Thermal Socks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436706 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Thermal Socks Market Size

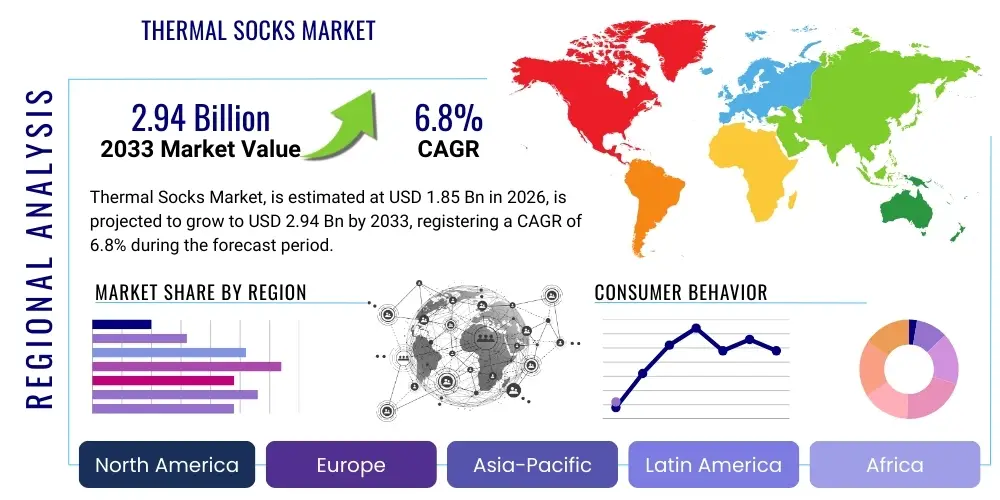

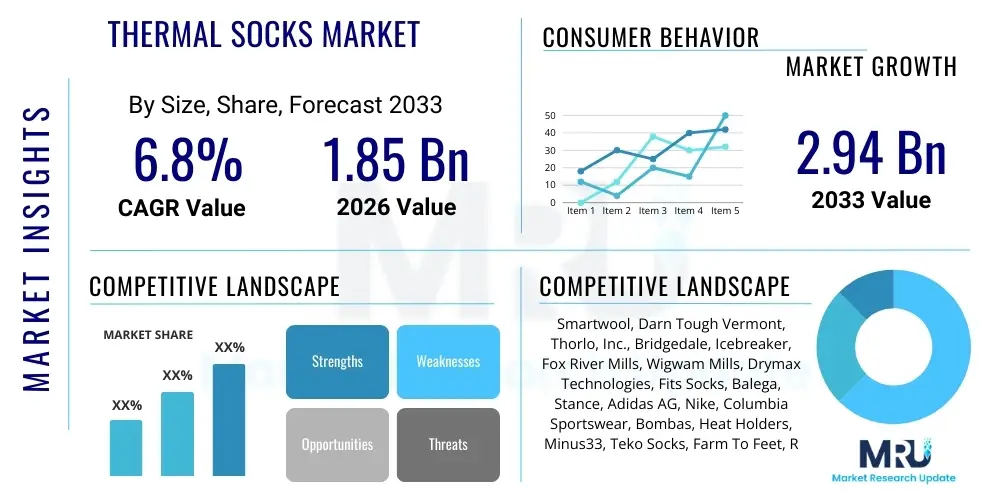

The Thermal Socks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.94 billion by the end of the forecast period in 2033.

Thermal Socks Market introduction

The Thermal Socks Market encompasses the global trade of specialized hosiery designed primarily to retain body heat and provide superior insulation in cold environments. These products utilize advanced material compositions, including merino wool, acrylic blends, synthetic fibers like polyester and polypropylene, and innovative thermal linings, to trap air and prevent heat loss. They are engineered to offer enhanced warmth without excessive bulk, often incorporating moisture-wicking capabilities to keep feet dry, which is critical for maintaining warmth and comfort during prolonged outdoor activities or in severely cold conditions. The fundamental objective is to provide a thermal barrier that adapts to varying levels of physical activity, making them indispensable gear for consumers.

Major applications of thermal socks span a wide range of activities and professions, driven primarily by leisure and occupational requirements. Key application areas include winter sports such as skiing, snowboarding, and ice climbing, where performance and thermal regulation are paramount. They are also heavily utilized by outdoor enthusiasts engaged in hiking, camping, and hunting during colder months. Furthermore, industrial and occupational applications, such as construction workers, delivery personnel, and military personnel operating in cold climates, constitute a significant segment of demand. The rise in popularity of adventure tourism and the increasing focus on health and wellness, which encourages participation in outdoor winter activities, further solidifies the market's application base.

The primary benefits driving consumer adoption include superior insulation properties compared to traditional cotton or standard wool socks, coupled with improved durability and comfort through advanced ergonomic design. Factors propelling market growth include the rising frequency of cold weather extremes globally, increased consumer spending on specialized athletic and outdoor apparel, and continuous innovation in textile technology that introduces lighter, warmer, and more breathable materials. The development of 'smart' thermal socks with integrated heating elements and temperature regulation features represents a key driver expanding the market beyond traditional materials, positioning thermal socks as an essential component of specialized cold-weather gear.

Thermal Socks Market Executive Summary

The Thermal Socks Market is characterized by robust growth, fueled by rising global participation in winter sports and increasing consumer awareness regarding the necessity of performance-driven cold-weather clothing. Key business trends indicate a strong shift toward sustainable and natural materials, particularly certified merino wool, driven by ethical sourcing mandates and consumer preference for eco-friendly products. Simultaneously, technological advancements are pushing the boundaries of material science, leading to the integration of phase change materials (PCMs) and battery-operated heating elements in premium offerings, thereby expanding the average selling price and profitability margins for high-end brands. Competitive strategies are centered on product differentiation through specialized design for niche activities (e.g., mountaineering versus casual wear) and aggressive digital marketing campaigns targeting the affluent outdoor recreation demographic, leading to heightened brand loyalty and fragmented market leadership across different price points.

Regionally, North America and Europe maintain dominance, attributed to high disposable incomes, deeply embedded winter sports cultures, and well-established retail infrastructure for specialized sporting goods. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily due to expanding middle classes in countries like China and India, coupled with increasing interest in trekking, skiing, and international travel to cold destinations. Market penetration strategies in APAC focus on balancing performance with affordability. Segment trends reveal that synthetic fibers still hold the largest volume share due to cost-effectiveness and excellent moisture management, but the natural fibers segment, led by merino wool, is commanding higher value share due to perceived quality, comfort, and sustainability credentials. The specialized heating element segment, while small, is exhibiting exponential growth, representing a critical future investment area for market incumbents seeking technological advantage.

The overall market trajectory is positive, reflecting resilience against minor economic fluctuations as thermal socks transition from a seasonal novelty to an essential component of safety and comfort gear in cold conditions. The market structure remains moderately consolidated, with a few global apparel giants competing fiercely with specialized hosiery manufacturers and niche outdoor gear companies. Strategic mergers, acquisitions, and collaborations focused on supply chain efficiency and material innovation are expected to shape the competitive landscape, while stringent quality standards and certifications pertaining to material composition and thermal rating will become increasingly important differentiation factors, impacting procurement decisions both by end-users and organizational buyers.

AI Impact Analysis on Thermal Socks Market

Common user questions regarding AI's impact on the thermal socks market primarily revolve around three key themes: manufacturing efficiency, material innovation driven by data, and personalized product recommendations. Users frequently inquire if AI can optimize knitting patterns to improve thermal retention without adding bulk, or if machine learning algorithms can predict consumer preferences for specific thermal ratings based on geographical location and activity type. Concerns often focus on the potential for AI-driven automation to reduce employment in textile manufacturing and how intellectual property related to AI-generated textile designs will be managed. Overall, the expectation is that AI will streamline the entire value chain, from predicting raw material costs and optimizing inventory management to designing next-generation adaptive thermal textiles that automatically adjust insulation based on real-time temperature fluctuations and user physiology, ultimately leading to highly customized, high-performance products and significantly reduced production waste.

The application of AI in textile manufacturing is poised to revolutionize the operational efficiency of thermal sock production. AI-powered monitoring systems can analyze data from high-speed knitting machines to predict equipment failure, minimizing downtime and ensuring consistent quality control across large production batches. Furthermore, deep learning models are capable of processing complex thermal imagery and biometric data collected from wear testing. This analysis informs design modifications, allowing manufacturers to create socks with spatially varied insulation densities—thicker padding in high-impact areas and precise thermal regulation zones—a level of customization and efficiency unattainable through traditional design methods. This shift ensures a faster iteration cycle for product development, directly translating to superior performance characteristics for the end-consumer.

Beyond manufacturing, AI significantly influences supply chain resilience and market forecasting. Predictive analytics utilizes historical sales data, weather patterns, and major event schedules (e.g., Winter Olympics, outdoor festivals) to forecast demand with unprecedented accuracy, allowing companies to optimize inventory levels and reduce costs associated with overstocking or stockouts. In the realm of retail, AI-driven recommendation engines analyze individual purchasing habits, preferred activities, and geographic climate profiles to suggest the optimal thermal sock material and style, dramatically enhancing the customer experience and increasing conversion rates. This personalization capability, driven by machine learning, is vital for maintaining competitive advantage in the fragmented e-commerce environment prevalent in specialized apparel markets, linking material innovation directly to targeted sales strategies.

- AI optimizes knitting machine parameters for maximized thermal efficiency and reduced material usage.

- Machine Learning algorithms predict raw material price fluctuations, enhancing procurement strategy and cost management.

- Predictive maintenance systems minimize production downtime by anticipating equipment failures in manufacturing facilities.

- AI-driven biometric analysis facilitates the design of personalized thermal zoning and adaptive insulation in performance socks.

- Natural Language Processing (NLP) analyzes customer feedback and reviews to rapidly identify and address product deficiencies or unmet thermal requirements.

- Automated demand forecasting integrates weather data and seasonal trends for optimized inventory and supply chain resilience.

DRO & Impact Forces Of Thermal Socks Market

The Thermal Socks Market is shaped by a confluence of influential factors that drive growth while simultaneously imposing regulatory and operational challenges. Key drivers include the pervasive trend toward outdoor recreational activities, such as hiking, mountaineering, and trail running, even in cooler seasons, coupled with an aging population in developed economies seeking comfort and therapeutic warmth. Restraints primarily involve the seasonal nature of demand, which complicates inventory management, and the high initial cost associated with specialized materials like high-grade merino wool or electrically heated components, often deterring price-sensitive consumers. Opportunities lie in the burgeoning market for 'smart' thermal wear and penetration into developing economies where harsh winters are common but access to specialized apparel is currently limited, enabling diversified revenue streams.

The primary impact forces governing the market dynamics are technological innovation and consumer lifestyle shifts. Technological advancements in synthetic fiber engineering and moisture management techniques continuously improve product performance, offering superior warmth-to-weight ratios, thus maintaining high consumer interest. Simultaneously, the pronounced global shift towards active lifestyles and the increasing focus on high-quality, durable goods influence purchasing decisions, demanding premiumization across product lines. External forces, such as climate change resulting in unpredictable severe cold snaps, also occasionally spike demand, though the regulatory push towards sustainable and ethical sourcing significantly impacts the supply chain structure and cost base, compelling manufacturers to invest in environmentally compliant processes and materials.

The interaction between these forces dictates the competitive intensity. The driver of enhanced outdoor participation necessitates continuous material science research, pushing the boundaries of insulation technology. Conversely, the restraint of high raw material costs for premium fibers like ethically sourced wool fosters intense competition in the synthetic segment, driving innovation toward more cost-effective, high-performance substitutes. Successful navigation of this market requires firms to balance premium material offerings with accessible, high-performing synthetic options, while simultaneously leveraging technological opportunities, such as incorporating flexible heating circuits, to capture the high-value niche segments of the market.

Segmentation Analysis

The Thermal Socks Market is fundamentally segmented based on factors such as the primary material composition, the specific end-user application, the distribution channel utilized for sales, and the technology incorporated for thermal regulation. Analyzing these segments provides a granular view of consumer preferences, competitive hotspots, and potential areas for investment. The segmentation reflects a consumer landscape that is increasingly polarized: on one hand, seeking performance and durability driven by material science; on the other, demanding convenience and accessibility through digital distribution channels. Understanding the performance disparities and cost structures across materials, particularly the divide between natural fibers like wool and specialized synthetic blends, is crucial for market positioning.

Segmentation by material is perhaps the most critical determinant of product value and market strategy, influencing attributes such as moisture-wicking capability, odor resistance, durability, and softness. Synthetic materials, predominantly polyester and acrylic, currently dominate the volume share due to their affordability, quick-drying properties, and inherent moisture management capabilities suitable for high-intensity activities. Conversely, the natural fiber segment, primarily centered on merino wool, commands a higher average selling price (ASP) and value share, capitalizing on consumer willingness to pay a premium for natural comfort, superior insulation, and inherent antimicrobial properties. The strategic interplay between these two segments involves synthetic brands attempting to mimic the feel of natural fibers, while natural fiber brands focus on enhancing durability and drying speed through blending techniques.

The end-user segmentation separates the market into various functional applications—Sports & Outdoor, Casual Wear, and Military & Industrial—each with distinct performance requirements and purchasing criteria. Sports and Outdoor users prioritize breathability, specific cushioning, and targeted insulation for intense activity. Casual users focus on comfort, style, and everyday warmth, often accepting slightly lower performance specifications for a reduced price point. The Military and Industrial segment, however, demands the highest level of durability, extreme cold protection (often requiring sub-zero ratings), and compliance with specific regulatory standards, often leading to specialized, high-cost, bulk procurement contracts. Distribution channels further segment the market into specialized retail (critical for high-touch, informed sales), mass retail (volume sales), and e-commerce, which is increasingly becoming the preferred channel for brand discovery and direct-to-consumer relationships due to optimized search capabilities.

- By Material:

- Natural Fibers (Merino Wool, Alpaca Wool, Cashmere)

- Synthetic Fibers (Polyester, Acrylic, Polypropylene, Nylon Blends)

- Blends (Wool/Synthetic Mixes)

- By End-User:

- Sports & Outdoor Enthusiasts (Skiing, Hiking, Hunting)

- Casual & Daily Wear

- Military & Industrial (Occupational Cold Protection)

- By Distribution Channel:

- Specialty Retail Stores (Outdoor Gear Shops)

- Hypermarkets/Supermarkets

- Online Retail (E-commerce Platforms and Direct-to-Consumer Websites)

- By Technology:

- Standard Insulation

- Heated (Battery-Operated/Electric)

- Phase Change Materials (PCM Integrated)

- By Thickness/Weight:

- Lightweight

- Midweight

- Heavyweight/Expedition

Value Chain Analysis For Thermal Socks Market

The value chain of the Thermal Socks Market begins with the upstream procurement of specialized raw materials, followed by complex manufacturing and finishing processes, culminating in multi-channel distribution to end-consumers. Upstream analysis focuses heavily on the sourcing of high-grade natural fibers, particularly specialized wool (like ethically certified ZQ Merino), and the formulation of proprietary synthetic blends. The efficiency and cost-effectiveness at this stage are paramount, as raw material costs constitute a significant portion of the final product price. Relationships with specialized textile producers and chemical companies for advanced finishes (e.g., moisture management, anti-odor treatments) dictate product quality and innovation speed. Sustainable sourcing certifications and vertical integration, particularly in the merino wool segment, offer significant competitive advantages by ensuring supply stability and quality control from the fiber stage onward.

Midstream activities involve spinning, dyeing, knitting, and finishing. The transition from bulk yarn to a finished thermal sock relies heavily on precision knitting technology, particularly computer-controlled seamless knitting machines (like Santoni or Lonati), which allow for differentiated cushioning, compression zones, and integrated thermal mapping without irritating seams. Quality control checkpoints are rigorous, ensuring consistency in thermal rating and structural integrity. Downstream analysis focuses on effective market penetration, primarily driven by branding, marketing, and distribution. Successful brands leverage digital platforms (direct-to-consumer e-commerce) to control brand narrative and margins, alongside strategic placement in specialized outdoor retail stores where staff expertise can effectively communicate the technical superiority of premium products.

Distribution channels are categorized into direct and indirect routes. Direct sales, typically through proprietary e-commerce sites or physical brand stores, offer higher margins and immediate consumer feedback loops, which are crucial for quick product iteration. Indirect channels involve partnerships with specialty sporting goods retailers, large department stores, and mass merchants. The choice of channel is often dictated by the product's price point and target audience; high-end performance socks favor specialty retail for consultative sales, while everyday thermal socks rely on the volume and reach of mass retail. Ensuring adequate inventory levels across all channels, especially given the seasonal peak demand, is a critical logistical challenge managed through sophisticated supply chain planning software.

Thermal Socks Market Potential Customers

The potential customer base for the Thermal Socks Market is extensive and highly diverse, encompassing anyone requiring enhanced foot warmth and protection in cold or adverse conditions. The largest volume segment consists of general consumers utilizing the product for casual, daily use during winter months, prioritizing comfort and basic insulation over technical specifications. However, the highest value customers are typically affluent, performance-oriented individuals engaged in specialized outdoor and winter recreational activities, such as expert skiers, snowboarders, mountaineers, and professional trekkers, who demand premium materials, targeted compression, and specialized thermal ratings, often purchasing multiple high-cost pairs annually for different activity levels and weather conditions. These buyers are highly informed, relying on specialized retail advice and peer reviews to guide their purchasing decisions, often showing strong brand loyalty to established performance names.

A second crucial segment comprises organizational buyers, primarily represented by military and governmental agencies, industrial entities, and specialized occupational groups. Military forces require rigorously tested, durable, and highly insulative socks that adhere to specific logistical and performance standards for operation in extreme climates. Similarly, construction companies, utility providers, and outdoor service professionals purchase industrial-grade thermal socks in bulk to ensure worker safety and compliance with occupational health standards during winter. These large-volume contracts are less sensitive to retail pricing fluctuations but highly sensitive to durability specifications and consistent supply, requiring manufacturers to maintain rigorous quality control protocols and robust bulk production capacity.

The emerging customer base includes travelers seeking cold-weather adventure tourism and the growing population of elderly individuals. As adventure tourism to destinations like Iceland, Patagonia, and the Himalayas becomes more accessible, the demand for reliable, high-performance thermal gear increases among casual tourists. Simultaneously, geriatric consumers seek thermal socks for therapeutic reasons, requiring enhanced blood circulation and consistent warmth management, driving demand for softer, non-binding materials and, increasingly, battery-heated options. Targeting these diverse end-users requires tailored marketing messages and product lines that address specific needs, such as non-restrictive designs for the elderly or extreme durability for industrial applications, utilizing data-driven personalization techniques to maximize outreach effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.94 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smartwool, Darn Tough Vermont, Thorlo, Inc., Bridgedale, Icebreaker, Fox River Mills, Wigwam Mills, Drymax Technologies, Fits Socks, Balega, Stance, Adidas AG, Nike, Columbia Sportswear, Bombas, Heat Holders, Minus33, Teko Socks, Farm To Feet, Rocky Mountain Stockings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Socks Market Key Technology Landscape

The technological evolution within the Thermal Socks Market is driven by the imperative to enhance warmth-to-weight ratios, improve moisture management, and increase overall durability and comfort. The core technology remains advanced textile engineering, focusing on utilizing hollow-core fibers (like polypropylene or specialized polyester) that trap air effectively, mimicking natural insulation mechanisms. Knitting technology has advanced significantly, moving from simple circular knitting to highly complex 3D mapping and compression techniques. Seamless toe closures and strategically placed cushioning zones, achieved through computer-aided design (CAD) and precision machinery, minimize friction and pressure points, a critical factor for performance users in activities like skiing or long-distance trekking, directly contributing to injury prevention and enhanced wearer comfort during prolonged use.

A major area of differentiation lies in proprietary moisture-wicking and anti-odor treatments. High-performance thermal socks integrate specialized chemical finishes, often utilizing silver ion technology or natural antimicrobial agents, to inhibit bacterial growth and manage odor, crucial for multi-day usage without washing. Furthermore, research into fiber blends, such as combining the softness and thermal regulation of merino wool with the strength and fast-drying capabilities of synthetic nylon, maximizes the benefits of both material types while mitigating their individual weaknesses. These technological material combinations are often patented and serve as key competitive assets for market leaders, ensuring their products maintain performance superiority across diverse environmental conditions, especially those involving rapid changes in physical activity and temperature.

The most transformative technology entering the market is the integration of electronic components, specifically in heated thermal socks. These products incorporate thin, flexible heating elements, often utilizing carbon fiber or specialized alloys, powered by small, rechargeable lithium-ion battery packs strategically placed in the cuff area. This innovation allows users to actively regulate foot temperature via integrated controls or even smartphone applications, offering precise warmth management critical for users in extremely cold conditions or those suffering from circulatory issues like Raynaud's phenomenon. Though currently a niche segment due to higher cost and maintenance, the heated thermal sock category represents the future intersection of apparel and smart technology, driving R&D efforts aimed at reducing battery size, increasing battery life, and enhancing the washability and durability of the embedded electronic circuits, significantly expanding the functional limits of traditional thermal protection.

Regional Highlights

The global demand for thermal socks exhibits distinct regional variations influenced by climatic conditions, cultural affinity for winter sports, and disposable income levels. North America (comprising the US and Canada) represents a mature, high-value market characterized by robust demand for premium, technically sophisticated products. Consumers here possess high purchasing power and engage extensively in recreational activities such as skiing, hunting, and mountaineering, necessitating specialized, high-performance thermal wear. The market is highly competitive, driven by strong brand loyalty and rapid adoption of innovations like smart heated socks and sustainable material options. The regulatory environment also emphasizes product safety and environmental compliance, pushing manufacturers toward certified sourcing and manufacturing processes.

Europe, particularly the Nordic countries, the Alps region, and Central Europe, is another dominant market, echoing North America’s focus on performance but with a potentially higher emphasis on sustainability and natural fibers, especially merino wool, driven by strong environmental awareness. Germany, France, and the UK are key markets, characterized by significant outdoor retail presence and strong domestic hosiery manufacturing capabilities. The demand is segmented strongly between high-performance sports socks and durable industrial thermal wear. Eastern Europe is showing rapid growth, fueled by rising disposable income and increasing integration into global winter tourism circuits, generating substantial demand for both mid-range and premium products tailored to diverse cold-weather needs.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven primarily by population size, rapid urbanization, and the expanding middle class in China, Japan, and South Korea, which are increasingly investing in winter leisure activities and experiencing severe cold weather in northern provinces. While manufacturing is highly concentrated in this region, consumer demand is rapidly shifting from basic thermal protection to branded, performance-oriented imports, reflecting changing lifestyle preferences and increased exposure to global retail trends. Market entry barriers for international brands are decreasing, but localized distribution strategies and culturally appropriate marketing are essential for success. Meanwhile, Latin America and the Middle East & Africa (MEA) remain smaller, more specialized markets. Demand in MEA is largely concentrated in high-altitude or extremely cold pockets and for military/industrial applications, with market dynamics highly dependent on import tariffs and logistics efficiency, often favoring durable, multi-purpose synthetic options due to cost considerations.

- North America: Dominant market share due to high consumer spending on specialized outdoor apparel, established winter sports culture, and early adoption of technological innovations like smart heating.

- Europe: Strong demand focused on performance and sustainability; high penetration of ethically sourced merino wool; robust demand from Alpine sports and general cold weather protection across densely populated regions.

- Asia Pacific (APAC): Highest CAGR driven by increasing middle-class disposable income, expanding winter sports infrastructure (especially in China and South Korea), and reliance on localized manufacturing hubs.

- Latin America (LATAM): Niche demand concentrated in the Andean mountain regions and southern cone (Patagonia); reliance on durable, cost-effective imported synthetics for functional needs.

- Middle East & Africa (MEA): Smallest market share, driven primarily by industrial (oil & gas, construction) and military requirements in areas with severe temperature variance or high-altitude cold.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Socks Market.- Smartwool

- Darn Tough Vermont

- Thorlo, Inc.

- Bridgedale

- Icebreaker

- Fox River Mills

- Wigwam Mills

- Drymax Technologies

- Fits Socks

- Balega

- Stance

- Adidas AG

- Nike

- Columbia Sportswear

- Bombas

- Heat Holders

- Minus33

- Teko Socks

- Farm To Feet

- Rocky Mountain Stockings

Frequently Asked Questions

Analyze common user questions about the Thermal Socks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between merino wool and synthetic thermal socks?

Merino wool thermal socks offer superior natural warmth, breathability, and inherent antimicrobial properties, making them ideal for multi-day use. Synthetic socks (polyester/acrylic) are generally cheaper, dry significantly faster, and provide excellent moisture-wicking capabilities, suitable for high-intensity, short-duration activities.

How is the market for thermal socks segmented by technology?

The market is segmented into Standard Insulation (relying on material properties), Heated (incorporating rechargeable electric elements for active warmth regulation), and Phase Change Material (PCM) integrated socks, which manage temperature by absorbing and releasing heat as needed for dynamic regulation.

Which regions are expected to drive the fastest growth in the thermal socks market?

The Asia Pacific (APAC) region, driven by countries like China and South Korea, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to increasing discretionary spending, growth in adventure tourism, and rising consumer awareness of performance apparel.

What are the main drivers influencing the price of premium thermal socks?

Premium thermal sock pricing is primarily driven by the high cost of specialized, ethically sourced raw materials (like certified merino wool), complex seamless knitting technologies that enhance comfort and fit, and proprietary moisture-wicking or anti-odor treatments applied during the finishing process.

How does the integration of AI affect the manufacturing of thermal socks?

AI impacts manufacturing by optimizing knitting machine parameters for maximized thermal efficiency, predicting equipment maintenance needs to reduce downtime, and analyzing large datasets of wear tests to inform precise designs for targeted cushioning and thermal zoning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager