimal, leading to a strong reliance on imports, making this region highly sensitive to global TBOS pricing and supply chain stability.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to massive infrastructure investment in the Gulf Cooperation Council (GCC) countries, driven by diversification away from hydrocarbon dependence. Major demand sources include the construction of petrochemical facilities, desalination plants, and renewable energy infrastructure, all requiring extensive, high-durability anti-corrosion coatings derived from TBOS. The market is projected for moderate growth, though localized consumption remains low relative to APAC and Europe, with demand spikes directly correlated to the commencement and completion of large-scale, strategic government projects requiring sophisticated protective materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tetrabutyl Orthosilicate Market.- Evonik Industries AG

- Dow Inc.

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Gelest Inc.

- Momentive Performance Materials Inc.

- Jiangxi Chenguang New Materials Co., Ltd.

- Nanjing Union Chemical Co., Ltd.

- Guangzhou Qianyi Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Reagent Chemical & Research, Inc.

- K. O. Chemicals Co., Ltd.

- Merck KGaA

- BASF SE

- PCC Group

- Alfa Aesar (Thermo Fisher Scientific)

- Hangzhou Qianfu Chemical Co., Ltd.

- Zhangjiagang Xinya Chemical Co., Ltd.

- Runhe Chemical Industry Co., Ltd.

- Inner Mongolia Baotou Zhongke Specialty Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Tetrabutyl Orthosilicate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Tetrabutyl Orthosilicate (TBOS) and its primary industrial function?

Tetrabutyl Orthosilicate (TBOS) is an organosilicon chemical compound primarily functioning as a precursor for highly pure silica (silicon dioxide) and as a potent cross-linking agent. Its main industrial utility is as a binder in high-performance protective coatings, particularly zinc-rich primers for corrosion resistance, and as a critical ceramic binder in precision investment casting for aerospace and automotive components due to its controlled hydrolysis and high thermal stability.

Which application segment holds the largest market share for Tetrabutyl Orthosilicate?

The Protective Coatings segment currently holds the largest market share for Tetrabutyl Orthosilicate. This dominance is driven by the extensive use of TBOS-derived binders in industrial, marine, and architectural coatings, where superior adhesion and long-term anti-corrosive performance are non-negotiable requirements for asset protection, contributing significantly to volume demand globally.

What is the projected growth rate (CAGR) for the Tetrabutyl Orthosilicate market between 2026 and 2033?

The Tetrabutyl Orthosilicate market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033. This robust growth is primarily fueled by increasing infrastructure spending in emerging economies, coupled with escalating demand for high-purity TBOS grades in the burgeoning global electronics and semiconductor manufacturing industries.

What are the primary restraints affecting the profitability of the TBOS market?

The primary restraints include the significant volatility and associated high costs of essential upstream raw materials, such as Silicon Tetrachloride and n-Butanol, which directly impact manufacturing margins and product pricing stability. Additionally, increasingly stringent environmental regulations regarding chemical manufacturing processes and waste disposal necessitate high capital investments in compliance and green technology, posing operational challenges for producers.

Why is the Asia Pacific (APAC) region crucial for the TBOS market?

APAC is critical because it functions as the largest manufacturing and consumption hub globally for TBOS, driven by unprecedented growth in infrastructure projects, rapid urbanization, and the concentration of major electronics and automotive production facilities. The region's sheer industrial scale and ongoing expansion of construction and maritime activities ensure sustained, high-volume demand across both industrial and high-purity grades, making it the fastest-growing market geographically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager