Thaumatin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432069 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Thaumatin Market Size

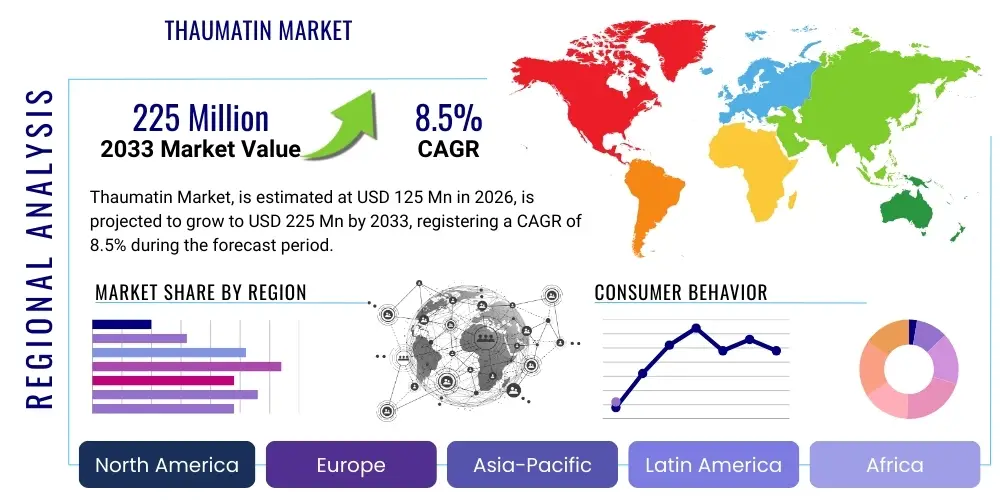

The Thaumatin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 125 million in 2026 and is projected to reach USD 225 million by the end of the forecast period in 2033. This robust expansion is primarily attributed to the global shift towards natural, low-calorie sweeteners and the increasing adoption of clean-label ingredients across the food and beverage industry.

Thaumatin Market introduction

Thaumatin, a highly potent natural protein sweetener derived from the katemfe fruit (Thaumatococcus daniellii), is gaining significant traction across various industrial applications due to its intense sweetness and flavor-modifying properties. Unlike conventional high-intensity sweeteners, Thaumatin offers a natural, clean-label profile, addressing the growing consumer demand for healthier food options that minimize artificial additives. It is substantially sweeter than sucrose (approximately 2,000 to 3,000 times), allowing manufacturers to achieve desired sweetness levels with minimal product volume, thereby reducing caloric content drastically without compromising taste quality.

Major applications of Thaumatin span the food and beverage sector, including soft drinks, confectionery, dairy products, and nutritional supplements, where it functions not only as a sweetener but also as a natural flavor enhancer, particularly effective in masking undesirable off-tastes associated with some vitamins or mineral fortification. Its stability under heat and wide pH range makes it versatile for processed foods and beverages. Furthermore, Thaumatin's regulatory acceptance in key markets, including the European Union (E957) and the United States (Generally Recognized As Safe - GRAS), solidifies its position as a preferred ingredient for global product development.

The primary driving factors fueling the market growth include stringent governmental regulations targeting sugar consumption and obesity rates, prompting manufacturers to reformulate products. Additionally, the functional benefits of Thaumatin, such as its protein nature and superior flavor modification capabilities—especially in enhancing fruit flavors or rounding out the taste profile of diet products—provide a competitive edge over synthetic alternatives. The continuous investment in advanced extraction and recombinant DNA technology to ensure a stable and cost-effective supply chain also supports its increasing market penetration.

Thaumatin Market Executive Summary

The Thaumatin market is characterized by strong upward momentum driven by health-conscious consumer behavior and aggressive sugar-reduction strategies implemented by multinational food and beverage corporations. Business trends indicate a shift toward bio-engineered production methods, specifically precision fermentation, to mitigate reliance on traditional botanical sourcing, which can be susceptible to geopolitical and climatic volatility. This technological evolution is pivotal for improving scalability and reducing the production cost of Thaumatin, thereby expanding its accessibility to broader market segments, including lower-margin applications in mass-market consumables and animal feed.

Regionally, the market exhibits dynamic growth, with Asia Pacific (APAC) emerging as the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and a burgeoning processed food industry adopting Western health trends. North America and Europe currently represent the largest revenue share, sustained by mature regulatory frameworks that favor natural sweeteners and high consumer awareness regarding sugar intake. Manufacturers are strategically focusing on regulatory compliance and intellectual property protection related to novel production strains, ensuring long-term competitive advantages in specialized ingredient supply.

Segment trends reveal that the Food & Beverages application segment maintains dominance, specifically within the dietary supplements and sports nutrition sub-segments, where the demand for natural, functional ingredients is highest. Furthermore, the market for fermentation-derived Thaumatin is anticipated to witness the most significant growth rate, promising greater purity and supply consistency compared to traditionally extracted forms. Companies are also investing heavily in developing customized Thaumatin blends tailored for specific matrices, such as those that require improved solubility or unique flavor synergies when combined with other sweeteners like Stevia or monk fruit extract.

AI Impact Analysis on Thaumatin Market

Common user questions regarding AI's impact on the Thaumatin market often revolve around how artificial intelligence can optimize the biosynthesis of the protein, enhance yield predictability from agricultural sources, and accelerate R&D for new applications. Users are concerned with whether AI can lower the currently high production costs associated with Thaumatin, particularly through optimizing fermentation parameters or identifying superior genetic strains for production. The key themes summarized from these inquiries are focused on efficiency improvements, cost reduction, and enhanced discovery capabilities provided by AI, specifically within supply chain risk management and quality control.

AI is increasingly employed to analyze complex genomic and proteomic data related to Thaumatin synthesis, enabling researchers to quickly model and simulate the effectiveness of different production pathways, significantly shortening the time required for strain optimization in precision fermentation. Machine learning algorithms are vital for interpreting large datasets generated during fermentation runs, allowing producers to fine-tune nutrient inputs, temperature profiles, and pH levels in real-time. This predictive modeling minimizes batch variations, maximizes the conversion rate of substrates into Thaumatin, and ensures a consistently high-quality final product, which is paramount in the pharmaceutical and premium food sectors.

Furthermore, the application of AI extends to market intelligence and supply chain logistics. AI tools analyze global agricultural conditions, predict potential supply chain disruptions related to the natural sourcing of the Katemfe fruit, and optimize warehousing and distribution networks, especially crucial for managing a high-value ingredient. In product formulation, AI models can simulate consumer sensory responses to new food and beverage prototypes containing Thaumatin blends, drastically reducing the number of physical trials needed and accelerating the speed-to-market for innovative, naturally sweetened products.

- AI optimizes precision fermentation parameters, boosting Thaumatin yield and purity.

- Machine learning predicts supply chain risks related to raw material sourcing and climate fluctuations.

- Genomic analysis powered by AI accelerates the identification of superior production strains.

- AI-driven sensory profiling reduces R&D time for new food and beverage formulations.

- Predictive maintenance schedules for bioprocessing equipment improve operational efficiency.

DRO & Impact Forces Of Thaumatin Market

The Thaumatin market is powerfully influenced by the synergistic combination of regulatory pressure against sugar and strong consumer preference for natural ingredients, which acts as the core driver (D). However, high production costs, volatility in natural supply chains, and the lingering aftertaste perception reported by some consumers in high concentrations pose significant restraints (R). The opportunity (O) lies in leveraging advanced biotechnologies like precision fermentation to achieve economies of scale and develop novel, synergistic blends with other high-intensity sweeteners to mask taste profile challenges, opening doors to previously inaccessible mass-market applications.

Impact forces acting upon the market are complex and multi-directional. The rapid shift in public health policy across developed and developing economies (Political/Regulatory force) mandates the reduction of sucrose and artificial sweeteners, significantly favoring natural alternatives like Thaumatin. Simultaneously, competitive intensity (Economic/Competitive force) increases as major ingredient companies invest heavily in fermentation infrastructure and patented strains, escalating the barrier to entry for smaller players. Furthermore, the increasing prominence of 'clean label' and 'sustainable sourcing' standards (Social/Environmental force) necessitates transparency and ethical practices, pushing the industry towards reliable, bio-engineered sourcing methods.

The continuous innovation in food technology (Technological force) offers a pathway to overcome the cost restraint. As fermentation processes become more efficient and yields improve, the cost of Thaumatin is expected to decrease, making it competitive against synthetic options and even other natural high-intensity sweeteners. These impact forces collectively propel market expansion while simultaneously demanding greater efficiency and strategic sourcing decisions from manufacturers to maintain profitability and meet stringent quality expectations in the specialized ingredient sector.

Segmentation Analysis

The Thaumatin market segmentation provides a granular view of market dynamics based on source, form, grade, and application. This structured analysis is essential for identifying high-growth pockets and tailoring marketing strategies to specific end-user requirements. The segmentation highlights the underlying transition from traditional extraction methods to biotechnological alternatives and the diversification of Thaumatin into premium, specialized grades necessary for sensitive applications such as pharmaceuticals and dietary supplements.

The market is predominantly segmented by application, where the Food and Beverage sector consumes the largest share, driven by its utility in calorie reduction and flavor enhancement across diverse products. However, the fastest-growing segment is projected to be the pharmaceutical industry, utilizing Thaumatin primarily for taste masking in liquid medications and chewable tablets, owing to its non-caloric, proteinaceous nature and excellent safety profile. Understanding these segments is crucial for supply chain planning and capacity expansion, especially for companies focused on the high-purity, high-margin Pharma Grade segment, which demands rigorous regulatory adherence and traceability.

The competitive landscape within these segments is evolving, with key players focusing on offering tailor-made solutions. For instance, companies are developing specialized Powder forms that offer better flowability and blend consistency for dry mixes, while Liquid forms cater to beverage manufacturers requiring instant solubility and ease of integration into existing processing lines. The ultimate success in the Thaumatin market depends heavily on securing intellectual property related to superior production strains and achieving cost optimization within the chosen production segment, whether natural extraction or advanced fermentation.

- Source:

- Natural Extraction (from Katemfe fruit)

- Fermentation (Recombinant DNA Technology)

- Form:

- Powder

- Liquid

- Grade:

- Food Grade

- Pharma Grade

- Feed Grade

- Application:

- Food & Beverages

- Confectionery

- Dairy Products

- Beverages (Soft Drinks, Juices)

- Baked Goods

- Dietary Supplements

- Pharmaceuticals (Taste Masking)

- Cosmetics (Fragrance Enhancement)

- Animal Feed (Palatability Enhancer)

- Food & Beverages

Value Chain Analysis For Thaumatin Market

The value chain for the Thaumatin market starts with the Upstream Analysis, focusing on the sourcing of raw materials. Traditionally, this involves the cultivation, harvesting, and initial processing of the Katemfe fruit, predominantly in West African regions. For fermentation-derived Thaumatin, the upstream phase involves sourcing high-purity substrates (like sugars and nutrients) and the maintenance and scaling of proprietary microbial strains (yeast or bacteria). High capital investment in biotechnology infrastructure and rigorous R&D for strain optimization characterize the upstream activities for fermentation producers, emphasizing efficiency and maximizing yield per batch.

The Core Processing stage involves the complex and specialized extraction, purification, and drying processes. For natural extraction, this requires solvent-based separation and multi-stage purification to achieve the high sweetness and purity required for food applications. Fermentation processing involves cultivation in bioreactors, followed by complex downstream processing (DAP) including cell lysis, filtration, chromatography, and spray drying to isolate and stabilize the protein. Quality control is paramount at this stage, ensuring the product meets international standards like GRAS and E957, verifying purity, stability, and absence of residual processing aids.

Distribution channels connect manufacturers to end-users, typically relying on a mix of Direct and Indirect sales models. Large multinational ingredient companies often employ direct sales teams to manage high-volume supply contracts with Tier 1 Food & Beverage corporations and pharmaceutical giants. Indirect channels utilize specialized chemical and food ingredient distributors who handle smaller orders, provide technical support, and manage local inventory, particularly effective in fragmented markets in Asia and Latin America. The efficiency of the distribution network, particularly the cold chain logistics required for some high-purity forms, directly impacts the final product cost and market accessibility.

Thaumatin Market Potential Customers

The primary End-Users and Buyers of Thaumatin are large-scale food and beverage manufacturers, particularly those focusing on 'better-for-you' product lines, functional foods, and dietary beverages aiming for significant sugar reduction. Companies in the confectionery and dairy segments, specifically those producing sugar-free chewing gums, low-sugar yogurts, and diet chocolates, constitute a significant customer base. These customers prioritize Thaumatin for its dual function as a sweetener and a flavor modulator, enabling them to achieve optimal taste profiles that often suffer when sugar is removed or replaced solely by bulk sweeteners.

Another crucial customer segment is the pharmaceutical industry, including manufacturers of over-the-counter (OTC) liquid medications, prescription drugs, and nutritional supplements (e.g., protein powders, vitamin gummies). For pharmaceuticals, Thaumatin is highly valued for its exceptional taste-masking ability, particularly useful for neutralizing the bitter or metallic notes associated with active pharmaceutical ingredients (APIs). The demand for Pharma Grade Thaumatin is driven by patient compliance, especially in pediatric and geriatric applications where taste is a critical factor influencing adherence to medication protocols.

Emerging potential customers include the cosmetics industry, where Thaumatin is used in oral hygiene products like toothpaste and mouthwash for subtle flavor enhancement, and the animal feed sector, particularly in high-value pet food and livestock feed. In animal nutrition, it serves as a palatability enhancer, encouraging consumption of specialized feed formulas, thereby improving animal health and growth rates. These customers seek ingredients that are both safe and highly effective at low inclusion rates, making Thaumatin a cost-effective choice despite its premium pricing compared to standard feed additives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125 million |

| Market Forecast in 2033 | USD 225 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Naturex (Givaudan), Ingredion Incorporated, Tate & Lyle PLC, Wuxi Chunhua Biology Co., Ltd., Natex S.A., Symrise AG, Layn Natural Ingredients Corp., Sensus, DSM-Firmenich, Cargill, Inc., Blue California, Stevia One, Interpolymer GmbH, Taiyo Kagaku Co., Ltd., Venus Biotech, Zhejiang Huahai Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thaumatin Market Key Technology Landscape

The technological landscape of the Thaumatin market is dominated by two distinct methodologies: traditional advanced extraction and purification techniques, and cutting-edge precision fermentation. Traditional extraction relies on multi-stage aqueous purification processes, often optimized through ultrafiltration and ion-exchange chromatography to separate the thaumatin proteins from other fruit components and residual impurities. Recent innovations in this area focus on environmentally friendly, solvent-free extraction methods and continuous processing to enhance efficiency and reduce the environmental footprint associated with processing the natural fruit source, thereby appealing to the sustainability mandates of end-users.

However, the most transformative technology is precision fermentation (or recombinant DNA technology). This biotech approach involves genetically engineering microorganisms (typically yeast or bacteria) to express the Thaumatin protein gene in controlled bioreactors. This method guarantees a highly pure, scalable, and consistent supply that is independent of agricultural cycles and geopolitical risks affecting the Katemfe fruit supply. Key technological advancements involve optimizing the expression vector, improving fermentation broth composition, and enhancing downstream processing yield. This technology addresses the core restraint of high cost and supply volatility, paving the way for Thaumatin's mass-market adoption.

Beyond production, formulation technology plays a crucial role. Microencapsulation and co-crystallization techniques are being utilized to stabilize Thaumatin, extend its shelf life, and manage its dissolution profile, particularly for applications sensitive to moisture or high processing temperatures, such as dry mixes and baked goods. Furthermore, analytical technologies like High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are essential for rapid and accurate quality control, ensuring the purity and stability of the delicate protein structure, particularly important for meeting the rigorous specifications of Pharma Grade material.

Regional Highlights

The regional analysis reveals distinct market maturity levels and growth trajectories driven by varying regulatory environments and consumer preferences regarding sugar reduction and natural ingredients.

- North America: This region holds a significant market share, driven by high consumer awareness regarding health and wellness, established regulatory clarity (GRAS status), and substantial R&D investment by major food and beverage players in reformulation efforts. The demand is particularly strong in the dietary supplements and functional beverage sectors, where premium pricing for natural, non-GMO, and protein-based ingredients is accepted. The focus here is on product innovation and synergistic blending with other natural sweeteners to achieve optimal taste profiles for products marketed towards fitness and clean-eating demographics.

- Europe: Europe is a highly competitive market, characterized by stringent EU regulations on food additives and strong consumer demand for E-number-free (clean label) products. Thaumatin (E957) benefits significantly from its classification as a natural flavor modifier and sweetener, positioning it ideally for the EU market's focus on transparency and natural sourcing. Growth is propelled by government initiatives aimed at reducing childhood obesity and the high penetration of premium organic and natural food products. Germany, the UK, and France are key consumers, often prioritizing fermentation-derived Thaumatin due to heightened sustainability and traceability concerns.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, although starting from a smaller base. Market expansion is fueled by the rapid growth of the processed food industry, rising health consciousness among the middle class in China and India, and increasing westernization of diets. Regulatory approval processes are gradually aligning with international standards, facilitating market entry. Key growth factors include the expanding use of Thaumatin in local dairy products, snacks, and traditional health supplements, often leveraging its heat stability for regional cooking methods. Investment in localized production facilities and distribution partnerships is critical for success in this heterogeneous region.

- Latin America (LATAM): Growth in LATAM is robust, driven primarily by government taxation on sugary beverages in countries like Mexico and Chile, forcing significant product reformulation. The market is highly price-sensitive, making the cost-efficiency of Thaumatin critical. While natural extraction remains common, there is a growing interest in imported fermentation-derived products to ensure quality consistency and meet the rapidly increasing demand from the beverage sector for high-intensity, natural sweetening solutions.

- Middle East and Africa (MEA): MEA presents emerging opportunities, linked to increasing urbanization and health spending. The market for Thaumatin is nascent but growing, particularly in Gulf Cooperation Council (GCC) countries due to high rates of diabetes and proactive health campaigns. The region is a vital source for the raw Katemfe fruit (originating largely from West Africa), creating localized supply chain advantages for extraction-based companies, though demand for highly purified, imported ingredients remains strong in the high-end consumer markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thaumatin Market.- Naturex (Givaudan)

- Ingredion Incorporated

- Tate & Lyle PLC

- Wuxi Chunhua Biology Co., Ltd.

- Natex S.A.

- Symrise AG

- Layn Natural Ingredients Corp.

- Sensus

- DSM-Firmenich

- Cargill, Inc.

- Blue California

- Stevia One

- Interpolymer GmbH

- Taiyo Kagaku Co., Ltd.

- Venus Biotech

- Biolactis Co., Ltd.

- GLG Life Tech Corporation

- Archer Daniels Midland Company (ADM)

- Kancor Ingredients Ltd.

- FoodChem International Corporation

Frequently Asked Questions

Analyze common user questions about the Thaumatin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Thaumatin market?

The primary driver is the pervasive global demand for natural, clean-label sugar alternatives, coupled with public health mandates and taxation policies targeting excessive sugar consumption in processed food and beverages. Thaumatin is highly favored for its natural source and intense sweetness.

How does precision fermentation impact the future supply of Thaumatin?

Precision fermentation technology fundamentally stabilizes the Thaumatin supply chain, offering highly scalable, consistent, and pure product independent of geographical and climate-related volatility associated with harvesting the natural Katemfe fruit. This lowers costs and ensures reliability for mass-market applications.

Is Thaumatin considered safe for consumption globally?

Yes, Thaumatin is widely regarded as safe. It holds Generally Recognized As Safe (GRAS) status in the United States (FDA) and is approved as E957 in the European Union (EFSA), confirming its safety profile for use across diverse food and beverage categories internationally.

What are the main application areas beyond sweetening?

Beyond intense sweetening, Thaumatin is crucial for flavor modification, specifically taste masking bitter notes in pharmaceuticals and neutralizing off-tastes caused by mineral fortification or other high-intensity sweeteners, significantly improving the sensory experience of reformulated products.

Which region currently dominates the Thaumatin market in terms of revenue?

North America and Europe collectively dominate the Thaumatin market revenue, driven by high consumer purchasing power, established regulatory frameworks supporting natural ingredients, and high prevalence of product reformulation in the functional food and dietary supplement industries.

The comprehensive analysis highlights that the trajectory of the Thaumatin market is intrinsically linked to ongoing technological advancements in biosynthesis, regulatory support for natural alternatives, and the accelerating global shift towards preventive health and clean-label diets. Success in this market requires strategic investment in scalable fermentation capacities and robust distribution networks capable of handling a highly specialized food ingredient.

Manufacturers must continuously focus on optimizing cost structures through process efficiencies and demonstrating superior functional performance, particularly in synergistic sweetener blends. As consumer scrutiny over ingredient origin intensifies, the shift toward fermentation offers a crucial advantage in providing transparent and sustainable sourcing narratives, further cementing Thaumatin’s role as a vital component in the future of reduced-sugar formulation globally. The market is primed for substantial value growth, underpinned by its irreplaceable role in managing complex taste profiles in low-calorie products.

Furthermore, competition is increasingly centered on intellectual property rights related to optimized microbial strains used in precision fermentation. Companies that secure patents on high-yield strains and develop proprietary downstream processing methods will command market leadership and benefit from superior profit margins. This intellectual arms race is accelerating innovation not just in production, but also in developing unique, tailor-made Thaumatin derivatives that exhibit specific benefits, such as enhanced stability or specific flavor-modifying capabilities suited for distinct application matrices, such as high-protein bars or acidified beverages.

The sustained demand from the pharmaceutical sector for high-purity, excipient-grade Thaumatin remains a key stabilizing factor for the market, offering attractive high-margin revenue streams that offset volatility sometimes experienced in the mass-market food segment. Regulatory hurdles, especially in emerging markets, still pose challenges, requiring localized strategic partnerships and extensive investment in data submission to achieve regulatory clearance, which is a necessary precursor to maximizing regional market penetration and fulfilling long-term growth forecasts.

In summary, the Thaumatin market is undergoing a fundamental transformation, transitioning from a niche, naturally extracted product with supply constraints to a high-technology, bio-engineered ingredient poised for broader industrial adoption. The integration of advanced analytics, AI-driven process control, and large-scale fermentation capacity ensures that Thaumatin is well-positioned to capitalize on the sustained global mega-trends of sugar reduction and clean-label ingredient sourcing throughout the forecast period.

The regulatory landscape, while generally favorable, necessitates continuous monitoring. Divergent standards between major economic blocs regarding the labeling and classification of ingredients derived from genetically modified organisms (GMOs) using fermentation technology require flexible labeling strategies. However, the overall benefits of Thaumatin—its natural origin, high potency, and protein structure—outweigh these complexities, ensuring its preferential inclusion in new product development pipelines over synthetic alternatives.

Investment into sustainable sourcing practices, even for the fermentation process (e.g., using renewable energy and minimizing waste), is becoming mandatory rather than optional. Stakeholders are recognizing that market advantage is now defined not just by price and purity, but also by demonstrable environmental and social governance (ESG) performance. This holistic approach ensures resilience and acceptance in socially conscious markets, particularly Northern Europe and North America.

The potential for synergistic market expansion, particularly through collaborations with manufacturers of other high-intensity natural sweeteners (like Stevia and Monk Fruit), represents a substantial opportunity. Thaumatin's ability to minimize the inherent bitterness or metallic aftertaste associated with these other natural sweeteners creates highly effective combination blends. These optimized blends often provide the closest sensory experience to sucrose, making them indispensable tools for manufacturers completing complex reformulation projects.

Finally, the long-term competitive dynamics will likely consolidate around those few major players who control the most advanced fermentation technology patents and maintain global supply capabilities. Smaller, specialized firms may find success focusing exclusively on niche, high-purity applications, such as the pharmaceutical or highly specialized sports nutrition segments, where exceptional quality and specialized technical support command a premium price and insulate them from mass-market price wars.

The increasing consumer acceptance of bio-engineered ingredients, provided they meet the criteria for natural functionality, removes a historical barrier to entry for fermentation-derived Thaumatin. This shift in consumer psychology, combined with regulatory pressure and technological optimization, confirms the market's trajectory towards significant expansion and increased market value, making it a critical ingredient segment to watch in the broader functional food landscape.

Future research efforts are concentrated on understanding the precise mechanisms of Thaumatin's flavor modification at a molecular level, allowing for even more targeted and effective deployment in complex food matrices. Success in this molecular understanding could unlock applications in completely new categories, such as savory products, where its protein properties might be utilized for texture or binding rather than solely for sweetening or masking, thus broadening the market scope substantially beyond its current primary application areas.

Addressing the inherent challenge of its relatively high cost compared to artificial sweeteners remains a continuous effort. Economies of scale achieved through optimized, large-scale fermentation facilities are the most viable long-term solution. As global production capacity increases and proprietary strains offer higher yields, the unit cost is expected to decline, enabling manufacturers to integrate Thaumatin into products that currently rely on cheaper, often less desirable, synthetic alternatives. This cost reduction is key to unlocking the full potential of the mass-market beverage segment globally.

The impact of digitalization on the supply chain must also be underscored. The implementation of blockchain technology is beginning to offer unprecedented levels of transparency and traceability for Thaumatin, particularly important for the high-end natural extraction segment, allowing consumers and manufacturers to verify the ethical sourcing and purity of the ingredient from the Katemfe fruit origin to the final product inclusion. This technological layer builds trust and reinforces the premium branding associated with natural Thaumatin products.

Moreover, the integration of Thaumatin in functional and medicinal foods is gaining momentum. Its stability allows it to be combined effectively with probiotics, prebiotics, and highly sensitive functional ingredients without degradation. This synergy positions Thaumatin as a preferred excipient and flavoring agent in the rapidly expanding health and wellness market, where consumers are actively seeking products that offer both low caloric content and demonstrable functional benefits for gut health and immunity.

The competitive landscape is characterized by a strong emphasis on strategic partnerships and mergers and acquisitions (M&A). Established flavor and fragrance houses are actively acquiring specialized ingredient producers to integrate Thaumatin into their broader portfolio of natural solutions, providing a complete systems approach to food and beverage formulation. This consolidation strengthens the market's stability and accelerates the rate of innovation, particularly in applying Thaumatin across a wider variety of specialized food categories worldwide.

Regulatory divergence continues to necessitate a cautious, market-by-market approach. While the FDA and EFSA have clear stances, regulatory bodies in key emerging markets often require unique toxicological and usage data. Ingredient suppliers must invest in comprehensive regulatory dossiers tailored to specific national requirements to ensure timely and effective market access, recognizing that delayed approval can significantly hinder regional growth opportunities and yield competitive advantage to locally approved alternatives.

In conclusion, the market outlook for Thaumatin is overwhelmingly positive, driven by favorable secular trends in consumer health and backed by significant technological leaps in production efficiency. The strategic focus remains on managing the high initial investment required for fermentation technology and navigating the nuanced global regulatory landscape to maximize market penetration across high-value applications, ultimately positioning Thaumatin as a staple ingredient for future food and drug reformulation initiatives globally.

The strategic differentiation based on the Source segment—natural versus fermentation—is increasingly critical. Companies relying on natural extraction must prove unparalleled supply chain sustainability and ethical sourcing, often commanding a premium niche market position. Conversely, fermentation producers compete aggressively on purity, scalability, and predictable pricing, targeting the mass-market segment where consistent supply is prioritized over geographical origin narrative. This dual market structure allows Thaumatin to address diverse customer needs across the price and quality spectrum.

Further innovation is being directed at creating 'designer Thaumatins'—modifications of the protein structure (through genetic engineering or post-fermentation modification) to slightly alter the flavor profile or improve stability characteristics. These proprietary variants offer an avenue for manufacturers to develop unique intellectual property and functional advantages, moving beyond basic sweetness equivalence to become integral flavor management tools within complex food systems.

The potential for Thaumatin in weight management products and clinically-focused nutrition cannot be overstated. As a zero-calorie protein, it provides an ideal ingredient profile for high-protein, low-carbohydrate, or ketogenic formulations. Its integration into medical nutrition products, where taste compliance is paramount for patient well-being and recovery, represents a high-growth, high-margin niche that will continue to attract significant investment and scientific focus during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager