Thermal Transfer Overprinting (TTO) Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438633 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Thermal Transfer Overprinting (TTO) Equipment Market Size

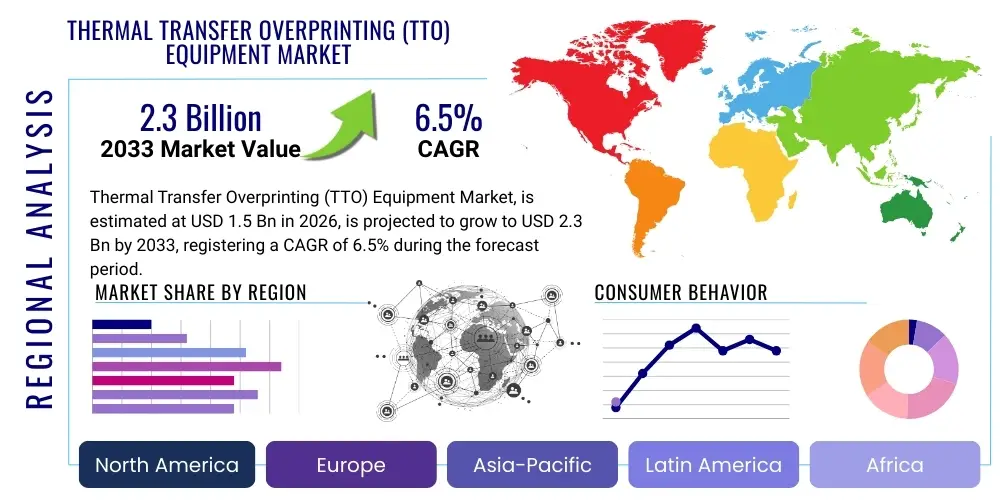

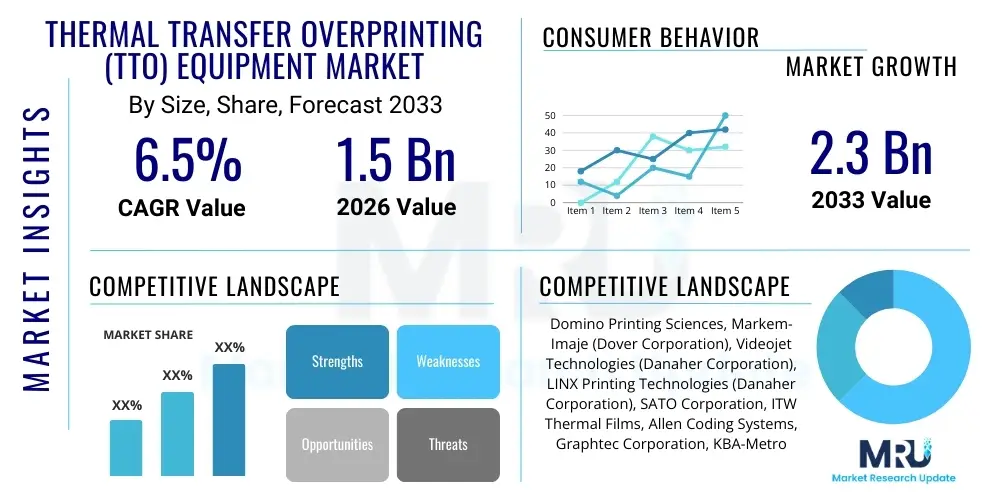

The Thermal Transfer Overprinting (TTO) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating global demand for high-resolution, variable data printing, particularly across the food and beverage, pharmaceutical, and cosmetic industries, which require precise date, batch, and serialization codes for enhanced traceability and regulatory adherence. The stability and durability of TTO codes on flexible packaging materials, coupled with advances in printer speed and ribbon efficiency, solidify its position as a preferred coding technology over traditional hot stamp or inkjet methods in high-volume production environments.

Thermal Transfer Overprinting (TTO) Equipment Market introduction

The Thermal Transfer Overprinting (TTO) Equipment Market encompasses specialized industrial printers designed to apply high-resolution, real-time variable information—such as best-before dates, batch numbers, barcodes, and regulatory logos—directly onto flexible packaging films, labels, and foils using a thermal transfer ribbon. These systems are characterized by their ability to produce crisp, durable, and instantly dry codes, making them indispensable in fast-paced manufacturing sectors. The core technology involves heating tiny elements (dots) on the printhead, which melts the ink coating on the ribbon and transfers it instantaneously to the substrate, ensuring superior print quality and minimizing smearing or fading compared to older coding methods. The critical application areas include vertical and horizontal form-fill-seal machines (VFFS/HFFS) used extensively in snack and confectionary packaging, as well as labeling lines for pharmaceutical blister packs and compliance labeling. The increasing complexity of global supply chains and stringent traceability regulations mandated by bodies like the FDA and EMA are the primary catalysts driving sustained adoption across major economic regions.

TTO equipment offers distinct advantages over alternative coding technologies, notably superior code permanence, high contrast printing suitable for machine vision systems, and operational cleanliness dueating to the absence of solvents or fluidic components. The market growth is being propelled by the shift towards flexible packaging formats, which inherently demand robust, integrated coding solutions capable of functioning reliably at high speeds without compromising packaging integrity or production throughput. Furthermore, manufacturers are increasingly launching high-performance TTO printers featuring larger print areas, enhanced ribbon saving features, and integrated network capabilities (Industry 4.0 readiness), allowing for centralized control and data management across multiple production lines. The versatility of TTO technology to print on various substrates, including plastics, laminates, and metallic foils, ensures its wide acceptance across diverse manufacturing environments requiring consistent, reliable identification marks.

Major applications of TTO equipment span the entirety of the packaged goods industry. In the food sector, they ensure compliance with expiration dating and allergen labeling; in pharmaceuticals, TTO is crucial for serialization, unique device identification (UDI), and anti-counterfeiting measures. Key driving factors include the global focus on food safety and product authentication, rising consumer demand for transparency in product sourcing, and technological advancements focusing on reducing operational costs through optimized ribbon usage and minimized maintenance requirements. The continuous development of specialized thermal transfer ribbons, tailored for specific environmental conditions (e.g., high humidity, cold chain storage), further reinforces the market’s positive outlook.

Thermal Transfer Overprinting (TTO) Equipment Market Executive Summary

The global Thermal Transfer Overprinting (TTO) Equipment market is experiencing robust expansion, primarily driven by mandatory global regulatory compliance requirements for traceability and the accelerating shift towards flexible packaging solutions across fast-moving consumer goods (FMCG) and healthcare sectors. Business trends emphasize the development of smarter, network-enabled TTO units that integrate seamlessly into Industry 4.0 manufacturing ecosystems, offering real-time performance monitoring and remote diagnostics. Key competitive strategies focus on optimizing ribbon consumption through advanced software features and improving overall equipment effectiveness (OEE) through enhanced printhead lifespan and reduced downtime, thereby addressing the crucial operational expenditure concerns of large-scale end-users. Consolidation among major original equipment manufacturers (OEMs) and partnerships with packaging machinery integrators are defining the current business landscape, ensuring TTO solutions are offered as comprehensive, bundled systems.

Regionally, the Asia Pacific (APAC) stands out as the highest growth market, largely fueled by burgeoning industrialization, significant expansion of the food processing and pharmaceutical manufacturing bases in nations like China and India, and the rising middle-class consumer base demanding packaged and branded goods. North America and Europe, while mature, continue to drive demand through stringent serialization mandates, particularly within the pharmaceutical sector, requiring investments in modern, high-speed continuous TTO models. Segment trends highlight the dominance of continuous motion TTO systems over intermittent systems in high-speed, flexible film applications, reflecting the market’s push for increased production efficiency. Furthermore, the specialized ribbon segment, encompassing wax-resin and full resin formulations, is seeing faster growth due to the need for chemical and abrasion resistance required in challenging industrial environments, such as those involving solvents or extreme temperature exposure.

Overall, the market trajectory is highly positive. Manufacturers are investing heavily in research and development to enhance print speeds, increase code density capabilities (handling 2D codes and intricate logos), and improve the intuitive usability of the human-machine interface (HMI). Sustainability is emerging as a critical trend, prompting the development of eco-friendly ribbon substrates and energy-efficient printers. The synthesis of regulatory pressure, continuous technological refinement, and the expanding global footprint of high-volume packaged goods production ensures that the TTO equipment market will maintain a significant growth momentum through the forecast period, positioning it as an essential component of modern packaging lines worldwide.

AI Impact Analysis on Thermal Transfer Overprinting (TTO) Equipment Market

Common user questions regarding AI's impact on the TTO market revolve around whether AI can automate fault detection, optimize ribbon usage, predict maintenance failures, and enhance print quality verification without human intervention. Users are particularly interested in how machine learning algorithms can analyze vast amounts of print data (speed, temperature, substrate type) to dynamically adjust printhead settings, ensuring optimal performance and minimizing material waste, a significant operational cost. The underlying concern is centered on integrating complex AI systems into existing, often legacy, industrial control systems (ICS) and the resulting ROI justification. This analysis summarizes the key themes, confirming that AI is primarily viewed as a tool for predictive maintenance, process optimization, and advanced quality assurance in high-throughput coding applications. Specifically, AI-driven vision systems are expected to replace manual and traditional rule-based quality checks, leading to near-perfect code verification and reduced product recalls.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is poised to significantly transform the operational dynamics of TTO equipment, shifting the focus from reactive maintenance to proactive operational excellence. AI algorithms can continuously monitor variables such as printhead temperature, ribbon tension, production speed variations, and ambient humidity, learning patterns that precede print quality degradation or mechanical failure. This capability allows the TTO system to issue preemptive alerts or even automatically self-correct parameters (like increasing printhead energy slightly in response to minor speed fluctuations), thus maximizing uptime and ensuring consistent, high-quality output throughout prolonged production runs. This level of autonomous optimization is critical for industries like pharmaceuticals, where validation and consistency are non-negotiable regulatory requirements.

Furthermore, AI-powered vision inspection systems are moving beyond simple pass/fail checks. These advanced systems use deep learning models trained on millions of images of correct and defective codes (including smearing, pinholes, or misplaced prints) to rapidly verify the integrity and readability of every code produced at high line speeds. This capability is crucial for 2D barcode validation and serialization data accuracy. The data collected by these AI modules provides invaluable feedback loops to the production planning software, facilitating superior inventory management, enhanced batch tracking, and improved overall traceability throughout the entire supply chain, making TTO equipment not just a printer, but an intelligent data gateway.

- AI-driven Predictive Maintenance: Analyzing operational data (printhead cycles, temperature) to forecast hardware failures, scheduling maintenance proactively, and minimizing costly unplanned downtime.

- Optimized Ribbon Consumption: Machine learning algorithms dynamically calculate and adjust printhead activation timing and ribbon advance based on variable data content, maximizing 'ribbon save' features and reducing material waste by 10-15%.

- Enhanced Quality Control (QC): AI-powered vision systems performing 100% inline inspection of printed codes, including data matrix and complex barcodes, ensuring superior readability and regulatory compliance verification.

- Autonomous Parameter Adjustment: Real-time analysis of environmental factors and substrate properties to automatically adjust print energy and pressure, maintaining optimal print clarity across diverse packaging materials.

- Data Integration and Reporting: AI compiling comprehensive operational reports suitable for regulatory audit trails, linking code printing events directly to enterprise resource planning (ERP) and manufacturing execution systems (MES).

- Improved Operator Training: Utilizing virtual reality (VR) and augmented reality (AR) tools, powered by AI models, to simulate complex TTO fault diagnosis and maintenance procedures for rapid skill development.

DRO & Impact Forces Of Thermal Transfer Overprinting (TTO) Equipment Market

The TTO Equipment market is shaped by a confluence of accelerating regulatory requirements (Drivers) demanding infallible traceability, counterbalanced by the relatively high initial capital expenditure (Restraints). Opportunities are abundant in the emerging markets of Asia and Latin America, driven by massive increases in packaged food consumption and evolving local regulatory frameworks. The primary impact forces include the critical need for compliance in pharmaceuticals, which sustains high-value purchases, and the ongoing competitive threat posed by advanced inkjet technologies, forcing TTO manufacturers to continuously innovate speed and efficiency. The market sustains positive momentum due to the intrinsic advantages of TTO, such as superior print quality and substrate versatility, essential for premium and flexible packaging formats.

Drivers: The most significant driver is the increasing legislative pressure globally, particularly in developed economies, mandating product serialization, tamper-evidence features, and detailed batch tracking for health and safety reasons. This regulatory environment compels pharmaceutical, food, and beverage manufacturers to invest in reliable, high-resolution coding equipment like TTO. Secondly, the widespread adoption of flexible packaging (pouches, flow wraps) as a sustainable and cost-effective alternative to rigid containers necessitates specialized overprinting technologies that can operate effectively on continuous web motion, where TTO excels due to its non-contact printing mechanism and quick-drying characteristics. Furthermore, the rising consumer demand for premium products featuring high-quality, aesthetically pleasing variable data printing (e.g., promotional codes, detailed nutritional information) necessitates the crisp, edge-to-edge printing capabilities offered by modern TTO systems.

Restraints: Despite its advantages, the TTO market faces restraints primarily centered around operational expenditure and competition. The recurring cost associated with thermal transfer ribbons, which are consumables required for every print, constitutes a significant long-term operating cost, potentially making it less competitive against low-cost, high-uptime continuous inkjet (CIJ) systems in certain basic industrial applications. Additionally, the initial capital investment for high-speed, wide-format TTO machines can be substantial, posing a barrier to entry for smaller or medium-sized enterprises (SMEs) in developing markets. The maintenance complexity related to printhead lifespan and replacement, although improving, also represents a technical hurdle that some manufacturers prefer to avoid by adopting simpler coding alternatives. The market is also consistently challenged by the rapid evolution of alternative digital coding technologies, such as UV inkjet, which offers comparable print quality without the need for ribbons.

Opportunities: Significant market opportunities exist in emerging economies (e.g., Southeast Asia, Africa) where the formalization of food safety standards and the dramatic expansion of local manufacturing capacity are driving first-time adoption of sophisticated coding equipment. The proliferation of e-commerce and subsequent requirements for robust tracking codes (logistics labels, 2D matrix codes) creates a new demand segment for TTO technology. Moreover, there is a clear opportunity for manufacturers to capitalize on the sustainability trend by developing and commercializing biodegradable or recyclable TTO ribbons and creating more energy-efficient printing units that integrate advanced power-saving modes, appealing to large corporations committed to green manufacturing initiatives. The development of 'smart' TTO devices integrated with cloud-based diagnostics and remote servicing capabilities further expands the service revenue opportunity.

Impact Forces: The most critical impact force is the pharmaceutical industry's strict compliance with global serialization standards (e.g., Drug Supply Chain Security Act in the US, Falsified Medicines Directive in the EU). TTO's ability to produce high-density 2D barcodes required for serialization reliably and consistently positions it as a market cornerstone. Another major impact force is the technological competition; advancements in alternative coding technologies, particularly high-resolution digital inkjet, continuously pressure TTO manufacturers to enhance speed, reduce ribbon costs, and increase the versatility of their equipment. Furthermore, fluctuating raw material costs for thermal ribbons (resins, waxes) directly impact the cost of ownership, influencing end-user purchasing decisions and driving the development of ribbon-saving software features as a market standard.

Segmentation Analysis

The Thermal Transfer Overprinting (TTO) Equipment Market is comprehensively segmented based on technology type, application speed, substrate compatibility, end-user industry, and geographical region, reflecting the diverse operational requirements across the manufacturing landscape. The primary segmentation centers around the printing action mechanism, distinguishing between intermittent TTO printers, ideal for slower packaging lines or stop-start applications (like vertical bagging machines), and continuous TTO printers, which are essential for high-speed, non-stop horizontal form-fill-seal lines. This differentiation is critical as it dictates the optimal printer choice for maximizing throughput and minimizing code distortion on the packaging web. Furthermore, the market is dissected by the ribbon formulation—wax, wax/resin, and pure resin—each catering to specific needs concerning resistance to heat, abrasion, and chemicals, crucial factors in food processing and industrial environments. This granular approach to segmentation allows market participants to tailor equipment design and sales strategies to specific industry vertical needs, maximizing solution effectiveness and penetration.

Segmentation by end-user industry is paramount, with the Food and Beverage sector consistently holding the largest market share due to the sheer volume of packaged goods requiring expiration and batch coding. However, the Pharmaceutical industry is projected to exhibit the highest growth rate, driven by significant capital expenditure on serialization infrastructure necessitated by global drug tracing regulations. Within the technology segment, advanced wide-format TTO printers (typically 107mm or wider) are gaining traction as companies seek to consolidate multiple lines of coding (e.g., ingredients, date, logo) onto a single print pass, simplifying operations and reducing the number of coding units required per packaging machine. The ongoing optimization of proprietary ribbon saving modes, which minimize the gap between prints, acts as a further sub-segmentation factor that influences purchasing decisions based on projected return on investment (ROI) calculations.

- By Type of Motion:

- Intermittent TTO Printers (Ideal for vertical form-fill-seal machines and slower lines)

- Continuous TTO Printers (Crucial for high-speed flow wrappers and horizontal form-fill-seal applications)

- By Printhead Width:

- Small Format (32mm)

- Medium Format (53mm)

- Wide Format (107mm and above)

- By End-User Industry:

- Food and Beverage (Bakery, Confectionery, Dairy, Snacks)

- Pharmaceutical and Healthcare (Serialization, Blister Packs, UDI)

- Cosmetics and Personal Care (Ingredient lists, Batch codes)

- Chemical and Industrial Goods (Hazard warnings, Barcodes)

- Automotive Parts (Tracking and identification)

- By Consumables (Ribbon Type):

- Wax Ribbons (Economical, standard applications)

- Wax-Resin Ribbons (Good abrasion resistance, versatile)

- Pure Resin Ribbons (Extreme durability, chemical and heat resistance)

- By Geographical Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Thermal Transfer Overprinting (TTO) Equipment Market

The value chain for the TTO equipment market is structured into upstream raw material suppliers, equipment manufacturers (OEMs), distributors and system integrators, and finally, the end-user manufacturers. Upstream analysis focuses on the sourcing of critical components, including high-precision printheads (thermal heads sourced primarily from specialized Japanese or global semiconductor firms), electronic control boards, chassis metals, and specialized coating materials for thermal ribbons (waxes, resins, and films). The health and stability of this upstream segment, particularly concerning printhead technology and global supply chain resilience, directly impacts the final product cost and reliability of the TTO unit. OEMs then undertake the complex assembly, software integration, and rigorous testing of the printing units, focusing heavily on proprietary ribbon-saving features and user interface design to gain competitive differentiation in the market.

The middle segment of the chain involves the critical role of distributors and system integrators. Due to the requirement for TTO units to be seamlessly incorporated into high-speed, complex packaging lines (e.g., flow wrappers, VFFS machines), specialized system integrators provide consultation, installation, and commissioning services, acting as the primary point of contact and technical support for the end-users. These channels often manage both the direct sales of equipment and the ongoing supply of high-margin consumables (TTO ribbons). Direct distribution channels are typically employed by large OEMs for strategic, high-volume accounts (e.g., multinational pharmaceutical companies), allowing for greater control over pricing and service delivery, while indirect channels (local dealers and value-added resellers) dominate servicing localized or smaller manufacturing operations, providing regional accessibility and customized technical expertise necessary for diverse market penetration.

Downstream analysis centers on the end-user adoption and post-sale servicing. The effectiveness of the TTO equipment is measured by its ability to maintain high OEE and minimize total cost of ownership (TCO). This segment is heavily influenced by the availability of fast, reliable technical support and the sustained supply of compatible, high-quality ribbons at competitive prices. The value chain is constantly striving for efficiency through vertically integrated models where major players manufacture both the hardware and the consumables, providing a "one-stop-shop" solution. Furthermore, the push towards Industry 4.0 connectivity means that software updates, remote diagnostics, and data reporting capabilities are becoming increasingly significant components of the perceived value, moving the TTO unit from a simple coder to an essential data collection point within the manufacturing ecosystem.

Thermal Transfer Overprinting (TTO) Equipment Market Potential Customers

Potential customers for Thermal Transfer Overprinting (TTO) equipment are primarily high-volume manufacturers across sectors requiring durable, high-resolution variable data printing on flexible substrates. The most significant customer base resides in the Food and Beverage industry, specifically companies involved in packaging snacks, frozen foods, ready meals, and confectionery, where TTO is integral for printing best-before dates, traceability codes, and nutritional facts onto flexible films. These companies prioritize speed, reliability, and the ability of the code to withstand environmental conditions (e.g., moisture, temperature changes) without degradation. The second critical customer segment is the Pharmaceutical and Healthcare sector, encompassing producers of medications, medical devices, and veterinary products, driven by mandatory global serialization requirements and the need for precision coding on blister packs and unit-dose packaging to ensure anti-counterfeiting measures and patient safety.

Beyond these two major verticals, other key buyers include producers of Cosmetics and Personal Care items, who utilize TTO for discreet batch coding on premium packaging and ingredient labeling, demanding crisp print quality for brand aesthetics. The Chemical and Industrial Goods sector also represents a stable customer base, using TTO for printing durable asset identification labels, safety warnings, and high-density barcodes onto industrial foils and specialized packaging that may face harsh industrial solvents or extreme temperatures, necessitating pure resin ribbon technology. The decision-making unit often includes packaging engineers, production managers focused on OEE, procurement specialists negotiating consumable supply contracts, and quality assurance departments responsible for regulatory compliance validation. The purchase decision typically weighs initial cost against the guaranteed reliability, print quality consistency, and the vendor’s ability to provide localized service and certified ribbons tailored for regulatory environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domino Printing Sciences, Markem-Imaje (Dover Corporation), Videojet Technologies (Danaher Corporation), LINX Printing Technologies (Danaher Corporation), SATO Corporation, ITW Thermal Films, Allen Coding Systems, Graphtec Corporation, KBA-Metronic, Mettler-Toledo International Inc., Macsa ID, EC-JET, Bizerba, HSA Systems, Rotech Machines, ID Technology, Bell-Mark Corporation, Weber Marking Systems, Norwood Marking Systems, Anser Coding Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Transfer Overprinting (TTO) Equipment Market Key Technology Landscape

The core technology defining the modern TTO equipment market centers on advanced digital control systems and high-precision printhead assemblies. Key advancements are focused on maximizing the efficiency of ribbon usage, significantly extending component lifespan, and improving network integration capabilities. Modern TTO printers utilize proprietary software algorithms, known as ribbon saving modes, which employ precise stepper motor control to minimize the ribbon gap between successive print cycles, effectively reducing consumables cost by optimizing ribbon advance. Furthermore, continuous motion TTO systems incorporate advanced encoder feedback loops and servo motor control to synchronize the printing process precisely with high-speed web movement, ensuring code quality remains stable even at speeds exceeding 600 millimeters per second. The printhead itself, typically a high-density, flat-edge or near-edge thermal head, is designed for rapid heat dissipation and extended durability, often featuring built-in diagnostic capabilities to monitor dot health and prevent premature print quality degradation.

A critical technological differentiator is the shift toward smarter, connected TTO devices compliant with Industry 4.0 standards. Equipment now commonly features Ethernet connectivity, allowing for centralized print job management, real-time performance monitoring via Manufacturing Execution Systems (MES), and remote diagnostics capabilities. This connectivity is essential for managing large fleets of printers across multiple factory locations, enabling proactive maintenance and rapid resolution of operational issues, thus significantly boosting Overall Equipment Effectiveness (OEE). High-resolution printing (300 dpi or greater) is now standard, driven by the need to accurately reproduce complex graphics, small font text, and dense 2D codes (like Data Matrix), which are necessary for pharmaceutical serialization and detailed nutritional labeling on small flexible packages. Near-edge printhead technology, increasingly prevalent in high-speed continuous applications, allows for faster printing on thin, flexible films and minimizes printhead maintenance requirements compared to older flat-edge designs.

Furthermore, the technological landscape is being shaped by user experience improvements. Modern TTO printers feature large, intuitive, color touchscreen interfaces (HMIs) that simplify setup, job selection, and fault diagnosis, reducing the need for specialized training. These systems often include internal databases for print job storage and validation tools to prevent operator errors related to incorrect date or batch entry. The integration of advanced vision inspection systems, sometimes built directly into the printer chassis or adjacent to the print zone, utilizes high-speed cameras and image processing software to verify code presence, readability, and correct content. This technological convergence—high-speed precision mechanics, sophisticated ribbon management software, and seamless connectivity—ensures TTO remains the preferred choice for mission-critical coding applications where quality and traceability are paramount regulatory concerns.

Regional Highlights

Regional dynamics play a crucial role in shaping the TTO equipment market, driven by varying regulatory environments, levels of industrial maturity, and consumer consumption patterns. North America, characterized by its mature manufacturing base and stringent regulatory frameworks, particularly the U.S. Drug Supply Chain Security Act (DSCSA), remains a major market for high-end, serialized TTO solutions. The region exhibits high demand for integration services and connectivity features (Industry 4.0), as large multinational corporations seek to standardize coding and marking operations across their global facilities. The market growth here is generally steady, focused primarily on replacement cycles and upgrades to faster, more efficient machines featuring advanced ribbon-saving technology to manage operational costs in a high-labor-cost environment. The food processing sector, especially prepared foods and snacks, continues to be a substantial consumer of intermittent and continuous TTO systems for date and allergen coding.

Europe represents another mature yet highly regulated market, driven by the EU's Falsified Medicines Directive (FMD) which mandates serialization for most prescription drugs, creating sustained demand for TTO in pharmaceutical packaging lines. Western European countries emphasize sustainability, leading to increasing demand for TTO systems capable of using eco-friendly thermal ribbons and for manufacturers demonstrating strong corporate social responsibility. The market in Eastern Europe is showing higher growth rates compared to the West, fueled by foreign direct investment in manufacturing and the modernization of local packaging operations to align with EU standards. European end-users prioritize precision and validated print quality, leading to strong sales of continuous, near-edge TTO technology essential for high-speed flexible packaging of consumer goods and processed meats.

Asia Pacific (APAC) is unequivocally the fastest-growing and largest market globally, propelled by explosive population growth, rapid urbanization, and the corresponding massive expansion of the packaged food and local pharmaceutical industries, particularly in China, India, and Southeast Asia. The region’s growth is characterized by high initial equipment installations (greenfield projects) across multiple sectors transitioning from manual coding methods to automated TTO systems. While price sensitivity is generally higher in APAC, leading to strong demand for entry-level and mid-range TTO models, regulatory movements—such as evolving food safety laws in China and India—are simultaneously pushing manufacturers toward adopting sophisticated serialization-ready equipment. Latin America and the Middle East & Africa (MEA) are emerging markets showing promising growth. LATAM demand is largely influenced by the food and beverage sectors of Brazil and Mexico, while the MEA market is seeing adoption driven by international pharmaceutical distribution hubs and local cosmetic manufacturing, focusing on equipment capable of reliable operation in diverse climate conditions.

- Asia Pacific (APAC): Highest growth region; driven by new manufacturing facility setup (greenfield investments) in food and pharmaceutical sectors; strong demand for both entry-level and advanced serialization systems.

- North America: Mature market; driven by strict regulatory compliance (DSCSA) and replacement demand; focus on integration, OEE improvement, and high-speed continuous systems.

- Europe: Regulatory focus (FMD); high adoption in pharmaceuticals and FMCG; increasing emphasis on sustainable ribbons and energy-efficient machinery.

- Latin America (LATAM): Growing rapidly in key economies (Brazil, Mexico); high utilization in local food and export-oriented industrial segments; focus on robust, reliable intermittent printers.

- Middle East and Africa (MEA): Emerging market; driven by infrastructure development in logistics, food processing, and regional pharmaceutical production; sensitive to equipment durability and service network accessibility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Transfer Overprinting (TTO) Equipment Market.- Domino Printing Sciences

- Markem-Imaje (Dover Corporation)

- Videojet Technologies (Danaher Corporation)

- LINX Printing Technologies (Danaher Corporation)

- SATO Corporation

- ITW Thermal Films

- Allen Coding Systems

- Graphtec Corporation

- KBA-Metronic

- Mettler-Toledo International Inc.

- Macsa ID

- EC-JET

- Bizerba

- HSA Systems

- Rotech Machines

- ID Technology

- Bell-Mark Corporation

- Weber Marking Systems

- Norwood Marking Systems

- Anser Coding Inc.

- Squid Ink Manufacturing

- Codeology Group Ltd.

- Interactive Coding Equipment (ICE)

- Newcode Partnership

Frequently Asked Questions

Analyze common user questions about the Thermal Transfer Overprinting (TTO) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Thermal Transfer Overprinting (TTO) and why is it preferred over continuous inkjet (CIJ) for flexible packaging?

TTO is a digital coding method that uses a heated printhead and a thermal ribbon to transfer durable, high-resolution codes (dates, barcodes, logos) directly onto flexible film, foil, or labels. It is preferred over CIJ for flexible packaging because TTO produces instantly dry, extremely crisp prints (300 dpi+) suitable for machine vision, offers superior code permanence, and avoids the use of solvents, making it cleaner and more suitable for pharmaceutical and food environments requiring high code aesthetics and regulatory compliance verification.

What are the key differences between intermittent and continuous TTO equipment?

Intermittent TTO printers are designed for packaging machines where the film momentarily stops during the sealing process (e.g., VFFS machines), printing the code during the static period. Continuous TTO printers are engineered for high-speed flow wrappers and HFFS lines where the film moves constantly, requiring complex encoder synchronization and rapid printhead firing to apply codes accurately onto the moving substrate without distortion. The choice depends entirely on the speed and motion characteristics of the primary packaging machine.

How do TTO manufacturers address the high operational cost associated with thermal transfer ribbons?

Manufacturers primarily address ribbon cost through advanced proprietary ribbon saving software features. These features include optimized ribbon advance mechanisms, sophisticated algorithms that minimize the ribbon gap between successive print cycles, and the capability to print codes using only the necessary portion of the ribbon, reducing overall material consumption by 10% to 30%. Furthermore, they promote high-yield ribbon formulations and offer specialized printhead widths to minimize waste.

Which end-user industries drive the highest demand for specialized TTO equipment?

The Pharmaceutical and Healthcare industry drives the highest demand for specialized, high-specification TTO equipment, specifically for continuous motion units capable of high-density 2D barcode printing required for serialization (e.g., DSCSA, FMD compliance). While the Food and Beverage sector accounts for the largest volume of TTO installations, pharmaceutical needs dictate the most rigorous requirements for validated print quality, consistency, and traceability functionality, often justifying the highest capital expenditure.

What role does Industry 4.0 connectivity play in modern TTO equipment adoption?

Industry 4.0 connectivity is crucial as it allows TTO systems to integrate seamlessly with Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP). This enables centralized print job management, real-time remote diagnostics, performance data collection (OEE tracking), and immediate software updates. This connectivity minimizes manual intervention, ensures production line efficiency, and facilitates regulatory audits by providing comprehensive data logs of all printing activities, positioning the TTO unit as an intelligent part of the digital factory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager