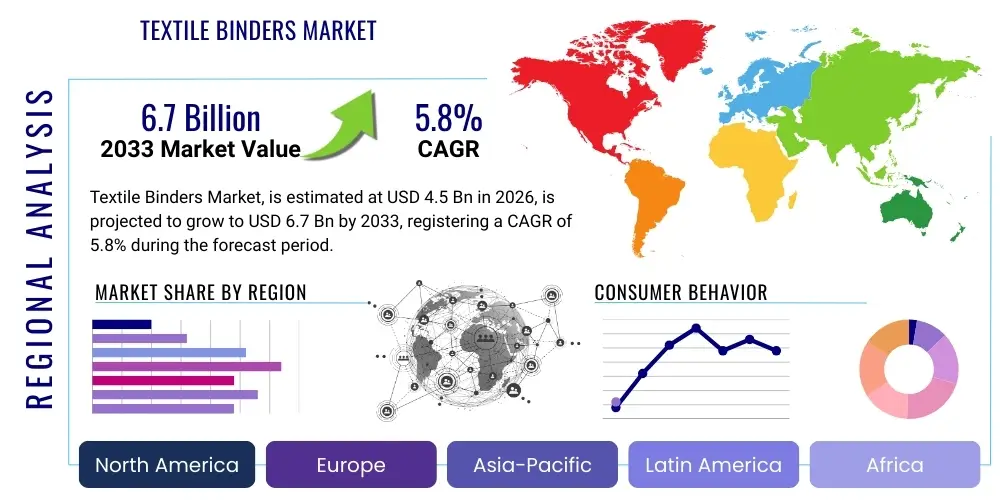

Textile Binders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437539 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Textile Binders Market Size

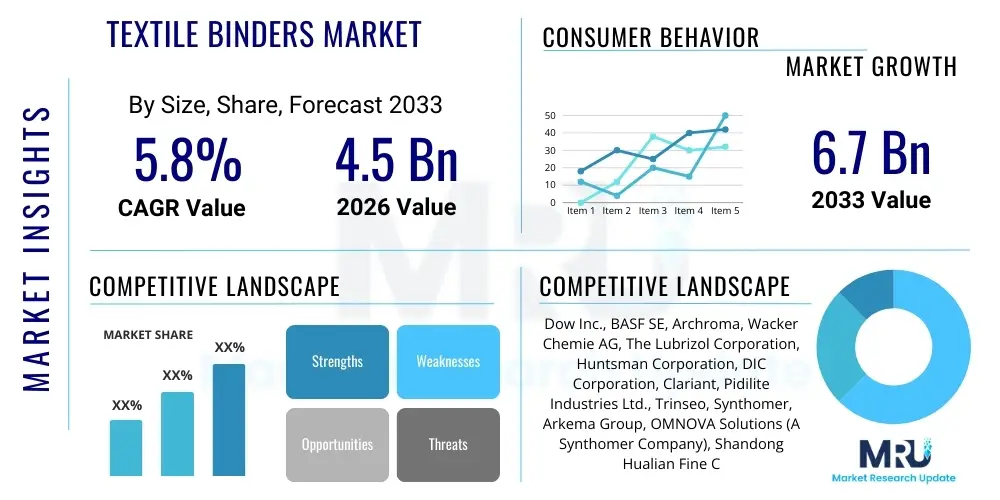

The Textile Binders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Textile Binders Market introduction

Textile binders, essential chemical auxiliaries, are polymeric substances utilized primarily to adhere pigments or functional chemicals to textile substrates, ensuring durability, wash fastness, and overall performance characteristics. These specialized formulations are crucial in various textile processing stages, including pigment printing, coating, lamination, and the consolidation of nonwoven fabrics. The effectiveness of a textile binder is determined by its binding strength, flexibility, resistance to aging and environmental factors, and compatibility with specific fibers and other chemical ingredients used in the formulation. The market is continuously driven by the demand for high-performance textiles across diverse sectors, necessitating binders that offer superior hand feel, exceptional color yield, and ecological compliance.

The primary product category includes synthetic latexes such as styrene-butadiene rubber (SBR), acrylics, vinyl acetate ethylene (VAE), and polyurethane dispersions (PUDs), with acrylic binders dominating due to their versatility, clarity, and resistance to yellowing. These binders serve major applications in apparel manufacturing, home textiles (carpets, upholstery), and increasingly in technical textiles, including automotive interiors, geotextiles, and medical supplies. The benefits derived from employing quality textile binders are manifold, ranging from enhanced aesthetic appeal and tactile properties to improved functional characteristics such as flame retardancy, water repellency, and antimicrobial protection. Binders are the backbone of modern textile finishing, ensuring that complex functional requirements are met efficiently.

Market expansion is significantly fueled by the rapid growth of the nonwovens sector, particularly in disposable hygiene products and durable applications like construction materials and filtration media. Furthermore, the global shift towards sustainable manufacturing practices is compelling manufacturers to invest in bio-based and low-VOC (Volatile Organic Compound) binders, aligning with stringent environmental regulations, particularly in Europe and North America. Key driving factors include technological advancements leading to superior binder performance, increasing penetration of digital printing techniques which require specific binder formulations, and rising consumer preference for durable and specialty textiles that incorporate advanced functional finishes. The Asia Pacific region, characterized by rapid industrialization and large-scale textile production bases, remains a pivotal driver of global demand.

Textile Binders Market Executive Summary

The global Textile Binders Market is exhibiting robust growth, propelled by sustained industrialization in emerging economies and intensive research focused on developing sustainable, high-performance binding solutions. Business trends indicate a strong move toward water-based and solvent-free binder systems, driven by regulatory pressures targeting VOC reduction and environmental stewardship. Strategic alliances, mergers, and acquisitions are common as established players seek to consolidate market share, integrate backward to secure raw material supply (monomers), or expand specialized application expertise, particularly in high-growth segments like technical textiles and digital printing inks. Furthermore, there is a distinct competitive trend focused on optimizing the cost-performance ratio of acrylic and polyurethane binders to meet the demanding requirements of fast-fashion cycles and industrial applications.

Regionally, Asia Pacific (APAC) maintains its dominance, primarily due to the concentration of large-scale textile and nonwoven manufacturing hubs in China, India, and Southeast Asian nations. This dominance is characterized by high production volumes and increasing domestic consumption of finished textile products. However, regions like Europe and North America, while having mature textile industries, are leading the charge in innovation, focusing heavily on premium, high-value technical textile applications and sustainable binder adoption. These regions enforce rigorous regulatory standards, which mandates manufacturers to develop specialized, compliant products, thereby positioning these markets as crucial centers for product development and technological advancement in eco-friendly chemical auxiliaries.

Segmentation trends highlight the increasing significance of acrylic binders due to their excellent all-around performance and cost-effectiveness, making them the preferred choice for pigment printing and general nonwoven bonding. Concurrently, the polyurethane segment is experiencing accelerated growth, driven by its superior elasticity, abrasion resistance, and use in high-end coatings, laminations, and technical apparel requiring advanced mechanical properties. In terms of application, the nonwovens sector—encompassing hygiene products, wipes, and construction materials—is the fastest-growing segment, necessitating binders tailored for diverse bonding methods, including thermal and chemical consolidation. The convergence of smart textiles and performance apparel further necessitates specialized binders that can withstand electronic integration and extreme conditions, opening new niche opportunities within the market landscape.

AI Impact Analysis on Textile Binders Market

Common user inquiries regarding AI's impact on the Textile Binders Market primarily revolve around its role in optimizing chemical synthesis, predicting polymer performance, and enhancing smart factory efficiency within textile processing plants. Users are keen to understand how AI-driven predictive modeling can accelerate the development of novel binder formulations, particularly bio-based or functionalized polymers, reducing R&D cycles and costs. There is also significant interest in using Machine Learning (ML) algorithms for quality control—specifically, analyzing complex interactions between binder chemistry, fabric structure, and process parameters (like curing temperature and application rate) to minimize defects and ensure consistent final product quality. Furthermore, stakeholders are investigating AI's potential in supply chain management, optimizing monomer procurement and inventory based on real-time market fluctuations and production forecasts.

The implementation of AI and related technologies such as Industrial Internet of Things (IIoT) sensors in textile processing plants facilitates real-time data collection on binder application parameters. This data, when analyzed by ML models, allows for automated adjustments to application machinery, ensuring precise coating weight, uniform distribution, and optimal curing conditions. This operational optimization directly translates into reduced material waste, lower energy consumption during the drying and curing phases, and significantly improved process repeatability. Manufacturers of textile binders are leveraging AI to simulate the long-term performance and durability of new products under various stress conditions (e.g., repeated washing, abrasion, UV exposure) before physical prototyping, dramatically improving time-to-market for innovative solutions.

AI's influence extends deeply into the realm of sustainability. By utilizing generative AI and predictive analytics, researchers can rapidly screen thousands of potential raw material combinations, identifying formulations that minimize the use of hazardous substances and maximize the incorporation of renewable resources. This capability is paramount in meeting stringent global environmental standards and consumer demands for eco-friendly textiles. The integration of AI into complex printing and coating machines also allows for dynamic recipe management, where the binder concentration and viscosity are instantaneously adjusted based on fabric porosity and ambient conditions, ensuring optimal pigment fixation and functional property achievement while conserving chemical resources. This data-driven approach institutionalizes efficiency across the entire manufacturing pipeline.

- AI-driven optimization of polymerization processes, enhancing batch consistency and yield.

- Predictive modeling for binder performance (durability, washfastness, hand feel) based on chemical structure.

- Implementation of Machine Vision and AI for real-time quality inspection of coated or printed textiles, minimizing defects.

- Optimization of application machinery (e.g., screen printing, saturation systems) using IIoT data analytics.

- Accelerated research and development of sustainable and bio-based binder formulations using generative chemistry models.

- Enhanced supply chain forecasting for key monomers and additives, mitigating price volatility and shortages.

- Energy consumption optimization in drying and curing ovens through AI-controlled temperature and air flow adjustments.

DRO & Impact Forces Of Textile Binders Market

The dynamics of the Textile Binders Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and the resulting Impact Forces. The primary drivers fueling growth include the expanding global nonwovens sector, particularly in healthcare and hygiene; the burgeoning demand for high-performance and functional textiles in automotive and aerospace applications; and increasing industrial focus on efficient, high-speed textile processing which demands superior chemical auxiliaries. Simultaneously, significant restraints dampen potential growth, notably the stringent and complex environmental regulations concerning volatile organic compounds (VOCs) and formaldehyde release, which impose high compliance costs and necessitate substantial R&D investments in safer alternatives. Furthermore, fluctuations in the price and availability of petrochemical-derived raw materials, such as acrylic monomers and ethylene, present ongoing cost pressure and supply chain volatility for binder manufacturers.

Opportunities for market players are concentrated in several key areas. The shift toward sustainable textiles offers a lucrative pathway for companies developing bio-based polymers derived from renewable resources, meeting the growing consumer and corporate mandate for circular economy principles. Furthermore, the rapid adoption of digital textile printing requires specialized, fast-curing binders that integrate seamlessly into inkjet systems, presenting a high-value niche segment. Expanding infrastructural development and increased spending on protective and technical textiles in emerging markets also provide avenues for market penetration. Companies focusing on specialized functional finishes—such as advanced UV resistance, thermal regulation, or integrated conductive properties for smart textiles—will capture premium market shares.

The impact forces influencing the market are high, driven predominantly by regulatory stringency and innovation speed. The increasing global regulatory harmonization, particularly the implementation of standards like REACH in Europe and similar initiatives worldwide, forces rapid technological change. The intense competitive landscape necessitates continuous innovation in polymerization techniques and product formulation to achieve improved cost-performance characteristics, specifically focusing on achieving superior hand feel with high binding strength. The major impact force remains the necessity for sustainability; manufacturers unable to transition away from solvent-based systems or high-VOC formulations face market exclusion, highlighting the power of environmental compliance as a competitive differentiator and a critical barrier to entry for conventional products. This pressure drives significant capital expenditure toward green chemistry and advanced process engineering.

Segmentation Analysis

The Textile Binders Market is systematically segmented based on product type (chemical composition), application, and end-user industry, enabling a nuanced understanding of market drivers and growth pockets. Segmentation by product type reveals that acrylic binders, owing to their cost-effectiveness, excellent durability, and wide applicability across various textile processes (especially pigment printing and nonwovens), hold the largest market share. However, polyurethane (PU) binders are gaining traction rapidly, particularly in performance coatings and lamination due to their inherent flexibility, superior abrasion resistance, and ability to impart highly resilient finishes required in high-stress applications like athletic wear and automotive upholstery. The choice of segment significantly impacts the final properties of the textile, dictating factors such as drape, stiffness, and resistance profile.

Application-wise, the market is broadly classified into nonwoven applications (including hygiene, medical, and filtration) and conventional textile applications (printing, coating, flocking, and sizing). Nonwoven bonding consumes the largest volume of textile binders, driven by the massive scale of disposable product manufacturing globally. Within the conventional textile sector, pigment printing represents a major application, requiring binders that provide excellent color fixation without compromising the textile’s tactile properties. The coating segment, which imparts advanced functionalities such as water resistance, flame retardancy, or anti-slip characteristics, demands highly engineered, specialized binder chemistries, often polyurethane or specialty acrylic copolymers, indicating a higher value proposition within this sub-segment.

The strategic analysis of these segmentations highlights distinct growth trajectories. The nonwovens sector is characterized by volume-driven growth and a preference for cost-efficient, high-solids SBR or VAE binders, especially in emerging markets. Conversely, the technical textiles and high-performance coating segments are characterized by value-driven growth, demanding premium, customized PUDs and cross-linking acrylics capable of meeting extremely high specifications. This divergence means manufacturers must strategically tailor their portfolios: high-volume capacity for commodity binders and agile, R&D-intensive production for specialized performance products. The ability to innovate within the acrylic and polyurethane segments, particularly concerning lower formaldehyde and bio-based content, will define competitive success across all end-use industries.

- By Product Type:

- Acrylic Binders (Styrene Acrylic, Pure Acrylic)

- Styrene-Butadiene Rubber (SBR) Latex Binders

- Vinyl Acetate Ethylene (VAE) Binders

- Polyurethane (PU) Dispersions

- Other Binders (including PVC, Specialty Resins)

- By Application:

- Nonwoven Bonding (Disposable, Durable)

- Pigment Printing and Dyeing

- Coating and Finishing (Waterproofing, Fire Retardancy)

- Flocking and Back-coating

- Lamination and Sizing

- By End-User Industry:

- Apparel and Clothing

- Home Furnishings and Textiles (Carpets, Upholstery)

- Technical Textiles (Automotive, Filtration, Construction, Medical)

- Hygiene and Personal Care

Value Chain Analysis For Textile Binders Market

The value chain of the Textile Binders Market begins with the upstream sourcing of crucial raw materials, predominantly petrochemical derivatives. Key inputs include various monomers such as acrylic esters (e.g., butyl acrylate, 2-ethylhexyl acrylate), styrene, butadiene, vinyl acetate, and isocyanates (for polyurethane). The cost and stability of these monomers are highly sensitive to crude oil prices and global supply chain dynamics, exerting significant pressure on the production costs of binder manufacturers. Upstream analysis also involves the supply of necessary auxiliary chemicals, including emulsifiers, stabilizers, and initiators required for the complex emulsion polymerization process. Manufacturers with strong backward integration or long-term supply contracts for these commodity chemicals possess a distinct competitive advantage in managing input price volatility and ensuring consistent quality.

The midstream segment involves the core manufacturing process, where chemical companies transform monomers into specialized polymer emulsions or dispersions tailored for textile applications. This conversion process is technologically complex, requiring specialized reactors and precise control over temperature and pressure to achieve the desired polymer molecular weight, particle size, and glass transition temperature (Tg). Distribution channels play a critical role, bridging the gap between binder producers and the diverse textile processing units (mills, finishers, nonwoven producers). Direct sales channels are often employed for large-volume customers and customized specialty binders where technical support and application expertise are paramount. Indirect distribution utilizes regional distributors and specialized chemical agents who manage smaller volumes and provide local inventory management and logistical support, particularly crucial in fragmented markets like South Asia.

The downstream analysis focuses on the end-users: textile mills, coating specialists, and nonwoven manufacturers, who apply the binders in processes ranging from pigment printing and back-coating to sophisticated lamination. The final consumption stage is heavily influenced by quality standards and functional requirements; a high-quality binder ensures the commercial viability and performance metrics (e.g., durability, hand feel) of the final textile product. Effective collaboration throughout the value chain, from monomer producers to end-users, is essential for rapid product innovation, especially for niche applications like flame-retardant or conductive binders. The push for sustainability necessitates a circular approach, focusing on binders that enable easier textile recycling or utilize renewable raw materials, forcing value chain restructuring toward greener supply partnerships.

Textile Binders Market Potential Customers

The primary consumers and end-users of textile binders span the entire spectrum of the global textile manufacturing ecosystem, driven by the necessity to fix pigments, consolidate fibers, and impart functional properties. The largest volume consumers are manufacturers in the nonwovens sector, including producers of disposable hygiene products (diapers, sanitary pads), medical nonwovens (surgical gowns, masks), and durable nonwovens used in construction, filtration, and insulation. These buyers require high-solids, cost-effective binders like SBR and VAE latexes that offer excellent wet strength and resilience for high-speed saturation or spray bonding processes. The continuous expansion of the global population and heightened awareness regarding health and hygiene protocols ensure sustained demand from this critical customer segment.

Another major customer group comprises textile printing and finishing mills, specializing in apparel, fashion textiles, and home furnishings. For pigment printing, these mills rely heavily on high-quality acrylic binders that deliver brilliant color depth, excellent wash fastness, and a soft hand feel, which is crucial for consumer garments. Finishing operations, such as textile coating, represent a high-value customer segment, including technical textile manufacturers and specialized finishers. These customers demand advanced polymers, often PUDs or cross-linking acrylics, to achieve specific functionalities such as waterproof breathable coatings, abrasion resistance for automotive seating, or enhanced UV protection for outdoor fabrics. Their purchasing decisions are highly weighted toward technical specifications, compliance certifications, and long-term performance guarantees rather than mere price.

A rapidly growing segment of potential customers is found within the technical textiles industry, encompassing sectors such as automotive textiles (carpeting, interior headliners), geotextiles (soil stabilization), and specialized protective clothing manufacturers. These customers require binders capable of enduring extreme conditions—high heat, constant flexing, chemical exposure—necessitating rigorous product testing and customization. Furthermore, new niche buyers are emerging in the smart textiles and wearable technology domain, where binders must be compatible with embedded electronic components, often requiring conductive or highly flexible, non-tacky formulations. Suppliers targeting these premium, specification-driven customers must provide specialized technical support and collaborative R&D services to secure long-term contracts and establish themselves as trusted partners in material innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., BASF SE, Archroma, Wacker Chemie AG, The Lubrizol Corporation, Huntsman Corporation, DIC Corporation, Clariant, Pidilite Industries Ltd., Trinseo, Synthomer, Arkema Group, OMNOVA Solutions (A Synthomer Company), Shandong Hualian Fine Chemical Co. Ltd., Michelman Inc., Polymer Group, Inc. (PGI), Sika AG, CHT Group, Evonik Industries AG, Nippon Shokubai. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Textile Binders Market Key Technology Landscape

The technological landscape of the Textile Binders Market is rapidly evolving, driven primarily by the dual objectives of enhancing performance attributes and achieving superior environmental compliance. A central technological focus is the development of advanced polymer chemistries, specifically utilizing techniques like controlled radical polymerization (CRP) to create binders with narrower molecular weight distributions and highly customized functional groups. This allows manufacturers to precisely engineer the polymer properties—such as glass transition temperature (Tg), adhesion characteristics, and cross-linking density—to meet the exacting requirements of highly technical applications, ensuring superior tensile strength, durability, and resilience in the final textile substrate without compromising the soft hand feel desired by consumers.

Sustainability and green chemistry represent a major technological frontier. Innovations in water-based and solvent-free systems, such as high-solids emulsions and polyurethane dispersions (PUDs), are becoming standard, replacing traditional solvent-borne formulations to drastically reduce VOC emissions. Furthermore, the development and commercialization of bio-based binders derived from renewable raw materials—like starches, cellulosic derivatives, or specialized biopolymers—are key disruptive technologies. These bio-based options aim to lower the carbon footprint of textile manufacturing while maintaining competitive performance metrics. Parallel advancements in nanotechnologies involve incorporating nano-sized particles within the binder formulation to improve penetration, enhance UV resistance, or introduce specialized antimicrobial functions at the fiber interface, demanding highly sophisticated compounding and dispersion techniques.

Another area of intense technological advancement lies in improving curing mechanisms to maximize efficiency and speed. The integration of specialized binders designed for low-temperature curing is critical for processing heat-sensitive synthetic fibers and achieving energy savings in textile mills. Furthermore, UV-curable binders and electron beam (EB) curable systems are emerging for high-speed, continuous coating and printing operations. These technologies offer instant curing, dramatically increasing throughput and minimizing the energy required for traditional thermal drying processes. The future technological landscape is centered on smart functionalization, developing binders that can effectively anchor conductive inks, phase change materials (PCMs), or advanced functional pigments, enabling the growth of the smart and technical textile markets requiring specialized, high-tech chemical solutions.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for textile binders globally, dominated by mass production capabilities in China, India, and Vietnam. The region’s growth is fueled by robust domestic consumption, low manufacturing costs, and substantial investments in both conventional textiles (apparel) and nonwovens (hygiene products). China remains the primary global exporter and consumer, driving high demand for commodity binders like SBR and standard acrylics. However, increasing environmental pressure in countries like China is rapidly accelerating the adoption of eco-friendly, low-VOC binders, shifting the focus towards higher-quality, compliant products. India and Southeast Asia are emerging as major growth hubs for technical textiles, demanding advanced polyurethane and specialty acrylic formulations for automotive and construction applications.

- Europe: Europe is characterized by stringent environmental regulations (e.g., REACH) and a strong focus on high-performance, sustainable, and technical textiles. The demand is heavily skewed towards innovative, bio-based, and PUD binders used in sophisticated finishing, protective clothing, and specialized industrial coatings. Germany, Italy, and Turkey are key markets, emphasizing high-value-added processes like lamination and complex functional coating. European manufacturers often lead in R&D for next-generation, solvent-free binders, positioning the region as a leader in technological sophistication despite having lower overall production volume compared to APAC. Consumer preference for certified eco-labels also dictates material choices.

- North America (NA): The North American market is mature, driven primarily by the technical textiles segment, particularly in automotive interiors, medical textiles, and nonwovens for filtration and construction. Demand is stable and focused on quality and compliance, favoring high-performance acrylic and polyurethane binders. The region exhibits a strong preference for domestically produced high-tech nonwovens (driven by FDA and local regulatory standards), emphasizing durable bonding solutions. Innovation centers around optimizing manufacturing efficiency, adopting high-solids dispersions, and integrating smart manufacturing techniques to reduce operational costs and enhance product consistency.

- Latin America (LA): Latin America presents moderate growth potential, primarily centered in Brazil and Mexico, catering mainly to domestic apparel production and automotive manufacturing. The market utilizes a mix of commodity and specialty binders, with economic stability and local industrial policies significantly influencing demand patterns. The push for localized production, particularly in the nonwovens hygiene sector, is expected to increase the consumption of standard latex binders.

- Middle East and Africa (MEA): MEA is a nascent but high-potential market, driven by growing textile production in countries like Turkey (often grouped with Europe for specialized textiles) and regional investments in infrastructure (geotextiles). Demand is primarily focused on importing cost-effective binders for fast-growing segments like nonwovens and basic apparel printing. Significant investment in industrial zones, particularly in the GCC countries, could accelerate the demand for specialized protective and industrial textile applications, requiring resilient binding systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Textile Binders Market.- Dow Inc.

- BASF SE

- Archroma

- Wacker Chemie AG

- The Lubrizol Corporation

- Huntsman Corporation

- DIC Corporation

- Clariant

- Pidilite Industries Ltd.

- Trinseo

- Synthomer

- Arkema Group

- OMNOVA Solutions (A Synthomer Company)

- Shandong Hualian Fine Chemical Co. Ltd.

- Michelman Inc.

- Sika AG

- CHT Group

- Evonik Industries AG

- Nippon Shokubai

- Indofil Industries Limited

Frequently Asked Questions

Analyze common user questions about the Textile Binders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for sustainable textile binders?

Demand is driven by increasingly stringent global environmental regulations, such as restrictions on formaldehyde and VOCs, combined with growing consumer and brand mandates for certified eco-friendly textiles and circular manufacturing practices. This pushes manufacturers toward bio-based polymers and water-based, solvent-free formulations.

Which binder chemistry segment holds the largest market share and why?

The acrylic binders segment currently holds the largest market share due to its versatility, cost-effectiveness, superior durability, and applicability across mass-market segments including pigment printing, coating, and the high-volume nonwoven industry. Their customization potential allows for diverse performance profiles.

How does the nonwoven industry impact the Textile Binders Market?

The nonwoven industry, particularly the disposable hygiene and medical sectors, is the largest volume consumer of textile binders (like SBR and VAE), demanding high-solids, fast-curing formulations for high-speed production lines. Its rapid global expansion is a key volume driver for the overall binder market.

What is the role of polyurethane dispersions (PUDs) in the high-performance textile sector?

PUDs are critical for high-performance applications like automotive, athletic wear, and technical coatings because they offer superior flexibility, exceptional abrasion resistance, enhanced mechanical strength, and chemical durability, often required for premium lamination and functional finishes.

What major constraints hinder the rapid growth of the Textile Binders Market?

Major constraints include the volatile pricing of petrochemical-derived raw materials (monomers) and the significant capital expenditure required for R&D to develop and certify new low-VOC, formaldehyde-free, and bio-based compliant binder technologies to satisfy evolving global regulatory standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager