Thermal Desorption Instrument Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434505 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Thermal Desorption Instrument Market Size

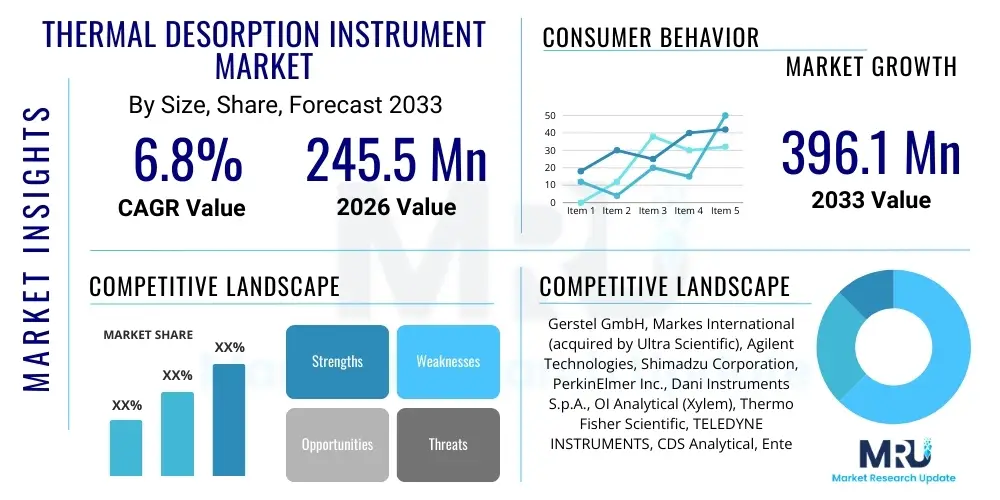

The Thermal Desorption Instrument Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $245.5 Million in 2026 and is projected to reach $396.1 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing global emphasis on monitoring volatile organic compounds (VOCs) and semi-volatile organic compounds (SVOCs) across environmental, industrial, and consumer product matrices, driven by increasingly stringent government regulations globally.

Thermal Desorption Instrument Market introduction

The Thermal Desorption (TD) Instrument Market encompasses sophisticated analytical devices designed for the extraction and concentration of volatile and semi-volatile organic compounds from various sample types, including solids, liquids, and gases, before their subsequent analysis, typically by Gas Chromatography (GC) or Gas Chromatography-Mass Spectrometry (GC-MS). TD instruments operate by heating the sample under controlled conditions, releasing the target analytes which are then focused onto a cold trap and subsequently injected rapidly into the GC column. This process provides significant advantages in terms of sample throughput, sensitivity, and the elimination of solvent use, positioning TD as a crucial technique in modern analytical chemistry.

Major applications of thermal desorption instruments span across critical sectors such as environmental monitoring, where they are indispensable for ambient air quality testing, indoor air analysis, and soil contamination assessment. Furthermore, they play a vital role in consumer product testing, often used for identifying chemicals leaching from packaging or materials (such as automobile interiors or electronic components), a process frequently referred to as ‘off-gassing’ analysis. The instruments’ capacity to handle low-concentration samples without extensive manual preparation significantly improves laboratory efficiency and the quality of trace analysis.

Key benefits driving market adoption include enhanced sensitivity, achieved through the pre-concentration step, which is vital for meeting ultra-low detection limits mandated by regulatory bodies like the US EPA and European standards organizations. The market is primarily driven by the escalating global necessity to adhere to stringent air quality standards and occupational safety regulations. Technological advancements, particularly in automated systems capable of handling large numbers of samples unattended, further solidify the market's growth trajectory, offering superior cost-effectiveness compared to traditional liquid extraction methods.

Thermal Desorption Instrument Market Executive Summary

The Thermal Desorption Instrument Market exhibits robust growth propelled by significant business trends centered around automation and portability. Major vendors are focusing on developing fully automated systems that integrate seamlessly with GC/GC-MS workflows, reducing operator intervention and increasing analytical precision. Furthermore, the trend toward miniaturization and field-portable TD units is opening new avenues, particularly in rapid response environmental assessments and on-site testing, thus broadening the user base beyond central laboratories. Successful competitive strategies heavily emphasize providing robust application support and developing dedicated consumables tailored for specific regulatory methods.

Regionally, North America and Europe currently dominate the market share due to the early adoption of advanced analytical techniques and the presence of highly stringent environmental protection legislation concerning VOC emissions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is driven by rapid industrialization, increasing awareness regarding air pollution, and massive investments in establishing modern, compliant environmental monitoring infrastructures, particularly in countries like China, India, and South Korea, where urbanization stress on air quality is immense.

Segmentation analysis highlights that Automatic Thermal Desorbers maintain the largest revenue share owing to their high throughput capabilities, essential for large-scale monitoring projects. The Environmental Monitoring application segment remains the primary revenue generator, deeply intertwined with governmental regulatory demands. However, the Materials Testing segment, driven by global supply chain regulations regarding product safety and off-gassing, is anticipated to show the fastest growth. End-users in the Pharmaceutical & Biotechnology sectors are increasingly adopting TD for residual solvent analysis and excipient characterization, further diversifying market growth beyond traditional environmental applications.

AI Impact Analysis on Thermal Desorption Instrument Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on Thermal Desorption Instruments frequently revolve around how AI can enhance data interpretation, optimize instrument performance, and streamline routine maintenance. Users express interest in predictive maintenance algorithms to minimize downtime, AI-driven method development tools to quickly establish optimal thermal profiles for complex matrices, and sophisticated data analysis platforms capable of identifying unexpected or trace contaminants buried within complex chromatograms. Key concerns often center on the robustness of AI models when dealing with highly varied sample types and ensuring the validation and regulatory compliance of AI-generated results, particularly in sensitive environmental and forensic applications. The consensus points towards AI becoming an indispensable tool for maximizing efficiency and accuracy in high-throughput analytical laboratories utilizing TD technology.

- AI enhances method optimization by predicting optimal thermal profiles based on sample matrix and target analytes, significantly reducing method development time.

- Predictive maintenance leverages machine learning to monitor instrument health, forecast component failures (e.g., trap degradation), and schedule proactive service, maximizing uptime.

- AI-powered data processing improves chromatographic deconvolution, enabling the accurate identification and quantification of co-eluting VOCs and SVOCs.

- Automated QA/QC processes use AI to rapidly flag non-conforming samples or results, improving data reliability and reducing manual review labor.

- Generative AI tools assist researchers in simulating thermal desorption processes under different conditions, aiding in educational and complex research scenarios.

DRO & Impact Forces Of Thermal Desorption Instrument Market

The Thermal Desorption Instrument Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. A primary driver is the proliferation of rigorous global environmental legislation, particularly concerning monitoring and limiting air pollutants such as benzene, toluene, ethylbenzene, and xylenes (BTEX), and other VOCs emanating from industrial processes, vehicular traffic, and consumer products. This regulatory pressure necessitates the use of highly sensitive, reliable analytical techniques like thermal desorption to meet mandated detection limits, ensuring continuous investment in updated instrumentation by environmental agencies and regulated industries worldwide. The increasing global focus on occupational health and safety, requiring monitoring of workplace air quality, further amplifies this demand.

However, the market faces significant restraints. The initial capital expenditure required for acquiring advanced automatic thermal desorption systems and associated GC/GC-MS instrumentation is substantial, presenting a barrier to entry, particularly for smaller laboratories or those in developing regions. Furthermore, thermal desorption is a technique that requires specific technical expertise for method setup, calibration, and routine troubleshooting, limiting its immediate adoption compared to simpler extraction techniques. These complexities necessitate continuous training and a specialized workforce, contributing to higher operational costs, which can slow down large-scale instrument procurement decisions in budget-constrained settings.

The market is ripe with opportunities that counteract these restraints. The expansion of applications into high-growth sectors, notably food and beverage analysis (for packaging materials and taint analysis) and sophisticated materials testing (e.g., electronic component off-gassing for cleanroom environments), provides new revenue streams beyond traditional environmental scope. Moreover, the accelerating adoption of automatic, high-throughput systems, coupled with ongoing technological miniaturization efforts leading to lower power consumption and smaller footprints, enhances accessibility and operational efficiency. These forces collectively push the market forward, transforming TD from a specialized environmental tool into a versatile platform essential for numerous quality control and safety checks globally.

Segmentation Analysis

The Thermal Desorption Instrument Market is segmented primarily across Type, Application, and End-User, reflecting the diverse analytical needs and operational scales of the global client base. The structure of these segments reveals shifts toward automation and the expansion of TD technology into non-traditional fields like advanced material characterization. Analyzing these segmentations provides clarity on where current technological investments are concentrated and which end-markets offer the most promising future growth trajectories, ensuring businesses align their product strategies with evolving regulatory and industrial requirements globally. The inherent flexibility and high sensitivity of TD technology enable it to cater effectively to these varied application demands, driving segmentation growth.

- By Type: Automatic Thermal Desorbers, Manual Thermal Desorbers, Accessories and Software.

- By Application: Environmental Monitoring, Food & Beverage Analysis, Materials Testing, Clinical and Forensic Analysis.

- By End-User: Environmental Agencies, Research Institutions, Chemical and Petrochemical Industry, Pharmaceutical & Biotechnology Companies.

Value Chain Analysis For Thermal Desorption Instrument Market

The value chain for the Thermal Desorption Instrument market initiates with the upstream activities centered on the procurement and manufacturing of specialized components, including highly inert flow path materials, specialized heated zones, cryo-focussing traps, and advanced electronic controls necessary for precise temperature and flow management. Key upstream suppliers include manufacturers of high-purity metal alloys, advanced ceramic materials, and sophisticated sensor and control systems. The quality and purity of these components are paramount as they directly influence the analytical performance and the absence of background contamination, which is critical in trace analysis. Strategic partnerships with reliable component suppliers ensure instrument manufacturers can maintain the high precision and reliability expected by end-users.

The central stage of the value chain involves instrument manufacturing, integration, and assembly, where core Intellectual Property (IP) relating to thermal management and focusing technology resides. Leading manufacturers, such as Markes International and Gerstel GmbH, invest heavily in R&D to develop proprietary desorption and focusing methodologies. Following manufacturing, instruments are distributed through a dual channel approach. Direct distribution is common for high-value strategic sales, especially to large government laboratories or major industrial clients, allowing manufacturers to maintain tight control over installation, training, and service quality. Indirect distribution involves leveraging specialized third-party distributors and local representatives, particularly beneficial for penetrating geographically diverse or niche markets, relying on their local expertise and established customer relationships.

Downstream activities focus on post-sale support, including installation qualification (IQ), operational qualification (OQ), ongoing preventative maintenance, and providing application-specific consumables such as desorption tubes and traps tailored for various matrices and standards. The end-users, primarily analytical chemists and lab managers in environmental monitoring, materials testing, and life sciences, depend heavily on robust technical support and high-quality training to maximize the utility and longevity of these complex instruments. Effective downstream engagement, including fast troubleshooting and continuous provision of certified consumables, is a critical differentiator influencing customer loyalty and repeat sales in this specialized analytical instrument market.

Thermal Desorption Instrument Market Potential Customers

The primary end-users and buyers of thermal desorption instruments are institutions and corporations requiring highly sensitive and accurate analysis of volatile and semi-volatile compounds in complex matrices, often driven by regulatory compliance or quality control mandates. These customers include national and regional environmental protection agencies and air quality monitoring networks that utilize TD for continuous or passive sampling of ambient and indoor air pollutants. Research Institutions, specifically university research labs and government research organizations focusing on atmospheric chemistry, toxicology, and materials science, represent another foundational customer base, utilizing the technology for pioneering analytical investigations and method development.

Industrial customers form a high-growth segment, encompassing large multinational corporations in the Chemical and Petrochemical sectors, which rely on TD for process monitoring, fugitive emissions testing, and product quality assurance, especially concerning solvents and additives. The Pharmaceutical & Biotechnology industries are expanding their adoption of TD instruments for precise analysis of residual solvents in drugs and packaging, and for characterizing volatile emissions from bioreactors or controlled storage environments. Lastly, Materials Testing laboratories, which serve the automotive, electronics, and construction industries, are crucial customers, demanding TD instruments for testing off-gassing from new materials to ensure product safety and compliance with international standards like VDA 278 and others governing interior air quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $245.5 Million |

| Market Forecast in 2033 | $396.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerstel GmbH, Markes International (acquired by Ultra Scientific), Agilent Technologies, Shimadzu Corporation, PerkinElmer Inc., Dani Instruments S.p.A., OI Analytical (Xylem), Thermo Fisher Scientific, TELEDYNE INSTRUMENTS, CDS Analytical, Entech Instruments, Skyray Instrument, Fuli Instrument Co., Ltd., Wasson-ECE Instrumentation, VICI AG International, ECC-Separation, SGE Analytical Science, ZY Analytical Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Desorption Instrument Market Key Technology Landscape

The technological landscape of the Thermal Desorption Instrument market is continuously evolving, focusing heavily on enhancing sensitivity, improving throughput, and ensuring robust integration with standard chromatographic systems, primarily GC/GC-MS. A crucial innovation revolves around cryo-focusing technology, which involves cooling the analytes released during the desorption process onto a specialized trap material before rapid, controlled heating for injection. Modern systems utilize advanced electronic cooling (Peltier cooling) or liquid nitrogen to achieve ultra-low temperatures, ensuring maximum concentration and sharp chromatographic peaks. This focusing step is essential for meeting the increasingly demanding regulatory requirements for trace-level analysis, necessitating instruments capable of handling extremely low parts-per-trillion (ppt) concentrations.

Another significant technological advancement is the development of robust automation and multi-gas operation capabilities. Contemporary thermal desorbers are often equipped with auto-sampling carousels capable of handling 50 to 100 sample tubes unattended, which is vital for high-volume environmental monitoring campaigns. Furthermore, systems are being designed to manage varied desorption parameters, allowing for sequential desorption steps (e.g., cold spot desorption followed by high-temperature desorption) to analyze a broader range of volatile and semi-volatile compounds in a single run. These automated features minimize human error, reduce operating costs, and ensure high reproducibility, which are primary purchasing criteria for professional analytical laboratories globally.

The integration of TD systems with sophisticated data processing and proprietary software platforms represents a critical technology differentiator. Manufacturers are embedding advanced algorithms for peak detection, library searching, and automated report generation, directly addressing the complexities of VOC and SVOC quantification. Furthermore, there is a rising trend toward developing specialized TD interfaces for direct coupling with compact or portable GC/MS systems, facilitating on-site, rapid analysis, moving critical analytical capabilities closer to the source of contamination or industrial processes. These developments reflect a market transition towards faster, smarter, and more integrated analytical solutions.

Regional Highlights

North America maintains a dominant position in the Thermal Desorption Instrument Market, primarily due to the stringent implementation of environmental regulations by agencies such as the EPA (Environmental Protection Agency) and OSHA (Occupational Safety and Health Administration). The region benefits from substantial investment in advanced laboratory infrastructure, a high concentration of leading analytical instrument manufacturers, and a mature market for environmental consulting and testing services. Demand is strong across environmental, automotive off-gassing, and pharmaceutical industries, ensuring sustained growth and acting as an early adopter of the newest, most automated TD technologies. The US market dictates many of the global trends in regulatory compliance methods requiring high-sensitivity VOC analysis.

Europe represents the second-largest market, characterized by comprehensive regulatory frameworks, including the EU Ambient Air Quality Directive and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which strictly control emissions and material safety. Countries like Germany, the UK, and France are major contributors, featuring advanced research institutions and a robust industrial base requiring sophisticated materials testing (e.g., VDA 278 standards for automotive interiors). The European market is highly focused on sustainable practices, driving demand for TD systems capable of analyzing low-impact materials and monitoring industrial solvent usage efficiently.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting significant growth opportunities. Rapid industrialization, coupled with increasing public awareness and governmental response to severe air pollution challenges in countries like China and India, mandates the swift development and deployment of advanced environmental monitoring solutions. Substantial government initiatives aimed at infrastructure modernization and investment in analytical equipment procurement programs are accelerating the adoption of thermal desorption technology across both environmental monitoring networks and newly established industrial QC labs throughout the region.

- North America: Market leader driven by strict EPA regulations, high R&D spending, and established presence in materials testing (automotive, electronics).

- Europe: Strong growth supported by EU directives (REACH, Air Quality Directives), focus on high-quality manufacturing, and robust academic research in environmental chemistry.

- Asia Pacific (APAC): Highest CAGR fueled by rapid industrialization, massive governmental investment in pollution control infrastructure, and increasing adoption in chemical and pharmaceutical manufacturing across China and India.

- Latin America (LATAM): Emerging market characterized by increasing regulatory development, particularly in Brazil and Mexico, leading to rising demand for entry-level and mid-range TD instruments for basic environmental compliance.

- Middle East and Africa (MEA): Growth driven by large-scale petrochemical projects and infrastructure development in the GCC countries, requiring specialized TD units for gas and oil analysis, and environmental impact studies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Desorption Instrument Market.- Gerstel GmbH

- Markes International (acquired by Ultra Scientific)

- Agilent Technologies

- Shimadzu Corporation

- PerkinElmer Inc.

- Dani Instruments S.p.A.

- OI Analytical (Xylem)

- Thermo Fisher Scientific

- TELEDYNE INSTRUMENTS

- CDS Analytical

- Entech Instruments

- Skyray Instrument

- Fuli Instrument Co., Ltd.

- Wasson-ECE Instrumentation

- VICI AG International

- ECC-Separation

- SGE Analytical Science

- ZY Analytical Instruments

- GBC Scientific Equipment

- Beijing Analytical Instrument Factory

Frequently Asked Questions

Analyze common user questions about the Thermal Desorption Instrument market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using thermal desorption (TD) over conventional extraction methods?

TD offers solvent-free analysis, significantly enhances sensitivity through analyte pre-concentration onto a specialized trap, and allows for complete automation. This minimizes sample handling risks, lowers detection limits, and improves overall laboratory throughput compared to lengthy liquid extraction processes.

Which industry applications are driving the highest demand for automatic thermal desorbers?

The highest demand is driven by Environmental Monitoring (ambient and indoor air quality regulated by EPA methods) and Materials Testing (off-gassing analysis in the automotive and electronics sectors, governed by standards like VDA 278), both of which require high-throughput and trace-level detection capabilities.

How is the Thermal Desorption Instrument Market responding to the need for portability and field analysis?

Manufacturers are increasingly developing compact, miniaturized TD units designed to interface with portable GC/MS systems. This facilitates rapid on-site screening and monitoring of air quality and chemical spills, moving analysis away from central laboratories and enhancing emergency response capabilities.

What major regulatory factors influence the adoption rate of TD instruments globally?

Regulatory frameworks such as the US EPA TO-15/TO-17 standards for air monitoring, EU REACH regulations, and ISO standards for consumer product emissions directly mandate or recommend techniques offering high sensitivity for VOC and SVOC analysis, thereby acting as the main market growth engine.

What are the key technological advancements shaping the future of thermal desorption?

Future advancements focus on incorporating AI for predictive maintenance and automated method development, improving trap materials for broader analyte coverage, and enhancing cryo-focusing efficiency (e.g., using electronic cooling) to achieve even lower detection limits necessary for next-generation trace analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager