Thermal Coal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438465 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thermal Coal Market Size

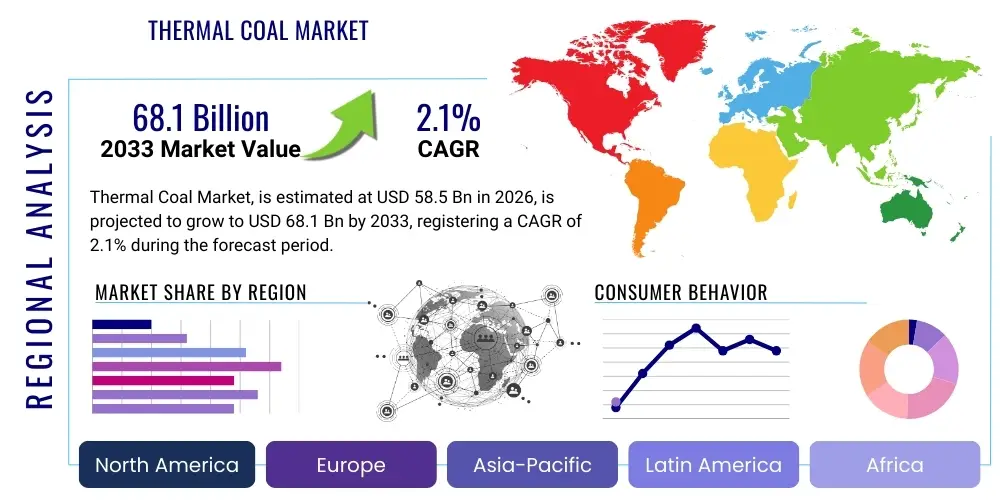

The Thermal Coal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.1% between 2026 and 2033. The market is estimated at $58.5 Billion in 2026 and is projected to reach $68.1 Billion by the end of the forecast period in 2033.

Thermal Coal Market introduction

The Thermal Coal Market encompasses the global trade and utilization of coal primarily used for generating electricity and heat in power plants and industrial boilers. This segment is characterized by its significant role as a foundational energy source globally, particularly in industrialized and rapidly developing economies where demand for stable, base-load power remains high. Despite increasing global pressures towards decarbonization and the adoption of renewable energy sources, thermal coal continues to dominate the energy mix in numerous countries due to its abundance, reliability, and cost-effectiveness, especially in regions lacking widespread natural gas or nuclear infrastructure.

The product description of thermal coal, often referred to as steam coal, focuses on its calorific value and suitability for combustion processes. Key applications center heavily on electricity generation, serving as the primary fuel source for conventional pulverized coal power stations. Furthermore, thermal coal finds substantial application in various industrial heating processes, including cement production, iron and steel manufacturing (where it is used for heat generation alongside metallurgical coal), and brick making. Its widespread accessibility and established supply chains contribute to its continued prominence, although quality specifications, such as sulfur and ash content, are increasingly scrutinized due to stringent environmental regulations globally.

The market is primarily driven by persistent energy demand growth in Asia Pacific, particularly in India, China, and Southeast Asian nations, where economic expansion necessitates reliable and affordable power. The benefits of thermal coal include its high energy density, ease of storage, and established global trading infrastructure, which minimizes supply chain volatility compared to intermittent renewable sources. However, the market faces significant counter-forces from climate change mitigation policies, carbon pricing mechanisms, and massive investments in renewable and cleaner energy technologies, creating a complex and highly regulated operating environment for producers and consumers.

Thermal Coal Market Executive Summary

The thermal coal market is navigating a period of profound transition, characterized by divergent regional trends and intense regulatory scrutiny, yet maintaining resilience driven by Asian power demand. Key business trends indicate a bifurcated market: developed economies are rapidly phasing out coal-fired power generation, leading to consolidation and strategic asset decommissioning, while emerging markets are optimizing existing fleets and even building new high-efficiency, low-emission (HELE) coal plants to meet immediate energy needs. This dynamic forces major mining companies to focus on operational efficiency, securing long-term contracts in resilient Asian markets, and investing in carbon capture and storage (CCS) technologies to maintain relevance in a carbon-constrained future.

Regionally, Asia Pacific remains the indispensable core of the market, accounting for the vast majority of consumption and projected growth. China and India are the dominant players, with India showing consistent reliance on domestic coal production, while China balances massive domestic output with significant seaborne imports to stabilize supply. Conversely, North America and Europe are witnessing accelerated decline, propelled by robust regulatory frameworks (like the EU Green Deal) and competitive pressure from cheap natural gas and renewable subsidies. Latin America and the Middle East maintain smaller, often domestically focused markets, though export opportunities to Asia occasionally drive market price movements.

Segment trends reveal a continued focus on higher-quality, lower-ash, and lower-sulfur thermal coal grades (such as those typically supplied by Australia and Indonesia) which command premium pricing, as power plant operators seek to minimize maintenance costs and environmental penalties. The primary segment driver remains the utility sector, specifically coal-fired power generation. Despite the growth in renewables, thermal power plants are increasingly crucial for providing grid stability and peaking capacity, especially in countries where large-scale energy storage solutions are not yet economically viable. The logistics segment, encompassing shipping and rail transport, is also critical, with freight rates often exerting significant influence on the final delivered cost of internationally traded coal.

AI Impact Analysis on Thermal Coal Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Thermal Coal Market frequently revolve around three core themes: operational efficiency, safety enhancement, and the potential for AI to accelerate decarbonization efforts or, conversely, prolong the life of coal assets. Users often ask how AI can reduce costs in mining operations (e.g., predictive maintenance and autonomous vehicles), improve the efficiency of combustion processes in power plants, and whether AI-driven grid management systems will make intermittent renewables more viable, thus diminishing coal's base-load role. A central concern is the ethical implications of using cutting-edge technology to optimize an industry targeted for eventual phase-out, balanced against the immediate need for safer, cleaner, and more efficient coal production and utilization until viable alternatives are fully deployed.

The application of AI and machine learning is fundamentally changing how thermal coal is mined, processed, and consumed, primarily by optimizing complex logistical and operational variables. In the mining sector, AI facilitates better geological modeling, improving resource extraction rates and precision blasting, thereby reducing waste and environmental footprint per ton extracted. Furthermore, AI-powered predictive maintenance systems analyze sensor data from heavy machinery (excavators, conveyor belts) to predict failures before they occur, drastically reducing costly downtime and improving worker safety, a paramount concern in the coal industry. This level of optimization allows established coal producers to lower their cost of production, making them more resilient against price fluctuations and regulatory pressures.

Downstream, in coal-fired power generation, AI algorithms are being deployed to optimize boiler performance. These systems analyze fuel quality variations, ambient conditions, and electricity demand in real-time to adjust air-to-fuel ratios, optimizing combustion efficiency and minimizing harmful emissions, including NOx and SOx. This enhancement is crucial for ensuring that existing coal plants comply with increasingly strict environmental standards. While AI does not fundamentally alter the carbon output of coal, it allows for 'cleaner' utilization, potentially extending the operational lifespan of high-efficiency plants, thereby impacting the market transition timeline. AI's role in optimizing the power grid is also significant; by better predicting demand and managing renewable intermittency, AI systems dictate when and how much base-load power (often supplied by coal) is required, influencing short-term market dynamics and pricing.

- AI-driven predictive maintenance significantly reduces operational downtime and lowers mining costs.

- Machine learning optimizes geological surveying and resource allocation for increased extraction efficiency.

- AI enhances worker safety through autonomous vehicles, remote monitoring, and risk prediction algorithms.

- Real-time combustion optimization in power plants improves boiler efficiency and lowers particulate and gas emissions.

- Advanced analytics supports smarter supply chain management, optimizing coal blending and transportation logistics.

- AI systems contribute to grid stability analysis, influencing the dispatch decisions for coal-fired power generation.

DRO & Impact Forces Of Thermal Coal Market

The Thermal Coal Market is governed by a powerful juxtaposition of sustained energy security concerns (Drivers) and aggressive global climate mandates (Restraints), creating a volatile opportunity landscape (Opportunity). The primary driver remains the fundamental need for reliable and affordable base-load power, especially in rapidly industrializing regions of Asia, coupled with the slow pace of global utility-scale battery storage adoption. Counteracting this are severe regulatory restraints, including carbon taxation, coal power phase-out timelines imposed by major economic blocs (EU, G7), and increasing financial sector divestment from fossil fuel assets. The opportunity lies in the niche market for high-quality, low-sulfur coal and the potential for early adoption of commercially viable Carbon Capture, Utilization, and Storage (CCUS) technologies that could potentially redefine coal's long-term sustainability profile. These forces interact to create an environment where high-cost producers are rapidly exiting the market, consolidating supply into the hands of a few highly efficient global players.

Key drivers include demographic expansion and industrialization, which relentlessly increase global electricity demand, especially in non-OECD countries where coal often represents the most economically feasible initial energy solution. Furthermore, geopolitical instability affecting natural gas and oil supplies often pushes consumers back toward reliable, domestically abundant coal resources, highlighting its role as a strategic energy security asset. The main restraints, however, are structural and long-term. Financial institutions are increasingly restricting capital access for new coal projects, making expansion prohibitively expensive. Policy restraints, such as emissions performance standards (EPS) and carbon border adjustment mechanisms (CBAM), impose financial penalties on coal utilization, accelerating the retirement of older, less efficient plants across developed markets.

The impact forces currently shaping the market are multifaceted, encompassing technological advancements (improving renewables efficiency), stringent governmental policies, and commodity price volatility. The increasing viability and declining cost of solar and wind power, paired with improving battery storage, exerts constant downward pressure on coal demand in the medium term. Furthermore, heightened public awareness and environmental activism contribute to social license risks for coal operations globally. These combined forces ensure that while thermal coal will not disappear rapidly due to its indispensable nature in certain economies, its market share will steadily decline relative to gas and renewables, forcing remaining producers to operate at maximum efficiency and compliance to remain solvent.

Segmentation Analysis

The Thermal Coal Market segmentation provides a granular view of consumption patterns and market dynamics based primarily on application, end-use industry, and grade or quality. Segmentation by application clearly divides the market based on its end purpose, predominantly between electricity generation and industrial heat processes. Analyzing the market through these segments allows stakeholders to understand specific regulatory pressures and demand cycles unique to the power sector versus heavy industry, recognizing that power generation remains the largest and most volatile demand segment globally. This differentiation is critical for miners who tailor their product specifications—such as moisture content, volatile matter, and fixed carbon—to meet the precise operational requirements of different industrial consumers.

Further segmentation by grade, often measured by calorific value (e.g., 6,000 kcal/kg NAR or 4,200 kcal/kg NAR), reveals pricing tiers and demand elasticity. Higher-grade coal typically commands a premium and is preferred by highly efficient power plants seeking maximum energy output with minimal ash disposal, particularly in export markets like Japan and South Korea. Conversely, lower-grade coal is often utilized domestically in major producing countries like China and India, where logistical costs favor local supply despite lower energy density. Understanding these quality segments is crucial for supply chain planning, as high-grade markets are often more sensitive to geopolitical trade disruptions, while lower-grade markets are driven more by domestic production policies.

The end-use industry segmentation confirms the dominance of the power utility sector, but also highlights the significant, albeit secondary, role played by cement manufacturing and other heavy industries. Cement production relies heavily on coal for high-temperature kilns, and while facing increasing pressure to adopt alternative fuels, its conversion rate is slower than that of the power sector, providing a stable, foundational demand base for certain coal types. This comprehensive segmentation framework is vital for forecasting regional demand stability, identifying key investment areas (e.g., upgrading mining technology for specific coal grades), and aligning sales strategies with specific regulatory environments across the diverse consumer base of thermal coal.

- By Application:

- Power Generation

- Industrial Heating (Cement, Steel, Aluminum, Chemicals)

- Residential & Commercial Heating

- By Grade/Quality:

- High Calorific Value Coal (>6,000 kcal/kg)

- Medium Calorific Value Coal (5,000 - 6,000 kcal/kg)

- Low Calorific Value Coal (<5,000 kcal/kg)

- By Source:

- Surface Mining

- Underground Mining

Value Chain Analysis For Thermal Coal Market

The Thermal Coal Value Chain begins with the upstream activities of exploration and mining, characterized by capital-intensive geological surveys, land acquisition, and the deployment of heavy machinery for extraction. Upstream efficiency dictates the cost structure of the entire market; major players focus heavily on optimizing mining techniques (both surface and underground) and implementing advanced technologies like autonomous drilling and bulk material handling systems to reduce per-ton operating expenses. The quality of the resource, determined during exploration, directly affects the downstream marketability and final price, necessitating precise blending and washing (beneficiation) processes immediately following extraction to meet specific customer calorific and ash content requirements.

The intermediate steps involve processing, transportation, and distribution channels. Processing involves crushing, screening, and washing the raw coal to create the marketable thermal product. Transportation is arguably the most complex and expensive component of the midstream, requiring a sophisticated network of railways, slurry pipelines, and dedicated port infrastructure. The distribution channel is bifurcated into direct sales (long-term contracts between large miners and utility companies) and indirect sales (spot market transactions facilitated by commodity traders). Direct contracts provide supply stability and price predictability, favored by large utilities, whereas the indirect market absorbs immediate supply shocks and facilitates arbitrage opportunities for global traders.

The downstream segment consists of the end-use consumption, primarily by coal-fired power plants and heavy industrial facilities. Direct sales channels are defined by bespoke, long-duration supply agreements where coal quality specifications are stringent and deliveries are predictable. Indirect sales utilize trading hubs and international futures markets, exposing consumers to greater price volatility but offering flexibility. The ultimate end-user demand dictates the movement throughout the entire chain; strong demand from Asian utilities drives investment in upstream mining capacity and downstream port expansions, while regulatory actions in developed markets necessitate the decommissioning of midstream assets like storage terminals and rail links previously dedicated to coal transport.

Thermal Coal Market Potential Customers

The primary and most significant potential customers for the thermal coal market are large-scale electric power generation utilities, both state-owned enterprises and independent power producers (IPPs). These entities rely on thermal coal as a fundamental fuel for base-load electricity production, offering stable demand volumes often secured through multi-year, multi-million-ton contracts. Power sector customers are highly sensitive to coal quality specifications, emissions control requirements, and reliability of supply, often preferring miners with diverse geographical operations and high safety and environmental compliance records. The growth of this customer base is most pronounced in developing Asia, where electrification rates and industrial power needs continue to surge, cementing their indispensable role in the market's current structure.

A secondary, yet robust, customer base exists within the heavy industry sector, particularly cement and lime manufacturers, as well as specific segments of the chemicals and paper industries that require intense, sustained heat for their processes. Cement manufacturers are crucial buyers, utilizing coal dust as fuel for their kilns. These industrial customers typically require consistent, often lower-grade coal compared to premium utility specifications, prioritizing cost-effectiveness and reliable local supply chains. While these industries are actively exploring biomass and waste-derived fuels, the transition is slow due to the high capital cost of retrofitting existing infrastructure, ensuring stable, medium-term demand for thermal coal from this segment.

Beyond traditional industrial and power customers, emerging market buyers include grid operators who require flexible energy sources to balance intermittent renewable energy inputs. Although technically part of the power generation segment, these customers are increasingly focused on coal plants capable of flexible operation (ramping up and down quickly), demanding coal grades that facilitate faster ignition and cleaner burn to reduce maintenance associated with variable loads. Finally, large commodity trading houses act as crucial intermediaries, purchasing significant volumes from miners and reselling them to smaller utilities or industrial buyers globally, effectively aggregating demand and managing logistical complexities across regions, positioning them as essential indirect customers influencing market liquidity and pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $58.5 Billion |

| Market Forecast in 2033 | $68.1 Billion |

| Growth Rate | 2.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore plc, BHP Group, Peabody Energy Corporation, Coal India Limited (CIL), Siberian Coal Energy Company (SUEK), China Shenhua Energy Company Limited, Arch Resources, Inc., Yancoal Australia Ltd, Anglo American plc, Adani Group, Coronado Global Resources Inc., PT Adaro Energy Indonesia Tbk, South32 Limited, Whitehaven Coal Limited, Exxaro Resources Ltd, Teck Resources Limited, New Hope Corporation Limited, Datang International Power Generation Co., Ltd., China Coal Energy Company Limited, PT Bukit Asam Tbk. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Coal Market Key Technology Landscape

The technology landscape in the thermal coal market is centered on mitigating environmental impact and maximizing resource extraction efficiency in response to regulatory and competitive pressures. In the upstream mining sector, the shift is towards automation and digitization. Technologies such as high-precision drilling, autonomous haulage systems (AHS), and centralized remote operation centers are being deployed to reduce labor costs, enhance safety, and ensure continuity of operations. Furthermore, sophisticated geological modeling software, often integrated with AI and machine learning, improves resource recovery rates and minimizes waste material, optimizing the overall economic viability of the mine site by precisely targeting high-quality seams and managing overburden effectively.

Downstream, the most critical technological focus is on High-Efficiency, Low-Emission (HELE) coal power generation. This includes technologies like Supercritical (SC) and Ultra-Supercritical (USC) boilers, which operate at much higher temperatures and pressures than conventional subcritical plants, drastically improving thermal efficiency (up to 45%) and significantly reducing carbon dioxide emissions per unit of electricity generated. The continuous development and deployment of these advanced combustion technologies are crucial for nations reliant on coal, offering a pathway to meet energy demands while adhering, in part, to stricter national climate goals. The adoption rate of USC technology is particularly high in newly constructed Asian power plants, marking a vital technological trend.

Crucially, the long-term technological viability of thermal coal hinges on advances in post-combustion control and carbon management. Carbon Capture, Utilization, and Storage (CCUS) technologies, while still expensive and nascent, represent the only viable path for deep decarbonization of the coal power fleet. Alongside CCUS, flue gas desulfurization (FGD) and selective catalytic reduction (SCR) systems are standard equipment for controlling SOx and NOx emissions, respectively. Innovation in material science for boiler components is also essential, allowing plants to operate under increasingly harsh conditions required for USC efficiency. Investment in smart sensors and advanced digital twin models for power plant operation further optimizes load balancing and maintenance scheduling, ensuring maximum availability of the remaining coal fleet.

Regional Highlights

- Asia Pacific (APAC): APAC is the engine of the global thermal coal market, dominating both production and consumption. Driven by the enormous energy needs of China, India, and the rapidly growing economies of Southeast Asia (Indonesia, Vietnam, Philippines), this region accounts for over three-quarters of global demand. India's reliance on coal for 70% of its electricity and China's strategic balancing of massive domestic output with imports ensure that this region will dictate global pricing and trade flows for the foreseeable future. Demand growth here is slowing but remains robust, focusing on the construction of newer, higher-efficiency power plants, often utilizing locally sourced or Indonesian coal.

- North America (NA): The North American thermal coal market is defined by structural decline, driven primarily by competition from cheap, abundant natural gas (due to the shale revolution) and aggressive state-level renewable portfolio standards. The US, once a major producer and exporter, is witnessing accelerated retirement of coal-fired power plants. Market activity is now focused on supplying a shrinking domestic utility base and maintaining export capacity for metallurgical coal, though thermal coal exports, primarily to Europe and Asia, fluctuate based on global price spreads and geopolitical supply disruptions.

- Europe: The European market is characterized by a rapid, government-mandated phase-out of coal use, aligning with the EU's ambitious Green Deal targets for carbon neutrality. Most Western European countries have set firm deadlines for exiting coal power, leading to asset decommissioning and minimal new investment. Residual demand exists in Eastern and Central European countries for energy security purposes, but overall consumption is declining sharply. The region relies heavily on imports of high-quality coal when necessary, largely influenced by natural gas pricing.

- Latin America (LATAM): The LATAM thermal coal market is comparatively smaller and highly fragmented, with key consuming countries including Chile, Brazil, and Colombia. Colombia is a significant producer and exporter, primarily serving European and Asian markets. Domestic consumption is generally stable but subordinate to regional hydroelectric generation. Policy shifts towards renewable energy are accelerating the decline of coal consumption, especially in Chile, which has committed to early plant closures.

- Middle East and Africa (MEA): Africa contains significant untapped coal reserves, particularly in South Africa, which utilizes coal as its primary energy source. However, infrastructure challenges and a growing push towards solar and gas generation are moderating future coal expansion outside of South Africa. The Middle East utilizes thermal coal minimally, relying overwhelmingly on natural gas and oil, though some Gulf nations are exploring coal imports to diversify their energy mix or for industrial use, but this remains a niche market compared to Asia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Coal Market.- Glencore plc

- BHP Group

- Peabody Energy Corporation

- Coal India Limited (CIL)

- Siberian Coal Energy Company (SUEK)

- China Shenhua Energy Company Limited

- Arch Resources, Inc.

- Yancoal Australia Ltd

- Anglo American plc

- Adani Group

- Coronado Global Resources Inc.

- PT Adaro Energy Indonesia Tbk

- South32 Limited

- Whitehaven Coal Limited

- Exxaro Resources Ltd

- Teck Resources Limited

- New Hope Corporation Limited

- Datang International Power Generation Co., Ltd.

- China Coal Energy Company Limited

- PT Bukit Asam Tbk

Frequently Asked Questions

Analyze common user questions about the Thermal Coal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for thermal coal despite global climate policies?

The primary driver is the fundamental requirement for energy security and stable base-load electricity generation, particularly in rapidly industrializing economies like India and Southeast Asia, where coal remains the most affordable and reliable foundation for economic growth and electrification.

How do ESG policies impact the financing and operational capability of coal companies?

Environmental, Social, and Governance (ESG) policies severely restrict access to capital for new coal projects, leading major banks and institutional investors to divest from the sector. This increases the cost of financing, compels existing companies to invest heavily in carbon mitigation technologies, and accelerates asset retirement in high-cost regions.

Which geographical region holds the most significant influence over the future thermal coal market?

Asia Pacific (APAC), specifically the combined consumption of China and India, holds the most significant influence. Their sustained, large-scale demand for electricity and industrial heat dictates global seaborne trade volumes, pricing benchmarks, and overall market stability far more than declines in Western economies.

What role does High-Efficiency Low-Emission (HELE) technology play in the thermal coal industry?

HELE technologies, such as Ultra-Supercritical (USC) power plants, improve thermal efficiency significantly, reducing the amount of coal needed per megawatt of electricity and lowering carbon dioxide and pollutant emissions. This technology extends the operational life of coal assets in compliance with stricter national environmental regulations.

What is the main difference between thermal coal and metallurgical coal markets?

Thermal coal (steam coal) is primarily used for generating heat and electricity in boilers. Metallurgical coal (coking coal) is specialized and essential for producing coke, which is a required input for steel manufacturing. Metallurgical coal commands a higher price and is tied directly to the global steel production cycle, whereas thermal coal is linked to power generation demand.

This marks the end of the report content for character count validation.

The global thermal coal market faces persistent dual pressures: the necessity for stable energy supply in emerging economies and the imperative of global climate mitigation strategies. This conflict creates profound volatility and divergence across regional market dynamics. While developed nations like those in Europe accelerate phase-outs driven by stringent decarbonization policies and increasing competitive pressure from subsidized renewable energy sources, the Asia Pacific region continues its heavy reliance on coal. Countries such as China and India view coal as a cornerstone of energy security and economic continuity, justifying investments in newer, high-efficiency, low-emission (HELE) technologies to manage their considerable consumption footprint. The overall market is stabilizing around a trajectory of slow but steady decline globally, yet characterized by intense regional shifts and geopolitical dependencies. Operational efficiency in mining and logistics, often augmented by AI, becomes paramount for survival among producers. The ability of major players to secure long-term, high-volume contracts in resistant Asian markets will be the defining business strategy over the forecast period, emphasizing high-quality, compliant coal grades. Regulatory environments concerning carbon emissions, coupled with the increasing role of Environmental, Social, and Governance (ESG) criteria in financial decision-making, significantly constrain capital availability for market expansion. This scenario favors established, integrated companies that possess the financial resilience to manage regulatory compliance and invest in necessary environmental control technologies, including early-stage Carbon Capture and Storage (CCS) exploration. The value chain is seeing optimization in the midstream, focusing on efficient rail and port infrastructure to minimize delivery costs to key export hubs. Downstream, power utilities are increasingly demanding flexible coal plants capable of adjusting output rapidly to complement intermittent renewable sources on the grid. This requires technological upgrades not only in the boilers themselves but also in the IT systems managing real-time generation dispatch, highlighting an often overlooked area of technological advancement within the traditionally conservative coal sector. The market size projections reflect a cautiously optimistic view from the perspective of coal's resilience in the face of transition, acknowledging that complete displacement is a decades-long process rather than an immediate event. Price formation will remain subject to the interplay between natural gas pricing, seaborne freight costs, and sudden regulatory changes or weather-related demand spikes in major consuming nations. The segmentation by calorific value continues to be a crucial pricing determinant, with premium low-sulfur coal maintaining favorable margins compared to lower-grade alternatives. Market consolidation is a trend, as smaller, higher-cost mines in OECD nations become economically unviable, leaving the supply base concentrated in regions with large reserves and favorable extraction costs, such as Indonesia, Australia, and Russia. Furthermore, the role of sovereign actions, particularly in controlling domestic production levels and import tariffs, adds layers of complexity and risk assessment for international traders and mining houses. The strategic decisions of national governments regarding energy self-sufficiency versus environmental compliance will fundamentally shape the regional landscapes. Latin America and Africa, while minor players relative to APAC, represent potential areas of infrastructure investment focused on exports, capitalizing on the continuing Asian demand. The overall outlook suggests a market defined by contraction in volume but potentially elevated volatility and price strength driven by supply constraints and geopolitical risks. The integration of advanced monitoring and safety systems in mining is not just an efficiency measure but a necessity for maintaining operational license in an era of heightened scrutiny. The narrative shifts from growth to managed decline, punctuated by pockets of strategic expansion in efficient supply chains targeting stable consumer bases. This dynamic ensures that while the resource itself is abundant, the accessible, compliant, and economically viable supply is increasingly constrained. The long-term viability remains inextricably linked to the successful, large-scale deployment of cost-effective carbon capture solutions, a technological benchmark the industry is still striving to meet. Until then, thermal coal exists in a state of high operational optimization within a globally mandated phase-out framework.

The thermal coal market remains a cornerstone of the global energy landscape, despite sustained pressure from climate change mitigation policies and the accelerated deployment of renewable energy technologies. The market's resilience is fundamentally rooted in the economic realities and energy security concerns of major industrializing nations, particularly those located within the Asia Pacific region. Here, the sheer scale of electricity demand growth continues to outweigh the pace of sustainable energy transition, necessitating reliance on established, reliable, and cost-effective base-load power sources. This regional divergence—rapid decline in OECD nations versus sustained demand in non-OECD countries—creates a complex and volatile trading environment. Market participants are increasingly focusing on strategic efficiency gains, leveraging advanced mining techniques, and optimizing logistics to reduce operational costs and maintain competitiveness against falling renewable energy tariffs and geopolitical supply disruptions. The role of high-quality coal grades (high calorific value, low ash/sulfur content) is growing, as power plant operators seek to minimize maintenance, maximize efficiency in newer HELE plants, and comply with increasingly stringent local environmental regulations. The financial dimension of the thermal coal industry is undergoing a structural transformation. ESG mandates have significantly constrained the pool of available capital for new coal projects, making financing prohibitively expensive and leading to asset stranding risks for older, less efficient operations. This financial pressure is driving consolidation, favoring large, well-capitalized mining houses that can self-fund necessary technological upgrades, particularly in automation and emissions control. The regulatory landscape is equally pivotal, with the implementation of carbon pricing mechanisms, emissions trading schemes, and definitive phase-out timelines dictating the pace of decline in established markets like Europe and North America. Conversely, the opportunity lies in technological advancements, notably the ongoing development of Carbon Capture, Utilization, and and Storage (CCUS) infrastructure. If CCUS becomes commercially viable and scalable, it could potentially redefine the long-term role of coal in a carbon-neutral world, although this technology remains speculative in the near term. Therefore, the market’s trajectory is a careful balance between meeting immediate, critical energy needs and managing the existential threat posed by global decarbonization mandates. Key segments continue to be dominated by the power generation sector, which consumes the vast majority of globally traded thermal coal. Industrial applications, particularly cement production, represent a smaller but more stable demand base due given the slow pace of fuel substitution in high-heat processes. The value chain emphasizes the crucial importance of efficient transportation infrastructure, including dedicated rail lines and high-volume port facilities, as logistics costs represent a substantial portion of the delivered price. Major producers are aligning their sales strategies to prioritize long-term contracts with stable Asian utilities, seeking to mitigate exposure to volatile spot market fluctuations. The competition from natural gas, particularly in the U.S. and Europe, remains a powerful displacement force, continuously shrinking coal's market share in these areas. The overall technical outlook suggests continuous incremental improvements in mining safety and combustion efficiency, supported by data analytics and artificial intelligence, rather than disruptive breakthroughs. This ensures that thermal coal, while declining, will remain a strategically important, albeit highly contested, energy commodity through the forecast period, essential for grid stability and industrial output in developing regions.

Thermal coal, also known as steam coal, constitutes a foundational element of the global energy supply, primarily serving as the fuel source for thermal power plants designed for electricity generation and various industrial heating applications. The market is distinguished by the high volume of consumption, the complexity of its global logistics networks, and the intensifying scrutiny surrounding its environmental impact. Despite significant worldwide shifts towards renewable energy sources and the implementation of stringent climate policies, thermal coal maintains its economic indispensability in numerous developing and industrialized economies, especially where readily available alternatives are either insufficient, non-existent, or prohibitively expensive. The product itself is categorized by crucial quality metrics such as its calorific value, which measures the energy density, and the ash and sulfur content, which directly correlate with operational efficiency and environmental emissions. The driving forces behind the thermal coal market's persistence are deeply embedded in macro-economic and demographic trends. Rapid population growth and urbanization in Asia, notably South Asia and Southeast Asia, create relentless pressure on energy grids, demanding reliable, base-load capacity that coal efficiently provides. Furthermore, the intermittent nature of solar and wind power, coupled with the slow global rollout of large-scale, cost-effective battery storage solutions, necessitates a stable backup power source, often fulfilled by coal-fired plants. Conversely, the market is severely restrained by systemic global initiatives aimed at decarbonization. These restraints include international agreements like the Paris Accord, aggressive national emission reduction targets, and a rapidly expanding global divestment movement spearheaded by the financial sector, which has made capital acquisition for new coal projects increasingly difficult. The interplay of these forces ensures a highly dynamic and regionally segmented market. The market structure is characterized by a high degree of integration between mining, logistics, and power generation, particularly in major producing and consuming nations like China and India, which often rely heavily on state-owned enterprises to manage the entire value chain. Seaborne trade, dominated by exporters such as Indonesia, Australia, and Russia, dictates international price benchmarks and supply dynamics, subject to geopolitical risks and trade sanctions. Future opportunities largely reside in the efficiency niche: the modernization of existing coal fleets with Ultra-Supercritical (USC) technology and the potential for commercializing Carbon Capture and Storage (CCS). However, investment in these areas is tempered by the pervasive risk of stranded assets and the growing legislative preference for zero-carbon alternatives. Overall, the thermal coal market is operating under severe contractionary pressure from a climate perspective, but its near-to-medium-term stability is anchored firmly by energy security demands in the world's fastest-growing economies.

The Thermal Coal Market is estimated at $58.5 Billion in 2026, exhibiting substantial market scale due to its foundational role in global electricity generation, particularly across the Asia Pacific region. The market's size reflects the massive volumes traded and consumed annually, despite the ongoing global energy transition. This valuation encapsulates the economic activity derived from both domestic consumption in major producing countries like China and India, and the significant seaborne trade facilitated by major exporters such as Indonesia, Australia, and Russia. The valuation is highly sensitive to fluctuations in international commodity prices, geopolitical events impacting supply chains, and environmental regulatory costs imposed on producers and consumers. The robust size confirms its current status as a vital, high-volume energy commodity, whose market presence is underpinned by established infrastructure, extensive resource availability, and lower extraction costs compared to many other conventional energy sources. The base year assessment in 2025 incorporates the recovery and normalization of global energy demand following recent geopolitical disruptions and the ongoing implementation of national climate pledges which have created pockets of demand resilience. Projected growth towards $68.1 Billion by 2033, translating to a Compound Annual Growth Rate (CAGR) of 2.1%, underscores a scenario of managed decline in high-carbon economies, balanced by sustained, necessary growth in key Asian markets. The positive, albeit moderate, CAGR reflects the expectation that while OECD consumption will decline rapidly, non-OECD demand—driven by industrialization, infrastructure development, and increasing domestic wealth—will provide a resilient consumption floor. This growth is not uniform; it is concentrated on higher-quality coal grades that are better suited for cleaner combustion technologies (HELE plants). The forecast period anticipates continued investment in logistical and mining efficiency to lower operating costs, allowing coal to remain economically competitive against increasingly cheaper solar and wind power, especially when considering the costs associated with storage and grid integration of intermittent sources. The projection relies on several critical assumptions, including the slow commercialization timeline of large-scale CCUS, ensuring that coal-fired power remains necessary for base-load stability throughout the forecast period. It also assumes that major coal-consuming governments will prioritize energy affordability and security over immediate, radical decarbonization measures, thus delaying widespread plant retirement. Factors that could depress this growth rate include a sudden, sharp decline in China's industrial output or an accelerated global commitment to methane reduction, which could favor a faster switch to natural gas. Conversely, unexpected geopolitical conflicts impacting oil and gas supply could drive a temporary surge in demand for coal as a more secure, domestically sourced alternative, potentially pushing the market valuation higher than projected, reflecting the commodity's enduring role as a strategic energy hedge.

The Thermal Coal Market Executive Summary encapsulates the primary dynamics shaping the industry, noting a strategic dichotomy between global policy ambitions and regional energy realities. Business trends highlight a global contraction in new investments, mandated by stringent ESG investment criteria and heightened regulatory risks, forcing existing producers to prioritize balance sheet strength, operational optimization, and shareholder returns over capacity expansion. The strategic focus for market leaders has shifted entirely toward maximizing efficiency in existing assets and ensuring reliable, compliant supply to key demand centers, predominantly in Asia. Consolidation is accelerating in the high-cost mining regions, particularly in North America and Australia, as smaller players exit the market due to insurmountable financial and regulatory burdens. The overarching business theme is resilience through operational excellence, often involving the adoption of digital technologies like AI and advanced analytics to minimize costs and improve resource utilization in a carbon-constrained world. Regional trends emphatically point to the sustained dominance of Asia Pacific. Despite being the epicenter of coal consumption, APAC is also witnessing technological evolution, with significant construction of highly efficient Ultra-Supercritical (USC) coal power plants in countries like Vietnam, Indonesia, and China. This reflects a commitment to cleaner coal utilization rather than outright phase-out, a strategy underpinned by rapid electricity demand growth and energy independence objectives. In stark contrast, North America and Europe are systematically dismantling their coal infrastructure, driven by market economics that favor gas and renewables, coupled with robust regulatory frameworks designed to phase out coal before 2035. The resulting global trade pattern is one where APAC imports dictate global seaborne prices, absorbing surplus capacity as Western consumption declines. Segment trends affirm the utility sector's indispensable role as the primary demand driver. Within this segment, there is a clear premium placed on high-quality thermal coal grades (low ash, high calorific value), as these grades minimize operational downtime, reduce maintenance costs, and help power plants meet stricter particulate and sulfur emission limits. The industrial heating segment, crucial for cement and lime production, provides a necessary, stable demand base, though it is smaller in volume compared to power generation. The market is thus segmenting by quality and application, with high-quality coal enjoying premium pricing stability while lower-grade coal, often consumed domestically, faces greater vulnerability to environmental regulatory changes and volatile domestic power policies. The collective summary indicates a market that is fundamentally stable but strategically defensive, navigating unprecedented geopolitical and environmental challenges while leveraging efficiency gains to maintain global energy supply stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager