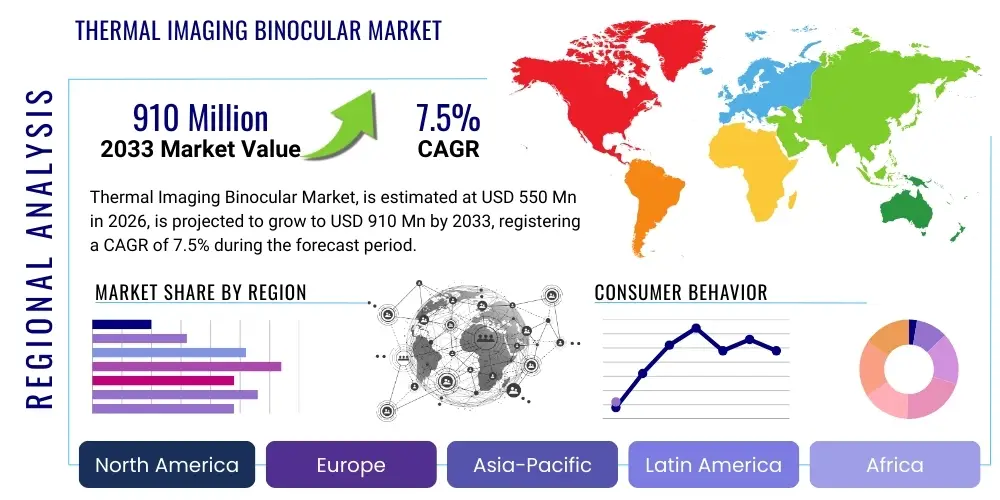

Thermal Imaging Binocular Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434617 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Thermal Imaging Binocular Market Size

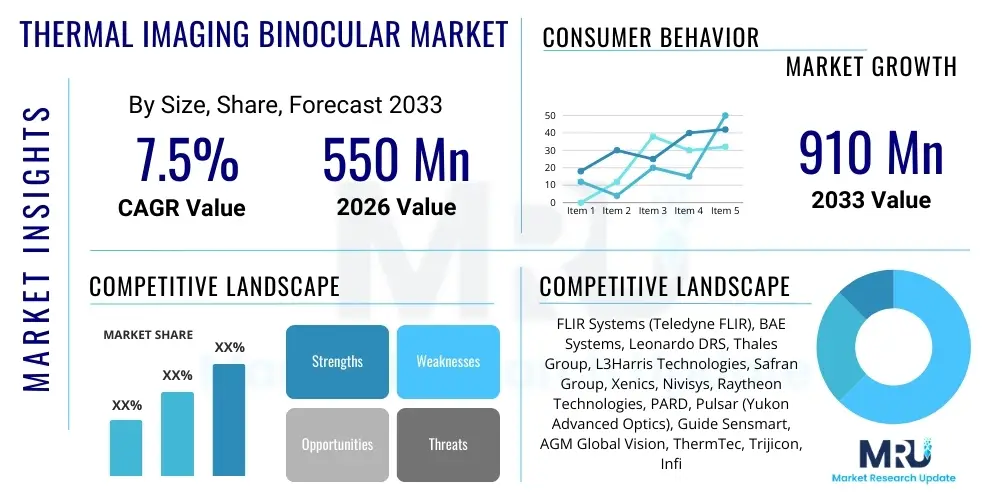

The Thermal Imaging Binocular Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033.

Thermal Imaging Binocular Market introduction

The Thermal Imaging Binocular Market encompasses devices designed to detect infrared radiation emitted by objects, translating these heat signatures into a visible image for observation, typically across both eyes for enhanced depth perception and reduced eye fatigue. These devices are integral tools utilized across various high-stakes environments where visibility is compromised by darkness, smoke, fog, or camouflage. The core product incorporates highly sensitive microbolometer arrays and complex processing algorithms to deliver real-time thermal data. Unlike traditional night vision technologies that rely on ambient light amplification, thermal imaging operates effectively in absolute darkness, offering a distinct operational advantage for surveillance and navigation.

Major applications of thermal imaging binoculars span military and defense, border patrol, maritime security, search and rescue (SAR), law enforcement, and specialized commercial sectors such as hunting and wildlife observation. In defense contexts, these binoculars are essential for target acquisition, reconnaissance, and situational awareness for ground troops and special operations forces. For civilian use, they are critical for locating missing persons in challenging environments or conducting nocturnal inspections of infrastructure. The inherent benefit of these systems lies in their ability to penetrate visual obstructions and highlight temperature differences, making hidden or obscured threats readily apparent.

Driving factors propelling market growth include escalating global security concerns, increased governmental spending on modernizing defense equipment, and rapid technological advancements leading to smaller, lighter, and more cost-effective devices. Furthermore, the rising adoption of advanced surveillance technologies by law enforcement agencies worldwide, coupled with the growing popularity of specialized outdoor and recreational activities requiring enhanced night vision capabilities, contributes significantly to sustained market expansion. The miniaturization of components and improvements in battery life also broaden the application scope, making the technology more accessible across diverse operational needs.

Thermal Imaging Binocular Market Executive Summary

The global Thermal Imaging Binocular Market is experiencing robust growth, primarily driven by governmental investments in defense and border security modernization efforts, particularly across North America and Asia Pacific. Business trends indicate a strong industry focus on developing high-resolution uncooled microbolometer technology, reducing the size and weight of optical systems, and integrating digital features such as GPS, recording capabilities, and wireless data transfer for enhanced operational utility. Leading manufacturers are emphasizing mergers, acquisitions, and strategic partnerships to consolidate market share and leverage specialized technological expertise, ensuring competitive pricing and feature superiority in a rapidly evolving landscape. The shift towards ruggedized, all-weather performance devices is a key business strategy addressing the stringent demands of military and outdoor professional end-users.

Regionally, North America remains the dominant market segment due to substantial defense budgets, extensive deployment in homeland security, and high adoption rates in hunting and professional surveillance. However, the Asia Pacific region is forecast to exhibit the fastest growth, propelled by territorial disputes, rapid military modernization programs in countries like China and India, and increasing investment in national infrastructure security. European market growth is steady, driven by heightened surveillance needs across borders and increased spending by law enforcement agencies combating organized crime and terrorism. Latin America and the Middle East & Africa are emerging markets, primarily focusing on coastal surveillance, energy infrastructure protection, and resource monitoring, fueled by foreign military aid and regional security agreements.

Segment trends highlight the dominance of the Uncooled Technology segment due to its lower cost, quicker startup time, and zero maintenance requirements compared to Cooled technology, although Cooled systems retain niche superiority in ultra-long-range military applications requiring extreme sensitivity. The Military & Defense application segment continues to hold the largest market share, but the Commercial segment, encompassing hunting, firefighting, and industrial monitoring, is projected to register the highest CAGR, spurred by decreasing device costs and greater public awareness of thermal technology's benefits. Resolution trends show a strong consumer preference for higher thermal resolution (640x480 and above) across both professional and recreational use cases, driving innovation in sensor manufacturing.

AI Impact Analysis on Thermal Imaging Binocular Market

User inquiries regarding AI's impact on thermal imaging frequently revolve around the potential for automated target recognition (ATR), real-time threat classification, and enhanced situational awareness without human intervention. Users are keen to understand how AI algorithms can reduce operator fatigue by filtering noise and false positives, especially in dynamic surveillance environments. Furthermore, questions address the integration of deep learning models for predictive tracking, fusing thermal data with other sensor inputs (like LiDAR or visible light cameras), and the computational requirements necessary to run sophisticated AI processing directly within handheld binocular units. The overarching expectation is that AI will transform thermal imaging from a passive visualization tool into an active, intelligent decision-support system, significantly improving operational effectiveness and speed of response across all major applications.

- AI enables sophisticated Automated Target Recognition (ATR) by analyzing thermal signatures against vast databases, classifying objects (human, vehicle, animal) instantly.

- Deep learning algorithms reduce false alarms and noise in complex environments, enhancing image clarity and focusing the operator's attention on genuine threats.

- Edge computing integration allows AI processing to occur directly within the binocular unit, providing real-time intelligence without reliance on external networks.

- AI facilitates sensor fusion, seamlessly combining thermal data with visible light, GPS, and rangefinder inputs to create a comprehensive, layered situational map.

- Predictive analytics powered by AI models can track movement patterns and forecast potential trajectories, significantly improving long-range surveillance and interception capabilities.

- Generative AI models assist in optimizing image reconstruction and enhancing resolution from lower-cost sensors, democratizing access to high-performance thermal viewing.

- Machine learning optimizes power consumption management within the device by intelligently allocating processing resources based on current operational demands.

DRO & Impact Forces Of Thermal Imaging Binocular Market

The Thermal Imaging Binocular Market is primarily driven by escalating security requirements globally and continuous miniaturization and cost reduction in sensor technology. Restraints include stringent regulatory hurdles regarding export controls (ITAR and similar regulations), which limit global market penetration, alongside the high initial investment required for high-end cooled thermal systems. Opportunities abound in the expanding commercial sector, particularly in industrial inspection (e.g., utility monitoring) and specialized recreational activities, alongside the potential for integrating advanced AI and augmented reality (AR) overlays onto thermal feeds. These forces collectively shape the competitive landscape, pushing manufacturers toward innovation in uncooled technology while navigating complex geopolitical trade limitations.

The primary impact forces influencing market dynamics are technological velocity and governmental security expenditure. Rapid advancements in microbolometer fabrication (e.g., smaller pixel pitch) significantly increase resolution and decrease manufacturing costs, broadening the consumer base beyond traditional military applications. Simultaneously, global conflicts, instability, and rising instances of illegal activities necessitate increased governmental investment in high-performance surveillance and reconnaissance tools, guaranteeing a steady demand floor for premium devices. Conversely, economic downturns and fluctuations in defense budgets in key procuring nations pose a significant restraining impact force, necessitating manufacturers to maintain flexible production capabilities and diversify end-user focus.

Geopolitical tensions also act as a crucial impact force, stimulating demand for advanced night operations equipment, especially in border protection and maritime security environments. The competitive intensity among key players is exceptionally high, particularly in the mid-range uncooled segment, leading to aggressive pricing strategies and rapid product iteration cycles. Intellectual property disputes surrounding patented sensor technology and signal processing algorithms further complicate the landscape, requiring significant R&D investment to maintain a competitive edge and secure proprietary features that differentiate products in saturated segments.

Segmentation Analysis

The Thermal Imaging Binocular Market is segmented based on critical technical specifications, operational components, and primary end-use applications. This structure allows for a detailed analysis of market penetration across different user types, ranging from highly specialized defense units requiring the highest sensitivity to commercial consumers seeking robust, cost-effective surveillance tools. Key segments include Technology (Cooled vs. Uncooled), Resolution (160x120 to >640x480), Application (Military & Defense, Commercial, Law Enforcement, etc.), and Distribution Channel. The segmentation highlights the underlying preference for uncooled, medium-to-high resolution systems across mass-market professional users, while military segments retain significant demand for the superior performance characteristics offered by cooled technology in extreme long-range scenarios.

- By Technology:

- Cooled Thermal Imaging Binoculars

- Uncooled Thermal Imaging Binoculars

- By Resolution:

- Below 320x240

- 320x240 to 640x480

- Above 640x480

- By Application:

- Military and Defense

- Law Enforcement and Surveillance

- Hunting and Wildlife Observation

- Search and Rescue (SAR)

- Industrial and Commercial Monitoring (e.g., Firefighting, Maritime)

- By Distribution Channel:

- Direct Sales (OEM to Government/Military)

- Indirect Sales (Retailers, E-commerce, Distributors)

Value Chain Analysis For Thermal Imaging Binocular Market

The value chain for the Thermal Imaging Binocular Market is complex, starting with highly specialized upstream activities involving materials science and sensor fabrication. Upstream analysis focuses on core component manufacturing, primarily the production of microbolometers, germanium optics, and sophisticated signal processing chipsets. This segment is characterized by a high degree of technological barriers, dominated by a few specialized firms globally that control the intellectual property related to sensor pixel pitch and wafer processing. Effective cost management and supply chain resilience in securing rare earth elements and specialized materials are critical success factors at this initial stage, directly influencing the final cost and performance characteristics of the binocular unit.

Midstream activities involve the design, assembly, calibration, and housing of the thermal sensor system into the rugged binocular chassis. This stage includes optics integration, software development for image processing algorithms, and quality control. Downstream analysis focuses on distribution and end-user engagement. Distribution channels are highly segregated: Direct sales dominate the lucrative Military and Defense procurement segment, involving long-term contracts and stringent technical specifications negotiated directly between the Original Equipment Manufacturer (OEM) and governmental defense ministries. This channel requires significant compliance and certification efforts.

The indirect channel caters mainly to commercial, law enforcement, and recreational customers through a network of specialized distributors, retailers, and increasingly, robust e-commerce platforms. The trend towards indirect sales is accelerating, driven by the increased accessibility and affordability of uncooled thermal units, allowing smaller manufacturers to reach a global consumer base more efficiently. Value addition at the downstream level includes offering comprehensive post-sale support, training, and specialized servicing, crucial for maintaining high reliability in mission-critical applications suchs as SAR and border security. Efficient logistics and robust inventory management across global regions are essential to minimize lead times for specialized high-demand products.

Thermal Imaging Binocular Market Potential Customers

Potential customers for Thermal Imaging Binoculars span several distinct sectors, each possessing unique purchasing requirements, technical specifications, and budgetary considerations. The largest and most demanding customer base remains governmental defense organizations, including army ground forces, naval surveillance units, and air force special operations groups. These customers prioritize military specifications (MIL-SPEC), extreme durability, long-range detection capabilities, high sensitivity (NETD), and integration with existing military communication and target acquisition networks. Procurement cycles are long and rely heavily on geopolitical and budgetary cycles.

A second major customer segment includes Law Enforcement and Civil Security agencies, such as border patrol, customs, state police tactical teams (SWAT), and specialized counter-terrorism units. These users require devices that balance high performance with portability and ease of use, often favoring uncooled, medium-resolution systems for urban and close-to-mid-range surveillance. The focus here is on rapid deployment and integration with digital evidence gathering systems. Furthermore, Search and Rescue (SAR) teams, both governmental and non-profit, represent critical customers, utilizing thermal binoculars for locating subjects in environments compromised by smoke, fog, or heavy foliage.

The rapidly expanding Commercial customer segment includes professional hunters, wildlife biologists, maritime commercial operators (fishing, transport), and industrial maintenance professionals (e.g., monitoring electrical substations or petrochemical leaks). These end-users are highly sensitive to price but demand reliable, user-friendly devices with excellent battery life and features tailored for specific tasks, such as rangefinding and digital video recording. The growth in this segment is driven by the decreasing cost of high-quality uncooled sensors and increased recreational disposable income in developed economies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), BAE Systems, Leonardo DRS, Thales Group, L3Harris Technologies, Safran Group, Xenics, Nivisys, Raytheon Technologies, PARD, Pulsar (Yukon Advanced Optics), Guide Sensmart, AGM Global Vision, ThermTec, Trijicon, Infiray. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Imaging Binocular Market Key Technology Landscape

The technological landscape of the Thermal Imaging Binocular Market is dominated by advancements in microbolometer arrays, which serve as the uncooled detectors converting infrared radiation into electrical signals. Key trends include the continuous reduction of pixel pitch (moving from 17 microns down to 12 microns and 10 microns), allowing manufacturers to achieve higher resolution (e.g., 640x480 and 1024x768) within smaller, lighter sensor packages. This miniaturization is crucial for reducing the overall size and weight of binoculars, increasing user portability and deployment flexibility, which are critical requirements for both military and recreational users. Material innovation, such as the use of Vanadium Oxide (VOx) and Amorphous Silicon (a-Si), dictates detector sensitivity and uniformity, directly impacting the image quality and thermal resolution (NETD - Noise Equivalent Temperature Difference).

Beyond the core sensor, significant technological advancements are occurring in peripheral systems. These include the implementation of sophisticated Image Signal Processing (ISP) algorithms, which enhance contrast, edge definition, and detail extraction in challenging environments, effectively making lower-cost sensors perform closer to high-end systems. Furthermore, the integration of advanced optics, specifically high-quality Germanium lenses, remains essential, although efforts are underway to find alternative, lower-cost lens materials. Crucially, power management technology is a focal point; improved battery chemistries and efficient circuit design are extending operational times, addressing a historical limitation of portable thermal devices.

Connectivity and data integration define the cutting edge of the binocular market. Modern thermal binoculars frequently incorporate high-speed digital video output, wireless connectivity (Wi-Fi, Bluetooth) for data transfer to command centers or smart devices, and integrated GPS/Inertial Measurement Units (IMU) for precise geo-location tagging of targets. The nascent adoption of Augmented Reality (AR) displays allows users to overlay crucial digital data—such as maps, friendly positions, target coordinates, and weapon reticles—directly onto the thermal image view, significantly boosting situational awareness and operational efficiency, especially in complex military environments and urban search and rescue operations.

Regional Highlights

- North America: This region holds the largest market share, characterized by high defense spending, stringent homeland security requirements, and a mature commercial hunting/outdoor recreation market. The US Department of Defense is a primary driver, continually seeking upgrades for ground surveillance and reconnaissance equipment.

- Europe: The European market shows steady growth, propelled by the need for advanced border surveillance solutions (especially along the EU's external borders) and increasing investment in counter-terrorism capabilities by national police forces. Germany, the UK, and France are key contributors, focusing on integrating advanced thermal systems into existing security infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by geopolitical tensions, rapid military modernization in China and India, and increasing maritime security needs across the South China Sea and Indian Ocean. Economic growth also fuels commercial demand for monitoring applications in construction, utilities, and safety.

- Latin America (LATAM): Market growth in LATAM is focused primarily on law enforcement applications, drug interdiction, and resource protection, particularly in mining and forestry sectors. Adoption is highly dependent on governmental budgetary allocations and international security aid programs.

- Middle East and Africa (MEA): This region exhibits high demand due to persistent regional conflicts and significant investment in oil and gas infrastructure protection. Countries like Saudi Arabia, UAE, and Israel are major consumers of high-end thermal imaging technology for strategic surveillance and defense applications, often preferring US or European suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Imaging Binocular Market.- FLIR Systems (Teledyne FLIR)

- BAE Systems

- Leonardo DRS

- Thales Group

- L3Harris Technologies

- Safran Group

- Xenics

- Nivisys

- Raytheon Technologies

- PARD

- Pulsar (Yukon Advanced Optics)

- Guide Sensmart

- AGM Global Vision

- ThermTec

- Trijicon

- Infiray

- Controp Precision Technologies

- DRS RSTA

- General Dynamics Mission Systems

- Axion Technologies

Frequently Asked Questions

Analyze common user questions about the Thermal Imaging Binocular market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cooled and uncooled thermal imaging binoculars?

Cooled thermal imaging binoculars operate at extremely low temperatures, utilizing internal cryocoolers to enhance sensitivity (lower NETD) and achieve superior long-range detection, making them ideal for high-end military and scientific applications. Uncooled systems operate at ambient temperature using microbolometers (e.g., VOx or a-Si), offering advantages in cost, size, power consumption, and instant startup time, dominating the commercial, law enforcement, and most mid-range surveillance markets.

How is resolution impacting the purchasing decisions for thermal binoculars?

Resolution directly affects image clarity, detail recognition, and maximum effective detection range. While lower resolutions (320x240) are sufficient for close-range observation, higher resolutions (640x480 and above) are increasingly preferred by professional users for better target identification at greater distances and enhanced digital zooming capabilities. The trend toward reduced pixel pitch (12μm) allows higher resolution without significantly increasing the device's physical size or cost.

Which application segment drives the most substantial demand for these devices?

The Military and Defense segment historically constitutes the largest share of market revenue, driven by consistent governmental procurement for night vision superiority, reconnaissance, and target acquisition systems. However, the Commercial and Law Enforcement segments are exhibiting the fastest growth rates due to decreasing device costs, leading to wider adoption in hunting, industrial inspection, and non-military surveillance operations globally.

What are the key technological advancements shaping the future of thermal binoculars?

The future market is being shaped by the integration of Artificial Intelligence (AI) for automated target recognition (ATR) and image enhancement, leveraging deep learning for real-time threat classification. Additionally, significant advancements are seen in sensor fusion, combining thermal feeds with visible light cameras and laser rangefinders, and the development of augmented reality (AR) overlays within the eyepiece to provide critical data directly to the user.

Are export regulations a major challenge for manufacturers in this market?

Yes, strict export regulations, such as the U.S. International Traffic in Arms Regulations (ITAR) and similar controls in other major manufacturing nations, present a significant challenge. These regulations impose severe restrictions on the cross-border transfer of high-performance thermal technology, requiring extensive licensing and compliance efforts, thereby limiting market reach and global supply chain flexibility for advanced systems.

What role does the supply chain of specialty materials play in market pricing?

The supply chain of specialty materials, particularly Germanium used in optical lenses and rare earth elements necessary for sensor fabrication, plays a critical role in market pricing and manufacturing lead times. Volatility in the global supply of these materials due to geopolitical factors or monopolistic control can lead to significant cost fluctuations and production delays, directly impacting the final retail price of thermal binoculars across all segments.

How does image signal processing (ISP) improve the performance of thermal binoculars?

Image Signal Processing (ISP) utilizes proprietary algorithms to manipulate raw sensor data, improving contrast, reducing temporal noise, and sharpening edges. Advanced ISP techniques, such as non-uniformity correction (NUC) and digital detail enhancement (DDE), allow manufacturers to maximize the visual quality derived from the underlying sensor, making lower-cost microbolometers deliver surprisingly high levels of observational detail, which is a major factor for commercial adoption.

Is the military segment shifting towards uncooled technology?

While high-performance military applications requiring extreme long range and sensitivity (e.g., airborne surveillance) continue to rely on cooled systems, military segments are increasingly adopting high-resolution uncooled technology for short-to-mid-range surveillance, personalized soldier systems, and vehicle driver vision enhancers. The advantages of instant readiness, lower maintenance, and reduced total cost of ownership make uncooled systems highly attractive for widespread field deployment.

What is the significance of Noise Equivalent Temperature Difference (NETD) in thermal imaging?

NETD is the primary metric quantifying the sensitivity of a thermal camera, representing the smallest temperature difference the sensor can reliably detect. A lower NETD value (e.g., 30mK vs. 50mK) signifies higher thermal sensitivity, crucial for detecting minute temperature variations—such as concealed targets or faint heat signatures—especially in environments with low thermal contrast, directly correlating with the overall quality and performance of the binocular.

How do technological breakthroughs affect the market entry barriers for new companies?

Technological breakthroughs, particularly the increasing availability of third-party microbolometer cores and standardized digital interfaces, have slightly lowered the barrier to entry for assembly and software-focused companies. However, high barriers persist in the upstream sensor manufacturing and core optics design segments, requiring vast capital investment and proprietary intellectual property, thereby sustaining the dominance of established Tier 1 manufacturers in high-end markets.

What are the primary challenges related to battery life in portable thermal binoculars?

The primary challenge for portable thermal binoculars is balancing high computational demands (for image processing and advanced features like AI) with the need for extended field operation time. Thermal processing, especially cooled systems and high-refresh-rate uncooled systems, consumes significant power. Manufacturers are addressing this through optimization of firmware, energy-efficient components, and the integration of high-density lithium-ion batteries and advanced power management circuits.

In which regions is the demand for thermal binoculars for Search and Rescue (SAR) operations highest?

Demand for thermal binoculars in Search and Rescue (SAR) operations is particularly high in regions prone to severe weather events, large wilderness areas, or dense urban environments where subjects must be located quickly, such as North America, Western Europe, and parts of the Asia Pacific (e.g., Japan and Australia). These areas prioritize rapid response tools capable of penetrating smoke, fog, and heavy forest cover.

How does the integration of laser rangefinders enhance the utility of thermal binoculars?

Integrating a laser rangefinder (LRF) directly into thermal binoculars dramatically increases their operational utility by providing accurate, real-time distance measurements to a detected thermal signature. This allows users, particularly in hunting, surveillance, and military contexts, to calculate precise ballistics, estimate target size, and accurately communicate target coordinates, eliminating the need for a separate ranging device and speeding up decision-making processes.

What is the market impact of reduced pixel pitch technology in thermal sensors?

Reduced pixel pitch (e.g., 12µm or 10µm) allows sensor manufacturers to fit more pixels onto the same or smaller physical chip size. This advancement results in binoculars that are more compact, lighter, and offer higher resolution than previous generations, crucially without a proportional increase in manufacturing cost, thereby driving down consumer prices and accelerating adoption in the mass-market professional sector.

How are government budget cycles linked to market fluctuations?

Government budget cycles, particularly those related to defense spending and homeland security procurements, directly influence market fluctuations, especially for high-end cooled systems. Procurement decisions often occur in large, multi-year contract bursts, creating peaks in demand followed by periods of relative stabilization, requiring manufacturers to manage long lead times and forecast production based on anticipated legislative approvals and geopolitical spending trends.

What factors are driving the growth of the commercial maritime application segment?

The growth in the commercial maritime segment is driven by the need for enhanced navigation safety (detecting hidden obstacles, floating debris, and unlit vessels at night or in fog), increased regulatory requirements for vessel security, and the need for efficient surveillance in fishing and patrol operations. Thermal binoculars provide an indispensable advantage in low-visibility coastal and open-sea environments where traditional night vision is ineffective.

What is the primary role of germanium in thermal binocular optics?

Germanium is essential for thermal binocular optics because it is opaque to visible light but highly transparent to infrared radiation in the relevant wavelength range (7 to 14 micrometers). Its unique refractive properties allow it to efficiently focus thermal energy onto the microbolometer sensor, making high-purity Germanium lenses critical components, although their high cost contributes significantly to the overall price of the optical system.

How are thermal binoculars utilized in industrial maintenance and inspection?

In industrial maintenance, thermal binoculars are used for non-contact, predictive inspection of critical infrastructure such as electrical grids, machinery, and piping systems. They quickly identify abnormal heat signatures (hot spots) indicative of failing components, overheating connections, or insulation defects, allowing proactive maintenance to prevent equipment failure, minimizing downtime and enhancing operational safety.

What challenges exist in integrating augmented reality (AR) into thermal devices?

Integrating AR into thermal devices presents challenges related to achieving precise registration (aligning digital overlays accurately with the real-world thermal image), managing the required computational power within a portable device, and optimizing the display technology to ensure the AR data does not obscure crucial thermal information. Furthermore, robust software development is needed to seamlessly fuse AR data from multiple external sources.

How do uncooled systems achieve non-uniformity correction (NUC) to maintain image quality?

Non-Uniformity Correction (NUC) is a crucial software calibration process applied to uncooled microbolometers to compensate for pixel-to-pixel response variations caused by manufacturing imperfections or temperature changes. NUC uses internal reference points (often a mechanical shutter) to recalibrate pixel outputs, ensuring a uniform and high-quality thermal image across the entire field of view, minimizing distracting artifacts.

What is the current trend regarding digital recording and data storage in binoculars?

Modern thermal binoculars increasingly feature integrated digital recording capabilities (video and stills), often in HD formats, along with significant internal or removable storage (microSD). The trend focuses on making data capture instantaneous, reliable, and easily transferable via wireless connection, fulfilling critical requirements for forensic analysis, post-mission debriefing, and evidence gathering in law enforcement and military applications.

Which regions are seeing the highest growth in the hunting and recreational thermal market?

North America (specifically the United States) and Europe are seeing the highest growth in the hunting and recreational thermal market. This growth is spurred by permissive regulations for nocturnal hunting in certain areas, disposable income, and the increasing affordability and performance of mid-range uncooled binoculars, which offer a significant advantage over traditional low-light optics.

How does the use of thermal binoculars aid in environmental monitoring and conservation?

Thermal binoculars are vital in environmental monitoring for detecting poaching activities at night, conducting nocturnal wildlife censuses without disturbing animals, and surveying remote ecosystems for changes in thermal patterns related to pollution or ecosystem health. They offer a non-invasive method for tracking animal movements and assessing population densities in difficult-to-access terrain.

What impact does battery chemistry have on device performance and market adoption?

Battery chemistry significantly impacts device performance, specifically runtime, weight, and reliability in extreme temperatures. The shift toward high-capacity, rechargeable lithium-ion cells has improved operational endurance while reducing device weight. Continuous refinement in battery technology ensures that professional-grade binoculars can meet the extended operational requirements often exceeding 8–10 hours of continuous use.

What is sensor fusion and why is it important in high-end thermal systems?

Sensor fusion is the process of combining data from multiple sensors (thermal, visible light, LiDAR, GPS, compass) to create a richer, more comprehensive, and robust image or situational assessment than any single sensor could provide alone. In high-end military systems, fusion is crucial because it mitigates the weaknesses of individual sensors (e.g., thermal lacks texture, visible light fails in darkness) to provide superior target identification and situational awareness.

How are manufacturers addressing ruggedization and extreme weather performance requirements?

Manufacturers meet ruggedization requirements by utilizing lightweight, high-strength aerospace-grade materials (like magnesium alloys or reinforced polymers) for the housing, ensuring the binoculars meet MIL-STD-810 standards for shock, vibration, and drop resistance. Furthermore, devices are sealed (IP ratings) to ensure protection against dust, extreme temperatures, and immersion in water, guaranteeing reliable operation in mission-critical environments.

What are the typical price brackets for commercial versus military-grade thermal binoculars?

Commercial-grade uncooled thermal binoculars (for hunting/recreation) typically range from $2,500 to $8,000, depending on resolution and features. Professional law enforcement models often fall between $8,000 and $15,000. Military-grade systems, particularly high-resolution cooled binoculars, command prices upwards of $25,000, often exceeding $50,000, due to stringent MIL-SPEC requirements, specialized optical components, and cryocooler technology.

How does technological obsolescence affect long-term governmental purchasing decisions?

Technological obsolescence is a major factor in governmental purchasing, often driving procurement strategies toward modular, upgradeable systems. Governments seek platforms that allow for easy replacement of sensor cores or processing units (e.g., AI modules) to extend the lifespan of the costly optical platform and housing, thereby reducing the high lifecycle cost associated with rapid advancements in thermal sensor technology.

What role do distribution channels play in the market penetration of thermal devices?

Distribution channels determine market reach and pricing flexibility. Direct sales (OEM to government) ensure high-margin, secure contracts but require specialized compliance. Indirect channels (retailers, e-commerce) are vital for market penetration in the burgeoning commercial sector, offering volume sales and brand visibility through competitive pricing and accessibility to a broad consumer base globally.

How is the adoption of 10-micron pixel pitch technology influencing the market?

The introduction and increasing adoption of 10-micron pixel pitch technology are revolutionary, enabling manufacturers to build 640x480 resolution sensors on smaller chips than ever before, leading to significantly smaller, lighter, and more power-efficient binoculars. This technology accelerates the miniaturization trend and further blurs the performance gap between specialized professional units and mass-market commercial devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager