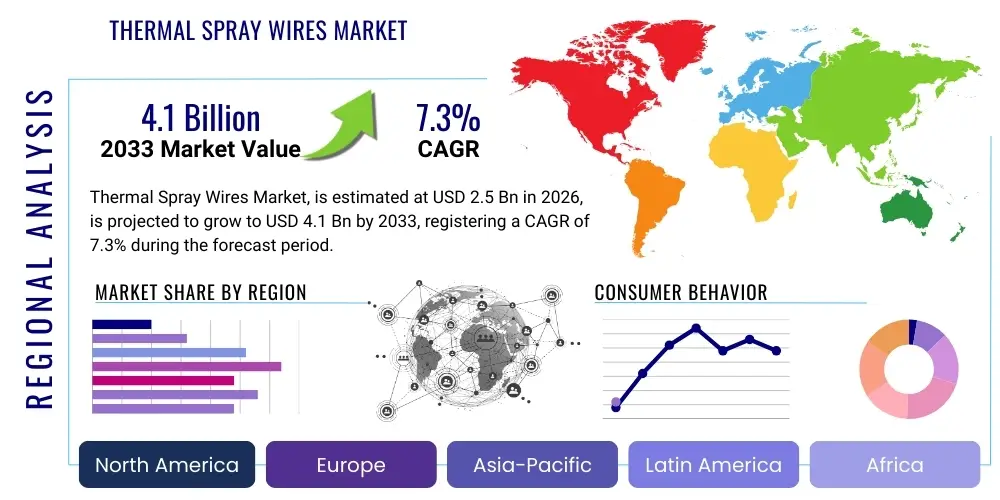

Thermal Spray Wires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432257 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Thermal Spray Wires Market Size

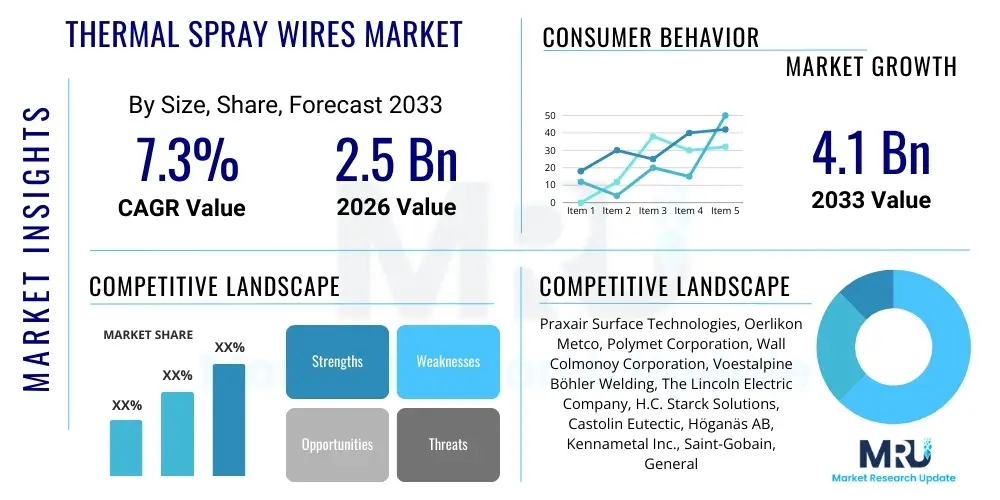

The Thermal Spray Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Thermal Spray Wires Market introduction

The Thermal Spray Wires Market encompasses the production and distribution of specialized feedstock materials used in various thermal spraying techniques, including arc spraying, flame spraying, and high-velocity oxy-fuel (HVOF) processes. These wires, typically composed of pure metals, alloys (like nickel, cobalt, aluminum, and zinc), or composite materials, are melted and propelled onto a substrate surface to create a durable protective coating. This crucial surface engineering process enhances the operational life and performance of components by imparting characteristics such as superior resistance to wear, corrosion, abrasion, erosion, and high temperatures, while also providing desired electrical or thermal properties.

Major applications for thermal spray wires span across heavy industries demanding component reliability under extreme conditions. The aerospace sector utilizes these wires for refurbishing and protecting critical engine and airframe components, ensuring safety and compliance with rigorous operational standards. Similarly, the automotive industry employs coatings for engine blocks, piston rings, and synchronization gears to improve efficiency and reduce friction. The energy sector, encompassing oil and gas, power generation (gas turbines, boilers), and renewable energy, relies heavily on thermal spray coatings to protect equipment from aggressive chemical environments and extreme heat exposure, which is fundamental to maintaining operational uptime and efficiency.

The key driving factors propelling market expansion include the global trend toward lightweighting materials in automotive and aerospace industries, the increasing demand for extending the operational life of legacy infrastructure, and the rising industrial focus on maintenance, repair, and overhaul (MRO) activities rather than full component replacement. Furthermore, the continuous development of advanced alloy wires, offering tailored properties for specific applications, coupled with stringent environmental regulations requiring more durable and efficient industrial processes, are cementing the essential role of thermal spray wires in modern manufacturing and protective engineering.

Thermal Spray Wires Market Executive Summary

The Thermal Spray Wires Market is characterized by robust growth fueled by increasing industrialization, particularly in the Asia Pacific region, and the escalating need for component protection against severe operating conditions across key end-use sectors like aerospace and power generation. Business trends indicate a strong focus on developing composite and complex alloy wires, moving beyond traditional pure metal wires, to cater to niche, high-performance applications that demand enhanced resistance properties and superior bonding strength. Strategic mergers and acquisitions, alongside partnerships between wire manufacturers and equipment suppliers, are observed as companies seek to integrate solutions and streamline the supply chain to offer comprehensive thermal spray packages to end-users globally. Furthermore, sustainability initiatives are driving innovation towards cleaner coating processes and materials with lower environmental impact.

Regional trends highlight Asia Pacific as the fastest-growing market, primarily due to massive investments in infrastructure development, rapid expansion of the automotive manufacturing base in countries like China and India, and significant MRO activities in the domestic airline industry. North America and Europe, while mature, maintain substantial market shares driven by stringent regulatory frameworks mandating high safety standards in aerospace and sophisticated energy infrastructure requirements, leading to consistent demand for high-value, specialized wires. The market structure remains moderately consolidated, with major players investing heavily in R&D to optimize wire feedstock quality, uniformity, and purity to meet increasingly precise application specifications from tier-one manufacturers.

Segment trends underscore the dominance of the Arc Spray segment due to its cost-effectiveness, high deposition rates, and ease of application, making it favorable for large-scale protective coatings like anticorrosion and infrastructure preservation. Material segmentation reveals that nickel- and aluminum-based alloys hold significant shares, driven by their superior performance in high-temperature and oxidation-resistant applications, especially within gas turbine components. The increasing adoption of zinc and zinc-aluminum wires is notable, primarily propelled by growing governmental infrastructure spending on bridge, pipeline, and marine structure protection, showcasing a balance between high-performance technical wires and bulk protective materials within the market landscape.

AI Impact Analysis on Thermal Spray Wires Market

User inquiries regarding AI's influence on the Thermal Spray Wires Market center predominantly on themes of quality control, process optimization, predictive maintenance of spraying equipment, and the acceleration of new material discovery. Key concerns revolve around how AI and machine learning algorithms can be integrated into existing thermal spray setups to minimize coating defects (such as porosity and oxide inclusions) and optimize parameters like current, voltage, and powder feed rates in real-time. Expectations include leveraging AI for predictive analytics to monitor wire quality during manufacturing and spraying, ensuring consistency across large production batches, and rapidly identifying novel wire compositions that offer superior performance characteristics, thereby reducing material R&D cycle times, which are critical for high-stakes industries like aerospace.

- AI-driven real-time process control optimizes thermal spray parameters (e.g., arc voltage, spray distance) to minimize coating defects and enhance deposition efficiency.

- Machine learning algorithms analyze acoustic and visual sensor data during spraying for non-destructive, instantaneous quality assurance and defect detection.

- Predictive maintenance schedules for thermal spray equipment (guns, feeders) are generated by AI, reducing unexpected downtime and MRO costs.

- Computational material science and AI accelerate the design and screening of novel alloy wire compositions, specifically tailored for extreme operating environments.

- Supply chain logistics optimization using AI enhances inventory management of diverse wire feedstocks, reducing lead times and ensuring just-in-time delivery.

- Automated surface inspection using computer vision algorithms improves the consistency and accuracy of coated product quality verification post-application.

DRO & Impact Forces Of Thermal Spray Wires Market

The Thermal Spray Wires Market is governed by a dynamic interplay of factors that both stimulate growth and introduce operational challenges. Drivers (D) largely stem from the global necessity to prolong the service life of critical infrastructure and high-value industrial components in sectors like aerospace, power generation, and oil & gas, which are continually exposed to abrasive and corrosive environments. The mandated use of protective coatings by governmental and industry bodies, particularly concerning safety and efficiency standards, further anchors the market’s positive trajectory. Conversely, Restraints (R) primarily involve the high initial investment required for sophisticated thermal spray equipment and the complexity associated with achieving consistent, high-quality coating results, necessitating specialized operator training and rigorous process control, which can be prohibitive for smaller enterprises.

Significant Opportunities (O) reside in the rapid expansion of emerging economies, particularly across Asia Pacific and Latin America, where industrial growth and large-scale infrastructural projects are surging, creating massive demand for anticorrosion and wear-resistant coatings. The ongoing technological evolution towards next-generation materials, such as cored wires, customized composite wires, and feedstock tailored for additive manufacturing (3D printing), presents lucrative avenues for market participants. Furthermore, the increasing focus on MRO services for aging assets globally offers a stable, recurring revenue stream, as thermal spray techniques are often the most cost-effective solution for component restoration and refurbishment.

The Impact Forces shaping the market trajectory are primarily technological advancements and competitive intensity. The continuous innovation in thermal spray technology, specifically improvements in arc spray systems for finer particle size and higher density coatings, acts as a pivotal force driving adoption. Competitive dynamics force manufacturers to constantly optimize their production processes to ensure wire purity, uniformity, and cost-effectiveness, while also adhering to strict industry certifications (e.g., NADCAP for aerospace applications). These forces collectively accelerate the market’s evolution, placing pressure on both established suppliers and new entrants to demonstrate superior material performance and integrated service capabilities to maintain relevance in a highly specialized protective coatings landscape.

Segmentation Analysis

The Thermal Spray Wires Market is systematically segmented based on material composition, spraying technology utilized, and the specific application or end-use industry. This multifaceted segmentation helps in understanding the varying demands across industrial sectors and the technological advancements required to meet them. Material composition is perhaps the most critical determinant, directly linking the wire's inherent properties (e.g., zinc for galvanic protection, nickel alloys for heat resistance) to the coating's intended function. Technological segmentation reflects the preference for specific spraying methods, such as Twin Wire Arc Spray (TWAS) for high-rate, cost-effective coatings or flame spraying for lower melting point materials, driven primarily by operational scale and required coating quality.

The segmentation by application highlights the vast and diverse utility of thermal spray wires, ranging from high-precision component protection in aerospace turbines to bulk anticorrosion applications on infrastructure and marine vessels. The selection of wire feedstock is highly customized, meaning that market players often specialize in producing wires tailored to specific regulatory requirements or performance metrics of a particular end-use industry. For instance, the demand for specialized cored wires in the power generation sector focuses on materials that offer exceptional resistance to high-temperature corrosion and erosion, often involving complex nickel-chromium-molybdenum alloys, illustrating the specialization inherent in the market structure.

Understanding these segments is essential for strategic planning, enabling manufacturers to prioritize R&D investments in high-growth material categories, optimize production efficiencies for prevalent spraying technologies, and strategically target end-use sectors with the highest potential return. The increasing trend towards automation and digitization in the manufacturing processes within key end-use industries is further refining these segments, demanding higher throughput and more consistent quality from the thermal spray wire feedstock supplied, driving a premium for certified, high-purity materials.

- By Material Type:

- Nickel-based Alloys

- Aluminum-based Alloys

- Zinc and Zinc/Aluminum Alloys

- Copper-based Alloys

- Cored/Composite Wires

- Others (e.g., Tin, Lead, Steel)

- By Technology:

- Twin Wire Arc Spray (TWAS)

- Flame Spraying (FS)

- High-Velocity Oxy-Fuel (HVOF)

- Plasma Spraying (PS)

- By End-Use Industry:

- Aerospace

- Automotive

- Power Generation (Gas Turbines, Boilers)

- Oil & Gas

- Infrastructure & Construction (Bridges, Marine Structures)

- Medical

- Printing & Packaging

- Others (e.g., Mining, Textile)

Value Chain Analysis For Thermal Spray Wires Market

The value chain for the Thermal Spray Wires Market begins with the upstream analysis, which involves the sourcing and refining of raw materials, primarily high-purity metals and alloying elements such as nickel, zinc, aluminum, and copper. This stage is dominated by large mining and refining companies, and fluctuations in commodity prices directly impact the cost of wire production. Wire manufacturers then process these raw metals through complex drawing, annealing, and sometimes powder metallurgy steps (especially for cored wires) to achieve the specified diameter, purity, and metallurgical structure required for high-performance thermal spraying. Quality control at this manufacturing stage is crucial, as wire consistency dictates the final coating performance, making supplier relationships with high-quality raw material producers a key competitive factor.

The distribution channel is multi-layered, involving direct sales from major wire manufacturers to large end-users (like major aerospace MRO facilities or integrated power companies) and indirect sales through specialized distributors and regional agents. These distributors play a vital role in providing technical support, smaller batch sizes, and quick local inventory access to smaller job shops and localized coating service providers. The shift towards integrated solutions means that some equipment manufacturers also act as distributors for proprietary wire feedstocks, bundling the wire, equipment, and expertise into a single package. Direct sales typically serve large-volume orders and specialized contracts where technical specifications are extremely stringent and require close coordination between the wire producer and the end-user engineer.

The downstream analysis focuses on the coating service providers (job shops) and the final end-use industries. The coating service providers purchase the wires and apply the coatings using thermal spray equipment, transforming the feedstock into a value-added, protective surface layer. The final recipients are the end-user sectors—aerospace, automotive, energy, and infrastructure. In this final stage, the wire's value is realized through the extended component life, improved efficiency, and reduced maintenance costs provided by the coating. The success of the downstream application is heavily dependent on the quality of the upstream wire production, highlighting the interconnectedness and necessity for strong communication throughout the value chain to meet performance specifications and ensure customer satisfaction.

Thermal Spray Wires Market Potential Customers

Potential customers for Thermal Spray Wires are predominantly high-value manufacturing and maintenance organizations whose operations rely on the integrity and durability of critical metallic components under harsh conditions. The largest segment of end-users are Maintenance, Repair, and Overhaul (MRO) facilities, particularly those serving the aviation and power generation sectors, who utilize thermal spray wires extensively for refurbishing worn or damaged parts rather than incurring the high cost of replacement. These customers demand high-specification materials, such as nickel-cobalt alloys, to restore dimensional tolerances and performance properties of turbine blades, landing gear components, and boiler tubes, making certified material traceability a non-negotiable requirement for purchase.

Another major buyer category includes original equipment manufacturers (OEMs) in the automotive and heavy machinery industries. Automotive OEMs utilize aluminum and zinc-based wires for anti-corrosion applications on vehicle bodies and chassis, and specialized wires for improving the wear resistance of engine parts like synchronizer rings and cylinder bores. Heavy machinery manufacturers (e.g., mining, construction) are significant consumers, using robust steel and alloy wires to protect hydraulic cylinders, shafts, and rollers from severe abrasive wear and impact damage encountered in demanding operational environments. These industrial users prioritize high deposition rates and materials that offer maximum longevity under constant mechanical stress.

Infrastructure developers and public works departments represent a rapidly growing customer base, especially for high-volume, cost-effective zinc and zinc-aluminum wires. These materials are crucial for providing galvanic corrosion protection to massive steel structures such as bridges, dams, transmission towers, and offshore platforms. For these customers, the key purchasing criteria include longevity, ease of application (often requiring high deposition rates for on-site spraying), and compliance with specific regional anti-corrosion standards. The diversity of buyers—from high-tech aerospace engineers demanding purity to civil engineers seeking long-term corrosion prevention—underscores the breadth of the thermal spray wire market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Praxair Surface Technologies, Oerlikon Metco, Polymet Corporation, Wall Colmonoy Corporation, Voestalpine Böhler Welding, The Lincoln Electric Company, H.C. Starck Solutions, Castolin Eutectic, Höganäs AB, Kennametal Inc., Saint-Gobain, General Plasma Inc., Metallizing Equipment Co. Pvt. Ltd. (MEC), Amperit GmbH, Powder Alloy Corporation, Shandong Futong Thermal Spray Materials Co., Ltd., C&M Technologies, Inc., Flame Spray Technologies B.V., Durum Wear Resistant Materials, Fujimi Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Spray Wires Market Key Technology Landscape

The technological landscape of the Thermal Spray Wires Market is characterized by continuous efforts to improve wire quality, application consistency, and coating density, primarily focusing on enhancing the effectiveness of the Twin Wire Arc Spray (TWAS) method, which is the most common utilization technology for wires. Modern advancements are centered on optimizing the wire manufacturing process itself, particularly developing specialized cored wires. These cored wires feature a metallic sheath encapsulating a core of composite powders, allowing for the creation of coatings with properties that are unattainable using traditional solid alloy wires, such as ceramics or specific carbides, thereby significantly expanding the functional scope of wire-based thermal spraying beyond traditional metallic protection and bridging the gap with powder-based spraying technologies.

Furthermore, significant technological progress is observed in the integration of intelligent monitoring and automation systems within the spraying equipment. New generation thermal spray guns incorporate advanced sensors (e.g., thermal, optical, acoustic) that monitor the arc stability, particle velocity, and temperature in real-time, feeding data back to the control system. This closed-loop control minimizes process variability, ensuring high metallurgical quality and reducing the prevalence of defects like oxide stringers or porosity in the final coating. Such technological sophistication is vital for high-compliance sectors like aerospace, where every coating application must adhere to extremely tight specifications, thereby increasing the technical demand placed upon the feedstock wire's consistency and purity.

Looking forward, the development of wire feedstocks compatible with emerging processes like Wire Arc Additive Manufacturing (WAAM) presents a critical area of growth and technological convergence. Although WAAM is primarily an additive technique, it utilizes similar wire feedstock metallurgy and deposition principles. Manufacturers are increasingly designing wires optimized for both traditional protective coatings and large-scale 3D printing applications, maximizing material utilization and expanding market reach. This intersection with additive manufacturing, combined with continuous improvements in wire drawing techniques to produce ultra-fine diameter wires for precise applications, signifies a market moving towards higher precision, multifunctional materials, and intelligent process execution.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region in the thermal spray wires market, driven by unparalleled growth in infrastructure development, rapid urbanization, and massive expansions in the automotive and heavy industrial sectors, particularly in China, India, and Southeast Asian countries. The region's increasing energy needs, especially in coal and gas power generation, necessitate extensive MRO operations on boiler tubes and turbine components, creating sustained demand for nickel-based and high-temperature alloy wires. Furthermore, burgeoning domestic air travel and defense modernization programs contribute significantly to the demand for certified aerospace-grade wires, positioning the region as the central engine for global market growth over the forecast period.

- North America: North America is characterized by high demand for specialized, high-performance wires, predominantly fueled by the stringent quality requirements of the aerospace, defense, and oil & gas industries. The region is a technological leader, with significant investment in advanced thermal spray equipment and R&D focused on developing next-generation alloy wires and composite materials for extreme environments. The focus here is less on volume (compared to APAC infrastructure) and more on high-value, niche applications such as land-based gas turbines and advanced aircraft engine components, ensuring a stable market characterized by high average selling prices for specialized feedstock.

- Europe: The European market is stable and mature, driven primarily by robust environmental regulations and high standards for industrial efficiency, particularly within the automotive, power generation, and advanced manufacturing sectors (Germany, France, UK). The emphasis on reducing carbon footprints and extending component life supports a strong MRO culture, driving demand for zinc/aluminum wires for anticorrosion protection of infrastructure, and specialized nickel and cobalt alloys for refurbishing industrial gas turbines. Technological innovation within Europe is heavily focused on optimizing coating homogeneity and reducing energy consumption in the spraying process.

- Latin America (LATAM): The LATAM market exhibits moderate growth, influenced significantly by regional investments in energy infrastructure, particularly in Brazil and Mexico's oil and gas sectors, and ongoing projects related to mining and port development. Demand is concentrated on standard, high-volume anticorrosion wires (zinc, aluminum) for protecting pipelines and marine equipment, reflecting a growing need for foundational industrial protection. Market expansion is sensitive to fluctuating commodity prices and governmental capital expenditure cycles on large-scale infrastructure projects.

- Middle East and Africa (MEA): The MEA region’s demand is fundamentally anchored by the massive scale of the oil and gas industry and associated infrastructure (refineries, petrochemicals, pipelines). Thermal spray wires are critical for protecting equipment from aggressive sour gas and high-temperature corrosion environments. Significant government diversification efforts in the UAE and Saudi Arabia towards non-oil sectors, including aerospace and tourism infrastructure development, are emerging drivers, increasing the need for both bulk anticorrosion and specialized wear-resistant coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Spray Wires Market.- Oerlikon Metco

- Praxair Surface Technologies (Now Linde PLC)

- Polymet Corporation

- Wall Colmonoy Corporation

- Voestalpine Böhler Welding

- The Lincoln Electric Company

- H.C. Starck Solutions

- Castolin Eutectic

- Höganäs AB

- Kennametal Inc.

- Saint-Gobain

- General Plasma Inc.

- Metallizing Equipment Co. Pvt. Ltd. (MEC)

- Amperit GmbH

- Powder Alloy Corporation

- Shandong Futong Thermal Spray Materials Co., Ltd.

- C&M Technologies, Inc.

- Flame Spray Technologies B.V.

- Durum Wear Resistant Materials

- Fujimi Corporation

Frequently Asked Questions

Analyze common user questions about the Thermal Spray Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Thermal Spray Wires over thermal spray powders?

Thermal spray wires, particularly used in Twin Wire Arc Spray (TWAS), offer significant cost-effectiveness and higher deposition rates compared to powders, making them ideal for large-area protective coatings such as anti-corrosion applications on bridges and storage tanks. Wires are easier to handle, pose fewer health risks associated with fine powder inhalation, and produce very dense, tightly bonded metallic coatings. Additionally, arc spraying requires less energy input than plasma or HVOF processes typically used for powders, reducing operational costs for high-volume applications.

Which alloy types are most crucial for the aerospace sector in the Thermal Spray Wires Market?

The aerospace sector heavily relies on nickel-based, cobalt-based, and specialized superalloys in wire form due to their critical performance characteristics, including exceptional resistance to high-temperature oxidation, thermal fatigue, and creep. These materials are essential for repairing and protecting hot section components of gas turbine engines, such as compressor blades, vanes, and combustion liners, ensuring extended component life and compliance with strict aviation safety standards and certification requirements like NADCAP.

How is the growth of infrastructure MRO influencing the demand for thermal spray wires?

The global increase in Maintenance, Repair, and Overhaul (MRO) activities for aging infrastructure, including pipelines, bridges, and marine structures, is a major demand driver. This activity primarily boosts the market for zinc and zinc/aluminum alloy wires, which provide superior galvanic corrosion protection essential for steel structures exposed to harsh weather and saline environments. MRO necessitates recurring material procurement, ensuring stable, high-volume demand for anticorrosion thermal spray wires globally.

What is a 'Cored Wire' in the context of thermal spraying, and why is it gaining popularity?

A cored wire is a composite feedstock material consisting of a metallic sheath (e.g., steel or copper) surrounding a core filled with specialized powders, such as ceramics, carbides, or specific alloys. Cored wires are gaining popularity because they enable the deposition of coatings with properties traditionally only achievable using powder feedstock, significantly broadening the functional capabilities of the simpler and more cost-effective wire spray processes (like arc spray), offering tailored hardness and wear resistance.

Which geographical region leads the demand for high-volume, low-cost Thermal Spray Wires?

The Asia Pacific (APAC) region, driven by countries like China and India, leads the demand for high-volume, cost-effective thermal spray wires. This is primarily attributed to the region’s massive, ongoing investment in infrastructure projects, rapid expansion of domestic manufacturing, and high-volume automotive production. The need for basic anti-corrosion and general wear resistance coatings across these vast industrial bases generates substantial, consistent demand for high-deposition rate materials such as zinc, aluminum, and general steel alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager