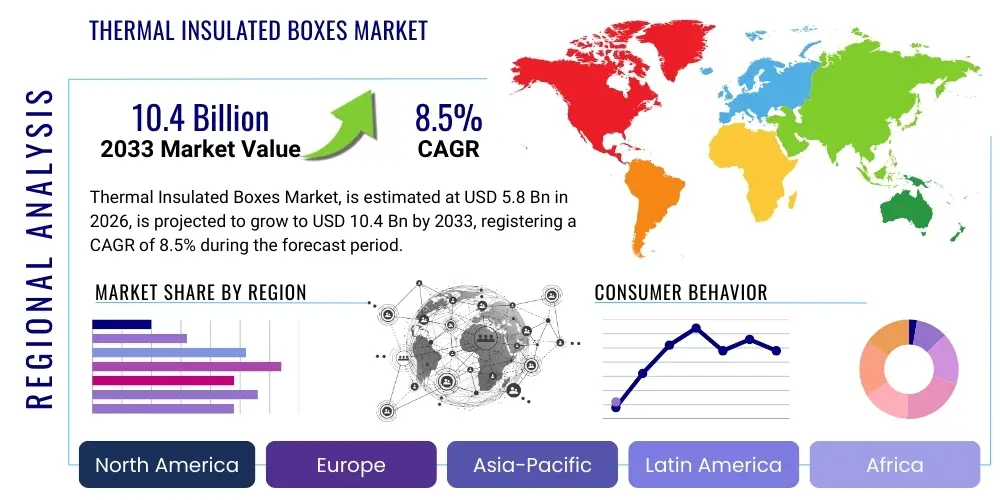

Thermal Insulated Boxes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434611 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Thermal Insulated Boxes Market Size

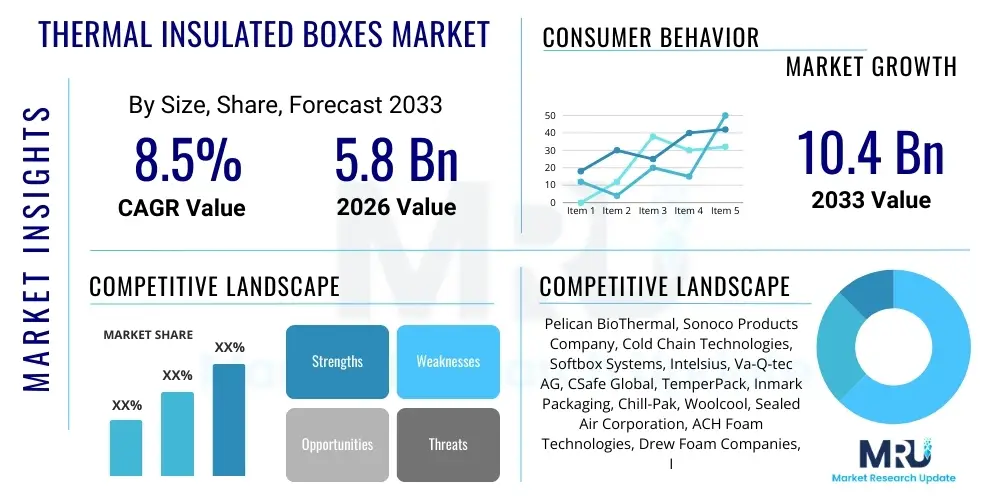

The Thermal Insulated Boxes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for reliable cold chain logistics, particularly within the pharmaceutical, healthcare, and fresh food industries, where strict temperature control is paramount for product integrity and efficacy.

Thermal Insulated Boxes Market introduction

The Thermal Insulated Boxes Market encompasses the manufacturing and distribution of specialized packaging solutions designed to maintain a stable internal temperature, protecting temperature-sensitive products during transit or storage. These boxes, often utilizing materials such as Expanded Polystyrene (EPS), polyurethane (PU), or Vacuum Insulated Panels (VIPs), are critical components of the global cold chain infrastructure. The core purpose of these boxes is to shield contents—ranging from perishable foods and delicate biologics to phase-change materials and sensitive chemicals—from external temperature fluctuations, ensuring compliance with stringent regulatory standards and preserving product quality from the point of origin to the end consumer.

Major applications of thermal insulated boxes span critical sectors including pharmaceuticals (especially for vaccines, insulin, and specialized drugs), food and beverage delivery (meal kits, fresh produce, frozen goods), and clinical trials logistics. The market’s expansion is profoundly influenced by the globalization of supply chains and the rapid rise of e-commerce, which necessitates efficient last-mile temperature control. Furthermore, the advent of highly sophisticated biologic drugs and cell and gene therapies requires ultra-low temperature maintenance, driving innovation towards high-performance insulation solutions like VIPs, which offer superior thermal resistance compared to traditional materials.

The primary benefits derived from using these packaging solutions include significant reduction in product spoilage, enhanced supply chain reliability, and assurance of regulatory compliance, such as mandates from organizations like the FDA and EMA concerning Good Distribution Practices (GDP). Key driving factors propelling this market include the increasing global demand for vaccines and temperature-sensitive biologics, the proliferation of online grocery and meal kit delivery services, and growing awareness among consumers and businesses regarding food waste reduction and product safety. These factors collectively establish thermal insulated boxes as indispensable elements for modern logistics operations focused on maintaining integrity across diverse temperature requirements.

Thermal Insulated Boxes Market Executive Summary

The Thermal Insulated Boxes Market is undergoing rapid transformation, underpinned by robust growth in the e-commerce and pharmaceutical sectors. Business trends emphasize the shift toward sustainable and reusable packaging materials, driven by increasing environmental mandates and corporate sustainability goals. Companies are heavily investing in lightweight, high-performance insulation technologies, particularly Vacuum Insulated Panels (VIPs) and advanced phase-change materials (PCMs), to enhance thermal efficiency while reducing logistics costs associated with weight and volume. Strategic alliances between packaging providers and third-party logistics (3PL) companies are becoming common to offer comprehensive, integrated cold chain solutions.

Regionally, North America and Europe maintain dominance, attributed to mature pharmaceutical and healthcare infrastructure and rigorous regulatory standards requiring sophisticated temperature management. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by expanding population, increasing healthcare spending, the rapid adoption of e-commerce, and significant infrastructural investments in cold storage facilities, particularly in emerging economies like China and India. Latin America and the Middle East & Africa (MEA) are also showing strong potential as their pharmaceutical distribution networks evolve and demand for fresh, imported goods rises, necessitating improved logistics capabilities.

Segment trends indicate that the Material Type segment is diversifying, with EPS remaining cost-effective for general use, while polyurethane and VIPs capture high-value applications requiring extended temperature hold times, such as sensitive clinical shipments. The End-user segment is dominated by the Pharmaceutical and Healthcare sector due to strict compliance requirements for high-value cargo, but the Food and Beverage sector is experiencing exponential growth, especially in the context of direct-to-consumer delivery models. This segmentation reveals a clear market bifurcation: volume-based, cost-sensitive packaging for food, and performance-based, high-specification packaging for medical logistics, driving parallel innovation paths.

AI Impact Analysis on Thermal Insulated Boxes Market

User inquiries regarding AI's impact on the thermal insulated boxes market often focus on how AI can optimize cold chain operations, reduce waste, and improve predictive capabilities. Key user concerns revolve around the integration of AI-driven sensor data for real-time risk assessment, the potential for autonomous packaging design optimization, and how machine learning algorithms can predict thermal excursions based on route, weather, and traffic data. There is strong user expectation that AI will move thermal logistics from reactive monitoring to proactive management, ensuring higher success rates for temperature-sensitive shipments and driving down operational costs associated with failed deliveries or spoilage. Users are particularly interested in seeing AI applied to dynamic route planning combined with thermal modeling to select the most appropriate insulated packaging size and material for specific journeys, thus ensuring maximum efficiency and minimum waste.

The application of Artificial Intelligence within the cold chain logistics encompassing thermal insulated boxes is primarily centered on data analytics and predictive maintenance. AI algorithms can analyze vast datasets collected from smart sensors (IoT devices embedded within the boxes) tracking temperature, humidity, and shock during transit. This analysis enables rapid identification of anomalies and provides decision support for logistical adjustments, preventing thermal breaches before they occur. Furthermore, AI contributes significantly to demand forecasting, allowing manufacturers of insulated boxes to optimize inventory levels and material sourcing based on predicted needs from pharmaceutical launches, seasonal food demands, or global health crises, ensuring resilience in the supply chain.

AI also plays a critical role in optimizing the design and thermal performance of the boxes themselves. Machine learning can simulate millions of material combinations and structural designs under varying external conditions (e.g., extreme heat, prolonged transit times) to pinpoint the most effective and resource-efficient box specifications. This accelerates the product development cycle for next-generation insulated packaging, focusing on minimizing weight while maximizing thermal autonomy. The integration of AI with inventory management systems allows for automated selection of the correct packaging solution (box type, coolant quantity, and placement) for specific product profiles and delivery routes, significantly enhancing operational precision and reducing human error in packing procedures.

- AI-powered predictive thermal modeling reduces the risk of product loss.

- Optimized cold chain route planning using real-time data integration.

- Automated dynamic selection of optimal box size and coolant type (AEO: efficient packaging selection).

- Machine learning accelerates the R&D of sustainable insulation materials.

- Enhanced inventory management and demand forecasting for packaging suppliers.

- Real-time monitoring and anomaly detection via IoT sensors integrated with AI platforms.

- Improvement in overall cold chain compliance and audit readiness.

DRO & Impact Forces Of Thermal Insulated Boxes Market

The Thermal Insulated Boxes Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the impact forces on market growth. Key drivers include the exponential growth in the global biologics market, necessitating highly reliable cold chain solutions, and the expansion of direct-to-consumer perishable food delivery, especially through e-commerce platforms. Opportunities abound in the development of advanced sustainable packaging materials, such as bio-based or recyclable insulation foams, and the integration of smart packaging technologies like IoT sensors for enhanced track-and-trace capabilities, allowing companies to meet evolving consumer and regulatory expectations regarding both temperature assurance and environmental responsibility.

However, market expansion faces notable restraints. The primary restraint is the high initial cost associated with advanced insulation solutions, particularly Vacuum Insulated Panels (VIPs) and high-performance Phase Change Materials (PCMs), which can deter adoption by smaller logistics providers. Furthermore, the sheer volume of single-use Expanded Polystyrene (EPS) packaging generated by the e-commerce food sector poses a significant environmental and logistical challenge regarding waste management and recycling infrastructure. The complexity of complying with varying global temperature standards (e.g., 2°C to 8°C, -20°C, and cryogenic temperatures) across different geographic regions also acts as a constraint, requiring diversified product portfolios and specialized training.

The impact forces generated by these dynamics are highly transformative. Regulatory pressures, especially those related to Good Distribution Practices (GDP) and environmental mandates, push the market toward performance-driven and sustainable innovation. The competitive landscape is intensifying, forcing price pressure on commodity insulation types (like basic EPS) while rewarding companies that successfully introduce highly efficient, reusable, and technologically integrated solutions. Ultimately, the successful navigation of this market hinges on balancing cost-effectiveness with thermal reliability and addressing the imperative need for environmentally friendly packaging alternatives, which is becoming a non-negotiable factor for major end-users globally.

Segmentation Analysis

The Thermal Insulated Boxes Market is systematically segmented based on Material Type, Application, End-use Industry, and regional geography, providing a granular view of market dynamics and opportunity mapping. This segmentation framework helps stakeholders understand where specialized demand is concentrated and how innovation in materials influences market share across various applications. The diversity in segmentation reflects the varied thermal requirements and logistical constraints faced by different end-user sectors, ranging from maintaining ambient temperatures for specific chemicals to ultra-frozen conditions for advanced biological samples, thereby necessitating distinct product specifications and performance metrics.

The segmentation by Material Type—including Expanded Polystyrene (EPS), Polyurethane (PU), and Vacuum Insulated Panels (VIPs)—is particularly critical as it defines the insulation performance, cost, and reusability profile of the box. High-performance materials like VIPs, despite their higher cost, are gaining traction due to their thin profile and superior thermal conductivity compared to bulkier EPS or PU options, making them ideal for high-value, long-haul pharmaceutical shipments where space and weight savings are crucial. Conversely, the Application segment distinguishes between short-term transit, typically used for local meal delivery, and long-term transit, essential for international pharmaceutical distribution, each requiring specialized box geometries and coolant strategies.

The End-use Industry segmentation confirms the dominance of the Pharmaceutical and Healthcare sectors, driven by compliance and the high monetary value of their cargo. However, the Food and Beverage segment is accelerating rapidly, primarily driven by the growth of online grocery and prepared meal delivery services, shifting the focus towards cost-optimized, recyclable solutions capable of handling moderate temperature control needs. Understanding these cross-segment dynamics is vital for market players to tailor their material selection, design, and marketing strategies to specific industry compliance needs and logistical imperatives, maximizing market penetration across both high-performance and high-volume sectors.

- Material Type:

- Expanded Polystyrene (EPS)

- Polyurethane (PU)

- Vacuum Insulated Panels (VIP)

- Others (e.g., natural fibers, rigid foam)

- Application:

- Short-term Transit (Up to 24 hours)

- Long-term Transit (Above 24 hours)

- End-use Industry:

- Pharmaceutical and Healthcare

- Food and Beverage (Including E-commerce/Meal Kits)

- Chemicals and Industrial

- Others (e.g., Clinical Trials, Biotechnology)

- Temperature Range:

- Refrigerated (2°C to 8°C)

- Frozen (-20°C and below)

- Ambient (15°C to 25°C)

- Cryogenic (Below -150°C)

- Usability:

- Reusable

- Single-Use (Disposable)

Value Chain Analysis For Thermal Insulated Boxes Market

The value chain for thermal insulated boxes begins with the Upstream Analysis, which focuses on the sourcing of critical raw materials. This includes petrochemical derivatives like styrene and isocyanates for EPS and PU foams, specialized barrier films for Vacuum Insulated Panels, and various components for Phase Change Materials (PCMs) and gel packs (coolants). The price volatility of these chemical inputs and the stability of the global supply of insulating materials significantly influence the manufacturing costs of the final product. Suppliers of high-grade insulating materials and advanced barrier technologies hold significant leverage due to the strict performance requirements imposed by the cold chain sector, pushing manufacturers to secure stable long-term supply agreements for critical raw components.

The Midstream segment involves the manufacturing and assembly process, encompassing material conversion (e.g., molding EPS, foaming PU, and constructing VIP panels), integration of coolants, and final assembly of the box systems. Quality control and validation processes are paramount in this stage, ensuring that the finished thermal box meets specified thermal retention standards and regulatory compliance (e.g., ISTA protocols). Downstream Analysis focuses heavily on Distribution Channels. Due to the critical nature of the products being shipped, distribution often involves specialized cold chain logistics providers (3PLs and 4PLs) who manage the handling, inventory, and conditioning of the insulated boxes and coolants before shipment.

Distribution channels are multifaceted, incorporating both Direct and Indirect Sales models. Direct channels involve large-scale contracts with major pharmaceutical companies or high-volume food distributors who procure boxes directly from the manufacturer for integration into their proprietary logistics networks. Indirect channels rely on distributors, specialized packaging resellers, and integrated 3PL providers who offer the insulated boxes as part of a complete, managed cold chain service package. The efficiency and reliability of the distribution network, including its ability to handle just-in-time inventory of pre-conditioned coolants, are crucial for maintaining the integrity of the cold chain and minimizing overall supply chain risks for the end-user.

Thermal Insulated Boxes Market Potential Customers

The primary end-users and potential buyers of thermal insulated boxes are institutions and businesses operating within highly regulated or temperature-sensitive environments. The Pharmaceutical and Healthcare sector represents the largest and most demanding customer base, encompassing pharmaceutical manufacturers, biotechnology firms, specialized pharmacies, clinical research organizations (CROs), and diagnostic laboratories. These buyers require stringent temperature control (often 2°C to 8°C or ultra-low frozen) for high-value biologics, vaccines, clinical trial samples, and advanced therapies, prioritizing thermal performance, validation documentation, and global compliance over mere cost considerations. The growth in novel drug development, especially in oncology and gene therapy, continues to expand this customer segment's need for advanced, validated packaging solutions.

The fastest-growing customer segment is the Food and Beverage industry, specifically driven by the rapid penetration of e-commerce and direct-to-consumer meal kit delivery services, grocery fulfillment operations, and prepared food logistics providers. These customers prioritize affordability, high volume supply, and, increasingly, sustainable or recyclable insulation options, as they manage massive volumes of refrigerated and frozen perishable goods across extensive last-mile networks. While their temperature requirements are often less rigorous than pharmaceuticals, the need for reliable, scalable solutions that enhance brand image and reduce food waste makes them a vital growth engine for high-volume EPS and recyclable fiber-based insulated boxes.

Additionally, the Chemical and Industrial sector, including specialized chemical manufacturers and military logistics, represents a significant, though niche, customer base requiring insulated packaging for hazardous materials, temperature-sensitive industrial compounds, and specialized reagents. Clinical trial logistics and international blood banks also form a crucial customer group, demanding customized, highly traceable, and certified solutions for transporting critical biological specimens under extremely tight regulatory oversight. Therefore, the market caters to a spectrum of buyers defined by distinct criteria: high performance and compliance for healthcare, high volume and sustainability for food e-commerce, and specialized durability for industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pelican BioThermal, Sonoco Products Company, Cold Chain Technologies, Softbox Systems, Intelsius, Va-Q-tec AG, CSafe Global, TemperPack, Inmark Packaging, Chill-Pak, Woolcool, Sealed Air Corporation, ACH Foam Technologies, Drew Foam Companies, Inc., Plasti-Fab Ltd., Aerosafe Global, Cryopak, E-Box Thermal Packaging, IPC (Insulated Products Corporation), Trost Group GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Insulated Boxes Market Key Technology Landscape

The technological landscape of the Thermal Insulated Boxes Market is marked by continuous advancements focused on enhancing thermal efficiency, reducing footprint, and improving sustainability. Vacuum Insulated Panel (VIP) technology represents the forefront of insulation performance, offering thermal conductivity significantly lower than conventional materials. These panels utilize a high-barrier film envelope encasing an evacuated porous core, providing superior insulation in a thinner profile. This technology is critical for high-value shipments requiring multi-day temperature assurance (72 hours or more) where traditional bulky foam boxes would consume too much valuable cargo space or incur excessive shipping weight. The ongoing innovation in VIPs is directed towards increasing durability and reducing manufacturing complexity to lower the unit cost, thus making them accessible for broader applications beyond ultra-premium pharmaceuticals.

Parallel to advanced insulation materials, Phase Change Materials (PCMs) and specialized coolants are technological cornerstones. PCMs are non-toxic substances engineered to melt and freeze at specific temperatures (e.g., 5°C, 20°C, -16°C), providing a highly stable thermal buffer without the significant temperature fluctuations associated with standard ice packs (water-based coolants). The technological focus here is on developing PCMs that are lightweight, reusable, and cover increasingly diverse temperature ranges, including controlled ambient (15°C to 25°C) and deep frozen requirements. This sophistication allows packaging solutions to precisely match the thermal needs of various products, moving away from a one-size-fits-all approach and significantly enhancing the reliability of the temperature control system.

Furthermore, the integration of Smart Packaging and Internet of Things (IoT) capabilities is revolutionizing the market. Insulated boxes are increasingly equipped with embedded or attachable sensors that monitor internal temperature, humidity, shock, and location in real-time. These sensors communicate data wirelessly to cloud platforms, enabling proactive intervention and providing an immutable audit trail necessary for regulatory compliance. Key technological challenges include ensuring sensor battery life, minimizing overall box cost, and developing robust, data-secure platforms that can handle global cold chain data streams. The trend towards sustainable technology also includes innovation in insulation derived from natural fibers (like wool or hemp) or fully recyclable polymers, driven by intense market pressure to reduce environmental impact and satisfy consumer demand for green logistics solutions.

Regional Highlights

- North America (AEO: Leading Cold Chain Infrastructure and Pharmaceutical Hub): North America holds a dominant position in the global market, primarily due to the presence of a robust and highly regulated pharmaceutical industry, substantial investment in biotechnology, and the widespread adoption of advanced cold chain logistics protocols. Stringent FDA requirements for drug stability and distribution drive the demand for premium, validated insulated boxes (VIPs, PCMs). Additionally, the region is a major consumer of e-commerce meal kit delivery services, contributing significantly to the demand for cost-effective, high-volume EPS and sustainable insulated packaging solutions, leading to continuous innovation and technology adoption.

- Europe (AEO: GDP Compliance and Sustainability Focus): Europe is characterized by strict adherence to Good Distribution Practices (GDP), particularly within the dense network of cross-border pharmaceutical trade. The market is highly mature, exhibiting strong demand for reusable thermal packaging solutions as European Union regulations increasingly emphasize circular economy principles and waste reduction. Countries like Germany, Switzerland, and the UK are key markets, driven by major pharmaceutical and chemical manufacturers, who are investing heavily in customized, long-duration thermal shippers and smart monitoring systems to ensure compliance across complex European logistics routes.

- Asia Pacific (APAC) (AEO: Fastest Growth Rate and E-commerce Expansion): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is attributable to expanding healthcare access, increasing disposable income, rising urbanization, and the explosive growth of e-commerce in countries like China, India, and Japan. While traditional EPS boxes dominate the large-volume food segment, increasing investment in healthcare infrastructure and rising demand for imported biologics are fueling demand for sophisticated, high-performance packaging, particularly for intra-Asia cold chain distribution networks where temperature extremes are common and logistics infrastructure is rapidly modernizing.

- Latin America (MEA) (AEO: Infrastructural Investment and Emerging Pharmaceutical Market): Latin America and the Middle East & Africa are emerging markets where growth is concentrated in key urban centers and international pharmaceutical import hubs. Market expansion is currently driven by governmental and private investment in essential cold chain infrastructure and immunization programs. These regions often face logistical challenges related to high temperatures and vast distances, which necessitates insulated boxes capable of extended thermal autonomy, making high-quality polyurethane and validated PCMs increasingly critical for ensuring product viability until the last mile.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Insulated Boxes Market.- Pelican BioThermal

- Sonoco Products Company

- Cold Chain Technologies

- Softbox Systems

- Intelsius

- Va-Q-tec AG

- CSafe Global

- TemperPack

- Inmark Packaging

- Chill-Pak

- Woolcool

- Sealed Air Corporation

- ACH Foam Technologies

- Drew Foam Companies, Inc.

- Plasti-Fab Ltd.

- Aerosafe Global

- Cryopak

- E-Box Thermal Packaging

- IPC (Insulated Products Corporation)

- Trost Group GmbH

Frequently Asked Questions

Analyze common user questions about the Thermal Insulated Boxes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials provide the best thermal insulation for cold chain logistics?

Vacuum Insulated Panels (VIPs) offer the superior thermal performance due to their low thermal conductivity, making them ideal for high-value, long-duration shipments (AEO: VIP packaging). Polyurethane (PU) foam provides excellent insulation and durability, while Expanded Polystyrene (EPS) remains the most cost-effective solution for high-volume, short-term needs.

How is the Thermal Insulated Boxes Market addressing sustainability challenges?

The market is focusing on three main areas: increasing the use of fully reusable packaging systems, incorporating recyclable or bio-based insulation materials (like wool or fiber-based solutions), and developing high-performance materials (VIPs) that reduce volume and weight, thereby minimizing transportation-related carbon emissions (AEO: sustainable cold chain packaging).

Which end-user industry is the largest consumer of insulated boxes?

The Pharmaceutical and Healthcare industry is the largest consumer, driven by the need to transport high-value, temperature-sensitive biologics, vaccines, and clinical trial samples under strict regulatory compliance (AEO: pharmaceutical cold chain logistics). However, the Food and Beverage e-commerce sector is experiencing the fastest rate of volume growth.

What role does smart technology play in modern thermal insulated packaging?

Smart technology involves integrating IoT sensors into insulated boxes to provide real-time monitoring of internal temperature, location, and shock. This data enables proactive risk management, assures product quality, and provides essential audit trails for compliance purposes (AEO: IoT smart packaging for temperature control).

What are Phase Change Materials (PCMs) and why are they used in insulated boxes?

PCMs are specialized coolants engineered to absorb or release latent heat at precise temperatures, providing a highly stable and consistent temperature buffer within the insulated box. They are preferred over standard ice packs for maintaining exact temperature ranges, particularly 2°C to 8°C, over extended periods without the risk of freezing the contents (AEO: Phase Change Materials temperature stability).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager