Thermal Dilatometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433945 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Thermal Dilatometers Market Size

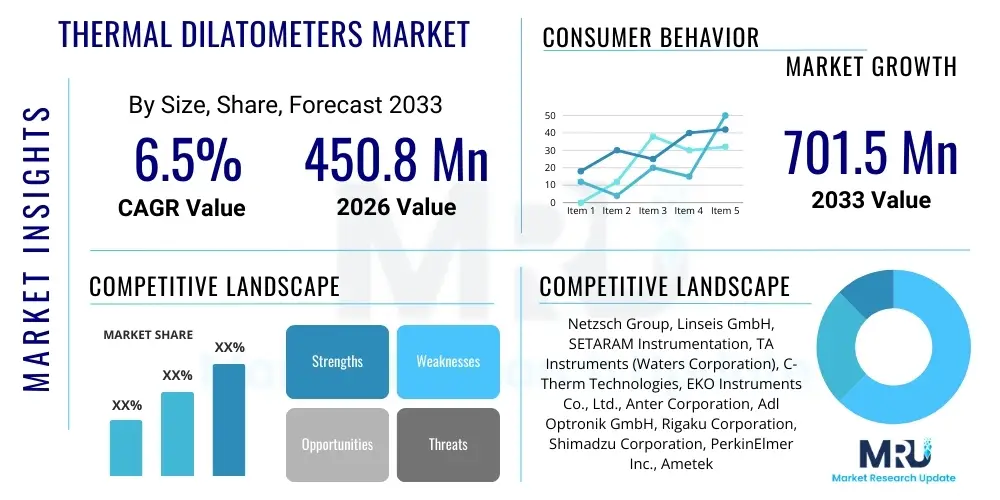

The Thermal Dilatometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 701.5 Million by the end of the forecast period in 2033.

Thermal Dilatometers Market introduction

The Thermal Dilatometers Market encompasses instruments designed to measure dimensional changes in materials (solids, liquids, or powders) as a function of temperature. These measurements, typically coefficient of thermal expansion (CTE) and phase transition behavior, are critical for quality control, material characterization, and advanced research across numerous industrial sectors. Thermal dilatometry is foundational in understanding material performance under varying thermal stresses, ensuring product reliability and structural integrity in demanding applications such as aerospace, automotive, and energy production. The increasing demand for novel, high-performance materials capable of withstanding extreme temperatures and pressures is fundamentally driving the adoption of precise and sophisticated dilatometry techniques.

Product descriptions within this market include pushrod dilatometers, optical dilatometers, and laser interferometric dilatometers, each catering to different temperature ranges, accuracy requirements, and sample geometries. Pushrod systems, utilizing mechanical or inductive sensors, remain highly popular due to their robustness and wide application scope, particularly in industrial quality assurance for ceramics and metals. Conversely, optical and laser techniques offer ultra-high resolution and are essential for characterizing delicate or rapidly reacting materials where direct contact could introduce measurement errors. These sophisticated instruments enable manufacturers to comply with stringent international standards regarding material properties, thereby reducing design failure rates and optimizing production processes.

Major applications of thermal dilatometers span materials science research, electronics manufacturing, civil engineering, and petrochemical analysis. The benefits derived from using these instruments include accurate prediction of thermal stress development, optimization of firing and sintering cycles for ceramic and powdered metal parts, and precise determination of glass transition temperatures (Tg). Driving factors for market growth include accelerating R&D spending in advanced composites and functional materials, the transition toward lightweight and high-strength alloys in transportation sectors, and the stringent regulatory environment demanding verifiable material properties in critical infrastructure components.

Thermal Dilatometers Market Executive Summary

The global Thermal Dilatometers Market is experiencing robust expansion, driven primarily by evolving business trends centered around miniaturization, high-temperature material development, and increasing automation in laboratory testing environments. Key business trends include the rising integration of advanced computing capabilities, facilitating complex data analysis and automated calibration routines, reducing human error, and increasing throughput. Furthermore, strategic partnerships between instrument manufacturers and specialized materials testing labs are enhancing service offerings and accelerating the commercialization of specialized testing protocols tailored for emerging materials like advanced ceramics and additive manufacturing components. The market structure remains moderately consolidated, with major players competing on precision, software capabilities, and after-sales support.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the highest growth, fueled by massive investment in manufacturing infrastructure, particularly in countries like China, India, and South Korea, which are expanding their capacities in automotive, electronics, and construction materials production. North America and Europe maintain technological leadership, focusing on high-end research applications, aerospace components testing, and compliance with stringent environmental and safety standards. Segment trends highlight a strong preference for differential dilatometers, which offer enhanced baseline stability and comparative measurements, particularly important in quality control settings where subtle batch variations need to be detected quickly. The software and services segment is also growing faster than hardware sales, reflecting the need for sophisticated data interpretation tools and predictive modeling based on thermal expansion data.

Overall, the market trajectory is upward, underpinned by the fundamental requirement across all material-intensive industries to accurately characterize thermal behavior. The convergence of high-precision sensor technology with analytical software platforms is defining the next generation of dilatometry instruments. This shift ensures not only accurate measurement but also seamless integration into larger digital laboratory networks (LIMS). The key challenges remain the high initial capital investment required for advanced laser and optical systems and the need for highly specialized personnel to operate and maintain these complex instruments effectively.

AI Impact Analysis on Thermal Dilatometers Market

Common user questions regarding AI's impact on thermal dilatometry center on how artificial intelligence can improve measurement accuracy, automate testing parameters, and accelerate the discovery of new material compositions with desirable thermal properties. Users frequently inquire about the feasibility of AI-driven predictive maintenance for complex dilatometer hardware and the development of machine learning models that can correlate thermal expansion data with other material properties (e.g., mechanical strength, fracture toughness). The core themes revolve around efficiency gains, predictive capabilities, and reducing the requirement for extensive physical testing through simulation informed by limited empirical dilatometry data. Users expect AI to transform data interpretation from a manual, expert-driven task into a standardized, automatic process capable of identifying anomalies and suggesting optimal processing conditions instantly.

AI's primary influence is expected in the data processing and analysis phases of thermal dilatometry. Machine learning algorithms are being employed to clean noisy sensor data, significantly improving the signal-to-noise ratio and thus the accuracy of CTE calculations, especially at high temperatures or rapid heating rates. Furthermore, AI models trained on vast databases of material expansion curves can automatically identify phase transitions, sintering endpoints, and decomposition temperatures with higher precision and objectivity than traditional manual analysis methods. This automation drastically reduces the turnaround time for material certification and R&D cycles, allowing scientists to focus on experimental design rather than tedious data evaluation.

In terms of optimizing laboratory operations, AI contributes through predictive modeling of optimal testing protocols. For instance, based on a material's initial composition, an AI system can suggest the ideal heating rate, soak time, and required atmosphere for a dilatometry run, minimizing instrument wear and maximizing data quality. This level of automation extends to preventative maintenance, where AI analyzes real-time sensor data (e.g., furnace heating element performance, displacement sensor drift) to predict potential component failures before they occur, ensuring instrument uptime and reliability, which is critical in production environments where continuous quality control is essential.

- AI algorithms enhance data noise reduction, yielding higher precision in Coefficient of Thermal Expansion (CTE) calculations.

- Machine learning facilitates automated identification of subtle material phase transitions and thermal events in complex expansion curves.

- Predictive maintenance schedules for dilatometer components (furnaces, sensors) are optimized using AI analysis of operational parameters.

- AI enables the correlation of dilatometry data with other material testing results, creating comprehensive, multi-property material databases.

- Automated optimization of testing parameters (heating rate, temperature limits) based on sample characteristics, maximizing test efficiency.

DRO & Impact Forces Of Thermal Dilatometers Market

The Thermal Dilatometers Market is profoundly shaped by a confluence of accelerating drivers related to material science innovation and strict regulatory demands, counterbalanced by significant restraints concerning operational complexity and capital costs, creating tangible opportunities in emerging high-tech sectors. The primary impact force accelerating market growth is the global push toward lightweighting and enhanced thermal stability in materials utilized across aerospace and electric vehicle (EV) manufacturing. As EV batteries require sophisticated thermal management systems, and aerospace components operate under extreme thermal cycling, the need for precise CTE data is non-negotiable. This demand translates directly into higher sales of advanced, high-temperature dilatometry equipment. Conversely, a substantial restraint is the high initial investment cost associated with advanced laser and optical dilatometers, which often limits adoption among smaller research facilities or educational institutions, compelling them to rely on outsourced testing services or less accurate methodologies.

Driving forces also include the rapid proliferation of additive manufacturing (3D printing). Materials used in additive manufacturing, especially specialized metal powders and polymer composites, require meticulous characterization of their sintering and melting behavior to ensure the final printed part meets structural specifications. Dilatometers are essential for optimizing the thermal profiles of 3D printing processes, such as binder jetting and selective laser sintering. Opportunities abound in the development of portable or benchtop dilatometers that offer competitive accuracy at a lower price point, thus democratizing access to this critical testing capability. Furthermore, the rising focus on sustainable material development, including bio-based plastics and recycled composites, necessitates new thermal characterization protocols, opening specific niches for specialized dilatometry systems.

The core impact forces determining market dynamics are technological advancement, standardization requirements, and economic cycles. The technological force involves continuous improvements in sensor resolution (nanometer level precision) and temperature range extension (up to 2800°C), perpetually raising the bar for instrument performance. Standardization, particularly driven by ISO and ASTM norms for material testing, ensures that accurate dilatometry is a mandatory step in product validation, thus providing sustained demand. However, global economic volatility can impact R&D budgets, temporarily restraining large capital equipment purchases. Ultimately, the market benefits from the irresistible long-term trend toward greater precision in material engineering, making the measurement of thermal expansion a core analytical necessity.

Segmentation Analysis

The Thermal Dilatometers Market segmentation provides a granular view of market dynamics based on technology, measurement range, application, and end-user. The technology segment is crucial, distinguishing between pushrod, optical, and laser interferometric systems, where performance metrics like accuracy and temperature limit determine suitability for high-end research versus routine quality control. Measurement range segmentation categorizes instruments into conventional (up to 1200°C) and high-temperature (up to 2800°C) instruments, directly correlating with applications in polymer science versus advanced ceramics and refractory metals, respectively. The evolution towards high-temperature systems is a major growth driver, responding to the increasing need for components used in extreme environments like gas turbines and nuclear reactors.

Application segmentation illustrates the varied utility of dilatometry, covering sintering studies, phase transition analysis, Coefficient of Thermal Expansion (CTE) determination, and density measurement. Sintering studies, particularly vital for powder metallurgy and ceramics, represent a large volume application, as manufacturers seek to optimize firing shrinkage and final product density. CTE determination is foundational and drives demand across all industries reliant on thermal stability. End-user segmentation reveals where the instruments are deployed, primarily dividing the market into research institutions, material manufacturing (metals, ceramics, polymers), and contract testing laboratories. The growth of contract testing labs is notable, providing specialized services to companies that cannot justify the capital expenditure for in-house equipment.

The interplay between these segments defines competitive strategies; for instance, manufacturers focusing on the aerospace end-user segment must prioritize laser interferometric technology capable of ultra-high precision and high-temperature ranges. Conversely, serving the general polymer manufacturing market requires robust, cost-effective pushrod systems. The trend towards integrated testing solutions, combining dilatometry with simultaneous thermal analysis techniques (STA), is blurring traditional segmentation lines, favoring multi-functional instruments that provide comprehensive thermal characterization data from a single run. This demand for integration is a key strategic focus for major market players aiming to deliver enhanced analytical value.

- By Technology:

- Pushrod Dilatometers (Horizontal, Vertical, Differential)

- Optical Dilatometers (Non-contact measurement)

- Laser Interferometric Dilatometers (Ultra-high precision)

- Capacitance Dilatometers

- By Measurement Range:

- Low Temperature (-180°C to Ambient)

- Conventional Temperature (Ambient to 1200°C)

- High Temperature (1200°C to 2000°C)

- Ultra-High Temperature (Above 2000°C)

- By Application:

- Coefficient of Thermal Expansion (CTE) Determination

- Phase Transition and Glass Transition Studies

- Sintering and Firing Optimization

- Density and Volume Change Analysis

- By End-User:

- Aerospace and Defense

- Automotive and Transportation (Including EV components)

- Ceramics and Glass Manufacturing

- Materials Research and Academic Institutions

- Electronics and Semiconductors

- Contract Testing Laboratories

Value Chain Analysis For Thermal Dilatometers Market

The value chain of the Thermal Dilatometers Market begins with upstream activities focused on the procurement and manufacturing of highly specialized components, followed by midstream instrument assembly and integration, and concluding with downstream distribution, installation, and after-sales service. Upstream analysis involves sourcing critical raw materials for sensors (e.g., high-purity quartz, alumina, and specialized alloys for pushrods and furnaces), along with advanced electronics for signal processing and precise temperature controllers. The quality and stability of these components directly dictate the final instrument's measurement accuracy and reliability. Suppliers in this segment specialize in high-precision machined parts and advanced thermal insulation materials, demanding rigorous quality assurance to meet the instruments' performance specifications, particularly for ultra-high temperature models.

Midstream activities involve the core competencies of the instrument manufacturers: R&D, software development, and assembly. Manufacturers integrate the sourced components with proprietary sensor technology (e.g., LVDTs, interferometers) and develop sophisticated control software essential for calibration, testing protocol execution, and data analysis. This stage also includes crucial quality control checks and compliance with international standards (e.g., ASTM E228). The downstream segment focuses on market access, involving sales, distribution channels, and end-user support. Distribution channels are typically a mix of direct sales teams for large industrial or research clients and specialized indirect distributors or agents who provide local sales, installation, and essential technical support in niche geographical markets.

The distribution network plays a pivotal role, particularly for complex, high-value systems, where expert knowledge is required for pre-sales consultation and post-installation training. Direct sales channels are often favored for major customers, ensuring closer manufacturer-client relationships and facilitating customized solution offerings. Indirect channels, however, are essential for penetrating geographically dispersed markets and supporting smaller clients with local technical expertise. Effective after-sales service, including calibration, maintenance contracts, and software updates, constitutes a significant portion of the downstream value, establishing long-term customer loyalty and ensuring the longevity and performance of the high-precision equipment.

Thermal Dilatometers Market Potential Customers

The potential customers and end-users of thermal dilatometers are diverse, primarily spanning sectors requiring rigorous material characterization to ensure product safety, performance, and compliance with industry standards. Key buyers include material manufacturers that produce ceramics, glass, metals, and polymers, where precise control over thermal expansion properties is essential for optimizing production processes such as sintering, annealing, and curing. For instance, ceramic tile producers use dilatometers to determine optimal firing curves, minimizing cracking and warpage, while specialized alloy producers rely on them to confirm CTE values for structural integrity in fluctuating temperature environments. These industrial customers prioritize robustness, high throughput, and seamless integration into quality control loops.

Another major segment comprises R&D organizations, including government research labs, university material science departments, and corporate central research facilities. These buyers often require the highest levels of accuracy and flexibility, opting for advanced laser or optical dilatometers capable of handling novel, experimental materials and non-standard testing conditions, such as reactive atmospheres or complex temperature programming. Their purchasing decisions are driven by the need for leading-edge capabilities to facilitate fundamental material discovery and intellectual property development, often prioritizing instrument resolution and the availability of advanced analytical software.

Furthermore, contract testing laboratories (CTLs) represent a rapidly growing customer base. CTLs offer outsourced testing services, catering to smaller companies or those needing independent verification of material properties. They typically invest in a range of dilatometer types to meet varied client requirements, seeking instruments that offer versatility, reliability, and accreditation compliance (e.g., ISO 17025 certification). The increasing complexity of material specifications and the high cost of in-house testing equipment contribute significantly to the demand placed on these specialized service providers, cementing their role as critical intermediaries in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 701.5 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netzsch Group, Linseis GmbH, SETARAM Instrumentation, TA Instruments (Waters Corporation), C-Therm Technologies, EKO Instruments Co., Ltd., Anter Corporation, Adl Optronik GmbH, Rigaku Corporation, Shimadzu Corporation, PerkinElmer Inc., Ametek (Ortec), Kemet International Ltd., Hitachi High-Tech Corporation, Sinosteel Advanced Materials, ZwickRoell GmbH & Co. KG, Eurofins Scientific, Hiden Analytical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Dilatometers Market Key Technology Landscape

The technological landscape of the Thermal Dilatometers Market is characterized by continuous innovation focused on improving resolution, expanding the operating temperature range, and enhancing software integration for data interpretation. Pushrod dilatometry, while mature, sees advancements through the incorporation of highly sensitive non-contact displacement sensors (like capacitive or LVDT sensors) coupled with superior furnace designs that ensure extremely uniform temperature distribution across the sample, minimizing thermal gradients which can distort measurements. Modern pushrod systems are increasingly integrating vacuum or controlled atmosphere capabilities to facilitate testing of reactive metals and sensitive powdered materials, addressing contamination and reaction concerns during high-temperature cycles.

The frontier of dilatometry technology is dominated by non-contact methods, particularly laser interferometry and high-resolution optical systems. Laser interferometric dilatometers offer unparalleled precision (often sub-nanometer resolution) by using laser beams to measure minute changes in sample length, essential for characterizing single crystals, thin films, and ultra-low expansion materials crucial for advanced optics and semiconductor lithography. Optical dilatometry, utilizing high-magnification cameras, provides flexibility for complex sample geometries and enables observation of sample geometry changes during heating, which is particularly useful for sintering studies where volume changes and shrinkage dynamics are complex. These high-end systems rely heavily on sophisticated optics and image processing software, making the software platform a core competitive differentiator.

Furthermore, technology trends emphasize multi-functional thermal analysis integration, moving beyond standalone dilatometers toward simultaneous thermal analyzers (STA) that combine dilatometry with thermogravimetric analysis (TGA) or differential scanning calorimetry (DSC). This combination provides a holistic view of thermal behavior, correlating dimensional change directly with mass loss or heat flow, which is invaluable for complex material decomposition or curing processes. Connectivity (IoT readiness) and enhanced software capabilities, including sophisticated deconvolution algorithms to separate thermal expansion from other phenomena like viscous flow, are foundational to meeting the future demands of material science R&D and automated industrial quality control.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region in the thermal dilatometers market, driven by extensive industrial expansion in China, India, and Southeast Asian nations. The region's dominant growth stems from massive investment in electronics manufacturing, automotive production (including a major push for EV battery R&D), and large-scale infrastructure projects requiring standardized materials. Demand is high for both high-throughput pushrod systems for quality control in ceramics and advanced laser systems for semiconductor and high-performance alloy research. Government initiatives supporting local R&D and materials innovation further solidify APAC’s market dominance, particularly in sintering optimization for powdered metals and advanced composites used in consumer goods and energy storage.

- North America: North America holds a significant market share, characterized by high adoption rates of advanced, high-precision instruments, largely serving the aerospace and defense sectors, where strict adherence to CTE specifications is mandatory for safety-critical components. The region is a hub for materials science innovation, driving demand for ultra-high-temperature dilatometers and advanced interferometric systems. Key growth drivers include private sector investments in additive manufacturing R&D and rigorous material testing standards enforced by bodies like the FAA and NASA, ensuring continuous investment in state-of-the-art analytical equipment for both research and production validation.

- Europe: The European market is mature and technology-focused, concentrating on stringent environmental standards and the development of sustainable materials. Western European countries, particularly Germany and the UK, exhibit strong demand due to their robust automotive and engineering industries. The focus is increasingly on differential dilatometers for high-accuracy comparative testing and instruments capable of handling unique, low-expansion materials used in precision optics and scientific instrumentation. Regulatory requirements related to material safety and longevity in infrastructure projects maintain steady demand, favoring manufacturers offering comprehensive compliance and certification support packages alongside their instruments.

- Latin America (LATAM): The LATAM market represents an emerging opportunity, primarily driven by expanding petrochemical, mining, and construction sectors in countries like Brazil and Mexico. Demand is generally focused on conventional, robust pushrod dilatometers suitable for routine industrial quality control and geological material analysis. Market growth is closely tied to commodity prices and foreign direct investment in manufacturing capabilities, presenting opportunities for cost-effective, reliable instrumentation supported by local service networks.

- Middle East and Africa (MEA): The MEA region shows steady growth, fueled primarily by large-scale infrastructure and construction projects (e.g., refractory materials testing) and expansion in the oil and gas sector, which requires highly stable materials for high-temperature drilling and refining components. Demand is concentrated in the Gulf Cooperation Council (GCC) countries, focusing on high-temperature and high-pressure testing capabilities. The development of local research universities specializing in materials science is also contributing to the incremental demand for advanced analytical instruments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Dilatometers Market.- Netzsch Group

- Linseis GmbH

- TA Instruments (Waters Corporation)

- SETARAM Instrumentation

- EKO Instruments Co., Ltd.

- C-Therm Technologies

- Anter Corporation

- Adl Optronik GmbH

- Rigaku Corporation

- Shimadzu Corporation

- PerkinElmer Inc.

- Ametek (Ortec)

- Hitachi High-Tech Corporation

- ZwickRoell GmbH & Co. KG

- Kemet International Ltd.

- Sinosteel Advanced Materials

- Eurofins Scientific

- Hiden Analytical

- JASCO International Co., Ltd.

- Mettler-Toledo International Inc. (Supplying integrated thermal analysis solutions)

Frequently Asked Questions

Analyze common user questions about the Thermal Dilatometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between pushrod and optical dilatometers?

Pushrod dilatometers (contact method) are robust and commonly used for industrial quality control of solids like ceramics and metals up to high temperatures. Optical and laser dilatometers (non-contact method) offer significantly higher resolution (often sub-nanometer) and are preferred for soft, fragile, or highly reactive materials where mechanical contact must be avoided, primarily in high-end research applications.

How is the thermal dilatometers market impacted by the growth of electric vehicles (EVs)?

The EV sector significantly boosts demand, primarily for testing battery components (anodes, cathodes, seals) and power electronics. Precise measurement of the Coefficient of Thermal Expansion (CTE) is crucial for thermal management systems and preventing mechanical failure in battery packs that experience wide temperature fluctuations, driving the need for highly accurate, often customized, testing equipment.

Which segmentation of the thermal dilatometers market is experiencing the fastest technological growth?

The Laser Interferometric Dilatometers segment within the Technology segmentation is seeing the fastest technological growth, driven by the demand for ultra-high precision (nanometer scale) measurements required for characterizing highly stable reference materials and components used in semiconductor manufacturing and advanced optical systems, demanding superior sensor integration and noise reduction.

What role does software play in modern thermal dilatometry?

Software is critical for calibration, instrument control, automated data acquisition, and advanced analysis. Modern software incorporates sophisticated algorithms for baseline correction, deconvolution of thermal events, and integration with AI/ML tools to identify optimal processing parameters and provide predictive material behavior modeling, moving beyond simple curve plotting to high-level material diagnostics.

What are the typical operating temperature limits for commercial thermal dilatometers?

Standard commercial dilatometers typically operate up to 1200°C for routine polymer and metal applications. High-end, research-grade instruments, often utilizing specialized graphite furnaces or induction heating, can reach ultra-high temperatures exceeding 2800°C, necessary for testing refractory ceramics, carbons, and specialized aerospace alloys in extreme operating environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager