Tetraethyl Orthosilicate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431666 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tetraethyl Orthosilicate Market Size

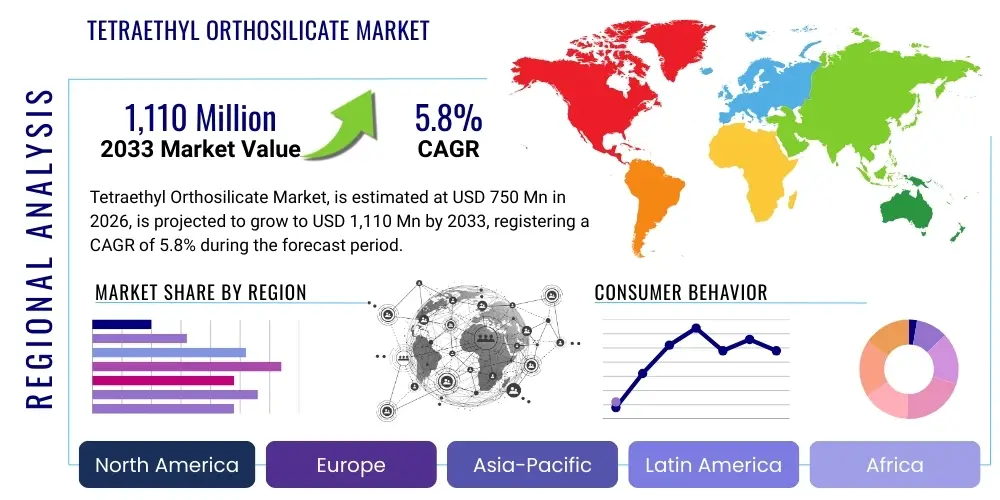

The Tetraethyl Orthosilicate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million USD in 2026 and is projected to reach $1,110 Million USD by the end of the forecast period in 2033.

Tetraethyl Orthosilicate Market introduction

Tetraethyl Orthosilicate (TEOS), chemically known as Si(OC2H5)4, is a crucial organosilicon compound utilized extensively across high-tech industries. TEOS serves primarily as a precursor for silicon dioxide (SiO2) synthesis, particularly via the sol-gel process or chemical vapor deposition (CVD). Its high purity, stability, and controlled hydrolysis rate make it an indispensable material in the fabrication of integrated circuits, optical fibers, and protective coatings. The rapid expansion of the semiconductor industry, driven by global demand for advanced consumer electronics and data infrastructure, remains the primary catalyst propelling the TEOS market forward.

The product's versatility allows for its application in diverse forms, ranging from thin-film deposition on silicon wafers to the creation of robust ceramic materials and high-performance paint additives. Key applications include the formation of insulating layers and planarization films in semiconductor manufacturing, the production of specialized glasses and ceramics requiring high purity silica content, and the development of scratch-resistant and UV-protective coatings for architectural and automotive sectors. Furthermore, its role as a cross-linking agent in silicone rubber and polymers provides foundational chemical stability in various industrial products.

Major benefits driving its adoption include excellent dielectric properties, thermal stability, and low toxicity compared to other silicon precursors. The driving factors involve stringent regulatory requirements in the semiconductor sector demanding ultra-high purity materials, increasing investment in infrastructure development that utilizes high-performance coatings, and the growing field of nanotechnology where TEOS is essential for synthesizing mesoporous silica materials and nanoparticles.

Tetraethyl Orthosilicate Market Executive Summary

The global Tetraethyl Orthosilicate (TEOS) market is poised for steady growth, characterized by significant momentum from the Asia Pacific region, particularly due to the dominance of semiconductor manufacturing in countries like China, Taiwan, and South Korea. Business trends indicate a shift towards ultra-high purity (UHP) TEOS grades, driven by shrinking feature sizes in microelectronics, demanding precursors with impurity levels measured in parts per trillion (ppt). Manufacturers are focusing on backward integration to control raw material quality and reduce production volatility, simultaneously investing heavily in sustainable synthesis routes to meet evolving environmental, social, and governance (ESG) standards. The market structure remains moderately consolidated, with key players competing intensely on product purity, supply chain reliability, and technical service capabilities tailored for sensitive end-use applications.

Regional trends clearly favor Asia Pacific, which accounts for the largest market share and is expected to exhibit the highest CAGR through 2033, benefiting from government initiatives supporting local chip production and massive foreign direct investment in electronics fabrication plants. North America and Europe, while representing mature markets, maintain strong demand primarily in high-value, niche applications such as advanced ceramics, specialized optical coatings, and high-reliability aerospace components. These regions are focused on innovation and R&D, often utilizing TEOS in developing next-generation battery technologies and lightweight composite materials for automotive electrification.

In terms of segment trends, the Purity segment is witnessing robust growth in the 99.9% and above category, directly reflecting the stringent requirements of the electronics and semiconductor industry, which dominates the consumption landscape. Application-wise, silicon wafers and insulating layers remain the most critical segments, though the use of TEOS in advanced coatings (anti-corrosion, fire-retardant) is accelerating, particularly in construction and infrastructure. The Electronics & Semiconductors end-use industry will continue to be the backbone of the TEOS market, but diversification into high-end ceramics and catalysts offers new avenues for market players.

AI Impact Analysis on Tetraethyl Orthosilicate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Tetraethyl Orthosilicate market typically center on three core themes: optimization of manufacturing processes, demand forecasting driven by AI in end-use industries, and the role of TEOS in AI infrastructure development. Users are specifically concerned about how AI can refine the complex synthesis and purification steps of TEOS to achieve unprecedented purity levels (critical for advanced chip manufacturing), thereby reducing waste and energy consumption. They also seek to understand if the exponential growth in demand for AI-specific hardware (GPUs, specialized accelerators) will accelerate the need for high-quality dielectric layers derived from TEOS precursors, thereby tightening supply chains. Furthermore, interest exists in predictive maintenance and quality control systems powered by machine learning (ML) to ensure consistency during thin-film deposition processes utilizing TEOS in semiconductor fabs.

The immediate impact of AI is most evident in enhancing operational efficiency and quality control within TEOS production facilities. AI/ML algorithms are being implemented to analyze vast datasets related to temperature, pressure, reaction kinetics, and impurity profiles, enabling predictive modeling that ensures real-time purity adjustments during distillation and synthesis. This precision is vital, as even trace impurities can render high-specification TEOS unusable for semiconductor applications. Moreover, AI-driven demand planning is helping manufacturers align complex, multi-stage production schedules with fluctuating market needs driven by unpredictable semiconductor cycles, improving inventory management and reducing lead times for critical UHP grades. Finally, AI is accelerating materials informatics, aiding in the design of novel, more efficient TEOS derivatives or substitutes.

- AI optimizes complex TEOS synthesis and purification processes, achieving ultra-high purity levels required for 5nm and 3nm node fabrication.

- Machine learning algorithms enhance predictive quality control (PQC) during CVD/PECVD thin-film deposition using TEOS in semiconductor manufacturing.

- Increased global deployment of AI infrastructure (data centers, edge computing) drives accelerated demand for TEOS-derived dielectric and insulating layers.

- AI-powered demand forecasting improves supply chain stability for UHP TEOS grades, mitigating risks associated with semiconductor production volatility.

- Robotics and AI in handling sensitive materials reduce human contamination risks during TEOS packaging and transport.

DRO & Impact Forces Of Tetraethyl Orthosilicate Market

The Tetraethyl Orthosilicate (TEOS) market is shaped by a confluence of powerful drivers related to technological advancements in microelectronics, structural restraints concerning raw material sourcing and purity standards, and significant opportunities emerging from green chemistry and materials science innovation. The primary driver is the pervasive digitization across all global sectors, necessitating continuous scaling and improvement in semiconductor technology, where TEOS is fundamental for insulation and gap-filling. However, the market faces strong headwinds from the complexity and capital intensity required to achieve ultra-high purity levels, coupled with logistical challenges in transporting highly sensitive precursor chemicals globally. The overall impact forces suggest a high-growth environment, albeit one demanding substantial ongoing investment in purification technologies and robust supply chain security.

Drivers: Exponential growth in 5G, IoT devices, and High-Performance Computing (HPC) mandates increasing volumes of high-quality silicon wafers, inherently boosting demand for UHP TEOS as a key dielectric precursor. Furthermore, rising infrastructural development globally, especially in emerging economies, spurs demand for high-durability coatings, paints, and protective glass, where TEOS acts as an essential binder and cross-linking agent. Investment in solar technology (photovoltaics) and the aerospace sector, requiring lightweight, thermally resistant, and durable silica-based materials, further solidifies the demand structure.

Restraints: The most significant restraint is the extreme sensitivity of UHP TEOS to moisture and contaminants, complicating storage, transport, and handling, which elevates operational costs. Regulatory scrutiny regarding volatile organic compounds (VOCs) and environmental disposal of spent solvents also poses a continuous challenge. Moreover, the industry is perpetually under pressure due to the cyclical nature of the semiconductor industry, leading to periods of inventory overstocking or critical shortages for specific purity grades.

Opportunities: Opportunities lie prominently in the development of next-generation sol-gel processes for advanced battery components, particularly solid-state batteries, and in the burgeoning field of bio-integrated electronics. The shift towards "green chemistry" synthesis methods for TEOS, aiming to reduce energy consumption and hazardous byproducts, presents a competitive advantage for innovative manufacturers. Finally, the customization of TEOS derivatives for specialized applications, such as anti-microbial coatings and high-refractive index optical materials, opens niche, high-margin markets.

Segmentation Analysis

The Tetraethyl Orthosilicate market is comprehensively segmented based on Purity, Application, and End-use Industry, reflecting the diverse and stringent requirements of its consumer base. The segmentation by Purity (99%, 99.9%, and Others, including UHP grades) is arguably the most crucial factor determining market value and pricing, given that impurities in precursors directly impact the performance and yield in microelectronics. The segmentation analysis reveals a clear premium commanded by ultra-high purity materials necessary for advanced node manufacturing (e.g., 7nm and below), driving investment into specialized purification techniques.

The Application segmentation highlights the critical role of TEOS in forming silicon wafers and insulating layers, which represent the largest volume consumption globally. However, the high-growth potential is increasingly visible in the Coatings segment, driven by demand for advanced protective layers in construction and automotive industries, and the emerging use of TEOS in specialized ceramic and glass formulations for energy storage and thermal management. Understanding these segments allows manufacturers to tailor their product offerings, logistics, and quality assurance protocols to specific industry demands, thereby optimizing market penetration and profitability across different value chains.

- By Purity:

- 99% Grade

- 99.9% Grade

- Ultra-High Purity (UHP) (>99.9999%)

- Others (Technical Grade)

- By Application:

- Silicon Wafers & Insulating Layers (Dielectrics)

- Coatings (Protective and Decorative)

- Ceramics & Glass Manufacturing

- Catalyst Production and Precursors

- Chemical Intermediates

- Others (Abrasives, Binders)

- By End-use Industry:

- Electronics & Semiconductors

- Construction

- Automotive & Transportation

- Healthcare & Medical Devices

- Aerospace & Defense

- Chemical Manufacturing

Value Chain Analysis For Tetraethyl Orthosilicate Market

The value chain of the Tetraethyl Orthosilicate market begins with the upstream sourcing of key raw materials, primarily silicon metal and ethanol. The highly integrated nature of this upstream segment means that major TEOS producers often secure long-term contracts or possess captive production capabilities for these precursors to maintain quality and supply stability. Silicon metal, extracted from quartz, undergoes processing to produce chlorosilanes, which are then reacted with ethanol to synthesize crude TEOS. The quality of these initial materials dictates the complexity and cost of the subsequent purification steps, particularly for UHP grades targeting the electronics sector.

Midstream activities center on synthesis and rigorous purification. The purification process—often involving complex multi-stage fractional distillation and proprietary filtration techniques—is the primary value-adding step, transforming standard TEOS into marketable UHP grades. High purity demands significant capital investment in cleanroom facilities and advanced analytical equipment. Distribution channels are specialized, relying heavily on a direct model for critical semiconductor clients (due to strict handling and logistics requirements) and utilizing indirect distribution (specialty chemical distributors) for lower-volume industrial applications like coatings and ceramics. The direct channel ensures complete control over product integrity up until the point of use.

Downstream, the market is characterized by diverse end-user applications. Semiconductor fabrication plants (fabs) are the most demanding consumers, requiring just-in-time delivery of specialized bulk containers or portable stainless steel drums under inert atmospheres. The construction, automotive, and materials science industries utilize TEOS for specific formulation needs in high-performance materials. The strong reliance on direct interaction with semiconductor clients highlights the need for deep technical support and collaboration in formulating TEOS delivery systems compatible with chemical vapor deposition (CVD) and plasma-enhanced CVD (PECVD) equipment, ensuring the final film properties meet exacting standards.

Tetraethyl Orthosilicate Market Potential Customers

Potential customers for Tetraethyl Orthosilicate are highly concentrated within industries that require exceptional material purity and functional performance in thin-film applications and material synthesis. The primary cohort of buyers consists of major semiconductor manufacturers, integrated device manufacturers (IDMs), and outsourced semiconductor assembly and test (OSAT) companies. These entities utilize TEOS extensively as a precursor to deposit high-quality dielectric layers, particularly silicon dioxide (SiO2), which is essential for insulating components, gap filling, and planarization across wafers ranging from 300mm to advanced 200mm formats.

A secondary, yet rapidly growing customer base includes specialty chemical formulators and advanced materials producers. This group comprises companies specializing in developing high-performance coatings—such as anti-corrosion paints, fire-retardant materials, and specialized aerospace coatings—where TEOS acts as a crucial binder or cross-linking agent, providing superior durability and chemical resistance. Furthermore, manufacturers of specialized glass and ceramics, including optical fibers, high-purity fused silica crucibles, and porous silica aerogels, are significant buyers, leveraging TEOS for its ability to produce highly homogenous and pure silica via the sol-gel method.

Lastly, research institutions, university labs, and catalytic manufacturers represent consistent, albeit smaller-volume, customers. These entities use TEOS as a foundational chemical intermediate in developing novel catalytic materials, synthesizing advanced nanomaterials (like mesoporous silica nanoparticles for drug delivery), and conducting fundamental materials science research. For all segments, purchasing decisions are driven not only by price and supply reliability but overwhelmingly by product specification, certified purity levels, and robust quality assurance documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million USD |

| Market Forecast in 2033 | $1,110 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Wacker Chemie AG, Dow Inc., Shin-Etsu Chemical Co. Ltd., Gelest Inc., Momentive Performance Materials Inc., Nanjing Capatue Chemical Co., Zhangjiagang E-Light Chemical Co. Ltd., Mitsubishi Chemical Corporation, ABCR GmbH, Merck KGaA, Reagent Chemical, Zhejiang Sucon Silicone Co., Ltd., BASF SE, Hexion Inc., Fushun Dongxin Chemical Co., Ltd., Versum Materials (acquired by Merck KGaA), Azelis Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tetraethyl Orthosilicate Market Key Technology Landscape

The technology landscape governing the Tetraethyl Orthosilicate market is primarily focused on enhancing two core aspects: the purity of the synthesized product and the efficiency of its subsequent application, particularly in thin-film deposition. State-of-the-art purification techniques, such as continuous fractional distillation under stringent vacuum conditions and advanced chromatographic separation methods, are essential for producing the UHP grades (often exceeding 99.9999% purity) demanded by the semiconductor industry. Manufacturers are continuously investing in proprietary filtration systems capable of removing trace metallic ions and particulates measured in the parts per billion (ppb) or parts per trillion (ppt) range, as these contaminants severely impair device performance and yield in sub-10nm node fabrication.

On the application front, significant technological advancements revolve around chemical vapor deposition (CVD) and plasma-enhanced chemical vapor deposition (PECVD) processes. TEOS is widely utilized as the silicon source in these processes, and ongoing technological evolution focuses on optimizing precursor delivery systems—including specialized bubblers and liquid injection systems—to ensure precise, stable, and residue-free delivery of the TEOS vapor to the reaction chamber. Furthermore, research is robust in developing novel TEOS derivatives or co-precursors that enable low-temperature deposition, thereby minimizing thermal stress on delicate integrated circuits and improving conformity in complex 3D transistor architectures.

A burgeoning technological area involves the refinement of the sol-gel process, an alternative deposition technique where TEOS hydrolyzes to form a silica network. Innovations here include developing modified TEOS formulations tailored to produce highly porous materials (aerogels) or dense, crack-free ceramic coatings at ambient temperatures. This lower-temperature, solution-based technology is driving adoption in non-electronic sectors like medical device coatings and advanced optics. Lastly, inline monitoring and analytical technologies, utilizing mass spectrometry and sophisticated spectroscopic techniques, are becoming integral for real-time quality assurance during both synthesis and application.

Regional Highlights

- Asia Pacific (APAC): Dominance in Electronics Manufacturing

APAC stands as the undisputed leader in the global TEOS market, commanding the largest share in terms of volume and value. This dominance is intrinsically linked to the region’s massive concentration of semiconductor fabrication plants (fabs), particularly in China, Taiwan, South Korea, and Japan. These nations are central hubs for the production of advanced memory chips, logic devices, and consumer electronics, all of which require high volumes of UHP TEOS for dielectric layer deposition. Government policies promoting self-sufficiency in chip production, such as those implemented in China, further fuel internal demand and drive capacity expansion among local TEOS manufacturers.

Beyond semiconductors, APAC’s rapidly expanding construction and infrastructure sectors in India and Southeast Asia propel demand for industrial-grade TEOS utilized in high-performance protective coatings and specialized glass applications. The logistical advantage of being proximal to both upstream silicon metal processing and downstream high-tech manufacturing strengthens the region's position. The competitive landscape in APAC is characterized by a balance between global players ensuring quality supply for high-end fabs and strong regional specialists focusing on volume and price competitiveness for industrial grades.

- North America: Focus on Advanced R&D and Niche Applications

The North American market, comprising the United States and Canada, represents a mature but technologically demanding segment. While the volume of consumption might be lower than APAC, the region commands high value due to its focus on cutting-edge applications, including advanced materials research, aerospace composites, and defense electronics. TEOS consumption here is highly concentrated in R&D facilities, specialized materials companies, and semiconductor manufacturers targeting high-reliability and low-volume production sectors. The stringent quality and testing standards imposed by the aerospace and defense industries drive sustained demand for the highest purity grades.

Investment in nanotechnology and the development of solid-state battery technology also contributes significantly to TEOS utilization. The presence of major TEOS producers and specialty chemical companies in this region ensures robust supply chains for complex precursor requirements. Furthermore, North America is a key adopter of green chemistry principles, fostering research into environmentally friendly synthesis routes and sustainable handling practices for TEOS and its derivatives.

- Europe: High-Value Industrial and Automotive Consumption

Europe holds a substantial market share, driven primarily by its world-leading automotive sector, advanced chemical industries, and specialized engineering applications. TEOS is critical in Europe for producing sophisticated automotive coatings, engineered plastics, and specialized glass used in high-end vehicles, focusing on lightweight materials and enhanced durability. Germany, France, and the Netherlands are key consuming countries, owing to their strong manufacturing bases.

The region is also a prominent hub for specialty ceramics and catalyst production. European semiconductor manufacturing, although smaller in scale than APAC, focuses heavily on specialized industrial electronics and power semiconductors, which still require highly pure TEOS precursors. Regulatory environments regarding chemical handling (REACH) significantly influence production and distribution protocols, emphasizing safety and environmental compliance, which tends to favor large, established TEOS suppliers.

- Latin America (LATAM): Emerging Industrial Demand

The LATAM market is characterized by emerging industrial growth, primarily driven by construction, infrastructure development, and localized chemical manufacturing, particularly in Brazil and Mexico. TEOS demand in this region is predominantly industrial grade, utilized for basic protective coatings, concrete additives, and standard glass production. While semiconductor manufacturing is less developed compared to APAC, the region represents a growth opportunity due to increasing industrialization and investment in localized manufacturing capabilities. Market expansion depends heavily on economic stability and foreign investment in large-scale infrastructure projects.

Logistical complexities and reliance on imports for high-purity grades remain defining features of the LATAM TEOS supply chain. However, as the automotive sector in Mexico expands its export capabilities and local chemical industries mature, the demand for higher-specification TEOS for coatings and sealants is projected to rise steadily over the forecast period.

- Middle East and Africa (MEA): Infrastructure and Energy Focus

The MEA region, particularly the GCC countries, shows growing demand for TEOS largely linked to massive ongoing and planned construction projects, oil and gas infrastructure, and diversification efforts into non-oil sectors. TEOS is utilized in high-performance anti-corrosion and thermal insulation coatings vital for protecting infrastructure in harsh desert and marine environments. The demand is heavily concentrated in industrial coatings and specialized glass. South Africa also contributes significantly, driven by local chemical manufacturing and mining industry needs.

Investment in renewable energy, particularly solar farms, in the Middle East provides a growth vector, as TEOS can be used in solar panel components and durable coatings. The MEA market currently relies significantly on imports, making supply chain resilience and price volatility critical factors for local consumers. Long-term growth is tied to the success of regional economic diversification plans and industrial expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tetraethyl Orthosilicate Market.- Evonik Industries AG

- Wacker Chemie AG

- Dow Inc.

- Shin-Etsu Chemical Co. Ltd.

- Gelest Inc.

- Momentive Performance Materials Inc.

- Nanjing Capatue Chemical Co.

- Zhangjiagang E-Light Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- ABCR GmbH

- Merck KGaA

- Reagent Chemical

- Zhejiang Sucon Silicone Co., Ltd.

- BASF SE

- Hexion Inc.

- Fushun Dongxin Chemical Co., Ltd.

- Versum Materials (acquired by Merck KGaA)

- Azelis Group

- Advanced Chemical Technology Inc.

- Tokuyama Corporation

Frequently Asked Questions

Analyze common user questions about the Tetraethyl Orthosilicate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Tetraethyl Orthosilicate (TEOS) primarily used for in the semiconductor industry?

TEOS is primarily utilized as a high-purity precursor for depositing silicon dioxide (SiO2) thin films via Chemical Vapor Deposition (CVD) or Plasma-Enhanced CVD (PECVD). These SiO2 layers function as critical insulating, dielectric, and passivation materials in the fabrication of integrated circuits, ensuring electrical isolation and structural integrity on silicon wafers.

How do the different purity grades of TEOS affect market pricing and application?

Purity grades, specifically Ultra-High Purity (UHP) TEOS (99.9999% and above), command a significant price premium due to the rigorous, high-cost purification processes required. UHP grades are mandatory for advanced semiconductor manufacturing (sub-10nm nodes), while standard 99% or 99.9% grades are typically sufficient and more cost-effective for industrial applications like coatings, ceramics, and standard glass manufacturing.

What are the key drivers propelling the growth of the global TEOS market?

The primary driver is the explosive demand growth in the global electronics and semiconductor sector, fueled by 5G deployment, IoT devices, and High-Performance Computing (HPC). Secondary drivers include the increasing application of TEOS in advanced protective and anti-corrosion coatings within the automotive and construction industries globally.

Which region holds the largest market share for Tetraethyl Orthosilicate consumption?

The Asia Pacific (APAC) region holds the largest market share. This dominance is attributed to the high concentration of major semiconductor fabrication facilities (fabs) located in countries such as China, Taiwan, and South Korea, which are the largest consumers of UHP TEOS for chip manufacturing.

What role does the sol-gel process play in the TEOS market?

The sol-gel process uses TEOS as a key reactant to synthesize highly pure silica materials, including advanced optical fibers, specialized ceramics, porous aerogels, and durable, low-temperature coatings. This method is crucial for applications where precise control over material microstructure and porosity is required, diversifying TEOS usage beyond traditional CVD methods.

Are there environmental concerns associated with TEOS production and use?

TEOS itself is generally considered lower in toxicity than certain other silicon precursors, but concerns exist regarding the handling and disposal of precursor chemicals and the Volatile Organic Compounds (VOCs), particularly ethanol, released during its hydrolysis and processing. Industry players are increasingly investing in green synthesis methods and closed-loop systems to minimize environmental impact and comply with global regulations like REACH.

How does the quality of silicon metal raw material impact the final TEOS product?

The quality and purity of the upstream silicon metal and ethanol directly influence the complexity and cost of the subsequent TEOS purification stages. Higher initial purity minimizes the presence of metallic impurities, which are extremely difficult and expensive to remove, ensuring the final UHP TEOS meets the critical specifications required by the semiconductor industry for defect-free film deposition.

What is the significance of TEOS in advanced coating applications?

In advanced coatings, TEOS acts as a crucial binder or cross-linking agent. When hydrolyzed, it forms a dense, glass-like silica network, imparting exceptional hardness, scratch resistance, UV stability, and chemical resistance to the final coating formulation, making it ideal for architectural, automotive, and industrial protective applications.

What competitive advantages do major integrated TEOS producers possess?

Major integrated producers, such as Evonik and Wacker Chemie, benefit from backward integration (controlling raw material supply), proprietary purification technologies (achieving guaranteed UHP consistency), and established global distribution networks optimized for sensitive chemical logistics, providing reliability and technical support critical to high-volume semiconductor clients.

How is TEOS being utilized in nanotechnology and research?

In nanotechnology, TEOS is fundamental for synthesizing highly uniform mesoporous silica nanoparticles (MSNs). These nanoparticles are utilized in drug delivery systems, advanced separation membranes, and as supports for catalytic materials due to their controllable pore size, high surface area, and non-toxicity, driving innovation in materials science and biomedicine.

What restraints are currently challenging the market growth of TEOS?

Key restraints include the extremely high capital and operational expenditure required for manufacturing UHP grades, the inherent difficulty and cost associated with moisture-sensitive handling and transportation, and the market's vulnerability to the cyclical investment and demand patterns characteristic of the semiconductor industry.

What emerging opportunities are shaping the future outlook for the TEOS market?

Emerging opportunities include the development of tailor-made TEOS derivatives for use in next-generation energy storage technologies, particularly solid-state battery electrolytes and binders. Further growth is anticipated from demand for high-performance optical coatings and the push towards sustainable, green chemistry synthesis methods.

What is the chemical abbreviation and formula for Tetraethyl Orthosilicate?

The common chemical abbreviation is TEOS, and its chemical formula is Si(OC2H5)4. It is a colorless liquid known for its ability to readily hydrolyze in the presence of water to form silicon dioxide.

How does AI technology specifically influence TEOS quality control in manufacturing?

AI technology, specifically machine learning models, is employed to analyze real-time data from chromatographic and spectroscopic analysis during purification. This allows for predictive quality control (PQC), enabling immediate, precise process adjustments to maintain target purity levels, thereby minimizing batch variation and maximizing yield for ultra-sensitive applications.

Is TEOS utilized in the production of optical fibers?

Yes, TEOS is a crucial precursor in the Modified Chemical Vapor Deposition (MCVD) process used to manufacture high-purity silica glass for optical fibers. Its high purity and ability to yield high-quality silica are essential for minimizing light loss and ensuring efficient data transmission over long distances.

What factors differentiate TEOS from other common silicon precursors like Silane (SiH4)?

TEOS is typically safer and easier to handle and transport compared to highly volatile and pyrophoric precursors like Silane. While Silane offers high deposition rates, TEOS is favored for applications requiring superior film uniformity, better gap-filling capabilities, and reduced hydrogen incorporation in the final silicon dioxide film, especially in PECVD processes.

What is the expected long-term impact of the shift to 3D NAND and FinFET architectures on TEOS demand?

The transition to 3D architectures (like 3D NAND and FinFETs) significantly increases the demand for TEOS because these complex structures require more intricate and conforming dielectric deposition, often utilizing multiple TEOS-based insulating layers for inter-layer dielectrics and gap filling, thus driving higher consumption per wafer.

How important is supply chain security for TEOS in the semiconductor industry?

Supply chain security is paramount. Since TEOS is a critical, single-source chemical for foundational dielectric layers, any disruption or contamination in the supply chain can halt multi-billion dollar semiconductor fabrication lines. Consequently, fabs often require dual sourcing and extensive qualification processes, demanding reliability and consistency from their TEOS suppliers.

Which end-use industry segment contributes the most to TEOS market revenue?

The Electronics & Semiconductors end-use industry segment contributes the most significantly to TEOS market revenue, specifically driven by the high volume requirement for UHP TEOS in wafer processing and the high pricing commanded by these specialized, high-specification products.

What regulations or standards particularly affect the TEOS market in Europe?

The European market is heavily influenced by the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation. REACH mandates rigorous safety assessments and documentation for chemical substances like TEOS, impacting its manufacture, import, and use, and driving compliance costs for all market participants in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Investment Casting Market Statistics 2025 Analysis By Application (Automotive, Aerospace and Military, Industrial Gas Turbines, General Industrial Machinery), By Type (Sodium Silicate Process, Tetraethyl Orthosilicate (Silica Sol Process)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Tetraethyl Orthosilicate Market Statistics 2025 Analysis By Application (Silicone rubber, High-purity silica, Vitrified bond, Silica gel material, Paint and Coating), By Type (Direct Method, STC Method and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager