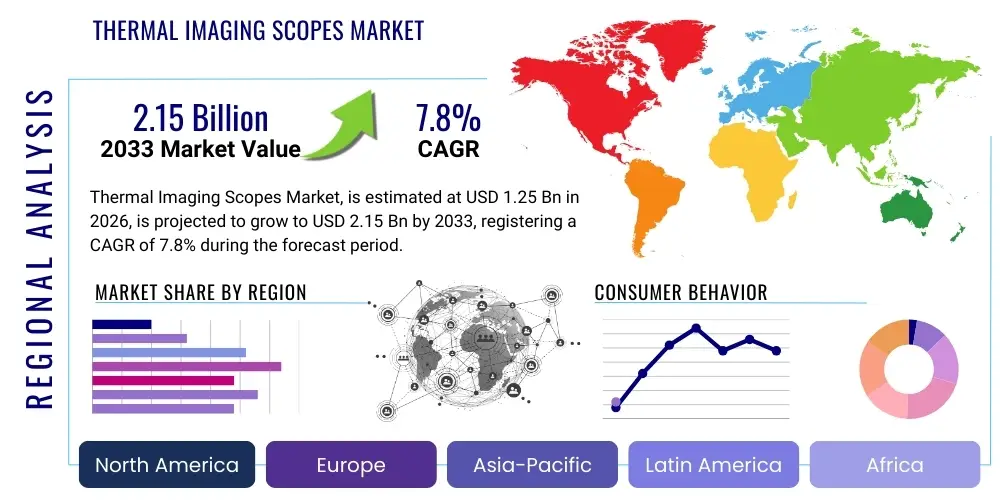

Thermal Imaging Scopes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438683 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thermal Imaging Scopes Market Size

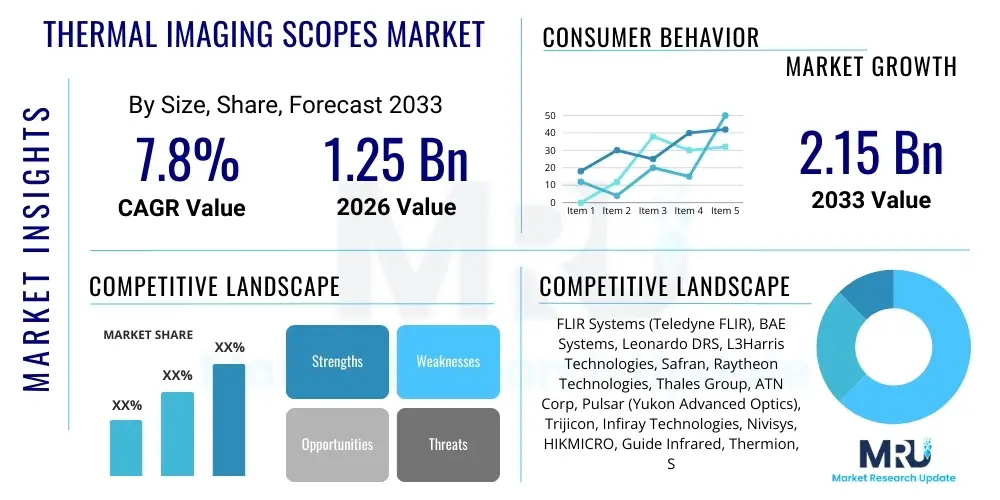

The Thermal Imaging Scopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

Thermal Imaging Scopes Market introduction

Thermal imaging scopes are advanced electro-optical devices designed to detect infrared energy (heat signatures) emitted by objects and convert them into visible images, independent of ambient light conditions. These devices typically incorporate sophisticated components such as microbolometers (uncooled infrared detectors), specialized germanium lenses, and high-resolution display screens. Unlike traditional night vision devices that rely on ambient light intensification, thermal scopes offer a distinct tactical advantage by penetrating fog, smoke, and camouflage, making them indispensable for detection, identification, and targeting in challenging environmental and operational scenarios. The core function revolves around detecting temperature differences, enabling users to spot living beings or recently used machinery even in pitch darkness.

Major applications of thermal imaging scopes span across military and defense sectors, where they are crucial for surveillance, reconnaissance, border security, and counter-terrorism operations. Furthermore, their utility extends significantly into commercial and civilian markets, notably in hunting, wildlife observation, and search and rescue missions. The intrinsic benefit lies in the capability to perform non-contact temperature measurement and visualization, which translates into enhanced situational awareness and operational efficiency. The robust design and versatility of these instruments allow for integration onto various platforms, including handheld devices, helmet-mounted systems, and weapon platforms, addressing diverse end-user requirements.

The market growth is primarily driven by escalating global defense modernization programs, particularly the replacement of legacy equipment with advanced thermal sighting systems, spurred by rising geopolitical tensions and the necessity for superior surveillance capabilities. Continuous advancements in sensor technology, leading to smaller, lighter, and higher-resolution uncooled detectors, are lowering manufacturing costs and expanding adoption across non-traditional sectors. The increasing demand from the civilian hunting community for high-performance thermal optics, coupled with regulatory support for border control technologies, further fuels the overall expansion and diversification of the thermal imaging scopes market landscape.

Thermal Imaging Scopes Market Executive Summary

The Thermal Imaging Scopes Market exhibits robust growth driven by accelerating demand from defense ministries globally prioritizing tactical superiority and comprehensive 24/7 surveillance capabilities. Key business trends include aggressive vertical integration among leading manufacturers to control the supply chain of critical components, specifically microbolometers and germanium optics, alongside an intensified focus on miniaturization and power efficiency to meet the rigorous demands of dismounted soldiers and lightweight platforms. The convergence of thermal technology with advanced data processing algorithms, often incorporating artificial intelligence, is transitioning the market towards systems offering automated target recognition (ATR) and fused imaging capabilities, thereby maximizing operational effectiveness and minimizing reaction time for end-users.

Regionally, North America maintains its dominance due to substantial and continuous investments in military modernization, significant homeland security spending, and a large, established recreational hunting market that rapidly adopts high-end commercial thermal products. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by territorial disputes, rapid military procurement cycles in countries like China and India, and increasing governmental investments in critical infrastructure protection and border surveillance technology. European markets are characterized by stringent regulations governing thermal device usage, balancing internal security needs with export control restrictions, leading to growth primarily driven by joint defense programs and specialized law enforcement requirements.

Segment trends reveal that the uncooled thermal scopes segment dominates the market due to its lower cost, extended battery life, and minimal maintenance requirements compared to cooled systems, making it highly suitable for mass deployment across military and commercial sectors. Application-wise, defense and military utilization remains the primary revenue generator, although the hunting and outdoor recreation segment demonstrates rapid expansion, capitalizing on affordable high-resolution consumer models. There is a noticeable shift toward multi-spectral imaging systems that combine thermal and visual data inputs, offering superior object discrimination and reduced false positive rates, which represents a significant technological and segmental opportunity moving into the latter half of the forecast period.

AI Impact Analysis on Thermal Imaging Scopes Market

User inquiries regarding the integration of Artificial Intelligence (AI) in thermal imaging scopes predominantly center on enhanced operational efficiency, specifically addressing automated target recognition (ATR), image clarity improvement under severe conditions, and extended battery life through optimized power management. Users are keenly interested in how AI algorithms can filter environmental noise and reduce cognitive load on operators by highlighting threats autonomously, thereby transforming raw thermal data into actionable intelligence. Concerns often revolve around the reliability of AI in diverse environments, minimizing false positives, and the secure implementation of deep learning models within rugged, portable hardware. Expectations are high that AI will move thermal scopes beyond mere detection, offering superior tracking, classification, and predictive capabilities crucial for complex tactical scenarios.

The incorporation of AI facilitates substantial advancements in image processing, overcoming historical limitations of low-resolution microbolometers by applying super-resolution techniques and noise reduction algorithms. This allows manufacturers to utilize cost-effective sensor arrays while delivering performance previously restricted to expensive, high-end devices. Furthermore, AI drives the development of intelligent fusion systems, seamlessly blending thermal imagery with visible light or shortwave infrared (SWIR) data to provide operators with a comprehensive, multi-spectral view. This data-rich output significantly improves target identification ranges and reduces ambiguity in challenging environments like dense urban settings or heavy foliage, creating a distinct competitive advantage for AI-enabled scopes.

For defense and security end-users, AI’s primary contribution lies in Automated Target Recognition (ATR), which enables the scope to identify specific classes of objects (e.g., personnel, vehicles, drones) without constant human monitoring. This capability is pivotal for autonomous surveillance systems and unmanned aerial vehicles (UAVs) where real-time decision-making is necessary. Moreover, AI models are optimizing the operational lifecycle of scopes by dynamically adjusting sensor settings, managing power consumption based on usage patterns, and implementing predictive maintenance alerts. This systemic efficiency, driven by machine learning, enhances the durability, mission readiness, and overall cost-effectiveness of next-generation thermal imaging devices.

- AI enables Automated Target Recognition (ATR), significantly reducing operator cognitive load.

- Deep learning algorithms enhance image resolution and reduce noise in degraded viewing conditions.

- AI facilitates intelligent sensor fusion, integrating thermal, visible, and SWIR data for superior situational awareness.

- Optimized power management systems extend battery life and operational duration in the field.

- Machine learning models are used for predictive maintenance and real-time operational diagnostics.

- Advanced tracking capabilities allow for persistent monitoring of multiple moving targets simultaneously.

DRO & Impact Forces Of Thermal Imaging Scopes Market

The Thermal Imaging Scopes Market is highly sensitive to geopolitical climate, defense expenditures, and rapid technological innovation, creating a dynamic set of drivers, restraints, and opportunities that define its growth trajectory. The primary drivers revolve around the global imperative for enhanced security, necessitating advanced surveillance tools for border protection, maritime security, and counter-insurgency operations. This is compounded by the steady transition from image intensification (I2) technology to superior thermal solutions across major defense forces. Conversely, stringent export controls, particularly the International Traffic in Arms Regulations (ITAR) and similar regional frameworks, significantly restrain international market reach and increase compliance costs for manufacturers, restricting the rapid global diffusion of high-performance systems. The high initial cost of components, particularly high-grade germanium lenses and advanced sensor arrays, also acts as a constraint, limiting mass adoption in budget-sensitive commercial markets.

A significant opportunity arises from the rapid decline in the cost of uncooled microbolometer technology, making high-resolution thermal imaging accessible to the expansive commercial and consumer markets, especially hunting, wildlife management, and general private security. Furthermore, the development of fused technologies that seamlessly integrate thermal with other spectral ranges (e.g., laser rangefinders, GPS, visible optics) offers manufacturers a pathway to creating highly differentiated, value-added products that solve complex battlefield challenges. The increasing utilization of these scopes in professional industrial applications, such as infrastructure inspection and firefighting, represents a diversification opportunity beyond traditional defense spending cycles.

The impact forces influencing the market are profound. Technology shifts, such as the maturity of AI-driven image processing and sensor miniaturization, exert strong upward pressure on market growth by enhancing product performance and reducing size and weight—critical factors for soldier systems. Geopolitical instability acts as a positive force, directly stimulating defense budgets and accelerating procurement cycles for proven surveillance technology. Regulatory impact forces, driven by international control regimes, temper expansion but ensure market segmentation between highly regulated military-grade equipment and commercially available civilian scopes. Overall, while cost and regulation present friction, the overwhelming forces of global security demands and continuous technological leapfrogging provide a powerful momentum favoring sustained market expansion throughout the forecast period.

Segmentation Analysis

The Thermal Imaging Scopes Market is extensively segmented based on technology type, resolution, application, platform, and end-user, reflecting the diverse requirements across defense, commercial, and civilian sectors. Analyzing these segments provides a nuanced understanding of market dynamics, highlighting areas of rapid growth and established revenue streams. The dominance of uncooled technology, driven by its cost-efficiency and maintenance ease, dictates the primary segment revenue, while segmentation by application clearly illustrates the critical reliance of military and defense sectors on this technology for mission success. Furthermore, the market's differentiation based on sensor resolution caters directly to performance needs, ranging from standard definition devices suitable for recreational use to high-definition arrays required for long-range reconnaissance.

- Technology

- Cooled Thermal Imaging Scopes

- Uncooled Thermal Imaging Scopes

- Sensor Resolution

- Below 384x288

- 384x288 to 640x512

- Above 640x512 (High Definition)

- Application

- Defense and Military (Surveillance, Targeting, Reconnaissance)

- Homeland Security and Law Enforcement (Border Patrol, Search & Rescue)

- Commercial (Hunting and Recreation, Wildlife Observation)

- Industrial and Others (Firefighting, Inspection)

- Mount Type/Platform

- Weapon Mounted Scopes

- Handheld/Monocular Scopes

- Helmet Mounted Scopes

- Wavelength

- Long-Wave Infrared (LWIR)

- Mid-Wave Infrared (MWIR)

Value Chain Analysis For Thermal Imaging Scopes Market

The value chain for thermal imaging scopes begins with upstream component suppliers, which are highly specialized and often consolidated, focusing on the fabrication of critical, high-cost materials. Key components include specialized infrared detectors, primarily microbolometers (uncooled) and MCT/InSb sensors (cooled), manufactured by a select group of global technological leaders. Additionally, the supply of high-purity germanium and chalcogenide glasses for optical lenses is vital, representing a significant portion of the final product cost. These upstream activities dictate the base performance characteristics and manufacturing scalability of thermal scope producers, with geopolitical factors often influencing raw material availability and pricing.

Midstream activities involve the core manufacturing process, where Original Equipment Manufacturers (OEMs) integrate these specialized components with complex electronics, proprietary image processing software, housing, and user interface systems. This stage involves sophisticated assembly, calibration, and ruggedization processes to meet military specifications (Mil-Spec) or stringent consumer durability standards. Effective inventory management and stringent quality control are crucial here, particularly for ensuring the thermal uniformity and reliability of the final product. Differentiation in this stage is achieved through proprietary algorithm development that enhances image clarity, battery life, and overall user experience.

The downstream segment focuses on distribution and sales, which are highly segmented based on the end-user. Military and government procurement typically utilize direct sales channels or specialized governmental contractors due to the classified and regulated nature of the technology. Commercial and recreational markets rely on a blend of specialized distributors, online retailers, and outdoor equipment stores. Post-sales service, including calibration, maintenance, and software updates, completes the value chain, ensuring long-term customer satisfaction and adherence to warranty agreements. Efficient direct and indirect distribution strategies, coupled with strong relationships with defense procurement agencies, are paramount for achieving substantial market penetration.

Thermal Imaging Scopes Market Potential Customers

The primary customer base for Thermal Imaging Scopes is deeply entrenched in the national security and defense ecosystem, encompassing diverse governmental agencies responsible for border integrity, military operations, and public safety. This group, constituting the largest revenue share, includes national armies, navies, and air forces requiring advanced targeting and surveillance equipment for both tactical and strategic applications. These customers prioritize ruggedization, high resolution, interoperability with existing battlefield management systems, and compliance with strict Mil-Spec standards. Procurement cycles are often long, contractual, and dictated by multi-year defense budgets and geopolitical threat assessments.

A rapidly expanding customer segment includes various civilian and commercial entities focused on specific operational needs. Law enforcement agencies, including SWAT teams, specialized police units, and border patrol services, utilize thermal scopes for enhanced surveillance, pursuit, and search & rescue operations, valuing portability and reliability. Furthermore, the commercial hunting and outdoor recreation community represents a significant, price-sensitive growth area. These consumers seek high-performance optics that offer detection capability in low-light environments, driving demand for technologically advanced but more affordable uncooled devices with user-friendly features like video recording and integration with mobile devices.

Beyond these core segments, emerging potential customers include industrial inspection professionals, such as those involved in detecting thermal leaks in energy infrastructure or conducting non-destructive testing, and professional security firms protecting critical private assets. The increasing global focus on climate change and environmental monitoring also positions researchers and wildlife management teams as niche, but high-potential, consumers who require reliable thermal signature analysis for population tracking and anti-poaching initiatives. The expansion into non-traditional sectors necessitates a shift in marketing focus from purely tactical performance to demonstrating clear return on investment (ROI) through efficiency and preventative maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), BAE Systems, Leonardo DRS, L3Harris Technologies, Safran, Raytheon Technologies, Thales Group, ATN Corp, Pulsar (Yukon Advanced Optics), Trijicon, Infiray Technologies, Nivisys, HIKMICRO, Guide Infrared, Thermion, Schmidt & Bender, Leupold & Stevens, American Technologies Network (ATN), Armasight, EOTech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Imaging Scopes Market Key Technology Landscape

The technological evolution of thermal imaging scopes is predominantly centered on enhancing the performance, reducing the size, weight, and power (SWaP) characteristics, and improving the operational capabilities of infrared detectors. The market's shift is characterized by the dominance of uncooled focal plane arrays (FPAs), primarily utilizing Vanadium Oxide (VOx) and Amorphous Silicon (a-Si) microbolometers. VOx technology often offers higher thermal sensitivity (low Noise Equivalent Temperature Difference or NETD) crucial for military-grade applications, while a-Si often provides lower manufacturing costs suitable for the commercial sector. Ongoing R&D efforts focus on reducing the pixel pitch—moving from 17 micrometers down to 12µm and even 10µm—which allows manufacturers to create scopes with smaller objective lenses while maintaining or even increasing field of view and resolution, thereby miniaturizing the entire device without compromising image quality.

Beyond the core sensor technology, significant advancements are occurring in digital image processing and fused imaging systems. High-speed, proprietary image processors are being integrated to handle the immense data throughput required for high-refresh-rate thermal imagery, providing smooth, lag-free viewing essential for tracking fast-moving targets. Digital processing algorithms, often incorporating Artificial Intelligence and Machine Learning (AI/ML), are being deployed to enhance edge detection, spatial resolution through software means, and dynamic range correction. This algorithmic enhancement is critical for maximizing performance under varying thermal gradients and atmospheric conditions, pushing the effective detection range of uncooled scopes closer to that of traditionally superior cooled systems.

The integration of multi-spectral technologies represents another pivotal area in the technology landscape. Modern scopes are increasingly incorporating complementary sensors such as visible light cameras, laser rangefinders, digital compasses, and GPS modules directly into the housing. This technological convergence enables sophisticated functionalities, including geo-referencing, automatic ballistic calculations, and fused display outputs where thermal highlights are overlaid onto a high-definition visible image. This hybrid approach overcomes the main limitation of thermal scopes—the inability to provide contextual detail—by integrating data from multiple sources, offering the operator unparalleled situational awareness and making the scopes true, multi-functional tactical instruments.

Regional Highlights

- North America: This region holds the largest market share, driven by the massive defense budget of the United States and the continuous modernization of its military equipment under programs focusing on soldier lethality and persistent surveillance. The US commercial hunting and outdoor recreation market is highly mature and rapidly adopts premium thermal optics. Strict government regulations surrounding the procurement of high-end systems ensure market stability, while robust R&D spending supports local technological innovation, especially in AI-enabled thermal sensors and integrated fusion systems.

- Europe: The European market is characterized by diverse demands from NATO allies upgrading their defense capabilities and addressing internal security concerns like border management and critical infrastructure protection. Growth is steady, propelled by joint procurement initiatives (e.g., EU PESCO projects) aimed at standardizing military equipment. Key markets like the UK, France, and Germany are leaders in both manufacturing and adoption, though the market faces constraints due to strict export controls on dual-use technology and varied national regulations regarding civilian use.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, driven primarily by intense military build-up and ongoing territorial disputes involving nations such as China, India, Japan, and South Korea. Rapid economic expansion facilitates large-scale defense spending, shifting procurement away from traditional suppliers toward indigenous manufacturing capabilities and local technology integration. Increased focus on homeland security, anti-piracy, and surveillance needs across maritime borders further stimulates demand for high-performance, cost-effective thermal scopes.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in countries with significant defense spending, particularly the GCC nations, due to ongoing regional conflicts and internal security threats. Thermal scopes are essential tools for oil and gas infrastructure security, border surveillance in vast desert terrains, and special operations forces. The market is highly dependent on imports from North America and Europe, requiring manufacturers to navigate complex political landscapes and security export restrictions.

- Latin America: This region represents a smaller but expanding market, primarily driven by the need for advanced systems to combat organized crime, drug trafficking, and illegal logging. Governments are increasingly investing in thermal imaging for border surveillance and law enforcement operations, favoring rugged, handheld, and vehicular-mounted systems. Market penetration is often constrained by budget limitations, leading to a preference for uncooled, mid-range resolution devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Imaging Scopes Market.- FLIR Systems (Teledyne FLIR)

- BAE Systems

- Leonardo DRS

- L3Harris Technologies

- Safran

- Raytheon Technologies

- Thales Group

- ATN Corp (American Technologies Network)

- Pulsar (Yukon Advanced Optics Worldwide)

- Trijicon

- Infiray Technologies Co., Ltd.

- Nivisys LLC

- HIKMICRO

- Guide Infrared Co., Ltd.

- Thermion (part of Yukon Advanced Optics)

- Schmidt & Bender GmbH & Co. KG

- Leupold & Stevens, Inc.

- Armasight by AGM Global Vision

- EOTech (L3Harris Technologies)

- Excelitas Technologies Corp.

Frequently Asked Questions

Analyze common user questions about the Thermal Imaging Scopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cooled and uncooled thermal imaging scopes?

Cooled thermal scopes utilize cryocoolers to reduce sensor temperature, significantly enhancing sensitivity (lower NETD) and allowing for longer detection ranges, particularly in the Mid-Wave Infrared (MWIR) spectrum. They are typically reserved for high-end military and aerospace applications due to their complexity, high cost, and maintenance. Uncooled scopes use microbolometers operating at ambient temperatures, offering smaller size, lower power consumption, faster startup, and lower cost, making them dominant in commercial, law enforcement, and general military applications (Long-Wave Infrared or LWIR).

How is Artificial Intelligence (AI) improving the performance of modern thermal scopes?

AI is primarily used to enhance image processing capabilities through advanced algorithms that perform noise reduction, super-resolution scaling, and dynamic range optimization, resulting in clearer thermal feeds. Crucially, AI enables Automated Target Recognition (ATR), allowing the scope to instantly classify objects (human, vehicle, animal) and reduce the operator's cognitive burden, especially in surveillance and targeting roles, significantly improving mission effectiveness.

Which geographical region is expected to show the fastest growth in the Thermal Scopes Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to escalating geopolitical tensions, resulting in substantial increases in defense budgets and military modernization programs across major economies like China and India. The rapid adoption of advanced surveillance technologies for border protection and counter-insurgency operations is the main catalyst for this accelerated regional growth.

What role does sensor resolution play in determining the cost and functionality of a thermal scope?

Sensor resolution (e.g., 640x512 pixels) directly impacts the image clarity and the maximum effective detection range of the scope. Higher resolution sensors require more complex manufacturing processes and specialized optics, leading to a higher unit cost. While standard definition scopes (e.g., 384x288) suffice for recreational hunting, high-definition (HD) systems are essential for military long-range reconnaissance where accurate target identification at extended distances is critical.

What are the main export regulations impacting the distribution of high-performance thermal imaging scopes?

The primary regulations are the U.S. International Traffic in Arms Regulations (ITAR) and the Wassenaar Arrangement, which control the export of military and dual-use technologies, including high-end thermal imaging devices. These regulations significantly restrict the international trade of sophisticated cooled systems and high-resolution uncooled devices, requiring manufacturers to obtain specific government licenses and often creating separate product lines for domestic defense and restricted international commercial sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager