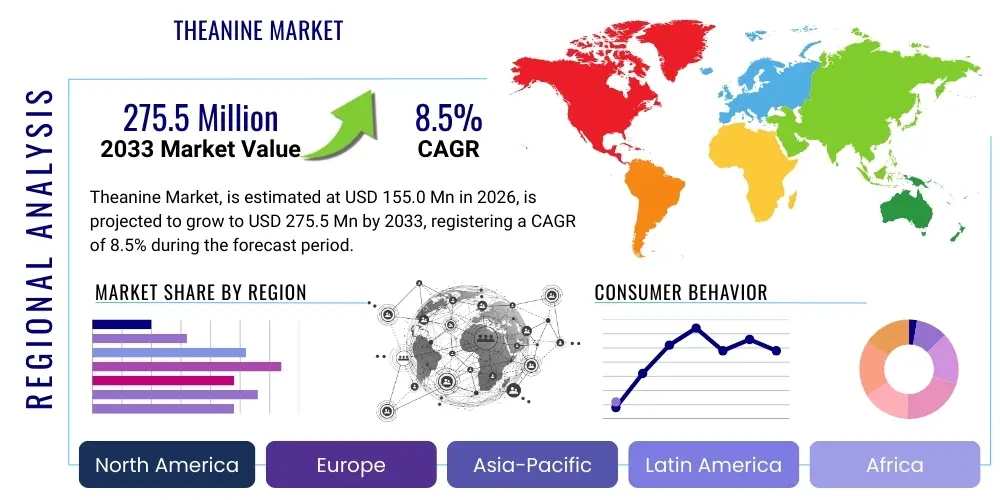

Theanine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438038 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Theanine Market Size

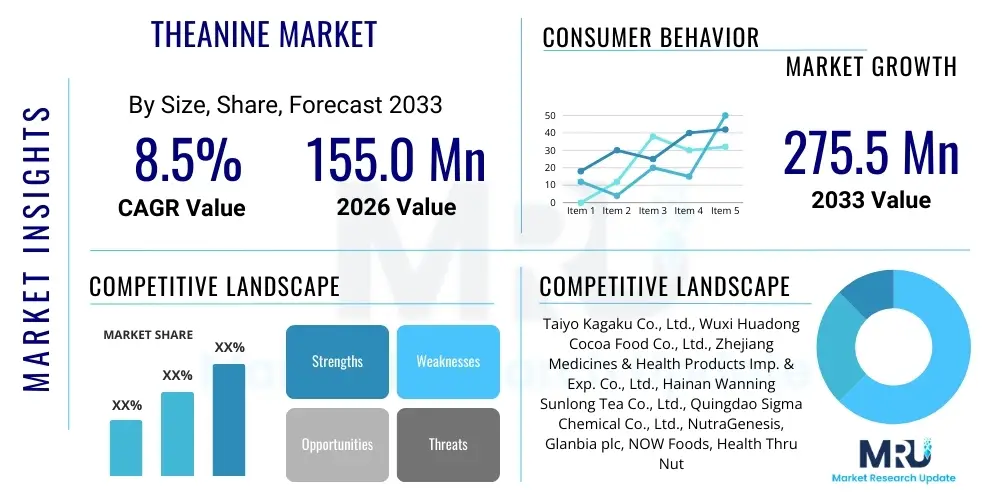

The Theanine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 275.5 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global consumer interest in functional ingredients that support cognitive performance, stress management, and improved sleep quality, positioning Theanine as a crucial compound within the burgeoning nutraceutical and functional food industries. The increased availability of high-purity, synthetically and naturally sourced L-Theanine has facilitated its incorporation into a diverse range of products, including dietary supplements, beverages, and specialized pharmaceutical formulations, contributing significantly to market value accretion across all major geographic regions.

Theanine Market introduction

The Theanine Market centers around the amino acid L-Theanine, primarily found in tea leaves, which is highly valued for its psychoactive properties, particularly its ability to cross the blood-brain barrier and induce relaxation without causing drowsiness. This non-proteinogenic amino acid modulates alpha brain wave activity, leading to enhanced focus and reduced anxiety, making it a critical ingredient in stress-relief and cognitive enhancement products, often used synergistically with caffeine. Major applications span the dietary supplement industry, functional food and beverages (such as energy drinks and fortified water), and the pharmaceutical sector for adjunctive therapy in mood disorders. The primary market driving factors include the global rise in chronic stress levels, increasing consumer adoption of preventative healthcare, the clean label movement demanding natural ingredients, and robust scientific validation supporting Theanine's neuroprotective benefits. Furthermore, the diversification of delivery formats, from traditional capsules to innovative gummies and liquid concentrates, is expanding its consumer base.

Theanine Market Executive Summary

The global Theanine market is experiencing robust growth fueled by several converging business trends, including the rapid expansion of personalized nutrition platforms and the high demand for "nootropic" or cognitive-enhancing supplements among students and working professionals. Business trends indicate a strong move towards vertically integrated supply chains, focusing on achieving pharmaceutical-grade purity for synthetic L-Theanine production while simultaneously enhancing sustainable extraction methods for natural sources, particularly from green tea. Regionally, North America maintains the dominant market share due to high consumer awareness, favorable regulatory environments for dietary supplements, and significant expenditure on wellness products. However, the Asia Pacific region is demonstrating the fastest CAGR, primarily propelled by the deeply ingrained cultural usage of tea, rapid urbanization, and increasing disposable income leading to higher adoption of health supplements in countries like China and India. Segment trends reveal that the application in functional beverages is accelerating, capitalizing on the convenient consumption method, while the natural source segment, despite its higher cost, is gaining traction due to consumer preferences for organic and minimally processed ingredients, compelling manufacturers to invest heavily in fermentation technologies.

AI Impact Analysis on Theanine Market

Common user questions regarding AI's impact on the Theanine market frequently revolve around how artificial intelligence can optimize the synthesis and extraction processes, enhance personalized dosing recommendations, and predict future consumer demand for specific nootropic stacks containing Theanine. Users are keen to understand if AI-driven analytical tools can improve the bioavailability and efficacy of Theanine formulations, reduce production costs, and accelerate new product development timelines through rapid ingredient screening. The primary themes emerging from this analysis include concerns about maintaining ingredient purity through automated quality control, the ethical implications of highly personalized brain health recommendations, and expectations that AI will unlock novel delivery systems that maximize Theanine's stress-reducing and cognitive-boosting effects. This collective user interest confirms that AI is perceived not just as an analytical tool but as a transformative force capable of redefining Theanine's journey from raw source to final consumer application, ensuring precision, efficiency, and customized effectiveness.

- AI optimizes complex fermentation processes for synthetic L-Theanine production, maximizing yield and purity while minimizing batch variations through predictive modeling.

- Generative AI models accelerate the discovery of novel synergistic ingredient combinations, identifying optimal nootropic stacks pairing Theanine with compounds like caffeine, magnesium, or specific B vitamins.

- Predictive analytics enables sophisticated supply chain management, forecasting demand fluctuations based on regional stress levels, seasonality, and social media sentiment, thereby minimizing inventory costs.

- AI-powered personalized nutrition platforms recommend precise Theanine dosages and consumption timing based on individual user biomarkers, genetic profiles, and reported cognitive needs.

- Automated quality control systems utilize machine learning and computer vision to inspect raw materials and finished products, ensuring compliance with stringent purity and safety standards beyond human capability.

DRO & Impact Forces Of Theanine Market

The Theanine market is fundamentally shaped by powerful synergistic forces that drive its expansion, counteract potential limitations, and unlock new avenues for penetration across diverse industrial applications. Key drivers include the overwhelming consumer demand for natural anxiolytic and cognitive-support agents, replacing traditional synthetic alternatives, coupled with robust clinical evidence supporting Theanine’s efficacy in promoting relaxation and enhancing focus, particularly in high-stress environments. Conversely, the market faces restraints such as the high cost associated with extracting natural L-Theanine from tea leaves, regulatory ambiguity surrounding its classification (food ingredient vs. dietary supplement) in specific developing markets, and intense competition from other natural calming agents like GABA and melatonin. Opportunities abound in expanding its use into clinical nutrition, targeting niche consumer groups such as e-sports athletes requiring enhanced reaction time and prolonged focus, and integrating Theanine into personalized health technology platforms. These factors collectively exert significant impact forces on market dynamics, forcing manufacturers to innovate in sourcing, formulation, and marketing to maintain competitive advantage and meet evolving consumer expectations for efficacy and safety.

Specifically regarding market drivers, the societal shift towards non-pharmaceutical interventions for stress and anxiety management represents the most potent growth catalyst. Theanine’s unique mechanism of action—increasing alpha wave production while balancing neurotransmitters like dopamine and serotonin—allows it to appeal to a broad demographic seeking functional benefits without sedation. Furthermore, the synergistic relationship between Theanine and caffeine, often referred to as the 'smart caffeine stack,' has garnered immense popularity in the functional beverage space, driving significant adoption among younger consumers who seek sustained energy and clarity without the typical jitters associated with high caffeine intake. Regulatory bodies, particularly in established markets like the US and Europe, have generally recognized Theanine as Generally Recognized As Safe (GRAS), which streamlines its incorporation into mass-market food and beverage products, accelerating its penetration beyond traditional supplement aisles and into mainstream consumption channels.

However, the market’s progression is tempered by crucial restraints, notably the disparity in price and consumer perception between synthetic and natural sources. While synthetic L-Theanine offers cost-effectiveness and scalability, the prevailing clean label movement favors naturally derived ingredients, placing pressure on sourcing sustainability and cost efficiency for extraction-based methods. Another critical impediment is the challenge of maintaining regulatory harmonization across different global jurisdictions, where Theanine’s maximum permissible dosage or ingredient status can vary widely, complicating global marketing strategies for major players. Successfully navigating the opportunities requires capitalizing on technological advancements in microencapsulation to improve stability and taste masking, essential for integrating Theanine into sensitive food matrixes, and aggressively pursuing clinical trials to validate its efficacy in specific clinical populations, thereby broadening its appeal beyond general wellness into targeted medical nutrition applications.

Segmentation Analysis

The Theanine market is comprehensively segmented based on Source, Application, and Form, providing crucial insights into consumer preference and industrial utilization patterns. The segmentation by source distinguishes between natural extraction (primarily from green tea) and synthetic production (fermentation or chemical synthesis), reflecting the ongoing tension between cost efficiency and consumer demand for natural labels, with synthetic sources generally dominating industrial volume due to scalability and cost-advantages. Application segmentation is crucial, highlighting the massive adoption in dietary supplements, functional beverages, and food applications, alongside emerging use in pharmaceutical and cosmetic sectors, where its anti-inflammatory and relaxation properties are being explored. Finally, the form segmentation reveals preferences for powder, liquid, and capsule/tablet formats, reflecting diverse end-user needs regarding convenience, bioavailability, and ease of integration into manufacturing processes, particularly the shift towards integrated powder mixes and ready-to-drink formulations that cater to on-the-go consumption habits.

Analysis of the source segment shows a critical divergence in market growth rates. While synthetic L-Theanine holds the largest revenue share due to high production yields and lower pricing, the natural L-Theanine segment is projected to exhibit the fastest growth trajectory, driven by premiumization and consumer willingness to pay more for transparency and perceived purity. This trend compels synthetic producers to invest in advanced purification techniques that minimize impurities and meet stricter regulatory thresholds, while natural extractors focus on sustainable sourcing and certified organic status. The application landscape is rapidly diversifying; although supplements remain the core revenue generator, the functional beverage segment is the major growth engine, with manufacturers increasingly positioning Theanine as a premium ingredient that provides 'calm energy'—a highly sought-after functional benefit in the modern consumer environment, thereby cannibalizing some market share from traditional high-sugar energy drinks.

The form segmentation illustrates a foundational aspect of product delivery and consumer acceptance. Powder forms are dominant in the business-to-business (B2B) market, utilized heavily by beverage and food manufacturers due to easy handling and blending capabilities. Conversely, the capsule/tablet segment remains the staple format for the retail dietary supplement market, valued for precise dosing and long shelf life. A noticeable trend is the accelerated growth of liquid and gummy formats, particularly appealing to younger consumers and those who experience pill fatigue, underscoring the necessity for innovation in palatable and convenient delivery systems to ensure continued market expansion across all consumer demographics and usage occasions, from pre-sleep routines to mid-day cognitive boosts.

- By Source:

- Natural (Tea Leaf Extraction)

- Synthetic (Fermentation/Chemical Synthesis)

- By Application:

- Dietary Supplements

- Functional Beverages

- Food Products (e.g., Confectionery, Cereals)

- Pharmaceuticals

- Cosmetics & Personal Care

- By Form:

- Powder

- Liquid

- Tablets & Capsules

- Gummies & Chews

- By End-Use Industry:

- Nutraceuticals

- Food & Beverage Industry

- Pharmaceutical Industry

Value Chain Analysis For Theanine Market

The Theanine market value chain begins with the critical upstream activities of sourcing, involving either the cultivation and harvesting of Camellia sinensis tea leaves for natural extraction or the complex bio-fermentation processes utilizing specific microbial strains for synthetic production. The quality and purity of Theanine are heavily determined at this stage, with rigorous standardization processes essential for both methods to ensure compliance with global food and supplement regulations, impacting initial manufacturing costs significantly. Midstream activities involve the extraction, purification, and formulation processes, where raw Theanine material is processed into various grades (e.g., food-grade, pharma-grade powder) and prepared for incorporation into final products. Downstream, the value chain is characterized by a multi-layered distribution network, utilizing both direct and indirect channels to reach end-users, with indirect distribution dominating, relying heavily on specialized ingredient distributors, contract manufacturers, and ultimately, retail platforms such as e-commerce, pharmacies, and dedicated wellness stores, where brand recognition and consumer trust dictate final product pricing and market penetration.

Upstream analysis reveals that raw material procurement poses distinct challenges depending on the source. For natural Theanine, geopolitical stability, climate conditions, and agricultural labor costs in major tea-producing regions (primarily Asia) influence supply reliability and pricing volatility. For synthetic production, the primary challenge lies in optimizing fermentation yields and maintaining proprietary microbial cultures, requiring substantial capital investment in biotechnological infrastructure. The choice between synthetic and natural heavily influences midstream processing complexity; synthetic production often requires fewer purification steps post-fermentation but demands extremely high standards of chemical safety, whereas natural extraction is highly dependent on solvent efficiency and chromatographic separation techniques to isolate L-Theanine from other tea compounds like catechins and polyphenols, adding complexity and cost to the process before final ingredient formulation.

The downstream sector is fragmented yet highly competitive, necessitating robust strategies for channel optimization. Direct channels, involving large nutraceutical firms or pharmaceutical companies purchasing directly from major Theanine manufacturers, focus on bulk contracts and consistent supply. Indirect channels, which encompass specialized ingredient brokers and major global distributors, allow smaller manufacturers and regional players access to high-quality ingredients, broadening market reach. The transition towards e-commerce platforms is significantly impacting the downstream dynamics, enabling brands to establish direct-to-consumer relationships, often emphasizing transparency regarding Theanine sourcing and purity, which demands highly efficient logistics and packaging tailored for individual consumer shipment rather than bulk distribution, thereby redefining profitability margins and supply chain flexibility across the entire value chain.

Theanine Market Potential Customers

The potential customers for Theanine are exceptionally diverse, spanning major consumer industries that utilize ingredients for functional benefits and enhancement of well-being. The largest cohort of buyers resides in the nutraceutical sector, comprising companies that develop and manufacture dietary supplements aimed at cognitive health, stress reduction, and sleep improvement, utilizing Theanine as a standalone ingredient or a core component in complex nootropic stacks. The second significant segment is the Food & Beverage industry, which integrates Theanine into functional drinks, specialty coffees, energy bars, and fortified snacks, appealing to health-conscious consumers seeking calm energy and sustained focus without adverse side effects. Furthermore, the pharmaceutical industry represents a growing, high-value segment, exploring Theanine’s potential as an adjuvant therapy for psychiatric conditions, requiring extremely high purity and compliance with strict Good Manufacturing Practices (GMP) regulations, defining them as premium customers.

Within the nutraceutical space, potential customers range from large multinational supplement corporations with global distribution networks to specialized, niche brands focusing on specific demographics, such as students or gamers, with purchasing decisions heavily influenced by the ingredient supplier's clinical data support and regulatory dossier. These buyers prioritize cost-effectiveness for mass-market products (favoring synthetic Theanine) while seeking premium, certified-natural sources for high-end product lines. The Food & Beverage sector's procurement strategy is driven by solubility, flavor profile neutrality, and stability within liquid formulations, making the form and ease of integration critical factors, with major beverage giants demanding vast volumes and stringent quality control standards to prevent product degradation during shelf life.

Emerging potential customer segments include the rapidly growing cosmetic and personal care industry, exploring Theanine for its anti-stress and potentially skin-soothing properties in topical applications, and the clinical nutrition sector, where it is being investigated for use in managing sleep disturbances or anxiety associated with chronic diseases. Engaging these customers requires suppliers to demonstrate ingredient stability in non-traditional matrices and provide tailored technical support for formulation challenges. Ultimately, the purchasing power and strategic focus of the dietary supplement sector, coupled with the volume demands from the functional beverage manufacturers, establish the dominant customer profile within the broader Theanine ingredient market, dictating innovation timelines and pricing pressures across the global supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 275.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Taiyo Kagaku Co., Ltd., Wuxi Huadong Cocoa Food Co., Ltd., Zhejiang Medicines & Health Products Imp. & Exp. Co., Ltd., Hainan Wanning Sunlong Tea Co., Ltd., Quingdao Sigma Chemical Co., Ltd., NutraGenesis, Glanbia plc, NOW Foods, Health Thru Nutrition, AorTech International PLC, Blue Sky Vitamin, Jarrow Formulas, Pure Encapsulations, Thorne Research, Swanson Health Products, Doehler GmbH, Fenchem, S.A. Herbal Bioactives, DSM Nutritional Products, Pure Bulk Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Theanine Market Key Technology Landscape

The technological landscape of the Theanine market is characterized by innovations focused on optimizing purity, scalability, and delivery efficiency across both synthetic and natural sourcing methodologies. For natural Theanine, advancements in supercritical fluid extraction (SFE) and membrane filtration technologies are proving crucial, offering more environmentally friendly and efficient methods for isolating L-Theanine from tea biomass while preserving its structural integrity and minimizing residual solvents. These techniques allow manufacturers to achieve higher concentration levels and comply with increasingly stringent requirements for solvent residue limits, essential for premium natural products. Concurrently, synthetic production relies heavily on sophisticated biotechnological processes, specifically optimized microbial fermentation, utilizing genetically engineered strains to enhance L-Theanine biosynthesis pathways. This allows for scalable, cost-effective production that can meet the massive volume demands from the functional beverage industry, making technological mastery in fermentation economics a significant competitive differentiator.

Beyond sourcing, crucial technological developments are concentrated in the formulation and delivery systems designed to improve Theanine’s consumer experience and efficacy. Microencapsulation technology is gaining prominence, specifically addressing challenges related to Theanine’s slight bitterness and its instability when incorporated into complex food and beverage matrices, especially those exposed to high heat or extreme pH levels. Microencapsulation provides a protective barrier, ensuring slow, controlled release and maintaining ingredient potency throughout the product’s shelf life, thereby enabling broader application possibilities in baked goods and specialized powdered drink mixes. Furthermore, advancements in analytical chemistry, utilizing high-performance liquid chromatography (HPLC) coupled with mass spectrometry, are paramount for quality control, guaranteeing the accurate identification and quantification of L-Theanine versus its inactive D-Theanine isomer, thereby ensuring product label accuracy and therapeutic consistency, which is vital for building consumer trust and regulatory compliance in high-value pharmaceutical-grade applications.

The integration of digital technology, particularly the Internet of Things (IoT) and AI, further defines the key technological landscape by enabling precision manufacturing and personalized consumption. IoT sensors are deployed in fermentation tanks and extraction equipment to monitor process parameters in real-time, allowing for immediate adjustments that minimize waste and improve batch consistency, significantly enhancing operational efficiency. On the consumer side, technology is driving personalized product development, where AI algorithms analyze consumer health data, often collected through wearable devices, to recommend tailored dosages and forms of Theanine for optimal stress reduction or focus enhancement. This technological convergence across sourcing, formulation, quality assurance, and consumer interaction solidifies a future where Theanine products are not only highly pure and cost-effective but also seamlessly integrated into personalized wellness regimens, requiring continuous investment in proprietary research and development to maintain market leadership.

Regional Highlights

- North America (NA): This region is the largest and most mature market for Theanine, characterized by exceptionally high health consciousness, proactive use of dietary supplements, and significant penetration of nootropic products among technology workers and students. The US market dominates regional consumption, driven by high disposable income, broad acceptance of functional ingredients, and a well-established regulatory framework (GRAS status) that facilitates Theanine's incorporation into mainstream food and beverage products. The regional growth is sustained by aggressive marketing emphasizing the "calm focus" benefit, high incidence of reported stress, and strong consumer adoption of clean label and natural ingredients, favoring premium natural or highly purified synthetic Theanine.

- Europe: The European market displays robust growth, particularly in Western European nations (Germany, UK, France), spurred by increasing consumer distrust of traditional synthetic anxiety medications and a shift towards botanicals and amino acids for mental well-being. Regulatory scrutiny, particularly concerning novel food status and health claims (EFSA), often presents complexities, but consumer demand for natural stress relief and sleep aids continues to drive consumption. The UK and Germany are leading the trend in functional beverages containing Theanine, seeking alternatives to high-sugar, stimulating drinks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, benefiting from being the primary source of natural Theanine (China, Japan, India) and rapidly increasing urbanization coupled with rising middle-class disposable income. Traditional usage of tea, which naturally contains Theanine, provides a foundational cultural acceptance. Japan has historically been a key innovator in L-Theanine synthesis and application, particularly in food additives and specialized health foods. China’s immense population and rapidly expanding nutraceutical industry present the largest potential volume opportunity, moving from raw material supplier to a significant end-product consumer base, although domestic regulatory complexity remains a factor.

- Latin America (LATAM): The Theanine market in LATAM is emerging, primarily concentrated in larger economies like Brazil and Mexico. Market growth is fueled by increasing awareness of functional foods and a modest but rising adoption of imported dietary supplements focused on brain health. However, market expansion is hindered by economic volatility, lower average consumer expenditure on supplements compared to North America, and less developed regulatory infrastructure specific to advanced nutraceutical ingredients.

- Middle East and Africa (MEA): This region currently represents the smallest market share, with consumption focused mainly in developed Gulf Cooperation Council (GCC) countries through imported high-end supplements. Growth is constrained by cultural preferences, high import duties, and general lower consumer expenditure on preventative health products. Future potential exists in South Africa and the UAE, driven by westernization of dietary habits and growing awareness of mental wellness ingredients, especially through tourism and expatriate communities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Theanine Market.- Taiyo Kagaku Co., Ltd.

- Wuxi Huadong Cocoa Food Co., Ltd.

- Zhejiang Medicines & Health Products Imp. & Exp. Co., Ltd.

- Hainan Wanning Sunlong Tea Co., Ltd.

- Quingdao Sigma Chemical Co., Ltd.

- NutraGenesis

- Glanbia plc

- NOW Foods

- Health Thru Nutrition

- AorTech International PLC

- Blue Sky Vitamin

- Jarrow Formulas

- Pure Encapsulations

- Thorne Research

- Swanson Health Products

- Doehler GmbH

- Fenchem

- S.A. Herbal Bioactives

- DSM Nutritional Products

- Pure Bulk Inc.

Frequently Asked Questions

Analyze common user questions about the Theanine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of L-Theanine and its main application?

L-Theanine is an amino acid recognized for its ability to promote relaxation and calmness without sedation by stimulating alpha brain waves. Its primary application is in the dietary supplement and functional beverage sectors as a nootropic for stress reduction, cognitive enhancement, and improved sleep quality, often paired with caffeine to smooth out stimulating effects.

Is L-Theanine sourced naturally or synthetically, and which source dominates the market?

L-Theanine is sourced both naturally, primarily extracted from green tea leaves (Camellia sinensis), and synthetically, through complex microbial fermentation processes. While natural sourcing is preferred by premium brands, synthetic L-Theanine currently dominates the market volume due to its superior scalability and cost-efficiency for mass-market applications, particularly functional beverages.

Which geographical region holds the largest market share for Theanine consumption?

North America currently holds the largest market share for Theanine consumption. This dominance is attributable to high consumer awareness regarding mental wellness supplements, high discretionary spending on preventative health products, and a favorable regulatory environment supporting its use in functional foods and dietary supplements.

What are the key drivers propelling the growth of the Theanine market?

Key growth drivers include the rising global prevalence of stress and anxiety disorders, the subsequent surge in demand for natural, non-sedating anxiolytic ingredients, increasing scientific validation of Theanine's neurocognitive benefits, and its high effectiveness when formulated into synergistic nootropic stacks with other popular ingredients like caffeine and specialized vitamins.

How is technological advancement impacting the purity and supply chain of Theanine?

Technology significantly impacts purity and supply chain through optimized manufacturing techniques like advanced microbial fermentation for synthetic production and supercritical fluid extraction for natural sourcing, ensuring high-grade purity. AI-driven predictive analytics also optimize the supply chain by forecasting demand accurately, thereby reducing waste and streamlining global logistics for both raw materials and finished products.

What distinguishes Theanine from other common sleep or stress supplements like Melatonin or GABA?

Theanine is primarily an anxiolytic that enhances alpha brain wave activity, inducing a state of calm focus without causing drowsiness, unlike melatonin which directly regulates the sleep-wake cycle. Unlike GABA, which is often poorly absorbed, Theanine readily crosses the blood-brain barrier, offering a more immediate and consistent psychoactive effect for daytime stress management and cognitive improvement.

What are the major challenges restraining the expansion of the Theanine market?

Major restraints include the higher production cost associated with high-purity natural L-Theanine compared to synthetic alternatives, the potential for price volatility in the tea leaf market, and the regulatory complexities and lack of complete harmonization concerning dosage limits and health claims across different international markets, particularly within emerging economies.

In which emerging applications is Theanine seeing increased interest and R&D?

Theanine is seeing increased R&D focus in specialized clinical nutrition formulations for managing anxiety symptoms associated with chronic illness, integration into supplements targeting the e-sports and competitive gaming community for enhanced focus under pressure, and its inclusion in high-end cosmetic formulations leveraging its purported antioxidant and anti-stress properties for topical application.

How does the clean label movement affect the segment preference for Theanine?

The clean label movement strongly favors naturally sourced L-Theanine, driving a premiumization trend within the market. Although synthetic Theanine remains crucial for high-volume, low-cost products, manufacturers catering to premium and organic consumers are increasingly investing in verifiable, sustainable natural extraction methods to meet consumer preference for transparency and minimally processed ingredients, directly influencing marketing strategies and sourcing priorities.

What are the future prospects for Theanine in the functional beverage segment?

The future prospects are extremely strong. The functional beverage segment is projected to be the fastest-growing application due to its convenience and Theanine’s ability to offer 'calm energy.' Manufacturers are innovating with unique flavor profiles and low/no-sugar formulations, positioning Theanine as a crucial ingredient to replace traditional, heavily stimulating ingredients, particularly targeting consumers seeking mental clarity and sustained energy without jitters or subsequent energy crashes.

Can Theanine be used in conjunction with pharmaceutical drugs, and what are the implications?

While generally considered safe, the use of Theanine with certain pharmaceutical drugs, particularly sedatives or blood pressure medications, requires caution and medical consultation due to potential synergistic or additive effects. The pharmaceutical industry is currently exploring its role as an adjuvant in psychiatric treatments to mitigate side effects or enhance efficacy, highlighting its high-purity requirements and the need for clinical oversight.

What role does the form factor play in consumer choice of Theanine products?

The form factor is crucial for consumer acceptance; capsules and tablets appeal to traditional supplement users seeking precise dosing, while liquid shots and chewable gummies cater to convenience-driven consumers, younger demographics, and those with difficulty swallowing pills. The growth in liquid and gummy forms reflects a shift towards more palatable and user-friendly delivery systems, broadening overall market reach.

How do quality control standards differ between food-grade and pharmaceutical-grade Theanine?

Pharmaceutical-grade Theanine demands significantly higher quality control standards, including stricter limits on impurities, heavy metals, and residual solvents, often requiring mandatory cGMP compliance and comprehensive stability testing, along with detailed documentation and clinical data support. Food-grade Theanine standards are rigorous but allow for broader application tolerances, reflecting the difference in intended therapeutic versus general wellness use.

Why is the synergy between L-Theanine and Caffeine highly valued in the market?

The synergistic combination of L-Theanine and Caffeine is highly valued because Theanine mitigates the negative side effects of caffeine, such as jitters, anxiety, and rapid heart rate, while preserving or enhancing its cognitive benefits and alertness. This pairing creates a state of 'relaxed alertness' or sustained focus, making it ideal for nootropic blends and functional energy products that promise sustained, smooth energy without the typical post-caffeine crash.

What are the primary upstream challenges for manufacturers of natural L-Theanine?

The primary upstream challenges for natural L-Theanine manufacturers include ensuring a consistent, high-quality supply of suitable tea leaves, managing the environmental impact of extraction solvents, and overcoming the inherently low yield of L-Theanine in tea, which results in higher manufacturing costs compared to large-scale synthetic fermentation, requiring significant investment in efficient extraction technology.

How is the Theanine market responding to the demand for personalized nutrition?

The market is responding by utilizing AI and digital health platforms to offer personalized dosing and formulation recommendations. This involves analyzing individual biometric data (e.g., stress markers, sleep patterns) to suggest optimal timings, dosages, and combinations of Theanine with other functional ingredients, moving away from one-size-fits-all supplements towards highly customized wellness solutions.

What impact does the regulatory landscape in Europe (EFSA) have on market entry for Theanine products?

The regulatory landscape in Europe, particularly the assessment by EFSA (European Food Safety Authority), significantly impacts market entry by requiring robust scientific evidence to substantiate any specific health claims made about Theanine. Manufacturers often rely on general wellness positioning rather than specific therapeutic claims to navigate the Novel Food Regulation framework, complicating aggressive marketing strategies typical in the US market.

Which specific consumer demographic is driving the fastest growth in Theanine consumption?

The fastest growth in Theanine consumption is driven by the younger demographic (Millennials and Gen Z) and working professionals, particularly those in high-stress, high-performance roles (e.g., tech, finance, academia). This group is actively seeking non-addictive, natural solutions to manage daily stress, enhance cognitive output, and improve sleep recovery, making them prime targets for nootropic formulations.

What differentiates the Asian Pacific market growth trajectory from North America?

APAC’s growth is fueled by rapidly increasing middle-class income and urbanization, shifting from a region primarily known for raw material supply to a major consumer base, building upon traditional cultural acceptance of tea and natural remedies. Conversely, North America's growth is driven by established supplement culture, high consumer spending, and early adoption of novel functional health trends, representing a mature, high-value market.

How are manufacturers addressing the challenge of integrating Theanine into functional beverages?

Manufacturers are addressing this challenge through innovations in form and formulation, primarily using microencapsulated powder forms to mask Theanine’s slightly bitter notes and ensure its stability within liquid matrices, especially in carbonated or acidic beverages, thus maintaining ingredient potency and a palatable final product taste over a long shelf life.

What is the significance of the D-Theanine isomer in market quality standards?

D-Theanine is an inactive isomer typically produced during synthetic manufacturing processes and is generally considered undesirable because it does not possess the same psychoactive benefits as L-Theanine. High-quality standards strictly limit the presence of D-Theanine, ensuring that products are predominantly composed of the biologically active L-Theanine isomer, which is crucial for therapeutic efficacy and regulatory compliance, demanding high precision in purification technologies.

What role does e-commerce play in the downstream distribution of Theanine products?

E-commerce plays a transformative role, increasingly becoming the dominant distribution channel, enabling brands (especially smaller, specialized nootropic companies) to establish direct-to-consumer relationships. This channel reduces reliance on traditional brick-and-mortar retail, facilitates transparency regarding sourcing, and allows for faster market testing of new Theanine-based products, accelerating market fragmentation and specialized product availability.

How do patent protections influence innovation within the Theanine market?

Patent protections are vital, particularly for proprietary synthesis methods, unique formulations (like combination therapies or specialized delivery systems), and specific clinical applications. These protections allow key players to maintain competitive advantages, justify higher R&D investments, and secure premium pricing for technologically advanced or scientifically validated Theanine products, influencing the landscape of market entry for generic versions.

Why is the nutraceutical industry the largest end-user of Theanine?

The nutraceutical industry is the largest end-user because Theanine perfectly aligns with several major supplement categories: brain health, stress management, and sleep support. Its GRAS status and robust clinical backing make it a highly desirable, marketable, and versatile ingredient that can be easily incorporated into high-margin products sold directly to health-conscious consumers worldwide.

What are the sustainability concerns associated with natural Theanine sourcing?

Sustainability concerns mainly revolve around the intensive agricultural practices required for tea cultivation, including land use, pesticide application, and labor ethics, particularly in high-volume production regions like China and India. Manufacturers are increasingly seeking certified organic and ethically sourced tea materials to mitigate these concerns and appeal to environmentally conscious consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- L-theanine Market Size Report By Type (Chemical Synthesis, Microbial Fermentation, Tea Extracts), By Application (Food & Beverage, Healthcare Products, Pharmaceutical Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Theanine Market Statistics 2025 Analysis By Application (Food Additives Industry, Natural Health Care Industry), By Type (Chemical synthesis, Enzyme synthesis, Natural theanine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager