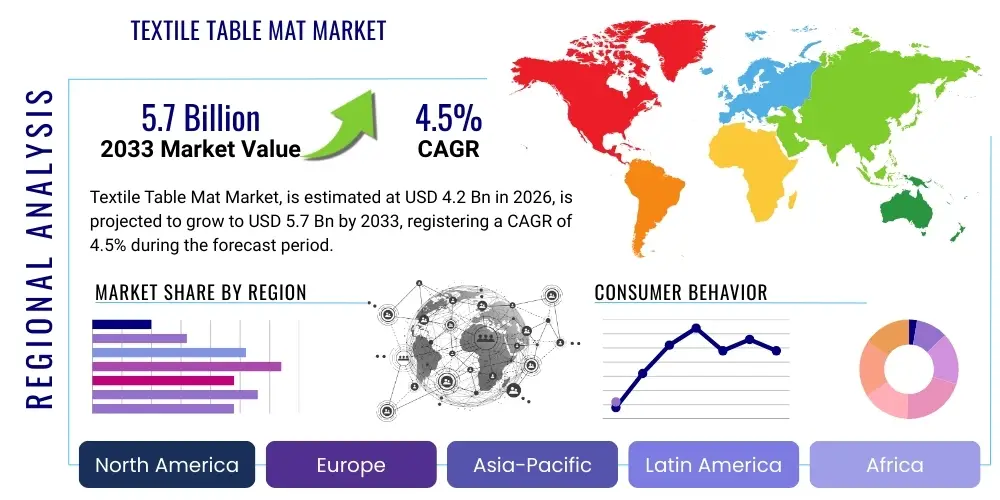

Textile Table Mat Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436793 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Textile Table Mat Market Size

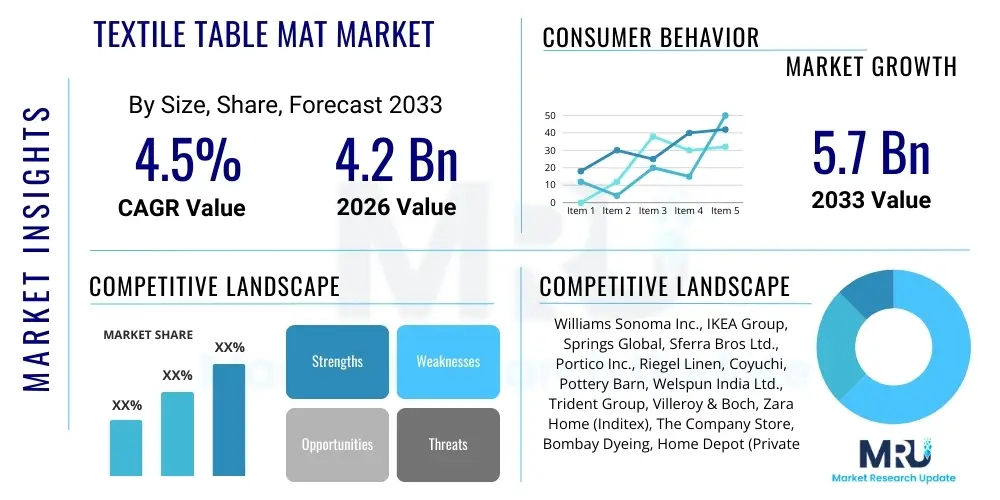

The Textile Table Mat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Textile Table Mat Market introduction

The Textile Table Mat Market encompasses the manufacturing, distribution, and sale of placemats and table linens primarily used for dining table protection, aesthetic enhancement, and sanitary purposes in both commercial and residential settings. These mats are typically manufactured from a variety of textile materials, including cotton, linen, polyester, jute, and various blended fabrics, catering to different aesthetic tastes, functional requirements, and budget constraints. The industry is driven by evolving consumer preferences for home décor, the resurgence of formal dining culture, and the continuous growth of the hospitality sector globally. Key product descriptions include reusable, washable, stain-resistant, and heat-resistant properties, often featuring intricate designs or sustainable materials like organic cotton or recycled fibers to appeal to environmentally conscious buyers.

Major applications of textile table mats span across household usage, institutional settings such as hospitals and schools, and commercial establishments, primarily hotels, restaurants, and catering services (HoReCa). In the residential segment, these mats are crucial for daily use and special occasions, providing protection against spills and scratches while serving as a fundamental element of interior design. For the HoReCa industry, durability, ease of maintenance, and high aesthetic appeal aligned with branding are paramount. The mats enhance the overall dining experience, contribute to hygiene standards, and offer a cost-effective way to refresh restaurant décor seasonally or thematically. The increasing disposable income in emerging economies and the expanding global tourism industry further fuel demand in the commercial segment.

Driving factors for the market include rapid urbanization leading to increased emphasis on interior design and household aesthetics, technological advancements in textile processing that enable the production of highly durable and diverse fabrics, and the growing focus on sustainable sourcing and ethical manufacturing practices. Furthermore, the rising popularity of themed dining and personalized home spaces encourages consumers to invest in varied collections of table mats. Benefits associated with these products are centered on ease of cleaning, protecting valuable furniture surfaces, dampening noise during dining, and significantly elevating the perceived quality and ambiance of a dining setting, making them indispensable components of modern table management.

Textile Table Mat Market Executive Summary

The global Textile Table Mat Market exhibits robust business trends characterized by a strong shift toward premiumization and sustainability. Manufacturers are increasingly focusing on incorporating innovative finishes, such as antimicrobial treatments and advanced stain repellents, particularly targeting the high-end HoReCa sector and health-conscious residential consumers. The direct-to-consumer (D2C) sales model through dedicated e-commerce platforms is gaining significant traction, allowing niche and sustainable brands to bypass traditional retail channels and connect directly with their target audience. Furthermore, collaborations between textile designers and famous interior decorators are driving limited edition and high-value product launches, bolstering market revenue and brand visibility. Supply chain resilience, especially concerning raw material sourcing from sustainable cotton and linen producers, remains a critical operational priority for market leaders navigating global trade complexities.

Regionally, Asia Pacific (APAC) is dominating the market, driven by rapid urbanization, substantial growth in the middle-class population, and deeply entrenched cultural practices surrounding elaborate dining and home furnishings in countries like China and India. North America and Europe, while mature markets, are leading the trend in product innovation, focusing heavily on eco-friendly materials and smart textile integration for enhanced durability and performance. Europe, in particular, showcases high demand for natural fibers like European linen and artisanal, handcrafted designs. The Middle East and Africa (MEA) region is experiencing accelerated growth, particularly within the luxury hospitality sector fueled by substantial investments in high-end resorts and residential developments, requiring bespoke, premium table mat solutions.

Segment trends highlight the dominance of natural fibers, such as cotton and linen, due to their aesthetic appeal, breathability, and traditional use, though polyester and other synthetic blends maintain a significant share owing to their superior durability and cost-effectiveness, especially for commercial use. The rectangular shape segment holds the largest market share, catering to standard dining table sizes, while the placemat application segment remains the primary revenue generator. Retail distribution channels, including hypermarkets and specialty home goods stores, account for the largest volume of sales, although online retail is poised for the fastest growth. The emphasis on custom sizing, personalized embroidery, and thematic collections across all segments indicates a market moving towards consumer-centric customization and experiential retailing.

AI Impact Analysis on Textile Table Mat Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the notoriously complex textile supply chain, optimize pattern and design generation to meet rapidly shifting consumer tastes, and enhance the efficiency of textile waste reduction. Key themes emerging from these questions center on leveraging AI for predictive demand forecasting to minimize overstocking of seasonal inventory, using computer vision systems for quality control in manufacturing processes—identifying minor weave defects or color inconsistencies—and automating customer service interactions related to product personalization. There is also a strong expectation that AI tools could significantly contribute to sustainability goals by tracking raw material origins and optimizing dyeing processes to reduce water usage, providing transparent, data-driven assurances to eco-conscious buyers regarding the environmental impact of textile table mats.

The direct impact of AI implementation is visible in product innovation and manufacturing optimization. AI algorithms can analyze vast datasets of current décor trends, historical sales data, and social media sentiment to predict future color palettes, textures, and design patterns that will resonate most effectively with target demographics. This predictive capability allows manufacturers to significantly shorten design cycles and minimize the risk associated with investing in unpopular styles, thereby improving resource allocation. Furthermore, AI-powered automation in cutting, stitching, and packaging lines increases production speed and precision, leading to higher output consistency and lower labor costs per unit, ultimately enhancing competitive positioning in the global market.

From a consumer engagement perspective, AI-driven platforms are transforming the purchasing experience. Virtual Reality (VR) and Augmented Reality (AR) tools, often powered by AI, allow customers to digitally place a table mat on their own dining table before purchase, visualizing how the texture and color integrate with their existing décor, drastically reducing return rates related to aesthetic mismatch. Additionally, personalized recommendation engines use machine learning to suggest complementary table linens or accessories based on past purchases and browsing behavior, increasing the average order value. This blend of operational efficiency and enhanced customer experience underscores the transformative, though indirect, influence of AI across the entire value chain of the textile table mat market.

- AI optimizes inventory management by predicting seasonal demand fluctuations with high accuracy, reducing holding costs.

- Machine learning algorithms analyze consumer aesthetic data to accelerate trend identification and design pattern creation.

- Computer vision systems deployed on production lines ensure stringent quality control by immediately spotting defects in weaving and printing.

- AI enhances customer personalization through sophisticated recommendation engines and virtual fitting room capabilities (AR/VR visualization).

- Blockchain systems, often integrated with AI monitoring, provide verifiable traceability of sustainable raw materials from farm to finished product.

- Automated textile cutting optimization minimizes fabric waste, directly contributing to sustainability targets and operational cost reduction.

DRO & Impact Forces Of Textile Table Mat Market

The dynamics of the Textile Table Mat Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces dictating market direction. A primary driver is the accelerating trend of home renovation and refurbishment activities globally, coupled with the increasing consumer expenditure on interior aesthetics, viewing table mats not merely as protective items but as essential décor accessories. This is strongly supported by the growth of the global HoReCa sector, which constantly requires durable, visually appealing, and easily replaceable linens to maintain high standards of customer presentation and hygiene. The expanding availability of affordable yet stylish products through diversified retail channels, especially e-commerce, further lubricates market expansion, enabling easier access for consumers worldwide.

However, the market faces significant restraints that slow potential growth. The most crucial restraint is the intense price volatility of raw materials, particularly cotton and linen, which are susceptible to climatic changes and geopolitical instabilities, leading to fluctuating manufacturing costs and unpredictable final pricing for consumers. Furthermore, the textile industry is highly susceptible to fast fashion and short product life cycles, increasing pressure on manufacturers to constantly innovate, often resulting in inventory obsolescence. The lack of standardized recycling infrastructure for mixed fiber textile products poses an environmental challenge, increasing the disposal burden and hindering the industry's shift toward a truly circular economy model.

Opportunities within the market largely revolve around sustainability and technological integration. There is a massive opportunity in developing and marketing innovative materials such as recycled polyester derived from plastic bottles, bamboo fiber, and waste-based textiles, catering to the burgeoning green consumer segment. Digitization offers another significant avenue, allowing manufacturers to adopt customized, on-demand production models (print-on-demand), minimizing waste and storage costs while maximizing personalization options. Additionally, penetration into untapped institutional markets, such as specialized catering services, corporate cafeterias, and mass transit dining, presents scalable growth avenues. The collective impact forces drive manufacturers towards greater operational efficiency, diversification in sustainable offerings, and intensified marketing efforts focused on lifestyle integration and superior product durability.

Segmentation Analysis

The Textile Table Mat Market is extensively segmented based on material, application, shape, distribution channel, and end-user, providing a granular view of market dynamics and consumer behavior across various sub-sectors. This comprehensive segmentation allows market participants to tailor their product development, marketing strategies, and pricing structures to specific consumer clusters, maximizing market penetration and profitability. The material segment—covering natural fibers like cotton and synthetic fibers such as polyester—is pivotal, as material choice directly influences cost, durability, and aesthetic finish. Application segmentation separates placemats (the largest category) from table runners and full tablecloths, recognizing distinct usage patterns and purchasing frequency for each category within households and commercial entities. Understanding these divisions is crucial for accurate forecasting and strategic decision-making in inventory management and capacity planning.

The market structure is also defined by the type of end-user, differentiating between high-volume commercial purchasers (HoReCa, institutions) and individual residential consumers. Commercial buyers typically prioritize durability, bulk pricing, and compliance with institutional safety standards, favoring synthetic or treated fabrics. Conversely, residential buyers place a higher premium on design, texture, and natural aesthetics, often selecting premium cotton or linen products. The distribution channel segment reveals the shift towards modern trade and e-commerce platforms. While traditional brick-and-mortar retail stores, including hypermarkets and specialty home stores, still dominate sales volume due to tactile experience, online channels are capturing an increasing share, driven by convenience, wider selection, and direct-to-consumer opportunities, particularly for niche or artisanal brands specializing in unique designs or custom orders.

Geographic segmentation is essential for understanding regional demand drivers; for instance, European consumers often prefer heavier, higher-quality textiles aligned with traditional craftmanship, while APAC consumers often seek cost-effective, high-design solutions compatible with fast-paced lifestyle changes. The constant introduction of new functional properties, such as advanced stain resistance and thermal insulation capabilities, also creates micro-segments focused on utility. Ultimately, these segmentations underpin the strategic approach of major manufacturers, enabling them to launch targeted product lines—ranging from affordable mass-market polyester mats to luxury, handcrafted organic linen mats—to effectively capture diverse demand across the global landscape.

- By Material: Cotton, Linen, Jute and Other Natural Fibers, Polyester, Blended Fabrics, Others (e.g., PVC-backed textiles).

- By Application: Placemats, Table Runners, Coasters, Full Tablecloths (including textile mats used underneath).

- By Shape: Rectangular, Round, Oval, Square, Custom Shapes.

- By End-User: Residential, Commercial (Hotels, Restaurants, Cafés), Institutional (Hospitals, Schools, Corporate).

- By Distribution Channel: Supermarkets and Hypermarkets, Specialty Stores, Online Retail (E-commerce Platforms), Direct Sales/Bespoke.

- By Design: Printed, Embroidered, Solid Color, Textured/Woven Patterns.

- By Price Range: Economy, Mid-Range, Premium/Luxury.

- By Functionality: Standard, Waterproof/Stain Resistant, Heat Resistant, Anti-slip.

Value Chain Analysis For Textile Table Mat Market

The value chain for the Textile Table Mat Market begins with upstream activities involving the sourcing of raw materials, which is crucial for determining the final product's quality, cost, and sustainability profile. This stage involves agricultural production of natural fibers like cotton, flax (for linen), and jute, alongside the chemical manufacturing of synthetic polymers for polyester and nylon textiles. Key upstream suppliers include global agricultural cooperatives and large petrochemical companies. Effective supply chain management at this stage requires rigorous quality checks for fiber length and strength, as well as verification of sustainable and ethical sourcing certifications (e.g., Organic Content Standard, Fair Trade). Price fluctuations in commodity markets significantly impact the cost structure of the entire value chain, necessitating sophisticated hedging and long-term procurement contracts by manufacturers.

Midstream activities involve core manufacturing processes: spinning raw fibers into yarns, weaving or knitting the yarns into fabric, dyeing and finishing the textile material (including applying stain resistance or antimicrobial coatings), and finally, the cut-and-sew operations that transform bulk fabric into finished table mats. This stage is capital intensive, requiring advanced machinery and specialized labor. Process optimization, particularly through lean manufacturing techniques and automation, is vital for maintaining competitive pricing and high quality. Finishing treatments, such as calendaring and digital printing technology, add significant value, allowing for complex designs and enhanced functional properties that differentiate products in the highly saturated market. Quality assurance checkpoints are crucial here to minimize textile waste and ensure aesthetic consistency across large production batches.

Downstream analysis focuses on distribution and final sales, which are facilitated by complex channels, including both direct and indirect routes. Indirect distribution predominantly utilizes wholesalers, distributors, and large retailers like hypermarkets and specialty home décor chains, offering broad market reach and inventory management support. Direct distribution channels, increasingly favored by premium and sustainable brands, involve dedicated brand stores, e-commerce platforms, and direct sales to HoReCa clients. The success of the downstream segment relies heavily on efficient logistics, warehousing capabilities, and sophisticated merchandising. Digital marketing and branding efforts, especially leveraging social media and SEO/AEO strategies, are critical for driving consumer pull and translating brand value into tangible sales in the competitive retail environment.

Textile Table Mat Market Potential Customers

The primary end-users and buyers in the Textile Table Mat Market are broadly categorized into Residential Consumers and Commercial/Institutional entities, each possessing distinct purchasing drivers and volume requirements. Residential consumers constitute the largest, most fragmented segment, characterized by purchasing decisions driven by lifestyle trends, disposable income levels, home décor aesthetic coherence, and seasonal or festive occasions. Within this segment, young professionals and families seeking functional protection and style, as well as affluent households demanding high-end, custom-designed, natural fiber mats (e.g., personalized linen sets), represent lucrative sub-segments. E-commerce platforms specifically target this group through highly visual and personalized marketing campaigns.

The Commercial sector is dominated by the Hospitality Industry, encompassing hotels, restaurants, resorts, and catering services (HoReCa). These buyers prioritize durability, washability, fire safety standards, bulk pricing, and the ability to source large volumes of consistently branded or color-matched products. For high-end luxury establishments, bespoke manufacturing capabilities are essential, requiring partnerships with suppliers who can deliver custom sizes, specialized logos, and unique textures that align with the establishment's premium branding. Purchases are often recurring and contractual, driven by replacement cycles necessitated by high usage and stringent hygiene standards.

Institutional customers, including corporate dining halls, educational establishments (schools and universities), and healthcare facilities, form the third significant customer base. These entities focus strictly on functionality, cost-effectiveness, and compliance with health regulations, often preferring easy-to-clean, durable synthetic blends or treated fabrics that withstand industrial laundering. Their purchasing decisions are highly centralized, governed by procurement tenders and long-term supply agreements where the lowest lifetime cost and regulatory compliance are prioritized over high aesthetic value. Suppliers targeting institutional clients must focus on robust supply capacity, verifiable safety certifications, and competitive bulk pricing models to secure these substantial contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Williams Sonoma Inc., IKEA Group, Springs Global, Sferra Bros Ltd., Portico Inc., Riegel Linen, Coyuchi, Pottery Barn, Welspun India Ltd., Trident Group, Villeroy & Boch, Zara Home (Inditex), The Company Store, Bombay Dyeing, Home Depot (Private Labels), Frette, Garnier-Thiebaut, Linum Home Textiles, Standard Textile Co., Pacific Coast Feather Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Textile Table Mat Market Key Technology Landscape

The manufacturing technology landscape for textile table mats is increasingly centered on enhancing durability, functional performance, and aesthetic complexity while minimizing environmental impact. Key advancements involve sophisticated weaving and knitting techniques, such as Jacquard weaving for intricate patterns and 3D knitting for seamless, multi-layer mats that offer superior cushioning and stability. The application of nanotechnology represents a significant technological leap, particularly in developing nanoparticle coatings that provide enhanced water repellency, stain resistance, and antimicrobial properties. These functional finishes address the primary concern of durability and hygiene in both residential and high-traffic commercial environments, positioning the product as a long-term investment rather than a disposable item. The shift towards automated production lines, utilizing high-speed cutting machines and robotic stitching arms, improves precision, scalability, and labor efficiency, directly lowering unit manufacturing costs.

Digital printing technology has revolutionized the aesthetic segment, allowing manufacturers to reproduce complex, photo-realistic designs and offer hyper-customization at lower volumes. Unlike traditional screen printing, digital textile printing reduces water usage and the need for excessive dye chemicals, aligning with sustainability mandates. This technology supports the burgeoning trend of print-on-demand services, enabling brands to react instantly to micro-trends and consumer requests for personalization, significantly reducing pre-production inventory risk. Furthermore, technology related to textile traceability, utilizing QR codes or RFID tags embedded into product labels, is becoming standard practice, driven by consumer demand for transparency regarding the origin of sustainable fibers and the entire product lifecycle.

In the context of material innovation, significant research and development efforts are focused on bio-based and recycled textiles. Technologies for chemical recycling of polyester fibers derived from post-consumer waste are now commercially viable, offering a closed-loop solution for synthetic materials. Similarly, advanced fiber processing techniques are improving the hand-feel and durability of highly sustainable materials like bamboo and Tencel (lyocell), making them suitable for premium table linens. The integration of sensors and smart functionalities, though currently nascent, holds future promise, potentially allowing mats to subtly indicate temperature or moisture levels for specialized applications. Overall, the technological evolution is characterized by a balance between functional enhancement (durability, hygiene) and operational sustainability (waste reduction, resource efficiency).

Regional Highlights

The Asia Pacific (APAC) region stands out as the undisputed leader in the Textile Table Mat Market, driven by a confluence of favorable macroeconomic factors, including robust economic growth, massive population bases, and rapidly increasing middle-class disposable income, particularly in China and India. The cultural significance of elaborate dining rituals and deep-rooted traditions in gifting and home furnishing stimulate high demand for quality textile products. Moreover, APAC is the world's largest manufacturing hub for textiles, benefiting from competitive labor costs, established supply chains for cotton and other raw materials, and high-volume production capabilities. This regional strength allows local manufacturers to cater efficiently to both domestic consumption and substantial export markets, often supplying private labels for major international retailers across North America and Europe. The rapidly expanding hospitality and tourism sectors across Southeast Asia further necessitate continuous bulk purchases of durable, aesthetically pleasing table linens.

Europe represents a mature yet high-value market, characterized by discerning consumers who prioritize quality, natural fibers (especially European linen), and ethical sourcing. The demand here is less focused on volume and more on premiumization, artisanal craftsmanship, and specialized certifications related to environmental and social compliance (e.g., OEKO-TEX standard). Countries like Germany, France, and Italy maintain strong textile traditions and high consumer spending on home décor, driving the luxury segment. The HoReCa sector in Europe, particularly the fine dining segment, requires bespoke, high-quality table mats that align with sophisticated brand identities, often dictating trends in design and color palettes globally. Regulatory requirements regarding textile safety and environmental impact are stringent in this region, compelling suppliers to invest heavily in sustainable manufacturing technologies and transparent supply chains, thereby pushing the entire market toward higher quality standards.

North America holds a substantial share, primarily driven by high consumer spending power, a strong culture of home decorating (especially seasonal décor changes), and the presence of major retail chains that drive mass-market consumption. The U.S. market is characterized by a mix of affordable, high-volume synthetic blends and a fast-growing niche demand for high-performance, easy-care products (like stain-resistant mats) and ethically sourced organic cotton. E-commerce penetration is highest in this region, facilitating market access for both domestic and international brands. Latin America and the Middle East and Africa (MEA) are emerging as high-growth regions. Latin America's growth is tied to rising urbanization and the expansion of modern retail infrastructure. MEA, particularly the GCC countries, is witnessing massive investment in luxury hotels and resorts, creating explosive demand for high-end, customized table linens, often imported from European or Asian premium manufacturers, emphasizing opulence and unique design elements.

- Asia Pacific (APAC): Dominant market in both manufacturing and consumption; high demand driven by population and urbanization.

- Europe: High-value, mature market focused on premiumization, natural fibers (linen), and stringent sustainability certifications.

- North America: Strong e-commerce penetration; balanced demand between mass-market synthetic blends and specialty organic/performance textiles.

- Latin America: Emerging market growth fueled by retail expansion and growing middle-class expenditure on home aesthetics.

- Middle East and Africa (MEA): Rapid growth driven by luxury hospitality development and substantial regional investments in high-end residential projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Textile Table Mat Market.- Williams Sonoma Inc.

- IKEA Group

- Springs Global

- Sferra Bros Ltd.

- Portico Inc.

- Riegel Linen

- Coyuchi

- Pottery Barn

- Welspun India Ltd.

- Trident Group

- Villeroy & Boch

- Zara Home (Inditex)

- The Company Store

- Bombay Dyeing

- Home Depot (Private Labels)

- Frette

- Garnier-Thiebaut

- Linum Home Textiles

- Standard Textile Co.

- Pacific Coast Feather Company

Frequently Asked Questions

Analyze common user questions about the Textile Table Mat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Textile Table Mat Market?

The Textile Table Mat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period spanning 2026 to 2033, driven by sustained growth in the global hospitality and home décor sectors.

Which material segment currently holds the largest share of the market?

The Cotton segment, including organic cotton, currently holds the largest market share due to its natural aesthetics, breathability, and versatility, although polyester and blended fabrics dominate the high-volume commercial (HoReCa) segment due to superior durability and cost efficiency.

How is sustainability impacting product development in textile table mats?

Sustainability is a major trend, driving demand for products made from recycled materials (e.g., recycled polyester), organic fibers (e.g., certified organic cotton), and materials sourced through ethical manufacturing practices, often verified by third-party certifications like Fair Trade and OEKO-TEX.

Which geographical region is leading the Textile Table Mat Market in terms of revenue and manufacturing?

The Asia Pacific (APAC) region leads the market both in manufacturing volume and consumption revenue, supported by rapid urbanization, increasing disposable income, and the region's established, cost-effective textile supply chain infrastructure.

What are the primary challenges restraining the growth of this market?

Key restraints include the intense volatility and unpredictable pricing of raw materials (such as cotton and linen) due to climatic factors, coupled with fierce competition from low-cost, non-textile alternatives like PVC and silicone placemats, which impacts overall profitability margins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager