Textile Implants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436525 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Textile Implants Market Size

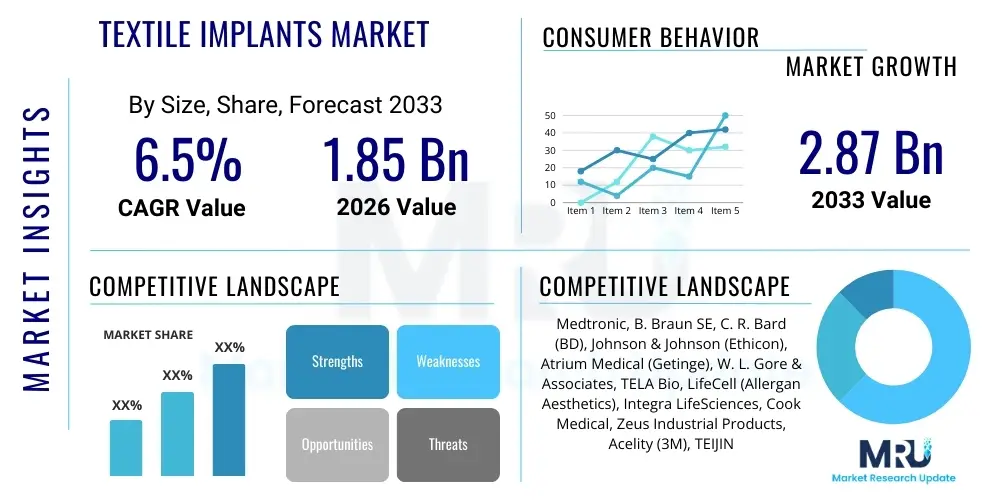

The Textile Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Textile Implants Market introduction

The Textile Implants Market encompasses specialized biomedical devices constructed primarily from textile-based materials, including woven, knitted, and non-woven structures, designed for permanent or temporary integration within the human body. These implants serve crucial functions such as tissue reinforcement, support, reconstruction, and regeneration across numerous surgical disciplines. Products range from vascular grafts and synthetic hernia meshes to ligament augmentation devices and specialized cosmetic textile scaffolds. The unique mechanical properties of textile structures—flexibility, porosity, and high tensile strength—make them ideal for interfacing with biological tissues, promoting cellular ingrowth, and providing long-term structural integrity. The demand for these sophisticated medical textiles is driven by the increasing global incidence of chronic diseases, the rise in geriatric populations requiring reconstructive surgeries, and advancements in minimally invasive surgical techniques that favor flexible, customizable implantable materials.

Major applications for textile implants are predominantly found in general surgery (hernia and abdominal wall reconstruction), cardiovascular surgery (stents, vascular patches, and grafts), and orthopedic procedures (ligament and tendon repair). The inherent benefit of using textile constructs lies in their ability to mimic the elasticity and anisotropic behavior of natural tissues, reducing stress shielding and improving patient recovery outcomes compared to rigid metallic devices. Furthermore, ongoing innovation in material science focuses on developing bioresorbable textile polymers and functionalized surfaces coated with pharmaceuticals or biological agents to enhance biocompatibility and actively promote tissue healing. The global market is intensely competitive, characterized by stringent regulatory environments, emphasizing high-quality manufacturing and rigorous clinical testing to ensure patient safety and long-term efficacy.

Key driving factors fueling market expansion include technological improvements in polymer chemistry leading to superior biomaterials, the widespread adoption of tension-free hernia repair techniques utilizing advanced meshes, and the growing prevalence of sports injuries requiring complex soft tissue reconstruction. Additionally, the shift towards personalized medicine encourages the development of customized, patient-specific textile implants produced through advanced manufacturing processes like 3D weaving and electrospinning. While cost constraints and the risk of post-operative complications, such as mesh erosion or infection, present ongoing challenges, the continuous effort to develop antimicrobial and bio-integrative textile surfaces ensures robust market growth and sustained investment in research and development aimed at next-generation medical textiles.

Textile Implants Market Executive Summary

The Textile Implants Market is poised for significant expansion, fundamentally driven by demographic shifts, particularly the aging population, and the corresponding increase in reconstructive and cardiovascular surgeries globally. Current business trends indicate a strong pivot towards absorbable and bio-integrated materials, minimizing long-term foreign body reactions and improving surgical outcomes. Strategic mergers and acquisitions are consolidating the market landscape, allowing key players to acquire specialized technology and expand their geographical footprint, particularly into high-growth emerging economies in the Asia Pacific region. Furthermore, there is a distinct trend toward vertically integrated supply chains, focusing on controlling raw material quality—especially high-performance biomedical polymers—and ensuring compliance with complex global medical device regulations.

Regional trends highlight North America and Europe as dominant forces, primarily due to well-established healthcare infrastructure, high healthcare spending, and rapid adoption of advanced surgical techniques, including robotic-assisted procedures that frequently utilize specialized textile implants. However, the Asia Pacific region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by expanding medical tourism, improving healthcare access, increasing disposable income, and government initiatives aimed at upgrading medical facilities. Countries like China, India, and Japan are becoming significant hubs for both manufacturing and consumption of complex medical textile products, necessitating localized distribution and clinical education strategies for global market participants.

Segment trends underscore the dominance of the hernia repair segment, driven by the high recurrence rate of hernias and the proven efficacy of synthetic textile meshes in providing durable reinforcement. The fastest-growing segment, however, is soft tissue reinforcement and specialized applications in cardiovascular implants, propelled by innovations in synthetic vascular grafts that offer superior patency rates compared to older materials. By material type, synthetic polymers like polypropylene and expanded polytetrafluoroethylene (ePTFE) maintain the largest share due to their mechanical robustness, while the market shows accelerating adoption of advanced biodegradable polymers and composites that address biocompatibility challenges and support tissue regeneration.

AI Impact Analysis on Textile Implants Market

User queries regarding the impact of Artificial Intelligence (AI) on the Textile Implants Market primarily revolve around three core themes: personalized implant design, optimization of manufacturing processes, and improvement of post-operative monitoring and risk prediction. Users frequently ask if AI can design textile architectures that perfectly match patient-specific tissue mechanics, whether AI-driven quality control can reduce manufacturing defects in complex weaves, and how predictive analytics can be used to forecast the risk of infection or rejection of textile grafts. The overriding expectation is that AI will introduce unprecedented levels of precision and personalization, moving away from standard, off-the-shelf sizes toward custom-fit, performance-optimized textile scaffolds that enhance surgical success rates and minimize adverse long-term effects.

- AI algorithms facilitate personalized geometry and material composition design based on patient imaging (MRI, CT scans) and biomechanical data, optimizing textile pore size and elasticity for specific implantation sites.

- Generative design and simulation tools powered by AI are used to optimize the mechanical performance of textile architectures (e.g., knit patterns, fiber density) before physical production, accelerating R&D cycles.

- AI-driven automated inspection systems using high-resolution cameras enhance quality control during textile production, detecting microscopic flaws or inconsistencies in weaving, knitting, or non-woven structures critical for implant safety.

- Machine learning models analyze vast patient datasets to predict the success rate, long-term stability, and potential for adverse events (such as mesh shrinkage or infection) associated with specific implant types and patient characteristics.

- AI assists in optimizing inventory management and supply chain logistics for customizable implants, ensuring just-in-time delivery for scheduled surgical procedures globally.

- Robotic-assisted surgery, often guided by AI for improved precision, increases the demand for highly specialized, flexible textile implants designed specifically for robotic manipulation and minimally invasive insertion.

DRO & Impact Forces Of Textile Implants Market

The Textile Implants Market is significantly influenced by a complex interplay of demographic shifts, technological maturity, and intense regulatory oversight. Key drivers include the global aging demographic, which directly increases the incidence of age-related conditions requiring hernia repair, cardiovascular reconstruction, and soft tissue support. Simultaneously, technological advancements, such as the introduction of electrospun nanofiber scaffolds and bioresorbable polymers, are expanding the functional scope and safety profile of textile implants. These drivers are fundamentally accelerating market adoption. However, market growth is restrained by well-documented risks associated with certain long-term synthetic textile implants, leading to highly publicized product recalls and subsequent patient litigation, which erodes consumer confidence and increases manufacturers' liability insurance costs. Furthermore, the high cost associated with advanced biocompatible materials and the complexity of achieving regulatory approval in multiple jurisdictions pose persistent operational barriers.

Opportunities for future expansion are predominantly found in the field of regenerative medicine, leveraging textile scaffolds integrated with biological components or stem cells to actively promote tissue regeneration rather than just providing passive support. The increasing prevalence of lifestyle diseases globally, particularly obesity and diabetes, fuels the need for specialized textile implants resilient to complex physiological environments. Furthermore, emerging markets in Asia and Latin America represent untapped growth potential, requiring tailored, cost-effective product lines. The impact forces acting on this market—defined by competitive intensity, buyer power, supplier power, threat of new entry, and threat of substitutes—are generally high. Buyer power is substantial, driven by large hospital purchasing groups and increasing patient awareness regarding alternative treatment options.

The threat of substitutes remains a critical impact force; advancements in purely biological tissue grafts, autologous tissue repair techniques, and next-generation biological materials (e.g., decellularized matrices) present viable alternatives to synthetic textile implants, compelling manufacturers to continually innovate and improve the long-term biological integration of their products. Supplier power is moderate to high, particularly for proprietary, high-grade biomedical polymers, necessitating strategic, long-term contracts with specialized raw material providers. Overall, the market remains characterized by a high need for differentiated, clinically superior products that can successfully navigate rigorous regulatory scrutiny and address documented concerns regarding long-term patient safety and performance.

Segmentation Analysis

The Textile Implants Market is structurally diverse, segmented based on material composition, specific surgical application, and end-user setting, reflecting the wide functional scope of these biomedical textiles. This segmentation is crucial for understanding specific growth vectors; for instance, materials are categorized into synthetic, natural, and composite types, with synthetic polymers currently dominating volume due to their durability and mechanical strength, while absorbable synthetic polymers are rapidly gaining market share due to improved biocompatibility profiles. Application segmentation highlights the dominance of high-volume procedures like hernia repair, juxtaposed against high-value, complex fields like cardiovascular and neurological applications. Analyzing these segments provides strategic insights into investment priorities, indicating where R&D efforts should focus to maximize clinical impact and market penetration.

- By Type: Non-Absorbable Implants, Absorbable/Bioresorbable Implants, Partially Absorbable Implants

- By Material:

- Synthetic Polymers: Polypropylene (PP), Polyester (PET), Polytetrafluoroethylene (PTFE) & Expanded PTFE (ePTFE), Polyethylene (PE), Polydioxanone (PDO)

- Natural Fibers: Silk, Collagen, Others

- Composites

- By Application:

- Hernia Repair (Inguinal, Incisional, Ventral)

- Soft Tissue Reinforcement and Reconstruction (Pelvic Floor Repair, Breast Reconstruction)

- Cardiovascular Implants (Vascular Grafts, Heart Valve Repair Patches)

- Orthopedic Implants (Ligament & Tendon Repair, Bone Scaffolds)

- Aesthetic and Cosmetic Surgery

- By End-Use: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Value Chain Analysis For Textile Implants Market

The value chain for textile implants is highly specialized and complex, beginning with the upstream segment focused on the synthesis and refinement of medical-grade raw materials. This includes specialized chemical manufacturers producing high-ppurity, biocompatible polymers (such as medical-grade polypropylene, PTFE resins, and complex biodegradable polylactides/polyglycolides). This stage requires rigorous quality control and specialized manufacturing environments to ensure material safety and traceability, which often results in strong supplier leverage over manufacturers. Key activities in the midstream involve advanced textile engineering processes, including precision knitting, weaving (flat and 3D), electrospinning, and coating technologies, converting raw fibers into finished implant structures. This manufacturing phase is capital-intensive and requires highly specialized technical expertise to meet biomechanical specifications and porosity requirements.

The downstream segment focuses on sterilization, packaging, regulatory approval, and distribution. Strict adherence to ISO standards and regional regulatory bodies (FDA, EMA) is mandatory before products enter the distribution channel. Distribution channels are typically bifurcated into direct and indirect methods. Direct distribution involves manufacturers selling directly to large hospital networks or Group Purchasing Organizations (GPOs), allowing for greater control over pricing and product education. Indirect channels involve utilizing specialized medical device distributors, particularly in fragmented or geographically dispersed markets, who manage localized inventory and maintain relationships with surgical teams. Strong, specialized sales forces focusing on educating surgeons about the biomechanical benefits of specific textile architectures are essential in both models.

In the Textile Implants Market, successful distribution hinges on timely logistics for temperature-sensitive or customized products. Potential customers, which are primarily hospitals and ASCs, demand comprehensive clinical evidence and economic value propositions. Manufacturers must manage complex inventory requirements, especially for custom-sized or niche products. Therefore, optimizing the entire value chain—from sourcing premium polymers to ensuring compliant, sterilized packaging—is critical for market success and maintaining product margins in a highly regulated and competitive industry. The increasing trend towards outsourcing sterilization and specialized coating processes to Contract Manufacturing Organizations (CMOs) is restructuring parts of the midstream and downstream segments, providing flexibility but introducing new risks related to quality oversight.

Textile Implants Market Potential Customers

The primary customers and end-users of textile implants are healthcare providers and surgical facilities specializing in reconstructive, cardiovascular, and general surgeries. Hospitals, particularly large university hospitals and regional medical centers that handle complex, high-volume surgical cases (e.g., major abdominal wall reconstructions or vascular bypasses), constitute the largest segment of end-users. These institutions often require large volumes of standardized synthetic meshes and advanced cardiovascular textile grafts. Purchasing decisions within hospitals are typically driven by multidisciplinary committees, considering clinical efficacy, long-term patient outcomes, cost-effectiveness (analyzing product cost versus complication rates), and compatibility with existing surgical equipment and robotic platforms.

Ambulatory Surgical Centers (ASCs) are rapidly growing consumers, especially for less complex, high-volume procedures like basic inguinal hernia repair and minor soft tissue reinforcement. ASCs prioritize products that facilitate quicker turnover times and have proven short-term safety profiles, often favoring minimally invasive textile implants. The purchasing power in ASCs is highly sensitive to price and inventory management efficiency. Additionally, specialty clinics focusing on niche areas such as cosmetic surgery (requiring textile scaffolds for breast lift support) or sports medicine (requiring advanced tendon/ligament fixation devices) form a crucial, though smaller, customer base that demands highly specialized and premium-priced textile solutions.

The increasing prevalence of chronic diseases and the rise in elective cosmetic procedures ensure sustained demand across all end-user segments. Manufacturers must focus their sales strategies on clinical education, providing robust data on biocompatibility and mechanical longevity to satisfy the discerning requirements of surgeons and the economic constraints imposed by hospital procurement departments and payer organizations. Patient demographics and regional regulatory environments dictate the specific product mix preferred by these end-users, requiring a customized marketing and distribution approach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, B. Braun SE, C. R. Bard (BD), Johnson & Johnson (Ethicon), Atrium Medical (Getinge), W. L. Gore & Associates, TELA Bio, LifeCell (Allergan Aesthetics), Integra LifeSciences, Cook Medical, Zeus Industrial Products, Acelity (3M), TEIJIN FRONTIER, Gunze Ltd., J-Pac Medical, Conmed Corporation, Arthrex, Stryker Corporation, Smith & Nephew, Boston Scientific Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Textile Implants Market Key Technology Landscape

The technological landscape of the Textile Implants Market is defined by continuous innovation aimed at enhancing biocompatibility, mechanical longevity, and regenerative capabilities. A foundational technology involves advanced weaving and knitting techniques, moving beyond simple flat meshes to complex 3D structures. These techniques allow manufacturers to precisely control pore size, fiber orientation, and overall geometry, enabling the creation of scaffolds that better mimic native tissue architecture and promote optimal cellular infiltration and neovascularization. Specialized knitting methods, such as warp knitting, are frequently employed in vascular graft manufacturing to achieve high burst strength and controlled porosity, critical for long-term functional success in high-pressure environments.

Another crucial technological advancement is the application of electrospinning, particularly for producing nanofiber scaffolds. Electrospinning creates ultra-fine fibers, often in the nanometer range, which closely resemble the native extracellular matrix (ECM). This technology is pivotal in developing bioresorbable scaffolds for tissue engineering, especially in cardiovascular and neural applications, where high surface area-to-volume ratio is necessary to facilitate cell adhesion and growth factors delivery. Furthermore, the integration of smart textiles is a growing area; this involves incorporating sensing elements or drug-eluting capabilities directly into the textile structure, enabling functionalities like monitoring mechanical stress in real-time or localized delivery of antibiotics or anti-inflammatory agents to prevent post-operative complications.

Finally, material science innovations in polymer chemistry are critical. The shift is moving away from purely inert synthetic materials towards composite and functionalized materials. Composites often combine the mechanical resilience of synthetic polymers (like polypropylene) with the regenerative potential of biological components (like collagen or hyaluronic acid). Surface modification technologies, including plasma treatment and bio-functional coatings, are widely adopted to improve the interface between the implant and host tissue, thereby reducing inflammatory response and the risk of fibrosis or rejection, cementing the trend toward active, rather than passive, textile implant performance.

Regional Highlights

- North America: North America, particularly the United States, commands the largest market share in the Textile Implants Market, driven by high adoption rates of advanced surgical procedures, robust reimbursement policies for implantable devices, and substantial R&D investment by major medical device manufacturers. The region benefits from a highly sophisticated healthcare infrastructure and early access to innovative products, including bioresorbable and customized 3D-printed textile scaffolds. The stringent but clear regulatory framework provided by the FDA encourages high standards of quality, although regulatory complexities related to older mesh products have driven demand for next-generation, clinically superior alternatives. The high prevalence of sports injuries and cardiovascular diseases further supports continuous market growth in this region.

- Europe: Europe represents a mature and significant market, characterized by strong governmental support for healthcare technology and widespread adoption of minimally invasive techniques. Countries like Germany, France, and the UK are key contributors, focusing heavily on clinical trials and evidence-based adoption of textile implants, particularly in hernia repair and vascular surgery. The emphasis on universal healthcare access contributes to stable demand. Regulatory harmonization through the European Medical Device Regulation (MDR) has intensified scrutiny on existing products, favoring manufacturers capable of demonstrating long-term safety and performance data, thereby accelerating the replacement of older generation implants with new, bio-integrative textile solutions.

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to rapidly improving healthcare expenditure, increasing health insurance penetration, and the vast patient pool requiring surgical interventions. Emerging economies such as China and India are expanding their medical infrastructure, leading to greater access to specialized surgeries. Furthermore, the region is becoming a critical manufacturing hub for medical devices, often offering cost-competitive production capabilities, attracting global players to establish local manufacturing and distribution centers. Awareness of advanced surgical methods and the rise in medical tourism further bolster the demand for high-quality textile implants.

- Latin America (LATAM): The LATAM market shows promising growth, although it faces challenges related to economic volatility and varied healthcare access levels across countries. Brazil and Mexico are the largest regional contributors. Growth is spurred by increased investment in private healthcare facilities and an emerging middle class seeking high-quality medical treatments. Demand is primarily focused on essential implants like hernia meshes and basic vascular grafts, with price sensitivity playing a significant role in purchasing decisions. Market penetration relies heavily on local distributor networks and efficient supply chain management to overcome logistical complexities.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. The Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) demonstrate high per capita healthcare spending, leading to rapid adoption of premium, cutting-edge textile implants, particularly in aesthetic and specialty surgeries. Conversely, growth in the African continent is more constrained by budget limitations and underdeveloped healthcare infrastructure, focusing primarily on essential, cost-effective implants. Overall regional growth is driven by government initiatives to establish world-class medical cities and diversification away from reliance on medical tourism overseas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Textile Implants Market.- Medtronic plc

- B. Braun SE

- Becton, Dickinson and Company (BD) (through C. R. Bard)

- Johnson & Johnson (Ethicon)

- Atrium Medical Corporation (a subsidiary of Getinge AB)

- W. L. Gore & Associates, Inc.

- TELA Bio, Inc.

- AbbVie Inc. (Allergan Aesthetics, including LifeCell)

- Integra LifeSciences Holdings Corporation

- Cook Medical Inc.

- Zeus Industrial Products, Inc.

- 3M Company (Acelity)

- TEIJIN FRONTIER CO., LTD.

- Gunze Ltd.

- J-Pac Medical

- Conmed Corporation

- Arthrex, Inc.

- Stryker Corporation

- Smith & Nephew plc

- Boston Scientific Corporation

Frequently Asked Questions

Analyze common user questions about the Textile Implants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving demand in the Textile Implants Market?

The primary applications fueling market growth are hernia repair, which accounts for the largest volume due to high incidence rates; cardiovascular procedures, including vascular grafting and patch repair; and soft tissue reinforcement, notably in areas like pelvic floor repair and abdominal wall reconstruction. Demand is increasingly driven by advancements that allow textile implants to be used in complex orthopedic and regenerative procedures, emphasizing structures that support natural tissue regrowth.

What is the difference between absorbable and non-absorbable textile implants?

Non-absorbable textile implants, typically made from materials like polypropylene or ePTFE, provide permanent mechanical support and structural reinforcement, crucial for high-stress areas like major hernia repairs. Absorbable (bioresorbable) implants, made from materials such as PDO or PGLA, provide temporary support and gradually degrade over time, leaving behind only the regenerated native tissue, thereby minimizing the risk of long-term foreign body reaction or chronic pain associated with permanent materials.

How is the Textile Implants Market being influenced by advancements in regenerative medicine?

Regenerative medicine is profoundly influencing the market by driving the development of specialized textile scaffolds designed not just for structural support but to actively promote tissue healing. This involves functionalizing textile surfaces with bioactive molecules, growth factors, or even integrating them with stem cells. These next-generation scaffolds aim to replace damaged tissue functionally, marking a significant shift away from passive mechanical reinforcement toward biological integration and regeneration.

Which geographical region exhibits the fastest growth potential for textile implants?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, substantial increases in surgical volumes, growing public health awareness, and rising disposable incomes. Expanding government investments in medical facilities and the emergence of regional manufacturing capabilities are accelerating the adoption of both standardized and advanced textile implant technologies across countries like China and India.

What are the main regulatory challenges faced by manufacturers in this industry?

Manufacturers face significant regulatory hurdles, primarily due to the stringent requirements under regulations like the FDA and the European MDR. Challenges include demonstrating long-term clinical safety and efficacy data, particularly for permanent synthetic implants which have faced historical scrutiny. Achieving product traceability, maintaining rigorous quality control throughout the textile manufacturing process, and navigating complex post-market surveillance obligations necessitate substantial and continuous investment in regulatory compliance and clinical validation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager