Thermal Imaging Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436101 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Thermal Imaging Camera Market Size

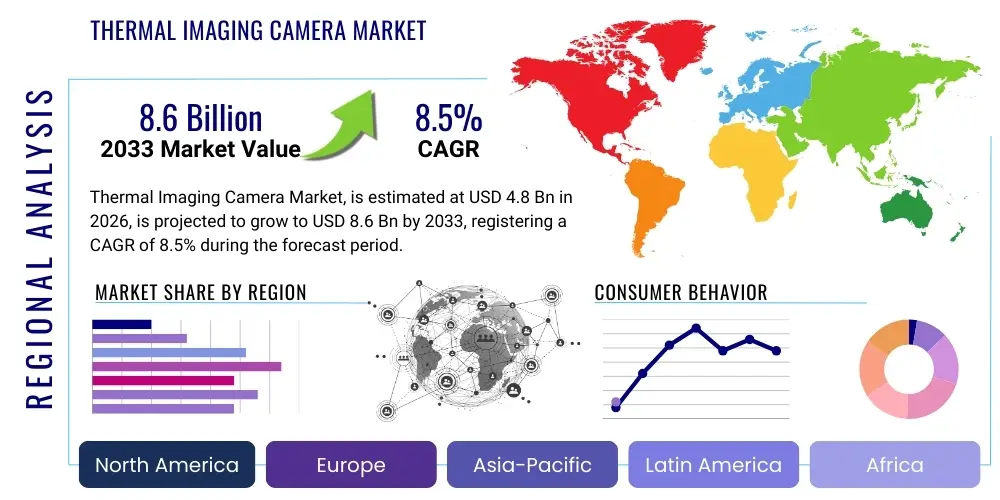

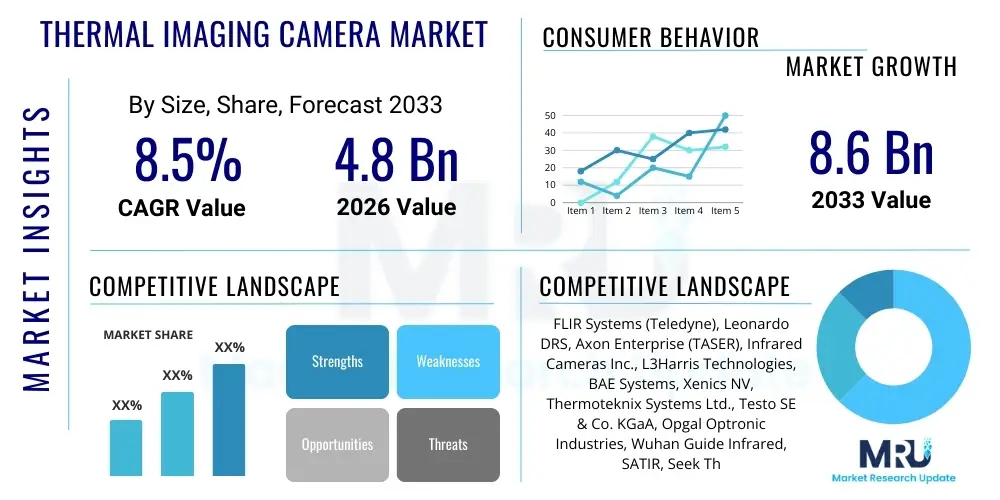

The Thermal Imaging Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Thermal Imaging Camera Market introduction

The Thermal Imaging Camera Market encompasses sophisticated devices designed to detect infrared energy, which is then converted into a visual image called a thermogram. Unlike traditional cameras that rely on visible light, thermal cameras capture the heat signature emitted by objects, allowing for effective operation in complete darkness, smoke, or other obscurants. These devices are fundamentally crucial for non-contact temperature measurement and visualization, making them indispensable across various critical infrastructure and security applications. The increasing adoption of predictive maintenance techniques across industrial sectors, coupled with stringent safety regulations globally, serves as the primary impetus for market expansion. Furthermore, the continuous technological progression toward smaller, higher-resolution microbolometers is enhancing the accessibility and portability of these advanced imaging solutions, widening their scope beyond traditional military use.

Product descriptions within this market segment are largely categorized based on detector type, primarily cooled and uncooled systems. Uncooled thermal cameras, utilizing microbolometers, dominate the commercial landscape due to their lower cost, lack of cryogenic cooling requirements, and rapid startup time, making them ideal for applications such as firefighting, drone surveillance, and general industrial inspections. Cooled cameras, on the other hand, utilize detectors requiring cryogenic cooling to achieve extremely high sensitivity and resolution, predominantly serving high-end military, scientific research, and advanced target acquisition systems where subtle temperature differences must be precisely discerned. The continuous innovation in sensor technology, including improvements in pixel pitch and thermal sensitivity (NETD), is driving the replacement cycle and spurring demand for next-generation devices capable of superior image quality and extended range performance, even under challenging atmospheric conditions.

Major applications of thermal imaging cameras span critical domains including perimeter security, preventative maintenance, automotive night vision, and medical diagnostics. In industrial settings, they are vital for identifying hotspots in electrical systems and mechanical components, thus preventing catastrophic failures and minimizing downtime. The benefits derived from deploying these technologies include enhanced operational efficiency, superior safety compliance, and significant cost savings through early fault detection. Key driving factors propelling market growth include the escalating global demand for advanced surveillance systems, the integration of thermal sensors into smart city infrastructure, and mandatory safety standards in the construction and manufacturing industries, alongside the rapidly decreasing cost of uncooled sensor technology, which facilitates mass market penetration.

- Market Scope: Detection and visualization of infrared radiation (heat signatures) for non-contact temperature measurement and imaging.

- Core Product: Devices categorized into cooled (high sensitivity, military/scientific) and uncooled (commercial, industrial, security) systems.

- Primary Applications: Security and surveillance, industrial predictive maintenance, firefighting, automotive safety, and military defense operations.

- Key Benefit: Ability to operate effectively irrespective of lighting conditions, smoke, or fog, offering enhanced situational awareness and preventative fault detection.

- Driving Factors: Increased investment in smart surveillance infrastructure, adoption of Industry 4.0 principles, and technological advancements leading to miniaturization and cost reduction.

Thermal Imaging Camera Market Executive Summary

The global Thermal Imaging Camera Market is characterized by robust growth, primarily fueled by the accelerating convergence of AI-driven analytics with sensor technology and the broadening application spectrum beyond traditional defense uses. Business trends indicate a strong move toward highly integrated, smaller, and more cost-effective solutions, particularly uncooled microbolometers, which are being heavily adopted in commercial drones (UAVs), consumer electronics, and specialized rugged handheld devices. Key market players are intensely focused on developing proprietary core sensor technology and leveraging strategic mergers and acquisitions to consolidate market share and integrate complementary software capabilities, such as advanced video analytics and fusion imaging, enhancing the utility and intelligence of the captured thermal data. Furthermore, supply chain resilience remains a critical factor, with increasing scrutiny on the sourcing of specialized materials like Germanium and Vanadium Oxide, essential for detector fabrication.

Regionally, the market demonstrates distinct dynamics. North America and Europe currently represent the largest revenue generators, primarily due to high military spending, stringent industrial safety regulations, and the early adoption of advanced surveillance technologies in critical infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is attributable to massive governmental investments in smart cities, urbanization projects, border security enhancements, and the booming manufacturing sector adopting predictive maintenance tools. The competitive landscape in APAC is intensifying, with local manufacturers in China and South Korea increasing their production capacity and technological capabilities, pressuring established Western market leaders on pricing and localized customization, particularly in the high-volume industrial inspection and commercial security segments.

Segment trends reveal that the uncooled technology segment maintains dominance, driven by widespread commercial applications that prioritize affordability and ease of integration over absolute temperature resolution. Within the application segment, Surveillance and Security remains the largest revenue contributor, bolstered by increasing security concerns globally and the mandatory installation of perimeter protection systems across diverse public and private premises. Crucially, the Industrial Monitoring segment is experiencing rapid expansion, propelled by the Industry 4.0 movement and the necessity for continuous condition monitoring of critical assets in sectors like oil and gas, utilities, and heavy manufacturing. These trends collectively underscore a significant market shift from purely niche military applications to broad commercial deployment, capitalizing on the affordability and enhanced performance of modern thermal sensors.

- Business Trends: Focus on miniaturization, integration with AI/analytics, sensor fusion, and consolidation of core IP through strategic M&A activities.

- Regional Trends: North America and Europe lead in revenue, while Asia Pacific demonstrates the highest growth rate driven by industrialization and smart city initiatives.

- Segment Trends: Uncooled thermal cameras dominate due to commercial viability; Surveillance and Security remains the leading application, with Industrial Monitoring showing the fastest adoption curve.

AI Impact Analysis on Thermal Imaging Camera Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Thermal Imaging Camera Market frequently center on themes such as enhanced operational efficiency, automatic anomaly detection, reduction of false alarms, and the potential for real-time predictive capabilities. Common questions explore how AI algorithms can process complex thermal data streams to identify subtle changes indicative of equipment failure (predictive maintenance), differentiate between human and animal heat signatures in security contexts, and improve the accuracy of automatic target recognition (ATR) in military and surveillance applications. Users are keenly interested in the shift from basic visualization tools to intelligent systems that can autonomously analyze data, make preliminary diagnoses, and alert operators only when genuine threats or critical anomalies are detected, thereby minimizing operator fatigue and maximizing response efficiency. The consensus expectation is that AI integration will fundamentally transform thermal cameras from passive sensors into proactive, intelligent monitoring nodes.

The core mechanism through which AI impacts the thermal market is through advanced image processing and machine learning, particularly Deep Learning (DL) models. Traditional thermal analysis often requires manual interpretation of temperature gradient patterns; however, AI allows for the training of neural networks on vast datasets of thermal imagery to automatically recognize patterns associated with specific failures, such as overheated circuits, gas leaks, or even early signs of infectious diseases (e.g., elevated body temperature screening). This automation significantly lowers the skill ceiling required for effective use of thermal technology, making sophisticated monitoring accessible to a wider range of industrial technicians and security personnel. Furthermore, AI facilitates sensor fusion, seamlessly combining thermal data with visible light, LiDAR, or radar inputs to create a comprehensive, highly reliable perception system, dramatically improving situational awareness.

This integration is essential for next-generation applications. For instance, in autonomous vehicles, AI processes thermal inputs to detect pedestrians and animals far beyond the range of standard headlights, ensuring safety under low-light conditions. In industrial maintenance, AI models can learn the normal operating temperature profile of specific machinery, instantly flagging deviations that signal impending failure—a capability critical for minimizing unplanned downtime. Consequently, market growth is increasingly linked not just to hardware advancements (detector resolution) but to software enhancements (embedded AI processing power), driving a competitive edge based on the intelligence and actionable insights derived from the captured thermal data rather than just the raw image quality. The trend signals a clear transition towards cognitive thermal systems across all major end-use segments.

- Automated Anomaly Detection: AI algorithms enable real-time detection of overheating or critical temperature deviations without human intervention, crucial for predictive maintenance.

- Reduced False Alarms: Machine learning differentiates between ambient noise, environmental changes, and genuine threats (human vs. non-human), enhancing security system reliability.

- Enhanced Situational Awareness: AI facilitates sensor fusion, combining thermal data with other sensor inputs (visual, radar) for a holistic, highly accurate environmental perception.

- Real-Time Target Recognition (ATR): Improves the speed and accuracy of identifying and tracking specific objects or individuals in complex surveillance and defense scenarios.

- Improved Diagnostics in Healthcare: AI assists in rapidly processing thermal scans for medical screening, identifying inflammation or fever patterns with high precision.

- Cognitive Edge Computing: Enables thermal cameras to perform processing and decision-making directly at the sensor level (edge), reducing latency and bandwidth requirements.

DRO & Impact Forces Of Thermal Imaging Camera Market

The dynamics of the Thermal Imaging Camera Market are dictated by a powerful interplay of increasing safety regulations, technological breakthroughs, and persistent cost barriers in specialized segments. The principal drivers are centered on the mandatory adoption of condition monitoring across heavy industries, the necessity for robust 24/7 surveillance systems globally, and the rapid deployment of thermal technology in emerging applications like autonomous vehicles and fever screening. These forces collectively create sustained demand for thermal systems capable of delivering high-fidelity data reliably under diverse environmental conditions. However, the market faces significant restraints, chiefly concerning the high initial cost of cooled infrared (IR) detectors, limitations in image resolution compared to visible light cameras, and stringent governmental controls on the export of advanced thermal technology, particularly high-performance sensors used in military applications, which fragment global supply chains and accessibility.

Opportunities within the market are predominantly anchored in miniaturization and integration. The continuous reduction in pixel pitch (down to 10µm or less) and improvements in the manufacturing yield of microbolometers are paving the way for thermal cameras to be embedded into mass-market devices, including smartphones, drones, and consumer smart home security systems, significantly expanding the addressable market beyond core industrial and defense users. Furthermore, the development of sophisticated software overlays, particularly those utilizing AI and Augmented Reality (AR) to interpret thermal data, provides substantial value-add, transforming raw sensor output into actionable, context-rich information. The transition to Industry 4.0 also presents a massive opportunity for thermal cameras as integrated components of IoT ecosystems, facilitating truly proactive, interconnected industrial maintenance strategies.

The overall impact forces are strongly positive, indicating that the technological drivers and expanding commercial opportunities significantly outweigh the current restraints. Key market acceleration factors include the global focus on renewable energy infrastructure maintenance (solar farms, wind turbines), which heavily relies on thermal inspection, and sustained government investment in high-definition border security systems. While the sensitivity of advanced cooled technology remains a limiting factor due to export restrictions (ITAR, EAR regulations), the widespread adoption of affordable, high-volume uncooled technology in commercial sectors ensures market momentum. Competitive intensity is high, focusing on strategic pricing for uncooled sensors and rapid technological iterations to improve thermal sensitivity (NETD), thereby making thermal technology a ubiquitous sensing modality rather than a specialized tool.

Segmentation Analysis

The Thermal Imaging Camera Market is meticulously segmented based on detector technology, type, application, and end-use industry, providing a granular view of market dynamics and adoption patterns. This detailed segmentation is crucial for understanding specific growth pockets and targeted investment areas, reflecting the distinct performance requirements and cost structures across different end-user needs. The primary segmentation centers on the cooled versus uncooled dichotomy, which fundamentally determines device cost, performance sensitivity, and target application. Application segmentation highlights critical areas like defense, security, and industrial maintenance, while the end-use segmentation differentiates between commercial, governmental, and residential buyers, offering clarity on consumption volume and purchasing motivations.

The segmentation by Type, specifically fixed vs. portable cameras, is also increasingly relevant. Portable thermal cameras, which include handheld devices and drone-mounted systems, are seeing massive growth due to their flexibility and ease of deployment in fieldwork, inspection, and rapid response scenarios like search and rescue or firefighting. Conversely, fixed thermal cameras, primarily used for continuous process monitoring, perimeter security, and machine vision applications, maintain steady demand, especially within critical infrastructure like power plants and data centers where continuous, automated surveillance is mandatory. The trend shows that while fixed cameras provide consistent baseline monitoring, the rising capability and cost-effectiveness of portable solutions are democratizing access to thermal inspection tools across smaller enterprises and individual consumers.

Furthermore, segmentation by Wavelength (Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), and Long-Wave Infrared (LWIR)) is vital as different wavelengths are suitable for different environmental conditions and material properties. LWIR (8–14 µm) is the most common for surveillance and industrial monitoring as it detects heat emitted from objects at room temperature and is highly effective through smoke and fog. MWIR (3–5 µm) systems, often cooled, offer better atmospheric transmission over longer distances and are preferred for advanced defense and aerospace applications. Analyzing these segments helps stakeholders tailor product development, ensuring alignment with specific technical requirements, such as high-range detection capability versus low-cost, near-field industrial inspection.

- By Technology: Cooled Thermal Cameras, Uncooled Thermal Cameras.

- By Type: Handheld Cameras, Fixed/Mounted Cameras, PTZ (Pan-Tilt-Zoom) Cameras.

- By Wavelength: Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR).

- By Application: Surveillance and Security, Research and Development, Industrial Monitoring and Inspection (Predictive Maintenance), Automotive (Night Vision Systems), Firefighting and SAR, Border Protection, Healthcare/Medical Screening.

- By End-Use Industry: Military and Defense, Commercial (Security, Retail), Industrial (Manufacturing, Oil & Gas, Power & Utility), Residential, Healthcare, Automotive.

Value Chain Analysis For Thermal Imaging Camera Market

The value chain for the Thermal Imaging Camera Market is complex, involving highly specialized technological dependencies, starting from fundamental materials and concluding with system integration and end-user services. Upstream analysis focuses intensely on the suppliers of highly specialized raw materials, including Germanium, Zinc Selenide, and exotic semiconductor wafers crucial for fabricating IR lenses and detector arrays (microbolometers or focal plane arrays). Detector manufacturing, characterized by high barriers to entry due to proprietary sensor technology, lithography requirements, and vacuum packaging, is a concentrated segment typically dominated by a few integrated device manufacturers (IDMs). The costs and performance limits established at this foundational stage heavily dictate the final price and capability of the finished camera system, emphasizing the strategic importance of secure, efficient supply of these core components.

The midstream component involves system assembly, including integrating the sensor core with optics, processing electronics, power management, and specialized ruggedized housing. This stage is where Original Equipment Manufacturers (OEMs) differentiate their products through proprietary image processing algorithms, user interface design, and integration compatibility (e.g., standardizing communication protocols for easy integration into existing security networks). Downstream activities primarily encompass distribution, sales, system integration, and post-sales maintenance. System integrators play a vital role, particularly in large-scale government or industrial projects, by customizing solutions, installing complex networks of fixed cameras, and ensuring interoperability with existing enterprise software, such as SCADA or VMS (Video Management Systems).

Distribution channels are multifaceted, employing both direct and indirect routes. Direct sales are prevalent for large government and military contracts, often requiring specialized security clearances and long-term service agreements. Indirect channels, utilizing specialized distributors, resellers, and value-added resellers (VARs), dominate the commercial and industrial segments, leveraging regional expertise and established networks to reach small to medium-sized enterprises (SMEs). The effectiveness of the indirect channel is critical for market penetration, as VARs often bundle the thermal cameras with complementary services like predictive maintenance software packages or advanced security monitoring services, transforming the product from a piece of hardware into a comprehensive, managed solution. Efficient logistics and after-sales support are paramount in the downstream segment to ensure optimal performance and longevity of these precision instruments.

Thermal Imaging Camera Market Potential Customers

The potential customer base for thermal imaging cameras is highly diverse, spanning governmental bodies requiring critical surveillance capabilities to multinational corporations focused on operational uptime and safety, down to individual consumers seeking enhanced home security solutions. End-users in the Military and Defense sectors represent the highest value customers, purchasing cooled, high-specification systems for long-range target acquisition, airborne reconnaissance, and situational awareness enhancement for personnel. These buyers prioritize sensitivity, range, and ruggedness, often procuring large volumes under long-term state contracts. Their purchasing decisions are driven primarily by defense strategy, technological superiority requirements, and national security mandates, rather than immediate cost sensitivity.

Industrial customers form a high-growth segment, driven by preventative maintenance needs. Key buyers include utility companies (power generation, transmission), oil and gas corporations, chemical processing plants, and manufacturing facilities. These end-users employ thermal cameras to monitor the condition of electrical panels, pipelines, furnaces, and rotating machinery, motivated by the desire to avoid costly unplanned downtime and comply with stringent safety regulations. Their purchasing rationale revolves around Return on Investment (ROI) derived from early fault detection, seeking high-accuracy, robust handheld and fixed uncooled systems that integrate seamlessly into existing Industrial Internet of Things (IIoT) frameworks and asset management software.

Furthermore, the rapidly expanding commercial security sector constitutes a significant potential customer group. This includes commercial property managers, retail chains, and operators of critical public infrastructure (airports, ports, railways). Their interest lies in using thermal cameras for 24/7 perimeter intrusion detection, complementing visible cameras by eliminating blind spots caused by poor lighting or environmental factors. In the consumer space, potential customers include high-end residential buyers and enthusiasts who purchase entry-level thermal cameras for home energy audits, outdoor activities (hunting, camping), and basic surveillance, showcasing the market’s expanding reach due to falling prices and increased product accessibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne), Leonardo DRS, Axon Enterprise (TASER), Infrared Cameras Inc., L3Harris Technologies, BAE Systems, Xenics NV, Thermoteknix Systems Ltd., Testo SE & Co. KGaA, Opgal Optronic Industries, Wuhan Guide Infrared, SATIR, Seek Thermal, Dali Technology, Nippon Avionics Co., Ltd., Hanwha Techwin, Raytheon Technologies, Sierra-Olympic Technologies, InfiRay Technologies, Bullard. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Imaging Camera Market Key Technology Landscape

The technological landscape of the Thermal Imaging Camera Market is currently dominated by advancements in microbolometer technology, specifically the ongoing reduction in pixel pitch and corresponding improvements in Thermal Sensitivity (NETD – Noise Equivalent Temperature Difference). Modern uncooled microbolometers are transitioning from 17µm pixel pitch to 12µm and even 10µm, enabling the creation of high-resolution cameras that are significantly smaller, lighter, and less power-intensive. This technological leap is critical for embedding thermal capability into highly mobile platforms such as drones, head-mounted displays, and vehicular systems, making thermal vision less bulky and more accessible. Furthermore, advancements in Vanadium Oxide (VOx) and Amorphous Silicon (a-Si) materials used in microbolometer fabrication are enhancing detector uniformity and overall image quality, ensuring reliable performance across a broader temperature spectrum and significantly extending battery life for portable devices.

Another crucial technology trend is the increasing sophistication of thermal sensor packaging and wafer-level optics (WLO). WLO allows for the mass production of infrared lenses and optics at a reduced cost and smaller size compared to traditional bulk optics, which is vital for realizing high-volume, low-cost thermal cores. Simultaneously, the integration of advanced image processing techniques, often running on specialized Field-Programmable Gate Arrays (FPGAs) or Application-Specific Integrated Circuits (ASICs), is enhancing the visual fidelity of the captured thermal scene. This processing includes sophisticated noise reduction, dynamic range compression, and proprietary algorithms like Digital Detail Enhancement (DDE), which sharpen edges and improve contrast, making it easier for human operators or AI systems to interpret the thermal image effectively, especially in noisy industrial environments.

Beyond traditional uncooled LWIR systems, the market is seeing a resurgence of interest in Short-Wave Infrared (SWIR) technology, particularly for specialized industrial inspection and high-end security applications where detecting specific material properties or penetrating through haze is required. SWIR cameras, while often requiring cooled InGaAs detectors, bridge the gap between visible light and traditional thermal infrared, offering unique sensing capabilities such as reading through silicon packaging or detecting certain chemical compositions invisible to standard thermal sensors. Finally, sensor fusion technology, where thermal data is intelligently combined with visible spectrum video, is becoming a standard feature. This fusion leverages the strengths of both modalities—the detailed texture and color from the visible camera combined with the robust contrast and heat signature from the thermal camera—to provide superior, contextually rich situational awareness, particularly in challenging light conditions or obscured scenes.

Regional Highlights

Regional dynamics heavily influence the Thermal Imaging Camera Market, reflecting disparities in technological maturity, defense spending, and industrial regulatory environments. North America (NA) currently holds the dominant market share, primarily driven by substantial and sustained military procurement budgets in the United States and Canada, coupled with high penetration of thermal technology in critical infrastructure protection and law enforcement agencies. NA is a technological hub, hosting leading manufacturers like Teledyne (FLIR) and L3Harris, which benefit from strong R&D capabilities and governmental defense contracts. The region’s early and widespread adoption of stringent industrial safety standards also mandates the use of thermal cameras for continuous condition monitoring in sectors such as utilities, petrochemicals, and HVAC maintenance, solidifying its revenue leadership.

Europe represents another key region, characterized by strong demand for sophisticated border surveillance systems, particularly in response to geopolitical instability and migration challenges. Countries like Germany, France, and the UK demonstrate high adoption rates in industrial automation and precision manufacturing, where thermal cameras are integral to quality control and efficiency optimization under the Industry 4.0 paradigm. European market growth is also supported by increasing investments in Smart City initiatives, integrating thermal cameras for traffic management, public safety monitoring, and energy auditing. While Europe maintains a robust market position, its growth rate is slightly moderated compared to Asia Pacific due to slower infrastructure expansion and high existing market saturation in certain industrial sectors.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This exponential growth is fueled by rapid urbanization, massive government investment in surveillance infrastructure (e.g., Smart Cities in China and India), and the swift industrialization across emerging economies like Vietnam and Indonesia, where new manufacturing facilities are adopting predictive maintenance strategies immediately upon establishment. Local manufacturers, especially in China and South Korea, are scaling production of cost-effective uncooled sensors, driving price competition and increasing accessibility across commercial and even consumer markets. Furthermore, increased territorial and maritime disputes are compelling countries across APAC to significantly upgrade their naval and aerial reconnaissance capabilities, creating robust demand for high-end cooled thermal systems for defense applications.

The Middle East and Africa (MEA) and Latin America (LATAM) markets, while smaller, show promising growth. MEA growth is primarily driven by massive investment in oil and gas infrastructure, where thermal monitoring is critical for safety and leak detection, and high defense spending by GCC countries for border and coastal security. LATAM market expansion is tied to industrial growth in Brazil and Mexico and the increasing need for advanced security solutions to combat illegal activities and protect remote assets, particularly in mining and agriculture. These regions are highly price-sensitive, meaning the adoption rate is intrinsically linked to the continued decline in the cost of high-performance uncooled thermal cores, making them crucial targets for high-volume commercial offerings.

- North America (NA): Market leader by revenue; driven by military spending, aerospace requirements, and strict industrial safety regulations. Focus on high-end cooled and integrated AI solutions.

- Asia Pacific (APAC): Fastest-growing region; fueled by rapid industrialization, smart city development, and increased government investment in security and infrastructure projects. High volume demand for affordable uncooled cameras.

- Europe: Strong adopter in defense, border surveillance, and Industry 4.0 applications (precision manufacturing and automation). Regulatory compliance drives industrial demand.

- Middle East & Africa (MEA): Growth centered on oil and gas infrastructure monitoring, critical asset protection, and increasing internal and border security expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Imaging Camera Market.- FLIR Systems (Teledyne Technologies)

- Leonardo DRS

- L3Harris Technologies

- BAE Systems

- Raytheon Technologies

- Axon Enterprise (TASER)

- Xenics NV

- Thermoteknix Systems Ltd.

- Testo SE & Co. KGaA

- Opgal Optronic Industries

- Wuhan Guide Infrared

- SATIR

- Seek Thermal

- Dali Technology

- Nippon Avionics Co., Ltd.

- Hanwha Techwin

- Sierra-Olympic Technologies

- Infrared Cameras Inc.

- InfiRay Technologies

- Bullard

Frequently Asked Questions

Analyze common user questions about the Thermal Imaging Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cooled and uncooled thermal imaging cameras?

Cooled thermal cameras operate at cryogenic temperatures, offering extremely high sensitivity (low NETD), rapid frame rates, and the ability to detect subtle temperature variations over long distances, making them ideal for high-end defense and scientific research. Uncooled cameras use microbolometers, operate at ambient temperature without complex cooling mechanisms, are significantly cheaper, smaller, and suitable for commercial, industrial inspection, and short-to-medium range surveillance applications, dominating the mass market due to their affordability and ease of integration.

How is the thermal imaging camera market being influenced by artificial intelligence (AI)?

AI integration is transforming thermal cameras into intelligent sensors by enabling automated data analysis, instant anomaly detection for predictive maintenance, and precise object recognition for security and defense. AI drastically reduces false alarms, allows for real-time diagnostics, and facilitates sensor fusion, enhancing the overall actionable intelligence derived from the heat signatures captured by the camera systems, driving adoption across autonomous systems.

Which geographical region exhibits the highest growth potential for thermal imaging technology?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by massive governmental investments in smart city infrastructure, rapid industrialization, increasing manufacturing activity necessitating predictive maintenance tools, and robust demand for cost-effective surveillance solutions provided by local manufacturers in countries like China and South Korea.

What are the key industrial applications driving the current demand for thermal cameras?

The primary industrial application driving demand is predictive maintenance and condition monitoring across critical infrastructure. This involves using thermal cameras to detect overheating components in electrical systems, mechanical friction in rotating machinery, and insulation failures in pipelines and furnaces. Early detection prevents catastrophic failures, reduces unplanned downtime, and significantly improves operational safety and efficiency across the oil and gas, utility, and manufacturing sectors.

What technological advancements are crucial for the future evolution of thermal imaging cameras?

Crucial technological advancements include the continued miniaturization of uncooled detectors through reduced pixel pitch (e.g., 10µm technology), leading to smaller and more power-efficient devices suitable for consumer electronics and drones. Further advancements focus on improved thermal sensitivity (lower NETD), wafer-level optics for cost-effective mass production, and enhanced proprietary image processing algorithms coupled with embedded edge AI for autonomous data interpretation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager