Tetramethyl Bisphenol A Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432041 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Tetramethyl Bisphenol A Market Size

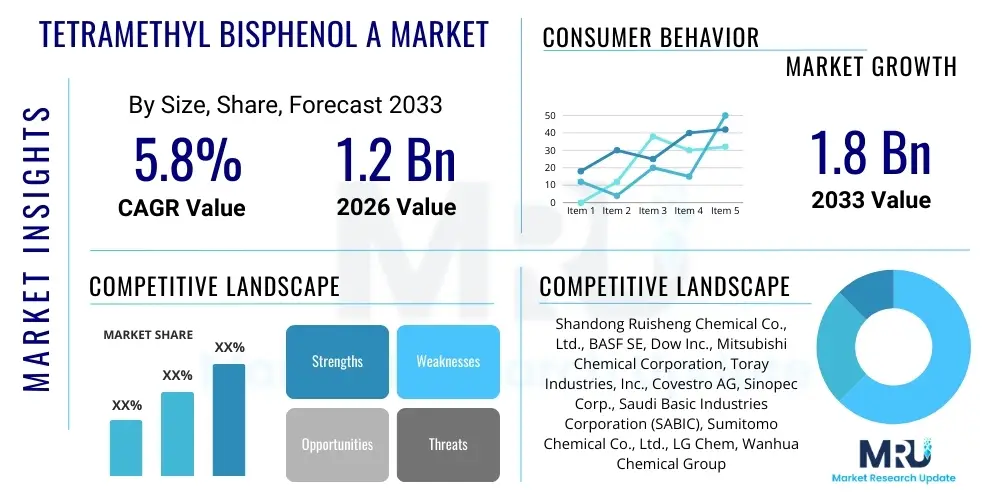

The Tetramethyl Bisphenol A Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Tetramethyl Bisphenol A Market introduction

Tetramethyl Bisphenol A (TMBPA) is a highly specialized chemical intermediate crucial for manufacturing advanced engineering polymers that possess exceptional resistance to thermal degradation, chemical attack, and electrical breakdown. Chemically known as 4,4'-(2,2-dimethyl-1,3-propanediyl)bis(2,6-dimethylphenol), TMBPA serves as a superior alternative to traditional bisphenol compounds in applications demanding high operational stability. The presence of four methyl groups substituted onto the aromatic rings sterically hinders rotational motion and elevates the glass transition temperature (Tg) of resulting polymers, such as epoxy resins and polycarbonates. This molecular architecture imparts unique benefits, including reduced coefficient of thermal expansion (CTE) and improved flame retardancy without relying on halogenated additives, making it indispensable in modern high-reliability systems. The fundamental growth trajectory of the TMBPA market is inherently tied to the global escalation of computational power and data transfer speeds, necessitating materials capable of operating flawlessly under increasing thermal loads and higher radio frequencies, particularly within the telecommunications and server infrastructure sectors.

The primary industrial consumption of TMBPA is concentrated in the production of high-performance epoxy resins, commonly formulated into prepregs and laminates for multi-layer Printed Circuit Boards (PCBs), especially those used in 5G base stations, data centers, and sophisticated avionics. In these applications, the TMBPA-derived resins offer a high Tg (often exceeding 200°C), low dielectric loss (Df), and low dielectric constant (Dk), properties essential for minimizing signal attenuation and ensuring data integrity at GHz frequencies. Furthermore, the material is pivotal in the synthesis of specialty polycarbonates, which are increasingly adopted in the automotive industry for electric vehicle (EV) battery casings, lighting systems, and interior components. The lightweight yet robust nature, coupled with enhanced thermal endurance provided by TMBPA, aligns perfectly with the strategic objectives of EV manufacturers seeking to improve performance, extend battery life, and enhance passenger safety through superior fire resistance.

Market expansion is also supported by increasing regulatory demands worldwide for safer, non-halogenated flame retardant solutions in construction and consumer electronics. TMBPA acts as a reactive intermediate, chemically integrating into the polymer backbone, which prevents leaching and maintains long-term flame retardant efficacy, unlike additive flame retardants. Beyond its primary polymer applications, TMBPA is also utilized in specialty polyester synthesis and the creation of advanced protective coatings and adhesives for extreme environments. Although the market faces challenges related to the complex, high-cost purification process required to achieve electronic-grade standards and the fluctuating prices of petrochemical feedstocks, continuous technological innovation aimed at catalyst efficiency and process yield optimization is expected to sustain its projected CAGR, particularly as global industrial standards for material performance continue to rise.

Tetramethyl Bisphenol A Market Executive Summary

The Tetramethyl Bisphenol A (TMBPA) market is poised for significant expansion, driven primarily by technological advancements in the electronics and electric vehicle sectors, which demand materials capable of surviving harsher operating conditions. Key business trends indicate a strategic pivot among chemical manufacturers toward securing long-term contracts with major PCB laminate producers and EV battery system integrators, prioritizing supply chain reliability and consistent quality over volume commoditization. There is a perceptible trend toward vertical integration, where TMBPA producers are either aligning closely with or acquiring downstream resin formulators to capture greater value and ensure precise material specification adherence. Furthermore, intense R&D investment is dedicated to developing scalable, environmentally friendlier synthesis routes, aiming to differentiate products in a market increasingly sensitive to sustainability metrics and regulatory pressures concerning chemical manufacturing footprints.

Regionally, the market's center of gravity remains firmly in Asia Pacific (APAC), which not only houses the bulk of TMBPA production capacity but also represents the largest consumption market due to its overwhelming concentration of global electronics assembly, semiconductor packaging, and battery manufacturing operations. The region’s competitive manufacturing ecosystem fosters aggressive pricing strategies and rapid product iteration, driving down overall cost curves. North America and Europe, in contrast, serve as key markets for innovation adoption, characterized by robust demand for niche, highly customized TMBPA derivatives utilized in specialized industrial segments such as aerospace, military communications, and high-end industrial machinery. The mature nature of these economies emphasizes regulatory compliance and material certification, ensuring a preference for established, high-quality suppliers.

Segment trends reveal that the application segment dominated by epoxy resins—specifically for high-frequency/high-speed PCB laminates—continues its high growth momentum, catalyzed by the global deployment of 5G and ongoing preparations for 6G infrastructure. Meanwhile, the specialty polycarbonate segment exhibits the most dynamic growth rate, directly correlated with the accelerating adoption curves in the EV market, where TMBPA provides crucial thermal management solutions. The overall market strategic outlook emphasizes flexibility in production capacity to swiftly respond to cyclical demand in consumer electronics, coupled with a long-term commitment to quality enhancement technologies. Successful market penetration necessitates establishing a reputation for supplying ultra-high-purity grades, thereby overcoming the moderate barrier of substitution risks from less performing but cheaper conventional bisphenols in non-critical applications.

AI Impact Analysis on Tetramethyl Bisphenol A Market

User queries regarding AI's influence on the TMBPA market often center on three main themes: optimization of chemical synthesis and manufacturing processes, predictive modeling for demand forecasting in electronic end-uses, and material discovery acceleration. Users are keen to know if AI can reduce the complexity and energy requirements associated with producing high-purity TMBPA, a process known for its precise reaction conditions. Furthermore, there is significant interest in how AI-driven predictive maintenance and quality control systems can ensure the batch-to-batch consistency required for electronic-grade TMBPA, minimizing waste and maximizing yields. The core expectation is that AI will primarily act as an efficiency booster in production and a powerful analytical tool in correlating material properties with application performance (e.g., thermal resistance in PCBs), thereby speeding up the material qualification process for new product formulations. The application of sophisticated AI algorithms in chemical process engineering promises a shift from heuristic decision-making to data-driven optimization, drastically shortening cycle times for product improvement and increasing the profitability of high-purity TMBPA production lines.

- AI-driven optimization of TMBPA reaction parameters, enhancing yield and purity levels through real-time adjustment of catalyst ratios and thermal profiles.

- Predictive maintenance analytics applied to synthesis reactors and purification equipment, minimizing unplanned downtime and maximizing asset utilization rates.

- Advanced quality control systems utilizing machine vision and sensor data for instantaneous TMBPA batch purity verification against electronic-grade specifications.

- AI-enabled material informatics accelerating the discovery and development of novel TMBPA-derived co-monomers and specialized flame retardant additives.

- Improved demand forecasting models integrated with global supply chain management systems, optimizing inventory and production scheduling based on real-time electronics and EV manufacturing outputs.

- Simulation tools powered by AI to predict the thermal, mechanical, and electrical performance of TMBPA-based polymers under diverse, simulated operating conditions (e.g., high humidity, elevated temperature).

- Enhanced energy efficiency management in chemical plants through AI algorithms optimizing utility consumption during crystallization and solvent recovery phases, contributing to sustainability goals.

- Deployment of robotic process automation (RPA) guided by AI for precise handling and blending of high-purity TMBPA components in sensitive downstream applications like optical lens manufacturing.

DRO & Impact Forces Of Tetramethyl Bisphenol A Market

The market dynamics of Tetramethyl Bisphenol A (TMBPA) are fundamentally shaped by a robust combination of internal drivers and external constraints, which collectively dictate investment and production strategies. A critical driver is the relentless technological push towards higher frequency and greater power density in electronic devices, requiring specialized insulation materials that TMBPA-based epoxy resins uniquely provide, offering superior dielectric performance and thermal stability necessary for 5G/6G circuits and high-performance computing hardware. Furthermore, the global proliferation of electric vehicles (EVs) mandates a substantial increase in the supply of high-temperature, flame-retardant polymers for battery casings and power management systems, directly channeling significant demand into the TMBPA market. Concurrently, regulatory frameworks worldwide increasingly favor non-halogenated flame retardants, positioning TMBPA and its derivatives advantageously over conventional alternatives, further accelerating its adoption across construction and consumer goods sectors.

Despite these powerful drivers, market growth is significantly restrained by the inherent technical difficulty and associated high cost of achieving and maintaining the stringent electronic-grade purity required by leading electronics manufacturers. The synthesis and purification process involves complex, energy-intensive separation stages, leading to higher capital expenditure and operational costs compared to bulk chemical production. Moreover, the market is subject to volatility in the pricing and availability of upstream petrochemical feedstocks, phenol and acetone, which directly impacts the profitability margins of TMBPA producers. Another persistent restraint is the historical association of the 'bisphenol' nomenclature with public health concerns linked to standard Bisphenol A (BPA), which, while scientifically distinct from TMBPA’s application profile, requires continuous effort from the industry to differentiate the product and manage regulatory perceptions effectively. The necessity for advanced technical expertise and proprietary catalyst technology also limits the number of global producers, thereby restraining rapid supply expansion.

Significant opportunities for future market growth lie in strategic technological diversification and geographical expansion. The development of sustainable, bio-based precursors for TMBPA synthesis represents a key opportunity to mitigate feedstock price volatility and enhance the product's environmental sustainability profile, attracting manufacturers aiming for carbon neutrality. Furthermore, emerging applications in high-temperature composites for aerospace, especially in engine components and structural parts, represent a high-value niche market requiring TMBPA’s unique thermal performance capabilities. Impact forces, such as global geopolitical trade tensions and disruptions in Asia Pacific manufacturing hubs, can severely constrain supply chains due to the concentration of TMBPA production. However, sustained investment in disruptive technologies like AI for process optimization and new catalyst systems for cleaner synthesis are powerful counteracting forces, ensuring the TMBPA market continues to provide specialized, irreplaceable material solutions for the world's most demanding technological applications, ultimately reinforcing its critical role in the specialty chemical landscape. The industry must strategically balance cost efficiency with the increasing demand for ultra-high-purity, sustainable materials.

Segmentation Analysis

The Tetramethyl Bisphenol A market segmentation provides a granular view of its structure and dynamic demand patterns, emphasizing the critical role of purity in determining application suitability and pricing tiers. Segmentation by Purity—including 99%, 98%, and specialized Electronic Grade—is paramount, as end-use performance, particularly in sensitive electronic environments, dictates strict control over trace impurities. Electronic Grade TMBPA, commanding a substantial price premium, must meet extremely low levels of metal ions and unreacted precursors (often below 10 parts per billion) to prevent signal integrity issues in high-speed, high-frequency PCB laminates. Conversely, 98% purity might suffice for certain industrial coatings or non-critical structural components where thermal stability is the primary requirement, leading to differentiated manufacturing processes and distribution channels based on the target purity level. The refinement of purification technologies is a defining characteristic of market competitiveness within these segments.

Application segmentation reveals the functional importance of TMBPA, dominated by its incorporation into Epoxy Resins and Specialty Polycarbonates. The epoxy resin segment is heavily leveraged by the electronics sector for producing high glass transition temperature (Tg) laminates, essential for modern servers and networking hardware that generate immense heat. The polycarbonate segment, while smaller in volume, is experiencing rapid growth driven by the need for thermally stable, lightweight, and flame-retardant plastics in the global electric vehicle supply chain, particularly for battery housings and interior panels. Polyesters and dedicated Flame Retardant additives constitute important niche segments, where TMBPA provides essential heat and fire resistance properties without resorting to halogenated substances, thereby aligning with evolving safety standards in construction and transportation. The versatility across these applications underscores the material's superior thermal performance profile.

The segmentation by End-Use Industry underscores the strategic value of TMBPA. The Electronics & Electrical sector is the largest consuming segment, intrinsically linked to global cycles of technological refresh and infrastructure buildout (e.g., fiber optics, data centers, 5G deployment). The Automotive & Transportation segment is emerging as the key growth driver, with electrification transforming material requirements and increasing demand for TMBPA-based components due to fire safety mandates. The Aerospace & Defense industry represents a high-barrier, low-volume segment requiring the highest certified purity and stability, focusing on composites for critical structural and electrical components. Understanding these interdependent segmentations allows manufacturers to strategically allocate resources, focusing R&D efforts on meeting the highest purity requirements of the Electronics and Aerospace segments, which often dictate industry-wide quality benchmarks and drive technological innovation across the entire value chain.

- By Purity:

- 99% Purity Grade (General Industrial Use)

- 98% Purity Grade (Standard Resin Formulation)

- Electronic Grade (High-Frequency PCB Laminates, Semiconductor Encapsulants)

- Others (Customized and Lower Purity Industrial Grades for bulk applications)

- By Application:

- Epoxy Resins (High-Tg Laminates, Encapsulation Materials, High-Temperature Adhesives)

- Polycarbonates (Automotive Components, Safety Glazing, Specialized Optical Media)

- Polyesters (Specialty Coatings, High-Heat Wire Enamels, Structural Composites)

- Flame Retardants (Reactive Intermediates for Non-Halogenated Systems in Construction)

- Specialty Chemicals and Intermediates (Custom Synthesis for niche polymer modification)

- By End-Use Industry:

- Electronics & Electrical (PCBs, Semiconductors, Data Centers, Power Electronics)

- Automotive & Transportation (EV Battery Housings, Interior Panels, Lightweight Structural Components)

- Aerospace & Defense (Structural Composites, Radomes, Advanced Wiring Insulation)

- Construction & Infrastructure (Protective Coatings, Fire-rated Panels, Insulating Foams)

- Medical Devices (Sterilizable Components, High-Heat Housings for Diagnostic Equipment)

Value Chain Analysis For Tetramethyl Bisphenol A Market

The TMBPA value chain begins with the critical upstream procurement and processing of petrochemical feedstocks, primarily phenol and acetone, which are derived from crude oil and natural gas. The stability and competitive pricing of these raw materials are foundational to the overall profitability of TMBPA manufacturing. Major chemical integrators often secure these inputs through long-term supply agreements or possess captive production facilities, mitigating price volatility risks. Upstream activities also involve the initial conversion stages leading up to the TMBPA synthesis, emphasizing efficient catalytic systems and reaction engineering to maximize the yield of the desired isomer and minimize the formation of impurities, which significantly dictates the complexity and cost burden of downstream purification. Successful upstream management requires robust hedging strategies against energy market fluctuations and continuous process improvement to reduce per-unit production costs, particularly as environmental regulations tighten globally regarding emissions from chemical precursor production.

The midstream component encompasses the core TMBPA synthesis and complex purification processes. This stage is characterized by high technological barriers to entry, demanding specialized knowledge in reaction kinetics, proprietary catalysts, and advanced separation science. Manufacturers utilize sophisticated batch or continuous chemical reactors, followed by energy-intensive purification techniques such as multi-effect evaporation and fractional crystallization to achieve the requisite purity, especially for electronic-grade products. The choice of solvent and the method of handling the intermediate bisphenol products are crucial for quality assurance. The midstream producers act as the gatekeepers of quality, directly influencing the performance metrics of the final end-products. They engage in rigorous internal quality control, often exceeding standard ISO requirements, to meet the specialized certifications demanded by the aerospace and electronics sectors, differentiating themselves through consistency and capability in ultra-purification.

The distribution channel links TMBPA producers to downstream converters, utilizing a mix of direct and indirect sales models. Direct distribution is favored for large-volume customers, such as multinational epoxy resin producers and integrated polymer compounders, enabling tailored logistics, technical support, and negotiated pricing based on annual volume commitments and specific purity requirements. Indirect channels, employing specialized chemical distributors and regional agents, cater to smaller manufacturers, research institutions, and geographically diverse end-users, providing inventory management and localized technical service. Downstream utilization involves the formulation of TMBPA into high-performance polymers—epoxy resins for laminates, polycarbonates for molding, and polyester derivatives—before final consumption by the Electronics, Automotive, and Aerospace industries. The successful conclusion of the value chain is measured by the end-product's ability to reliably perform under extreme conditions, validating the need for the high-value specialty chemical that is TMBPA, making the information flow regarding performance needs from end-user back to the primary manufacturer critical for innovation.

Tetramethyl Bisphenol A Market Potential Customers

The customer ecosystem for Tetramethyl Bisphenol A (TMBPA) comprises highly technical and demanding industries where material failure is not an option, making performance metrics far outweigh considerations of initial cost. The primary segment consists of multinational manufacturers of high-performance Printed Circuit Board (PCB) laminates, who use TMBPA-based epoxy resins (such as high-Tg FR-4 alternatives) to fabricate circuit boards for critical infrastructure like 5G base stations, military communication systems, and large-scale data center servers. These buyers are acutely focused on consistency, low dielectric loss (Df), and ultra-high purity, often sourcing only from certified suppliers capable of meeting precise electronic-grade specifications and providing extensive certification documentation required for complex regulatory approvals. Their purchasing cycles are often linked to major technology refresh cycles, necessitating secure and consistent long-term supply agreements.

A rapidly expanding segment of potential customers includes leading Automotive Tier 1 suppliers and Original Equipment Manufacturers (OEMs), particularly those focused on the electrification and autonomous vehicle transition. TMBPA is critical in formulating specialty polycarbonates and compounds used in electric vehicle battery systems—specifically housings, modules, and internal structural components—where heat management and intrinsic flame retardancy are paramount safety requirements. These customers prioritize lightweighting, mechanical robustness, and long-term durability under thermal cycling, seeking TMBPA derivatives that can withstand the intense thermal environment generated by high-density batteries. Furthermore, manufacturers of high-performance protective coatings and industrial adhesives, particularly those serving the oil and gas sector or requiring excellent corrosion resistance in aggressive environments, constitute another steady customer base for TMBPA derivatives.

Lastly, high-technology niche segments, including aerospace primes, defense contractors, and specialized medical device manufacturers, represent potential customers that demand the highest possible material quality. In aerospace, TMBPA is used in advanced composite matrices for structural parts and thermal insulation where resistance to extreme temperatures (cryogenic to high heat) and radiation is necessary. Medical device manufacturers use TMBPA-based polymers for components requiring frequent sterilization without degradation, such as surgical instrument housings or diagnostic machine parts. These potential customers operate under highly regulated environments, meaning their purchasing decisions are heavily influenced by material traceability, supplier reliability, and compliance with specific industry standards like AS9100 or FDA requirements, making technical support and comprehensive documentation essential components of the sales process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shandong Ruisheng Chemical Co., Ltd., BASF SE, Dow Inc., Mitsubishi Chemical Corporation, Toray Industries, Inc., Covestro AG, Sinopec Corp., Saudi Basic Industries Corporation (SABIC), Sumitomo Chemical Co., Ltd., LG Chem, Wanhua Chemical Group Co., Ltd., Asahi Kasei Corporation, DIC Corporation, Nan Ya Plastics Corporation, Chang Chun Group, Zhejiang Keyi Chemical Co., Ltd., Shanghai Resin Factory Co., Ltd., Jiangsu Jichang Chemical Co., Ltd., PTT Global Chemical Public Company Limited, Huntsman Corporation, Evonik Industries AG, Solvay S.A., Shin-Etsu Chemical Co., Ltd., Kao Corporation, Hexion Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tetramethyl Bisphenol A Market Key Technology Landscape

The technological core of the Tetramethyl Bisphenol A (TMBPA) market is centered around optimizing the complex chemical synthesis process to achieve required isomeric purity and high yield efficiently. The established industrial methodology involves the acid-catalyzed alkylation of ortho-cresol, followed by reaction with acetone, but the key technological differentiation lies in the development and application of advanced, selective catalyst systems. Modern producers are moving towards solid-acid catalysts, often based on specialized ion-exchange resins or supported metal oxides, which offer advantages over traditional liquid acids by simplifying post-reaction neutralization and reducing effluent generation. Process intensification techniques, such as microreactor technology and continuous flow chemistry, are being explored and gradually implemented to enhance reaction control, improve heat transfer, and rapidly screen new catalytic formulations, thereby increasing throughput and consistency necessary for bulk production of high-grade TMBPA. Continuous research focuses on improving the selectivity of the ortho-methylation step to reduce undesirable byproducts that complicate purification.

The most crucial aspect of the technology landscape is the purification and separation technology. For TMBPA to be viable in advanced electronic applications, impurities must be meticulously removed. Manufacturers are investing heavily in sophisticated, multi-stage crystallization and vacuum distillation processes. Continuous crystallization, which allows for precise control over crystal growth kinetics and particle size distribution, is increasingly replacing less efficient batch methods, leading to lower operating costs and higher purity levels suitable for electronic lamination grades. Furthermore, analytical technologies, including High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS), are non-negotiable for real-time process monitoring and final product certification. The integration of advanced sensor technology (IoT) and centralized data analytics (AI/Machine Learning) is rapidly becoming standard practice, enabling instantaneous identification and correction of deviations in process parameters, ensuring batch-to-batch homogeneity and compliance with exacting customer specifications, minimizing the risk of expensive product recalls.

Looking forward, technological innovation is focusing on sustainable production methods and functional enhancement. Research into bio-based feedstocks derived from renewable sources is a significant area of interest, aiming to decrease dependence on volatile petrochemical markets and improve the material's lifecycle assessment. Simultaneously, application-specific technological developments involve co-polymerization techniques where TMBPA is incorporated with other specialized monomers (e.g., silicones or fluorinated compounds) to create novel resins exhibiting even lower dielectric constants, essential for 6G and advanced photonics applications. The ability to precisely tailor the thermal, electrical, and mechanical properties of the final polymer system via controlled modification of the TMBPA structure is the primary technological competitive edge, driving producers toward greater investment in proprietary R&D and intellectual property protection related to specialized synthesis and formulation techniques, ensuring the material remains relevant in the rapidly evolving high-tech landscape.

Regional Highlights

Geographical market dynamics are central to the global consumption and supply structure of Tetramethyl Bisphenol A, reflecting localized industrial density and technological specialization.

- Asia Pacific (APAC): APAC is the unequivocally dominant market, both in terms of production volume and final consumption value, largely spearheaded by China, South Korea, and Japan. This region benefits from a dense cluster of global electronics manufacturers, semiconductor foundries, and the world's leading EV battery production capabilities. Demand is exceptionally high for electronic-grade TMBPA used in high-frequency laminates required for 5G infrastructure and data centers. The competitive manufacturing environment in APAC ensures cost-efficient production, but often necessitates stringent quality oversight to meet export standards to North America and Europe. Future growth is projected to be fueled by Southeast Asia's emerging industrial zones, capitalizing on lower labor costs and diversifying supply chains.

- North America: North America represents a mature, premium market where demand is sustained by the aerospace, defense, and high-specification industrial sectors. Consumption is characterized by high-value, low-volume requirements, with a strong emphasis on certified materials meeting stringent governmental and military specifications. The ongoing technological advancements in advanced composites and R&D for next-generation telecommunications hardware ensure steady demand for specialty, high-purity TMBPA derivatives. Compliance with US environmental regulations also pushes suppliers towards cleaner manufacturing processes and verifiable material traceability, supported by robust R&D spending and academic-industry collaboration.

- Europe: Europe is a key consumer driven primarily by the high-performance automotive sector and specialized machinery manufacturing, coupled with robust regulatory frameworks like REACH, which favor non-halogenated specialty chemicals. Countries such as Germany, Italy, and the UK utilize TMBPA extensively in high-end automotive components, protective industrial coatings, and specialized construction materials requiring excellent fire ratings and thermal stability. The European market is highly sensitive to sustainability credentials, prioritizing TMBPA suppliers who can demonstrate reduced environmental impact throughout their production lifecycle and adhere to strict chemical management protocols.

- Latin America (LATAM): This region is an expanding market, with TMBPA demand tied closely to regional infrastructure investments, urbanization trends, and the growth of localized automotive assembly operations, particularly in Brazil and Mexico. While consumption volume is lower compared to APAC, the growth rate is projected to accelerate as domestic manufacturing capacity expands and reliance on imported specialty materials decreases. The focus here is often on standard industrial-grade TMBPA for general composites and coatings, with increasing interest in flame retardant solutions for civil construction applications.

- Middle East and Africa (MEA): Demand in the MEA region is predominantly influenced by large-scale petrochemical projects, infrastructure buildout (smart cities), and the specific material needs of the oil and gas industry, which requires TMBPA-based coatings for chemical and thermal resistance. The development of domestic polymer conversion facilities in the Gulf Cooperation Council (GCC) states is expected to boost future demand for TMBPA as a strategic intermediate chemical, supporting regional economic diversification efforts away from solely crude oil export.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tetramethyl Bisphenol A Market.- Shandong Ruisheng Chemical Co., Ltd.

- BASF SE

- Dow Inc.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- Covestro AG

- Sinopec Corp.

- Saudi Basic Industries Corporation (SABIC)

- Sumitomo Chemical Co., Ltd.

- LG Chem

- Wanhua Chemical Group Co., Ltd.

- Asahi Kasei Corporation

- DIC Corporation

- Nan Ya Plastics Corporation

- Chang Chun Group

- Zhejiang Keyi Chemical Co., Ltd.

- Shanghai Resin Factory Co., Ltd.

- Jiangsu Jichang Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

- Huntsman Corporation

- Evonik Industries AG

- Solvay S.A.

- Shin-Etsu Chemical Co., Ltd.

- Kao Corporation

- Hexion Inc.

- Mitsui Chemicals, Inc.

- Kingfa Sci. & Tech. Co., Ltd.

- Kukdo Chemical Co., Ltd.

- Kumho P&B Chemicals, Inc.

- TPC Group

Frequently Asked Questions

Analyze common user questions about the Tetramethyl Bisphenol A market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Tetramethyl Bisphenol A (TMBPA)?

The primary demand driver for TMBPA is its indispensable role in formulating high glass transition temperature (Tg) epoxy resins required for advanced Printed Circuit Boards (PCBs) used in 5G and data centers, as well as specialty polycarbonates for electric vehicle (EV) battery components that demand high thermal stability and inherent flame retardancy.

How does the performance of TMBPA-based polymers compare to standard Bisphenol A (BPA) derivatives?

TMBPA derivatives offer superior performance, specifically exhibiting significantly higher heat deflection temperatures (Tg), superior resistance to oxidation and chemical exposure, and enhanced electrical insulating properties (lower dielectric loss), making them optimal for high-speed, high-frequency, and extreme temperature operational environments where conventional BPA substitutes fail.

Which geographical region holds the largest market share for Tetramethyl Bisphenol A, and why?

Asia Pacific (APAC) holds the largest market share due to its dominant position in global electronics manufacturing, semiconductor production, and the massive scale of its electric vehicle supply chain. This concentration of high-tech manufacturing necessitates high volumes of TMBPA, particularly the electronic-grade variants, supported by strong government backing for industrial growth.

What is the main challenge faced by manufacturers in the TMBPA market regarding production?

The central challenge is the technical complexity and high cost involved in the multi-stage purification process required to achieve electronic-grade purity (often <10 ppb impurities), which mandates intensive capital investment in advanced separation technologies and rigorous, continuous quality control protocols to meet stringent end-user requirements.

How is the electric vehicle (EV) industry impacting TMBPA market growth?

The EV industry is a crucial growth accelerator, increasing demand for TMBPA-based specialty polycarbonates and epoxy encapsulants used in battery modules and components. These materials provide essential thermal management, lightweighting, and meet stringent fire safety standards required for next-generation electric vehicle architecture, ensuring TMBPA's sustained relevance.

What role does TMBPA play in non-halogenated flame retardancy?

TMBPA acts as a reactive monomer, permanently integrating into the polymer backbone (such as epoxy or polyester resins). This integration allows it to effectively impart superior thermal stability and intrinsic flame retardancy without relying on volatile or leachable halogenated additives, aligning with stricter environmental and safety regulations globally.

What are the key raw materials used in TMBPA synthesis?

The primary raw materials for Tetramethyl Bisphenol A synthesis are petrochemical derivatives, namely phenol and acetone. The cost volatility and stable supply of these upstream feedstocks directly influence the final pricing, production economics, and strategic sourcing decisions across the TMBPA market value chain.

How is AI expected to influence the future production of TMBPA?

AI is anticipated to optimize production by implementing predictive maintenance, improving energy efficiency in purification stages, and accelerating R&D through material informatics. AI will transform TMBPA synthesis into a more precise, data-driven, and resource-efficient operation, minimizing quality variation and maximizing production yields.

In which specific sector of the electronics industry is TMBPA most critical?

TMBPA is most critical in the production of high-frequency and high-speed multi-layer Printed Circuit Boards (PCBs) used in telecommunications infrastructure (5G/6G) and high-performance data servers, where material stability, minimal dielectric loss, and thermal endurance are absolutely essential for maintaining signal integrity and operational reliability.

What distinguishes TMBPA from traditional BPA concerning regulatory perception?

While related chemically, TMBPA is primarily used as a reactive intermediate to form high molecular weight, inert polymers for durable goods like PCBs and composites. This contrasts with traditional BPA, often scrutinized for potential migration from food contact materials, giving TMBPA a distinct and generally more favorable regulatory and industry perception for high-performance applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager