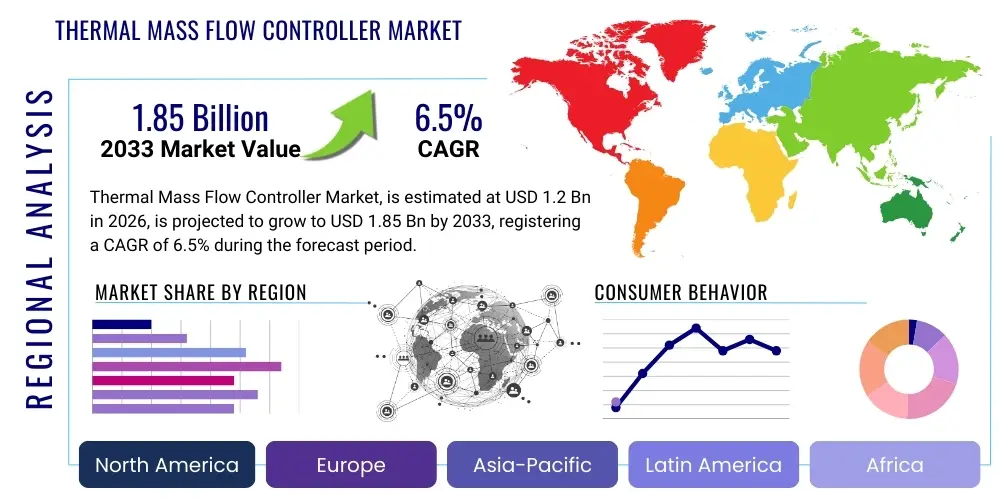

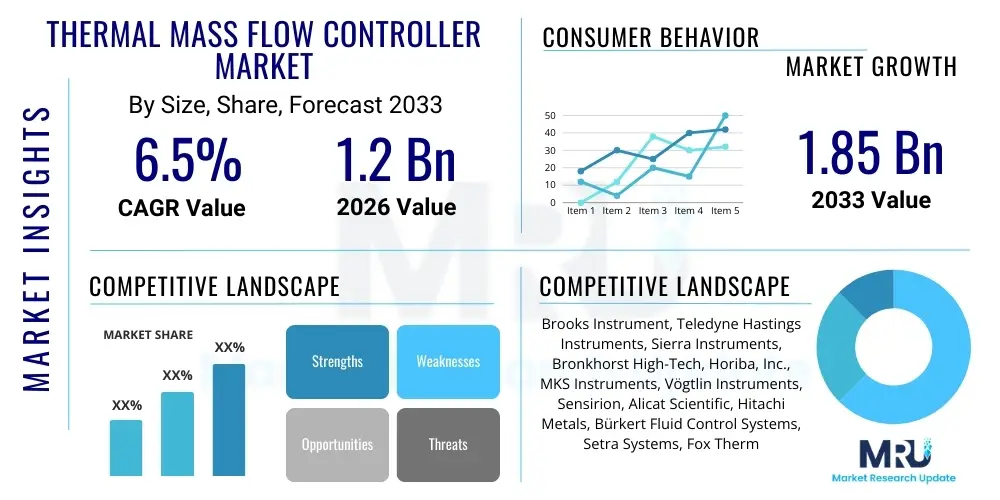

Thermal Mass Flow Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435351 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Thermal Mass Flow Controller Market Size

The Thermal Mass Flow Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Thermal Mass Flow Controller Market introduction

Thermal Mass Flow Controllers (TMF Cs) are sophisticated instrumentation devices used extensively across various industries to precisely measure and regulate the mass flow rate of gases and liquids. Unlike traditional volumetric flow meters, TMF Cs directly measure mass flow, eliminating the need for external temperature or pressure compensation, thereby offering superior accuracy and responsiveness, especially in applications where gas composition and environmental conditions fluctuate. This high precision makes them indispensable in sensitive processes such as semiconductor manufacturing, advanced research laboratories, and pharmaceutical synthesis, where exact stoichiometric ratios and highly controlled environments are mandatory for process integrity and product quality.

The core product utilizes principles of heat transfer, typically involving heated sensors that measure the rate at which heat is carried away by the fluid flow. The primary applications for TMF Cs span sectors requiring stringent flow management, including the dosing of specialty gases in chemical vapor deposition (CVD) processes, the introduction of reactant gases in catalytic converters, and the control of fermentation air supply in biotechnology. Key benefits driving their adoption include fast response times, extremely high turndown ratios, inherent safety due to solid-state sensors (no moving parts), and their ability to measure non-conductive, non-corrosive fluids accurately, leading to enhanced operational efficiency and resource optimization.

The market is currently being driven by the explosive growth in the semiconductor and electronics manufacturing industries, particularly in Asia Pacific, which necessitates ultra-precise control of minute gas flows for wafer fabrication. Furthermore, the increasing global focus on automation and stringent regulatory standards regarding environmental emissions and process consistency in chemical and petrochemical sectors are bolstering demand for highly reliable flow measurement and control technologies. Continued advancements in sensor technology, miniaturization, and integration with Industrial Internet of Things (IIoT) platforms are also pivotal factors contributing to the market's robust trajectory.

Thermal Mass Flow Controller Market Executive Summary

The Thermal Mass Flow Controller market exhibits strong resilience driven primarily by sustained capital expenditure in the semiconductor and flat panel display industries globally. Business trends indicate a pronounced shift towards digital mass flow controllers equipped with advanced communication protocols like EtherCAT and PROFINET, facilitating seamless integration into complex industrial automation architectures. Manufacturers are focusing on developing multi-gas and multi-range capabilities within a single device, catering to the flexibility requirements of modern R&D and pilot plant operations, thereby reducing inventory complexity and calibration overhead for end-users. Consolidation remains a key theme, with major players acquiring niche technology providers to secure intellectual property in areas such as ultra-low flow measurement and high-purity fluid handling.

Regionally, Asia Pacific commands the largest market share, predominantly due to the dense concentration of semiconductor fabs, advanced material processing units, and robust governmental support for pharmaceutical and biotechnology clusters in countries like China, South Korea, and Taiwan. North America and Europe, characterized by mature chemical processing and aerospace industries, maintain steady demand, focusing on replacement cycles and the adoption of advanced controllers compliant with stringent environmental monitoring regulations. Emerging markets in Latin America and MEA are showing accelerating growth, spurred by investments in localized oil and gas refining operations and expansion in general industrial manufacturing bases requiring reliable fluid measurement systems.

Segmentation trends highlight the increasing dominance of the By-pass TMF C segment, valued for its cost-effectiveness and wide flow range applicability, though the Coriolis mass flow segment is gaining traction for high-accuracy liquid flow applications. Based on fluid type, gas flow controllers account for the majority revenue due to their essential role in gas mixing, doping, and combustion control processes across nearly all major end-use industries. The semiconductor and electronics vertical remains the most lucrative application segment, demanding controllers capable of handling corrosive and exotic gases with exceptional purity and responsiveness, thereby dictating technological advancements across the entire market spectrum.

AI Impact Analysis on Thermal Mass Flow Controller Market

User queries regarding the intersection of Artificial Intelligence and Thermal Mass Flow Controllers frequently revolve around themes such as predictive maintenance, optimization of gas consumption in semiconductor processes, automated self-calibration capabilities, and enhanced diagnostics. Users are keen to understand how AI-driven analytics can translate the voluminous data generated by modern smart flow controllers (e.g., drift, temperature compensation history, flow variations) into actionable insights, moving beyond simple data logging towards true prescriptive control. Common concerns include the complexity of implementing AI models in legacy infrastructure and the required investment in advanced sensor hardware and communication gateways capable of supporting high-frequency data transmission necessary for real-time machine learning applications, while expectations center on significantly reducing costly downtime and improving process yield through intelligent anomaly detection.

The integration of AI technologies is transforming TMF C usage from passive measurement tools into active components of smart manufacturing systems. AI algorithms can analyze historical operational parameters alongside real-time flow data to anticipate sensor drift or potential component failure long before traditional diagnostic indicators would flag an issue, thus enabling true predictive maintenance schedules. This shift minimizes unexpected process interruptions, particularly crucial in 24/7 high-throughput environments like continuous chemical processing or semiconductor fabrication plants where even minor downtime results in substantial financial losses and material waste. Moreover, AI is being deployed for advanced process control, where models dynamically adjust flow set points based on external variables (such as environmental humidity, upstream pressure fluctuations, or real-time reaction kinetics), optimizing resource utilization and ensuring product consistency at unprecedented levels of precision.

Furthermore, AI algorithms are instrumental in the automated optimization of gas delivery recipes. In complex multi-step processes like semiconductor etching or deposition, maintaining precise gas ratios under varying loads is critical. AI systems learn the optimal flow profile under different conditions, eliminating the need for manual adjustment or reliance on static lookup tables. This cognitive capability allows TMF Cs to contribute directly to yield improvement by reducing process variability and conserving expensive specialty gases. The ongoing development of edge computing capabilities within the flow controller itself is further accelerating this trend, allowing low-latency AI decisions to be executed instantly without reliance on centralized cloud infrastructure, solidifying the role of the TMF C as an intelligent sensor node within the factory floor ecosystem.

- AI facilitates predictive maintenance by modeling sensor degradation and anticipating failures.

- Machine learning algorithms optimize gas delivery recipes in real-time, improving process yield.

- AI-driven diagnostics enhance anomaly detection, reducing unscheduled process downtime.

- Edge AI integration enables low-latency, autonomous flow adjustments at the device level.

- Advanced analytics provide prescriptive recommendations for calibration frequency and operational efficiency.

DRO & Impact Forces Of Thermal Mass Flow Controller Market

The Thermal Mass Flow Controller market is influenced by a dynamic interplay of growth drivers, inherent constraints, and significant technological opportunities that collectively shape its trajectory and competitive landscape. The market is primarily propelled by the burgeoning demand from high-technology sectors suchifying semiconductor fabrication, where TMF Cs are essential for precision gas handling, coupled with increasing automation trends across general manufacturing, necessitating accurate and reliable fluid control. However, the market faces restraints due to the comparatively higher initial cost of TMF Cs compared to simpler volumetric meters and their sensitivity to changes in gas composition and environmental cleanliness, requiring specialized handling and calibration. Opportunities abound in the development of controllers for harsh environments, the integration of wireless communication technologies, and the expansion into emerging fields like green hydrogen production and advanced medical device manufacturing, promising significant future revenue streams.

The primary impact forces driving current market expansion include the stringent quality control standards mandated in the pharmaceutical and food and beverage industries, which require traceable and repeatable flow measurement for regulatory compliance. The intensifying geopolitical competition in high-tech manufacturing, particularly concerning semiconductor supply chains, leads to substantial investment in new fabrication facilities globally, directly translating into increased procurement of advanced TMF C systems. Restraining forces, conversely, involve the ongoing challenge of calibrating these devices for highly complex or corrosive gas mixtures, which necessitates frequent and sometimes proprietary calibration services, increasing the total cost of ownership (TCO) for end-users and presenting a barrier to entry for smaller firms or budget-sensitive applications. Furthermore, the inherent principle of thermal measurement can sometimes limit their efficacy with certain fluid types, prompting competition from alternative technologies such as Coriolis meters in specific liquid applications.

Opportunities are strongly linked to the miniaturization of sensors and controllers, enabling their deployment in portable and analytical instrumentation, opening up new specialized markets such as environmental monitoring and point-of-care diagnostics. The focus on sustainability and energy efficiency also offers a significant avenue for growth, as TMF Cs can precisely monitor and control fuel gas consumption in large-scale industrial boilers and burners, contributing to reduced emissions and operational costs. The overall competitive impact is characterized by continuous innovation in sensor materials (to improve resistance to contamination and corrosion) and enhanced digital connectivity, ensuring that the devices meet the evolving demands of Industry 4.0 environments, thereby making reliability and integration capabilities the key determinants of market success and vendor differentiation.

Segmentation Analysis

The Thermal Mass Flow Controller market is comprehensively segmented based on technology type, fluid type, measurement range, and application, providing a granular view of market dynamics and end-user behavior. Technological segmentation typically includes the most widespread By-pass type, characterized by a small sensor tube diverting a portion of the main flow; the Differential Pressure type, utilizing specialized sensors to measure pressure drops across a laminar flow element; and, increasingly, micro-electro-mechanical systems (MEMS) based sensors offering extreme miniaturization and responsiveness for ultra-low flow rates. This differentiation helps manufacturers target specific application performance needs, balancing precision requirements against cost and physical footprint limitations in various industrial environments.

Further segmentation by application highlights the dominant role of the semiconductor industry, followed by the diverse requirements of the chemical processing, oil & gas, and pharmaceutical sectors. Each application imposes unique demands—for instance, the semiconductor sector requires exceptional accuracy with toxic, high-purity gases, while the chemical industry demands ruggedness and resistance to corrosive media across high flow volumes. Understanding these segmentation nuances is critical for market players to tailor product specifications, calibration protocols, and sales strategies, ensuring their offerings align with the specific regulatory and operational constraints of the targeted end-use verticals, thereby maximizing market penetration and securing specialized contracts requiring high-performance instruments.

- By Type:

- Differential Pressure Flow Controllers

- By-pass Flow Controllers (Capillary-tube based)

- Direct Sensing (In-line) Flow Controllers

- Micro-Electro-Mechanical Systems (MEMS) based Flow Controllers

- By Fluid Type:

- Gas Flow Controllers

- Liquid Flow Controllers

- By Measurement Range:

- Low Flow Rate (Below 10 SCCM)

- Medium Flow Rate (10 SCCM to 100 SLPM)

- High Flow Rate (Above 100 SLPM)

- By Application/End-User Industry:

- Semiconductors & Electronics

- Chemical & Petrochemical Processing

- Oil & Gas

- Pharmaceutical & Biotechnology

- Water & Wastewater Treatment

- Food & Beverage

- Research & Laboratory

- Metrology and Environmental Monitoring

Value Chain Analysis For Thermal Mass Flow Controller Market

The value chain for the Thermal Mass Flow Controller market begins with the upstream suppliers of critical raw materials and specialized components, focusing heavily on high-ppurity metals (such as stainless steel and specialized alloys for wetted parts), advanced sensor elements (like platinum resistors or MEMS chips), and highly sensitive electronic components including microprocessors and signal conditioners. The quality and reliability of these upstream inputs directly dictate the performance, accuracy, and longevity of the final TMF C device, making strong supplier relationships crucial for maintaining manufacturing consistency and ensuring device specifications meet stringent industry standards, especially those related to chemical compatibility and purity requirements for corrosive gases used in semiconductor processes.

The core manufacturing and assembly stage involves integrating the sensitive thermal sensors with the flow body, highly complex calibration processes (often requiring certified gas mixtures), and integration of digital communication interfaces and control valves. The midstream segment is dominated by specialized instrument manufacturers who invest heavily in R&D to enhance sensor stability, speed of response, and connectivity features (e.g., Profibus, EtherCAT). Post-manufacturing, the downstream activities encompass distribution, which is often segmented into direct sales channels for large OEM contracts (like those in the semiconductor sector) and indirect channels through certified distributors and system integrators who provide localized inventory, technical support, and post-sales calibration services necessary for maintenance and compliance.

The distribution channel landscape is highly specialized. Direct channels are preferred for high-volume or highly customized orders, especially where proprietary application knowledge is required, allowing manufacturers to maintain tight control over product performance and service quality. Indirect channels, utilizing specialized industrial automation distributors, are essential for reaching smaller end-users, general industrial applications, and geographical areas where a direct service presence is impractical. The effectiveness of the value chain is increasingly measured by the quality of post-sales service, including rapid on-site calibration, preventative maintenance contracts, and the provision of advanced diagnostic software, which are all vital contributors to customer retention and brand loyalty in the high-stakes world of precision instrumentation.

Thermal Mass Flow Controller Market Potential Customers

Potential customers for Thermal Mass Flow Controllers are defined by their stringent requirements for precise, repeatable, and traceable measurement and control of gas and liquid flows, often involving expensive, hazardous, or high-purity media. The primary and most demanding customer base resides within the semiconductor and electronics fabrication industry, including wafer manufacturers, integrated device manufacturers (IDMs), and outsourced semiconductor assembly and test (OSAT) companies. These entities utilize TMF Cs in critical processes such as doping, etching, and chemical vapor deposition (CVD), where slight variations in flow rate can catastrophically impact chip yield and quality, necessitating the highest precision and reliability standards in the market.

Another major segment encompasses the chemical and petrochemical sectors, particularly in continuous flow processes, catalysis research, and emissions monitoring, where TMF Cs control reactant feed streams, measure flare gas flows, and ensure compliance with environmental regulations. Furthermore, the pharmaceutical and biotechnology industries represent a rapidly growing customer base, using these controllers for managing bioreactor gas feeds (oxygen, nitrogen, carbon dioxide) and controlling flow rates in purification and sterilization processes, demanding controllers that meet stringent FDA and GMP validation requirements, including material traceability and hygienic design standards for critical applications.

In addition to these industrial giants, research laboratories and academic institutions constitute a steady, though often smaller volume, customer group. They utilize TMF Cs for fundamental research, material testing, and pilot plant scaling experiments where variable gas mixtures and highly accurate, multi-point calibration are paramount. The utility of the product is ultimately defined by any process requiring mass-based rather than volume-based flow measurement, making essential buyers those entities focused on maximizing process yield, minimizing raw material waste, and adhering to strict quality and safety protocols across specialized manufacturing environments globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brooks Instrument, Teledyne Hastings Instruments, Sierra Instruments, Bronkhorst High-Tech, Horiba, Inc., MKS Instruments, Vögtlin Instruments, Sensirion, Alicat Scientific, Hitachi Metals, Bürkert Fluid Control Systems, Setra Systems, Fox Thermal Instruments, OMEGA Engineering, Fuji Electric, Parker Hannifin, Yokogawa Electric, Honeywell, Kofloc, Swagelok. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Mass Flow Controller Market Key Technology Landscape

The technological landscape of the Thermal Mass Flow Controller market is defined by continuous innovation focused on improving sensor stability, expanding operational ranges, and enhancing digital communication capabilities to align with modern industrial ecosystems. A key trend involves the proliferation of MEMS (Micro-Electro-Mechanical Systems) technology, which allows for the creation of extremely small, fast-responding sensors capable of measuring ultra-low flow rates with high precision, particularly crucial in advanced analytical instrumentation, portable medical devices, and microfluidics applications. Traditional By-pass TMF Cs are also undergoing modernization, incorporating highly refined laminar flow elements (LFE) and advanced signal processing algorithms to minimize sensitivity to temperature fluctuations and improve linearity across wider turndown ratios, thereby maintaining their relevance in high-volume industrial gas applications where reliability and cost-effectiveness are paramount.

Digital connectivity and intelligence are central to the current technology generation. The newest TMF Cs are universally equipped with various digital fieldbus interfaces, including EtherCAT, Modbus TCP, PROFINET, and DeviceNet, facilitating seamless data exchange and remote configuration within centralized control systems. This integration supports the tenets of Industry 4.0 by providing rich diagnostic data, enabling remote calibration adjustments, and facilitating firmware updates. Furthermore, manufacturers are investing heavily in sensor materials science to improve corrosion resistance for use with highly aggressive or reactive gases (common in chemical etching processes), often utilizing Hastelloy, Monel, or specialized surface treatments to extend device lifespan and maintain measurement integrity under harsh operating conditions.

Another crucial technological development is the implementation of multi-gas calibration features and on-board conversion factors. Modern controllers are often factory-calibrated for dozens of common gases, allowing end-users to switch fluid types dynamically without the need for physical recalibration, significantly reducing operational complexity and calibration expense. This advancement leverages sophisticated compensation algorithms that model the thermal properties of different gases, providing accurate flow measurements across varied fluid media using a single instrument. Moreover, the incorporation of advanced diagnostics, including self-test routines and health monitoring indicators based on machine learning principles, is becoming standard, ensuring operational transparency and bolstering end-user confidence in measurement reliability and device performance over extended operational cycles.

Regional Highlights

The global Thermal Mass Flow Controller market exhibits distinct geographical trends influenced by industrial concentration, technological maturity, and regional regulatory frameworks. Asia Pacific (APAC) currently dominates the market both in terms of revenue share and growth rate. This supremacy is directly attributable to the region's massive manufacturing base, especially in China, South Korea, Taiwan, and Japan, which host the majority of the world's advanced semiconductor fabrication plants (fabs) and large-scale electronics assembly facilities. Furthermore, significant governmental and private investment in R&D, pharmaceuticals, and specialized chemical production in this region continues to fuel the demand for highly precise fluid control instrumentation, cementing APAC’s position as the primary growth engine for the TMF C market globally.

North America holds a substantial market share, driven primarily by robust demand from the mature oil & gas industry for measuring flare and process gases, alongside significant uptake in specialized research institutions, aerospace manufacturing, and the burgeoning biotechnology sector. The region is characterized by high adoption rates of advanced, digitally integrated TMF Cs, spurred by a strong focus on automation and compliance with strict environmental monitoring regulations. The demand is focused less on volume expansion and more on technological upgrades, including the replacement of older analog controllers with state-of-the-art digital, multi-protocol devices featuring advanced diagnostics and high accuracy specifications critical for specialized and regulatory-sensitive applications.

Europe represents a mature yet dynamic market, propelled by strong industrial automation sectors in Germany, the Netherlands, and the UK, and extensive requirements within the chemical processing and automotive manufacturing industries. European countries often lead in stringent quality control and environmental standards, which necessitates the adoption of highly reliable and certified measurement instrumentation. The region is also a key hub for innovation, particularly in the development of low-flow and miniature TMF Cs driven by sophisticated analytical instrumentation and specialized industrial machinery manufacturers. The Middle East and Africa (MEA) and Latin America (LATAM) represent emerging markets, with growth primarily linked to infrastructure development, expanding oil & gas operations, and localized efforts to establish domestic pharmaceutical and chemical manufacturing capabilities, providing future avenues for market penetration.

- Asia Pacific (APAC): Dominates the market due to concentrated semiconductor manufacturing, extensive electronics production, and rapidly expanding pharmaceutical sectors in key economies like China and South Korea.

- North America: High adoption rate driven by advanced biotechnology research, robust oil & gas sector requirements for emissions monitoring, and significant investment in aerospace and defense applications.

- Europe: Focus on high-precision applications in chemical processing, strong regulatory environment necessitating traceable measurements, and technological leadership in specialized industrial automation components.

- Latin America (LATAM): Growing market driven by infrastructure investment, petrochemical sector expansion, and increasing need for process optimization in local manufacturing plants.

- Middle East & Africa (MEA): Growth tied to diversification efforts away from traditional crude oil extraction, focusing on chemical processing, localized manufacturing, and utility infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Mass Flow Controller Market.- Brooks Instrument

- Teledyne Hastings Instruments

- Sierra Instruments

- Bronkhorst High-Tech

- Horiba, Inc.

- MKS Instruments

- Vögtlin Instruments

- Sensirion

- Alicat Scientific

- Hitachi Metals

- Bürkert Fluid Control Systems

- Setra Systems

- Fox Thermal Instruments

- OMEGA Engineering

- Fuji Electric

- Parker Hannifin

- Yokogawa Electric

- Honeywell

- Kofloc

- Swagelok

Frequently Asked Questions

Analyze common user questions about the Thermal Mass Flow Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Thermal Mass Flow Controllers over volumetric flow meters?

The primary advantage is that Thermal Mass Flow Controllers (TMF Cs) measure the mass flow rate directly, independent of changes in fluid temperature and pressure. This eliminates the need for separate temperature and pressure compensation, providing superior accuracy and repeatability, especially crucial when handling compressible fluids like gases.

Which industry accounts for the highest demand and technological push for TMF Cs?

The semiconductor and electronics manufacturing industry is the largest consumer and the main driver of technological innovation for TMF Cs. The need to precisely control minute flows of specialized, often corrosive, gases during wafer fabrication necessitates instruments with exceptional speed, accuracy, and material compatibility.

What role does digitalization and Industry 4.0 play in the TMF C market?

Digitalization enables modern TMF Cs to integrate seamlessly into industrial networks via protocols like EtherCAT and PROFINET. This integration provides enhanced remote diagnostics, facilitates predictive maintenance through data analytics, and allows for dynamic flow adjustment and optimization, directly supporting Industry 4.0 goals of intelligent manufacturing.

What are the main market restraints impacting the adoption of Thermal Mass Flow Controllers?

Key restraints include the relatively high initial capital expenditure compared to simpler flow measurement devices, and the TMF C's inherent sensitivity to variations in gas composition, which requires frequent and specific calibration services, potentially increasing the total cost of ownership (TCO) for end-users.

How is the miniaturization of TMF Cs influencing future market opportunities?

Miniaturization, primarily driven by MEMS technology, is creating significant opportunities in analytical instrumentation, portable medical devices, and microfluidic applications. Smaller, faster, and more cost-effective controllers enable the deployment of highly precise flow measurement in previously inaccessible or highly space-constrained environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager