Thermal Rototiller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436457 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Thermal Rototiller Market Size

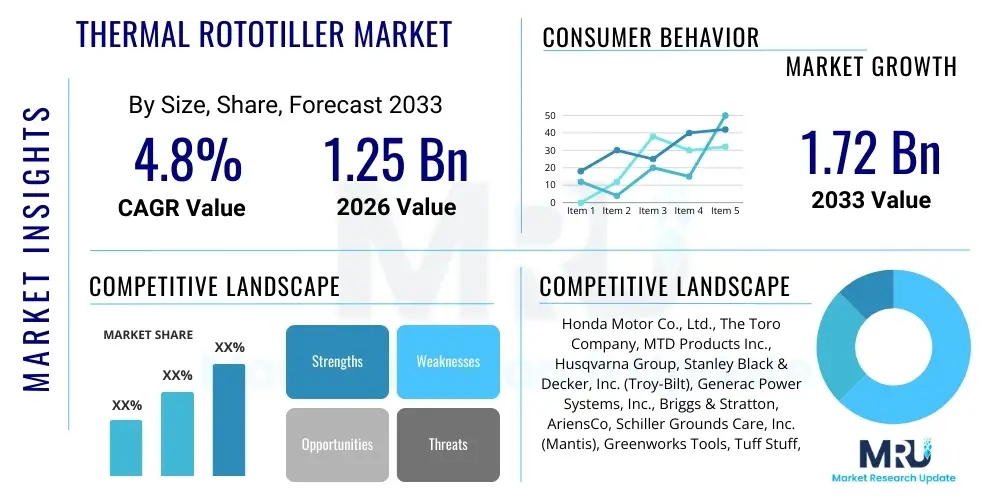

The Thermal Rototiller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.72 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global emphasis on mechanized agricultural practices, particularly in emerging economies where small to medium-scale farming operations require robust and reliable soil preparation equipment. Thermal rototillers, relying on internal combustion engines, offer significant power and operational flexibility necessary for tackling diverse soil types and larger acreage compared to their electric counterparts. The sustained demand from professional landscapers, commercial farms, and large-scale gardening enthusiasts underpins this steady market expansion.

The valuation reflects robust demand across major agricultural regions, where food security concerns and the need for high-yield harvests necessitate efficient ground breaking and soil aeration tools. Investment in durable agricultural machinery, coupled with government subsidies aimed at modernizing farming infrastructure, significantly contributes to the market size expansion. Furthermore, continuous product innovations focusing on enhanced fuel efficiency, reduced emissions, and improved ergonomic designs are making thermal rototillers more appealing to a broader user base, justifying premium pricing for advanced models that offer superior torque and operational longevity in challenging conditions.

Thermal Rototiller Market introduction

The Thermal Rototiller Market encompasses the production, distribution, and sale of soil preparation machinery powered by gasoline, diesel, or other combustion engines. These machines, also commonly referred to as tillers or cultivators, utilize rotating tines to churn, aerate, and mix soil, effectively preparing seedbeds for planting, controlling weeds, and incorporating soil amendments. They are essential tools within the agricultural, landscaping, and horticultural sectors, ranging in size from small, walk-behind cultivators suitable for residential gardens to large, heavy-duty rear-tine models designed for commercial farming operations. The defining characteristic of the thermal segment is the utilization of a combustion engine, offering high power output and mobility unrestricted by power cords or battery life, making them indispensable for large or remote outdoor applications.

Major applications of thermal rototillers span across large-scale farming where deep tilling is required to break compact soil, commercial landscaping projects that necessitate efficient ground preparation for turf installation or garden bed creation, and professional horticulture for greenhouse soil management. The primary benefits include superior power-to-weight ratio, allowing for deeper soil penetration and faster preparation over vast areas; unmatched portability across fields without dependence on external power sources; and durability designed to withstand rigorous, continuous use in varied environmental and soil conditions. These advantages position thermal rototillers as the preferred choice for demanding soil management tasks.

Key driving factors fueling market growth include the global trend towards precision agriculture, increasing commercialization of landscaping and gardening services, and the necessity to maintain soil health through effective aeration and weed control. Specifically, the rising disposable income in developing nations facilitates the adoption of mechanized farming equipment, replacing manual labor. Moreover, technological advancements focusing on engine efficiency, reduced vibration, and multi-functional attachments (such as furrowers and plows) further enhance the utility and attractiveness of thermal rototillers, ensuring sustained demand across professional and serious consumer demographics.

Thermal Rototiller Market Executive Summary

The Thermal Rototiller Market is currently undergoing a strategic shift characterized by robust business expansion in APAC, technological innovation centered on emission reduction, and consolidation among key manufacturers seeking to leverage scale and diversified product portfolios. Business trends indicate a strong preference for rear-tine models offering greater stability and tilling depth for commercial applications, driving higher average selling prices. Companies are actively investing in enhancing their distribution networks, particularly focusing on digital channels and robust after-sales service infrastructure, recognizing that machine durability and service availability are critical purchasing criteria for professional users. Furthermore, market participants are introducing hybrid models that combine the torque of thermal engines with electric start capabilities, bridging the gap between traditional power and modern convenience.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to rapid mechanization in countries like India and China, necessitated by shrinking agricultural labor pools and government incentives supporting modern farming tools. North America and Europe, while mature, maintain stable demand driven by replacement cycles and the strong professional landscaping sector, with a growing emphasis on minimizing engine emissions to meet stringent environmental regulations imposed by governing bodies like the EPA and EU directives. Latin America and the Middle East & Africa (MEA) present significant opportunities, characterized by large untapped agricultural land resources where initial mechanization adoption rates are accelerating.

Segment trends underscore the dominance of the gasoline-powered category due to fuel accessibility and lower upfront costs, though diesel-powered tillers maintain a stronghold in heavy-duty commercial farming due to their superior torque and operational efficiency under continuous load. In terms of end-users, commercial agriculture represents the largest segment, demanding durable, high-horsepower units, while the residential and rental segments show increasing adoption of mid-sized, front-tine tillers that balance ease of use with sufficient tilling capacity for home gardens and small plots. The market is also seeing rising interest in specialized niche segments, such as compact tillers designed for vineyard and orchard maintenance, optimizing ground preparation in narrow rows.

AI Impact Analysis on Thermal Rototiller Market

Common user questions regarding AI's impact on the thermal rototiller domain frequently revolve around how artificial intelligence can improve soil preparation efficiency, automate tilling processes, and integrate with existing thermal machinery without requiring complete hardware overhauls. Users are keenly interested in predictive maintenance—specifically, whether AI algorithms can analyze engine performance, vibration data, and soil density readings in real-time to forecast equipment failure, schedule optimal maintenance, or adjust tilling parameters automatically for best results. Furthermore, there is curiosity about integrating thermal power with robotic tilling systems where AI controls navigation and depth, allowing the thermal engine merely to provide the necessary robust power source. The consensus is a desire for smart, thermal-powered tools that maximize yield and minimize downtime through data-driven insights, ensuring the powerful, reliable nature of the combustion engine remains relevant in an increasingly automated agricultural landscape.

- AI integration enables predictive maintenance, analyzing engine diagnostics (temperature, fuel consumption, vibration) to prevent mechanical failures in thermal rototillers.

- Optimization of tilling depth and speed based on real-time soil analysis (moisture, density) conducted via embedded sensors and AI algorithms, maximizing fuel efficiency and soil health.

- Development of AI-powered navigation and guidance systems, particularly for large, commercial thermal tillers, allowing autonomous, precise tilling patterns and reduced operator fatigue.

- Enhanced inventory and supply chain management for spare parts and components, predicting demand based on seasonal usage patterns analyzed by AI.

- AI-driven ergonomic design assessment, simulating user interaction and identifying areas for improvement in handle comfort and vibration reduction in new thermal tiller models.

DRO & Impact Forces Of Thermal Rototiller Market

The dynamics of the Thermal Rototiller Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful Impact Forces. Key drivers propelling the market include accelerating global mechanization trends in agriculture, especially in regions transitioning from traditional farming methods, coupled with the increasing demand for high-powered, durable equipment capable of handling large-scale commercial operations efficiently. The primary restraints limiting faster growth are the stringent environmental regulations regarding engine emissions (e.g., Tier 4 standards), which necessitate higher manufacturing costs for compliance, and the fluctuating prices of petroleum products, which directly impact operating costs for end-users. Significant opportunities arise from the untapped potential in developing markets and the growing trend toward rental services, which broaden consumer access to expensive, high-quality thermal equipment.

Impact forces represent macroeconomic and structural elements that exert pressure on the market. These include geopolitical stability affecting agricultural trade and machinery exports, technological advances in battery technology which pose a competitive threat to the thermal segment, and demographic shifts suching as rural-to-urban migration, increasing the need for efficient mechanized substitutes for manual labor. The combined effect of these forces suggests a market that is fundamentally robust due to agricultural necessity but is simultaneously challenged to innovate rapidly to maintain compliance and competitive edge against emerging electric alternatives.

The market faces constant pressure from regulatory bodies to reduce the environmental footprint of small internal combustion engines. This constraint forces manufacturers to invest heavily in R&D for cleaner engine technologies, increasing the complexity and cost of thermal rototillers. However, this restraint simultaneously drives opportunity by favoring companies that successfully develop and market fuel-efficient, low-emission models. The overall impact forces dictate that while power and durability remain paramount, sustainability and compliance are rapidly becoming non-negotiable purchasing criteria for institutional buyers and environmentally conscious consumers globally.

Segmentation Analysis

The Thermal Rototiller Market segmentation provides a granular view of diverse consumer preferences and operational requirements, primarily categorized by Engine Type, Operation Type, Power Output, and End-User. Analyzing these segments helps manufacturers tailor product development and marketing strategies to specific user groups, ranging from residential homeowners requiring small, manageable units to large commercial farms demanding heavy-duty, high-horsepower machines. The structure of the market reveals a mature landscape where product differentiation, especially based on operational stability (front-tine vs. rear-tine) and power source (gasoline vs. diesel), dictates market share and revenue generation across various geographic regions and application niches. The complexity of segmentation reflects the wide array of tasks thermal rototillers perform, necessitating specialized design characteristics for optimal performance in diverse soil conditions.

The segmentation by Engine Type is critical as it defines performance characteristics and operational cost; gasoline engines dominate the consumer and mid-range professional market due to their balance of cost, weight, and power, whereas diesel engines are reserved for the most demanding commercial applications requiring sustained high torque and durability. Operation Type distinguishes between front-tine, rear-tine, and mini-tillers, where rear-tine models command a higher price point and are preferred by professional users for deep, stable tilling. Meanwhile, segmentation by Power Output categorizes tillers into low, medium, and high horsepower ranges, directly correlating with the size of the area they are designed to manage and the intensity of the soil preparation required. This layered segmentation analysis is essential for understanding competitive positioning and identifying the fastest-growing sub-markets within the overall thermal rototiller ecosystem.

- By Engine Type:

- Gasoline Thermal Rototillers

- Diesel Thermal Rototillers

- By Operation Type:

- Front-Tine Rototillers

- Rear-Tine Rototillers

- Mini/Cultivator Rototillers

- By Power Output (HP):

- Below 5 HP

- 5 HP to 10 HP

- Above 10 HP

- By End-User:

- Commercial Agriculture

- Landscaping and Horticulture

- Residential Gardening

- Rental Services

- By Distribution Channel:

- Online Sales

- Offline Sales (Dealerships, Retail Stores)

Value Chain Analysis For Thermal Rototiller Market

The value chain for the Thermal Rototiller Market initiates with upstream activities involving the sourcing and processing of raw materials, primarily specialized steel for tines and chassis, aluminum for engine components, and various plastics for housing and ergonomic parts. Key upstream suppliers include steel manufacturers, engine component fabricators, and specialized engine development firms (often external contractors for smaller tiller brands). Efficiency at this stage is crucial, as the cost of raw materials significantly dictates the final product price. Successful upstream management involves strategic long-term contracts and diversification of suppliers to mitigate geopolitical and commodity price risks, ensuring a steady supply of high-quality, durable materials necessary for equipment longevity and performance.

Manufacturing and assembly constitute the core phase, where engine integration, transmission systems, and frame welding take place. Companies with vertically integrated manufacturing processes, particularly those that produce their own engines or key transmission components, often achieve higher cost efficiencies and better quality control. Following assembly, the downstream activities focus heavily on distribution. This involves a dual channel approach: direct sales via company websites and specialized commercial partnerships for high-volume orders, and indirect sales through a robust network of authorized dealerships, large agricultural equipment retailers, and general hardware stores. Dealerships play a critical role, providing hands-on product demonstration, financing options, and essential post-sales support like maintenance and spare parts.

The market relies heavily on knowledgeable sales channels, particularly for professional-grade tillers, where technical specifications and application knowledge are vital for customer conversion. Direct distribution channels, particularly online platforms, are gaining prominence for smaller, consumer-focused models, offering transparency and competitive pricing. The effectiveness of the value chain is ultimately measured by the responsiveness of the after-sales service (parts availability and repair turnaround), which is a major differentiator in the professional segment. Optimization across the chain—from material procurement to service delivery—is essential for maintaining competitive pricing and customer loyalty in this heavy machinery market.

Thermal Rototiller Market Potential Customers

The potential customer base for the Thermal Rototiller Market is diverse, spanning multiple sectors that prioritize powerful, self-contained machinery for rigorous soil preparation tasks. The primary and largest segment of end-users are professional commercial farmers and large-scale agricultural enterprises who require heavy-duty, often diesel-powered, rear-tine tillers (typically 10 HP and above) for extensive field preparation, residue incorporation, and soil aeration across hundreds of acres. These buyers prioritize durability, horsepower, fuel efficiency, and compatibility with standardized tractor hitches, viewing the rototiller as a long-term capital investment directly impacting crop yield and operational efficiency. They demand robust warranty coverage and guaranteed access to immediate service and spare parts to minimize costly downtime during critical planting seasons.

The second major consumer segment includes professional landscaping firms and commercial horticulture operators. These buyers typically require mid-range gasoline tillers (5-10 HP) that offer a blend of power, maneuverability, and ease of transport. Their applications focus on preparing soil for new lawns, garden beds, large flower displays, and managing ground cover in public parks or corporate campuses. For this group, ergonomic design, ease of use in confined spaces, and reliability are key purchasing factors. The third significant customer segment encompasses residential gardening enthusiasts and small-plot farmers (hobby farmers), who typically opt for smaller, front-tine or mini-tillers (below 5 HP). While they prioritize affordability and simple operation, they still require the reliable power of a thermal engine for breaking new ground or turning over compacted soil that electric models struggle to manage.

Additionally, equipment rental companies constitute a crucial buying segment. These businesses purchase a broad fleet of tillers across all power outputs to cater to intermittent professional and consumer needs. Rental companies seek machinery known for its ruggedness, simplicity of maintenance, and high resistance to wear and tear due to diverse user handling. Their purchasing decisions are heavily influenced by the equipment’s expected lifespan and total cost of ownership (TCO) over frequent operational cycles. Therefore, manufacturers must cater product features, warranty structures, and service packages specifically to the demanding requirements of the rental industry to secure substantial bulk orders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.72 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honda Motor Co., Ltd., The Toro Company, MTD Products Inc., Husqvarna Group, Stanley Black & Decker, Inc. (Troy-Bilt), Generac Power Systems, Inc., Briggs & Stratton, AriensCo, Schiller Grounds Care, Inc. (Mantis), Greenworks Tools, Tuff Stuff, Earthwise, YARDMAX, DR Power Equipment, BCS S.p.A., Grillo S.p.A., Texas A/S, Pubert, STIHL Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Rototiller Market Key Technology Landscape

The technology landscape for the Thermal Rototiller Market is primarily centered around optimizing internal combustion engine performance while adhering to environmental standards, improving transmission systems for enhanced durability and efficiency, and implementing advanced material science for lighter yet stronger chassis and tines. Key technological advancements in engines focus on electronic fuel injection (EFI) systems, replacing traditional carburetors, to ensure precise fuel delivery, resulting in better fuel economy, easier starting in various weather conditions, and lower harmful emissions, crucial for meeting modern regulatory mandates like EPA and Euro Stage V standards. Furthermore, muffler and catalytic converter technology is continually evolving to manage noise levels and particulate matter emissions effectively, making the equipment more suitable for use in proximity to residential areas and enclosed spaces.

In terms of operational technology, advanced hydrostatic transmissions are increasingly being adopted, particularly in high-end rear-tine tillers. Hydrostatic drive systems provide smooth, infinite variability of speed control both forward and reverse, allowing the operator to precisely match tilling speed to soil conditions without engaging clutches, significantly reducing operator fatigue and improving the quality of the soil preparation. Complementing this, manufacturers are utilizing high-tensile, heat-treated steel alloys for tines and blades, which increases resistance to abrasion and breakage, thereby extending the operational lifespan of the critical working components and reducing the frequency of maintenance and replacement costs for professional users operating in rocky or compacted soils. This focus on material innovation directly contributes to the overall ruggedness expected of thermal machinery.

Beyond core mechanics, connectivity and smart features are slowly permeating the thermal market, albeit less rapidly than in the electric segment. Telematics systems are being integrated into large commercial rototillers, enabling fleet managers to track location, monitor operating hours, and receive diagnostic alerts remotely. While not a fully autonomous technology, these basic telematics improve asset utilization and facilitate proactive maintenance scheduling, further driving operational efficiency. Future technology development is expected to focus on coupling these remote monitoring capabilities with sophisticated anti-vibration technologies, utilizing advanced dampening materials and counterweights integrated into the gearbox and handle assemblies to enhance user comfort and reduce the risk of long-term operational injuries, making the thermal rototiller a safer and smarter piece of heavy equipment.

Regional Highlights

Regional dynamics significantly influence the demand, technology adoption, and regulatory environment of the Thermal Rototiller Market. North America, characterized by large-scale commercial farming operations in the Midwest and a robust professional landscaping industry nationwide, represents a mature market segment. Demand here is stable, driven primarily by equipment replacement cycles and the need for high-horsepower, emission-compliant thermal tillers. Manufacturers in this region focus intensely on developing machines that meet stringent EPA regulations (Tier 4 Final) while maintaining the power output required for intensive agricultural use. The strong presence of the rental market also fuels consistent demand for durable, professional-grade machinery.

Europe mirrors North America in terms of maturity but exhibits a stronger focus on smaller, highly maneuverable tillers due to smaller average farm sizes and a greater prevalence of specialized horticulture, particularly in countries like Italy and Germany. European regulations, particularly the EU’s Stage V emissions standards, are among the strictest globally, mandating continuous technological investment in clean diesel and gasoline engines. Consequently, the European market shows a higher willingness to pay a premium for advanced, ergonomic, and environmentally compliant equipment. Furthermore, the strong integration of safety features is a major regional procurement criteria, prioritizing operator well-being and reducing accident rates on smaller, tightly managed plots.

Asia Pacific (APAC) is the engine of growth for the thermal rototiller market. Countries such as China, India, and Southeast Asian nations are experiencing rapid agricultural mechanization as labor costs rise and government policies promote farming modernization. This region demonstrates immense demand for affordable, durable, and mid-range horsepower tillers (5-8 HP) suitable for rice paddies, vegetable farming, and mixed-crop cultivation on smaller, dispersed land holdings. The market is less constrained by emission regulations than the West, allowing for greater affordability, though this is beginning to change. The market is highly competitive, dominated by both local manufacturers providing cost-effective solutions and international players introducing quality, reliable thermal units tailored to local soil conditions and farming practices.

Latin America and the Middle East & Africa (MEA) are emerging markets offering substantial long-term growth opportunities. Latin America, with vast expanses of undeveloped or under-mechanized agricultural land, is seeing increased government focus on improving farming efficiency, driving initial adoption of basic, rugged thermal rototillers. In MEA, particularly in regions where irrigation is successfully implemented, the need for effective soil preparation for cash crops and staple foods is growing. These regions typically demand machines that are easy to maintain, can handle extreme heat and dust, and operate reliably using locally available fuel sources. Infrastructure challenges, including limited dealership networks and difficulty in servicing complex machinery, mean simpler, robust thermal designs often perform better here, making them crucial focus areas for manufacturers seeking geographic diversification and first-mover advantage.

- North America: Market stability driven by equipment replacement, strong rental sector, and compliance with stringent EPA emission standards for high-horsepower commercial tillers.

- Europe: High demand for advanced, ergonomic, and low-emission machinery (Stage V compliant), focusing on specialized horticulture and smaller, intensively managed plots.

- Asia Pacific (APAC): Fastest-growing region due to rapid agricultural mechanization, demanding affordable, durable, mid-range tillers for small and medium-scale farming in countries like India and China.

- Latin America & MEA: Emerging markets with potential, focused on basic, rugged, and easily maintainable thermal units for large-scale agricultural modernization projects and resilience in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Rototiller Market.- Honda Motor Co., Ltd.

- The Toro Company

- MTD Products Inc.

- Husqvarna Group

- Stanley Black & Decker, Inc. (Troy-Bilt)

- Generac Power Systems, Inc.

- Briggs & Stratton

- AriensCo

- Schiller Grounds Care, Inc. (Mantis)

- Greenworks Tools

- Tuff Stuff

- Earthwise

- YARDMAX

- DR Power Equipment

- BCS S.p.A.

- Grillo S.p.A.

- Texas A/S

- Pubert

- STIHL Group

- Maschio Gaspardo S.p.A.

Frequently Asked Questions

Analyze common user questions about the Thermal Rototiller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key differentiator between front-tine and rear-tine thermal rototillers?

The key differentiator lies in stability and power application. Front-tine tillers, where the tines are located under the engine, are generally lighter, more suitable for cultivation, and propel themselves forward. Rear-tine tillers are heavier, use powered wheels, and have tines located behind the wheels, offering superior stability, deeper tilling depth, and are ideal for breaking tough, compacted soil over large areas, making them the preferred choice for commercial use.

How do emission regulations impact the cost and design of modern thermal rototillers?

Stringent global emission regulations, such as EPA Tier 4 and EU Stage V, necessitate the integration of expensive components like catalytic converters, advanced muffler systems, and electronic fuel injection (EFI) technology. This regulatory compliance directly increases the manufacturing cost, leading to higher retail prices for modern thermal rototillers, but ensures improved fuel efficiency and reduced environmental pollutants.

Is the Thermal Rototiller Market facing competition from electric models?

Yes, electric (battery-powered) rototillers are growing rapidly, primarily competing in the residential and light-duty segments due to their low noise, zero emissions, and minimal maintenance. However, thermal rototillers maintain a competitive advantage in the professional and heavy-duty commercial sectors where their superior sustained power, longer run times, and ability to handle deeply compacted or rocky soil remain indispensable features.

Which regions are driving the highest growth rates for thermal rototillers?

The Asia Pacific (APAC) region, specifically emerging economies like India and China, is projected to drive the highest growth rates. This acceleration is attributed to increasing government support for agricultural mechanization, rising farm income, and the critical need to replace manual labor with efficient, robust thermal machinery to maximize crop yields across diverse terrains.

What are the primary factors consumers consider when purchasing a thermal rototiller?

Consumers prioritize several key factors, including Engine Reliability and Power Output (horsepower), which dictates tilling capacity; Tine Durability and Material Quality; Operational Ergonomics (vibration dampening and ease of handling); and importantly, the availability and reputation of Local After-Sales Service and Spare Parts, ensuring minimal operational downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager